As the backbone of the insurance industry, Insurance Clerks play a crucial role in processing claims, managing policies, and ensuring that clients receive the best service possible. If you're looking to carve out a successful career in this field, having a standout CV is essential. In this article, we’ll provide you with a comprehensive guide on writing an effective CV that not only highlights your skills and experiences but also positions you as the ideal candidate for the role. From formatting tips to essential sections that should never be overlooked, we will cover everything you need to know to create a compelling CV that catches the eye of hiring managers. Here’s what you can expect to learn:

- Understanding the Insurance Clerk Role: Key responsibilities and skills required.

- Structuring Your CV: How to organize your information for maximum impact.

- Tailoring Your CV: Customizing your application to the job description.

- Highlighting Relevant Experience: Showcasing internships, part-time jobs, and volunteer work.

- Essential Skills to Include: Identifying and emphasizing both hard and soft skills.

- Professional Formatting Tips: Best practices for layout and design.

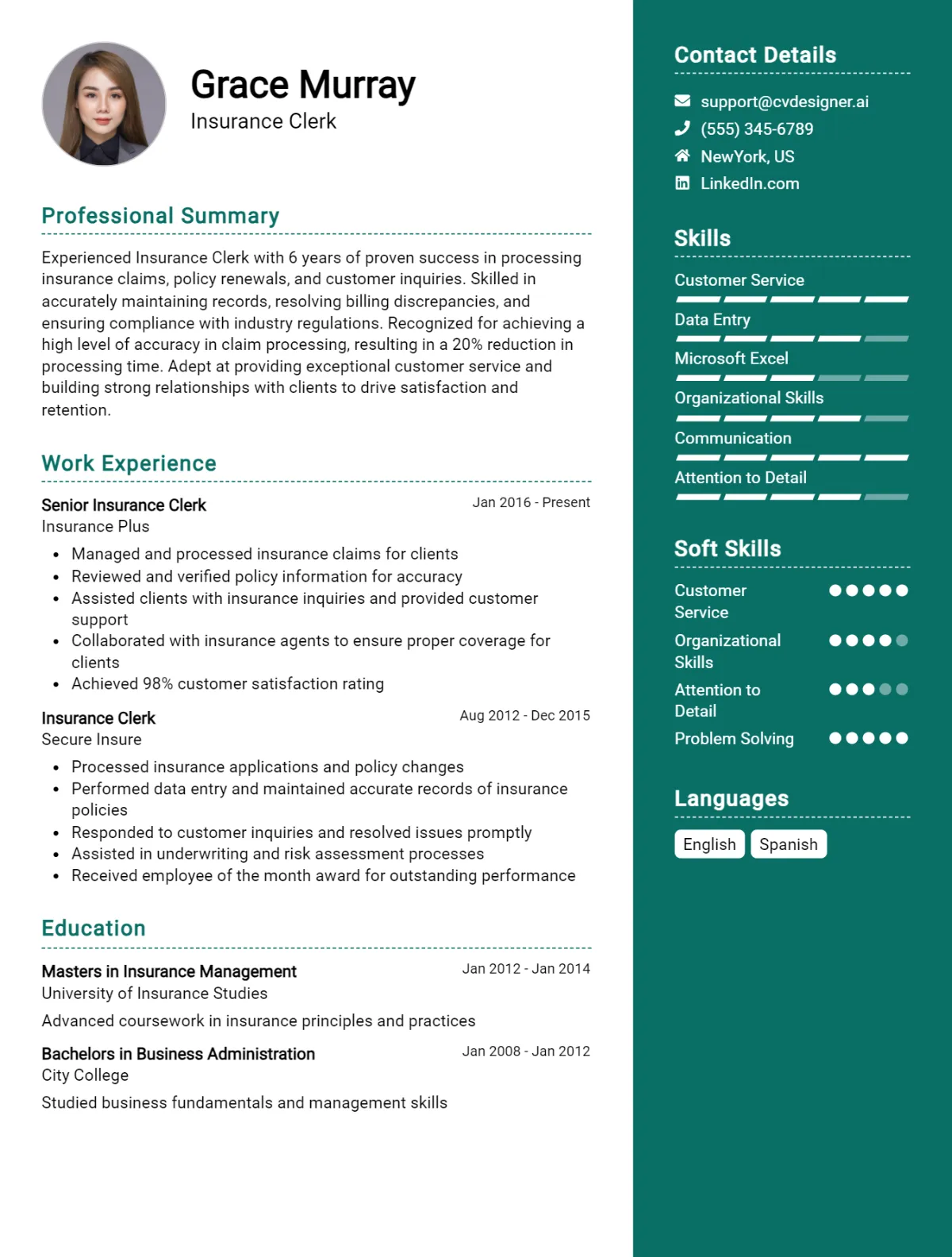

- CV Example: A practical template to guide your writing.

Dive in to discover how to craft a CV that sets you apart in the competitive insurance job market!

What is a Insurance Clerk CV?

A CV for an Insurance Clerk serves as a crucial document that outlines the candidate's skills, experience, and qualifications relevant to the insurance industry. This role typically involves managing policy information, processing claims, and assisting clients with their inquiries. A well-crafted CV highlights essential competencies such as attention to detail, organizational skills, and knowledge of insurance regulations. It not only presents the candidate's professional journey but also demonstrates their ability to meet the specific demands of the insurance sector, making it an essential tool in the job application process. For more detailed tips on crafting an effective CV, refer to our cv writing guide.

The importance of a CV for an Insurance Clerk cannot be overstated, as it acts as the first impression to potential employers. A compelling CV can significantly enhance a candidate's chances of securing an interview by effectively showcasing their relevant experience and achievements. Utilizing a CV maker can streamline this process, allowing candidates to create a polished and professional document that stands out in a competitive job market. By presenting their qualifications clearly and succinctly, aspiring Insurance Clerks can better position themselves as ideal candidates for the roles they seek.

