Are you looking to kickstart your career as a Mortgage Closer? Crafting a compelling CV is essential to stand out in the competitive job market. In this comprehensive guide, we will walk you through the essential tips and tricks to create a standout Mortgage Closer CV. From showcasing your relevant experience to highlighting your skills and qualifications, we've got you covered. Stay tuned as we dive into the key points including:

- How to tailor your CV to the Mortgage Closer role

- The importance of highlighting your attention to detail and organizational skills

- Tips for including relevant certifications and training

- Crafting a strong professional summary to grab the recruiter's attention.

What is a Mortgage Closer CV?

A Mortgage Closer CV is a crucial document that outlines the professional experience, skills, and qualifications of an individual working in the mortgage closing industry. This document serves as a comprehensive overview of the candidate's background, showcasing their ability to efficiently and accurately handle the final stages of the mortgage process. By highlighting relevant experience in loan closing, attention to detail, and knowledge of industry regulations, a Mortgage Closer CV helps potential employers assess the candidate's suitability for the role.

In the competitive job market, a well-crafted CV can make a significant difference in securing a job interview for a Mortgage Closer position. By following a CV writing guide like the one provided by CV Designer, candidates can learn how to structure their CV effectively, highlight key skills and accomplishments, and tailor their document to the specific requirements of the job. A strong Mortgage Closer CV not only demonstrates the candidate's qualifications but also showcases their professionalism and attention to detail, which are essential qualities for success in this role.

Key Components of a Mortgage Closer CV

- Strong understanding of mortgage closing procedures and regulations

- Proficient in reviewing loan documents and ensuring accuracy

- Excellent communication skills to coordinate with various parties involved in the closing process

- Attention to detail to catch any errors or discrepancies in documentation

- Ability to work efficiently under pressure and meet tight deadlines

- Knowledge of mortgage software and systems used in the closing process

- Experience in preparing closing disclosures and settlement statements

- Familiarity with title insurance and escrow processes

- Strong organizational skills to keep track of multiple closings simultaneously

- Problem-solving skills to resolve any issues that may arise during the closing process

- Ability to work independently and as part of a team

- Certification or training in mortgage closing processes and regulations.

