Are you a detail-oriented individual with a knack for numbers and a passion for finance? Look no further, as we delve into the world of Revenue Accountants and how to craft the perfect CV to showcase your skills and expertise. In this comprehensive guide, we will cover everything from formatting tips to key skills to include. Whether you're a seasoned professional or just starting out in your career, this article is sure to provide you with valuable insights to help you land your dream job as a Revenue Accountant. Stay tuned as we explore the essential tips and tricks to make your CV stand out from the crowd.

What is a Revenue Accountant CV?

A Revenue Accountant CV is a crucial document that outlines a candidate's qualifications, skills, and experience in the field of accounting, specifically focusing on revenue recognition and financial reporting. This document serves as a snapshot of the candidate's professional background, highlighting their ability to accurately record and analyze revenue data, ensure compliance with financial regulations, and provide valuable insights to support business decision-making. By presenting a well-structured and detailed CV, a Revenue Accountant can effectively showcase their expertise and stand out to potential employers in the competitive job market.

In addition to providing a comprehensive overview of their professional background, a well-crafted CV for a Revenue Accountant also demonstrates the candidate's attention to detail, organization skills, and dedication to accuracy in financial reporting. Employers rely on CVs to evaluate candidates' qualifications and suitability for the role, making it essential for Revenue Accountants to present their experience and accomplishments in a clear and concise manner. By following a CV writing guide like this one, candidates can ensure that their CV effectively communicates their expertise in revenue accounting, ultimately increasing their chances of securing interviews and advancing in their careers.

Key Components of a Revenue Accountant CV

- Proficiency in financial accounting software such as QuickBooks or SAP

- Strong analytical skills and attention to detail

- Experience in revenue recognition and analysis

- Knowledge of GAAP and IFRS standards

- Ability to work independently and meet deadlines

- Excellent communication skills, both written and verbal

- Bachelor's degree in Accounting or Finance

- CPA certification preferred

- Experience in preparing financial statements and reports

- Familiarity with Microsoft Excel and other financial analysis tools

- Understanding of internal controls and audit procedures

- Experience in collaborating with cross-functional teams to achieve financial goals.