Key Components of a Insurance Clerk CV

- Contact Information: Include your full name, phone number, email address, and location to make it easy for employers to reach you.

- Professional Summary: A brief overview of your career, highlighting your experience and skills relevant to the insurance industry.

- Key Skills: List essential skills such as attention to detail, communication, and customer service. For more on this, check out our guide on skills.

- Work Experience: Detail your previous roles, focusing on responsibilities and achievements that demonstrate your insurance knowledge. For guidance on this, refer to our section on work experience.

- Education: Include your educational background, listing relevant degrees or certifications related to insurance or finance.

- Certifications: Mention any professional certifications, such as those from the Insurance Institute, that enhance your qualifications.

- Technical Skills: Highlight proficiency in insurance software, data entry systems, and Microsoft Office, which are crucial for an insurance clerk role.

- Customer Service Experience: Emphasize your experience in dealing with clients, resolving issues, and providing support, as these are key aspects of the job.

- Attention to Detail: Showcase your ability to spot errors and ensure accuracy in documentation and data entry.

- Team Collaboration: Note your experience working in teams, as collaboration is often essential in the insurance sector.

- Problem-Solving Skills: Illustrate your capacity to handle challenges and find solutions within the insurance processes.

- References: Provide contacts who can vouch for your professionalism and expertise, ideally from the insurance industry.

Sample Insurance Clerk CV for Inspiration

John Doe

123 Main Street

Cityville, ST 12345

(123) 456-7890

john.doe@email.com

LinkedIn: linkedin.com/in/johndoe

Professional Summary

Detail-oriented and organized Insurance Clerk with over 5 years of experience in processing insurance applications, managing client records, and providing exceptional customer service. Proven ability to handle sensitive information with confidentiality and accuracy. Strong communication skills and a commitment to maintaining compliance with industry regulations while assisting clients in understanding their insurance options.

