Are you a seasoned investment professional looking to take your career to the next level as a Portfolio Manager? Crafting a compelling CV is essential to stand out in a competitive job market. In this comprehensive guide, we will walk you through the essential tips and strategies to create a standout Portfolio Manager CV that showcases your skills and experience effectively. From highlighting your investment expertise to showcasing your track record of success, we've got you covered. Get ready to elevate your CV game and land that dream Portfolio Manager role with confidence. Keep reading for expert insights and a stellar CV example to guide you on your journey.

Key points covered in this article:

- Crafting a compelling summary statement that showcases your expertise and professional achievements

- Highlighting your key skills and qualifications relevant to the Portfolio Manager role

- Showcasing your investment experience and track record of success through quantifiable achievements

- Formatting tips to ensure your CV is visually appealing and easy to navigate

- Including relevant certifications, licenses, and professional development courses to enhance your credibility as a Portfolio Manager.

What is a Portfolio Manager CV?

A Portfolio Manager CV is a crucial document that outlines a professional's qualifications, experience, and skills in managing investment portfolios. This document serves as a snapshot of the candidate's career trajectory, showcasing their ability to make strategic investment decisions, monitor portfolio performance, and mitigate risks. In a competitive job market, a well-crafted CV can set a Portfolio Manager apart from other candidates by highlighting their achievements, certifications, and industry knowledge. It provides hiring managers with valuable insights into the candidate's expertise and suitability for the role.

In the world of finance, where precision and attention to detail are paramount, a Portfolio Manager CV serves as a comprehensive record of the candidate's accomplishments and capabilities. It not only showcases their educational background and work history but also demonstrates their ability to generate returns, manage client relationships, and adapt to changing market conditions. By following a CV writing guide, Portfolio Managers can ensure that their CV effectively communicates their value proposition to potential employers, ultimately increasing their chances of securing interviews and advancing their career in the financial industry.

Key Components of a Portfolio Manager CV

- Strong analytical skills

- Proven track record of successful investment strategies

- Experience in managing diverse portfolios

- Knowledge of financial markets and trends

- Proficiency in risk management

- Excellent communication and presentation skills

- Ability to work well under pressure

- Strong attention to detail

- Experience with portfolio management software

- Ability to work collaboratively with a team

- Relevant certifications or qualifications

- Demonstrated ability to achieve financial goals

For more information on how to highlight these key components in your CV, check out our article on skills and work experience.