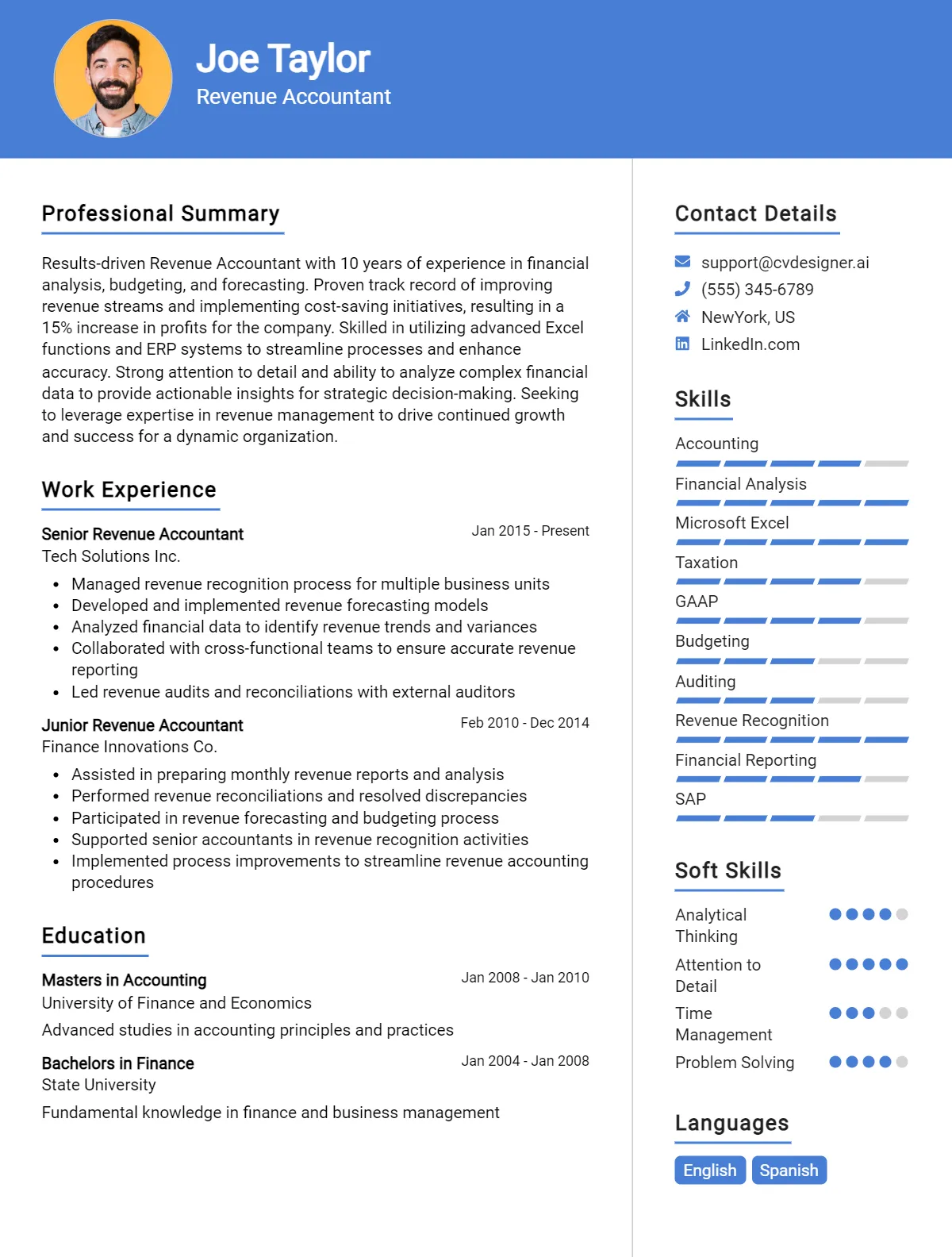

Sample Revenue Accountant CV for Inspiration

John Doe

123 Main Street, Anytown, USA | (555) 555-5555 | john.doe@email.com

Professional Summary: Dedicated Revenue Accountant with 5+ years of experience in financial analysis and reporting. Skilled in revenue recognition, financial forecasting, and budgeting. Proven track record of improving financial processes and increasing revenue for organizations. Strong attention to detail and ability to work under pressure in a fast-paced environment.

Work Experience: Senior Revenue Accountant ABC Company, Anytown, USA | January 2017 - Present

- Analyze revenue streams and identify trends to optimize revenue generation

- Prepare monthly financial reports and variance analysis for management review

- Collaborate with cross-functional teams to streamline revenue recognition processes

- Conduct audits and ensure compliance with accounting standards and regulations

Revenue Accountant XYZ Corporation, Anytown, USA | July 2014 - December 2016

- Managed revenue recognition for multiple business units and ensured accuracy of financial data

- Prepared revenue forecasts and budget projections to support strategic decision-making

- Assisted in the implementation of new accounting software to improve efficiency and accuracy

- Participated in internal and external audits to ensure compliance with GAAP

Education: Bachelor's Degree in Accounting Anytown University, Anytown, USA | Graduated May 2014

Skills:

- Proficient in Microsoft Excel, SAP, and QuickBooks

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal abilities

- Detail-oriented and organized

- Knowledge of GAAP and financial reporting standards

Certifications: Certified Public Accountant (CPA) - State of Anytown, USA

Publications:

- Doe, J. (2019). "Optimizing Revenue Recognition Processes in the Digital Age." Accounting Today, 45(2), 78-82.

This sample CV provides a comprehensive overview of a Revenue Accountant's qualifications and experience. It highlights key skills, work experience, education, and certifications that are essential for this role. Feel free to customize and tailor this template to fit your own experiences and accomplishments.

Revenue Accountant CV Writing Tips

When writing a CV for a Revenue Accountant position, it is important to highlight your experience with financial analysis, reporting, and revenue recognition. Be sure to showcase your attention to detail, strong analytical skills, and ability to work with complex financial data. Tailor your CV to emphasize your understanding of accounting principles and regulations, as well as your proficiency with financial software and tools. Additionally, include specific examples of successful revenue management projects you have overseen and any certifications or professional development courses you have completed in the field.

