Are you looking to kickstart your career as a Teller in the banking industry? Crafting a compelling CV is the first step towards landing your dream job. In this comprehensive guide, we will walk you through the essential tips and tricks to create a stellar Teller CV that will impress potential employers. From highlighting your relevant skills and experience to showcasing your customer service expertise, we've got you covered. Stay tuned for expert advice and a sample Teller CV that will set you apart from the competition. Let's dive in!

Key points covered in this article:

- Crafting a professional summary that highlights your strengths

- Showcasing your relevant experience and skills

- Highlighting your customer service abilities

- Including relevant certifications or training

- Formatting and organizing your CV effectively

- Sample Teller CV for inspiration

What is a Teller CV?

A Teller CV is a crucial document that highlights a Teller's qualifications, experience, and skills to potential employers. It serves as a tool to showcase their expertise in handling financial transactions, providing exceptional customer service, and ensuring accuracy in their work. A well-written Teller CV can make a strong impression on hiring managers and increase the chances of securing a job in the banking industry.

In today's competitive job market, having a professionally crafted CV is essential for Tellers looking to stand out from the crowd. A well-structured CV not only demonstrates a Teller's proficiency in handling cash transactions and maintaining customer satisfaction but also showcases their attention to detail and ability to work efficiently under pressure. By following a comprehensive CV writing guide, Tellers can highlight their relevant skills and experiences effectively, making them more attractive candidates for potential employers.

