As a Financial Planner, you play a crucial role in guiding individuals and businesses toward achieving their financial goals. Your expertise helps clients navigate complex financial landscapes, ensuring they make informed decisions about investments, savings, and retirement planning. However, to secure a position in this competitive field, a well-crafted resume is essential. Your resume is not just a document; it’s your first opportunity to make a lasting impression on potential employers, showcasing your skills, experience, and dedication to helping others achieve financial stability.

In this comprehensive guide on Financial Planner resume writing, we’ll delve into the key responsibilities and skills that employers look for in candidates. We’ll discuss the best resume format to highlight your strengths effectively and outline common mistakes to avoid that could hinder your chances of landing an interview. Whether you’re just starting your career or looking to advance to a senior role, we’ll provide resume examples tailored for all experience levels. Additionally, you’ll find valuable tips on crafting an outstanding resume and selecting the right resume templates that align with your professional brand. Get ready to elevate your job application materials and increase your chances of success in the dynamic world of financial planning!

Key Responsibilities and Skills for a Financial Planner

As a Financial Planner, professionals are tasked with guiding clients toward achieving their financial goals through comprehensive planning and investment strategies. The role encompasses several key responsibilities:

- Conducting thorough financial assessments to understand clients' financial situations.

- Developing personalized financial plans that align with clients’ objectives and risk tolerance.

- Offering investment advice and portfolio management services.

- Monitoring clients’ financial progress and making adjustments as needed.

- Educating clients on financial concepts and investment strategies.

- Staying informed about financial regulations and market trends.

To be successful in this role, a Financial Planner must possess essential skills, including:

- Strong analytical and problem-solving abilities

- Excellent communication and interpersonal skills

- Proficiency in financial software and tools

- Knowledge of investment strategies and financial markets

- Attention to detail and organizational skills

- Ethical judgment and decision-making capabilities

Highlighting these skills effectively in the resume skills section is crucial since it provides potential employers with a clear understanding of your qualifications. Tailoring these responsibilities and skills to match the specific job description can significantly enhance your application. Additionally, consider how these skills are relevant when crafting a compelling CV, ensuring that you showcase your strengths in a way that resonates with prospective employers.

Best Resume Format and Structure for a Financial Planner

When creating a resume for a Financial Planner position, it’s essential to choose a format that showcases your experience, skills, and qualifications effectively. A well-structured resume not only grabs the attention of hiring managers but also provides a clear narrative of your professional journey. Here’s a detailed guide on the best resume format and structure for a Financial Planner:

Contact Information

Begin your resume with your contact information at the top. Include your full name, phone number, email address, and LinkedIn profile or professional website if applicable. Make sure this section is easy to read and stands out.

Professional Summary

Craft a concise professional summary that highlights your key qualifications and career goals. This section should be 2-4 sentences long and summarize your experience, areas of expertise, and what you can bring to the role. For example, “Certified Financial Planner with over 5 years of experience in investment strategy, retirement planning, and client relationship management. Proven track record of helping clients achieve their financial goals through personalized financial plans.”

Work Experience

List your work experience in reverse chronological order, starting with your most recent position. For each job, include the following details:

- Job Title

- Company Name

- Location (City, State)

- Dates of Employment (Month/Year)

- Bullet points outlining your responsibilities and achievements. Use action verbs and quantify your accomplishments where possible (e.g., “Increased client investment returns by 15% over three years”).

Education

Provide details about your educational background, including:

- Degree(s) obtained

- Major(s) and minors

- University/College Name

- Graduation Date (Month/Year) If you have relevant coursework or honors, you may include them as well.

Skills

In this section, list the skills that are pertinent to the Financial Planner role. This can include both hard skills (e.g., financial analysis, investment management, tax planning) and soft skills (e.g., communication, problem-solving, interpersonal skills). Tailor this list to match the job description you are applying for.

Certifications

Include any relevant certifications that demonstrate your qualifications as a Financial Planner. Common certifications include:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Financial Fiduciary (CFF) List the certification name along with the date obtained.

Additional Sections (Optional)

Depending on your experience and the job requirements, consider adding additional sections such as:

- Professional Affiliations: Membership in organizations like the Financial Planning Association (FPA).

- Publications or Speaking Engagements: If you’ve written articles or spoken at events related to financial planning.

- Volunteer Experience: Relevant volunteer work that demonstrates your commitment to the field.

Tips for Formatting

- Use a clean, professional font (e.g., Arial, Calibri, or Times New Roman) and maintain consistent formatting throughout the document.