- Quantify Your Accomplishments: Use numbers and percentages to demonstrate the impact of your work on revenue generation and financial performance.

- Highlight Your Technical Skills: Mention any software or tools you are proficient in, such as SAP, Oracle, or QuickBooks.

- Showcase Your Analytical Skills: Provide examples of how you have analyzed financial data to identify trends and make strategic recommendations.

- Include Relevant Certifications: List any certifications you hold, such as CPA or CMA, to demonstrate your expertise in the field.

- Customize Your CV: Tailor your CV to the specific job description, highlighting relevant experience and skills that align with the requirements of the role.

- Use Action Verbs: Start bullet points with strong action verbs to demonstrate your accomplishments and contributions in previous roles.

- Show Your Attention to Detail: Mention your ability to ensure accuracy in financial reporting and adherence to accounting standards.

- Demonstrate Your Communication Skills: Highlight your ability to effectively communicate complex financial information to stakeholders and colleagues.

Revenue Accountant CV Summary Examples

As a Revenue Accountant, I am a detail-oriented professional with a strong background in financial analysis and reporting. I have a proven track record of accurately managing revenue streams and ensuring compliance with accounting standards. My expertise in reconciling accounts and identifying discrepancies has led to increased efficiency and profitability for the organizations I have worked with. I am seeking a challenging role where I can utilize my skills and contribute to the financial success of a company.

- Experienced Revenue Accountant with 5+ years of experience in managing revenue recognition processes and analyzing financial data. Proficient in preparing financial statements and conducting audits to ensure accuracy and compliance with regulations.

- Skilled Revenue Accountant with a background in conducting revenue forecasting and variance analysis. Strong knowledge of GAAP and IFRS standards, with a proven ability to streamline revenue reporting processes and improve financial performance.

- Detail-oriented Revenue Accountant with a track record of identifying revenue discrepancies and implementing corrective measures to improve accuracy. Proficient in utilizing accounting software and Excel to track revenue streams and analyze financial data.

- Results-driven Revenue Accountant with a passion for maximizing revenue streams and optimizing financial performance. Strong communication skills and the ability to collaborate with cross-functional teams to achieve revenue targets and drive business growth.

- Certified Revenue Accountant with a solid understanding of revenue recognition principles and experience in preparing revenue reports for senior management. Proven ability to analyze financial data and provide valuable insights to support strategic decision-making.

Build a Strong Experience Section for Your Revenue Accountant CV

As a Revenue Accountant, it is crucial to showcase your experience in managing financial transactions, analyzing revenue data, and ensuring compliance with accounting standards. When crafting your CV, make sure to highlight your accomplishments and responsibilities in previous roles to demonstrate your expertise in revenue accounting. Here are 6-8 examples of strong work experience descriptions for a Revenue Accountant:

- Managed the monthly revenue recognition process, ensuring accuracy and timeliness in recording revenue transactions.

- Conducted detailed analysis of revenue trends and variances to identify potential areas for improvement and optimization.

- Collaborated with cross-functional teams to streamline revenue accounting processes and enhance overall efficiency.

- Prepared and reviewed financial reports related to revenue performance, presenting findings to senior management for strategic decision-making.

- Implemented internal controls to safeguard revenue integrity and mitigate risks of misstatements or fraud.

- Led the reconciliation of revenue accounts and resolved discrepancies in a timely manner to maintain accurate financial records.

- Stayed current on accounting regulations and industry standards to ensure compliance with revenue recognition principles.

- Assisted in the preparation of annual budgets and forecasts, providing valuable insights into revenue projections and performance metrics.

Revenue Accountant CV Education Examples

As a Revenue Accountant, having a strong educational background is essential to ensure accuracy and efficiency in managing financial records and analyzing revenue data. Here are some examples of educational backgrounds that are relevant to excelling in this role:

- Bachelor's degree in Accounting: A strong foundation in accounting principles and practices is crucial for a Revenue Accountant to accurately record and report revenue.

- Master's degree in Finance: A deeper understanding of financial analysis and reporting can provide valuable insights for a Revenue Accountant to optimize revenue streams and identify potential areas for improvement.

- Certified Public Accountant (CPA) designation: Holding a CPA designation demonstrates a high level of expertise in accounting and financial management, which can be beneficial for a Revenue Accountant in ensuring compliance and accuracy in revenue recognition.

