Are you looking to secure a rewarding career as a Personal Financial Advisor? Look no further! In this comprehensive guide, we will walk you through the essential steps to creating a standout CV that will land you your dream job in the financial industry. From highlighting your key skills and accomplishments to showcasing your relevant experience, we've got you covered. Stay tuned as we dive into the top CV writing tips for Personal Financial Advisors.

What is a Personal Financial Advisor CV?

A Personal Financial Advisor CV is a crucial document that outlines a candidate's professional background, skills, and experience in the field of financial advising. This document serves as a snapshot of the advisor's qualifications and expertise, providing potential employers or clients with a comprehensive overview of their capabilities. By showcasing their education, certifications, work history, and achievements, a well-crafted CV can help a Personal Financial Advisor stand out in a competitive job market or attract new clients.

In the financial services industry, where trust and credibility are paramount, a strong CV can be the key to securing lucrative opportunities and building a successful career. A well-written CV not only highlights the advisor's technical expertise and industry knowledge but also showcases their communication skills and ability to build relationships with clients. By following a CV writing guide, Personal Financial Advisors can ensure that their CV effectively communicates their value proposition and sets them apart from their peers in the industry.

Key Components of a Personal Financial Advisor CV

- Professional summary showcasing financial expertise and experience

- Education and certifications related to finance, such as a degree in finance or a Certified Financial Planner (CFP) designation

- Relevant skills, including financial analysis, investment strategies, and risk management skills

- Work experience in financial advising roles, detailing responsibilities and achievements work experience

- Client testimonials or references demonstrating successful financial planning outcomes

- Knowledge of financial products and services, such as retirement planning, insurance, and investments

- Familiarity with financial software and tools for analysis and reporting

- Strong communication and interpersonal skills for building client relationships

- Ability to create personalized financial plans based on individual goals and needs

- Compliance with regulations and ethical standards in the financial industry

- Continuing education or professional development courses to stay current on industry trends and best practices

- Proficiency in creating financial reports and presentations for clients.

