Are you looking to kickstart your career in tax assistance? Look no further! In this comprehensive guide, we will walk you through everything you need to know about crafting a standout Tax Assistant CV. From highlighting your relevant skills and experience to showcasing your knowledge of tax laws and regulations, we've got you covered. Get ready to impress potential employers with a professionally crafted CV that sets you apart from the competition. Stay tuned for expert tips on formatting, content, and presentation. Let's dive in!

Key points covered in this guide include:

- How to effectively showcase your tax knowledge and expertise

- Highlighting your attention to detail and analytical skills

- Demonstrating your ability to work well under pressure and meet deadlines

- Crafting a professional summary that grabs the reader's attention

- Formatting tips to ensure your CV is visually appealing and easy to read.

What is a Tax Assistant CV?

A Tax Assistant CV is a crucial document that outlines a candidate's education, skills, work experience, and accomplishments in the field of taxation. This document serves as a snapshot of the candidate's qualifications and helps potential employers assess whether the individual is a good fit for the role. A well-crafted CV can highlight a Tax Assistant's knowledge of tax laws, attention to detail, and ability to work with complex financial information.

In the competitive job market, a Tax Assistant CV is essential for standing out among other candidates. It provides a comprehensive overview of the candidate's background and expertise in tax preparation and compliance. By following a CV writing guide, Tax Assistants can effectively showcase their skills and experiences, increasing their chances of securing interviews and ultimately landing their desired job in the taxation field.

Key Components of a Tax Assistant CV

- Relevant qualifications in accounting or finance

- Knowledge of tax laws and regulations

- Proficiency in tax preparation software

- Attention to detail and accuracy

- Strong analytical and problem-solving skills

- Experience in preparing tax returns

- Ability to communicate effectively with clients and colleagues

- Understanding of financial statements and tax implications

- Time management and organizational skills

- Familiarity with Microsoft Excel and other accounting software

- Experience in conducting tax research

- Strong work ethic and commitment to professional development.

