Are you a detail-oriented individual with a knack for analyzing financial documents and assessing risk? Do you thrive in a fast-paced environment where accuracy and efficiency are key? If so, the role of a Mortgage Underwriter may be the perfect fit for you. In this comprehensive CV writing guide, we will delve into the essential tips and tricks for crafting a standout resume that showcases your skills and experience in mortgage underwriting. From highlighting your relevant qualifications to emphasizing your ability to make sound lending decisions, we will cover it all. Get ready to take your career to the next level with our expert advice and CV examples. Don't miss out on this invaluable resource - read on to unlock the secrets to success in the competitive field of mortgage underwriting. Key points covered in this guide include:

- Tailoring your CV to the mortgage underwriting role

- Showcasing your relevant skills and experience

- Highlighting your attention to detail and analytical abilities

- Emphasizing your track record of making sound lending decisions

- Including quantifiable achievements and results to demonstrate your impact.

What is a Mortgage Underwriter CV?

A Mortgage Underwriter CV is a crucial document that outlines a professional's qualifications, experience, and skills in the field of mortgage underwriting. This document serves as a summary of the individual's career achievements and capabilities, providing potential employers with a comprehensive overview of their suitability for the role. A well-crafted CV can help a Mortgage Underwriter stand out in a competitive job market by highlighting their expertise in analyzing financial documents, assessing loan applications, and mitigating risks associated with mortgage lending.

In the highly regulated mortgage industry, having a strong CV is essential for Mortgage Underwriters to showcase their compliance knowledge, attention to detail, and decision-making skills. A well-written CV can demonstrate to hiring managers that the candidate possesses the necessary qualifications and experience to effectively evaluate loan applications and make informed lending decisions. By following a CV writing guide like CV Designer, Mortgage Underwriters can create a professional and compelling document that highlights their expertise and sets them apart from other applicants in the industry.

Key Components of a Mortgage Underwriter CV

- Strong analytical skills

- Attention to detail

- Knowledge of mortgage lending regulations

- Ability to assess risk

- Excellent communication skills

- Proficiency in financial analysis

- Experience in underwriting mortgages

- Familiarity with loan programs and products

- Ability to work under pressure

- Time management skills

- Certification in mortgage underwriting

- Proficiency in using underwriting software

For more information on how to highlight these key components in your CV, check out our article on skills and work experience.

