Are you ready to take the next step in your insurance career? Crafting a compelling CV is your ticket to standing out in a competitive job market, and as an insurance broker, your CV needs to showcase not only your qualifications but also your unique selling points. In this comprehensive guide, we’ll walk you through the essential elements of a successful insurance broker CV, complete with a practical example to help you visualize what you need to include. You’ll learn how to highlight your skills, experience, and achievements effectively, ensuring that potential employers see the value you bring to their team. Here’s what we’ll cover:

- Key components of an insurance broker CV

- Tips for tailoring your CV to specific job applications

- How to showcase your relevant skills and certifications

- Strategies for highlighting your achievements and successes

- Common mistakes to avoid when writing your CV

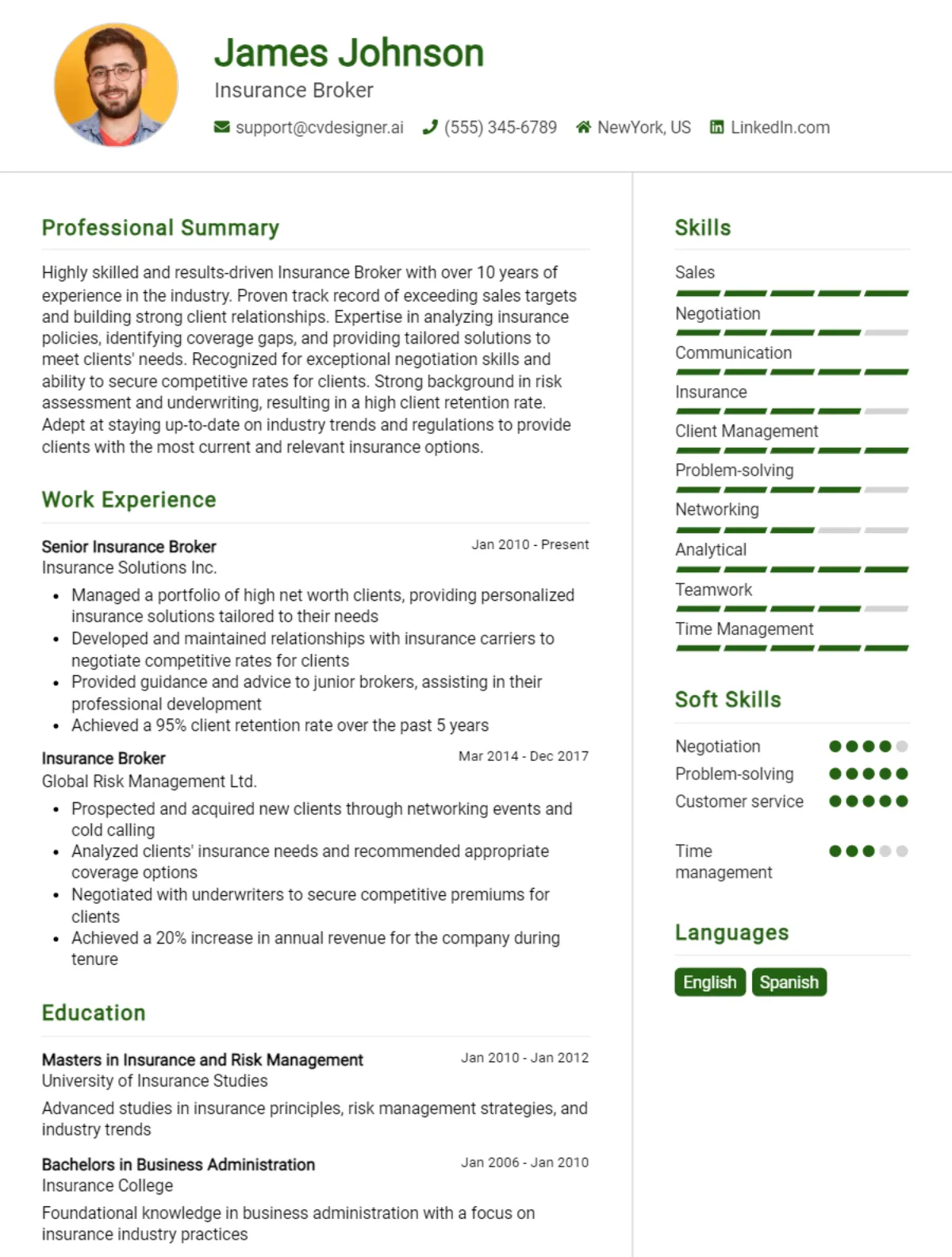

- A CV example to guide your writing process

Dive in to transform your CV into a powerful tool that opens doors to exciting new opportunities in the insurance industry!

