As the financial landscape continues to evolve, the role of a Credit Investigator is becoming increasingly vital in assessing creditworthiness and preventing fraud. Crafting a compelling CV that showcases your expertise in credit analysis, investigative techniques, and communication skills is essential for standing out in this competitive field. In this guide, we will delve into the nuances of writing an effective Credit Investigator CV, ensuring you present your qualifications in the best light. Here's what you'll discover:

- Understanding the Role: Insights into the responsibilities and skills essential for a Credit Investigator.

- CV Structure: How to format your CV to capture attention and highlight your strengths.

- Key Skills to Highlight: Essential skills and qualifications that employers look for in candidates.

- Tailoring Your CV: Tips on customizing your CV for specific job applications to increase your chances of success.

- Common Mistakes to Avoid: Pitfalls to watch out for that could undermine your CV's impact.

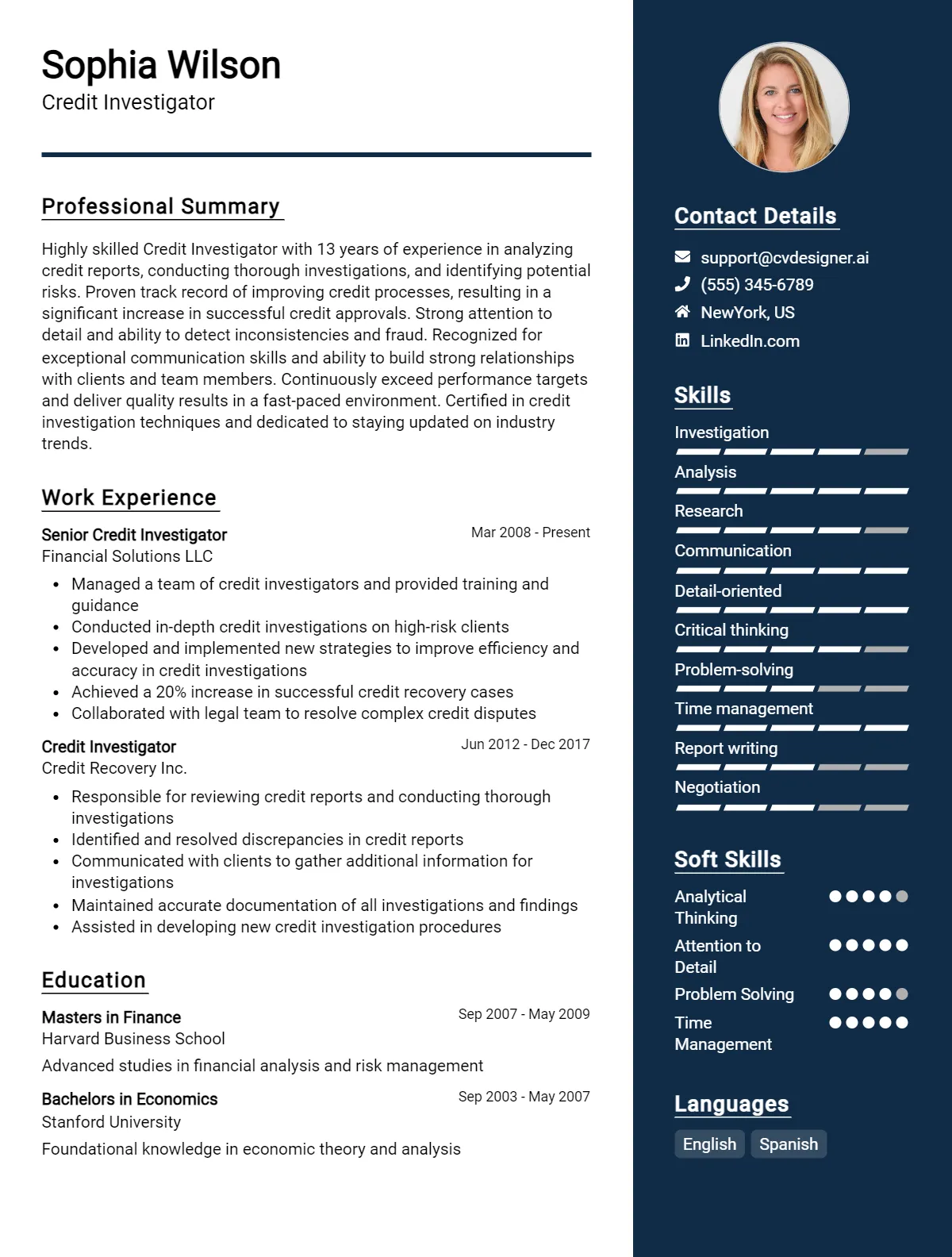

- CV Example: A comprehensive example of a well-crafted Credit Investigator CV to guide your writing process.