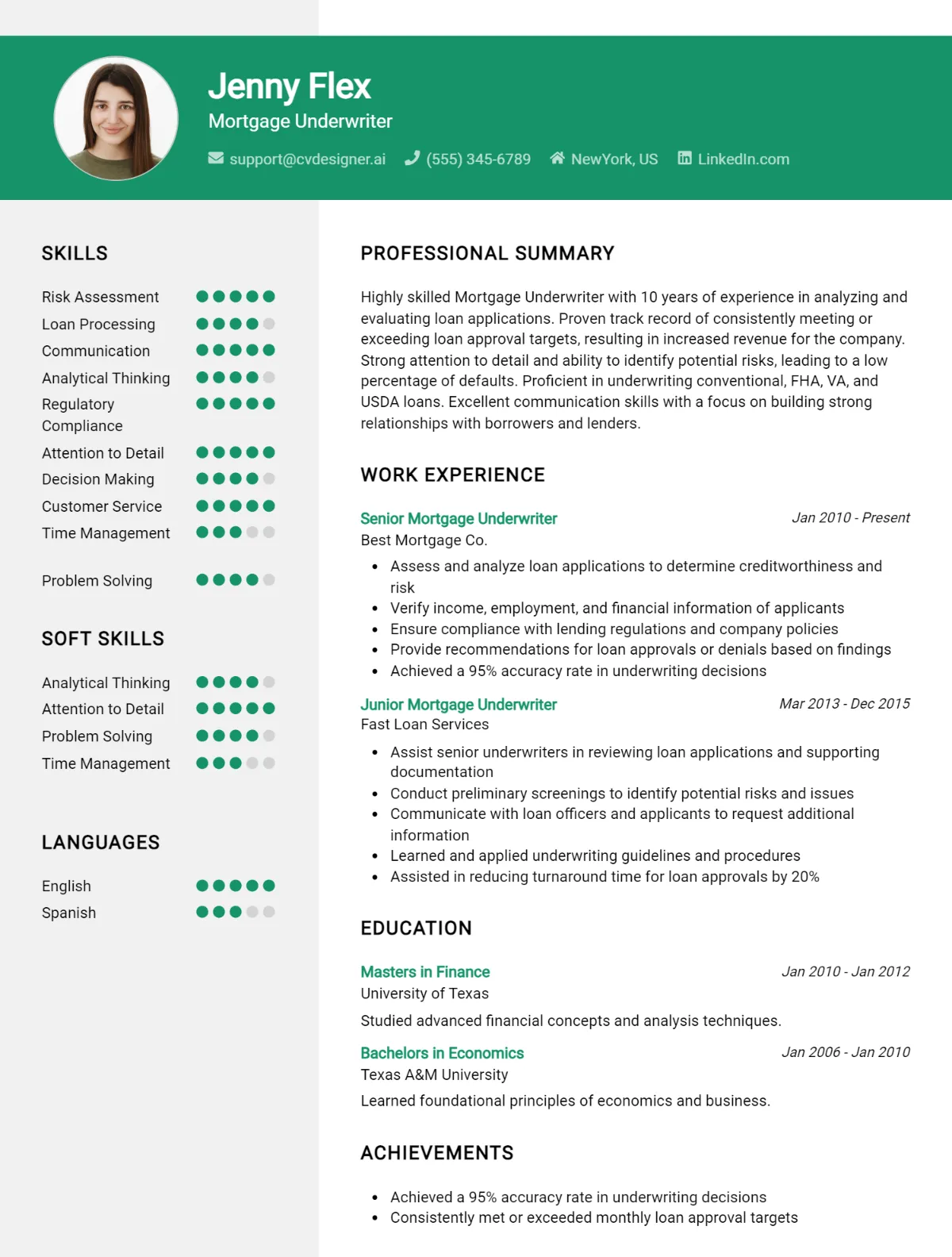

Sample Mortgage Underwriter CV for Inspiration

Sample Mortgage Underwriter CV for Inspiration:

Contact Information: Name: John Smith Address: 123 Main Street, Anytown, USA Phone: (555) 123-4567 Email: johnsmith@email.com LinkedIn: linkedin.com/in/johnsmith

Professional Summary: Experienced Mortgage Underwriter with over 5 years of experience in analyzing and evaluating loan applications. Strong background in risk assessment, financial analysis, and regulatory compliance. Proven track record of making sound lending decisions to minimize risk and maximize profitability.

Work Experience: Mortgage Underwriter XYZ Bank, Anytown, USA January 2018 - Present

- Review and analyze loan applications to determine creditworthiness and risk level

- Verify borrower information, income, assets, and liabilities

- Assess property values and ensure compliance with lending guidelines and regulations

- Communicate with loan officers, borrowers, and third-party vendors to gather necessary information

- Make recommendations for loan approval or denial based on credit risk assessment

Senior Loan Processor ABC Mortgage Company, Anytown, USA June 2015 - December 2017

- Processed and underwrote mortgage loan applications for conventional, FHA, and VA loans

- Reviewed and verified borrower documents, including pay stubs, tax returns, and bank statements

- Coordinated with loan officers, appraisers, and title companies to ensure timely closings

- Conducted quality control reviews to identify and resolve discrepancies in loan files

- Maintained up-to-date knowledge of lending guidelines and regulations

Education: Bachelor's Degree in Finance Anytown University, Anytown, USA Graduated May 2015

Skills:

- Strong analytical and problem-solving skills

- Excellent attention to detail

- Proficient in mortgage underwriting software and systems

- Knowledge of federal and state lending regulations

- Effective communication and interpersonal skills

Publications:

- "The Role of Mortgage Underwriters in Risk Management" - Journal of Mortgage Banking, 2019

Certifications:

- Certified Mortgage Underwriter (CMU) - Mortgage Bankers Association, 2017

This sample Mortgage Underwriter CV provides a comprehensive overview of the candidate's qualifications, experience, and skills in the field. Customize this template to highlight your own unique strengths and accomplishments in mortgage underwriting.