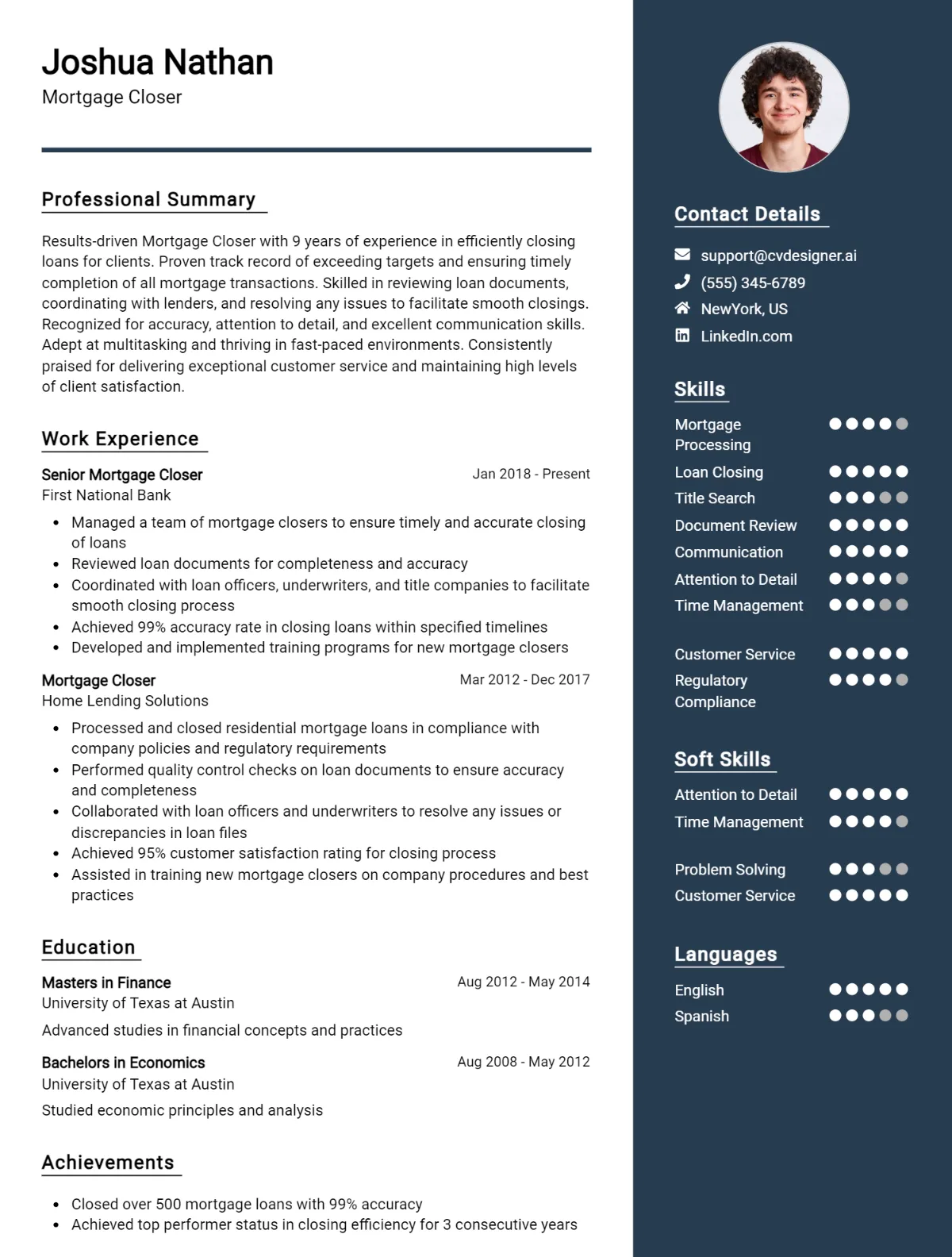

Sample Mortgage Closer CV for Inspiration

[Full Name] [Address] [City, State, Zip Code] [Phone Number] [Email Address]

Professional Summary: Dedicated and detail-oriented Mortgage Closer with over 5 years of experience in the real estate and finance industry. Adept at managing the closing process efficiently to ensure timely completion of mortgage transactions. Proficient in reviewing loan documents, coordinating with various parties, and ensuring compliance with regulations and guidelines.

Work Experience: Mortgage Closer ABC Mortgage Company, City, State March 2016 - Present

- Review loan documents and coordinate with borrowers, lenders, and title companies to facilitate the closing process

- Ensure accuracy and completeness of all closing documents to meet regulatory requirements

- Communicate effectively with all parties involved to resolve any issues and ensure smooth closing transactions

- Conduct final reviews of loan files to verify all conditions have been met before closing

- Maintain detailed records of all closing transactions for reference and audit purposes

Loan Processor XYZ Finance, City, State August 2014 - February 2016

- Assisted loan officers in processing mortgage applications and gathering necessary documentation from borrowers

- Reviewed credit reports, income verification, and other financial documents to assess loan eligibility

- Communicated with borrowers to request additional information and clarify any discrepancies in loan applications

- Worked closely with underwriters to ensure timely approval of mortgage loans

Education: Bachelor's Degree in Finance University Name, City, State Graduated May 2014

Skills:

- Proficient in reviewing and analyzing loan documents

- Strong attention to detail and organizational skills

- Excellent communication and interpersonal abilities

- Knowledge of mortgage industry regulations and guidelines

- Ability to work effectively in a fast-paced environment

Certifications: Certified Mortgage Closer (CMC) Issuing Organization, Date

Publications:

- "Navigating the Mortgage Closing Process: A Comprehensive Guide"

- "Understanding Mortgage Documents: What Borrowers Need to Know"

This sample CV for a Mortgage Closer can serve as a guide for crafting your own resume to highlight your relevant experience and qualifications in the field. Tailor the content to showcase your unique skills and accomplishments to stand out to potential employers.

