Most Popular Tax Examiner Resume Examples

Explore additional Tax Examiner resume samples and guides and see what works for your level of experience or role.

As a Tax Examiner, you play a crucial role in ensuring the integrity of the tax system by reviewing and analyzing tax returns, conducting audits, and ensuring compliance with tax laws. Your expertise not only helps maintain the financial stability of the government but also provides essential support to taxpayers navigating their obligations. Crafting a well-structured resume is vital in showcasing your skills and experience in this competitive field. A polished resume can be the difference between landing an interview and getting lost in the shuffle, making it essential that you present yourself effectively to potential employers.

In this comprehensive guide, we will explore the key responsibilities and skills required for a Tax Examiner, helping you to highlight your qualifications effectively. We will discuss the best resume formats to use, ensuring that your document is both visually appealing and easy to read. Additionally, we’ll point out common mistakes to avoid that could hinder your chances of being noticed. Whether you're a seasoned professional or just starting your career, we’ll provide resume examples tailored for all experience levels. Plus, you’ll find valuable tips on effective resume writing and guidance on selecting the right resume templates that align with your personal brand and the expectations of hiring managers. Let’s dive in and equip you with the tools you need to create a standout resume that opens doors to your next opportunity!

Key Responsibilities and Skills for a Tax Examiner

Tax Examiners play a crucial role in the financial landscape, ensuring compliance with tax laws and regulations. Their primary responsibilities include reviewing tax returns for accuracy, conducting audits, and identifying discrepancies that may warrant further investigation. They also provide guidance to taxpayers regarding their tax obligations, assess penalties for non-compliance, and prepare reports summarizing their findings.

To excel in this role, a Tax Examiner should possess the following essential skills:

- Analytical Skills: Ability to analyze complex financial data and identify patterns or discrepancies.

- Attention to Detail: Meticulous attention to detail to ensure accuracy in tax assessments and documentation.

- Communication Skills: Strong verbal and written communication skills to explain tax laws and findings clearly to clients and colleagues.

- Problem-Solving Skills: Capability to develop solutions for discrepancies or disputes that arise during audits.

- Knowledge of Tax Laws: In-depth understanding of federal, state, and local tax laws and regulations.

- Organizational Skills: Ability to manage multiple cases and maintain detailed records efficiently.

- Computer Proficiency: Familiarity with tax software and databases, as well as proficiency in using spreadsheets for data analysis.

Highlighting these skills effectively in the resume skills section is vital for standing out in a competitive job market. Tailoring your listed responsibilities and skills to the specific job description can significantly increase your chances of being noticed by potential employers. Additionally, consider how these skills contribute to creating a strong CV that showcases your qualifications and aligns with the demands of the role you are applying for. This targeted approach can make a compelling case for your candidacy and demonstrate your suitability for the position of Tax Examiner.

Best Resume Format and Structure for a Tax Examiner

When crafting a resume for a Tax Examiner position, it’s essential to adopt a clear and professional format that highlights your qualifications effectively. The following sections should be included to create a compelling resume:

Contact Information

- Your full name should be prominently displayed at the top.

- Include your phone number, professional email address, and LinkedIn profile (if applicable).

- Optionally, you can add your physical address or just the city and state.

Professional Summary

- Write a brief 2-4 sentence summary that encapsulates your experience, skills, and what you bring to the role.

- Focus on your years of experience in tax examination, key areas of expertise, and any notable achievements.

- Tailor this section to reflect your alignment with the specific job description.

Work Experience

- List your professional experience in reverse chronological order, starting with your most recent position.

- For each role, include the job title, company name, location, and dates of employment.

- Use bullet points to describe your responsibilities and achievements. Focus on quantifiable outcomes, such as the number of audits conducted or discrepancies resolved.

- Highlight any specialized areas of tax examination, such as corporate taxes, individual income taxes, or compliance issues.

Education

- List your degrees in reverse chronological order. Include the degree obtained, major, institution name, and graduation year.

- If you have relevant coursework or honors, consider adding those as well.

Skills

- Include a list of key skills relevant to the Tax Examiner role.

- Focus on both hard skills (e.g., tax law knowledge, data analysis, audit techniques) and soft skills (e.g., communication, attention to detail, problem-solving).

- Tailor this section to align with the job requirements listed in the job posting.

Certifications

- List any relevant certifications that enhance your qualifications, such as Certified Public Accountant (CPA) or Enrolled Agent (EA).

- Include the full name of the certification and the year obtained.

Tips for Format

- Utilize a clean, professional layout with consistent font and size throughout.

- Use headings to clearly delineate each section, making it easily scannable.

- Aim for a one-page resume unless extensive experience warrants a second page.

- Ensure there are no typos or grammatical errors; consider having a peer review your resume.

A well-structured resume can significantly complement your cover letter, which should follow a similar format. For instance, the cover letter can elaborate on your professional summary, providing context to your qualifications. Use the same font and header style to create a cohesive application package.

By adhering to this guide, you’ll create a polished and effective resume that captures the attention of hiring managers in the field of tax examination.

