Are you a numbers guru with a passion for the stock market? Do you thrive in fast-paced environments and have a keen eye for spotting market trends? If so, then the role of an Equity Trader may be the perfect fit for you. In this CV guide, we will cover everything you need to know about becoming a successful Equity Trader, including:

- The responsibilities and duties of an Equity Trader

- Key skills and qualifications needed for the role

- Tips for building a successful career in equity trading

- Common interview questions and how to ace them

So if you're ready to take your career in finance to the next level, dive into our comprehensive guide and learn how to excel as an Equity Trader.

What is a Equity Trader CV?

A Equity Trader CV is a crucial document that outlines an individual's professional experience, skills, and qualifications in the field of equity trading. It serves as a snapshot of a candidate's background and expertise, allowing potential employers to quickly assess their suitability for a role. A well-crafted CV can help highlight a trader's track record of successful trades, knowledge of financial markets, and proficiency in using trading platforms, ultimately increasing their chances of securing a job in the competitive world of equity trading.

In addition to showcasing a trader's relevant experience and skills, a CV also serves as a marketing tool that helps them stand out from other candidates. By including key achievements, certifications, and industry-specific training, a trader can demonstrate their expertise and commitment to their profession. A strong CV is essential for making a positive first impression on hiring managers and recruiters, setting the stage for a successful job application process. For tips on how to write a compelling CV for an Equity Trader role, check out this CV writing guide.

Key Components of a Equity Trader CV

- Relevant skills such as financial analysis, market research, and risk management

- Work experience in equity trading or a related field

- Education background in finance, economics, or a related field

- Certifications or licenses related to trading or finance

- Proficiency in trading software and platforms

- Knowledge of regulatory requirements and compliance in the finance industry

- Ability to work well under pressure and make quick decisions

- Strong communication and interpersonal skills

- Track record of successful trades and portfolio management

- Understanding of macroeconomic factors and market trends

- Ability to analyze and interpret financial data

- Strong attention to detail and organizational skills.