Mortgage Closer CV Writing Tips

When writing a CV for a Mortgage Closer position, it is essential to highlight your experience in the mortgage industry, attention to detail, and strong organizational skills. Make sure to emphasize your ability to work efficiently and accurately under pressure, as well as your excellent communication skills. Tailor your CV to showcase your relevant experience and accomplishments in closing mortgage loans. Be sure to include any certifications or training that demonstrate your expertise in mortgage closing processes.

Specific Tips:

- Highlight your experience: Clearly outline your experience in mortgage closing, including the number of loans closed and any specific achievements or recognitions.

- Showcase your skills: Emphasize your attention to detail, organizational skills, and ability to work efficiently in a fast-paced environment.

- Use keywords: Incorporate industry-specific keywords and phrases to ensure your CV gets noticed by hiring managers and applicant tracking systems.

- Quantify your achievements: Include specific numbers and metrics to demonstrate the impact of your work, such as reduced processing times or increased loan approvals.

- Include relevant certifications: List any relevant certifications or training in mortgage closing processes, such as a Certified Mortgage Closer (CMC) designation.

- Tailor your CV: Customize your CV for each job application to highlight the most relevant skills and experiences for the specific role you are applying for.

- Proofread carefully: Double-check your CV for any spelling or grammatical errors, as attention to detail is crucial in a mortgage closer role.

- Keep it concise: Keep your CV concise and focused on the most important information, using bullet points to make it easy for hiring managers to quickly scan and identify your qualifications.

Mortgage Closer CV Summary Examples

As a Mortgage Closer, my primary goal is to ensure all necessary documentation is in order for the final stages of a mortgage application. I thrive in a fast-paced environment, have excellent attention to detail, and possess strong communication skills to effectively coordinate with all parties involved in the closing process.

- Experienced Mortgage Closer with over 5 years of experience in the banking industry. Proven track record of accurately preparing and reviewing loan documents to ensure compliance with regulations. Strong organizational skills and ability to work efficiently under pressure.

- Detail-oriented Mortgage Closer with a background in real estate and financial services. Skilled in coordinating with loan officers, underwriters, and title companies to facilitate smooth closings. Proficient in using mortgage processing software to streamline workflow.

- Dedicated Mortgage Closer with a passion for delivering exceptional customer service. Known for effectively communicating with clients to explain closing documents and answer any questions they may have. Ability to prioritize tasks and meet tight deadlines.

- Results-driven Mortgage Closer with a reputation for accuracy and efficiency. Proficient in conducting final reviews of loan documents to identify any discrepancies or missing information. Strong problem-solving skills and a commitment to ensuring a seamless closing process for clients.

- Motivated Mortgage Closer with a strong understanding of mortgage regulations and industry standards. Capable of managing multiple closings simultaneously while maintaining a high level of quality and compliance. Excellent interpersonal skills and a proactive approach to resolving issues that may arise during the closing process.

Build a Strong Experience Section for Your Mortgage Closer CV

As a Mortgage Closer, my role involves ensuring all necessary documentation is in place for the finalization of mortgage loans. I work closely with borrowers, lenders, and title companies to coordinate the closing process efficiently and accurately. Here are some examples of strong work experience descriptions for a Mortgage Closer:

- Managed a pipeline of mortgage loans, coordinating with various parties to ensure timely and accurate closings.

- Reviewed closing documents for accuracy and compliance with lending regulations.

- Conducted final loan signings with borrowers, explaining all terms and conditions thoroughly.

- Collaborated with underwriters and loan officers to resolve any issues that may arise during the closing process.

- Maintained detailed records of all closing transactions for auditing purposes.

- Communicated effectively with all parties involved in the closing process to ensure a smooth and successful closing experience.

- Stayed up-to-date on industry regulations and best practices to ensure compliance in all closing transactions.

- Provided exceptional customer service to borrowers throughout the closing process, addressing any concerns or questions promptly.

Mortgage Closer CV Education Examples

As a Mortgage Closer, having a strong educational background is essential to excel in this role. Here are some examples of educational qualifications that can be relevant for a Mortgage Closer:

- Bachelor's degree in Finance or Business Administration: A degree in finance or business administration can provide a solid foundation in understanding financial concepts and principles, which are crucial in the mortgage closing process.

