As the financial markets continue to evolve, the demand for skilled Equity Research Analysts has never been higher. Crafting a compelling CV that showcases your analytical abilities, financial acumen, and industry knowledge is crucial for standing out in this competitive field. In this comprehensive guide, we will delve into the essential elements of a successful Equity Research Analyst CV, providing you with valuable insights to enhance your job application. By the end of this article, you will have a clear understanding of how to present your qualifications effectively, including:

- Key skills to highlight for an Equity Research Analyst role

- The importance of tailoring your CV to specific job descriptions

- Tips for showcasing your analytical and quantitative skills

- How to effectively present your work experience and achievements

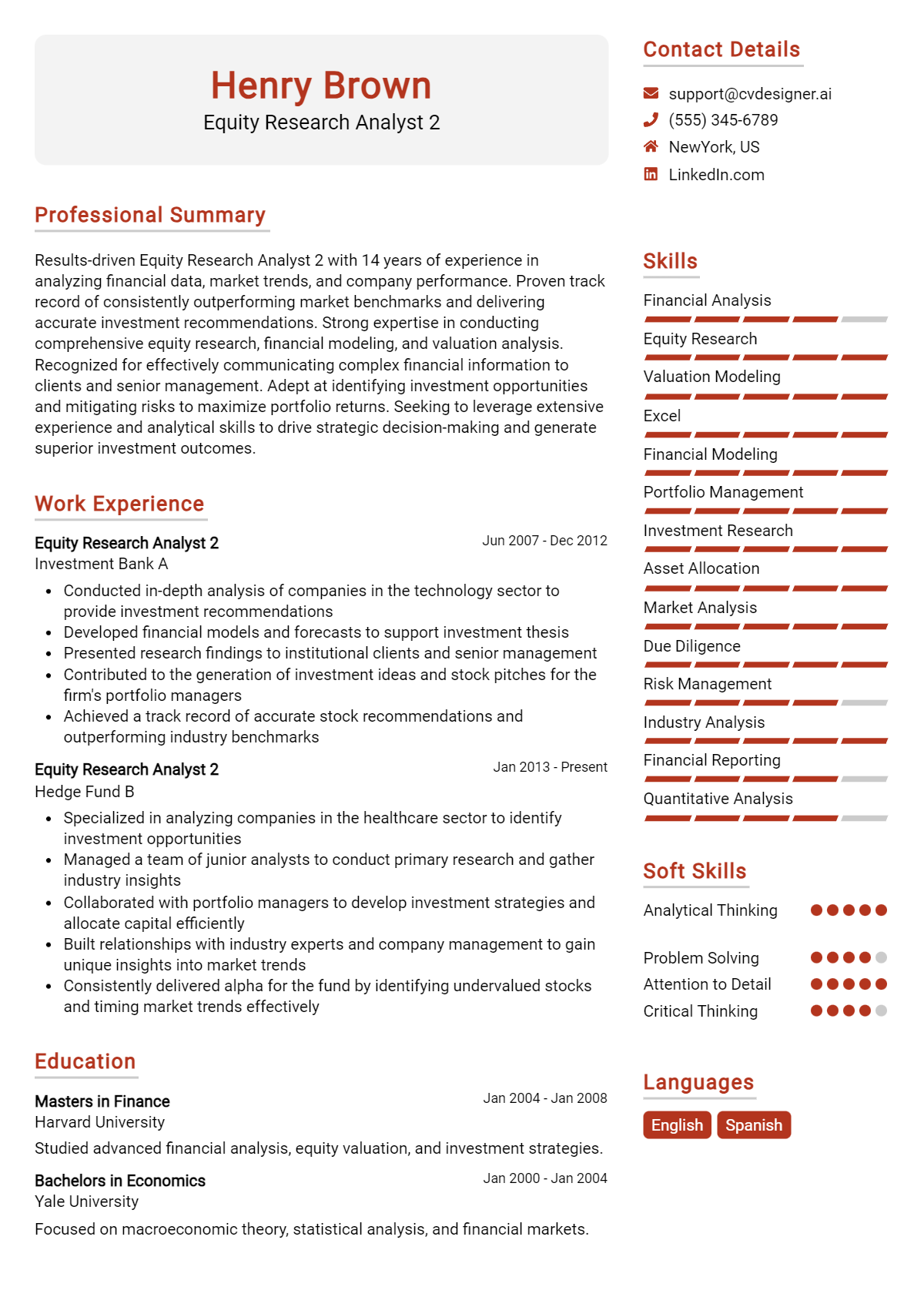

- Examples of strong CV formatting and layout

- Common pitfalls to avoid when writing your CV

Join us as we navigate the intricacies of CV writing for Equity Research Analysts, ensuring you are well-prepared to make a lasting impression on potential employers.

