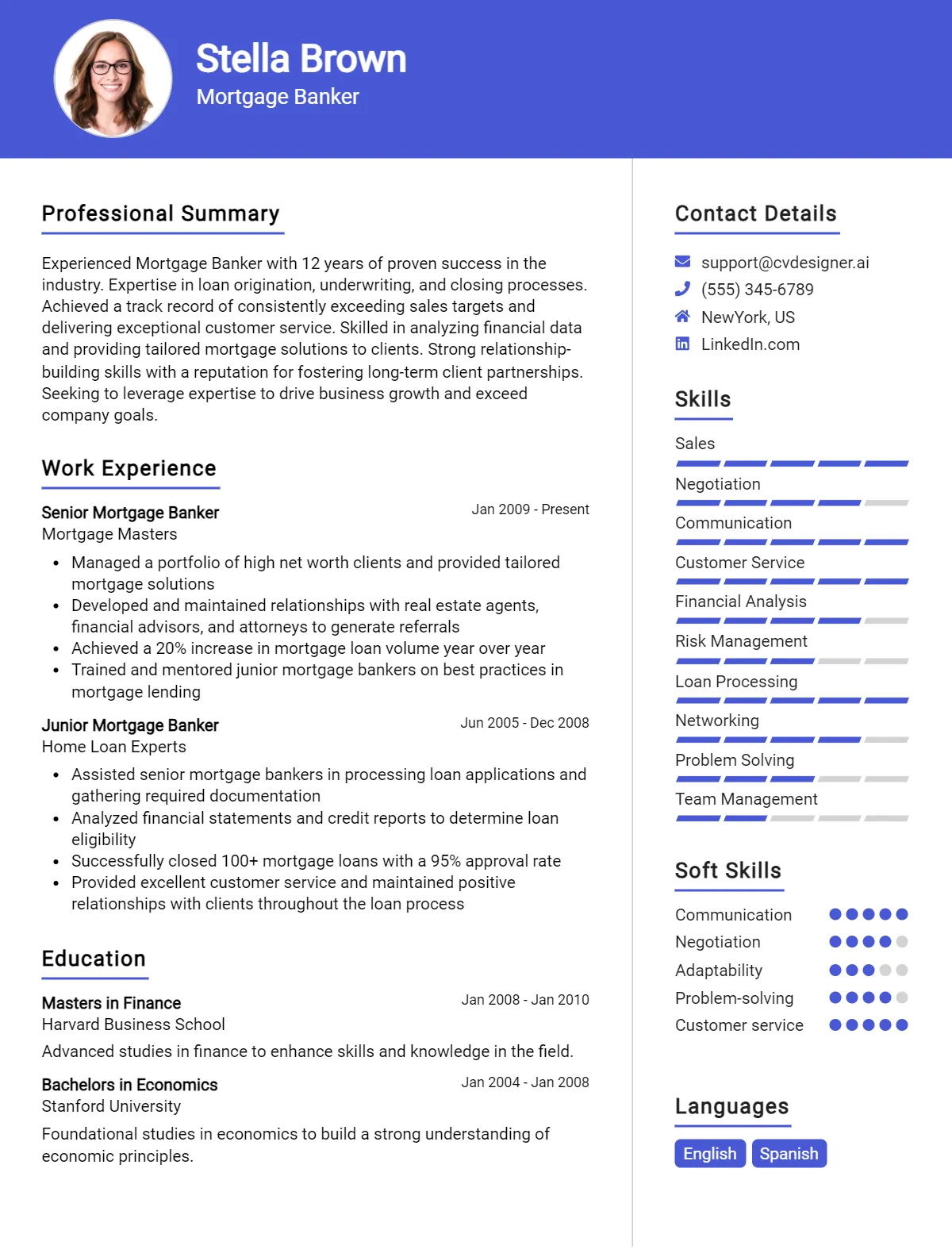

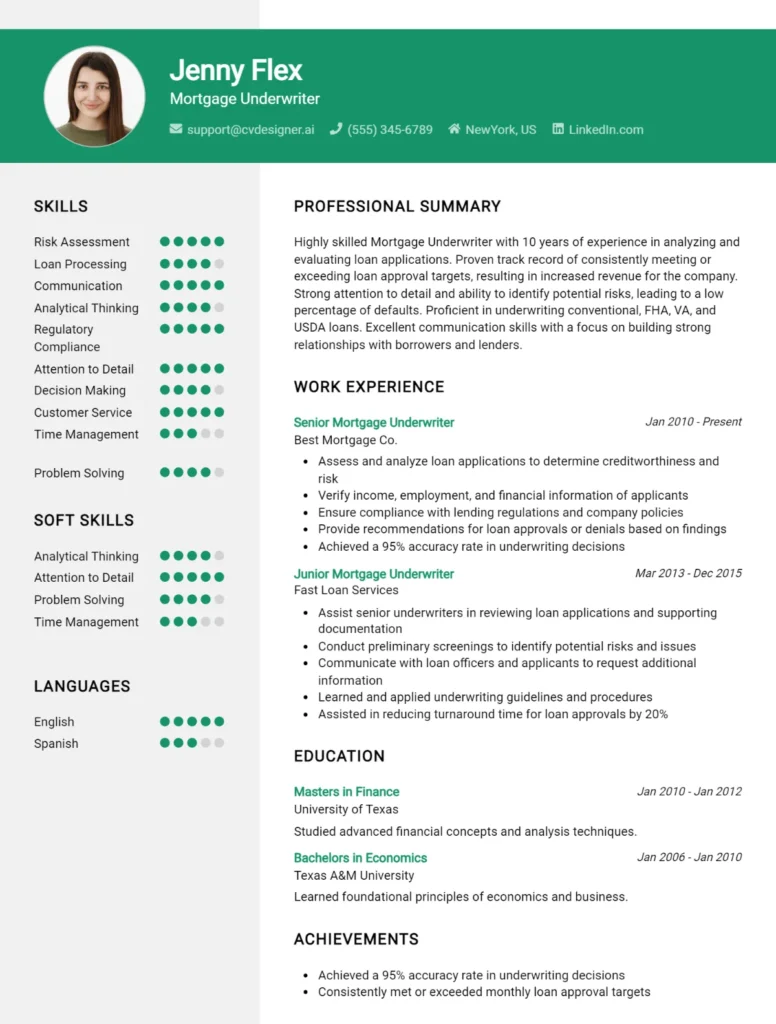

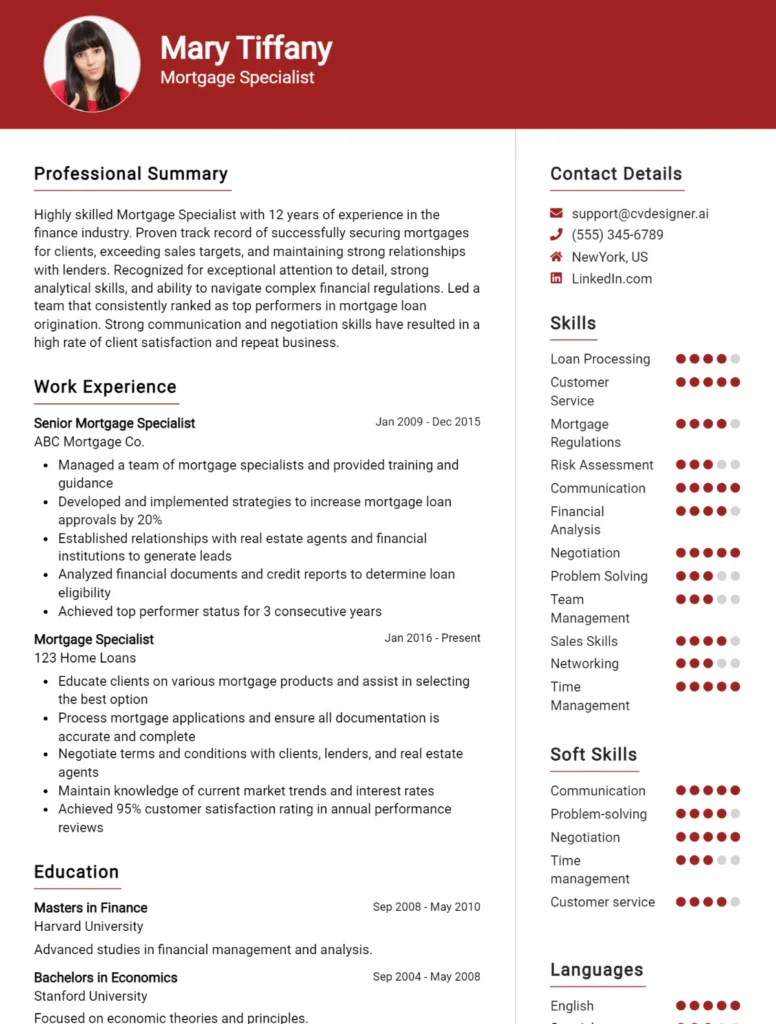

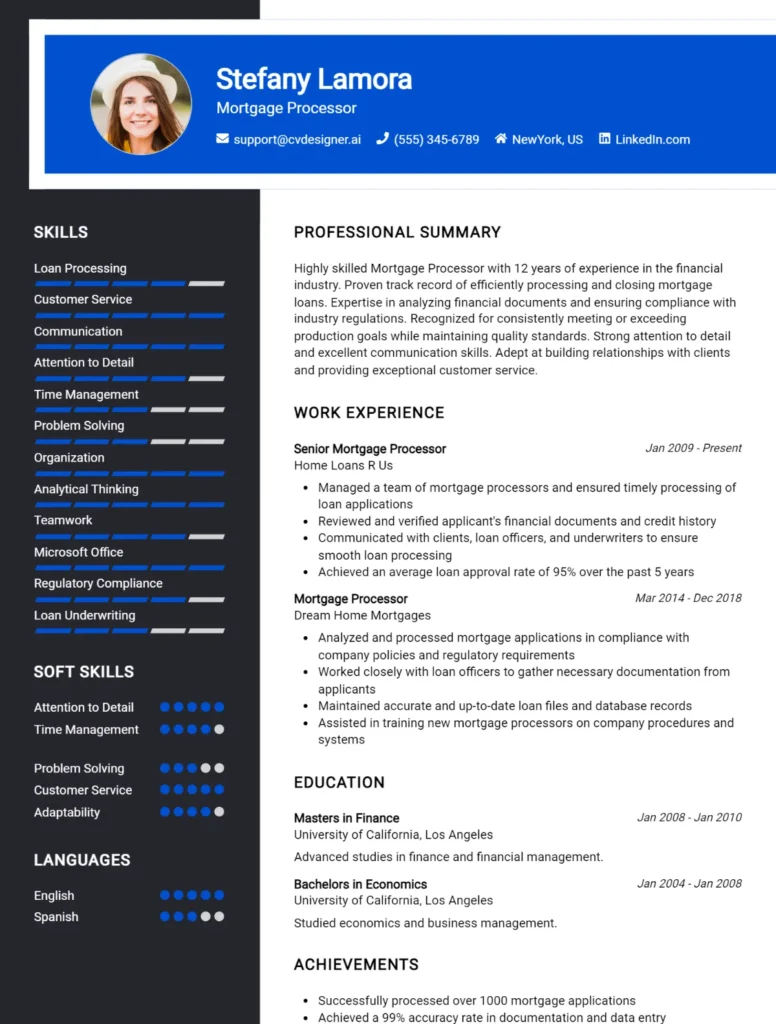

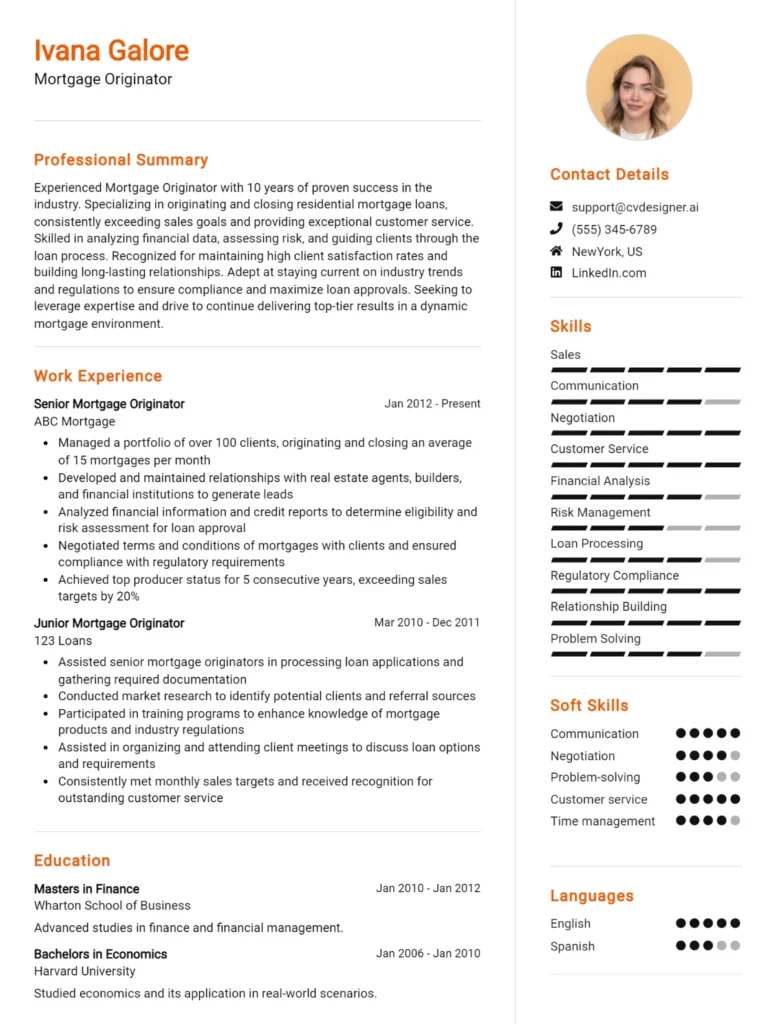

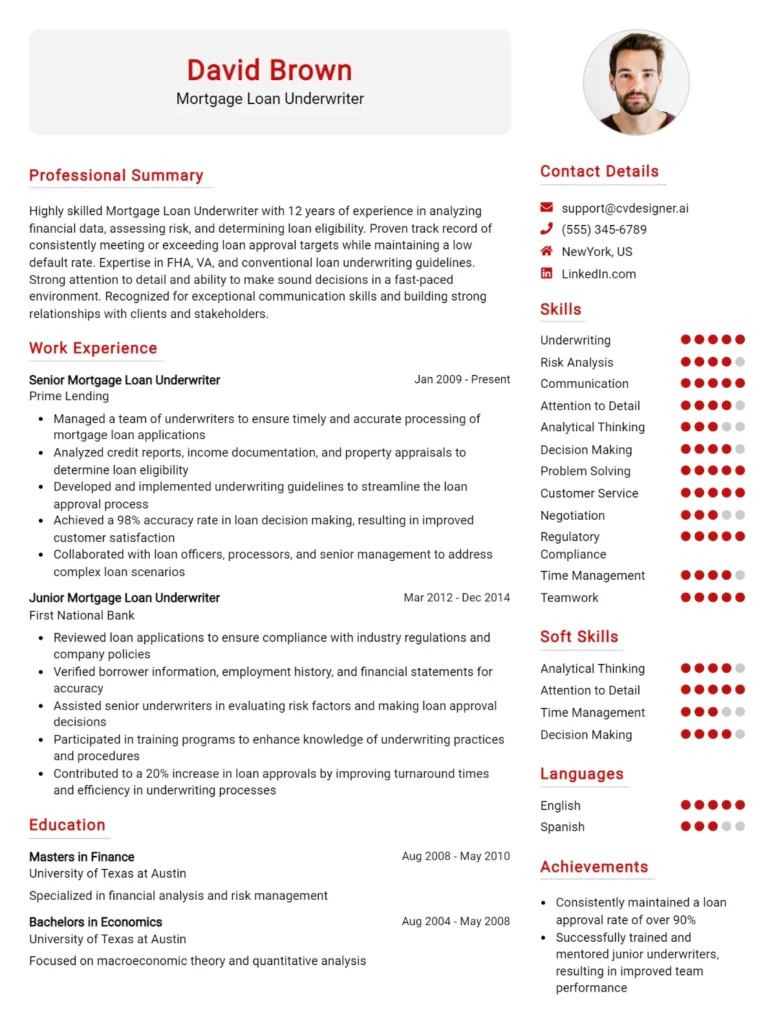

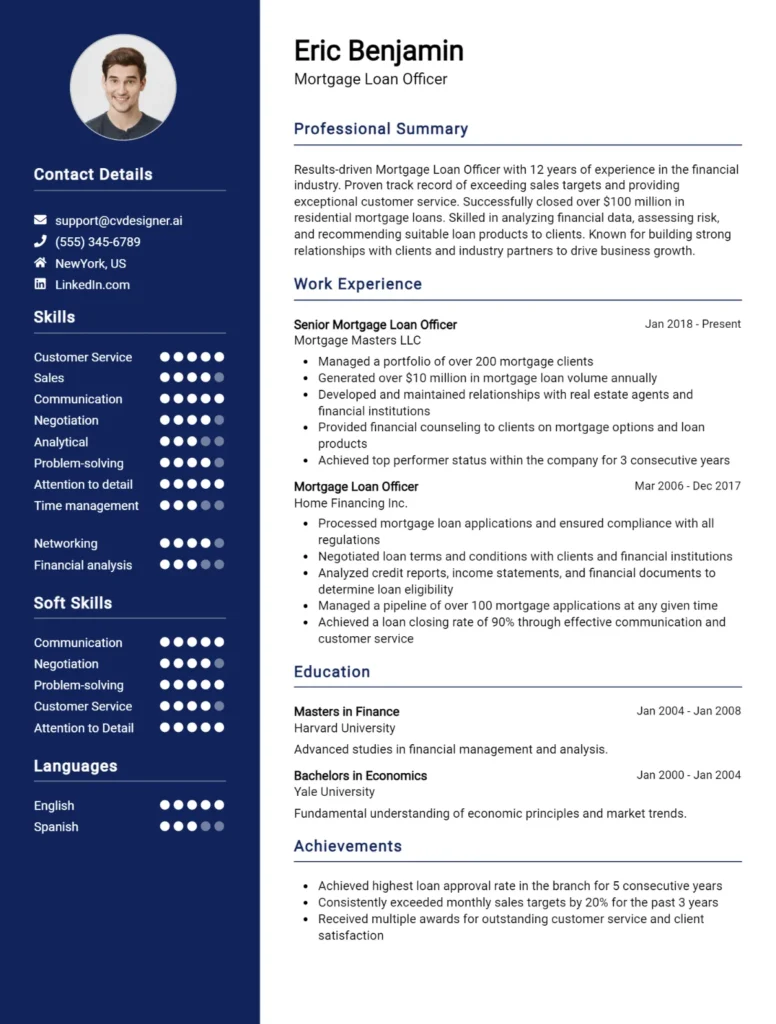

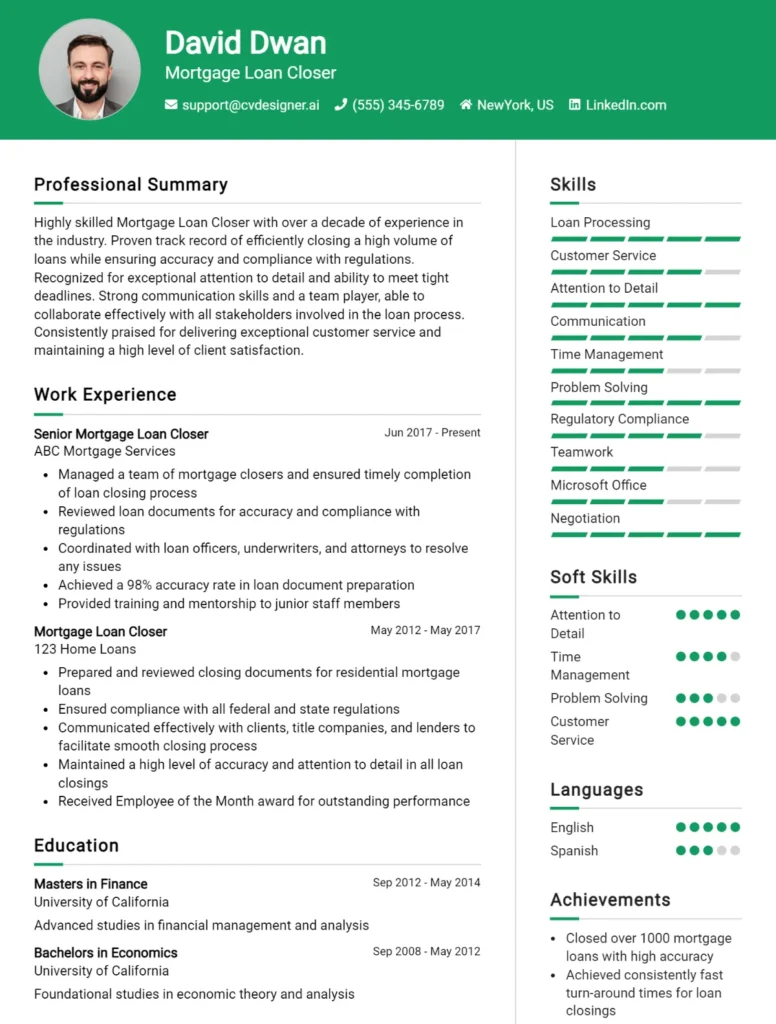

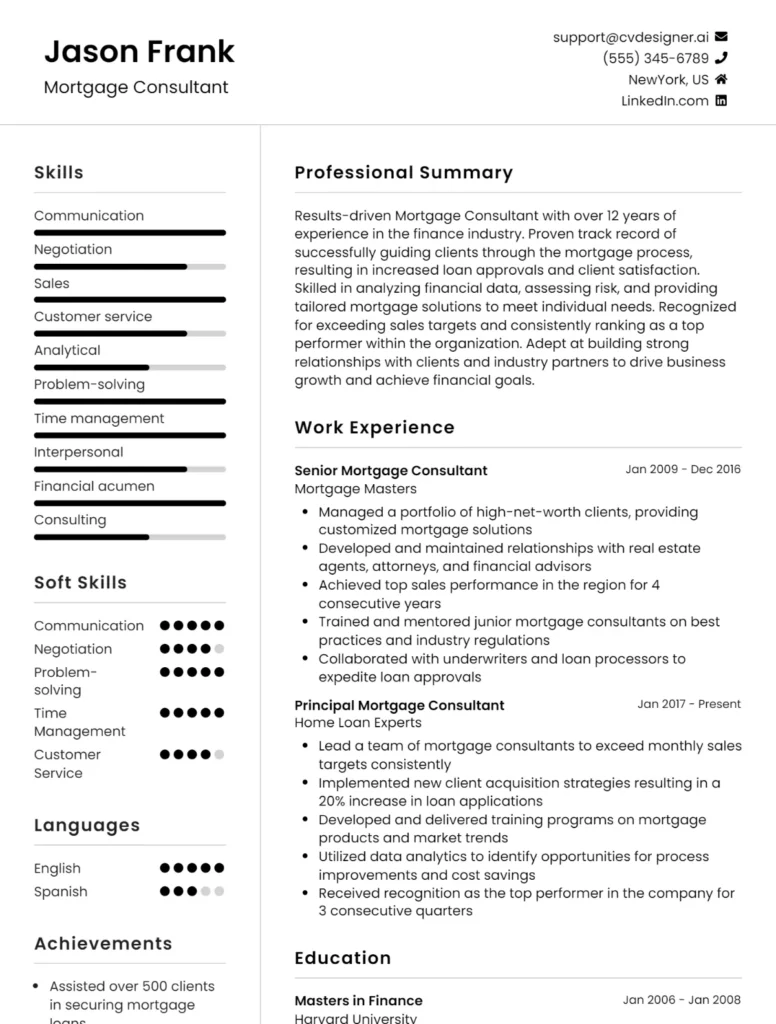

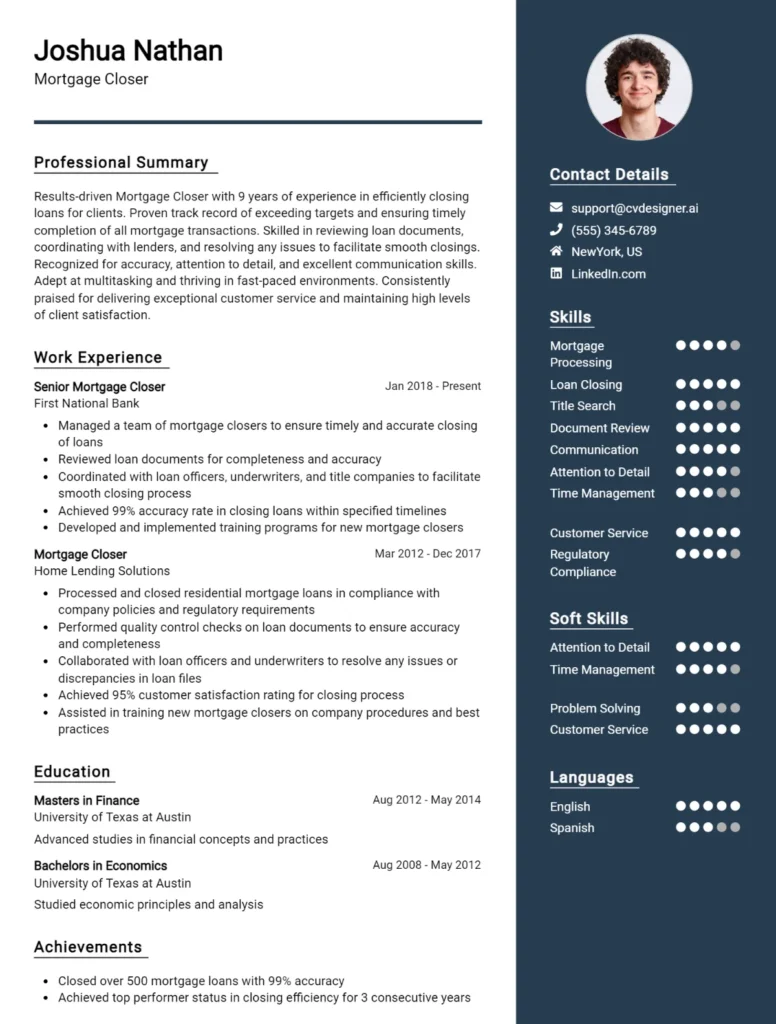

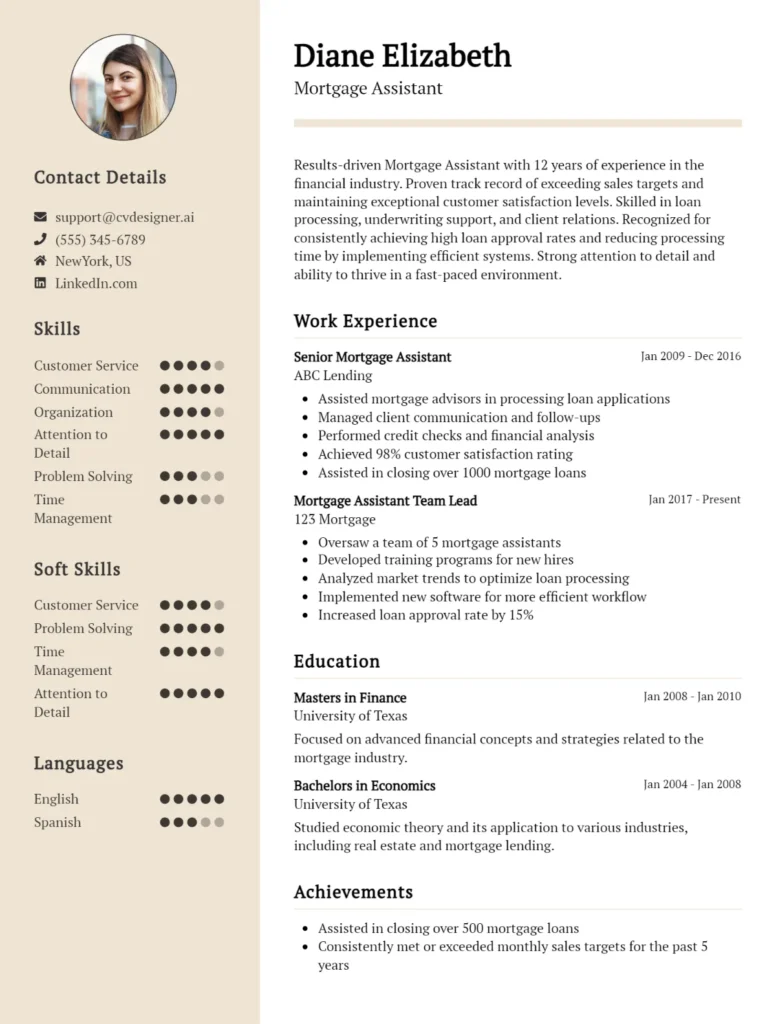

Most Popular Mortgage Banker CV Examples

Explore additional Mortgage Banker CV samples and guides and see what works for your level of experience or role.