What is a Insurance Broker CV?

A CV for an insurance broker serves as a comprehensive summary of the candidate's professional experience, skills, and qualifications specifically tailored to the insurance industry. It highlights critical competencies such as risk assessment, client relationship management, and policy negotiation, which are essential for success in this role. A well-crafted CV not only showcases the broker's expertise but also demonstrates their understanding of the unique demands of the insurance market. For those looking to enhance their CV writing skills, utilizing a cv writing guide can provide valuable insights into crafting an effective document.

Furthermore, an insurance broker's CV is crucial in making a positive first impression on potential employers or clients. It serves as a marketing tool that differentiates the broker from competitors, helping them to secure interviews and expand their professional network. Utilizing a professional cv maker can streamline the creation of a visually appealing and impactful CV, ensuring that all relevant information is presented clearly and effectively. In a competitive field like insurance, a standout CV can be the key to landing lucrative opportunities.

Key Components of a Insurance Broker CV

- Contact Information: Include your full name, phone number, email address, and LinkedIn profile link to ensure potential employers can easily reach you.

- Professional Summary: A brief overview of your career as an insurance broker, highlighting your key strengths, years of experience, and areas of expertise.

- Skills: A dedicated section showcasing relevant skills, such as client relationship management, negotiation, and risk assessment.

- Work Experience: A comprehensive outline of your work experience, detailing your roles, responsibilities, and achievements in previous positions.

- Education: List your educational qualifications, including degrees, certifications, and relevant training related to insurance and finance.

- Licenses and Certifications: Specify any insurance licenses or certifications you hold that are pertinent to the role, such as a Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU).

- Industry Knowledge: Highlight your understanding of different types of insurance products, market trends, and regulatory requirements.

- Client Management: Showcase your experience in managing client portfolios, demonstrating your ability to build and maintain long-term relationships.

- Sales Achievements: Include quantifiable sales achievements or targets met, illustrating your effectiveness in generating new business.

- Technical Proficiency: Mention any software or tools you are proficient in, such as CRM systems or insurance underwriting software.

- Professional Affiliations: List memberships in relevant professional organizations or associations that enhance your credibility as an insurance broker.

- References: Offer to provide references upon request, or include contact information for professional references who can vouch for your expertise and work ethic.

Sample Insurance Broker CV for Inspiration

[Your Name]

[Your Address]

[City, State, Zip Code]

[Your Phone Number]

[Your Email Address]

LinkedIn Profile URL

Professional Summary

Dedicated and results-driven Insurance Broker with over 5 years of experience in providing tailored insurance solutions to clients. Adept at assessing client needs, identifying appropriate coverage options, and negotiating terms to ensure optimal protection. Proven track record of building long-lasting relationships with clients through exceptional customer service and in-depth market knowledge. Committed to staying updated with industry trends and regulations to offer the best possible advice.

Work Experience

Insurance Broker

XYZ Insurance Agency, City, State

January 2020 – Present

- Develop and maintain a portfolio of clients by identifying their insurance needs and providing customized solutions.

- Conduct comprehensive market analysis to identify the best insurance products and negotiate terms with various insurance providers.

- Provide ongoing support and advice to clients, ensuring they understand their policies and coverage options.

- Achieved a 25% increase in client retention rates through exceptional service and follow-up.

- Collaborate with underwriters to assess risk and develop quotes for clients.

Junior Insurance Broker

ABC Insurance Group, City, State

June 2018 – December 2019

- Assisted senior brokers in managing client accounts and processing applications for various types of insurance.

- Conducted client interviews to gather information on their insurance needs and preferences.

- Supported in the development of marketing strategies to attract new clients, resulting in a 15% growth in new business.

- Managed administrative tasks including policy renewals, claims processing, and maintaining client databases.

Insurance Sales Associate

123 Insurance Solutions, City, State

March 2016 – May 2018

- Provided customer service to clients seeking information about insurance products and policies.