- Keep your resume to one page, especially if you have less than 10 years of experience. For more extensive careers, two pages are acceptable.

- Use bullet points for easy readability and to highlight key information.

- Ensure there’s plenty of white space to avoid clutter.

Complementing Your Resume with a Cover Letter

The format of your resume can complement your cover letter, creating a cohesive application package. Maintain consistency in font style and size between the two documents. In your cover letter, briefly expand on the highlights from your resume, providing context and illustrating how your experiences make you an ideal candidate for the Financial Planner role. Tailor both documents to the specific job you are applying for, reiterating your enthusiasm for the position and the value you can add to the organization.

By following this structured format and including these key sections, you will present a compelling resume that effectively communicates your qualifications for a Financial Planner position.

Writing Tips and Best Practices for a Financial Planner Resume

When crafting a resume as a Financial Planner, it’s crucial to present your qualifications and achievements in a clear, concise manner that resonates with potential employers. Use a professional format that highlights your skills and experience, and ensure your resume is tailored to the specific job description. Incorporating resume writing tips can help you achieve a polished look that stands out. Additionally, consider how these practices can translate into your cover letter for a cohesive application.

- Use action verbs such as "analyzed," "developed," and "advised" to convey your responsibilities and achievements effectively.

- Quantify your accomplishments whenever possible, such as specifying the percentage increase in client satisfaction or the amount of assets managed.

- Incorporate industry-specific keywords from the job description to enhance your chances of passing through applicant tracking systems (ATS).

- Keep your resume to one page if you have less than 10 years of experience, focusing on the most relevant information.

- Highlight any certifications or licenses, such as CFP or CFA, as these are crucial in the financial planning industry.

- Include a summary statement that encapsulates your experience and skills in a compelling way.

- Use bullet points for easy readability and to draw attention to key achievements.

- Ensure consistency in formatting, font choice, and spacing to maintain a professional appearance throughout your resume.

Common Mistakes to Avoid in a Financial Planner Resume

When crafting a resume for a Financial Planner position, it’s crucial to present your qualifications and experience in a clear and compelling manner. However, many candidates fall into common traps that can undermine their application. Avoiding these pitfalls can significantly enhance your chances of standing out in a competitive job market. Below are some of the most frequent mistakes to steer clear of:

- Overloading the resume with excessive information or irrelevant details.

- Using generic job descriptions that fail to highlight specific skills and accomplishments.

- Failing to tailor the resume to the specific job description, which can make your application seem unfocused.

- Neglecting to quantify achievements, such as savings generated for clients or portfolio growth percentages.

- Using an unprofessional or overly creative format that distracts from the content.

- Ignoring the importance of keywords relevant to the financial planning industry.

- Making spelling and grammatical errors that can tarnish your professionalism.

- Including outdated or unnecessary information, such as high school education or irrelevant job experiences.

- Not including a summary statement that effectively encapsulates your skills and career goals.

- Overly lengthy resumes that exceed two pages, which can lead to important information being overlooked.

For more insights, consider reviewing the common mistakes to avoid in a resume. Additionally, remember that your cover letter is equally important; avoid pitfalls outlined in the common cover letter mistakes to create a comprehensive and appealing application package.

Sample Financial Planner Resumes

As a Financial Planner, showcasing your skills and experience effectively in your resume is crucial for securing a position in this competitive field. Below are three sample resumes tailored for different levels of experience: one for an experienced professional, one for an entry-level candidate, and one for a career changer. Each resume highlights relevant skills and accomplishments that can help you stand out to potential employers. For additional inspiration, feel free to explore more resume templates. Additionally, corresponding cover letter examples can assist in crafting a comprehensive job application package.