What is a Equity Research Analyst CV?

A CV for an Equity Research Analyst serves as a crucial tool to showcase an individual's expertise, analytical skills, and industry knowledge. This document highlights the candidate's educational background, relevant work experience, and proficiency in financial modeling and valuation techniques. It allows hiring managers to quickly assess a candidate’s ability to analyze financial data, interpret market trends, and make informed investment recommendations. A well-crafted CV not only outlines professional qualifications but also reflects a candidate's understanding of the financial sector, making it an essential component in the competitive job market.

The importance of a CV for an Equity Research Analyst extends beyond mere qualification listing; it is an opportunity to convey a strong personal brand. A compelling CV can set a candidate apart from the competition by demonstrating their analytical prowess and attention to detail through quantifiable achievements and relevant coursework. To ensure that your CV stands out, consider utilizing a comprehensive cv writing guide or employing a cv maker for a polished, professional presentation. This approach helps to create a memorable impression, enhancing the chances of securing interviews in this challenging field.

Key Components of a Equity Research Analyst CV

- Contact Information: Include your full name, phone number, email address, and LinkedIn profile for networking opportunities.

- Professional Summary: A brief statement summarizing your experience, skills, and career goals relevant to equity research.

- Education: List your degrees, institutions, and graduation dates, highlighting relevant coursework in finance, economics, or business.

- Certifications: Mention any relevant certifications such as CFA (Chartered Financial Analyst) or CMT (Chartered Market Technician).

- Technical Skills: Highlight your proficiency in financial modeling, valuation techniques, and analytical tools. For a comprehensive list of essential skills, refer to the skills section.

- Work Experience: Detail your previous roles, focusing on relevant positions in finance or equity research. Use the work experience section to guide how to effectively present this information.

- Research Projects: Include any significant research projects or reports you have completed that demonstrate your analytical capabilities.

- Industry Knowledge: Showcase your understanding of specific sectors or industries you have researched, including trends and key players.

- Publications: List any articles or papers you have authored or contributed to in finance-related publications.

- Networking and Mentorship: Mention any professional organizations or networks you are part of, as well as mentors who have influenced your career.

- Awards and Recognitions: Highlight any accolades or recognitions received in your field, such as scholarships or awards from finance competitions.

- References: Optionally, provide references or state that they are available upon request, ensuring they are relevant to the equity research field.

Sample Equity Research Analyst CV for Inspiration

John Doe

123 Finance Avenue

New York, NY 10001

(555) 123-4567

john.doe@email.com

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Detail-oriented Equity Research Analyst with over 5 years of experience in analyzing financial data, building financial models, and providing actionable investment recommendations. Proven track record of generating insightful reports that have enhanced portfolio performance and attracted new investments. Strong analytical skills combined with a deep understanding of market trends and economic indicators. Exceptional communication abilities, capable of presenting complex financial concepts to diverse audiences.

Work Experience

Equity Research Analyst

XYZ Investment Bank, New York, NY

June 2020 - Present

- Conduct comprehensive analysis of publicly traded companies in the technology sector, focusing on revenue drivers, competitive positioning, and market trends.

- Prepare detailed financial models, including discounted cash flow (DCF) analysis and comparative company analysis, to forecast potential stock performance.

- Write and present quarterly equity research reports, summarizing findings and investment recommendations to internal stakeholders and clients.

- Collaborate with sales and trading teams to provide insights that inform investment strategies and client pitches.

- Monitor industry news and economic developments to update investment thesis and adjust recommendations accordingly.

Equity Research Associate

ABC Capital Management, New York, NY

August 2017 - May 2020

- Assisted senior analysts in conducting industry research and financial analysis for the consumer goods sector, contributing to reports that informed investment decisions.