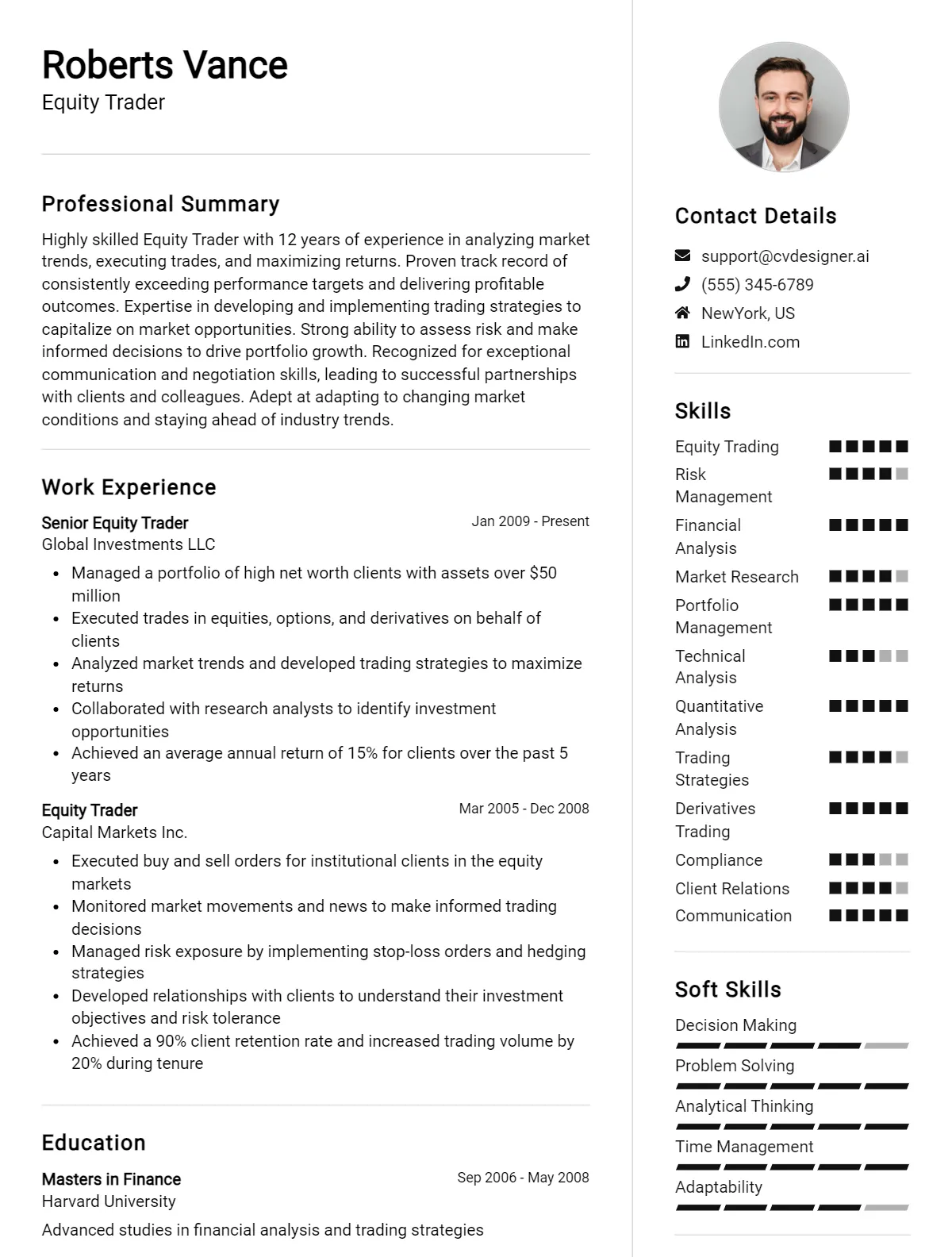

Sample Equity Trader CV for Inspiration

[Full Name] [Address] [City, State, Zip Code] [Phone Number] [Email Address]

Professional Summary: Dynamic and results-driven Equity Trader with over 5 years of experience in analyzing market trends, executing trades, and maximizing returns for clients. Proven track record of success in fast-paced trading environments. Strong analytical skills and a deep understanding of market dynamics.

Work Experience:

Equity Trader XYZ Investment Firm, New York, NY January 2017 - Present

- Analyze market trends and economic indicators to make informed trading decisions

- Execute trades on behalf of clients to maximize returns and minimize risks

- Monitor portfolio performance and adjust trading strategies as needed

- Collaborate with research analysts and portfolio managers to develop investment strategies

- Communicate with clients to provide updates on market conditions and portfolio performance

Equity Trading Intern ABC Capital Management, Chicago, IL June 2015 - December 2016

- Assisted senior traders with market research and analysis

- Executed trades under the supervision of experienced traders

- Monitored market news and corporate announcements for potential trading opportunities

- Developed Excel models to track portfolio performance and analyze trading strategies

Education:

Bachelor of Science in Finance University of XYZ, New York, NY Graduated May 2015

Skills:

- Strong analytical skills

- Proficient in market analysis tools such as Bloomberg and Reuters

- Excellent communication and interpersonal skills

- Ability to work under pressure and make quick decisions

- Detail-oriented and organized

Publications:

- "The Impact of Macroeconomic Factors on Equity Prices" - Journal of Finance, 2018

Certifications:

- Chartered Financial Analyst (CFA) Level 1

References available upon request.

Equity Trader CV Writing Tips

When writing a CV for an Equity Trader position, it is important to highlight your relevant experience, skills, and achievements in the financial industry. Focus on showcasing your ability to analyze market trends, make informed investment decisions, and manage risk effectively. Tailor your CV to emphasize your proficiency in using trading platforms and software, as well as your track record of delivering profitable trades. Be sure to include any certifications or licenses you hold, such as the Series 7 or CFA designation. Additionally, highlight your strong communication and interpersonal skills, as well as your ability to work well under pressure.