Key Components of a Teller CV

- Customer service skills

- Cash handling experience

- Attention to detail

- Ability to work in a fast-paced environment

- Knowledge of banking products and services

- Strong communication skills

- Accuracy in processing transactions

- Ability to work as part of a team

- Experience with financial software

- Problem-solving skills

- Sales experience

- Bilingual proficiency

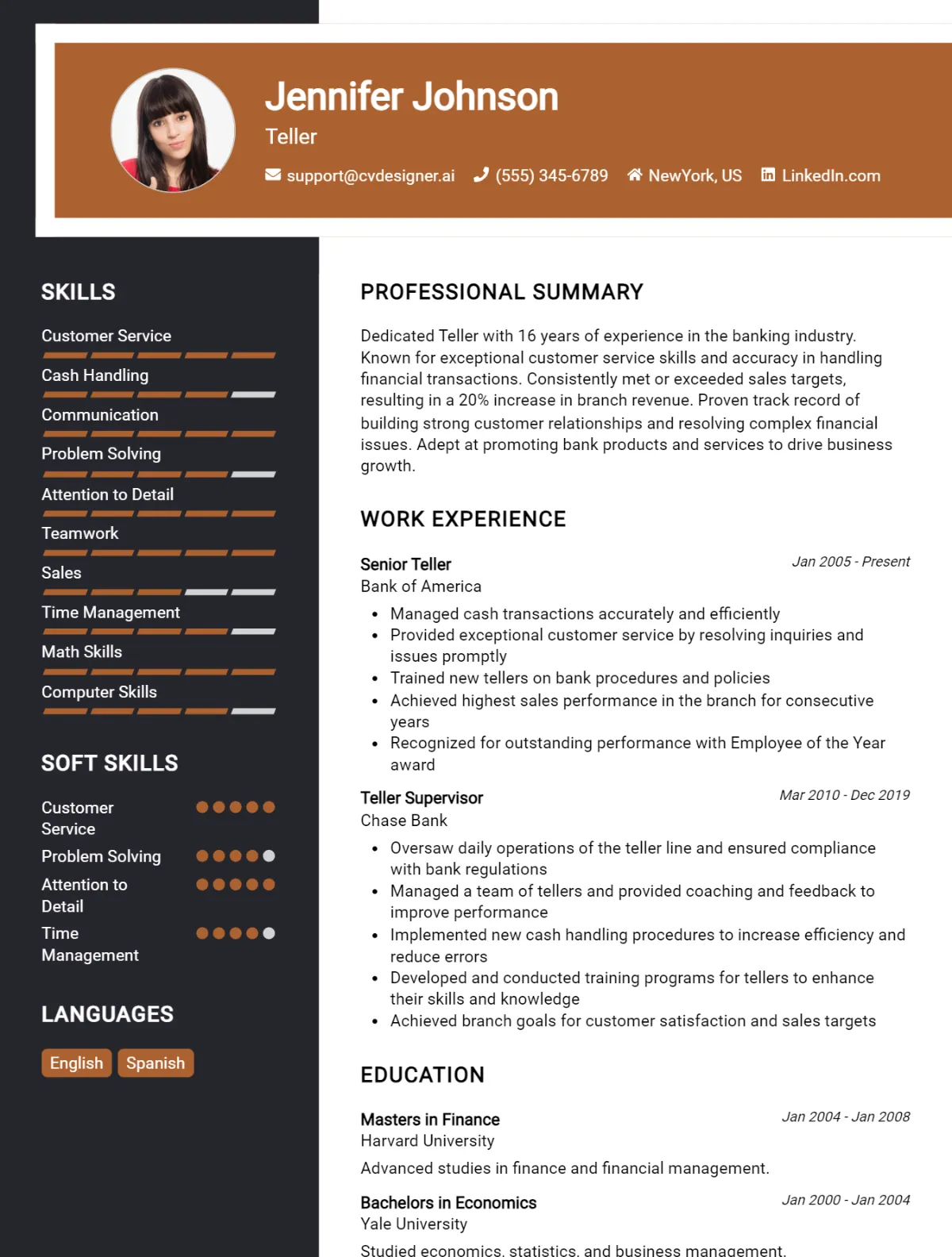

Sample Teller CV for Inspiration

Sample Teller CV

Contact Information: Name: Jane Smith Address: 123 Main Street, City, State, Zip Code Phone: (555) 123-4567 Email: janesmith@email.com

Professional Summary: Experienced and customer-focused Teller with over 5 years of experience in the banking industry. Skilled in handling cash transactions, providing exceptional customer service, and promoting financial products. Adept at working in a fast-paced environment while maintaining accuracy and attention to detail.

Work Experience: Teller - ABC Bank, City, State June 2016 - Present

- Processed customer transactions accurately and efficiently, including deposits, withdrawals, and transfers

- Provided exceptional customer service by addressing inquiries, resolving issues, and promoting bank products

- Balanced cash drawer daily and ensured compliance with bank policies and procedures

- Collaborated with team members to meet branch goals and targets

Teller - XYZ Credit Union, City, State January 2014 - May 2016

- Conducted routine cash transactions for customers, including check cashing and money orders

- Assisted customers with account inquiries, account maintenance, and online banking services

- Participated in cross-selling initiatives to promote credit union products and services

- Maintained a clean and organized work area to enhance customer experience

Education: Bachelor's Degree in Finance - City University, City, State Graduated: May 2013

Skills:

- Strong knowledge of banking products and services

- Proficient in cash handling and transaction processing

- Excellent customer service and communication skills

- Ability to work efficiently in a fast-paced environment

- Attention to detail and accuracy in financial transactions

Certifications: Certified Bank Teller (CBT) - American Bankers Association

Publications: None

References: Available upon request.

Teller CV Writing Tips

When crafting a CV for a Teller position, it's important to highlight your attention to detail, strong numerical skills, and customer service experience. Make sure to include any relevant banking or financial qualifications, as well as any previous experience handling cash transactions. Tailor your CV to the specific job requirements and showcase your ability to work efficiently in a fast-paced environment.

- Start with a strong summary: Begin your CV with a brief summary highlighting your relevant skills and experience as a Teller.

- Highlight your numerical skills: Emphasize your ability to accurately handle cash transactions, balance cash drawers, and spot discrepancies.

- Showcase your customer service experience: Detail your experience working with customers, resolving issues, and providing excellent service.

- Include relevant qualifications: List any banking or financial qualifications you have, such as a degree in finance or a certification in banking operations.

- Use quantifiable achievements: Include specific examples of your successes as a Teller, such as exceeding sales targets or reducing errors in cash handling.

- Keep it concise: Be succinct in your descriptions and use bullet points to make your CV easy to read.

- Customize for each job application: Tailor your CV to each Teller position you apply for, highlighting the most relevant skills and experience.

- Proofread carefully: Double-check your CV for any spelling or grammar errors, and ensure all information is accurate and up-to-date.

Teller CV Summary Examples

As a Teller, I am a dedicated and detail-oriented professional with a strong background in financial transactions and customer service. I possess excellent communication skills, attention to detail, and a proven track record of accuracy and efficiency in handling cash and processing transactions. I am seeking a challenging role where I can utilize my skills and contribute to the success of a reputable financial institution.

- Experienced Teller with over 5 years of experience in processing transactions, handling cash, and providing exceptional customer service in a fast-paced banking environment. Proven track record of accuracy and efficiency in cash handling and balancing daily transactions.

- Detail-oriented Teller with a strong understanding of banking regulations and procedures. Skilled in processing deposits, withdrawals, and transfers, while providing excellent customer service and building strong relationships with clients.

- Results-driven Teller with a passion for delivering exceptional service to customers. Proficient in handling large volumes of cash, processing transactions accurately, and resolving customer inquiries and concerns in a professional manner.

- Motivated Teller with a solid background in financial services and a strong commitment to accuracy and compliance. Skilled in performing end-of-day balancing, maintaining security protocols, and providing personalized assistance to customers to meet their banking needs.

- Customer-focused Teller with a friendly and approachable demeanor, dedicated to providing a positive banking experience for clients. Proficient in operating cash drawers, processing checks, and promoting bank products and services to enhance customer satisfaction and loyalty.