By the end of this article, you’ll be equipped with the knowledge and tools necessary to create a standout CV that aligns with the expectations of hiring managers in the credit investigation sector.

What is a Credit Investigator CV?

A Credit Investigator's CV serves as a crucial marketing tool that highlights their expertise in evaluating creditworthiness and assessing the financial viability of individuals or businesses. This document showcases essential skills such as analytical thinking, attention to detail, and knowledge of credit laws and regulations. A well-crafted CV should emphasize relevant experience in financial analysis, risk assessment, and investigative techniques. For guidance on structuring your CV effectively, refer to this cv writing guide, which offers insights into creating a document that captures the attention of potential employers.

In addition to demonstrating qualifications and experience, a Credit Investigator's CV plays a vital role in establishing credibility within the financial sector. It provides a platform for showcasing achievements, certifications, and specialized training that can set a candidate apart from others. Utilizing a cv maker can streamline the process of designing an appealing and professional CV, ensuring that all pertinent information is presented clearly and effectively. Ultimately, a strong CV not only opens doors to job opportunities but also reflects the professionalism and diligence expected of a Credit Investigator.

Key Components of a Credit Investigator CV

- Contact Information: Include your full name, phone number, email address, and LinkedIn profile link.

- Professional Summary: A brief overview of your experience, highlighting your expertise in credit investigation and analysis.

- Skills: A section dedicated to showcasing your key skills relevant to the role, such as analytical thinking, attention to detail, and knowledge of credit laws.

- Work Experience: A chronological list of your previous roles, detailing your responsibilities and achievements in each position. Be sure to include relevant work experience that demonstrates your ability to investigate credit histories and assess risks.

- Education: Your academic qualifications, including degrees earned and institutions attended, particularly in finance, business, or a related field.

- Certifications: Any relevant certifications, such as Credit Risk Management or Certified Credit Professional, that enhance your qualifications.

- Technical Proficiency: A list of software and tools you are proficient in, such as credit analysis software, databases, and Excel.

- Professional Affiliations: Memberships in professional organizations that relate to credit investigation or financial analysis, showcasing your commitment to the field.

- Key Achievements: Specific accomplishments that demonstrate your impact in previous roles, such as the successful recovery of delinquent accounts or improvements in credit assessment processes.

- References: A statement indicating that references are available upon request, or include a list of professional references if appropriate.

- Continuing Education: Any additional training or courses completed that are relevant to credit investigation, showing your commitment to staying updated in the field.

- Volunteer Experience: Relevant volunteer work that demonstrates your skills or commitment to the community, particularly in financial literacy or credit education.

Sample Credit Investigator CV for Inspiration

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Phone Number]

[Your Email Address]

[LinkedIn Profile URL]

Professional Summary

Detail-oriented and analytical Credit Investigator with over 5 years of experience in assessing creditworthiness, investigating financial records, and conducting thorough risk assessments. Proven track record in identifying discrepancies and fraudulent activities, ensuring compliance with regulations, and providing insightful recommendations to enhance credit policies. Adept at collaborating with cross-functional teams and utilizing data-driven methodologies to support decision-making processes.

Work Experience

Credit Investigator

XYZ Financial Services, City, State

March 2020 - Present

- Conduct in-depth investigations into credit applications, analyzing financial histories and credit reports to determine creditworthiness and potential risks.

- Collaborate with the underwriting team to develop credit policies and procedures, resulting in a 15% reduction in credit risk.

- Identify and report fraudulent activities, working closely with law enforcement and legal departments to resolve cases and mitigate losses.

- Utilize advanced analytical tools and software to assess data trends, improving the efficiency of the investigation process by 30%.