Writing Tips and Best Practices for a Tax Examiner Resume

When crafting a resume for a Tax Examiner position, it is essential to present your skills and experiences in a clear and compelling manner. Start by tailoring your resume to highlight relevant qualifications, ensuring that it effectively communicates your expertise in tax regulations and analytical skills. Utilize industry-specific keywords to align with job descriptions, which can enhance your visibility to potential employers and applicant tracking systems. Additionally, remember that a professional and polished appearance is crucial, so consider incorporating resume writing tips to refine your document. These best practices also extend to your cover letter, where you can further emphasize your qualifications and enthusiasm for the role.

- Use strong action verbs, such as "analyzed," "audited," and "collaborated" to describe your experiences.

- Quantify your achievements whenever possible, for example, "recovered $500,000 in unpaid taxes" or "processed over 1,000 tax returns annually."

- Incorporate industry-specific keywords related to tax laws, compliance, and financial analysis to enhance the relevance of your resume.

- Tailor your summary statement to reflect your unique skills and experiences, making sure to connect them directly to the job description.

- Focus on your analytical abilities and attention to detail, as these are crucial traits for a Tax Examiner.

- Include any relevant certifications, such as a CPA or Enrolled Agent, to demonstrate your qualifications and commitment to the field.

- Highlight your proficiency with tax software and technology, which can streamline processes and improve efficiency.

- Ensure your resume is organized and easy to read, using bullet points and clear headings to guide the reader through your professional journey.

Common Mistakes to Avoid in a Tax Examiner Resume

Creating a standout resume for a Tax Examiner position requires careful attention to detail and an understanding of the specific skills and experiences that employers value. However, many job seekers make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can present a polished and professional resume that highlights your qualifications effectively. Here are some common mistakes to avoid:

- Overloading the resume with excessive information or irrelevant details.

- Using generic descriptions that fail to showcase your unique skills and accomplishments.

- Failing to quantify achievements, which can leave hiring managers without a clear sense of your impact.

- Ignoring the importance of tailoring your resume to the specific job description.

- Using an unprofessional email address or contact information.

- Neglecting to include key tax-related certifications or licenses.

- Skipping a clear and concise summary or objective statement that outlines your career goals.

- Using inconsistent formatting, which can make the document difficult to read.

- Not proofreading for grammatical or spelling errors, which can create a negative impression.

- Omitting keywords relevant to tax examination that could help your resume pass through applicant tracking systems.

For a deeper understanding of how to refine your resume, consider reviewing additional common mistakes to avoid in a resume. Additionally, be sure to pay attention to your cover letter, as it is equally important to avoid common cover letter mistakes that could undermine your application.