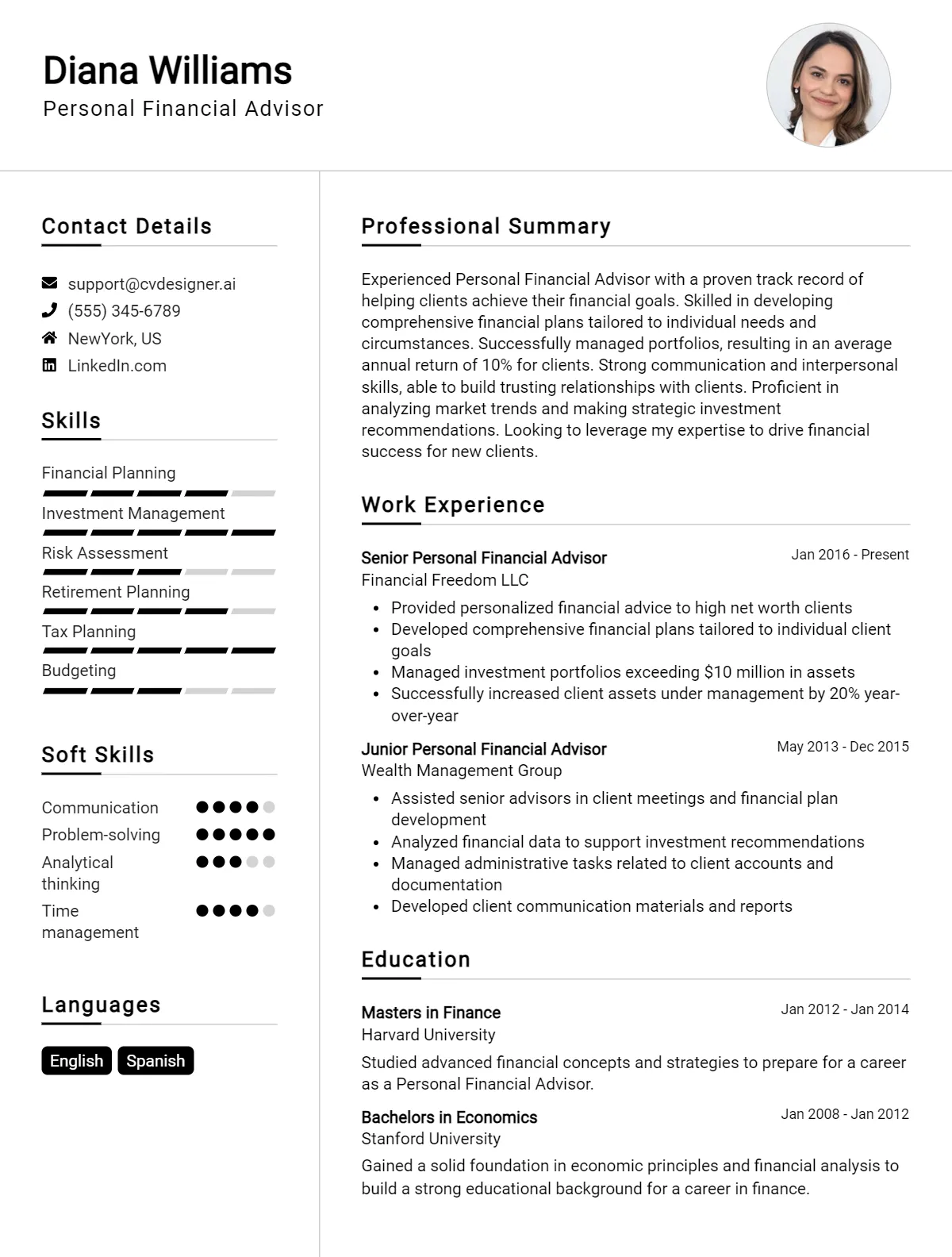

Sample Personal Financial Advisor CV for Inspiration

Sample Personal Financial Advisor CV for Inspiration:

Full Name Address City, State, Zip Code Phone Number Email Address

Professional Summary: Highly skilled and experienced Personal Financial Advisor with a proven track record of providing comprehensive financial planning services to clients. Possess excellent communication and analytical skills, with a strong ability to build and maintain client relationships. Seeking to leverage my expertise in financial advising to help individuals achieve their financial goals.

Work Experience: Personal Financial Advisor XYZ Financial Services, City, State Month Year - Present

- Conduct financial assessments and develop customized financial plans for clients based on their goals and risk tolerance.

- Provide investment advice and recommendations on various financial products, such as stocks, bonds, and mutual funds.

- Monitor and review client portfolios regularly to ensure they align with their financial objectives.

- Collaborate with tax professionals and estate planners to provide holistic financial planning solutions.

Education: Bachelor's Degree in Finance ABC University, City, State Year of Graduation

Skills:

- Strong knowledge of financial markets and investment products

- Proficient in financial planning software and tools

- Excellent communication and presentation skills

- Ability to analyze complex financial data and provide actionable insights

- Detail-oriented and highly organized

Publications:

- "The Importance of Diversification in Investment Portfolios", Finance Journal, Month Year

Certifications:

- Certified Financial Planner (CFP)

- Series 7 and Series 66 licenses

References: Available upon request

This sample CV provides a comprehensive overview of a Personal Financial Advisor's background, experience, skills, and qualifications. It showcases the candidate's expertise in financial planning and investment management, as well as their commitment to ongoing professional development through certifications and publications. By including all essential sections and highlighting relevant achievements, this CV can serve as a template for crafting a strong and compelling resume for a Personal Financial Advisor role.

Personal Financial Advisor CV Writing Tips

When crafting your CV as a Personal Financial Advisor, it's important to showcase your expertise in financial planning and investment strategies. Highlight your ability to analyze complex financial data and provide tailored recommendations to clients. Make sure to include any certifications or licenses you hold in the financial industry. Additionally, emphasize your strong communication skills and ability to build trust with clients.