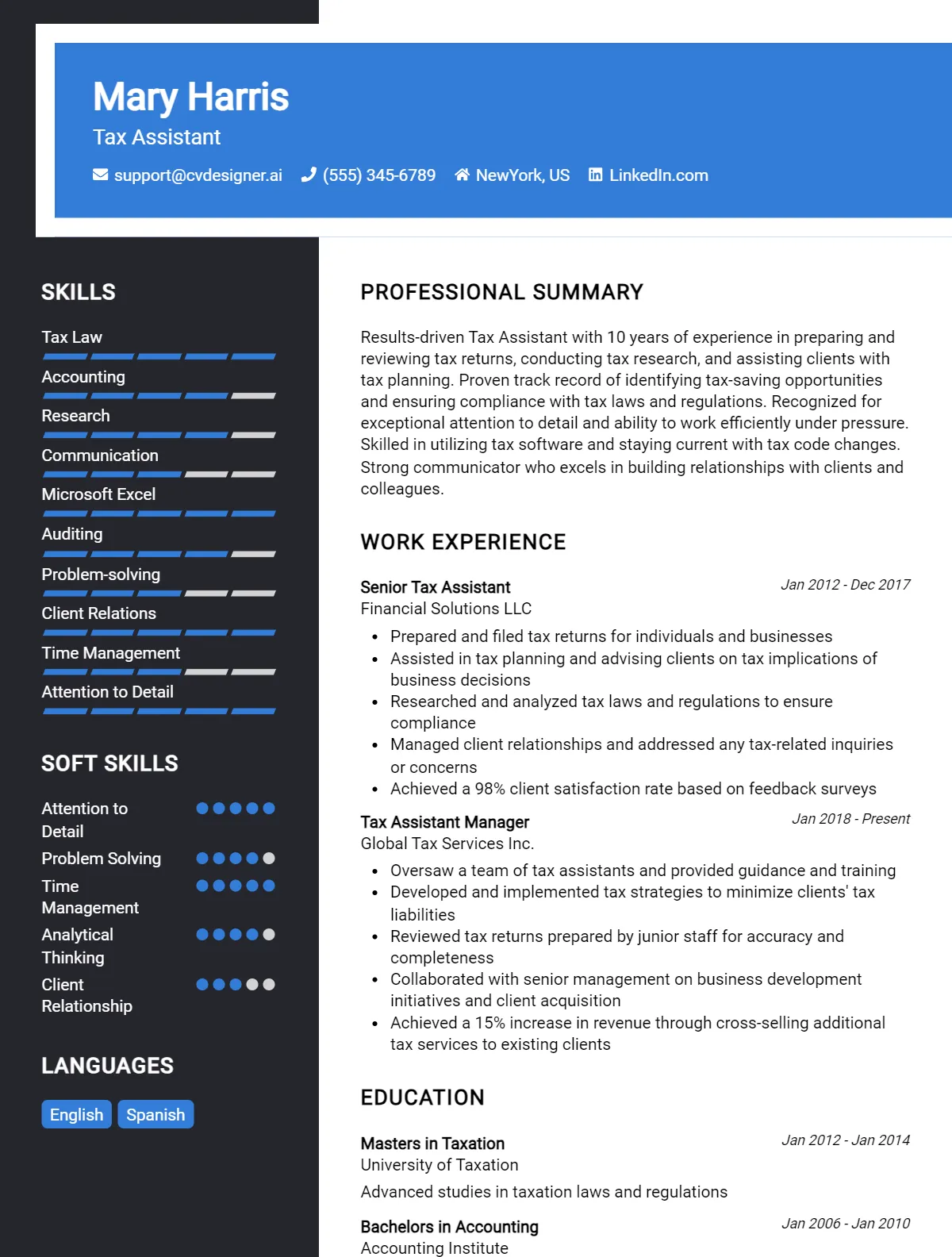

Sample Tax Assistant CV for Inspiration

[Full Name] [Address] [City, State, Zip Code] [Phone Number] [Email Address]

Professional Summary: Highly organized and detail-oriented Tax Assistant with over 3 years of experience in assisting tax professionals in preparing and filing tax returns. Proficient in conducting research, analyzing data, and ensuring compliance with tax laws and regulations. Strong communication skills and ability to work effectively in a fast-paced environment.

Work Experience: Tax Assistant ABC Tax Services, City, State June 2018 - Present

- Assisted tax professionals in preparing and filing individual and business tax returns

- Conducted research on tax laws and regulations to ensure compliance

- Prepared tax documents and organized client files

- Communicated with clients to gather necessary information for tax filings

- Assisted in resolving tax-related issues and discrepancies

Tax Intern XYZ Accounting Firm, City, State January 2017 - May 2018

- Assisted tax professionals in preparing tax returns for individuals and businesses

- Conducted research on tax codes and regulations

- Assisted in resolving client inquiries and issues related to tax filings

- Prepared tax documents and organized client files

Education: Bachelor's Degree in Accounting University Name, City, State Graduated May 2017

Skills:

- Proficient in tax preparation software such as TurboTax and TaxAct

- Strong knowledge of tax laws and regulations

- Excellent research and analytical skills

- Strong attention to detail and organizational skills

- Effective communication and interpersonal skills

Certifications:

- Certified Tax Preparer (CTP)

- Certified Public Accountant (CPA) (in progress)

Publications:

- "Understanding Tax Deductions for Small Businesses" - Published in Tax Advisor Magazine, July 2019

References: Available upon request.

Tax Assistant CV Writing Tips

For a Tax Assistant CV, it is important to highlight your attention to detail, analytical skills, and knowledge of tax laws and regulations. Make sure to include any relevant certifications or training you have completed in the field of taxation. When writing your CV, be sure to customize it for each job application by focusing on the specific skills and experience that match the job requirements. Utilize keywords and phrases from the job description to ensure your CV gets noticed by applicant tracking systems. Keep your CV concise and organized, with clear headings and bullet points to make it easy for employers to scan. Avoid including irrelevant information and focus on showcasing your relevant experience and accomplishments in the tax field. Proofread your CV carefully to ensure there are no typos or errors. Finally, consider including a cover letter that highlights your passion for tax work and explains why you are a good fit for the position.

Tax Assistant CV Summary Examples

As a Tax Assistant, I am detail-oriented and analytical, with a strong understanding of tax laws and regulations. I am committed to providing accurate and efficient tax assistance to clients, ensuring compliance and maximizing tax savings. With a proven track record of assisting in tax preparation and planning, I am well-equipped to handle a variety of tax-related tasks.

- Experienced Tax Assistant with a background in tax compliance and preparation. Skilled in conducting tax research, analyzing financial data, and assisting in tax planning strategies. Strong attention to detail and ability to meet deadlines in a fast-paced environment.