- Developed and maintained financial models to evaluate company performance, including revenue forecasts and earnings projections.

- Participated in client meetings and presentations, effectively communicating insights and recommendations based on research findings.

- Conducted peer comparisons and market analysis to identify investment opportunities and risks within the sector.

Intern, Equity Research

DEF Financial Services, New York, NY

June 2016 - August 2016

- Supported the equity research team by gathering data and performing preliminary analysis on potential investment opportunities.

- Assisted in the preparation of pitch books and investment reports, gaining exposure to the equity research process.

- Developed an understanding of financial metrics and valuation methods, enhancing analytical skills and knowledge of the industry.

Education

Master of Business Administration (MBA)

Columbia Business School, New York, NY

Graduated: May 2017

Bachelor of Science in Finance

University of California, Berkeley, CA

Graduated: May 2015

Skills

- Financial Modeling

- Equity Valuation

- Market Analysis

- Investment Research

- Data Analysis (Excel, Bloomberg, FactSet)

- Report Writing

- Presentation Skills

- Team Collaboration

Publications

- "The Future of E-Commerce: Investment Opportunities in the Digital Marketplace," Published in The Journal of Financial Research, March 2022.

- "Evaluating the Impact of Macroeconomic Trends on Consumer Spending," Featured in the Equity Research Insights Newsletter, November 2021.

Certifications

- Chartered Financial Analyst (CFA) Level II Candidate

- Financial Risk Manager (FRM) Certification, Global Association of Risk Professionals (GARP)

- Bloomberg Market Concepts (BMC) Certification

Equity Research Analyst CV Writing Tips

When crafting a CV for an Equity Research Analyst position, it's essential to present a clear and concise overview of your qualifications and experience in financial analysis, market research, and investment strategy. Start with a strong professional summary that highlights your analytical skills and relevant experience in the finance sector. Use quantifiable achievements to demonstrate your impact in previous roles, such as successful investment recommendations or enhanced portfolio performance. Tailor your CV to align with the specific requirements of the job you're applying for, emphasizing your proficiency with financial modeling and valuation techniques. Lastly, ensure your CV is well-structured and visually appealing to make a lasting impression on hiring managers.

CV Writing Tips for Equity Research Analysts:

- Include a Professional Summary: Start with a brief section that encapsulates your experience, skills, and career goals relevant to equity research.

- Highlight Relevant Skills: List key analytical skills such as financial modeling, valuation techniques, and proficiency in software tools like Excel and Bloomberg.

- Quantify Achievements: Use specific figures to demonstrate the impact of your work, such as percentage returns on investments or successful stock picks.

- Tailor Your Experience: Customize your work experience section to reflect the specific responsibilities and achievements that relate to equity research roles.

- Showcase Educational Background: Include your degrees, relevant coursework, and any certifications like CFA or CFP that enhance your qualifications.

- Use Industry Keywords: Incorporate keywords from the job description to optimize your CV for applicant tracking systems (ATS).

- Keep it Concise: Aim for a one-page CV if you have less than 10 years of experience, focusing on the most relevant information.

- Proofread Thoroughly: Ensure your CV is free of typos and grammatical errors, as attention to detail is crucial in financial analysis roles.

Equity Research Analyst CV Summary Examples

As an Equity Research Analyst, your CV summary should succinctly highlight your analytical skills, financial acumen, and investment insights. Below are several examples that effectively showcase these attributes:

“Detail-oriented Equity Research Analyst with over 5 years of experience in analyzing financial data and market trends to provide actionable insights. Proven track record in delivering investment recommendations that enhance portfolio performance and drive client satisfaction.”

“Results-driven Equity Research Analyst proficient in evaluating company fundamentals and macroeconomic factors to support investment strategies. Expertise in building financial models and conducting comprehensive industry research, leading to successful stock recommendations.”

“Analytical and motivated Equity Research Analyst with a strong background in finance and investment management. Adept at leveraging quantitative analysis and financial modeling to identify undervalued stocks and inform strategic investment decisions.”

“Dynamic Equity Research Analyst with a passion for the financial markets and a deep understanding of various sectors. Experienced in preparing detailed equity research reports and presenting findings to clients and stakeholders, driving informed investment choices.”

