As the backbone of the insurance industry, Claims Investigators play a crucial role in ensuring that claims are handled fairly and accurately. Their expertise not only protects companies from fraudulent claims but also ensures that genuine claims are processed efficiently, ultimately providing peace of mind to policyholders. Given the complexity and importance of this role, crafting a compelling resume is essential to stand out in a competitive job market. A well-written resume not only highlights your qualifications but also showcases your understanding of the claims process and your ability to analyze intricate details—skills that are invaluable in this position.

In this comprehensive guide, we will explore the key responsibilities and skills that make an exceptional Claims Investigator, helping you understand what employers are looking for. We’ll discuss the best resume formats to use, ensuring your experience is presented in the most effective way. Common mistakes to avoid will be highlighted, so you don’t fall into the trap of overlooking critical elements. Additionally, we will provide resume examples tailored to various experience levels, giving you concrete references to draw from. Lastly, we’ll share practical tips on writing an impactful resume and selecting the right resume templates to make your application shine. Prepare to elevate your job application with insights that could set you apart from the competition!

Key Responsibilities and Skills for a Claims Investigator

As a Claims Investigator, one of the primary responsibilities is to thoroughly examine insurance claims to determine their validity. This involves gathering and reviewing documentation, interviewing claimants and witnesses, and collaborating with other professionals, such as law enforcement and medical experts, to gather necessary information. Investigators must also evaluate the evidence collected to identify any discrepancies or fraudulent activity, and subsequently prepare detailed reports outlining their findings.

Key Responsibilities:

- Review and analyze insurance claims to verify their legitimacy

- Conduct interviews with claimants, witnesses, and experts to gather relevant information

- Collect and assess evidence, including documents, photographs, and medical records

- Collaborate with law enforcement and legal teams when necessary

- Prepare comprehensive reports detailing findings and recommendations

- Maintain accurate records of investigations and correspondence

- Stay updated on industry regulations and fraud detection techniques

Essential Skills:

- Strong analytical and critical thinking abilities

- Excellent communication and interpersonal skills

- Attention to detail and strong observational skills

- Knowledge of insurance policies and procedures

- Proficiency in research and investigative techniques

- Ability to work independently and manage time effectively

- Familiarity with legal and regulatory frameworks

Highlighting these skills effectively in the resume skills section is crucial for a Claims Investigator role. Tailoring these responsibilities and skills to align with the specific job description can significantly enhance your chances of being noticed by hiring managers. Consider how each skill not only aligns with the job requirements but also illustrates your qualifications in a strong CV. By doing so, you can present yourself as a compelling candidate well-suited to meet the demands of the position.