Are you a Mortgage Banker looking to land your dream job? Look no further! In this comprehensive CV writing guide, we will walk you through the essential tips and tricks to create a standout resume that will impress potential employers. From highlighting your relevant experience to showcasing your skills and achievements, we've got you covered. Get ready to take your career to the next level with our expert advice. Stay tuned for valuable insights on CV writing, including:

- Tailoring your CV to the Mortgage Banking industry

- Highlighting your key achievements and skills

- Showcasing your experience in a clear and concise manner

- Formatting your CV for maximum impact

Don't miss out on this opportunity to elevate your career as a Mortgage Banker. Let's get started!

What is a Mortgage Banker CV?

A Mortgage Banker CV is a crucial document that outlines a professional's qualifications, experience, and skills in the mortgage banking industry. It serves as a tool for potential employers to assess the candidate's suitability for the role and determine if they possess the necessary expertise to excel in the position. A well-written CV can make a significant impact on the hiring process by showcasing the individual's achievements, certifications, and specialized knowledge in mortgage lending.

In the competitive job market of mortgage banking, a strong CV can set a candidate apart from other applicants and increase their chances of securing a desired position. By highlighting relevant experience in loan origination, underwriting, and customer service, a Mortgage Banker CV demonstrates the candidate's ability to effectively manage mortgage transactions and provide exceptional client support. Additionally, a well-crafted CV can demonstrate the candidate's commitment to professional development and continuous learning in the ever-evolving field of mortgage banking. For helpful tips on how to write a compelling CV, check out this CV writing guide.

Key Components of a Mortgage Banker CV

- Contact information: Include your full name, phone number, email address, and LinkedIn profile link.

- Summary or objective statement: Briefly summarize your experience and skills as a Mortgage Banker.

- Skills: Highlight relevant skills such as financial analysis, customer service, and knowledge of mortgage products. For tips on showcasing your skills, visit this article on CV skills.

- Work experience: Detail your previous roles in the mortgage industry, including specific accomplishments and responsibilities. For assistance on formatting your work experience section, check out this article on CV work experience.

- Education: List your degrees, certifications, and any relevant coursework related to finance or banking.

- Licenses and certifications: Include any licenses or certifications required for the Mortgage Banker role, such as a Mortgage Loan Originator license.

