Most Popular Credit Specialist Resume Examples

Explore additional Credit Specialist resume samples and guides and see what works for your level of experience or role.

As a Credit Specialist, you play a crucial role in the financial sector, evaluating creditworthiness and helping clients manage their financial health. Your expertise not only aids organizations in making informed lending decisions but also empowers individuals to secure the funds they need for their endeavors. Given the significance of this role, having a well-crafted resume is essential to stand out in a competitive job market. A compelling resume highlights your skills and experiences, effectively showcasing your value to potential employers and setting the stage for a successful job search.

In this comprehensive guide, we will delve into the key responsibilities and skills required for a Credit Specialist, ensuring you understand what employers are looking for. We’ll discuss the best resume formats to utilize, common pitfalls to avoid, and provide resume examples tailored for all experience levels. Additionally, we’ll offer valuable tips on crafting your resume and selecting the right resume templates that align with your professional identity. By the end of this article, you’ll be equipped with the tools and insights needed to create a powerful resume that opens doors to new opportunities in your career as a Credit Specialist.

Key Responsibilities and Skills for a Credit Specialist

A Credit Specialist is primarily responsible for evaluating and managing the creditworthiness of individuals or businesses, as well as ensuring that credit policies are adhered to. Their key responsibilities include:

- Assessing credit applications and conducting thorough credit checks

- Analyzing financial data and credit reports to determine risk levels

- Communicating with clients to gather necessary documentation and resolve discrepancies

- Developing and implementing credit policies and procedures

- Monitoring and reviewing accounts for potential credit risks

- Collaborating with sales and finance teams to provide insights on credit limits and terms

- Maintaining accurate records and documentation related to credit assessments

- Providing guidance and recommendations for credit decisions to management

Essential skills required for a Credit Specialist include:

- Strong analytical and critical thinking skills

- Attention to detail and accuracy

- Excellent communication and interpersonal skills

- Proficiency in financial analysis and risk assessment

- Knowledge of credit laws and regulations

- Problem-solving skills to address credit-related issues

- Experience with credit management software and tools

Highlighting these skills effectively in the resume skills section is crucial, as it allows potential employers to quickly assess your qualifications. Tailoring these responsibilities and skills to align with the specific job description will increase your chances of standing out in the application process. Additionally, consider how these skills can be integrated into a strong CV, showcasing your ability to contribute effectively to a potential employer's credit management strategies.

Best Resume Format and Structure for a Credit Specialist

When crafting a resume for a Credit Specialist position, it's essential to choose a format that highlights your qualifications, experience, and skills effectively. Below is a detailed guide on the best resume format and structure, including key sections and tips for each.

Contact Information

- What to Include:

- Full name

- Professional title (e.g., Credit Specialist)

- Phone number

- Email address

- LinkedIn profile (optional)

- Location (city and state)

Professional Summary

- What to Include:

- A brief 2-3 sentence overview of your career highlights, emphasizing your experience in credit analysis, risk assessment, and relationship management.

- Use quantifiable achievements (e.g., "Successfully reduced delinquency rates by 15% through strategic credit policies").

- Tips: Tailor this section to reflect the specific requirements of the job you’re applying for, making it clear why you are a strong candidate.

Work Experience

- What to Include:

- Job title, company name, location, and dates of employment for each position.

- Bullet points detailing your responsibilities and achievements, focusing on those relevant to credit analysis and management.

- Tips: Use action verbs and quantify achievements (e.g., "Reviewed and analyzed credit applications for accuracy, resulting in a 20% increase in approval rates"). Prioritize your most recent experiences.

Education

- What to Include:

- Degree(s) obtained, institution names, and graduation dates.

- Relevant coursework or honors, particularly those related to finance, accounting, or business.

- Tips: If you have advanced degrees or certifications, place this section after the Professional Summary or Work Experience to highlight your advanced qualifications.

Skills

- What to Include:

- A list of relevant skills such as credit analysis, risk assessment, financial reporting, data analysis, and knowledge of credit regulations.

- Tips: Tailor this list to match the job description, including both hard and soft skills. Consider using a mix of technical skills (e.g., proficiency in credit analysis software) and interpersonal skills (e.g., strong communication skills).

Certifications

- What to Include:

- Any relevant certifications, such as Certified Credit Professional (CCP), Certified Risk Manager (CRM), or others related to finance and credit.

