Are you passionate about finance and eager to make a difference in the investment world? As an Investment Officer, you play a crucial role in managing investment portfolios, analyzing market trends, and maximizing returns for clients. In this comprehensive CV writing guide, we will walk you through the essential tips and strategies to create a standout resume that will impress potential employers. From showcasing your financial expertise to highlighting your strong analytical skills, we will cover everything you need to know to land your dream job as an Investment Officer. Stay tuned for expert advice and a sample CV that will help you stand out in the competitive finance industry. Get ready to take your career to the next level!

CV Writing Tips:

- Highlight your relevant experience in the finance industry

- Showcase your expertise in investment analysis and portfolio management

- Emphasize your strong analytical skills and attention to detail

- Quantify your achievements with measurable results

- Use a professional format and language to make a great first impression.

What is a Investment Officer CV?

A Investment Officer CV is a crucial document that outlines a professional's qualifications, experiences, and skills related to the field of investment management. This document serves as a summary of the individual's career trajectory, showcasing their expertise in analyzing financial data, making strategic investment decisions, and managing portfolios. A well-crafted CV can help a Investment Officer stand out in a competitive job market, highlighting their achievements and capabilities to potential employers.

In the world of finance, where attention to detail and strong analytical skills are paramount, a Investment Officer CV plays a vital role in showcasing the candidate's suitability for the role. Employers rely on CVs to quickly assess a candidate's qualifications and determine if they possess the necessary skills and experience for the position. Therefore, it is essential for Investment Officers to ensure that their CV is professionally written, tailored to the specific job requirements, and effectively communicates their unique value proposition. For tips on how to write a compelling CV, check out this CV writing guide for valuable insights and advice.

Key Components of a Investment Officer CV

- Summary statement highlighting relevant skills and experience

- Educational background, including degrees and certifications

- Relevant skills, such as financial analysis, risk assessment, and portfolio management skills

- Work experience, detailing previous roles in investment management or related fields work experience