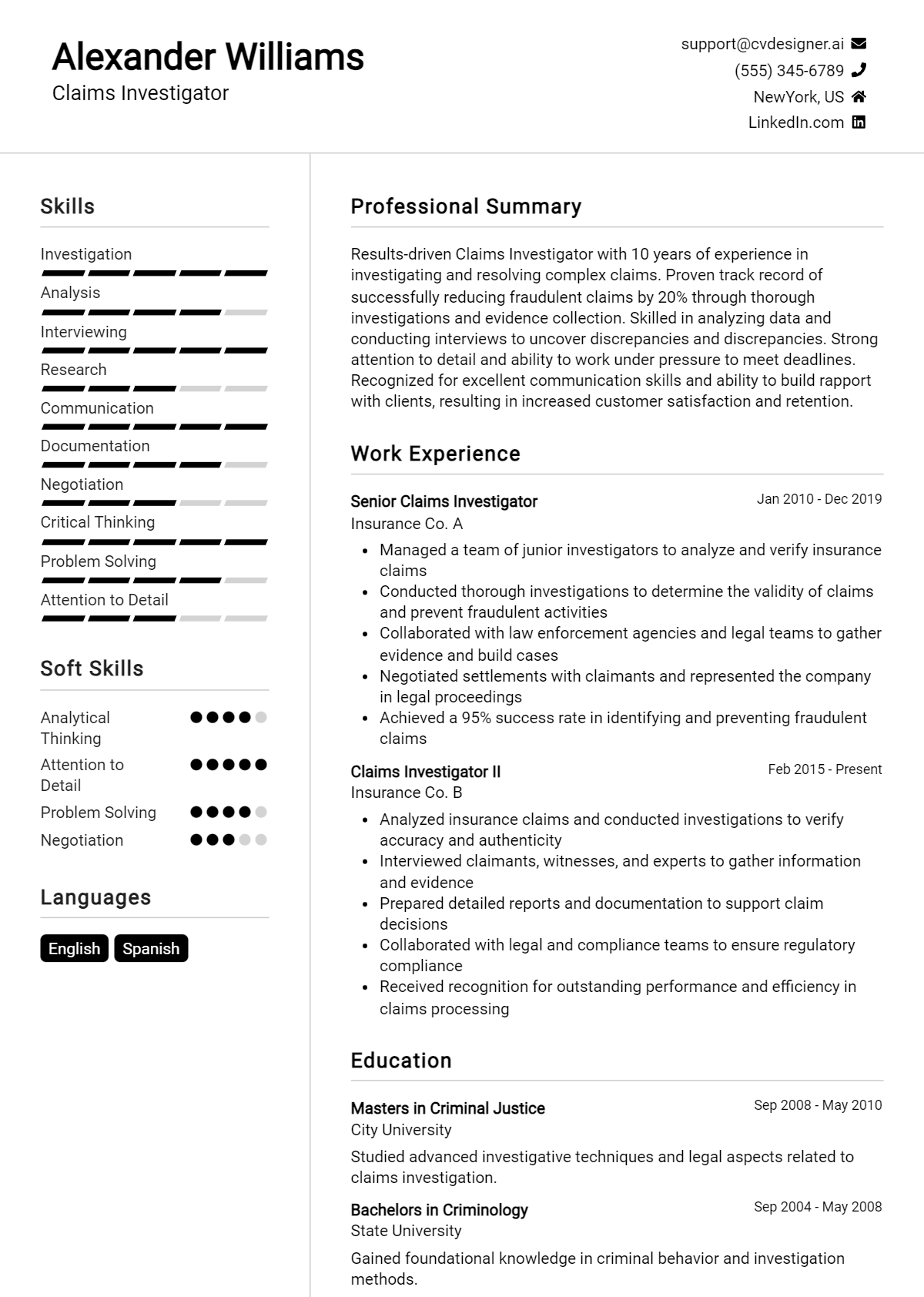

Best Resume Format and Structure for a Claims Investigator

When crafting a resume for a Claims Investigator position, it’s important to choose a format that highlights your relevant experience, skills, and qualifications effectively. Here’s a detailed guide on the best resume format and structure for this role.

Contact Information

- Name: Your full name should be prominently displayed at the top of the resume.

- Phone Number: Include your primary contact number.

- Email Address: Use a professional email address.

- LinkedIn Profile (optional): If you have a LinkedIn profile that showcases your professional history, include a link.

Professional Summary

This section should be a brief overview of your qualifications, experience, and what makes you a great fit for the Claims Investigator role. Aim for 3-4 sentences that encapsulate your expertise in investigations, knowledge of claims processes, and any specific areas of specialization (e.g., insurance, fraud detection).

Example: “Detail-oriented Claims Investigator with over 5 years of experience in analyzing claims and uncovering fraudulent activities. Proven track record of resolving complex cases and providing accurate reporting to ensure compliance with industry regulations. Strong analytical skills combined with exceptional attention to detail.”

Work Experience

List your work experience in reverse chronological order, starting with your most recent position. For each role, include:

- Job Title: Clearly state your title.

- Company Name: Include the name of the organization.

- Location: City and state of the company.

- Dates of Employment: Use month and year format (e.g., Jan 2020 – Present).

- Bullet Points: Under each job, use bullet points to detail your responsibilities and achievements. Focus on quantifiable results and specific contributions, such as successful investigations, reduction in fraud cases, or improvements in claims processing time.

Example:

- Conducted thorough investigations of insurance claims, resulting in a 30% reduction in fraudulent payouts.

- Collaborated with legal teams to prepare cases for litigation, enhancing the department’s success rate by 15%.

Education

List your educational background, starting with the most recent degree:

- Degree: Specify the degree obtained (e.g., Bachelor of Science in Criminal Justice).

- Institution: Name of the college or university.

- Graduation Date: Month and year of graduation (e.g., May 2018).

- Relevant Coursework (optional): If applicable, mention courses relevant to claims investigation.

Skills

Include a section dedicated to highlighting skills relevant to the Claims Investigator role. Use bullet points for clarity and consider including both hard and soft skills, such as:

- Analytical thinking

- Attention to detail

- Knowledge of insurance regulations

- Investigative techniques

- Communication skills

- Proficiency in claims management software

Certifications

If you have any relevant certifications, list them in this section. Include:

- Certification Name: Name of the certification (e.g., Certified Fraud Examiner).

- Issuing Organization: Who issued the certification.

- Date Obtained: When you received it.

Tips for Formatting

- Font and Size: Use a clean, professional font (e.g., Arial, Calibri) in 10-12 point size.

- Margins: Keep margins between 0.5 to 1 inch to ensure readability.

- Length: Ideally, limit your resume to one page unless you have extensive experience.

- Consistency: Ensure consistent formatting throughout, including bullet points, headings, and spacing.