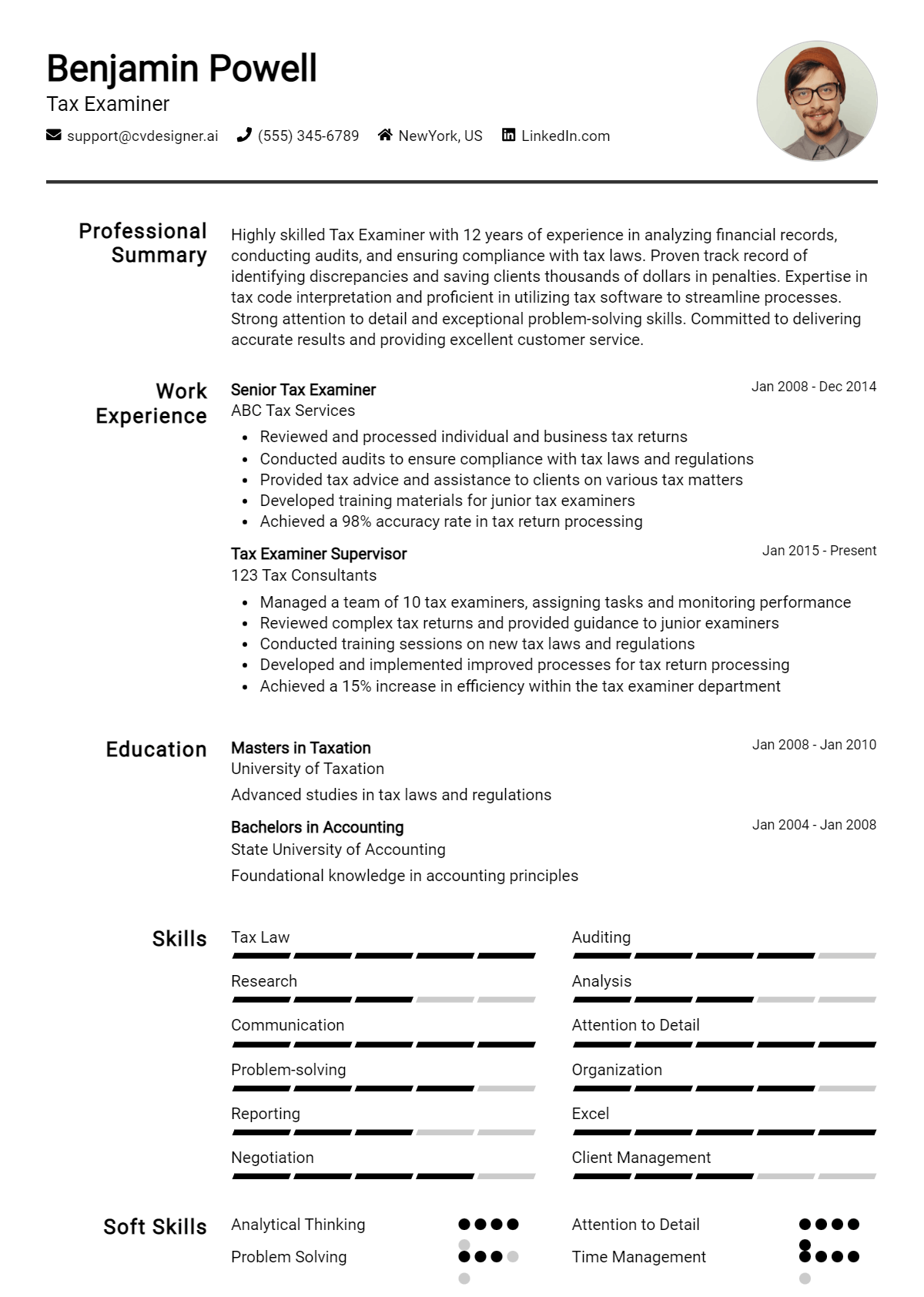

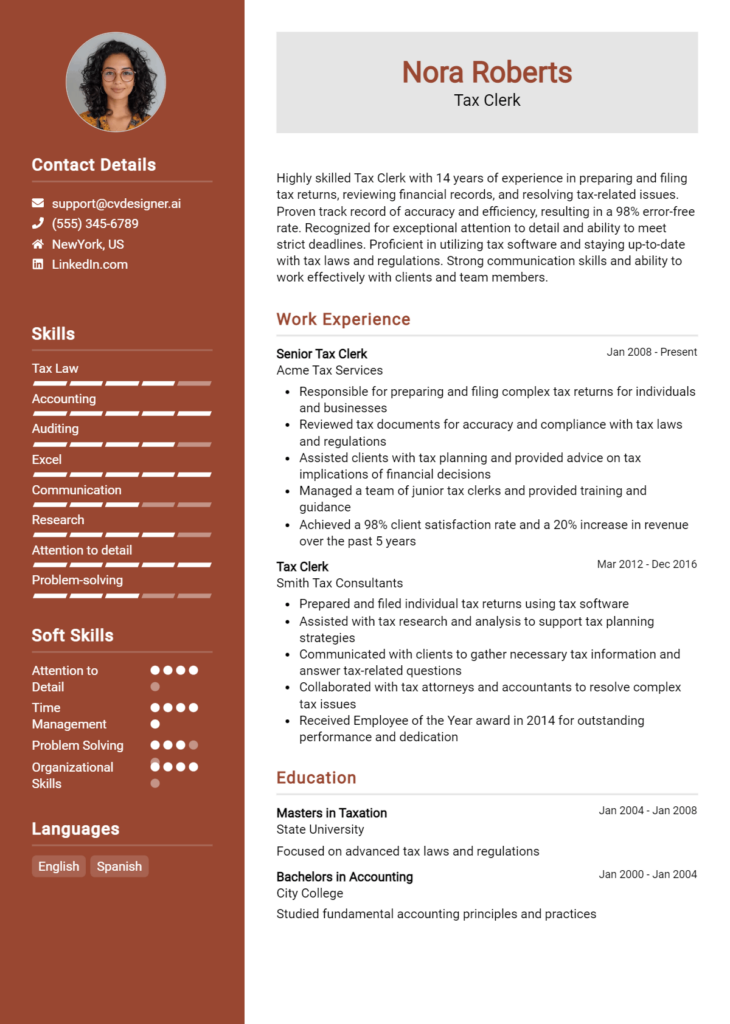

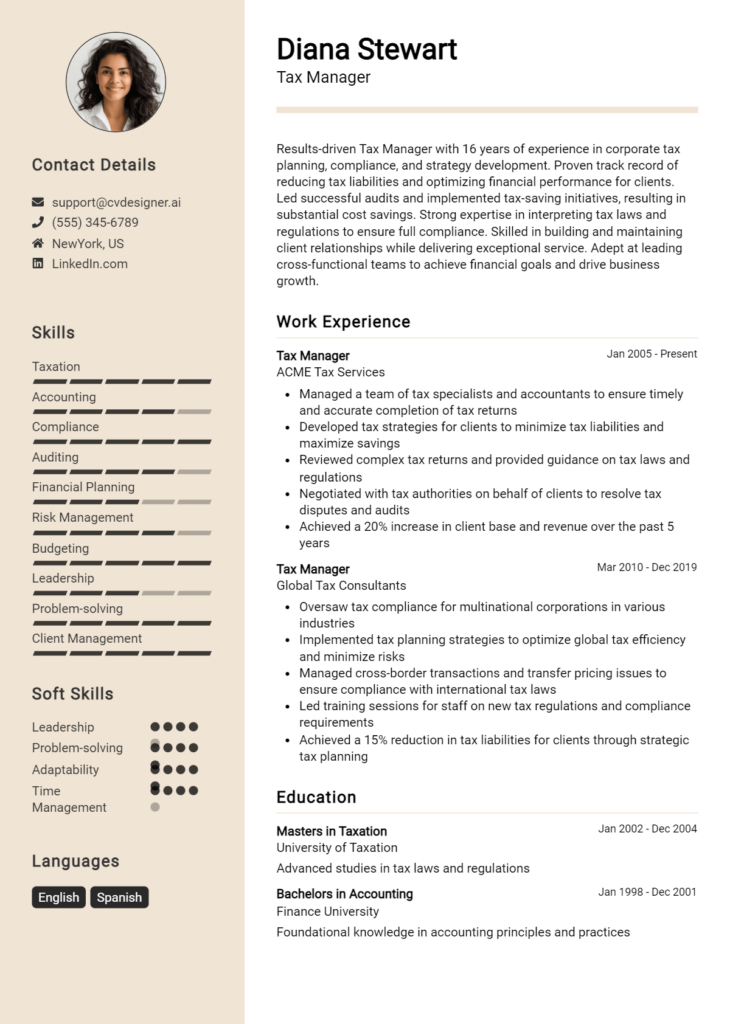

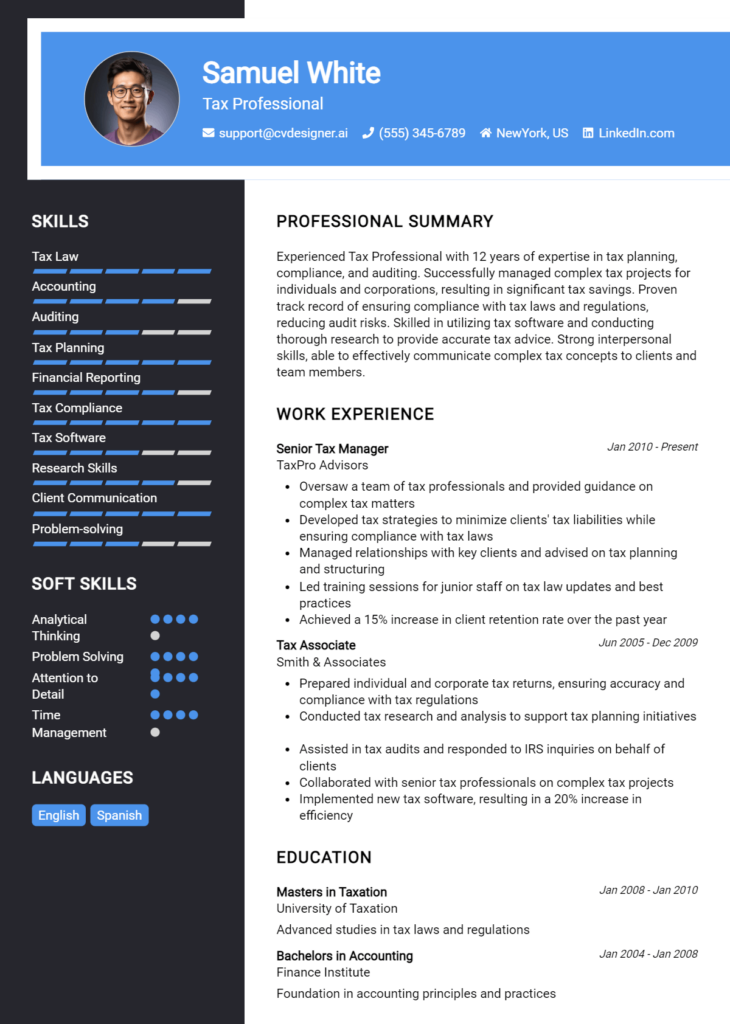

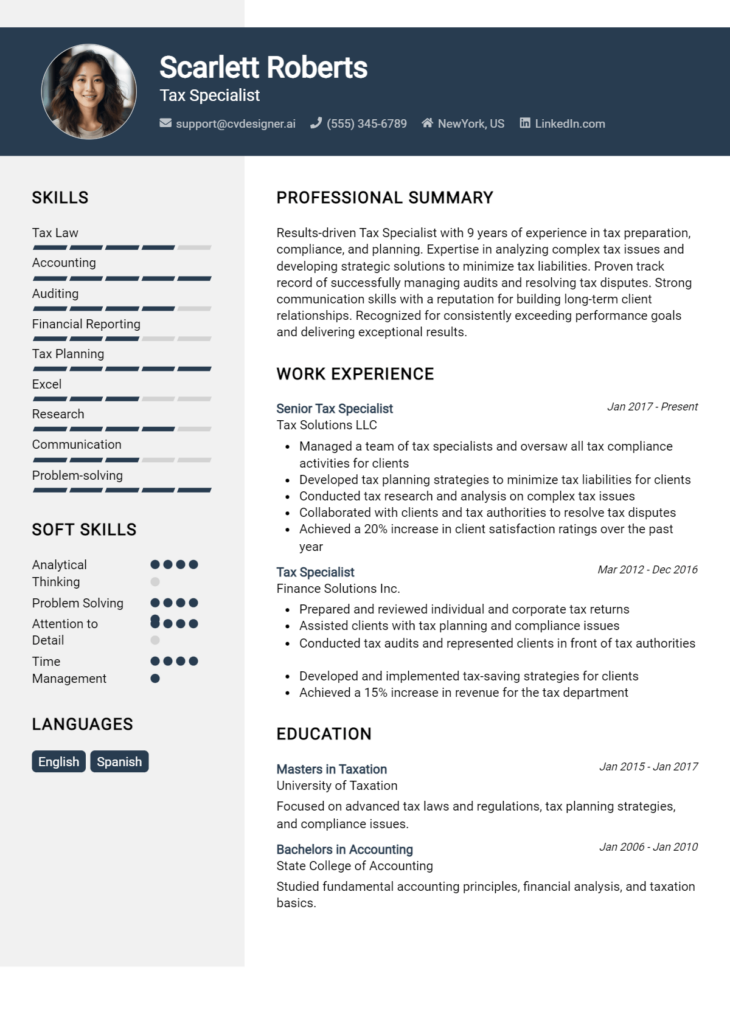

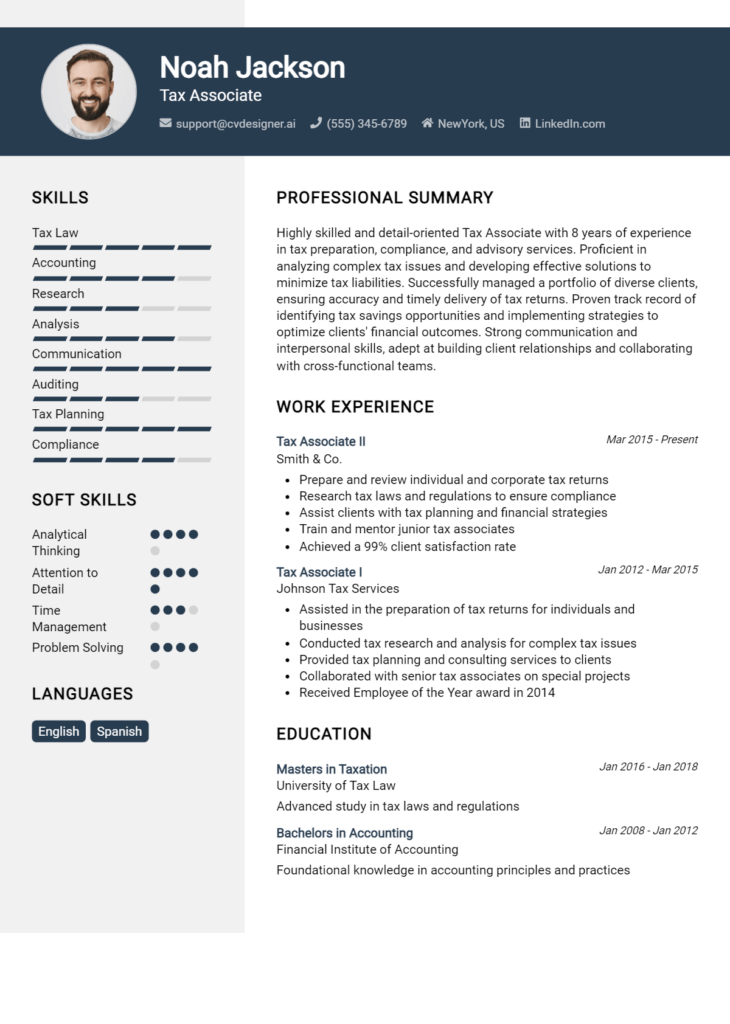

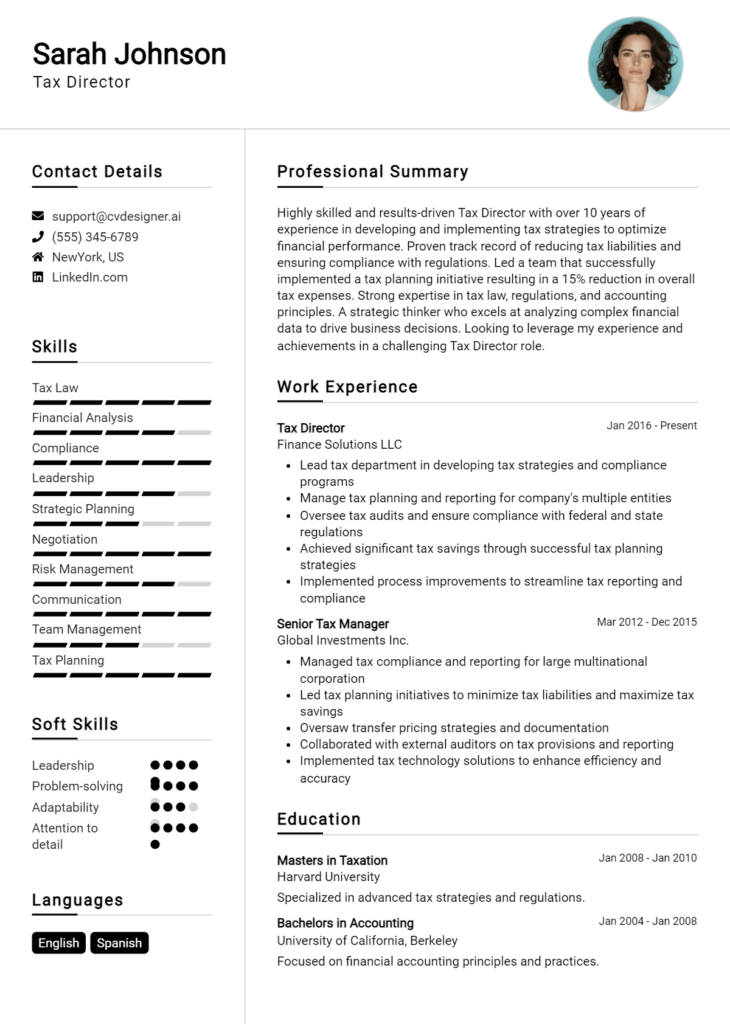

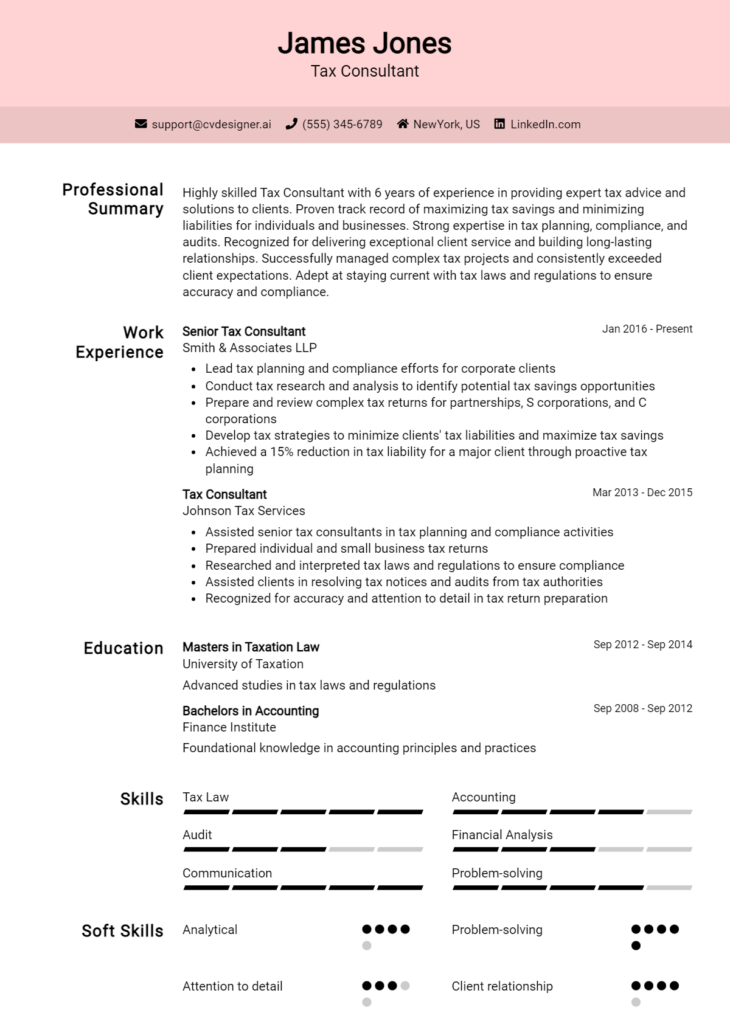