Build a Strong Experience Section for Your Teller CV

As a Teller, I have developed strong communication and customer service skills while handling financial transactions and providing excellent service to clients. My experience in handling cash, processing deposits and withdrawals, and balancing daily transactions has allowed me to excel in this role. Here are some examples of strong work experience descriptions for a Teller CV:

- Processed an average of 200 transactions daily with precision and accuracy, ensuring a high level of customer satisfaction.

- Maintained a balanced cash drawer at the end of each shift, with a 99% accuracy rate.

- Assisted customers with account inquiries, providing information on products and services to meet their financial needs.

- Identified and resolved discrepancies in customer transactions, ensuring compliance with banking regulations.

- Promoted bank products and services to customers, resulting in a 20% increase in cross-selling opportunities.

- Collaborated with team members to streamline processes and improve efficiency in daily operations.

- Conducted thorough verification of customer identification and security procedures to prevent fraud and protect customer accounts.

- Trained new tellers on banking procedures and customer service best practices to ensure a cohesive and knowledgeable team.

Teller CV Education Examples

As a Teller, having a strong educational background can set you apart from other candidates. Here are some examples of educational backgrounds that are relevant to a Teller role:

- Bachelor's degree in Finance or Accounting: A solid understanding of financial principles and practices can be beneficial in a Teller role, as it involves handling money transactions and assisting customers with their financial needs.

- Associate's degree in Business Administration: This degree provides a good foundation in business concepts and customer service skills, which are essential for a Teller to effectively interact with clients and provide excellent service.

- High school diploma or GED: While not a formal educational degree, having a high school diploma or GED is typically required for a Teller position. It demonstrates basic education and competency in math and communication skills.

- Certification in Banking: Obtaining a certification in banking, such as a Certified Bank Teller (CBT) designation, can demonstrate specialized knowledge and skills in the banking industry, making you a more competitive candidate for a Teller role.

- Continuing education in customer service or financial literacy: Taking courses or workshops in customer service or financial literacy can enhance your skills in dealing with customers and providing them with valuable information and assistance as a Teller.

Skills to Highlight in Your Teller CV

As a Teller, it's essential to possess a unique blend of soft and hard skills to excel in your role. Soft skills such as communication and customer service are crucial for building rapport with clients, while hard skills like cash handling and attention to detail are necessary for accuracy in financial transactions. Highlighting these skills in your Teller CV can showcase your ability to provide excellent service and maintain a high level of professionalism in a fast-paced banking environment.

Soft Skills:

- Communication

- Customer service

- Problem-solving

- Time management

- Teamwork

- Adaptability

- Conflict resolution

- Attention to detail

- Organization

- Empathy

Hard Skills:

- Cash handling

- Numeracy

- Banking regulations knowledge

- Computer literacy

- Financial product knowledge

- Fraud prevention

- Data entry

- Sales skills

- Multitasking

- Compliance with policies and procedures.

Teller CV Format

As a Teller, it is essential to have a well-crafted CV that showcases your skills and experience in the banking industry. When it comes to formatting your CV, it is important to keep it clean, organized, and easy to read. For entry-level positions, a simple and straightforward format is best, while for more senior roles, you may want to include additional sections such as a summary of qualifications or a list of accomplishments. Here are some key points to keep in mind when formatting your Teller CV:

- Start with a clear and concise summary of your skills and experience

- Include a section for your education and any relevant certifications

- Highlight your customer service and communication skills

- List any relevant work experience in the banking industry

- Include any additional skills or languages spoken that may be relevant to the role

For more tips on CV formatting, check out this cv format article.

Common Mistakes to Avoid in a Teller CV

As a Teller, your CV is your first impression to potential employers. Avoiding common mistakes can help you stand out and increase your chances of landing the job. Here are some common mistakes to avoid in a Teller CV:

- Not tailoring your CV to the specific job you are applying for

- Including irrelevant work experience or skills

- Failing to highlight your customer service skills

- Using generic language instead of specific examples of your accomplishments

- Neglecting to proofread for spelling and grammar errors

- Not including any relevant certifications or training

- Using a generic or unprofessional email address

- Focusing too much on duties rather than achievements

- Forgetting to include contact information or having outdated contact information

- Using a cluttered or hard-to-read format

Key Takeaways for a Teller CV

- Include a professional summary at the top of your CV to highlight your experience and skills relevant to the Teller role.

- List your relevant work experience in reverse chronological order, starting with your most recent job.

- Highlight your proficiency in handling cash transactions and balancing cash drawers accurately.

- Showcase your knowledge of banking products and services to assist customers with their inquiries.

- Mention any certifications or training related to banking or customer service.

- Emphasize your strong communication skills and ability to work efficiently in a fast-paced environment.

- Use action verbs to describe your responsibilities and achievements in previous Teller positions.

- Customize your CV for each job application by tailoring your skills and experiences to match the job requirements.

For more guidance on creating a standout CV, check out our CV Templates and use our CV Builder to easily create a professional-looking document. Don't forget to also explore our Cover Letter Templates for a well-rounded job application package.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.