- Provide training and support to junior investigators on best practices in credit analysis and fraud detection.

Junior Credit Investigator

ABC Credit Bureau, City, State

June 2018 - February 2020

- Assisted in the evaluation of credit applications and investigations, gathering necessary documentation and conducting interviews with applicants.

- Performed credit checks and analyzed financial data to support the underwriting process, ensuring compliance with regulatory standards.

- Developed and maintained relationships with clients and stakeholders, providing exceptional customer service and addressing inquiries related to credit investigations.

- Prepared detailed reports summarizing findings and recommendations for management review.

Intern - Credit Analysis

DEF Bank, City, State

January 2018 - May 2018

- Supported the credit analysis team in reviewing loan applications, conducting background checks, and verifying financial information.

- Compiled data and generated reports to assist in the assessment of credit risk for potential borrowers.

- Gained hands-on experience with credit scoring models and risk assessment tools.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2017

Skills

- Credit Risk Assessment

- Fraud Detection and Prevention

- Regulatory Compliance

- Data Analysis and Reporting

- Financial Statement Analysis

- Excellent Communication Skills

- Proficient in Microsoft Office Suite and Credit Analysis Software

Publications

- “Understanding Credit Risk: A Comprehensive Guide,” Finance Journal, Vol. 12, No. 3, 2021.

- “The Impact of Fraud on Credit Markets: Trends and Solutions,” Financial Investigations Review, 2022.

Certifications

- Certified Credit Professional (CCP) - Association of Credit Professionals, 2021

- Certified Fraud Examiner (CFE) - Association of Certified Fraud Examiners, 2022

- Credit Risk Management Certification - Risk Management Association, 2023

References available upon request.

Credit Investigator CV Writing Tips

When crafting a CV for a Credit Investigator position, it's essential to highlight your analytical skills, attention to detail, and knowledge of financial regulations. Begin with a strong summary that showcases your expertise in credit analysis, risk assessment, and investigative techniques. Use clear and concise language, focusing on quantifiable achievements that demonstrate your impact in previous roles. Tailor your CV to the specific job description, ensuring that relevant experience and skills are prioritized. Additionally, consider including keywords from the job listing to enhance your chances of passing through applicant tracking systems.

CV Writing Tips for a Credit Investigator:

- Highlight Relevant Experience: Focus on roles that involved credit analysis, fraud detection, or financial investigations, emphasizing specific duties and accomplishments.

- Showcase Analytical Skills: Provide examples of how you've used data analysis to identify trends, assess risk, or improve credit processes.

- Include Certifications: Mention any relevant certifications, such as Certified Fraud Examiner (CFE) or Certified Credit Executive (CCE), to demonstrate professional credibility.

- Quantify Achievements: Use numbers and statistics to back up your accomplishments, such as reducing fraud by a certain percentage or improving approval times.

- Tailor to Job Descriptions: Customize your CV for each application, incorporating keywords and phrases from the job listing to align your experience with the employer's needs.

- Maintain Professional Format: Use a clean, professional layout with clear headings and bullet points to enhance readability.

- Focus on Problem-Solving Skills: Highlight instances where you've successfully resolved complex credit issues or improved investigative processes.

- Proofread Thoroughly: Ensure there are no spelling or grammatical errors, as attention to detail is crucial for a Credit Investigator role.

Credit Investigator CV Summary Examples

As a Credit Investigator, your CV summary should effectively showcase your skills, experience, and value to potential employers. Here are several examples to help you craft a compelling summary that highlights your qualifications and expertise in the field.

“Detail-oriented Credit Investigator with over 5 years of experience in analyzing financial records, identifying discrepancies, and mitigating potential risks. Proven track record in conducting thorough investigations to ensure compliance with credit regulations, resulting in a 30% reduction in fraud cases within the organization.”

“Results-driven Credit Investigator skilled in evaluating credit applications and conducting in-depth background checks. Adept at utilizing advanced investigative techniques and data analysis to uncover financial irregularities. Committed to providing accurate assessments and maintaining the integrity of credit processes.”

“Experienced Credit Investigator with a strong background in financial analysis and risk assessment. Known for exceptional analytical skills and attention to detail, successfully identifying high-risk applicants and preventing fraudulent activities. Proficient in using credit reporting tools and software to streamline investigation processes.”