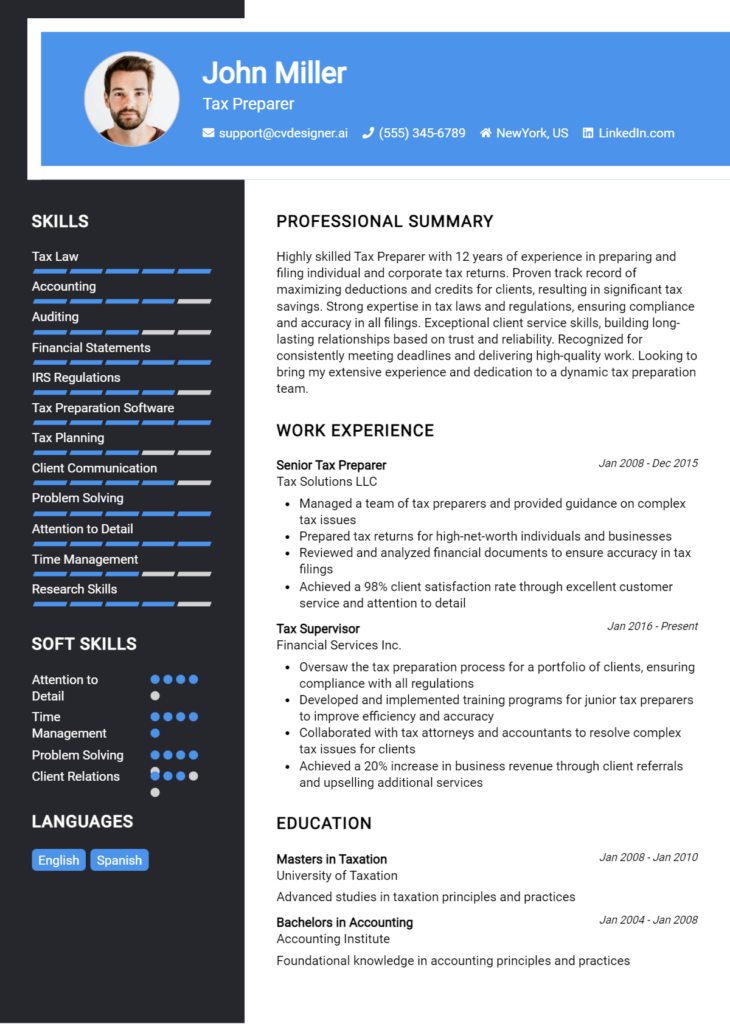

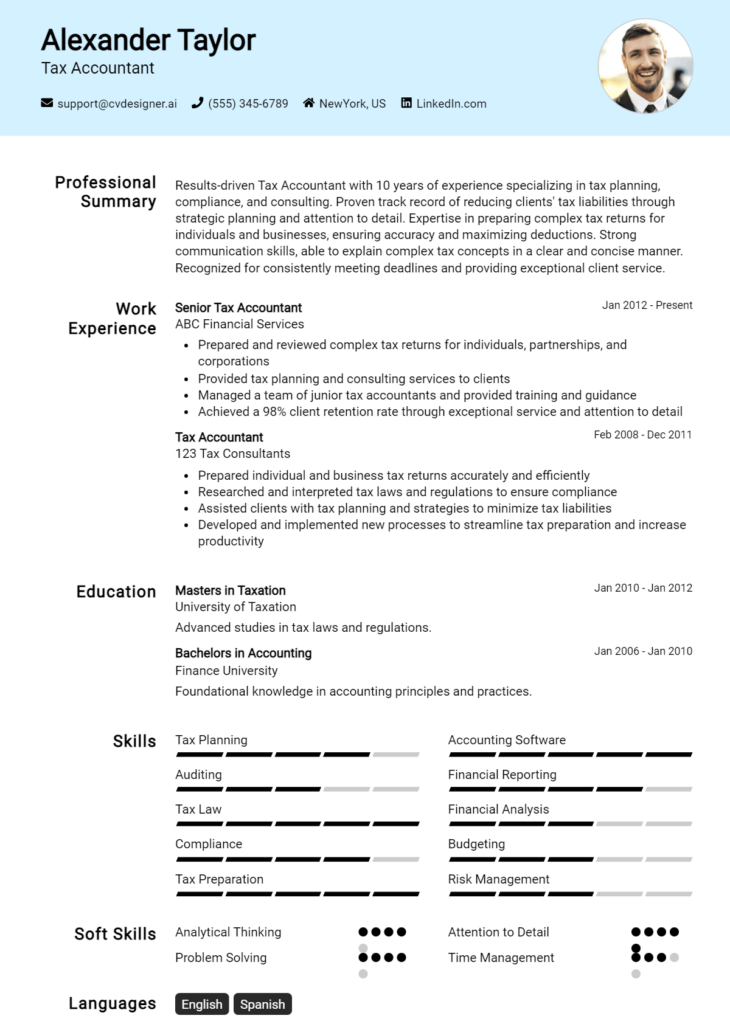

Sample Tax Examiner Resumes

As a Tax Examiner, your role involves reviewing tax returns, ensuring compliance with tax laws, and assisting taxpayers with questions and issues. Crafting a strong resume is essential to showcase your skills and experiences in this field. Below are three sample resumes tailored for different levels of experience and career paths in tax examination. These examples can guide you in creating a compelling resume that highlights your qualifications.

Experienced Tax Examiner Resume

John Doe

123 Finance Lane

Cityville, ST 12345

(123) 456-7890

john.doe@email.com

Professional Summary

Detail-oriented Tax Examiner with over 8 years of experience in federal and state tax compliance. Proven track record of identifying discrepancies and providing exceptional customer service to taxpayers. Strong analytical skills and a comprehensive understanding of tax laws and regulations.

Professional Experience

Senior Tax Examiner

Department of Revenue, Cityville, ST

June 2018 – Present

- Conduct detailed audits of individual and corporate tax returns, ensuring compliance with federal and state tax laws.

- Collaborate with taxpayers to resolve disputes and clarify tax liabilities, resulting in a 95% resolution rate.

- Train and mentor junior examiners on best practices and regulatory updates.