- Professional affiliations: Mention any memberships in industry organizations like the Mortgage Bankers Association.

- Awards and achievements: Highlight any awards or recognition you've received for your work in the mortgage industry.

- Software proficiency: Specify any software programs you are proficient in, such as loan origination systems or customer relationship management (CRM) software.

- Languages: Note any additional languages you speak, especially if it may be beneficial for communicating with diverse clients.

- Professional development: Mention any relevant training programs or workshops you've completed to stay current in the mortgage industry.

- References: Optionally, provide the names and contact information of professional references who can speak to your qualifications as a Mortgage Banker.

Sample Mortgage Banker CV for Inspiration

[Full Name] [Address] [City, State, ZIP Code] [Phone Number] [Email Address]

Professional Summary: Highly skilled Mortgage Banker with over 8 years of experience in the mortgage industry. Proven track record of successfully closing loans and providing exceptional customer service. Strong knowledge of mortgage products, regulations, and compliance requirements. Excellent communication and negotiation skills.

Work Experience: Mortgage Banker ABC Mortgage Company, City, State January 2015 - Present

- Originate and process mortgage loans for clients, ensuring compliance with all regulatory requirements

- Build and maintain relationships with real estate agents, builders, and clients to generate leads and referrals

- Analyze financial information and credit reports to determine eligibility for mortgage loans

- Guide clients through the loan application process, explaining terms and conditions clearly

- Collaborate with underwriters and processors to ensure timely and accurate loan processing

Senior Loan Officer XYZ Bank, City, State June 2012 - December 2014

- Managed a portfolio of mortgage clients, providing personalized service and solutions

- Conducted thorough analysis of client financials and credit history to recommend suitable loan products

- Developed marketing strategies to attract new clients and increase loan volume

- Worked closely with loan processors and underwriters to expedite loan approvals and closings

- Stayed current on industry trends and regulations to ensure compliance

Education: Bachelor's Degree in Finance University of State, City, State Graduated: May 2012

Skills:

- Strong knowledge of mortgage products and lending guidelines

- Excellent communication and interpersonal skills

- Proficient in loan origination software and Microsoft Office Suite

- Detail-oriented and organized

- Ability to work independently and as part of a team

Publications:

- "The Role of Technology in Mortgage Lending," Mortgage Industry Journal, June 2019

Certifications:

- Licensed Mortgage Banker, State of State

References available upon request.

Mortgage Banker CV Writing Tips

When writing your CV as a Mortgage Banker, it is important to highlight your experience in the financial industry, specifically in mortgage lending. Emphasize your ability to build relationships with clients, understand complex financial documents, and navigate the loan approval process efficiently. Make sure to showcase your strong communication skills and attention to detail, as these are crucial in this role. Additionally, include any relevant certifications or licenses you hold, such as a Mortgage Loan Originator license. Tailor your CV to the specific job you are applying for, focusing on the skills and experiences that make you a strong candidate for the position.

Specific tips for writing a Mortgage Banker CV:

- Include specific metrics or achievements from previous mortgage lending roles, such as loan volume or client satisfaction ratings.

- Highlight any specialized training or certifications related to mortgage lending, such as FHA or VA loan experience.

- Use action verbs to describe your responsibilities and accomplishments, such as "Managed a portfolio of mortgage clients" or "Increased loan approvals by 20%."

- Include any relevant software or technology skills, such as experience with loan origination systems or financial analysis software.

- Showcase your ability to work under pressure and meet tight deadlines, as this is often required in the mortgage banking industry.

- Demonstrate your knowledge of industry regulations and compliance standards, such as the Truth in Lending Act or Fair Housing Act.

- Consider including a summary or objective statement at the beginning of your CV to highlight your career goals and qualifications as a Mortgage Banker.

- Proofread your CV carefully to ensure there are no typos or grammatical errors, as attention to detail is crucial in this profession.

Mortgage Banker CV Summary Examples

- Experienced Mortgage Banker with a proven track record of exceeding sales targets and providing exceptional customer service. Strong knowledge of mortgage products and regulations, with the ability to analyze financial data and offer tailored solutions to clients. Skilled in building relationships and networking to generate new business opportunities.

- Results-driven Mortgage Banker with a background in financial services and a passion for helping clients achieve their homeownership goals. Proficient in conducting loan assessments, evaluating creditworthiness, and structuring loan packages. Excellent communication skills and the ability to educate clients on the mortgage process.

- Seasoned Mortgage Banker with extensive experience in loan origination and mortgage underwriting. Detail-oriented and analytical, with a focus on ensuring compliance with industry regulations and company policies. Proven ability to manage a high volume of loan applications while maintaining a high level of customer satisfaction.

- Dynamic Mortgage Banker with a client-centric approach and a dedication to providing personalized mortgage solutions. Skilled in building rapport with clients and industry professionals to drive business growth. Strong negotiation skills and a deep understanding of market trends and interest rates.

- Motivated Mortgage Banker with a solid background in finance and a passion for helping individuals and families achieve their homeownership dreams. Proficient in analyzing financial documents, assessing risk, and recommending appropriate loan products. A proactive and resourceful professional with a commitment to delivering exceptional service.

Build a Strong Experience Section for Your Mortgage Banker CV

As a Mortgage Banker, my primary role is to assist clients in securing financing for their homes or properties. With a strong background in financial analysis and customer service, I have successfully helped numerous individuals and families achieve their dream of homeownership. Below are examples of strong work experience descriptions that highlight my skills and accomplishments in the mortgage banking industry:

- Evaluated clients' financial profiles to determine eligibility for various mortgage products.