This format not only organizes your information effectively but also complements a corresponding cover letter. Use a similar font and style for your cover letter to maintain a cohesive look. Your cover letter can expand on the experiences listed in your resume, allowing you to demonstrate your passion for the role and explain why you are the ideal candidate.

By following this structured approach, you can create a compelling resume that stands out to potential employers in the field of claims investigation.

Writing Tips and Best Practices for a Claims Investigator Resume

When crafting a resume for a Claims Investigator position, it's essential to present your skills and experiences in a clear and compelling manner. Focus on showcasing your investigative skills, attention to detail, and ability to analyze complex information. Use a clean format that enhances readability, and make sure to tailor your resume to the specific job you are applying for, highlighting relevant experiences that align with the job description. Additionally, employing resume writing tips can greatly enhance the professionalism of your document. Remember that the same principles apply to your cover letter, where you can further elaborate on your qualifications and interest in the role.

- Use action verbs such as "investigated," "analyzed," "resolved," and "collaborated" to convey your contributions effectively.

- Quantify your achievements whenever possible, for example, "reduced claim processing time by 30%" or "successfully resolved 95% of cases."

- Incorporate industry-specific keywords from the job listing to pass through applicant tracking systems and to demonstrate your familiarity with the field.

- Highlight relevant certifications or training specific to claims investigation, such as fraud detection or insurance law.

- Tailor your resume to emphasize skills that are in high demand, like negotiation, communication, and critical thinking.

- Ensure that your resume is free from errors and formatted consistently to present a polished and professional appearance.

- Consider adding a summary statement at the beginning of your resume that encapsulates your key qualifications and career objectives.

- Keep your resume concise, ideally one page, and limit your experiences to those most relevant to the Claims Investigator role.

Common Mistakes to Avoid in a Claims Investigator Resume

When crafting a resume for the role of a Claims Investigator, it's crucial to present your qualifications and experiences effectively. However, many candidates inadvertently make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more compelling and professional resume that accurately reflects your skills and suitability for the position. Below are some prevalent errors to steer clear of:

- Overloading the resume with excessive information, making it overwhelming to read.

- Using generic descriptions that fail to highlight specific skills and achievements.

- Neglecting to tailor the resume to the specific job description, missing out on relevant keywords.

- Focusing too much on responsibilities rather than accomplishments, which can diminish the impact of your contributions.

- Failing to quantify achievements, such as stating the number of cases investigated or the percentage of claims resolved successfully.

- Ignoring formatting consistency, which can make the resume appear unprofessional.

- Omitting important relevant skills, such as analytical thinking and attention to detail.

- Including outdated or irrelevant experiences that do not contribute to the current job application.

- Using passive language instead of strong action verbs, which can weaken the overall message.

- Forgetting to proofread for grammatical errors and typos, which can leave a negative impression.

To enhance your chances of success, consider reviewing the common mistakes to avoid in a resume for additional insights. Also, don't overlook the importance of a well-crafted cover letter; check out the common cover letter mistakes that should be avoided to ensure your entire application package is polished and professional.

Sample Claims Investigator Resumes

As a Claims Investigator, your role is crucial in assessing and resolving insurance claims, ensuring accuracy and integrity in the process. Crafting a compelling resume is essential to highlight your skills, experience, and suitability for this role. Below are three sample resumes tailored for different experience levels and career paths: an experienced professional, an entry-level candidate, and a career changer. These examples can serve as a valuable guide for your job application.

Experienced Professional Resume

Jane Doe

123 Claim St.

Insurance City, ST 12345

(123) 456-7890

janedoe@email.com

Summary

Detail-oriented Claims Investigator with over 8 years of experience in evaluating complex insurance claims and mitigating fraud risks. Proven track record of reducing loss ratios through meticulous investigations and strong analytical skills.

Professional Experience

Senior Claims Investigator

ABC Insurance Co., Insurance City, ST

March 2018 – Present

- Conduct thorough investigations into high-value and suspicious claims, collaborating with law enforcement and legal teams as necessary.

- Analyze documentation and evidence to determine claim legitimacy, resulting in a 20% reduction in fraudulent claims.

- Train and mentor junior investigators, enhancing team efficiency and accuracy.

Claims Investigator

XYZ Insurance Group, Insurance Town, ST

June 2015 – February 2018

- Investigated property and casualty claims, conducting interviews and site visits to gather relevant information.

- Developed detailed reports for claims approval, ensuring compliance with company policies and state regulations.

- Assisted in the development of new procedures that improved claims processing time by 15%.