Specific CV writing tips for an Equity Trader:

- Quantify your achievements by including specific examples of successful trades you have executed.

- Use action verbs such as "analyzed," "implemented," and "optimized" to describe your responsibilities and accomplishments.

- Include any relevant internships or volunteer work in the financial industry to demonstrate your commitment and passion for trading.

- Highlight your ability to work in a fast-paced environment and make quick decisions under pressure.

- Showcase your knowledge of different trading strategies and techniques, such as technical analysis and fundamental analysis.

- Include any relevant coursework or training you have completed in finance, economics, or related fields.

- Emphasize your ability to work well in a team and collaborate with colleagues to achieve common goals.

- Proofread your CV carefully to ensure it is free of any spelling or grammar errors, and consider having a trusted friend or mentor review it for feedback.

Equity Trader CV Summary Examples

- Experienced Equity Trader with a proven track record of success in analyzing market trends, executing trades, and generating profits for clients. Skilled in risk management, financial analysis, and portfolio management. Seeking to leverage my expertise in equity trading to contribute to a dynamic trading team.

- Results-driven Equity Trader with a background in quantitative analysis and a strong understanding of market dynamics. Proficient in executing trades across various asset classes and implementing trading strategies to maximize returns. Looking for opportunities to further develop my skills and contribute to a successful trading desk.

- Seasoned Equity Trader with over 10 years of experience in the financial industry. Expertise in conducting thorough research, identifying investment opportunities, and making informed trading decisions. Proven ability to thrive in high-pressure environments and deliver consistent results. Seeking a challenging role that allows me to utilize my skills and contribute to a top-performing trading team.

- Detail-oriented Equity Trader with a passion for the financial markets and a strong background in technical analysis. Skilled in developing trading strategies, managing risk, and optimizing portfolio performance. Looking for a new opportunity to apply my knowledge and expertise in equity trading to drive profitability and achieve investment goals.

- Dynamic Equity Trader with a solid understanding of market trends and a proven ability to generate profits through strategic trading decisions. Proficient in utilizing trading platforms, analyzing market data, and executing trades with precision. Seeking a challenging role where I can continue to grow professionally and make a significant impact in the world of equity trading.

Build a Strong Experience Section for Your Equity Trader CV

As an Equity Trader, my role involves analyzing market trends, executing trades, and managing portfolios to maximize returns for clients. My experience in this field has equipped me with a strong understanding of financial markets and the ability to make informed decisions in fast-paced environments. Here are some examples of strong work experience descriptions for a Equity Trader:

- Successfully executed buy and sell orders for equities, options, and other financial instruments to achieve optimal results for clients.

- Utilized advanced technical analysis tools to identify trading opportunities and develop trading strategies.

- Managed risk by implementing stop-loss orders and closely monitoring market fluctuations to protect clients' investments.

- Built and maintained strong relationships with clients, providing regular updates on market conditions and investment performance.

- Collaborated with research analysts and other team members to stay informed about market developments and potential investment opportunities.

- Demonstrated strong analytical skills by conducting in-depth research on companies and industries to make informed investment decisions.

- Effectively communicated with clients to understand their financial goals and tailor investment strategies to meet their specific needs.

- Maintained accurate records of trades and performance metrics to track investment results and make adjustments as needed.

Equity Trader CV Education Examples

As an Equity Trader, having a strong educational background is essential to succeed in the fast-paced world of finance. Here are some examples of educational backgrounds that are relevant to this role:

- Bachelor's degree in Finance or Economics: A degree in finance or economics provides a solid foundation in understanding financial markets, investment strategies, and economic principles that are crucial for an Equity Trader.

- Master's degree in Business Administration (MBA): An MBA with a concentration in finance can provide advanced knowledge and skills in financial analysis, risk management, and portfolio management, which are all important aspects of equity trading.

- Chartered Financial Analyst (CFA) designation: Obtaining a CFA designation demonstrates a high level of expertise in investment analysis and portfolio management, making it a valuable qualification for Equity Traders.

