Introduction:

Are you a meticulous individual with a knack for numbers and a passion for helping others navigate the complex world of taxes? If so, a career as an Income Tax Preparer might be the perfect fit for you. In this comprehensive guide, we will walk you through the essential steps of crafting a standout CV that will impress potential employers and land you your dream job. From highlighting your relevant skills and experience to showcasing your attention to detail, we've got you covered. Keep reading for valuable insights and a CV example that will set you on the path to success.

Key points covered in this guide:

- Crafting a targeted CV that highlights your tax preparation skills

- Showcasing your attention to detail and accuracy in tax calculations

- Highlighting your experience in tax law and regulations

- Demonstrating your ability to communicate effectively with clients

- Utilizing relevant software and tools in tax preparation

- Including any relevant certifications or training in tax preparation

Don't miss out on this opportunity to take your career to the next level. Dive into our CV writing guide and get started on creating a CV that will make you stand out in the competitive field of tax preparation.

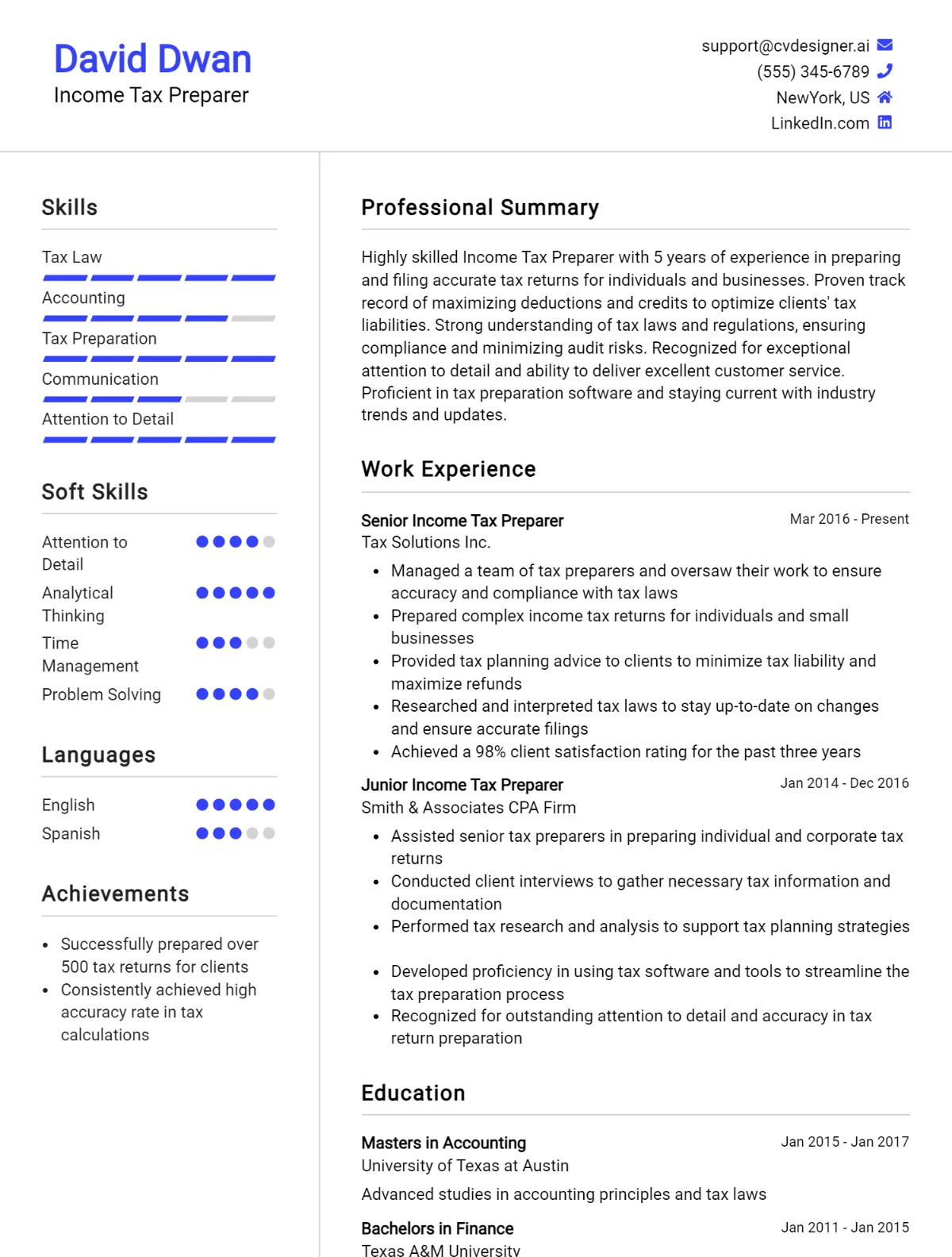

Key Components of a Income Tax Preparer CV

- Contact Information: Include your name, phone number, email address, and location.