Education

Bachelor of Science in Criminal Justice

State University, Insurance City, ST

Graduated May 2015

Skills

- Fraud Detection

- Risk Assessment

- Report Writing

- Communication & Negotiation

- Data Analysis

Entry-Level Candidate Resume

John Smith

456 New Claim Ave.

Insurance Town, ST 67890

(987) 654-3210

johnsmith@email.com

Objective

Motivated and detail-oriented recent graduate seeking an entry-level Claims Investigator position to leverage analytical skills and a keen eye for detail in evaluating insurance claims.

Education

Bachelor of Arts in Business Administration

State University, Insurance Town, ST

Graduated May 2023

Relevant Experience

Intern, Claims Department

XYZ Insurance Co., Insurance Town, ST

January 2023 – April 2023

- Assisted in the review of insurance claims documentation and coordinated with claims adjusters to gather necessary information.

- Conducted preliminary investigations, including interviews with claimants, to support the claims processing team.

- Developed a comprehensive understanding of industry regulations and company policies.

Customer Service Representative

Service Solutions, Insurance City, ST

June 2021 – December 2022

- Provided excellent customer service to clients, addressing inquiries related to insurance claims and policies.

- Maintained accurate records of client interactions and escalated concerns to appropriate departments.

Skills

- Strong Analytical Skills

- Effective Communication

- Team Collaboration

- Customer Service Orientation

- Time Management

Career Changer Resume

Emily Johnson

789 Transition Rd.

Career City, ST 34567

(321) 654-9870

emilyjohnson@email.com

Summary

Dedicated professional transitioning from a background in law enforcement to a Claims Investigator role. Skilled in conducting investigations, gathering evidence, and working collaboratively with diverse teams to achieve results.

Professional Experience

Police Officer

City Police Department, Career City, ST

August 2015 – Present

- Conducted investigations on various incidents, gathering evidence, interviewing witnesses, and preparing detailed reports.

- Collaborated with legal teams to support case prosecution, demonstrating strong analytical and problem-solving skills.

- Developed community outreach programs focused on fraud awareness and prevention.

Security Officer

SafeGuard Security, Career Town, ST

January 2013 – July 2015

- Monitored premises and conducted investigations of incidents, ensuring safety and compliance with regulations.

- Prepared incident reports and provided recommendations for improving security measures.

Education

Associate Degree in Criminal Justice

Community College, Career City, ST

Graduated May 2012

Skills

- Investigative Techniques

- Evidence Collection

- Conflict Resolution

- Strong Communication

- Attention to Detail

Explore more resume templates for inspiration to create your perfect resume. Additionally, corresponding cover letter examples can help you build a complete job application package to enhance your chances of landing your desired role.

Checklist for a Claims Investigator Resume

- Proofread for Errors: Carefully review your resume for spelling, grammar, and punctuation errors. Even minor mistakes can create a negative impression.

- Check Consistency: Ensure that your formatting, font style, and sizes are consistent throughout the document. This includes bullet points, headings, and dates.

- Tailor to the Job Description: Customize your resume to align with the specific job description for the Claims Investigator role. Highlight relevant skills and experiences that match the requirements.

- Use Action Verbs: Start bullet points with strong action verbs to convey your achievements and contributions effectively. Words like "investigated," "analyzed," and "resolved" can make your experience stand out.

- Quantify Achievements: Where possible, use numbers to illustrate your accomplishments, such as the percentage of claims investigated successfully or the number of cases resolved.

- Include Relevant Skills: Highlight key skills that are pertinent to the role of a Claims Investigator, such as analytical skills, attention to detail, and knowledge of insurance policies.

- Keep it Concise: Aim for a clear and concise resume, ideally one page. Focus on the most relevant information and avoid unnecessary details.

- Format for Readability: Use clear headings, bullet points, and spacing to make your resume easy to read. A well-organized document is more likely to catch the hiring manager's eye.

- Get Feedback: Have a friend or colleague review your resume to provide constructive feedback. A fresh set of eyes can catch errors you might have missed.

- Consider an AI Resume Builder: Use an AI resume builder to ensure your resume is well-organized and visually appealing. The tool can help you streamline the process and enhance the overall presentation.

Remember, a similar checklist can be followed when creating a CV or cover letter to ensure all documents are polished and professional.

Key Takeaways for a Claims Investigator Resume Guide

In conclusion, crafting a strong Claims Investigator resume is essential for standing out in a competitive job market. By utilizing the examples and tips provided, you can effectively showcase your skills and experience, making a compelling case for your candidacy. We encourage you to take the next step in your job search by downloading a professional resume template from resume templates or a tailored cover letter template from cover letter templates. For those looking for a more personalized approach, our best resume maker offers an easy way to design your resume. Remember, adhering to these guidelines will not only help you create an impressive resume but will also assist in developing a captivating CV and cover letter. Start your journey today and make your application stand out!