- Tips: List the certification name, issuing organization, and date obtained. If you are pursuing certifications, you can mention them as "In Progress."

Format and Structure Tips

- Resume Format: The reverse chronological format is often the best choice for a Credit Specialist because it showcases your most recent experience first, making it easier for hiring managers to see your latest achievements.

- Font and Design: Use a clean, professional font (like Arial or Calibri) and ensure consistent formatting throughout your resume. Keep the layout organized with clear headings and ample white space to enhance readability.

- Length: Aim for one page if you have less than 10 years of experience; two pages may be acceptable for more extensive backgrounds.

Complementing Your Cover Letter

The resume format you choose should align with your cover letter format. Use the same fonts, colors, and overall design style to create a cohesive application package. Your cover letter should expand on the highlights of your resume, providing context and narrative to your qualifications, while your resume offers a structured overview of your skills and experiences.

By carefully structuring your resume and aligning it with your cover letter, you can present a professional image that captures the attention of hiring managers and enhances your chances of securing an interview.

Writing Tips and Best Practices for a Credit Specialist Resume

When crafting a resume as a Credit Specialist, it's essential to present your skills and experiences in a clear, compelling manner that highlights your expertise in financial analysis, credit evaluation, and risk management. A well-structured resume not only showcases your qualifications but also makes a strong first impression on potential employers. To enhance your resume, consider the following tips:

- Use action verbs such as "analyzed," "evaluated," and "managed" to convey your impact effectively.

- Quantify your achievements with specific metrics, such as "reduced delinquency rates by 15%" or "managed a portfolio of over $2 million."

- Incorporate industry-specific keywords relevant to credit analysis and finance to pass through applicant tracking systems (ATS).

- Tailor your resume for each job application by aligning your skills and experiences with the job description.

- Keep your format clean and professional; use bullet points for easy readability.

- Highlight relevant certifications, such as Certified Credit Professional (CCP) or Financial Risk Manager (FRM), to demonstrate your commitment to the field.

- Ensure your resume is concise, ideally one page, unless you have extensive relevant experience.

Remember, utilizing resume writing tips can greatly enhance the professional appearance of your document. Additionally, consider how these best practices can be applied when drafting your cover letter, ensuring a cohesive presentation of your qualifications.

Common Mistakes to Avoid in a Credit Specialist Resume

When crafting a resume for a Credit Specialist position, it’s crucial to present your qualifications and experience in a manner that stands out to potential employers. However, many candidates fall into common traps that can undermine their chances of landing an interview. Avoiding these mistakes can significantly enhance the effectiveness of your resume, ensuring it accurately reflects your skills and experiences relevant to the role. Here are some common mistakes to steer clear of:

- Overloading your resume with excessive information that can overwhelm the reader.

- Using generic job descriptions that fail to highlight your unique contributions.

- Neglecting to tailor your resume to the specific job you are applying for.

- Failing to quantify achievements, which can make your accomplishments seem less impactful.

- Ignoring the importance of formatting, leading to a cluttered and unprofessional appearance.

- Using jargon or technical terms that may not be understood by all hiring managers.

- Listing responsibilities without demonstrating how you added value or achieved results.

- Omitting relevant keywords that align with the job description, which can affect the chances of passing through Applicant Tracking Systems (ATS).

- Not proofreading for spelling and grammatical errors, which can create a negative impression.

- Including outdated or irrelevant information that doesn’t pertain to the Credit Specialist role.

To ensure your resume is polished and effective, consider reviewing the common mistakes to avoid in a resume. Additionally, don't overlook the importance of your cover letter; check out the common cover letter mistakes that should also be avoided to create a cohesive application package.