- Collaborated with underwriters to ensure timely processing and approval of loan applications.

- Educated clients on the home buying process and provided guidance on selecting the right mortgage product.

- Maintained relationships with real estate agents, builders, and other industry professionals to generate leads and referrals.

- Managed a pipeline of loan applications, ensuring efficient communication and follow-up with clients throughout the process.

- Achieved a high closing ratio by effectively overcoming objections and addressing client concerns.

- Conducted regular market research to stay informed about industry trends and changes in mortgage products.

- Acted as a trusted advisor to clients, providing personalized solutions to meet their unique financial needs and goals.

These examples demonstrate my ability to effectively navigate the complexities of the mortgage industry and provide exceptional service to clients.

Mortgage Banker CV Education Examples

As a Mortgage Banker, having a strong educational background is crucial in understanding the complexities of the financial industry and providing sound advice to clients. Here are some examples of educational backgrounds that would be relevant for a Mortgage Banker:

- Bachelor's degree in Finance or Economics: A solid foundation in finance or economics can provide a deep understanding of market trends, interest rates, and financial analysis, all of which are essential for a Mortgage Banker.

- Master's degree in Business Administration (MBA): An MBA can provide advanced knowledge in financial management, risk assessment, and strategic decision-making, all of which are important skills for a Mortgage Banker.

- Certification in Mortgage Banking: Obtaining a certification in mortgage banking demonstrates a commitment to the profession and a deep understanding of industry regulations, loan products, and underwriting guidelines.

- Real Estate License: Having a real estate license can be beneficial for a Mortgage Banker, as it provides a thorough understanding of the real estate market, property values, and the home buying process.

- Continuing Education in Mortgage Lending: Keeping up-to-date with the latest trends and regulations in the mortgage industry through continuing education courses can help Mortgage Bankers stay competitive and provide the best service to their clients.

Skills to Highlight in Your Mortgage Banker CV

As a Mortgage Banker, it is essential to possess a combination of soft and hard skills to excel in the competitive industry. Soft skills such as communication, attention to detail, and problem-solving are crucial for building relationships with clients and navigating complex financial transactions. On the other hand, hard skills like financial analysis, knowledge of mortgage lending regulations, and proficiency in loan origination software are necessary for effectively managing the mortgage process. Here are 10 soft skills and 10 hard skills to highlight in your Mortgage Banker CV:

Soft Skills:

- Communication

- Customer service

- Time management

- Negotiation

- Adaptability

- Empathy

- Teamwork

- Critical thinking

- Conflict resolution

- Organizational skills

Hard Skills:

- Financial analysis

- Mortgage underwriting

- Loan origination

- Knowledge of mortgage products

- Compliance with lending regulations

- Credit analysis

- Risk assessment

- Property appraisal

- Market research

- Proficiency in loan origination software.

Mortgage Banker CV Format

As a Mortgage Banker, it is crucial to have a well-crafted CV that highlights your skills and experience in the financial industry. The best format for different job levels can vary, but generally, a combination of a professional summary, work experience, education, skills, and certifications is recommended. Utilize this cv format to create a standout CV for your next job application. Some key points to include in your Mortgage Banker CV are:

- Strong understanding of mortgage products and services

- Proven track record of meeting and exceeding sales targets

- Excellent communication and negotiation skills

- Ability to analyze financial data and make sound lending decisions

- Proficiency in mortgage software and CRM systems

- Knowledge of current market trends and regulations in the mortgage industry

Common Mistakes to Avoid in a Mortgage Banker CV

As a Mortgage Banker, having a strong CV is crucial in showcasing your skills and experience to potential employers. Avoiding common mistakes can help ensure that your CV stands out amongst the competition. Here are some key mistakes to avoid when crafting your Mortgage Banker CV:

- Including irrelevant work experience

- Failing to quantify achievements and results

- Using a generic template instead of customizing for the job

- Neglecting to highlight specific mortgage industry skills and knowledge

- Providing inaccurate or outdated contact information

- Using too much industry jargon or technical language

- Not proofreading for spelling and grammar errors

- Omitting important certifications or licenses related to mortgage banking

- Focusing too much on responsibilities rather than accomplishments

- Failing to tailor your CV to each specific job application

Key Takeaways for a Mortgage Banker CV

- Utilize a professional CV template from CV Templates to ensure a clean and organized layout.

- Highlight your experience in the mortgage industry, including any specific roles or responsibilities you have held.

- Showcase your knowledge of financial products and services related to mortgages.

- Include any relevant certifications or licenses, such as a Mortgage Loan Originator license.

- Quantify your achievements, such as the number of loans closed or the total loan volume managed.

- Emphasize your communication and customer service skills, as building relationships with clients is crucial in this role.

- Use action verbs and specific examples to describe your accomplishments and responsibilities.

- Customize your CV for each job application, incorporating keywords from the job description.

- Consider using a CV Builder to easily create a professional CV tailored to the mortgage banking industry.

- Attach a well-written cover letter using templates from Cover Letter Templates to further enhance your job application.

- Proofread your CV carefully to ensure there are no errors or inconsistencies.

- Provide references from colleagues or supervisors who can speak to your qualifications and performance in the mortgage banking field.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.