“Strategic Equity Research Analyst possessing extensive knowledge of valuation methodologies and market dynamics. Committed to delivering high-quality research and analysis that supports investment portfolios and enhances client relationships.”

Build a Strong Experience Section for Your Equity Research Analyst CV

As an Equity Research Analyst, showcasing your professional experience is crucial to demonstrate your analytical skills, market knowledge, and ability to generate actionable investment insights. Below are examples of strong work experience descriptions that highlight key responsibilities and achievements in this role.

- Conducted in-depth financial analysis and valuation of over 25 publicly traded companies across various sectors, utilizing DCF, comparable company analysis, and precedent transactions to inform investment recommendations.

- Developed comprehensive sector reports that identified emerging trends and investment opportunities, leading to a 15% increase in portfolio performance for clients over a 12-month period.

- Collaborated with the investment team to construct and maintain financial models, ensuring accurate forecasting of earnings, cash flows, and key performance indicators, which improved decision-making efficiency by 20%.

- Presented investment theses and market insights to senior management and institutional investors, effectively communicating complex financial concepts and increasing client engagement by 30%.

- Monitored and analyzed macroeconomic indicators and industry developments to assess their impact on equity markets, resulting in timely adjustments to investment strategies that minimized portfolio risk.

- Utilized Bloomberg and FactSet to extract and analyze financial data, preparing detailed reports and presentations that supported investment decisions and enhanced client relationships.

- Conducted peer analysis and competitive benchmarking to evaluate company performance, providing actionable recommendations that led to successful investment initiatives and increased client satisfaction.

- Assisted in the preparation of quarterly earnings call reports, synthesizing management commentary and financial results to create informative summaries that guided investor relations strategies.

Equity Research Analyst CV Education Examples

An Equity Research Analyst plays a crucial role in financial markets by analyzing stocks and providing investment recommendations based on thorough research and data analysis. A solid educational foundation is vital for success in this role, equipping analysts with the necessary knowledge and skills to evaluate company performance and market trends effectively. Below are examples of educational backgrounds that are particularly relevant for aspiring Equity Research Analysts:

- Bachelor of Science in Finance

A degree in finance provides a fundamental understanding of financial principles, investment analysis, and market dynamics, all of which are essential for conducting equity research. - Bachelor of Arts in Economics

An economics degree offers insights into market behavior and economic indicators, enabling analysts to better interpret data and make informed predictions about stock performance. - Master of Business Administration (MBA) with a Concentration in Finance

An MBA equips individuals with advanced business acumen, financial modeling skills, and strategic thinking capabilities, enhancing their ability to analyze investment opportunities. - Bachelor of Science in Accounting

A background in accounting is valuable for understanding financial statements, balance sheets, and cash flow analysis, which are critical components of stock evaluation. - Master of Science in Financial Engineering

This degree provides expertise in quantitative analysis and risk management, allowing analysts to leverage complex models and algorithms in their equity research efforts.

Skills to Highlight in Your Equity Research Analyst CV

As an Equity Research Analyst, your ability to analyze financial data, assess market trends, and communicate insights effectively is crucial for success in the role. Highlighting a blend of both soft and hard skills in your CV will showcase your qualifications to potential employers and set you apart in a competitive field. Here are essential skills to consider including in your CV:

Soft Skills:

- Analytical Thinking

- Attention to Detail

- Strong Communication Skills

- Problem-Solving Ability

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Persuasion and Negotiation

- Relationship Management

Hard Skills:

- Financial Modeling

- Valuation Techniques

- Proficiency in Excel and Financial Software

- Knowledge of Financial Statements

- Market Research and Analysis

- Statistical Analysis

- Data Visualization Tools (e.g., Tableau)

- Understanding of Investment Strategies

- Knowledge of Regulatory Compliance

- Experience with Programming Languages (e.g., Python, R)

Equity Research Analyst CV Format

As an Equity Research Analyst, crafting an effective CV is crucial to standing out in a competitive field. The format you choose should reflect your experience level, showcasing your analytical skills and market knowledge. For entry-level positions, a functional format highlighting relevant coursework and internships may be best, while mid-level analysts might benefit from a chronological format that emphasizes professional achievements. Senior analysts should consider a combination format to showcase both their extensive experience and key results.

- Entry-Level Analysts: Focus on skills and relevant projects or internships. Use a clean, simple layout that emphasizes education.