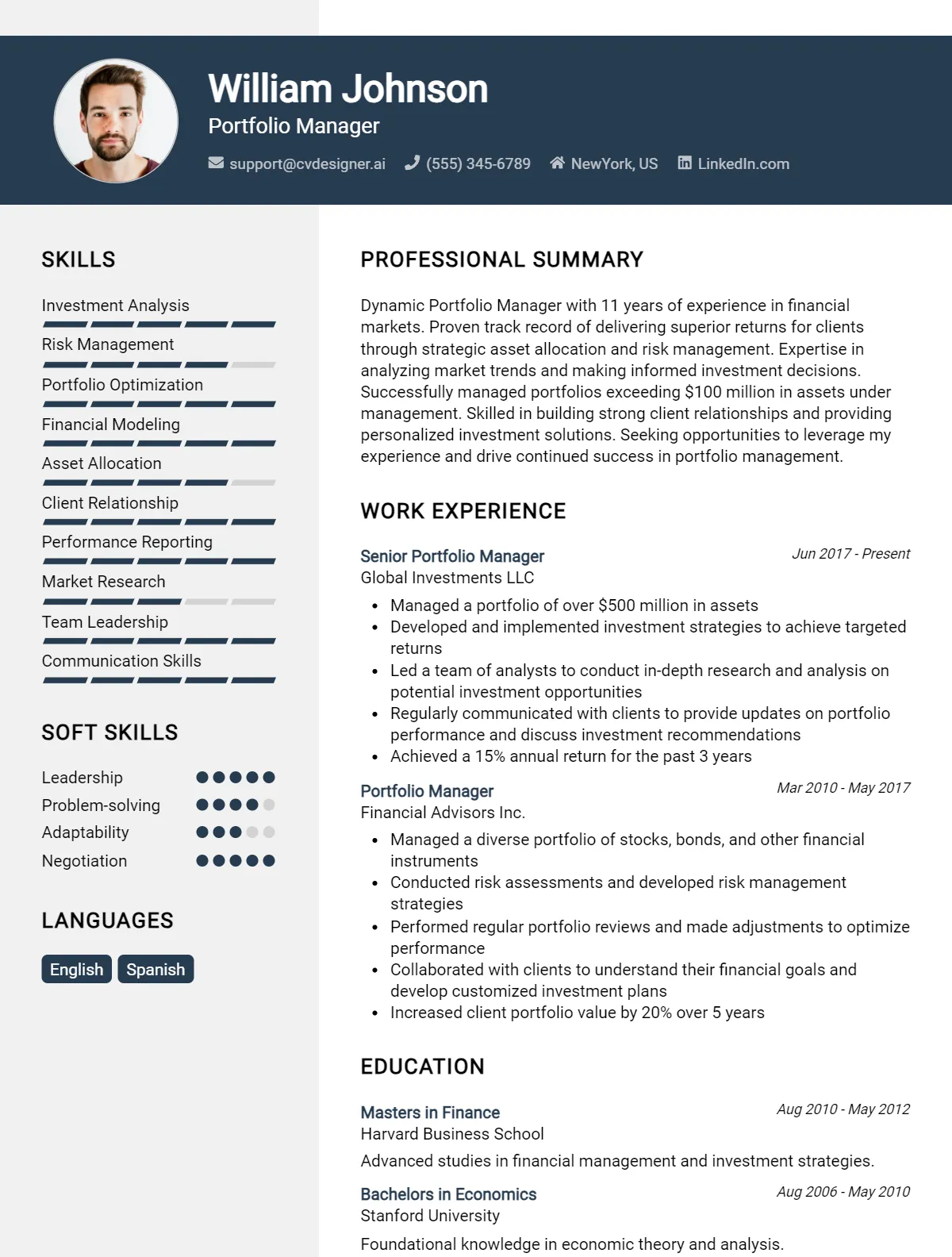

Sample Portfolio Manager CV for Inspiration

John Doe

123 Main Street, New York, NY 10001

(555) 555-5555

johndoe@email.com

Professional Summary:

Experienced Portfolio Manager with over 10 years of experience in managing investment portfolios for high-net-worth individuals and institutional clients. Proven track record of delivering strong investment performance and exceeding client expectations. Skilled in asset allocation, risk management, and financial analysis.

Work Experience:

Portfolio Manager ABC Investment Management, New York, NY 2015-present

- Manage a portfolio of over $100 million in assets for high-net-worth individuals and institutional clients

- Conduct research and analysis to identify investment opportunities and make strategic investment decisions

- Monitor portfolio performance and make adjustments as needed to achieve client goals

- Communicate regularly with clients to provide updates on portfolio performance and address any concerns

Senior Analyst XYZ Capital, New York, NY 2010-2015

- Conducted in-depth financial analysis and valuation of companies in various industries

- Assisted Portfolio Managers in making investment decisions and managing client portfolios

- Developed financial models and presentations for client meetings

Education:

Master of Business Administration (MBA) New York University, New York, NY 2008

Bachelor of Science in Finance University of Pennsylvania, Philadelphia, PA 2006

Skills:

- Strong analytical and quantitative skills

- Proficient in financial modeling and analysis

- Knowledge of investment strategies and asset classes

- Excellent communication and presentation skills

- CFA Charterholder

Publications:

- "The Role of Portfolio Managers in Wealth Management" - Journal of Financial Planning, 2017

Certifications:

- Chartered Financial Analyst (CFA)

Portfolio Manager CV Writing Tips

When crafting your Portfolio Manager CV, it is important to highlight your diverse skill set, including your analytical abilities, financial expertise, and risk management experience. Tailor your CV to showcase your track record of successful investment strategies and your ability to deliver strong returns for clients. Be sure to include any relevant certifications or licenses, such as the Chartered Financial Analyst (CFA) designation. Use specific metrics and examples to quantify your achievements and demonstrate your impact in previous roles. Additionally, emphasize your communication skills and ability to build strong relationships with clients and stakeholders.