“Dynamic Credit Investigator with a comprehensive understanding of credit laws and regulations. Equipped with excellent communication skills and a proactive approach to resolving disputes and discrepancies. Passionate about leveraging investigative expertise to enhance credit decision-making and protect organizational interests.”

“Dedicated Credit Investigator with a solid foundation in forensic accounting and risk management. Experienced in collaborating with law enforcement and regulatory agencies to address fraud cases. Known for delivering thorough reports and recommendations that bolster credit policies and improve overall compliance.”

Build a Strong Experience Section for Your Credit Investigator CV

As a Credit Investigator, showcasing relevant work experience is crucial to demonstrate your expertise in analyzing credit histories, assessing risk, and conducting thorough investigations. Below are examples of strong work experience descriptions that can enhance your CV and highlight your qualifications for this role.

- Conducted detailed investigations into credit applications, identifying discrepancies and potential fraud, resulting in a 30% reduction in fraudulent approvals over a one-year period.

- Collaborated with financial institutions to gather necessary documentation and data, performing comprehensive analyses of credit reports to assess the creditworthiness of applicants.

- Developed and implemented a streamlined process for reviewing credit applications, which improved response times by 25% and enhanced customer satisfaction ratings.

- Utilized advanced forensic analysis techniques to uncover hidden debts and unresolved issues in applicants' credit histories, leading to informed decision-making and risk mitigation for the lending institution.

- Reviewed and analyzed complex financial documents, including tax returns, bank statements, and loan agreements, to verify applicants' income and financial stability.

- Trained and mentored junior investigators on best practices for credit analysis and fraud detection, fostering a culture of continuous improvement within the team.

- Prepared comprehensive reports and presentations summarizing investigation findings for senior management, aiding in policy formation and risk management strategies.

- Liaised with external agencies, including law enforcement and credit bureaus, to gather additional information for investigations and ensure compliance with regulatory requirements, enhancing the organization’s credibility and integrity.

Credit Investigator CV Education Examples

A strong educational background is essential for a Credit Investigator, as it equips individuals with the analytical skills and financial knowledge required for assessing creditworthiness and conducting thorough investigations. Below are several examples of educational qualifications that are particularly relevant to the role of a Credit Investigator:

- Bachelor's Degree in Finance

A degree in finance provides a solid foundation in financial principles, including risk assessment, credit analysis, and investment strategies, all of which are crucial for evaluating credit applications. - Bachelor's Degree in Business Administration

This degree offers a broad understanding of business operations and management, with courses in accounting, economics, and marketing that can enhance a Credit Investigator's ability to analyze financial documents and business creditworthiness. - Bachelor's Degree in Criminal Justice

A background in criminal justice can be beneficial for a Credit Investigator, as it includes training in investigative techniques, legal procedures, and ethics, which are important for conducting thorough and compliant investigations. - Master's Degree in Accounting

An advanced degree in accounting provides deeper insights into financial reporting, auditing, and compliance standards, equipping Credit Investigators with the skills to detect discrepancies and assess financial integrity. - Certification in Credit Risk Management

Specialized certifications, such as those offered by professional organizations, can enhance a candidate's knowledge of credit risk assessment and management, demonstrating a commitment to the field and a mastery of advanced credit evaluation techniques.

Skills to Highlight in Your Credit Investigator CV

As a Credit Investigator, showcasing a balance of soft and hard skills on your CV is essential to demonstrate your capabilities in assessing creditworthiness and conducting thorough investigations. Highlighting these skills will not only reflect your ability to navigate complex financial situations but also your aptitude for communicating findings effectively and maintaining ethical standards in the evaluation process.