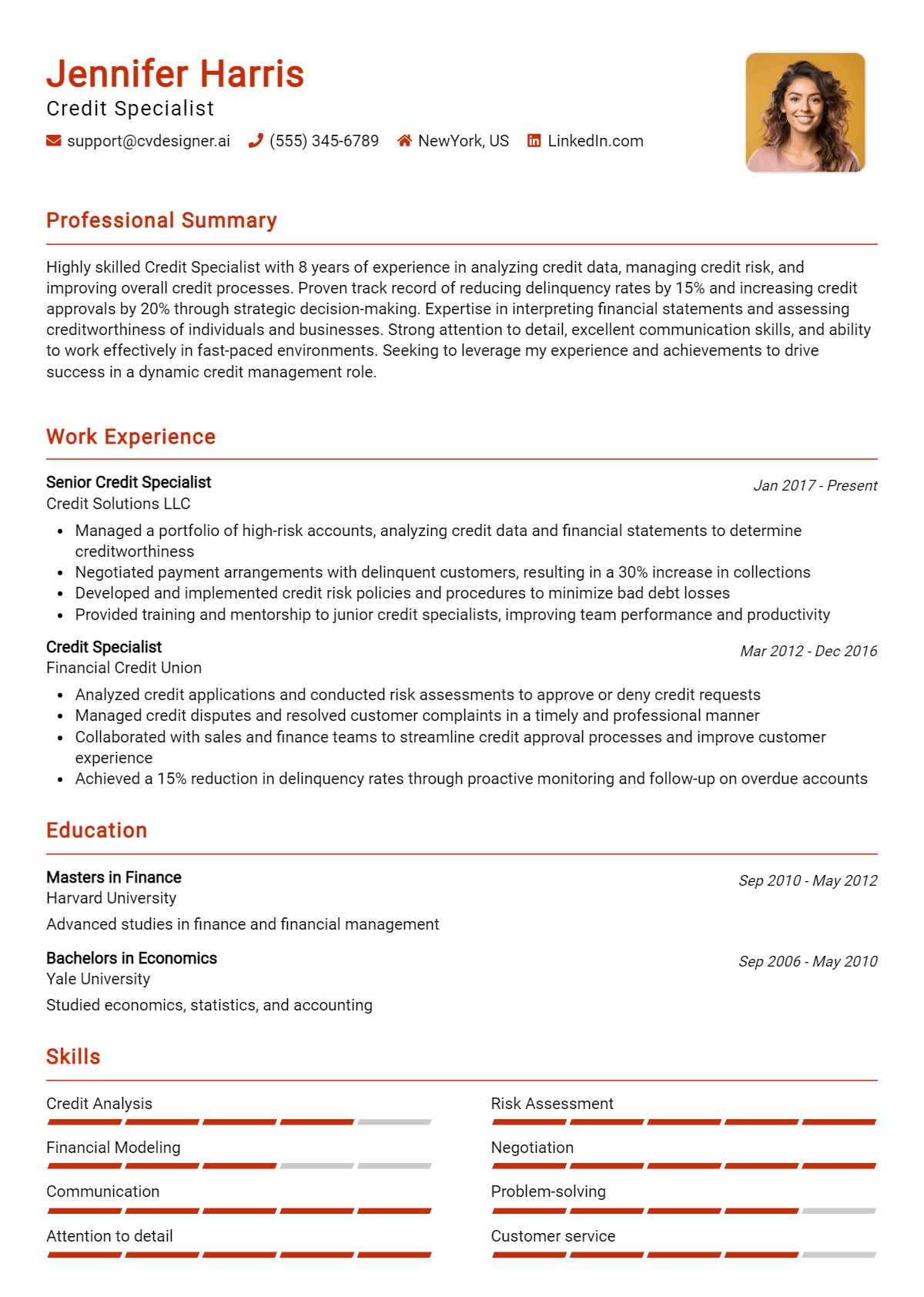

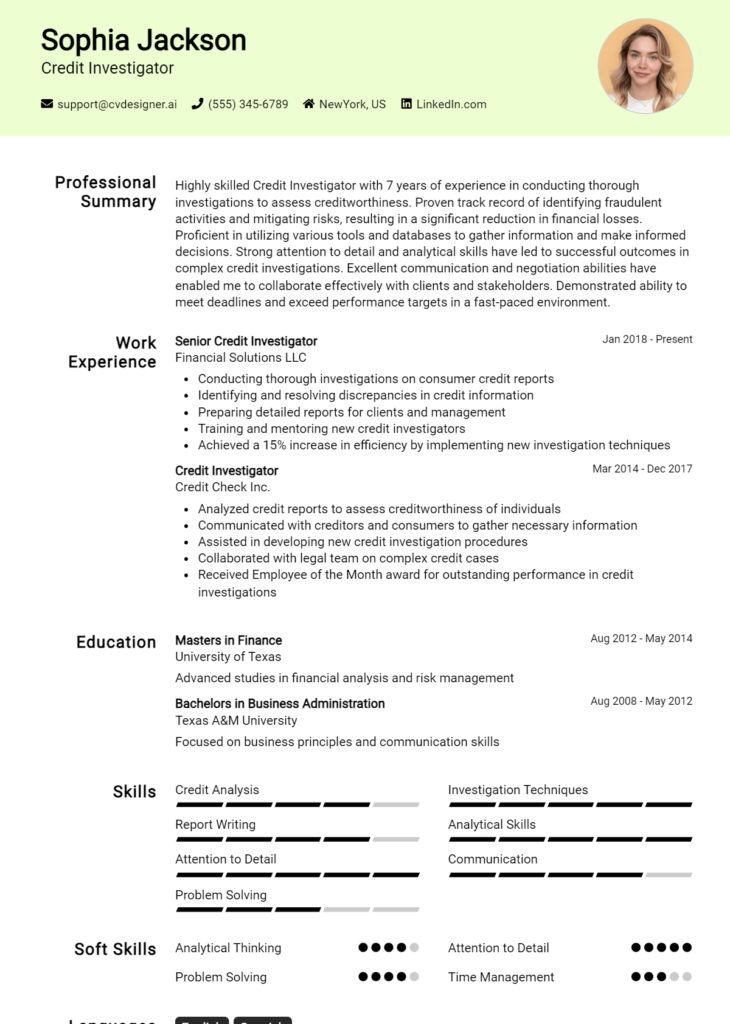

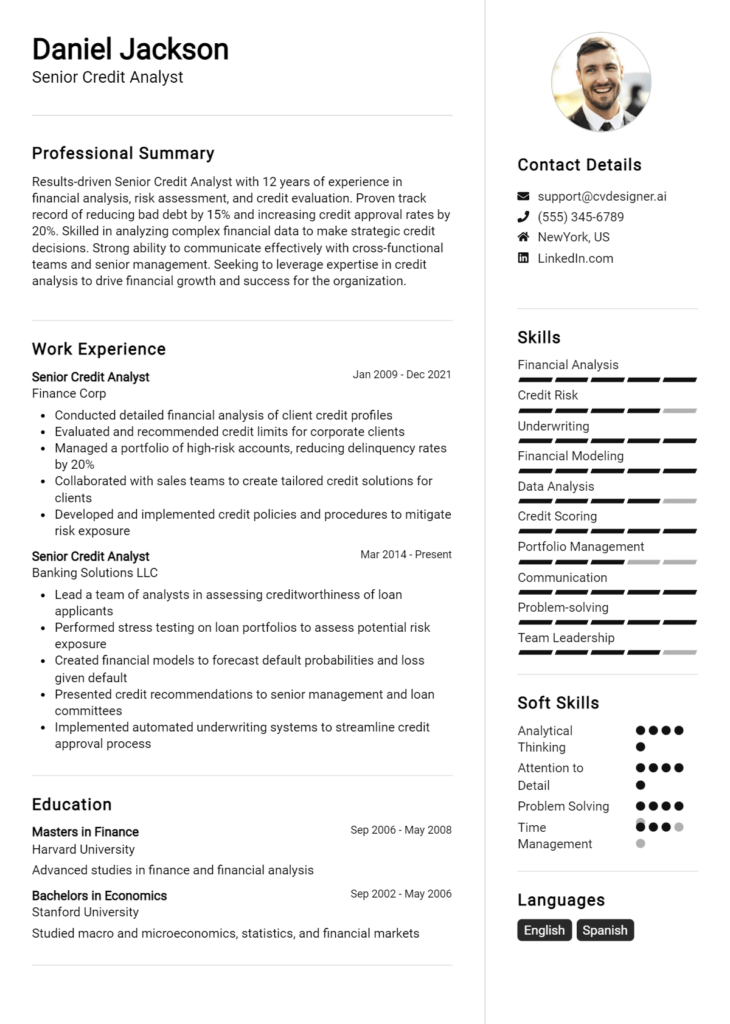

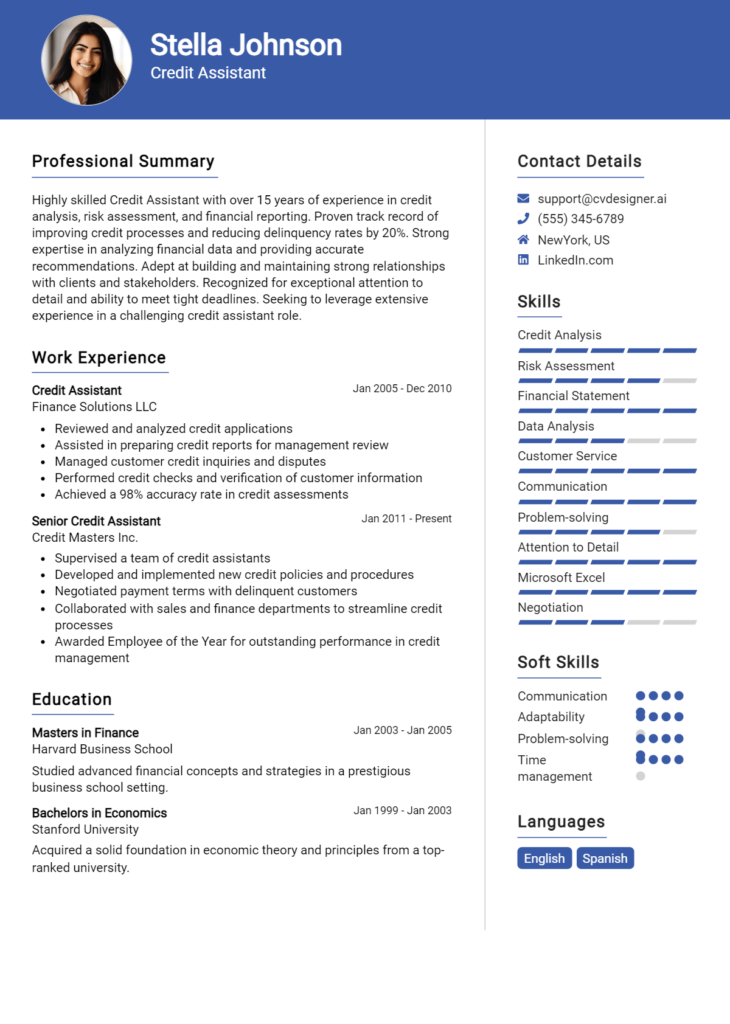

Sample Credit Specialist Resumes

As a Credit Specialist, your role is pivotal in managing and analyzing credit risk, ensuring that clients are able to obtain the financing they need while safeguarding the interests of the lending institution. Crafting an effective resume is essential to showcase your skills, experience, and qualifications. Below are three sample resumes tailored to different levels of experience in the Credit Specialist field: one for an experienced professional, one for an entry-level candidate, and one for a career changer. These examples can serve as a guide to help you create your own standout resume.