- Certification in Mortgage Closing: Obtaining a certification in mortgage closing can demonstrate specialized knowledge and skills in the field, making you a more competitive candidate for mortgage closing positions.

- Associate's degree in Real Estate: An associate's degree in real estate can provide a comprehensive understanding of the real estate industry, including mortgage processes and regulations, which are essential for a Mortgage Closer.

- Courses in Legal Studies or Paralegal Studies: Taking courses in legal studies or paralegal studies can be beneficial for a Mortgage Closer, as it can provide knowledge of legal requirements and documentation involved in mortgage closing.

- Continuing education in mortgage regulations: Staying updated on mortgage regulations and industry trends through continuing education courses can demonstrate your commitment to professional development and staying current in the field of mortgage closing.

Skills to Highlight in Your Mortgage Closer CV

As a Mortgage Closer, it is essential to possess a unique set of skills that will help you excel in your role. From attention to detail to excellent communication skills, here are some key skills to highlight in your Mortgage Closer CV:

Soft Skills:

- Attention to detail

- Strong communication skills

- Ability to work under pressure

- Strong organizational skills

- Problem-solving skills

- Excellent time management

- Customer service orientation

- Team player

- Adaptability

- Integrity

Hard Skills:

- Knowledge of mortgage lending regulations

- Proficiency in mortgage closing software

- Understanding of title and escrow processes

- Ability to review legal documents

- Experience in preparing closing documents

- Knowledge of loan programs and products

- Familiarity with TRID guidelines

- Proficiency in Microsoft Office Suite

- Ability to meet tight deadlines

- Strong analytical skills.

Mortgage Closer CV Format

As a Mortgage Closer, it is crucial to have a well-structured CV that highlights your experience and skills in the mortgage industry. When it comes to the CV format, it is essential to keep it professional and easy to read. For entry-level positions, a chronological format works best to showcase relevant coursework and internships. For mid-level positions, a combination format can be effective to highlight both experience and skills. For senior-level positions, a functional format may be preferred to focus on achievements and leadership roles.

- Use a clean and organized layout

- Include a professional summary at the top

- List relevant work experience in reverse chronological order

- Highlight key skills and accomplishments

- Include relevant certifications and licenses

- Use bullet points to make information easily scannable

For more information on CV formats, visit cv format.

Common Mistakes to Avoid in a Mortgage Closer CV

As a Mortgage Closer, it is crucial to have a well-crafted CV that highlights your skills and experience in the mortgage industry. Avoiding common mistakes in your CV can make a significant impact on your job application success. Here are 8-10 common mistakes to avoid in a Mortgage Closer CV:

- Not tailoring your CV to the specific job requirements

- Including irrelevant information or skills

- Failing to showcase your attention to detail and organizational skills

- Using a generic CV template instead of customizing it for the mortgage industry

- Not including specific achievements or quantifiable results

- Neglecting to proofread for spelling and grammar errors

- Listing job duties instead of highlighting your accomplishments

- Omitting relevant certifications or training in mortgage closing

- Failing to demonstrate your knowledge of mortgage closing processes and regulations

- Not including contact information or references for potential employers to reach out to.

By avoiding these common mistakes, you can create a standout Mortgage Closer CV that effectively showcases your qualifications and increases your chances of landing your desired job.

Key Takeaways for a Mortgage Closer CV

- Utilize a professional CV template from CV Templates to showcase your experience and skills effectively.

- Highlight your relevant experience in mortgage closing, including knowledge of loan documents and regulations.

- Showcase your attention to detail and ability to work efficiently in a fast-paced environment.

- Include any certifications or training related to mortgage closing, such as NMLS certification.

- Use a CV Builder to create a polished and well-organized CV that stands out to potential employers.

- Emphasize your communication skills, as well as your ability to work with clients, lenders, and other stakeholders.

- Include any experience with mortgage software or systems to demonstrate your technical proficiency.

- Customize your CV with a professional cover letter template from Cover Letter Templates to make a strong first impression.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.