Mortgage Underwriter CV Writing Tips

When writing your CV as a Mortgage Underwriter, it's important to highlight your attention to detail, analytical skills, and ability to make sound financial decisions. Make sure to showcase your experience in reviewing loan applications, assessing risk, and ensuring compliance with regulations. Tailor your CV to highlight relevant qualifications and accomplishments in the mortgage industry.

- Start with a strong summary statement that captures your experience and skills as a Mortgage Underwriter.

- List your relevant qualifications, such as a degree in finance or a related field, and any certifications in mortgage underwriting.

- Highlight your experience in reviewing loan applications, analyzing financial documents, and assessing risk factors.

- Showcase your knowledge of mortgage industry regulations and guidelines, including FHA, VA, and conventional loan requirements.

- Include specific examples of successful loan approvals and your role in mitigating risk for the lender.

- Quantify your achievements, such as the number of loans processed or the percentage of loan approvals during your tenure.

- Demonstrate your proficiency in using underwriting software and tools to streamline the loan review process.

- Emphasize your strong communication skills, both written and verbal, as well as your ability to work collaboratively with loan officers and other team members.

Mortgage Underwriter CV Summary Examples

As a Mortgage Underwriter, it is crucial to highlight your skills, experience, and accomplishments in a concise and compelling CV summary. Here are some examples to help you craft an effective introduction:

- Experienced Mortgage Underwriter with a proven track record of accurately assessing loan applications and mitigating risk. Strong analytical skills and attention to detail ensure thorough evaluation of borrower qualifications.

- Results-driven Mortgage Underwriter with expertise in reviewing financial documents and determining loan eligibility. Exceptional communication skills facilitate effective collaboration with loan officers and clients.

- Detail-oriented Mortgage Underwriter with a background in evaluating creditworthiness and ensuring compliance with lending regulations. Proficient in utilizing underwriting software to streamline processes and expedite loan approvals.

- Seasoned Mortgage Underwriter with a background in conducting thorough risk assessments and making sound lending decisions. Ability to work efficiently under pressure and meet tight deadlines in a fast-paced environment.

- Skilled Mortgage Underwriter with a comprehensive understanding of industry guidelines and regulations. Proven ability to analyze complex financial information and make informed decisions to support successful loan outcomes.

Build a Strong Experience Section for Your Mortgage Underwriter CV

As a Mortgage Underwriter, my role involves evaluating and determining the creditworthiness of individuals applying for mortgage loans. I have a keen eye for detail, strong analytical skills, and the ability to make sound decisions based on financial information. Here are some examples of strong work experience descriptions for a Mortgage Underwriter:

- Analyzed and assessed loan applications to ensure compliance with company guidelines and investor requirements.

- Reviewed financial documents, including income statements, tax returns, and credit reports, to determine the borrower's ability to repay the loan.

- Communicated with loan officers, borrowers, and other stakeholders to gather additional information and resolve any discrepancies in the loan file.

- Made recommendations for loan approvals or denials based on credit risk assessment and underwriting guidelines.

- Conducted thorough risk assessments to identify potential red flags and mitigate lending risks.

- Maintained a high level of accuracy and attention to detail in reviewing and documenting loan files.

- Stayed current on industry regulations and guidelines to ensure compliance with all applicable laws and regulations.

- Collaborated with team members to streamline the underwriting process and improve efficiency in loan processing.

These examples showcase my ability to effectively evaluate loan applications, communicate with stakeholders, and make informed decisions to mitigate lending risks.

Mortgage Underwriter CV Education Examples

As a Mortgage Underwriter, having a strong educational background is crucial to success in this role. Below are some examples of educational paths that can prepare individuals for a career in mortgage underwriting:

- Bachelor's Degree in Finance or Accounting: A degree in finance or accounting provides a solid foundation in financial analysis, risk assessment, and decision-making skills, all of which are essential for a mortgage underwriter.

- Master's Degree in Business Administration (MBA): An MBA can further enhance a candidate's understanding of financial principles and strategic decision-making, making them a valuable asset in the mortgage underwriting process.

- Certification in Mortgage Underwriting: Obtaining a certification in mortgage underwriting demonstrates a commitment to the profession and a deep understanding of industry standards and regulations.

- Real Estate or Mortgage Broker License: Holding a real estate or mortgage broker license can provide valuable insights into the mortgage industry, giving candidates a competitive edge in the field of mortgage underwriting.