- Series 7 and Series 63 licenses: These licenses are required for individuals who trade securities, and having them demonstrates knowledge of securities regulations and ethical standards in the financial industry.

- Internship or work experience at a financial institution: Hands-on experience in a financial institution, such as a trading floor or investment firm, can provide practical knowledge and skills that are directly applicable to a career as an Equity Trader.

Skills to Highlight in Your Equity Trader CV

As an Equity Trader, it is crucial to possess a unique blend of soft and hard skills to be successful in the fast-paced world of finance. Soft skills such as communication, decision-making, and adaptability are just as important as hard skills like financial analysis, risk management, and technical expertise. Below are 10 soft skills and 10 hard skills that should be highlighted in your Equity Trader CV:

Soft Skills:

- Communication

- Critical thinking

- Problem-solving

- Time management

- Teamwork

- Adaptability

- Leadership

- Stress management

- Attention to detail

- Emotional intelligence

Hard Skills:

- Financial analysis

- Market research

- Risk management

- Trading strategies

- Data analysis

- Quantitative skills

- Technical analysis

- Proficiency in trading platforms

- Regulatory compliance

- Knowledge of financial markets and instruments

By showcasing a combination of these soft and hard skills in your CV, you can demonstrate your ability to excel as an Equity Trader in a competitive and dynamic industry.

Equity Trader CV Format

As an Equity Trader, your CV plays a crucial role in showcasing your skills and experience in the competitive finance industry. When it comes to the format of your CV, it is important to tailor it to your specific job level. For entry-level positions, a clean and simple format is recommended to highlight your education and any relevant internships. For mid-level positions, a more detailed format with clear sections for experience, skills, and achievements is ideal. For senior-level roles, a more strategic and leadership-focused format is recommended to demonstrate your impact and expertise in the field. When crafting your Equity Trader CV, be sure to consider these key points:

- Clearly state your career objective and summary at the top of the CV

- Highlight your relevant experience in equity trading and financial analysis

- Showcase your technical skills, such as proficiency in trading platforms and market analysis tools

- Include quantifiable achievements, such as successful trades or portfolio growth

- Demonstrate your ability to work under pressure and make sound decisions in fast-paced environments

For more tips on CV formatting, check out this article on cv format.

Common Mistakes to Avoid in a Equity Trader CV

When applying for a job as an Equity Trader, it's important to ensure that your CV is polished and professional. Avoiding common mistakes can help you stand out to potential employers and increase your chances of landing the job. Here are 8-10 common mistakes to avoid in an Equity Trader CV:

- Including irrelevant information or skills that are not related to the position

- Not using specific examples or quantifiable achievements to demonstrate your experience and success in trading

- Failing to tailor your CV to the specific job and company you are applying to

- Using a generic or outdated CV template that does not showcase your individuality and skills

- Neglecting to proofread for spelling and grammar errors, which can make you appear careless or unprofessional

- Overloading your CV with too much information, making it difficult for the employer to quickly identify your key qualifications

- Listing job duties without highlighting your accomplishments or contributions in each role

- Omitting important details such as your certifications, licenses, or relevant coursework that could set you apart from other candidates

- Including personal information such as age, marital status, or hobbies that are not relevant to your qualifications for the job.

Key Takeaways for a Equity Trader CV

- Highlight your experience in equity trading, including specific strategies and markets traded

- Showcase your track record of successful trades and investment returns

- Detail your understanding of market trends and analysis techniques

- Emphasize your ability to manage risk and make informed decisions under pressure

- Include any relevant certifications or licenses, such as Series 7 or CFA

- Demonstrate strong communication and interpersonal skills, especially when working with clients or colleagues

- Utilize quantifiable metrics, such as percentage returns or trading volume, to showcase your achievements

- Customize your CV to the specific job you are applying for, tailoring your skills and experiences to match the job description

For professional CV templates and assistance in creating a standout CV, check out CV Templates and use the CV Builder tool. Additionally, consider using Cover Letter Templates to create a strong cover letter to accompany your CV.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.