Work Experience

Insurance Clerk

XYZ Insurance Company, Cityville, ST

March 2019 – Present

- Processed a high volume of insurance applications and renewals, ensuring accuracy and compliance with company policies and state regulations.

- Managed client records and documentation, maintaining confidentiality and data integrity in compliance with HIPAA guidelines.

- Assisted clients with inquiries regarding policy details, claim processes, and coverage options, resulting in a 95% satisfaction rate in customer feedback surveys.

- Collaborated with underwriters and agents to expedite the approval process for new policies and claims, improving overall efficiency by 20%.

- Developed and maintained a tracking system for claims, ensuring timely follow-up and resolution of outstanding issues.

Insurance Assistant

ABC Insurance Services, Cityville, ST

June 2016 – February 2019

- Supported insurance agents in the preparation and submission of policy applications and documentation, contributing to a 30% increase in new client acquisitions.

- Conducted data entry and maintained accurate records in the agency management system, reducing discrepancies by 15%.

- Communicated with clients to gather necessary information and documentation for claims processing, ensuring a smooth and efficient claims experience.

- Assisted in the training of new hires on company policies, procedures, and software systems, enhancing team productivity.

Education

Associate of Applied Science in Business Administration

Cityville Community College, Cityville, ST

Graduated: May 2016

Skills

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

- Experience with insurance management software (e.g., Applied Epic, Vertafore)

- Strong organizational and time-management abilities

- Excellent verbal and written communication skills

- Knowledge of insurance policies, procedures, and regulations

- Ability to handle sensitive information with discretion

Certifications

- Insurance Fundamentals Certificate, National Alliance for Insurance Education and Research, 2021

- HIPAA Compliance Training Certification, Health Insurance Portability and Accountability Act, 2022

Publications

- "Best Practices for Efficient Claims Processing," Insurance Clerk Journal, August 2022

- "Understanding Insurance Policies: A Guide for Clients," Cityville Community Newsletter, January 2023

References available upon request.

Insurance Clerk CV Writing Tips

When crafting a CV for an Insurance Clerk position, it’s essential to highlight relevant skills and experiences that align with the requirements of the role. Focus on showcasing your attention to detail, organizational abilities, and familiarity with insurance processes and regulations. Be sure to tailor your CV to the job description, using keywords that reflect the qualifications sought by employers. Additionally, include quantifiable achievements where possible to demonstrate your impact in previous roles. A clean and professional layout will also enhance readability, making it easier for hiring managers to see your qualifications at a glance.

CV Writing Tips for Insurance Clerk:

- Highlight Relevant Experience: Clearly outline your previous roles in insurance or related fields, emphasizing your responsibilities and accomplishments.

- Showcase Technical Skills: Mention any software or tools you are proficient in, such as claims processing systems or customer relationship management (CRM) software.

- Use Keywords: Incorporate industry-specific terminology and keywords from the job description to help your CV pass through applicant tracking systems.

- Emphasize Attention to Detail: Provide examples that demonstrate your meticulousness in data entry, document handling, and compliance with regulations.

- Quantify Achievements: Where possible, use numbers to illustrate your contributions (e.g., "Processed over 100 insurance claims per week with a 98% accuracy rate").

- Include Soft Skills: Highlight interpersonal skills like communication, problem-solving, and teamwork, which are essential in customer-facing roles.

- Keep It Concise: Aim for a clear and concise CV, ideally one page, ensuring that every point you include is relevant to the position.

- Professional Formatting: Use a clean, professional layout with consistent fonts and spacing, making your CV easy to read and visually appealing.

Insurance Clerk CV Summary Examples

As an Insurance Clerk, it's essential to present a strong CV summary that highlights your skills, experience, and dedication to providing excellent service. Below are several examples of effective CV summaries tailored for this role:

Detail-oriented Insurance Clerk with over 5 years of experience in processing claims and managing policy documentation. Proven ability to maintain accurate records and ensure compliance with industry regulations, resulting in a 20% reduction in processing errors.