- Continuing Education in Mortgage Underwriting: Staying current with industry trends and regulations through continuing education courses can help mortgage underwriters stay at the forefront of their field and make informed decisions when assessing loan applications.

Skills to Highlight in Your Mortgage Underwriter CV

As a Mortgage Underwriter, it is essential to possess a unique blend of soft and hard skills to effectively assess and evaluate loan applications. In addition to technical expertise, strong communication and critical thinking skills are crucial for success in this role.

Soft Skills:

- Attention to detail

- Strong analytical skills

- Excellent time management

- Ability to work under pressure

- Effective problem-solving skills

- Strong interpersonal skills

- Adaptability

- Customer service orientation

- Team player

- Decision-making skills

Hard Skills:

- Knowledge of mortgage lending regulations

- Proficiency in financial analysis

- Familiarity with loan underwriting software

- Strong mathematical skills

- Understanding of credit risk assessment

- Ability to interpret complex financial documents

- Knowledge of property appraisal techniques

- Ability to assess borrower qualifications

- Proficiency in Microsoft Office Suite

- Knowledge of industry guidelines and standards

Mortgage Underwriter CV Format

As a Mortgage Underwriter, it is essential to have a well-crafted CV that highlights your skills and experience in the mortgage industry. The best format for a Mortgage Underwriter CV will vary depending on the level of the job seeker.

For entry-level Mortgage Underwriters:

- Begin with a strong objective or summary statement.

- Highlight any relevant coursework or certifications.

- Include any internships or part-time work experience in the finance industry.

- Emphasize strong analytical and communication skills.

- Showcase any relevant software proficiency, such as Microsoft Excel or loan processing systems.

For experienced Mortgage Underwriters:

- Start with a professional summary that highlights years of experience and key achievements.

- List specific accomplishments, such as achieving high loan approval rates or reducing turnaround times.

- Include details about specialized training or certifications, such as FHA or VA underwriting.

- Showcase leadership skills or experience in mentoring junior underwriters.

- Highlight any experience with complex loan scenarios or underwriting exceptions.

For senior-level Mortgage Underwriters:

- Open with a powerful executive summary that showcases leadership and strategic thinking.

- Detail extensive experience in underwriting various types of loans, including jumbo or commercial mortgages.

- Include any speaking engagements or published articles related to mortgage underwriting.

- List any industry awards or recognition for excellence in underwriting.

- Highlight experience in developing underwriting policies or procedures.

For more tips on creating a standout CV, check out cv format.

Common Mistakes to Avoid in a Mortgage Underwriter CV

As a Mortgage Underwriter, your CV is a crucial tool in showcasing your skills and experience to potential employers. Avoiding common mistakes in your CV can help you stand out and increase your chances of landing your dream job in the competitive mortgage industry.

Common mistakes to avoid in a Mortgage Underwriter CV include:

- Not tailoring your CV to the specific job requirements

- Including irrelevant work experience or skills

- Failing to highlight your accomplishments and quantifiable results

- Using generic language and cliches

- Overloading your CV with too much information

- Neglecting to proofread for spelling and grammar errors

- Not including a professional summary or objective statement

- Using a dated or unprofessional CV format

- Failing to provide contact information or references

- Including personal information that is not relevant to the job application

Key Takeaways for a Mortgage Underwriter CV

- Utilize a professional CV template from CV Templates to ensure a polished and organized layout

- Highlight relevant experience in mortgage underwriting, including skills in risk assessment, financial analysis, and compliance

- Showcase your ability to analyze financial documents, credit reports, and income verification to make informed decisions

- Demonstrate strong communication skills in collaborating with loan officers, clients, and other stakeholders

- Include any certifications or licenses related to mortgage underwriting, such as NMLS certification

- Use quantifiable achievements to showcase your success in meeting or exceeding underwriting standards

- Customize your CV for each application to emphasize skills and experiences relevant to the specific job requirements

- Consider using a cover letter template from Cover Letter Templates to further highlight your qualifications and interest in the position

- Utilize the CV Builder tool to easily create and customize your CV for a professional and visually appealing presentation

- Proofread your CV carefully to ensure accuracy, consistency, and professionalism in your document.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.