Specific CV Writing Tips for a Personal Financial Advisor:

- Quantify your achievements: Include specific examples of how you have helped clients achieve their financial goals.

- Highlight your education and certifications: List any relevant degrees or certifications, such as CFP or CFA.

- Customize your CV for each job application: Tailor your CV to match the requirements of the specific job you are applying for.

- Showcase your experience with financial software: Mention any experience you have with financial planning software or tools.

- Include client testimonials or recommendations: If possible, include quotes from satisfied clients to demonstrate your expertise.

- Demonstrate your knowledge of financial markets: Show that you stay up-to-date on market trends and can provide informed advice to clients.

- Emphasize your ability to work under pressure: Highlight any experience you have in managing high-stress financial situations.

- Keep your CV concise and easy to read: Use bullet points and clear headings to make it easy for recruiters to quickly scan your qualifications.

Personal Financial Advisor CV Summary Examples

As a Personal Financial Advisor, it is crucial to have a strong CV summary that highlights your expertise and experience in managing clients' finances. Here are some examples of effective CV summaries for a Personal Financial Advisor:

- Experienced financial advisor with a proven track record of helping clients achieve their financial goals. Skilled in creating personalized financial plans tailored to individual needs and objectives.

- Detail-oriented financial advisor with a strong background in investment management and retirement planning. Adept at analyzing financial data and providing sound advice to clients to optimize their financial portfolios.

- Results-driven financial advisor with excellent communication skills and a passion for helping clients make informed financial decisions. Proven ability to build strong relationships with clients and provide ongoing support and guidance.

- Certified financial planner with expertise in tax planning, estate planning, and risk management. Committed to staying current on industry trends and regulations to provide clients with the most up-to-date financial advice.

- Skilled financial advisor with a comprehensive understanding of financial products and services. Dedicated to helping clients build wealth and secure their financial futures through strategic financial planning and investment strategies.

Build a Strong Experience Section for Your Personal Financial Advisor CV

As a Personal Financial Advisor, it is crucial to showcase your expertise and experience in helping clients achieve their financial goals. Your experience section on your CV should highlight your ability to provide personalized financial advice and recommendations to clients. Here are 6-8 examples of strong work experience descriptions for a Personal Financial Advisor:

- Developed comprehensive financial plans for clients based on their individual goals, risk tolerance, and financial situation.

- Conducted in-depth investment research and analysis to recommend suitable investment strategies for clients.

- Provided ongoing financial education and guidance to clients to help them make informed decisions about their finances.

- Collaborated with clients' other financial professionals, such as accountants and attorneys, to create holistic financial plans.

- Monitored and reviewed clients' portfolios regularly to ensure they remained aligned with their financial goals and objectives.

- Successfully grew client base through referrals and networking efforts, resulting in increased assets under management.

- Stayed current on industry trends and regulations to provide clients with the most up-to-date and relevant financial advice.

- Demonstrated exceptional communication and interpersonal skills in building strong relationships with clients and earning their trust in managing their finances.

Personal Financial Advisor CV Education Examples

As a Personal Financial Advisor, it is crucial to have a strong educational background to effectively advise clients on their financial goals and strategies. Here are examples of educational backgrounds that would be relevant for this role:

- Bachelor's degree in Finance or Business Administration: A solid foundation in finance and business principles is essential for understanding complex financial concepts and strategies.

- Certified Financial Planner (CFP) certification: This professional certification demonstrates expertise in financial planning and signifies a commitment to upholding ethical and professional standards in the industry.

- Master's degree in Financial Planning or Wealth Management: A higher level of education in financial planning or wealth management can provide a deeper understanding of advanced financial planning techniques and strategies.

- Chartered Financial Analyst (CFA) designation: This prestigious designation is recognized globally and demonstrates expertise in investment analysis and portfolio management, making it a valuable asset for a Personal Financial Advisor.

- Continuing education in tax planning or estate planning: Specialized education in areas such as tax planning or estate planning can enhance a Personal Financial Advisor's ability to provide comprehensive financial advice tailored to individual client needs.