Tax Examiner

Department of Revenue, Cityville, ST

January 2015 – May 2018

- Reviewed and analyzed tax returns for accuracy and compliance, identifying potential fraud and discrepancies.

- Assisted taxpayers with inquiries, providing clear explanations of tax regulations and procedures.

- Developed and implemented strategies to streamline the examination process, improving efficiency by 20%.

Education

Bachelor of Science in Accounting

University of Cityville, Cityville, ST

Graduated: May 2014

Skills

- Tax Law Compliance

- Auditing and Analysis

- Customer Service

- Data Entry and Reporting

- Microsoft Office Suite

Entry-Level Tax Examiner Resume

Jane Smith

456 Tax Road

Townsville, ST 67890

(321) 654-0987

jane.smith@email.com

Professional Summary

Motivated and detail-oriented recent graduate with a Bachelor’s degree in Accounting. Eager to leverage strong analytical skills and knowledge of tax regulations in an entry-level Tax Examiner position. Committed to delivering excellent service to taxpayers while ensuring compliance.

Education

Bachelor of Science in Accounting

College of Townsville, Townsville, ST

Graduated: May 2023

Internship Experience

Tax Intern

City Tax Office, Townsville, ST

January 2023 – April 2023

- Assisted in the review of tax returns for accuracy and compliance under the supervision of senior tax examiners.

- Helped prepare correspondence for taxpayers regarding tax inquiries and discrepancies.

- Gained hands-on experience with tax software and documentation processes.

Skills

- Understanding of Tax Regulations

- Strong Analytical Skills

- Attention to Detail

- Communication Skills

- Proficient in Microsoft Excel

Career Changer Tax Examiner Resume

Michael Johnson

789 Career Path St.

Villagetown, ST 54321

(987) 654-3210

michael.johnson@email.com

Professional Summary

Dedicated professional with 10 years of experience in financial analysis seeking to transition into a Tax Examiner role. Proven ability to analyze complex financial data and provide strategic recommendations. Strong communicator with a commitment to helping individuals and businesses comply with tax regulations.

Professional Experience

Financial Analyst

ABC Financial Services, Villagetown, ST

March 2013 – Present

- Conduct comprehensive financial analyses to support strategic decision-making and improve compliance with financial regulations.

- Collaborate with clients to identify financial discrepancies and implement corrective actions.

- Prepare detailed reports and presentations for management and stakeholders.

Customer Service Representative

XYZ Corp, Villagetown, ST

January 2011 – February 2013

- Provided exceptional customer service while handling inquiries and resolving issues regarding financial products.

- Developed strong communication skills through direct interaction with clients and stakeholders.

Education

Bachelor of Arts in Finance

University of Villagetown, Villagetown, ST

Graduated: December 2010

Skills

- Financial Analysis

- Problem-Solving

- Tax Compliance Knowledge

- Client Relations

- Proficient in Financial Software

Explore more resume templates for inspiration, and don’t forget that corresponding cover letter examples can help you create a complete job application package.

Checklist for a Tax Examiner Resume

- Proofread for Errors: Carefully read through your resume to catch any spelling, grammar, or punctuation mistakes. Consider reading it aloud to identify awkward phrasing.

- Consistency in Formatting: Ensure that your font style, size, and bullet point format are consistent throughout the document to maintain a professional appearance.

- Tailor to the Job Description: Customize your resume for the Tax Examiner role by incorporating relevant keywords and phrases from the job posting to align your skills and experiences with the employer's requirements.

- Highlight Relevant Experience: Focus on your most pertinent job experiences and accomplishments in tax examination, showcasing your analytical skills and attention to detail.

- Quantify Achievements: Where possible, include numbers or percentages to illustrate your contributions and successes, such as the number of tax returns processed or audits completed.

- Use Action Verbs: Start bullet points with strong action verbs (e.g., analyzed, reviewed, resolved) to convey your contributions effectively and exhibit proactivity.

- Include Professional Certifications: List any relevant certifications or licenses, such as CPA or Enrolled Agent, to enhance credibility and demonstrate your qualifications in the field.

- Contact Information: Double-check that your contact information is current and formatted correctly, ensuring potential employers can easily reach you.

- Seek Feedback: Consider asking a colleague or mentor to review your resume for additional feedback and perspectives on its clarity and professionalism.

- Utilize AI Tools: Use an AI resume builder for a polished and organized presentation of all elements, ensuring your resume meets industry standards.

Remember, a similar checklist can also be applied when creating a CV or a cover letter.

Key Takeaways for a Tax Examiner Resume Guide

In conclusion, crafting a strong resume as a Tax Examiner is essential for standing out in a competitive job market. By utilizing the provided examples and tips, you can highlight your relevant skills, experiences, and qualifications effectively. We encourage you to take the next step by downloading a professional template from our resume templates or exploring our cover letter templates to complement your application. Additionally, consider using our highly-rated resume maker to create a polished and tailored resume that reflects your expertise. Remember, following similar guidelines will also be beneficial in developing a compelling CV and cover letter, ensuring that your entire application package stands out. Start building your path to success today!