Specific CV Writing Tips for Portfolio Managers:

- Start with a strong summary or objective statement that highlights your key skills and experience.

- Include a section dedicated to your investment strategies and performance metrics.

- Use action verbs and quantifiable achievements to describe your previous roles and responsibilities.

- Highlight any specialized knowledge or expertise in specific asset classes or industries.

- Showcase your risk management techniques and how you have protected client portfolios in volatile markets.

- Include any leadership experience, such as managing a team of analysts or overseeing a specific investment fund.

- Be sure to list any software or tools you are proficient in, such as Bloomberg Terminal or Excel for financial analysis.

- Proofread your CV carefully to ensure there are no errors or inconsistencies in formatting.

Portfolio Manager CV Summary Examples

As a Portfolio Manager, I have a proven track record of strategically managing investment portfolios to maximize returns and minimize risks. With a strong background in financial analysis, asset allocation, and market research, I excel in making informed decisions to drive portfolio performance. My ability to adapt to changing market conditions and implement innovative investment strategies sets me apart in the industry.

- Experienced Portfolio Manager with over 10 years of experience managing multi-million dollar investment portfolios for high net worth clients. Proven ability to deliver consistent returns through a combination of asset allocation, risk management, and performance monitoring.

- Results-driven Portfolio Manager with a strong background in quantitative analysis and financial modeling. Skilled in identifying investment opportunities, conducting due diligence, and executing trades to optimize portfolio performance. Excellent communication skills and a track record of building and maintaining relationships with clients.

- Seasoned Portfolio Manager with expertise in managing diversified portfolios across various asset classes. Proficient in conducting market research, analyzing economic trends, and implementing strategic investment decisions to achieve client objectives. Strong leadership skills and a passion for delivering exceptional results.

- Dynamic Portfolio Manager with a passion for finance and a keen eye for market trends. Skilled in developing and implementing investment strategies tailored to individual client needs and risk profiles. Proven ability to build strong relationships with clients and provide personalized investment solutions to help them achieve their financial goals.

- Strategic Portfolio Manager with a hands-on approach to managing investment portfolios. Proficient in evaluating risk-return profiles, conducting performance analysis, and making tactical adjustments to optimize portfolio performance. Strong analytical skills, attention to detail, and a commitment to delivering superior results for clients.

Build a Strong Experience Section for Your Portfolio Manager CV

As a Portfolio Manager, it is essential to highlight your expertise in managing investments and maximizing returns for clients. In your CV, make sure to showcase your experience in analyzing market trends, making strategic investment decisions, and effectively managing diversified portfolios. Here are 6-8 examples of strong work experience descriptions for a Portfolio Manager:

- Led a team of analysts to conduct in-depth research on various industries and asset classes to identify lucrative investment opportunities.

- Implemented risk management strategies to protect clients' portfolios from market volatility and ensure consistent returns.

- Developed and executed investment strategies tailored to clients' financial goals and risk tolerance, resulting in significant portfolio growth.

- Monitored and adjusted portfolios regularly to capitalize on market trends and optimize asset allocation for maximum returns.

- Collaborated with clients to understand their investment objectives and provide personalized investment recommendations based on their financial needs.

- Utilized advanced financial modeling techniques to forecast market performance and make informed investment decisions that outperformed benchmarks.

- Maintained strong relationships with clients and provided timely updates on portfolio performance, market insights, and investment opportunities.

- Stayed current on industry trends and regulatory changes to ensure compliance with investment guidelines and deliver value-added services to clients.

Portfolio Manager CV Education Examples

As a Portfolio Manager, possessing a strong educational background is crucial in order to effectively manage and strategize investments for clients. Below are some examples of educational backgrounds that would be beneficial for aspiring Portfolio Managers:

- Bachelor's degree in Finance or Economics: A solid foundation in finance or economics is essential for understanding market trends, financial instruments, and risk management strategies.