Skills to Highlight in Your Personal Financial Advisor CV

As a Personal Financial Advisor, it is crucial to possess a diverse set of skills to effectively assist clients in managing their finances and achieving their financial goals. When crafting your CV, be sure to highlight both soft skills, such as communication and empathy, as well as hard skills like financial analysis and investment management. Here are 10 soft skills and 10 hard skills that are essential for a successful career as a Personal Financial Advisor:

Soft Skills:

- Communication

- Empathy

- Active listening

- Problem-solving

- Time management

- Adaptability

- Relationship-building

- Attention to detail

- Patience

- Emotional intelligence

Hard Skills:

- Financial analysis

- Investment management

- Tax planning

- Retirement planning

- Estate planning

- Risk management

- Portfolio management

- Budgeting

- Financial modeling

- Regulatory compliance

Personal Financial Advisor CV Format

As a Personal Financial Advisor, your CV should clearly showcase your expertise in managing finances and providing sound advice to clients. When it comes to formatting your CV, it is important to tailor it to the specific job level you are applying for. For entry-level positions, a clean and organized format with a focus on education and relevant skills is key. For mid-level positions, highlight your experience and achievements in the field. For senior-level roles, emphasize your leadership skills and strategic approach to financial planning.

Here are 5-6 bullet points to consider when formatting your Personal Financial Advisor CV:

- Include a professional summary at the top of your CV to provide a snapshot of your skills and experience.

- Use a clear and easy-to-read font, such as Arial or Calibri, and stick to a simple layout with consistent formatting.

- Organize your CV into sections, such as education, work experience, certifications, and skills, to make it easy for employers to find relevant information.

- Use bullet points to list your accomplishments and responsibilities in each role, focusing on quantifiable results whenever possible.

- Include keywords from the job description to ensure your CV gets past applicant tracking systems.

- Proofread your CV carefully to catch any errors or inconsistencies before submitting it to potential employers.

For more tips on CV formatting, check out this cv format article. Good luck with your job search!

Common Mistakes to Avoid in a Personal Financial Advisor CV

As a Personal Financial Advisor, your CV is essentially your first impression to potential employers. It is crucial to make sure your CV is well-crafted and free of common mistakes that could hinder your chances of landing the job. Here are 8-10 common mistakes to avoid in a Personal Financial Advisor CV:

- Using a generic template without customizing it to highlight your specific skills and experiences

- Failing to showcase your relevant certifications, licenses, and qualifications

- Including irrelevant work experience or information that does not pertain to the financial advising industry

- Not quantifying your achievements and successes in previous roles

- Neglecting to include specific examples of how you have helped clients achieve their financial goals

- Providing too much unnecessary information or including a long list of job duties without highlighting your accomplishments

- Using slang or informal language in your CV instead of professional and concise language

- Forgetting to proofread your CV for spelling and grammar errors, which can make you appear careless and unprofessional

- Not tailoring your CV to the specific job description and requirements of the position you are applying for

- Failing to include a professional summary or objective that highlights your skills, experience, and career goals in a clear and concise manner.

Key Takeaways for a Personal Financial Advisor CV

- Utilize a professional CV template from CV Templates to enhance the visual appeal of your resume.

- Highlight your experience in financial planning, investment management, and retirement planning.

- Showcase your certifications and licenses such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Use action verbs to describe your accomplishments and responsibilities in previous roles.

- Quantify your achievements with specific numbers and percentages to demonstrate your impact.

- Include a strong objective statement at the beginning of your CV to grab the hiring manager's attention.

- Customize your CV for each job application to align with the specific requirements of the role.

- Create a compelling cover letter using Cover Letter Templates to accompany your CV and stand out to employers.

- Emphasize your soft skills such as communication, problem-solving, and attention to detail.

- Provide references or testimonials from satisfied clients to validate your expertise as a Personal Financial Advisor.

- Use CV Builder to easily create and customize your CV for a polished and professional presentation.

- Showcase your knowledge of financial products and services, including insurance, investments, and tax planning.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.