Soft Skills:

- Analytical Thinking

- Attention to Detail

- Problem-Solving

- Communication Skills

- Interpersonal Skills

- Time Management

- Ethical Judgment

- Adaptability

- Research Skills

- Conflict Resolution

Hard Skills:

- Credit Analysis

- Financial Reporting

- Risk Assessment

- Data Analysis Software (e.g., Excel, SQL)

- Knowledge of Credit Laws and Regulations

- Financial Statement Analysis

- Investigative Techniques

- Experience with Credit Scoring Systems

- Proficiency in Database Management

- Report Writing and Documentation

Credit Investigator CV Format

As a Credit Investigator, your CV should effectively highlight your analytical skills, attention to detail, and experience in evaluating creditworthiness. The best format for your CV can vary based on your level of experience. For entry-level positions, a functional format that emphasizes skills over experience is ideal. Mid-level candidates may benefit from a chronological format that showcases career progression, while senior professionals should adopt a combination format to demonstrate both their extensive work history and key competencies.

- Entry-Level Candidates: Use a functional format to emphasize relevant skills and education, especially if you lack extensive work experience in the field.

- Mid-Level Professionals: A chronological format works best, allowing you to showcase a clear career trajectory and achievements in past roles.

- Senior-Level Candidates: Consider a combination format that highlights both your significant work history and specific skills, showcasing your leadership and strategic impact.

- Tailored Content: Customize your CV for each job application, aligning it with the specific requirements and keywords found in the job description.

- Quantifiable Achievements: Include metrics and examples of your accomplishments, such as improvements in credit assessment processes or successful investigations.

- Professional Summary: Start with a compelling summary that encapsulates your experience, skills, and what you bring to the role, making it clear to potential employers why you are a strong candidate.

For more detailed guidance on crafting your CV, you can refer to this cv format.

Common Mistakes to Avoid in a Credit Investigator CV

When applying for a position as a Credit Investigator, your CV is a crucial tool in showcasing your skills and experience. However, there are several common pitfalls that candidates often encounter, which can hinder their chances of making a positive impression. Avoiding these mistakes can significantly enhance the effectiveness of your CV and help you stand out in a competitive job market.

- Failing to tailor your CV to the specific job description and requirements.

- Including irrelevant work experience that does not pertain to the role of a Credit Investigator.

- Neglecting to highlight key skills such as analytical abilities, attention to detail, and knowledge of credit policies.

- Using vague language or overly complex jargon that may confuse the reader.

- Making grammatical or spelling errors, which can undermine your professionalism.

- Overloading the CV with too much information, making it difficult to read and navigate.

- Not showcasing relevant certifications or training related to credit investigation or financial analysis.

- Omitting quantifiable achievements or metrics that demonstrate your impact in previous roles.

- Using a generic CV format instead of a clean, professional layout that enhances readability.

- Ignoring the importance of a strong summary statement that captures your career goals and key qualifications.

Key Takeaways for a Credit Investigator CV

- Professional Summary: Start with a concise summary that highlights your experience, skills, and expertise in credit analysis and investigation. Tailor it to the specific role you're applying for.

- Relevant Experience: List your work history in reverse chronological order, emphasizing roles that involve credit investigation, risk assessment, and fraud detection. Use action verbs to describe your responsibilities and achievements.

- Key Skills: Include a section that outlines specific skills related to credit investigation, such as analytical skills, attention to detail, proficiency in financial software, and knowledge of credit laws and regulations.

- Education: Detail your educational background, including degrees, certifications, and relevant coursework. Highlight any specialized training in finance, accounting, or credit analysis.

- Certifications: If applicable, mention certifications such as Certified Credit Professional (CCP) or other relevant credentials that demonstrate your expertise in the field.

- Technical Proficiency: List any relevant software and tools you are proficient in, such as credit reporting systems, data analysis tools, and Microsoft Office Suite.

- Achievements and Metrics: Quantify your accomplishments where possible, such as the percentage of cases resolved, reductions in fraud rates, or improvements in credit assessment processes.

- Professional Affiliations: Include memberships in professional organizations related to credit investigation, finance, or risk management, which can enhance your credibility.

- Tailored CV Format: Choose a format that suits your experience level, whether chronological, functional, or a combination. For inspiration, explore various cv templates.

- Cover Letter Integration: Don't forget to pair your CV with a compelling cover letter that elaborates on your experience and motivation for the role. Consider using cover letter templates for guidance.

- Use a CV Builder: To streamline the creation of your CV, consider utilizing a cv builder that can help you format and present your information professionally.

- Proofreading and Feedback: Always proofread your CV for errors and seek feedback from colleagues or mentors to ensure clarity and impact.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.