- Objective Statement: Briefly summarize your career goals and how they align with the role of an Income Tax Preparer.

- Skills: Highlight your relevant skills such as attention to detail, knowledge of tax laws, and proficiency in tax preparation software. For more information on CV skills, click here.

- Work Experience: List your previous job roles related to tax preparation, including the name of the company, dates of employment, and key responsibilities. For tips on how to structure your work experience section, click here.

- Education: Include your degree, major, graduation date, and any relevant certifications or licenses.

- Certifications: List any certifications you have obtained related to tax preparation, such as Enrolled Agent or Certified Public Accountant.

- Professional Affiliations: Mention any memberships in organizations like the National Association of Tax Professionals or the American Institute of CPAs.

- Software Proficiency: Highlight your proficiency in tax preparation software such as TurboTax or Drake Tax.

- Language Skills: If you are bilingual or multilingual, include this information on your CV.

- Achievements: Mention any awards or accolades you have received for your work in tax preparation.

- References: Include references from previous employers or colleagues who can speak to your skills and experience in tax preparation.

- Additional Information: Include any other relevant information, such as volunteer experience or extracurricular activities related to tax preparation.

Income Tax Preparer CV Writing Tips

When writing a CV for an Income Tax Preparer position, it is important to highlight your experience and expertise in tax preparation, as well as your attention to detail and ability to meet deadlines. Make sure to include any relevant certifications or licenses you may hold, and emphasize your strong communication and problem-solving skills. Tailor your CV to the specific job you are applying for, and use quantifiable data to demonstrate your accomplishments. Be sure to proofread your CV carefully to ensure it is error-free and easy to read.

Specific CV Writing Tips for Income Tax Preparers:

- Include a professional summary at the top of your CV highlighting your years of experience and expertise in tax preparation.

- List any relevant certifications or licenses, such as Enrolled Agent or Certified Public Accountant (CPA).

- Showcase your knowledge of tax laws and regulations, and any specialized areas of taxation you may have experience in.

- Use bullet points to list your key responsibilities and accomplishments in previous tax preparation roles.

- Highlight your ability to work accurately and efficiently under pressure, especially during busy tax seasons.

- Include any software or technology skills relevant to tax preparation, such as experience with tax preparation software or Microsoft Excel.

- Provide examples of your strong communication skills, both written and verbal, as well as your ability to explain complex tax concepts to clients.

- List any continuing education or professional development courses you have completed to stay current with changes in tax laws and regulations.

Income Tax Preparer CV Summary Examples

- Detail-oriented and highly experienced Income Tax Preparer with a proven track record of accurately preparing and filing tax returns for individuals and businesses. Strong knowledge of tax laws and regulations, with a focus on maximizing deductions and credits for clients.

- Results-driven Income Tax Preparer with over 5 years of experience in the industry. Skilled in conducting thorough tax consultations, preparing accurate returns, and providing exceptional customer service. Proficient in utilizing tax software and staying up-to-date on changes in tax laws.

- Organized and efficient Income Tax Preparer with a passion for helping clients navigate the complexities of tax preparation. Excellent communication skills and the ability to work well under pressure to meet deadlines. Adept at identifying tax-saving opportunities for clients.

- Certified Income Tax Preparer with a strong background in accounting and tax preparation. Proficient in analyzing financial documents, identifying tax implications, and preparing accurate tax returns. Dedicated to providing personalized service and ensuring clients receive the maximum refund possible.

- Experienced Income Tax Preparer with a reputation for delivering high-quality tax services and maintaining client satisfaction. Skilled in conducting in-depth tax interviews, accurately inputting data, and resolving complex tax issues. Strong attention to detail and a commitment to staying current on tax laws and regulations.

Build a Strong Experience Section for Your Income Tax Preparer CV

As an experienced Income Tax Preparer, I have a proven track record of accurately preparing and filing tax returns for individuals and businesses. My attention to detail and thorough understanding of tax laws allows me to provide clients with reliable and efficient tax services. Below are some examples of my strong work experience descriptions:

- Conducted thorough reviews of clients' financial documents to ensure accurate reporting of income, deductions, and credits.

- Researched and interpreted complex tax regulations to minimize clients' tax liabilities and maximize their refunds.

- Collaborated with clients to address any tax-related inquiries or concerns in a timely and professional manner.

- Utilized tax preparation software to accurately input financial data and generate error-free tax returns.

- Stayed up-to-date on changes in tax laws and regulations to provide clients with the most current and relevant tax advice.

- Assisted clients in resolving any tax-related issues with the IRS or state tax authorities, ensuring compliance with tax laws.

- Prepared and submitted tax returns for individuals, sole proprietors, partnerships, and corporations, ensuring timely filing and adherence to deadlines.

- Maintained confidentiality and integrity in handling sensitive financial information for clients, building trust and loyalty in the client-advisor relationship.