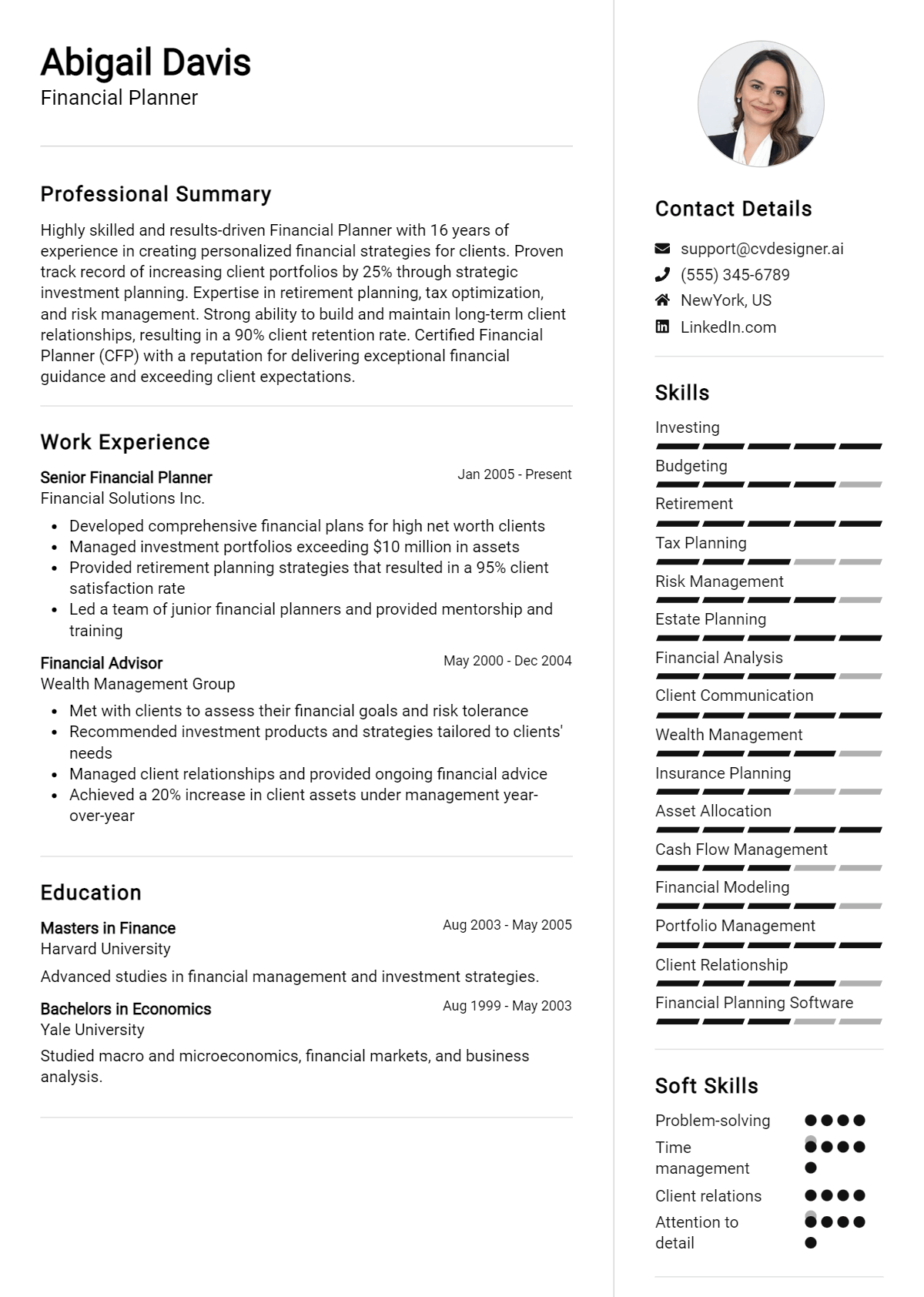

Experienced Financial Planner Resume

John Smith

123 Finance Lane

New York, NY 10001

(123) 456-7890

john.smith@email.com

Professional Summary

Results-driven Financial Planner with over 10 years of experience in providing expert financial advice and developing comprehensive financial plans for clients. Proven track record of improving clients’ financial health through tailored investment strategies and retirement planning.

Core Competencies

- Investment Management

- Retirement Planning

- Tax Strategies

- Risk Assessment

- Financial Analysis

- Client Relationship Management

Professional Experience

Senior Financial Planner

ABC Financial Services, New York, NY

March 2015 - Present

- Developed customized financial plans for over 150 high-net-worth clients, achieving an average portfolio growth of 15% annually.

- Conducted in-depth financial analyses to identify clients’ needs and recommended suitable investment options.

- Led seminars on retirement and tax planning, increasing client acquisition by 25%.

Financial Planner

XYZ Wealth Management, New York, NY

June 2010 - February 2015

- Managed a diverse portfolio of clients, providing ongoing support in investment choices and financial strategies.

- Collaborated with tax professionals to optimize clients' tax situations and improve overall financial outcomes.

- Maintained compliance with financial regulations and ethical standards.

Education

Bachelor of Science in Finance

University of New York, New York, NY

Graduated: May 2010

Certifications

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

Entry-Level Financial Planner Resume

Emily Johnson

456 Investment Road

Los Angeles, CA 90001

(987) 654-3210

emily.johnson@email.com

Professional Summary

Motivated and detail-oriented recent finance graduate seeking an entry-level Financial Planner position. Strong analytical skills and a passion for helping clients achieve their financial goals through personalized planning and investment strategies.