- Assisted in the preparation of insurance quotes and policy documentation.

- Conducted follow-ups with clients to ensure satisfaction and address any concerns.

- Achieved monthly sales targets through effective communication and relationship-building skills.

Education

Bachelor of Science in Business Administration

University of State, City, State

Graduated: May 2015

- Major: Finance

- Relevant Coursework: Risk Management, Insurance Principles, Financial Analysis

Skills

- Strong understanding of various insurance products (life, health, property, casualty)

- Excellent negotiation and sales skills

- Proficient in customer relationship management (CRM) software

- Strong analytical and problem-solving abilities

- Ability to communicate complex information clearly and effectively

- Detail-oriented with strong organizational skills

Certifications

- Licensed Insurance Broker, State License Number: [Your License Number]

- Chartered Insurance Professional (CIP) - [Issuing Organization, Year]

- Certified Insurance Counselor (CIC) - [Issuing Organization, Year]

Publications

- "Understanding the Importance of Life Insurance: A Guide for First-Time Buyers," Insurance Monthly, June 2023

- "Navigating Health Insurance: Tips for Small Business Owners," Business Insights Journal, March 2022

References

Available upon request.

Insurance Broker CV Writing Tips

When crafting a CV for an insurance broker role, it's essential to highlight both your technical knowledge of various insurance products and your interpersonal skills. Focus on showcasing your ability to build relationships with clients, assess their needs, and provide tailored solutions. Use clear, concise language and ensure your CV is well-organized, making it easy for hiring managers to spot your relevant experience and achievements. Incorporate industry-specific terminology to demonstrate your expertise and familiarity with the insurance landscape. Tailor your CV for each application, emphasizing the skills and experiences that align with the specific position you are pursuing.

CV Writing Tips for Insurance Brokers:

- Highlight Relevant Experience: Focus on your previous roles in insurance, sales, or customer service, emphasizing achievements like sales targets met or client accounts managed.

- Showcase Skills: Include both hard skills (like knowledge of insurance policies, regulations, and software) and soft skills (like communication, negotiation, and relationship-building).

- Use Quantifiable Achievements: Whenever possible, include numbers and metrics to illustrate your success, such as percentage increases in sales or client retention rates.

- Tailor Your CV: Customize your CV for each job application, aligning your skills and experiences with the specific requirements mentioned in the job description.

- Include Certifications: List any relevant certifications or licenses, such as a Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU).

- Professional Summary: Start with a strong professional summary that captures your experience, skills, and what you can bring to the potential employer in a few impactful sentences.

- Networking and References: Consider including a section for professional references or networking connections in the insurance industry, which can add credibility to your application.

- Clean Layout: Use a clean, professional layout with clear headings and bullet points to ensure your CV is easy to read and visually appealing.

Insurance Broker CV Summary Examples

As an Insurance Broker, your CV summary is your opportunity to make a strong first impression. It should encapsulate your skills, experience, and what sets you apart in the industry. Here are some effective CV summary examples tailored for an Insurance Broker role:

“Dynamic and results-oriented Insurance Broker with over 7 years of experience in providing tailored insurance solutions to clients. Proven track record of building strong client relationships and increasing policy sales through exceptional customer service and strategic marketing initiatives.”

“Detail-oriented Insurance Broker with expertise in commercial and personal lines insurance. Adept at analyzing client needs and developing comprehensive insurance plans that mitigate risk and maximize coverage. Committed to continuous professional development and staying abreast of industry trends.”

“Proficient Insurance Broker with a solid background in risk assessment and management. Skilled in negotiating with underwriters to secure optimal terms for clients. Recognized for a client-first approach and the ability to simplify complex insurance concepts.”

“Seasoned Insurance Broker with a passion for helping clients navigate the complexities of insurance products. Strong analytical skills combined with an extensive network of industry contacts. Dedicated to fostering long-term relationships and delivering exceptional value through personalized service.”

“Ambitious Insurance Broker with expertise in both individual and group insurance policies. Excellent communication and interpersonal skills, with a focus on educating clients about their options. Proven ability to exceed sales targets and enhance client satisfaction through proactive engagement.”

Build a Strong Experience Section for Your Insurance Broker CV

As an Insurance Broker, showcasing your work experience effectively is crucial to highlight your skills, achievements, and the value you bring to potential employers. Below are examples of strong work experience descriptions that illustrate your capabilities in the insurance industry and your ability to manage client relationships, assess risks, and provide tailored insurance solutions.