- Mid-Level Analysts: Utilize a chronological format that lists work history with clear metrics and accomplishments to demonstrate impact.

- Senior Analysts: Adopt a combination format that highlights both a solid work history and specific achievements, such as successful stock picks or research reports.

- Tailor Your CV: Always customize your CV for the specific role and company, using keywords from the job description.

- Quantify Achievements: Include numbers and results that illustrate your contributions, such as percentage growth in stock recommendations.

- Professional Summary: Start with a compelling summary that encapsulates your expertise, industry knowledge, and career goals.

For more guidance on creating a standout CV, check out this cv format article.

Common Mistakes to Avoid in a Equity Research Analyst CV

When crafting a CV for an Equity Research Analyst position, it's essential to present your qualifications and experiences in the most effective manner. A well-structured CV can make a significant difference in capturing the attention of hiring managers. However, many candidates make common mistakes that could hinder their chances of landing an interview. Here are some pitfalls to avoid when developing your CV for this specialized role:

- Overloading with Technical Jargon: Using excessive industry-specific terminology can alienate recruiters; ensure clarity and accessibility.

- Neglecting Soft Skills: Focusing solely on technical skills and ignoring soft skills like communication, teamwork, and analytical thinking can create an incomplete picture.

- Lack of Quantifiable Achievements: Failing to include measurable results in your previous roles may diminish the impact of your accomplishments.

- Generic Objective Statements: Using a one-size-fits-all objective can make your CV feel impersonal; tailor it to reflect your career goals relevant to equity research.

- Ignoring Formatting Consistency: Inconsistent fonts, bullet points, or spacing can make your CV look unprofessional; ensure a clean and uniform layout.

- Too Much Length: A lengthy CV can overwhelm recruiters; strive for conciseness while maintaining essential information, ideally fitting on one page.

- Omitting Relevant Coursework or Projects: Not highlighting pertinent academic achievements or projects can overlook your foundational knowledge in finance and investment.

- Failure to Customize for Each Application: Sending out a generic CV without adjusting it to align with specific job descriptions can reduce your chances of standing out.

- Inaccurate or Outdated Information: Including incorrect details, such as job titles or dates of employment, can raise red flags about your attention to detail.

- Not Proofreading: Typos and grammatical errors can undermine your professionalism; always review your CV carefully before submitting it.

Key Takeaways for a Equity Research Analyst CV

- Tailored Summary: Start with a strong professional summary that highlights your experience in equity research, analytical skills, and knowledge of financial markets.

- Relevant Experience: List your work experience in reverse chronological order, focusing on roles related to equity research, analysis, or finance. Highlight specific achievements, such as successful stock recommendations or research reports.

- Quantitative Skills: Emphasize your proficiency in financial modeling, valuation techniques (DCF, comparables), and data analysis. Mention any programming languages or tools you are familiar with (e.g., Excel, Python, Bloomberg).

- Educational Background: Include your academic qualifications, particularly if you have a degree in finance, economics, or a related field. Mention any relevant certifications (CFA, CPA) that enhance your credibility.

- Industry Knowledge: Demonstrate your understanding of specific sectors or industries you specialize in. Include any relevant market research or sector analysis you've conducted.

- Technical Proficiency: Highlight your expertise with financial software and databases. Familiarity with platforms like Bloomberg, FactSet, or Thomson Reuters can be a significant advantage.

- Soft Skills: Showcase essential soft skills such as communication, teamwork, and critical thinking. Equity research often requires presenting findings clearly and collaborating with other analysts.

- Professional Development: Mention any continuous education efforts, such as workshops, seminars, or courses relevant to equity research. This demonstrates your commitment to staying updated in the field.

- Networking and Collaboration: Include any experience in building relationships with industry professionals, attending conferences, or participating in investment clubs. Networking is vital in the finance sector.

- Achievements and Recognition: If applicable, highlight any awards, recognitions, or accolades received in your previous roles. This adds credibility to your expertise.

- Customization: Use cv templates to create a visually appealing layout. Tailor your CV for each job application to align with the specific requirements of the role.

- Cover Letter Integration: Consider using cover letter templates to complement your CV. A well-crafted cover letter can further showcase your passion and fit for the equity research analyst role.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.