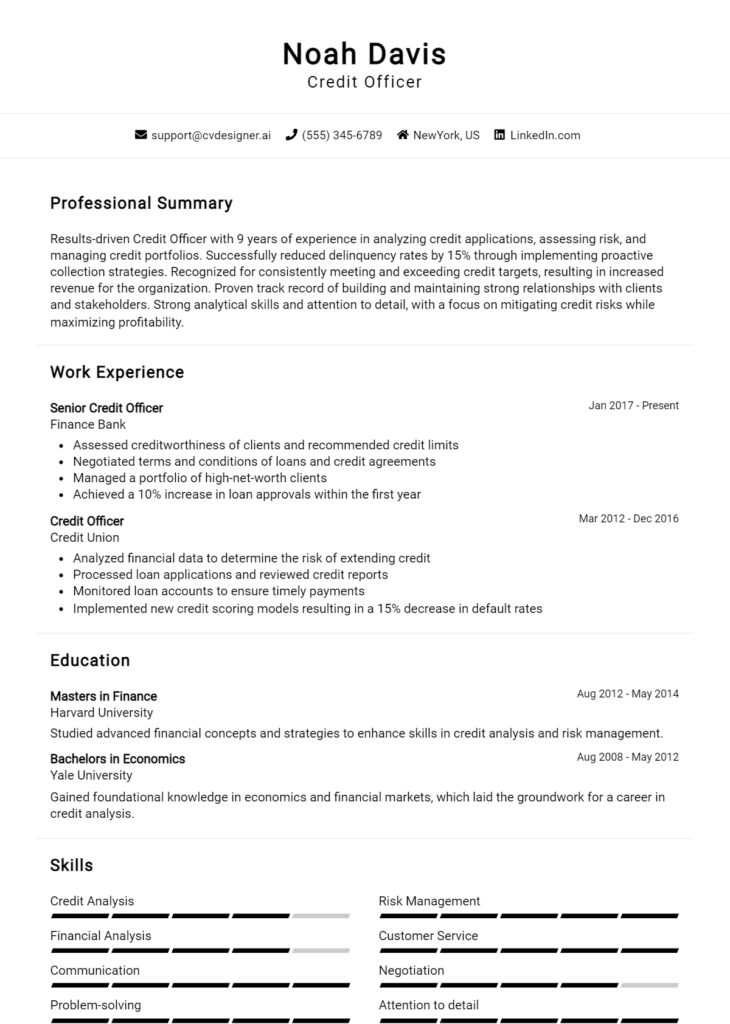

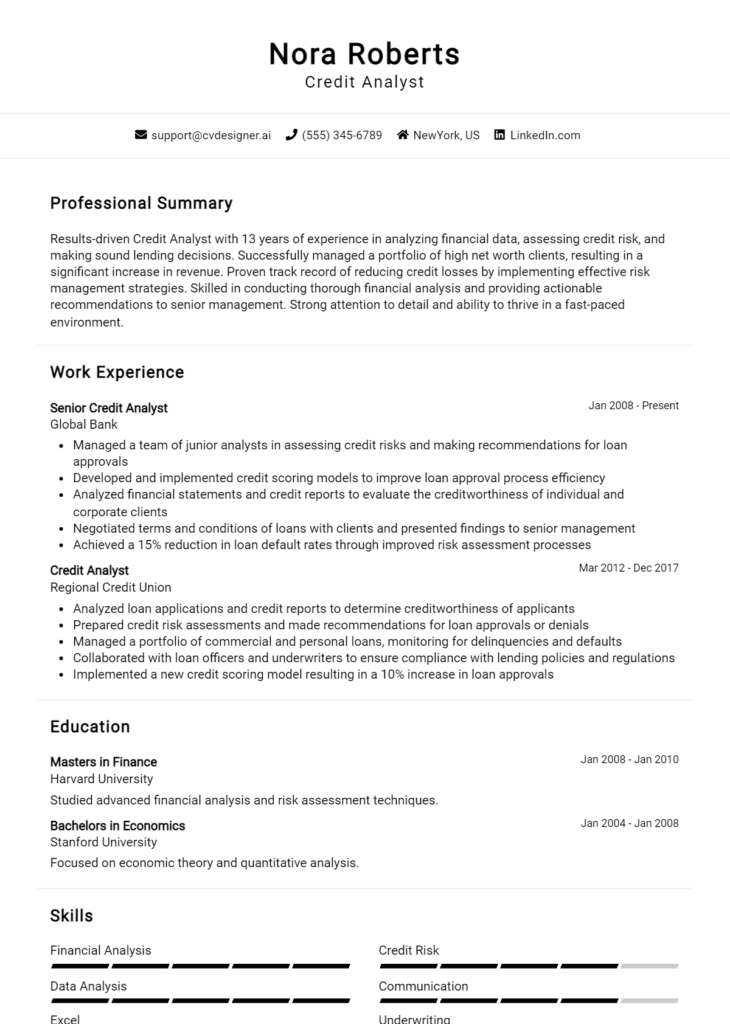

Experienced Credit Specialist Resume Sample

Jane Doe

123 Finance St.

New York, NY 10001

(555) 123-4567

janedoe@email.com

Professional Summary

Detail-oriented and results-driven Credit Specialist with over 8 years of experience in credit analysis and risk management. Proven track record of effectively evaluating creditworthiness, enhancing credit policies, and improving collection processes. Strong analytical skills combined with excellent communication abilities.

Experience

Senior Credit Specialist

ABC Financial Services, New York, NY

June 2018 – Present

- Conduct comprehensive credit assessments for corporate clients, resulting in a 20% reduction in default rates.

- Collaborate with the underwriting team to refine credit policies and improve approval processes.

- Train and mentor junior credit analysts on credit evaluation techniques and risk assessment methodologies.

Credit Analyst

XYZ Bank, New York, NY

January 2015 – May 2018

- Analyzed financial statements and credit reports to make informed lending decisions.

- Developed and maintained relationships with clients to facilitate the credit review process.

- Assisted in the implementation of new credit scoring models that increased efficiency by 30%.

Education

Bachelor of Science in Finance

University of New York, New York, NY

Graduated: May 2014

Entry-Level Credit Specialist Resume Sample

John Smith

456 Credit Ave.

Los Angeles, CA 90001

(555) 987-6543

johnsmith@email.com

Objective

Motivated and detail-oriented recent finance graduate seeking an entry-level Credit Specialist position to leverage strong analytical skills and a solid understanding of credit principles.