- Developed and maintained relationships with over 150 clients, providing personalized insurance solutions and achieving a 95% client retention rate through exceptional service and follow-up.

- Conducted comprehensive risk assessments for clients in various industries, resulting in customized coverage plans that reduced overall risk exposure by an average of 30%.

- Collaborated with underwriters to negotiate policy terms and premiums, successfully securing favorable conditions for clients and increasing overall client satisfaction scores by 20%.

- Implemented a new client management software system that streamlined the onboarding process, reducing the time taken to issue policies by 40% and improving team productivity.

- Trained and mentored junior brokers on industry best practices and customer service techniques, contributing to a 15% increase in team sales performance within the first year.

- Analyzed market trends and competitor offerings to identify opportunities for new product development, leading to the launch of two innovative insurance products that generated an additional $500,000 in annual revenue.

- Prepared and delivered informative presentations to clients on the benefits of various insurance products, enhancing client understanding and increasing policy uptake by 25%.

- Managed claims processes for clients, ensuring timely communication and resolution, which resulted in a 30% increase in client satisfaction ratings regarding claims handling.

Insurance Broker CV Education Examples

An effective education background is essential for a successful career as an insurance broker. Having a solid foundation in finance, business, and risk management can significantly enhance your ability to serve clients and navigate the complexities of the insurance industry. Here are some relevant educational qualifications that can benefit aspiring insurance brokers:

- Bachelor’s Degree in Finance: A degree in finance provides a deep understanding of financial markets, investment strategies, and risk assessment, all of which are crucial for advising clients on their insurance needs.

- Bachelor’s Degree in Business Administration: This program covers various aspects of business operations, including management, marketing, and economics, equipping brokers with the necessary skills to manage their practices effectively.

- Degree in Risk Management and Insurance: Specialized programs focusing on risk management delve into the principles of insurance, allowing brokers to understand and analyze risks associated with different insurance products.

- Certification in Insurance: Professional certifications, such as the Chartered Property Casualty Underwriter (CPCU) or Associate in Commercial Underwriting (AU), enhance credibility and demonstrate a commitment to the insurance profession.

- Master’s Degree in Business or Finance: An advanced degree can provide a competitive edge in the industry, offering higher-level insights into strategic decision-making and advanced financial analysis relevant to insurance brokerage.

Skills to Highlight in Your Insurance Broker CV

As an insurance broker, having a well-rounded skill set is essential for success in navigating the complex landscape of insurance products and client needs. A compelling CV should highlight both soft and hard skills that demonstrate your ability to build relationships, analyze risks, and provide tailored solutions. Here’s a comprehensive list of skills to consider showcasing in your CV.

Soft Skills:

- Excellent Communication – Ability to convey complex information clearly to clients.

- Negotiation Skills – Expertise in negotiating terms and prices with insurers.

- Relationship Building – Strong aptitude for developing and maintaining client relationships.

- Problem-Solving – Proficient in assessing client needs and providing effective solutions.

- Empathy – Understanding clients' concerns and providing reassurance.

- Time Management – Capable of managing multiple clients and deadlines efficiently.

- Adaptability – Flexibility to adjust strategies based on changing market conditions.

- Attention to Detail – Keen eye for detail when reviewing policies and documents.

- Customer Service Orientation – Commitment to serving clients and exceeding their expectations.

- Team Collaboration – Ability to work effectively with colleagues and stakeholders.

Hard Skills:

- Knowledge of Insurance Products – Familiarity with various types of insurance and their features.

- Risk Assessment – Ability to evaluate and analyze client risks thoroughly.

- Regulatory Compliance – Understanding of industry regulations and compliance requirements.

- Data Analysis – Skills in interpreting and analyzing insurance data and trends.

- Financial Acumen – Proficiency in understanding financial documents and metrics.

- Sales Techniques – Knowledge of effective sales strategies and techniques.

- Market Research – Ability to conduct research on market trends and competitors.

- Policy Underwriting – Understanding of the underwriting process and criteria.

- IT Proficiency – Competence in using insurance software and CRM systems.

- Report Writing – Capable of creating clear and concise reports for clients and management.