Dedicated Insurance Clerk skilled in customer service and administrative support, with a strong background in claims processing and policy management. Recognized for exceptional organizational skills and the ability to handle multiple tasks efficiently in a fast-paced environment.

Results-driven Insurance Clerk with expertise in data entry and record-keeping, complemented by a strong understanding of insurance policies and procedures. Committed to providing timely and accurate support to clients and colleagues, contributing to a 30% improvement in customer satisfaction ratings.

Proficient Insurance Clerk with a solid foundation in claims assessment and policy administration. Adept at utilizing insurance software systems to streamline processes and enhance communication between clients and insurance providers.

Motivated Insurance Clerk with a comprehensive background in handling insurance inquiries and resolving customer issues. Strong analytical skills and attention to detail, enabling the accurate processing of claims while ensuring adherence to company policies and regulations.

Build a Strong Experience Section for Your Insurance Clerk CV

As an Insurance Clerk, your experience section should highlight your attention to detail, organizational skills, and ability to manage various administrative tasks effectively. Below are examples of strong work experience descriptions that showcase relevant skills and responsibilities.

- Processed and verified insurance claims, ensuring accuracy and compliance with company policies, resulting in a 15% reduction in claim processing time.

- Maintained comprehensive records of policyholders, including personal information, coverage details, and payment history, contributing to improved customer service and satisfaction rates.

- Assisted in the development of new insurance product materials and promotional content, enhancing the understanding of offerings among clients and increasing sales by 10%.

- Coordinated communication between clients, underwriters, and claims adjusters, facilitating timely resolution of inquiries and claims, which improved overall workflow efficiency.

- Conducted regular audits of policy documents and claims files, identifying discrepancies and implementing corrective measures, leading to a 20% decrease in errors.

- Provided exceptional front-line customer service by addressing inquiries and resolving issues swiftly, contributing to a 30% increase in client retention.

- Trained new staff on insurance processing systems and customer service protocols, fostering a knowledgeable team and improving overall operational performance.

- Utilized insurance software programs to update client databases and generate reports, enhancing data analysis capabilities and supporting management decision-making processes.

Insurance Clerk CV Education Examples

An Insurance Clerk plays a vital role in the insurance industry, handling administrative tasks, processing claims, and ensuring accurate record-keeping. A solid educational foundation is essential for this position, as it equips candidates with the necessary skills and knowledge to succeed. Below are several examples of relevant educational backgrounds that can enhance a candidate's qualifications for the role of an Insurance Clerk.

- Associate Degree in Business Administration

This degree provides a strong understanding of business principles, including accounting, management, and marketing, which are essential for managing insurance documentation and client interactions. - Certificate in Insurance and Risk Management

This specialized program focuses on the fundamentals of insurance policies, claims processing, and risk assessment, helping clerks understand the intricacies of the industry. - Bachelor’s Degree in Finance

A finance degree offers in-depth knowledge of financial management and investment strategies, useful for understanding policy costs and handling financial transactions related to insurance claims. - Diploma in Office Administration

This program emphasizes administrative skills, including data entry, record maintenance, and customer service, which are critical for the day-to-day operations of an Insurance Clerk. - Course in Medical Billing and Coding

For those working in health insurance, this course provides essential knowledge of medical terminology, billing practices, and coding systems, enabling clerks to process claims accurately and efficiently.

Skills to Highlight in Your Insurance Clerk CV

As an Insurance Clerk, your role is crucial in ensuring the smooth operation of insurance processes and maintaining accurate records. Highlighting both soft and hard skills on your CV can significantly enhance your candidacy, demonstrating your ability to work effectively in a dynamic environment while managing detailed information. Below are essential skills to consider showcasing on your CV.