Income Tax Preparer CV Education Examples

As an Income Tax Preparer, having a strong educational background is essential to effectively navigate the complex world of tax laws and regulations. Here are some examples of educational backgrounds that would be beneficial for this role:

- Bachelor's degree in Accounting: A degree in accounting provides a solid foundation in financial reporting, tax preparation, and auditing, which are all key skills for an Income Tax Preparer.

- Master's degree in Taxation: A master's degree in taxation offers in-depth knowledge of tax laws, planning strategies, and compliance issues, making it an ideal educational background for this role.

- Certified Public Accountant (CPA) license: Becoming a CPA demonstrates a high level of expertise in accounting and taxation, showcasing a candidate's commitment to professionalism and ethical standards.

- Enrolled Agent (EA) certification: An EA certification is granted by the IRS and allows individuals to represent taxpayers in front of the IRS. This certification is highly valuable for Income Tax Preparers who work with clients facing tax issues.

- Continuing education in tax law updates: Staying current with changes in tax laws and regulations is crucial for Income Tax Preparers. Continuing education courses in tax law updates ensure that professionals are equipped to provide accurate and up-to-date tax advice to clients.

Skills to Highlight in Your Income Tax Preparer CV

As an Income Tax Preparer, it is essential to possess a unique combination of soft and hard skills to effectively assist clients with their tax preparation needs. Soft skills such as attention to detail and strong communication abilities are crucial for building rapport with clients and ensuring accuracy in tax filings. On the other hand, hard skills like proficiency in tax software and knowledge of tax laws play a vital role in preparing accurate and compliant tax returns. Below are 10 soft skills and 10 hard skills to highlight in your Income Tax Preparer CV:

Soft Skills:

- Attention to detail

- Strong communication skills

- Problem-solving abilities

- Time management skills

- Customer service orientation

- Analytical thinking

- Adaptability

- Integrity and ethics

- Organizational skills

- Teamwork and collaboration

Hard Skills:

- Proficiency in tax preparation software (e.g., TurboTax, H&R Block)

- Knowledge of federal and state tax laws

- Understanding of tax deductions and credits

- Ability to analyze financial documents

- Familiarity with IRS regulations

- Experience in preparing individual and business tax returns

- Accuracy in data entry and calculations

- Proficiency in Microsoft Excel

- Certification as a tax preparer (e.g., Enrolled Agent, Certified Public Accountant)

- Ability to stay updated on changes in tax laws and regulations.

Income Tax Preparer CV Format

As an Income Tax Preparer, it is important to have a well-structured CV that highlights your skills and experience in tax preparation. The best format for a CV can vary depending on the level of the job seeker. For entry-level positions, a chronological format may be best to showcase relevant coursework and internships. For mid-level positions, a combination format that highlights both skills and experience could be beneficial. And for senior-level roles, a targeted format that focuses on achievements and leadership skills may be most effective. Here are some key points to consider when formatting your Income Tax Preparer CV:

- Start with a clear and concise summary of your qualifications and experience.

- Highlight your relevant skills, such as tax preparation software proficiency and knowledge of tax laws.

- Include any certifications or licenses you hold, such as a Certified Public Accountant (CPA) designation.

- Showcase your experience preparing various types of tax returns, such as individual, business, and estate taxes.

- Mention any specializations you have, such as international tax or tax planning.

- Provide examples of successful client interactions and problem-solving skills in tax-related situations.

For more information on CV formats, visit cv format.

Common Mistakes to Avoid in a Income Tax Preparer CV

As an Income Tax Preparer, your CV is your first impression to potential employers. It's important to ensure that your CV is free of common mistakes that could hinder your chances of landing the job. Here are 8-10 common mistakes to avoid in an Income Tax Preparer CV:

- Spelling and grammatical errors

- Lack of specific details about tax preparation experience

- Not highlighting relevant certifications or qualifications

- Including irrelevant work experience

- Failing to showcase knowledge of tax laws and regulations

- Using a generic template instead of customizing for the job

- Omitting key skills such as attention to detail and problem-solving abilities

- Not including any references or testimonials from previous clients or employers

- Overselling or exaggerating experience or skills

- Ignoring the importance of a professional and polished appearance in the CV layout and design.

Key Takeaways for a Income Tax Preparer CV

- Utilize a professional CV template from CV Templates to create a visually appealing resume.

- Highlight relevant experience in income tax preparation, including any certifications or qualifications.

- Showcase strong analytical and problem-solving skills in dealing with complex tax situations.

- Include specific examples of successful tax filings and client satisfaction in previous roles.

- Demonstrate proficiency in tax software and knowledge of current tax laws and regulations.

- Emphasize attention to detail and accuracy in preparing and reviewing tax documents.

- Use CV Builder to easily create a customized CV tailored to the income tax preparer role.

- Incorporate a cover letter using templates from Cover Letter Templates to further enhance your job application.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.