Education

Bachelor of Arts in Finance

University of California, Los Angeles, CA

Graduated: June 2023

- Relevant Coursework: Credit Analysis, Risk Management, Financial Reporting

Internship Experience

Credit Intern

DEF Lending Co., Los Angeles, CA

January 2023 – May 2023

- Assisted in evaluating loan applications and conducting credit checks.

- Collaborated with team members to review credit reports and prepare summaries for senior analysts.

- Gained hands-on experience with credit evaluation software and data analysis tools.

Skills

- Proficient in Microsoft Excel and credit analysis software

- Strong analytical and problem-solving skills

- Excellent written and verbal communication

Career Changer Credit Specialist Resume Sample

Emily Johnson

789 Business Rd.

Chicago, IL 60601

(555) 321-6549

emilyjohnson@email.com

Professional Summary

Dynamic professional transitioning into the finance sector with 5 years of experience in customer service and business operations. Strong analytical skills and a passion for finance, seeking to apply transferable skills in a Credit Specialist role.

Experience

Operations Manager

GHI Retail Group, Chicago, IL

March 2018 – Present

- Managed daily operations and trained staff on financial transactions and reporting.

- Analyzed sales data to assess credit risks and develop strategic plans to mitigate potential losses.

- Enhanced customer satisfaction scores by 25% through effective communication and problem-solving.

Customer Service Representative

JKL Services, Chicago, IL

June 2016 – February 2018

- Provided exceptional service to customers, resolving inquiries related to billing and account management.

- Maintained accurate records of client interactions to support credit assessment processes.

Education

Bachelor of Arts in Business Administration

University of Chicago, Chicago, IL

Graduated: May 2016

Skills

- Strong customer service and communication skills

- Excellent analytical and organizational abilities

- Familiarity with financial software and credit assessment tools

For more inspiration, explore our extensive collection of resume templates tailored to various job roles. Additionally, don’t forget to check out our cover letter examples to complement your resume and create a comprehensive job application package.

Checklist for a Credit Specialist Resume

- Proofread for Spelling and Grammar: Carefully read through your resume to catch any spelling mistakes or grammatical errors. Consider using tools like Grammarly for assistance.

- Check for Consistency: Ensure that the formatting, font style, and size are consistent throughout the document. This includes headings, bullet points, and spacing.

- Tailor to the Job Description: Review the job posting and incorporate relevant keywords and phrases that highlight your qualifications and experience specific to the Credit Specialist role.

- Highlight Relevant Experience: Focus on your experience in credit analysis, risk assessment, and customer service. Use bullet points to clearly outline your achievements and responsibilities.

- Include Quantifiable Achievements: Whenever possible, include numbers or percentages to showcase your impact, such as improvements in credit approval times or reductions in default rates.

- Keep it Concise: Aim for a one-page resume if you have less than 10 years of experience. Be concise and eliminate any unnecessary information.

- Use Action Verbs: Start each bullet point with strong action verbs to convey your contributions effectively, such as "analyzed," "developed," or "managed."

- Check Contact Information: Ensure that your contact details are accurate and professional. Include your name, phone number, email address, and LinkedIn profile if applicable.

- Consider Visual Appeal: Use an AI resume builder like CV Designer to create a visually appealing layout that enhances readability and organization.

- Adapt for Other Documents: Remember that a similar checklist can be followed when creating a CV or cover letter, ensuring all your professional documents are polished and effective.

Key Takeaways for a Credit Specialist Resume Guide

In conclusion, crafting a strong resume as a Credit Specialist is essential to stand out in a competitive job market. By utilizing the provided examples and tips, you can effectively highlight your skills and experiences that are most relevant to the role. Remember to focus on your analytical abilities, attention to detail, and customer service skills, as these are key attributes that employers look for.

As the next step, consider downloading a professional resume template from resume templates to help structure your information effectively. If you also need a cover letter, explore our collection of cover letter templates to complement your application. For a more personalized touch, our best resume maker can guide you in creating a tailored resume that showcases your qualifications.

Moreover, following similar guidelines will not only enhance your resume but also aid in crafting a compelling CV and an impactful cover letter. Take these steps to ensure your application stands out and increases your chances of landing that desired position as a Credit Specialist.