Insurance Broker CV Format

When crafting a CV for an Insurance Broker position, it's essential to tailor the format to reflect your level of experience and expertise within the industry. A well-structured CV not only highlights your qualifications but also presents your professional journey in a clear and engaging manner. For different job levels, the format can vary:

- Entry-Level: Use a chronological format that emphasizes education, relevant internships, and any sales or customer service experience. Focus on transferable skills and certifications.

- Mid-Level: Opt for a combination format that showcases both work history and skills. Include specific achievements in previous roles, such as client acquisition or retention rates, and any specialized training or certifications.

- Senior-Level: A targeted format is ideal, highlighting leadership roles and strategic contributions to previous employers. Focus on quantifiable results, such as increased revenue or market share, and include industry-specific accomplishments.

- Specialist Roles: For niche positions, consider a functional format that emphasizes relevant certifications, specialized skills, and significant projects or cases handled.

- Freelance or Independent Brokers: A portfolio-style CV can work well, showcasing a summary of clients, types of insurance handled, and successful case studies.

For more detailed guidance on the best CV format for your specific needs, check out this cv format resource.

Common Mistakes to Avoid in a Insurance Broker CV

When crafting a CV as an insurance broker, it's essential to present your qualifications and experience in a way that stands out to potential employers. However, there are several common mistakes that candidates often make, which can hinder their chances of securing an interview. Avoiding these pitfalls can significantly enhance the effectiveness of your CV and showcase your professionalism in the competitive insurance industry.

- Neglecting a Professional Format: Using an unprofessional layout or an overly complex design can make your CV hard to read. Stick to a clean, simple format.

- Lack of Specificity: Failing to include specific details about your roles and achievements can leave employers unclear about your capabilities. Use quantifiable metrics where possible.

- Generic Objective Statements: Using a vague or generic objective statement does not demonstrate your unique value. Tailor your objective to reflect your aspirations in the insurance field.

- Overloading with Irrelevant Information: Including unrelated work experiences or skills can dilute the focus of your CV. Stick to information relevant to the insurance industry.

- Ignoring Keywords: Not incorporating industry-specific keywords can lead to your CV being overlooked by applicant tracking systems (ATS). Research common terms used in the insurance sector.

- Excessive Length: Making your CV too long can overwhelm hiring managers. Aim for a concise, one to two-page document that highlights your most relevant experiences.

- Poor Grammar and Spelling: Typos and grammatical errors can create a negative impression. Always proofread your CV multiple times or have someone else review it.

- Lack of Professional Development: Failing to mention certifications, licenses, or ongoing education can suggest a lack of commitment to professional growth. Highlight relevant qualifications.

- Not Tailoring for Each Application: Sending the same CV for every job application can be detrimental. Customize your CV to align with the specific requirements of each position you apply for.

Key Takeaways for a Insurance Broker CV

- Contact Information: Clearly list your name, phone number, email address, and LinkedIn profile at the top of your CV for easy accessibility.

- Professional Summary: Write a compelling summary that highlights your experience, skills, and career goals as an insurance broker, tailored to the job you are applying for.

- Relevant Experience: Detail your previous roles in the insurance industry, focusing on achievements, responsibilities, and any specializations, such as life, health, or property insurance.

- Key Skills: Include a section on pertinent skills such as customer service, negotiation, risk assessment, and regulatory knowledge to showcase your qualifications.

- Certifications and Licenses: List relevant certifications and licenses that are essential for an insurance broker, ensuring compliance with industry standards.

- Education: Mention your educational background, including degrees and any relevant coursework or honors that pertain to the insurance sector.

- Sales Achievements: Quantify your success with specific metrics, such as sales figures, client retention rates, or growth in market share to demonstrate your effectiveness.

- Professional Affiliations: Highlight memberships in professional organizations or associations related to insurance that can enhance your credibility.

- Technical Proficiency: Include any specialized software or tools you are proficient in, such as CRM systems or insurance underwriting software.

- Networking Skills: Emphasize your ability to build and maintain relationships with clients, underwriters, and other stakeholders in the insurance industry.

- Tailored Application: Tailor your CV for each application, aligning your experience and skills with the specific requirements of the job description.

- Cover Letter: Consider creating a customized cover letter using our cover letter templates to complement your CV and provide a more personal touch.

For a polished CV, explore our cv templates or utilize our cv builder to create a professional layout that stands out.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.