- Bachelor's degree in Business Administration: A broad understanding of business operations and management can complement the financial acumen needed for a Revenue Accountant to effectively collaborate with cross-functional teams and contribute to strategic decision-making processes.

- Professional certifications in revenue recognition: Additional certifications specific to revenue recognition standards, such as ASC 606, can enhance a Revenue Accountant's knowledge and skills in accurately applying revenue recognition principles in financial reporting.

Skills to Highlight in Your Revenue Accountant CV

As a Revenue Accountant, it is crucial to possess a diverse set of skills to effectively manage financial data and ensure accurate reporting. When creating your CV, be sure to highlight both soft skills and hard skills that showcase your ability to excel in this role.

Soft Skills:

- Attention to detail

- Analytical thinking

- Problem-solving

- Time management

- Communication skills

- Teamwork

- Adaptability

- Organizational skills

- Critical thinking

- Integrity

Hard Skills:

- Proficiency in accounting software (e.g. QuickBooks, SAP)

- GAAP knowledge

- Financial analysis

- Microsoft Excel expertise

- Revenue recognition principles

- Budgeting and forecasting

- Auditing experience

- Data reconciliation

- Financial reporting

- Tax compliance expertise

By showcasing a combination of these soft and hard skills on your CV, you can demonstrate to potential employers that you are well-equipped to excel in a Revenue Accountant role.

Revenue Accountant CV Format

As a Revenue Accountant, it is important to showcase your financial expertise and attention to detail in your CV. The best format for a Revenue Accountant CV will vary depending on your level of experience. For entry-level positions, a clean and simple format highlighting relevant coursework and internships is recommended. For mid-level positions, a more detailed CV emphasizing specific achievements and skills is ideal. For senior-level roles, a comprehensive CV showcasing leadership experience and strategic thinking is key. Here are some key bullet points to include in your Revenue Accountant CV:

- Experience in revenue recognition and analysis

- Proficiency in financial reporting and forecasting

- Strong knowledge of accounting principles and regulations

- Ability to collaborate with cross-functional teams

- Excellent communication and analytical skills

- Proficient in financial software and ERP systems

For more tips on CV formatting, check out this cv format article.

Common Mistakes to Avoid in a Revenue Accountant CV

As a Revenue Accountant, your CV is your first impression to potential employers. Avoiding common mistakes can help you stand out and increase your chances of landing your dream job. Here are 8-10 common mistakes to avoid in a Revenue Accountant CV:

- Using a generic CV template instead of customizing it to highlight your relevant skills and experiences

- Failing to quantify your accomplishments and results, such as increasing revenue or reducing expenses

- Including irrelevant information or details that do not pertain to the job you are applying for

- Not tailoring your CV to the specific job description and requirements of the position

- Using a cluttered or difficult to read format, instead opt for a clean and professional layout

- Overemphasizing job duties rather than focusing on your achievements and contributions

- Leaving out important details such as certifications, software skills, or relevant coursework

- Neglecting to proofread for spelling and grammar errors, which can make you appear careless or unprofessional

- Forgetting to include contact information or failing to update it with your current information

- Not providing specific examples or evidence of your skills and experience in revenue accounting.

Key Takeaways for a Revenue Accountant CV

- Clearly state your professional title as "Revenue Accountant" at the top of your CV.

- Highlight your experience in revenue recognition, financial analysis, and reporting.

- Showcase your skills in auditing, reconciliation, and compliance with accounting standards.

- Include your proficiency with accounting software such as QuickBooks or SAP.

- Quantify your achievements with specific examples of revenue growth or cost savings.

- List any relevant certifications such as CPA or CMA.

- Use action verbs to describe your responsibilities and accomplishments in previous roles.

- Customize your CV to tailor it to the specific job requirements and company culture.

- Format your CV using a professional template from CV Templates to make it visually appealing and easy to read.

- Consider using CV Builder to create a customized and professional CV in minutes.

- Attach a cover letter that complements your CV and highlights your passion for revenue accounting using Cover Letter Templates.

- Proofread your CV carefully to ensure there are no typos or grammatical errors.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.