- Specific achievements and accomplishments in previous roles

- Knowledge of investment products and markets

- Familiarity with financial regulations and compliance standards

- Strong communication and interpersonal skills

- Ability to work well under pressure and meet deadlines

- Proficiency in financial software and tools

- Professional affiliations or memberships in industry organizations

- References from previous employers or colleagues

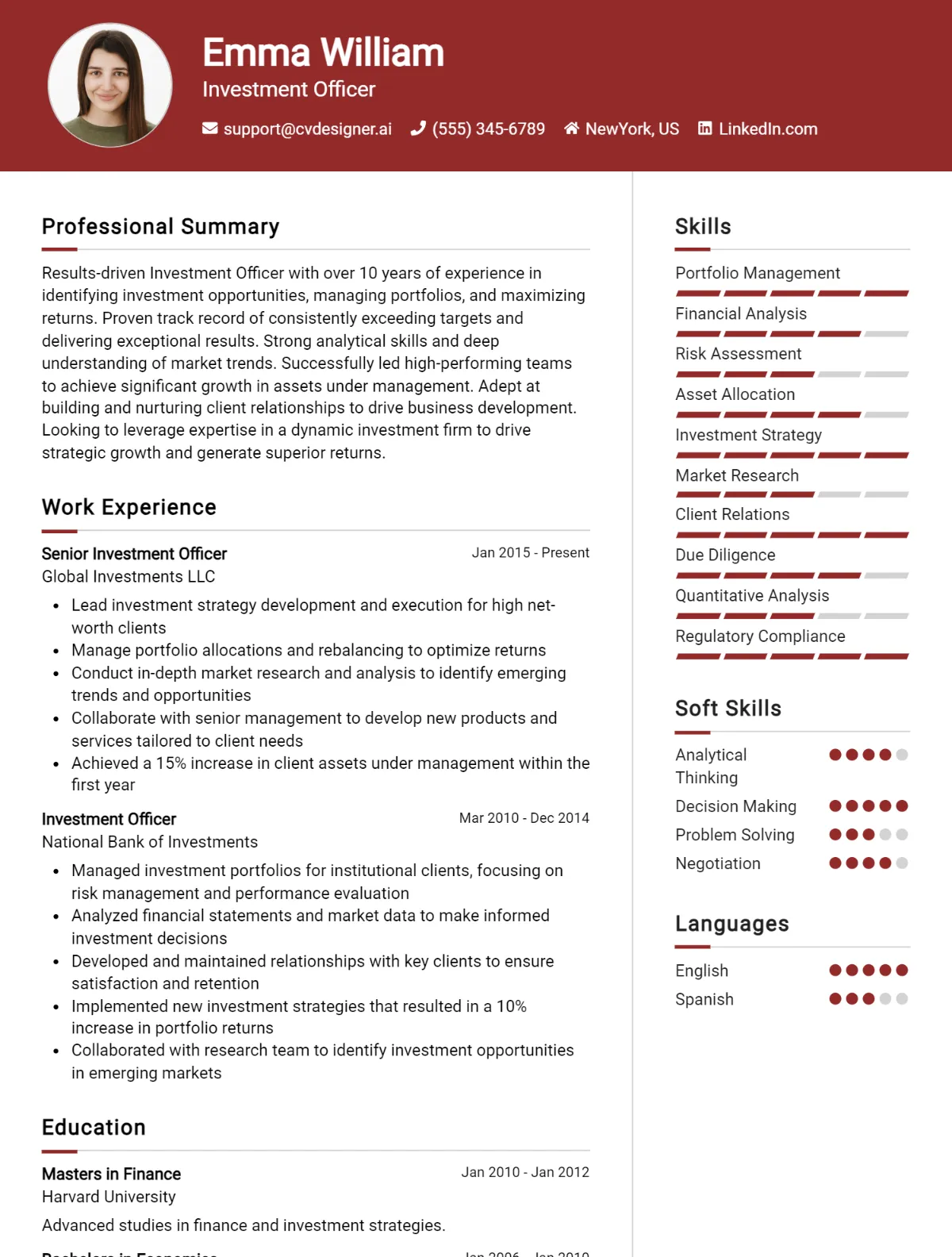

Sample Investment Officer CV for Inspiration

John Doe

123 Investment Street, New York, NY 10001 | (555) 555-5555 | johndoe@email.com

Professional Summary: Experienced and results-driven Investment Officer with a proven track record of successfully managing investment portfolios for high-net-worth individuals and institutional clients. Skilled in conducting financial analysis, market research, and due diligence to identify profitable investment opportunities. Strong communication and negotiation skills with the ability to build and maintain relationships with clients.

Work Experience:

Senior Investment Officer ABC Investment Firm, New York, NY July 2015 - Present

- Manage a portfolio of high-net-worth clients, providing investment recommendations and executing trades to achieve financial goals.

- Conduct in-depth financial analysis and market research to identify potential investment opportunities.

- Develop investment strategies based on client risk tolerance and financial objectives.

- Monitor portfolio performance and make adjustments as needed to optimize returns.

- Collaborate with internal teams and external partners to provide comprehensive investment solutions for clients.

Investment Analyst XYZ Wealth Management, New York, NY January 2012 - June 2015

- Assisted senior investment officers in analyzing investment opportunities and preparing investment proposals for clients.

- Conducted due diligence on potential investments, including financial modeling and risk assessment.

- Monitored market trends and provided regular updates to clients on portfolio performance.

- Participated in client meetings and presentations to discuss investment strategies and recommendations.

Education:

Bachelor of Business Administration in Finance University of New York, New York, NY Graduated May 2012

Skills:

- Financial Analysis

- Portfolio Management

- Market Research

- Investment Strategies

- Risk Management

- Communication

- Relationship Building

- Negotiation

Publications:

- "The Impact of Market Volatility on Investment Performance" - Journal of Finance, 2014

Certifications:

- Chartered Financial Analyst (CFA)

- Series 7 and 63 licenses

Investment Officer CV Writing Tips

When writing a CV for a Investment Officer role, it is important to highlight your experience in financial analysis, investment management, and risk assessment. Be sure to showcase your strong analytical skills and attention to detail. Tailor your CV to the specific job requirements and showcase your track record of successful investments.

- Include a professional summary at the beginning of your CV that highlights your relevant experience and skills.

- List any certifications or licenses related to finance or investments.

- Highlight any specific achievements or successful investments you have made in the past.

- Showcase your knowledge of different investment strategies and financial products.

- Emphasize your ability to conduct thorough research and analysis to make informed investment decisions.

- Include any experience with portfolio management or asset allocation.

- Demonstrate your proficiency with financial software and tools.

- Provide references from previous employers or clients who can attest to your investment expertise.

Investment Officer CV Summary Examples

- Accomplished Investment Officer with over 8 years of experience in analyzing market trends, identifying investment opportunities, and managing client portfolios. Proven track record of delivering exceptional returns for clients while minimizing risk. Strong analytical skills and a deep understanding of financial markets.

- Results-driven Investment Officer with a background in wealth management and financial advisory services. Skilled in conducting thorough research, developing investment strategies, and building strong relationships with clients. Proficient in analyzing financial statements and market data to make informed investment decisions.

- Seasoned Investment Officer with a passion for helping clients achieve their financial goals. Expertise in asset allocation, risk management, and portfolio optimization. Strong communication skills and the ability to explain complex financial concepts in a clear and concise manner.

- Dynamic Investment Officer with a knack for identifying emerging market trends and investment opportunities. Experienced in conducting due diligence, evaluating investment options, and monitoring portfolio performance. Proven ability to adapt to changing market conditions and deliver positive results for clients.

- Strategic Investment Officer with a proven track record of building and managing successful investment portfolios. Skilled in conducting financial analysis, developing investment strategies, and implementing risk management techniques. Strong attention to detail and a commitment to delivering superior results for clients.

Build a Strong Experience Section for Your Investment Officer CV

As an Investment Officer, my role involves analyzing market trends, conducting research, and making strategic investment decisions to maximize returns for clients. My experience includes managing portfolios, evaluating risk factors, and developing investment strategies to meet financial goals. Here are some examples of strong work experience descriptions for a Investment Officer:

- Conducted thorough research on various industries and companies to identify potential investment opportunities.