Core Competencies

- Financial Analysis

- Client Communication

- Investment Research

- Data Analysis

- Problem Solving

- Microsoft Excel

Education

Bachelor of Arts in Finance

California State University, Los Angeles, CA

Graduated: May 2023

Internship Experience

Financial Planning Intern

LMN Financial Advisors, Los Angeles, CA

June 2022 - August 2022

- Assisted senior planners in developing financial plans for clients, conducting research on investment opportunities.

- Created client presentations and reports, improving the clarity and effectiveness of financial advice.

- Participated in client meetings and recorded essential information for follow-up.

Relevant Coursework

- Investment Strategies

- Personal Finance

- Risk Management

- Financial Markets

Career Changer Resume

Michael Anderson

789 Business Ave

Chicago, IL 60601

(555) 123-4567

michael.anderson@email.com

Professional Summary

Dynamic professional with 8 years of experience in corporate finance and a strong desire to transition into financial planning. Adept at analyzing financial data and developing strategies that enhance financial performance. Eager to leverage analytical skills and client-focused approach in a financial planning role.

Core Competencies

- Financial Analysis

- Budgeting and Forecasting

- Strategic Planning

- Client Management

- Investment Analysis

- Regulatory Compliance

Professional Experience

Finance Manager

DEF Corporation, Chicago, IL

January 2015 - Present

- Managed financial planning and analysis for a $50M budget, providing insights that improved operational efficiency and profitability.

- Developed and presented financial forecasts to senior management, influencing key business decisions.

- Collaborated with cross-functional teams to align financial strategies with organizational goals.

Financial Analyst

GHI Solutions, Chicago, IL

June 2013 - December 2014

- Conducted financial reporting and analysis to support business development and operational strategies.

- Assisted in the preparation of annual budgets and financial forecasts, ensuring accuracy and compliance with industry standards.

Education

Master of Business Administration (MBA)

University of Chicago, Chicago, IL

Graduated: June 2013

Bachelor of Science in Accounting

University of Illinois, Chicago, IL

Graduated: May 2011

Certifications

- Financial Planning Certificate (in progress)

- Certified Management Accountant (CMA)

Explore the diverse landscape of financial planning careers, and remember that a well-crafted resume paired with a strong cover letter can significantly enhance your job application efforts.

Checklist for a Financial Planner Resume

- Proofread for Errors: Carefully check for spelling, grammar, and punctuation mistakes. Read your resume multiple times and consider using tools or services for additional support.

- Consistency in Formatting: Ensure that font styles, sizes, and bullet point styles are uniform throughout your resume. Consistent formatting reflects professionalism.

- Tailor to the Job Description: Customize your resume to match the specific requirements of the financial planner position you are applying for. Highlight relevant experience and skills that align with the job.

- Clear and Concise Language: Use straightforward language and avoid jargon. Make sure your achievements are clearly stated and quantifiable where possible.

- Highlight Relevant Certifications: Include any financial planning certifications (such as CFP, CFA, etc.) prominently. This adds credibility and showcases your qualifications.

- Professional Summary: Write a compelling summary at the top of your resume that encapsulates your experience and skills in financial planning. This should entice hiring managers to read further.

- Use Action Verbs: Start bullet points with strong action verbs (e.g., "developed," "analyzed," "managed") to convey your contributions effectively.

- Include Relevant Skills: List both hard and soft skills that are pertinent to financial planning, such as analytical skills, attention to detail, and customer service proficiency.

- Contact Information: Double-check that your contact information is accurate and up-to-date. Include a professional email address and a reliable phone number.

- Consider an AI Resume Builder: To ensure all elements are well-organized and visually appealing, consider using an AI resume builder. This can help streamline the process and enhance the overall presentation.

For a complete job application, remember that a similar checklist can also be followed for creating a CV or cover letter.

Key Takeaways for a Financial Planner Resume Guide

In conclusion, crafting a compelling resume as a Financial Planner is essential to stand out in a competitive job market. By utilizing the examples and tips provided in this guide, you can create a strong resume that highlights your skills, experiences, and qualifications effectively. Don't forget to explore our selection of downloadable templates for resumes and cover letters at resume templates and cover letter templates. Additionally, consider using our best resume maker for a more streamlined approach to building your professional documents. Remember, following similar guidelines will also assist you in developing a persuasive CV and a standout cover letter. Take the next step towards your career success by implementing these strategies today!