Soft Skills:

- Attention to Detail

- Strong Communication Skills

- Time Management

- Customer Service Orientation

- Problem-Solving Abilities

- Adaptability

- Team Collaboration

- Organizational Skills

- Critical Thinking

- Empathy

Hard Skills:

- Proficiency in Insurance Software (e.g., Policy Management Systems)

- Data Entry and Management

- Knowledge of Insurance Policies and Procedures

- Familiarity with Regulatory Compliance

- Microsoft Office Suite (Excel, Word, Outlook)

- Basic Accounting Principles

- Claims Processing Experience

- Record Keeping and Documentation

- Risk Assessment Techniques

- Understanding of Underwriting Practices

Insurance Clerk CV Format

As an Insurance Clerk, your CV should effectively showcase your skills, experience, and qualifications in a clear and concise manner. The best format for your CV can vary based on your level of experience, whether you are an entry-level candidate, have some experience, or are a seasoned professional. A well-structured CV can help you stand out in a competitive job market.

For entry-level positions, a functional format that highlights relevant skills and education is ideal. For mid-level roles, a chronological format that emphasizes work experience and achievements is more effective. Senior-level candidates may benefit from a combination format that showcases both skills and a detailed work history.

- Start with a strong objective statement that clearly outlines your career goals and what you bring to the table.

- List relevant skills such as data entry, customer service, and knowledge of insurance policies.

- Include your educational background, emphasizing any certifications or training related to insurance.

- Highlight your work experience, focusing on specific achievements or contributions in previous roles.

- Use quantifiable metrics to demonstrate your impact, such as processing times or customer satisfaction rates.

- Tailor your CV to the job description by incorporating keywords that align with the position's requirements.

For more guidance on formatting your CV, check out this cv format resource.

Common Mistakes to Avoid in a Insurance Clerk CV

When applying for a position as an Insurance Clerk, your CV serves as your first point of contact with potential employers. It's essential to make a strong impression by presenting your skills and experiences effectively. However, many applicants make common mistakes that can undermine their chances of securing an interview. By being aware of these pitfalls and avoiding them, you can enhance the quality of your CV and increase your chances of landing the job.

- Failing to tailor the CV to the specific job description.

- Using generic language and clichés without showcasing unique skills.

- Omitting relevant insurance industry certifications or qualifications.

- Listing job duties instead of focusing on achievements and contributions.

- Neglecting to include specific software or technical skills relevant to the role.

- Providing excessive personal information that is not pertinent to the job.

- Using a cluttered layout or unprofessional formatting.

- Ignoring grammar and spelling errors, which can create a negative impression.

- Not including quantifiable results to demonstrate the impact of previous roles.

- Overloading the CV with irrelevant information or experiences.

Key Takeaways for a Insurance Clerk CV

- Begin with a clear and concise professional summary that highlights your experience and skills relevant to the insurance industry.

- List your relevant work experience chronologically, focusing on roles that demonstrate your understanding of insurance processes and customer service.

- Highlight specific skills such as data entry accuracy, attention to detail, and proficiency in insurance software or databases.

- Include any relevant certifications or training programs you have completed that relate to insurance or clerical work.

- Emphasize your ability to handle customer inquiries, process claims, and maintain accurate records, showcasing your communication skills.

- Mention your familiarity with various types of insurance policies and regulations, as this knowledge is crucial for the role.

- Use action verbs in your bullet points to describe your responsibilities and achievements, making your CV more dynamic.

- Quantify your accomplishments where possible, such as "Processed over 200 claims per month" or "Achieved a 98% customer satisfaction rating."

- Tailor your CV to the specific job description by incorporating keywords and phrases that align with the insurer's requirements.

- Consider using cv templates to create a professional layout that enhances readability.

- Utilize a cv builder for a streamlined process that ensures your CV is polished and well-structured.

- Don’t forget to include a cover letter that introduces you to potential employers; you can find helpful cover letter templates to assist you in crafting a compelling narrative.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.