- Managed a diverse portfolio of assets, consistently exceeding performance benchmarks and delivering strong returns for clients.

- Collaborated with financial analysts and research teams to assess market conditions and make informed investment decisions.

- Implemented risk management strategies to mitigate potential losses and protect client investments.

- Communicated regularly with clients to provide updates on portfolio performance and discuss investment strategies.

- Monitored economic indicators and global market trends to adjust investment strategies accordingly.

- Developed comprehensive investment proposals and presented recommendations to investment committees.

- Stayed current on industry regulations and compliance standards to ensure all investments were in accordance with legal requirements.

Investment Officer CV Education Examples

As an Investment Officer, having a strong educational background is crucial to success in the field. Here are a few examples of relevant educational backgrounds for a Investment Officer:

- Bachelor's Degree in Finance or Economics: A degree in finance or economics provides a solid foundation in financial markets, investment strategies, and economic principles.

- Master's Degree in Business Administration (MBA): An MBA can provide a deeper understanding of financial analysis, risk management, and investment decision-making.

- Chartered Financial Analyst (CFA) Certification: Achieving a CFA designation demonstrates expertise in investment analysis, portfolio management, and ethical standards in the financial industry.

- Bachelor's Degree in Mathematics or Statistics: Strong analytical and quantitative skills are essential for evaluating investment opportunities and assessing risk.

- Certified Financial Planner (CFP) Certification: CFP certification demonstrates expertise in financial planning, wealth management, and investment advisory services.

Skills to Highlight in Your Investment Officer CV

As an Investment Officer, it is essential to possess a diverse set of skills in order to excel in this role. In addition to technical knowledge and expertise in financial markets, strong communication, analytical, and decision-making skills are crucial for success. Below are 10 soft skills and 10 hard skills that should be highlighted in your Investment Officer CV:

Soft Skills:

- Communication skills

- Analytical thinking

- Problem-solving abilities

- Adaptability

- Attention to detail

- Time management

- Teamwork

- Interpersonal skills

- Critical thinking

- Conflict resolution

Hard Skills:

- Financial analysis

- Investment management

- Risk assessment

- Portfolio management

- Data analysis

- Market research

- Asset allocation

- Financial modeling

- Compliance knowledge

- Proficiency in financial software and tools.

Investment Officer CV Format

As an Investment Officer, it is crucial to have a well-structured and professional CV that highlights your financial expertise and experience in managing investments. When it comes to formatting your CV, it is important to tailor it based on your level of experience in the industry. For entry-level positions, a chronological format may be best to showcase your education and any relevant internships, while for mid to senior-level positions, a combination format that highlights both your skills and experience may be more effective. Here are some key points to consider when formatting your Investment Officer CV:

- Start with a strong summary or objective statement that highlights your investment management skills and experience.

- Include a section that outlines your education, certifications, and any relevant coursework in finance or economics.

- Highlight your professional experience in managing investments, including any specific achievements or successful investment projects.

- Showcase your skills in financial analysis, risk assessment, and portfolio management.

- Include any relevant software proficiency in programs such as Bloomberg Terminal or financial modeling tools.

- End with a section that lists any professional affiliations, such as memberships in finance or investment associations.

For more tips on CV formatting, you can visit cv format.

Common Mistakes to Avoid in a Investment Officer CV

As an Investment Officer, your CV plays a crucial role in showcasing your skills and experience to potential employers. To ensure you make a strong impression, it's important to avoid common mistakes that can detract from your qualifications. Here are 8-10 mistakes to steer clear of in your Investment Officer CV:

- Including irrelevant or outdated information

- Failing to tailor your CV to the specific job requirements

- Using a generic template that doesn't stand out

- Neglecting to highlight your achievements and quantifiable results

- Overloading your CV with technical jargon and industry-specific terms

- Not proofreading for spelling and grammatical errors

- Omitting important credentials or certifications

- Listing job duties instead of demonstrating your impact and contributions

- Forgetting to include contact information or a professional summary at the top of your CV

- Using a cluttered or disorganized layout that makes it difficult for recruiters to find key information

By avoiding these common mistakes, you can create a compelling Investment Officer CV that effectively showcases your qualifications and helps you stand out in a competitive job market.

Key Takeaways for a Investment Officer CV

- Utilize a professional CV template from CV Templates to showcase your experience and skills effectively

- Highlight your experience in investment analysis, portfolio management, and financial modeling

- Mention any certifications or licenses related to investment management

- Include specific examples of successful investment strategies you have implemented

- Showcase your ability to conduct market research and analyze financial data

- Emphasize your track record of achieving financial goals and delivering strong returns on investments

- Use CV Builder to create a visually appealing and well-organized CV

- Customize your CV to align with the job description and emphasize relevant skills and experience

- Include a cover letter using Cover Letter Templates to further highlight your qualifications and interest in the position

- Provide references from previous employers or clients to validate your expertise in investment management

- Quantify your achievements with specific numbers and percentages to demonstrate your impact in previous roles

- Proofread your CV carefully to ensure it is free of errors and presents you in the best possible light.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.