- Master's degree in Business Administration (MBA): An MBA can provide a more in-depth understanding of financial analysis, investment management, and portfolio optimization.

- Chartered Financial Analyst (CFA) certification: Achieving a CFA designation demonstrates a high level of expertise in investment analysis, portfolio management, and ethical standards.

- Bachelor's degree in Mathematics or Statistics: Strong quantitative skills are essential for analyzing data, performing risk assessments, and creating investment models.

- Certified Financial Planner (CFP) certification: A CFP certification can demonstrate expertise in financial planning, asset allocation, and client relationship management, which are all important skills for a Portfolio Manager.

Skills to Highlight in Your Portfolio Manager CV

As a Portfolio Manager, it is crucial to have a diverse set of skills that can effectively manage investments and assets while also building strong relationships with clients. Here are some key soft skills and hard skills to highlight in your Portfolio Manager CV:

Soft Skills:

- Communication skills

- Analytical skills

- Problem-solving skills

- Time management

- Leadership skills

- Attention to detail

- Adaptability

- Relationship building

- Decision-making abilities

- Strategic thinking

Hard Skills:

- Financial analysis

- Asset allocation

- Risk management

- Portfolio optimization

- Investment research

- Data analysis

- Excel proficiency

- Knowledge of financial markets

- Performance evaluation

- Compliance and regulatory knowledge

By showcasing these skills in your CV, you can demonstrate to potential employers your ability to effectively manage portfolios and drive successful outcomes for clients.

Portfolio Manager CV Format

As a Portfolio Manager, having a well-crafted CV is essential to showcase your skills and experience in the finance industry. When it comes to formatting your CV, it's important to tailor it based on your level of experience. For entry-level roles, a clean and concise format highlighting relevant coursework and internships is key. For mid-level positions, emphasize your track record of successful projects and leadership skills. For senior-level roles, focus on your strategic vision and achievements in managing large portfolios. Here are some tips for formatting your Portfolio Manager CV:

- Start with a professional summary highlighting your expertise and achievements.

- Use a clean and organized layout with clear headings for each section.

- Include specific examples of your portfolio management experience and the results achieved.

- Highlight your skills in risk management, asset allocation, and financial analysis.

- Quantify your accomplishments with specific numbers and metrics.

- End with a strong conclusion summarizing your qualifications and goals.

For more information on CV formats, check out this cv format article.

Common Mistakes to Avoid in a Portfolio Manager CV

As a Portfolio Manager, crafting a strong CV is crucial in showcasing your skills and experience in the financial industry. Avoiding common mistakes can make a big difference in standing out to potential employers. Here are 8-10 common mistakes to avoid in a Portfolio Manager CV:

- Including irrelevant information or experience that does not relate to the finance industry

- Failing to quantify achievements and results in previous roles

- Using a generic template that does not highlight your unique qualifications

- Having spelling or grammatical errors in your CV

- Not tailoring your CV to each specific job application

- Listing duties rather than accomplishments in previous roles

- Including too much personal information that is not relevant to the job

- Using jargon or technical language that may be difficult for non-finance professionals to understand

- Not including a professional summary or objective at the beginning of your CV

- Failing to showcase your investment strategy and success in managing portfolios.

Key Takeaways for a Portfolio Manager CV

- Utilize a professional CV template to showcase your experience and skills effectively. Check out CV templates like this one to make a great impression.

- Highlight your relevant experience in portfolio management, including your track record of successful investments and strategies.

- Use a CV builder like this one to easily create a customized and professional CV that stands out to potential employers.

- Include key skills such as financial analysis, risk management, and market research to demonstrate your expertise in portfolio management.

- Showcase your education and certifications related to finance and investment management to strengthen your CV.

- Tailor your CV to the specific job requirements and company culture to increase your chances of landing an interview.

- Include quantifiable achievements, such as percentage return on investments or successful portfolio growth, to demonstrate your impact in previous roles.

- Use cover letter templates like these to create a compelling introduction that complements your CV and highlights your enthusiasm for the role.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.