- Results-driven Tax Assistant with a passion for helping clients navigate complex tax situations. Proficient in preparing and reviewing tax returns, identifying tax-saving opportunities, and communicating effectively with clients and colleagues. Proven ability to handle confidential information with discretion.

- Detail-oriented Tax Assistant with a keen eye for accuracy and compliance. Skilled in performing tax calculations, reconciling financial records, and assisting in tax audits. Strong organizational skills and ability to prioritize tasks to meet deadlines efficiently.

- Dedicated Tax Assistant with a solid understanding of tax laws and regulations. Proficient in using tax software and tools to streamline tax preparation processes. Excellent communication skills and ability to collaborate with team members to deliver exceptional tax assistance to clients.

Build a Strong Experience Section for Your Tax Assistant CV

As a Tax Assistant, I have gained valuable experience in assisting with tax preparation, filing, and compliance. I have a strong attention to detail and a thorough understanding of tax laws and regulations. Here are some examples of strong work experience descriptions for a Tax Assistant CV:

- Prepared and reviewed individual and corporate tax returns accurately and in a timely manner.

- Assisted with researching and interpreting tax laws to ensure compliance.

- Communicated with clients to gather necessary tax information and address any questions or concerns.

- Participated in tax planning meetings to help clients minimize tax liabilities and maximize tax savings.

- Conducted tax audits and assisted in resolving any issues or discrepancies.

- Utilized tax software programs to input data and generate accurate tax forms and reports.

- Collaborated with team members to streamline tax preparation processes and improve efficiency.

- Stayed up-to-date on changes in tax laws and regulations to provide accurate and timely advice to clients.

Tax Assistant CV Education Examples

As a Tax Assistant, having a strong educational background in accounting, finance, or taxation is crucial for success in the role. Here are some examples of educational backgrounds that would be relevant for a Tax Assistant:

- Bachelor's degree in Accounting: A degree in accounting provides a solid foundation in financial reporting, auditing, and taxation principles, which are essential skills for a Tax Assistant.

- Master's degree in Taxation: A more specialized degree in taxation can provide in-depth knowledge of tax laws, regulations, and compliance requirements, making a candidate a valuable asset in a tax department.

- Bachelor's degree in Finance: A degree in finance can also be beneficial for a Tax Assistant, as it provides a strong understanding of financial markets, investment analysis, and risk management, which are all relevant to tax planning and strategy.

- Professional certification in Taxation: Obtaining a professional certification, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), can demonstrate expertise in tax preparation, planning, and compliance, making a candidate a competitive choice for a Tax Assistant position.

- Continuing education in Tax Law: Keeping up to date with the latest developments in tax laws and regulations through continuing education courses or workshops can show a commitment to professional growth and development in the field of taxation.

Skills to Highlight in Your Tax Assistant CV

As a Tax Assistant, it is essential to possess a combination of soft and hard skills in order to excel in this role. Soft skills such as attention to detail, strong communication, and the ability to work well under pressure are crucial for effectively assisting with tax preparation and compliance. On the other hand, hard skills like knowledge of tax laws and regulations, proficiency in using tax software, and analytical skills are also important for success in this position. Here are 10 soft skills and 10 hard skills that should be highlighted in your Tax Assistant CV:

Soft Skills:

- Attention to detail

- Strong communication

- Time management

- Problem-solving

- Teamwork

- Adaptability

- Organization

- Critical thinking

- Customer service

- Stress management

Hard Skills:

- Knowledge of tax laws and regulations

- Proficiency in tax preparation software

- Accounting skills

- Research skills

- Data analysis

- Financial reporting

- Microsoft Excel proficiency

- Audit preparation

- Tax planning

- Familiarity with IRS guidelines and procedures

By showcasing a combination of these soft and hard skills on your CV, you can demonstrate to potential employers that you have the necessary qualifications to succeed as a Tax Assistant.

Tax Assistant CV Format

As a Tax Assistant, it is crucial to have a well-organized and professional CV format to showcase your skills and experience in the best possible way. For entry-level positions, a chronological format highlighting relevant coursework and internships can be effective. For mid-level positions, a combination format that combines skills and experience can be beneficial. For senior-level positions, a functional format that focuses on achievements and leadership roles is recommended.

Here are 5-6 bullet points to include in your Tax Assistant CV:

- Proficient in tax preparation software such as TurboTax and QuickBooks

- Strong understanding of tax laws and regulations

- Experience in preparing individual and business tax returns

- Excellent communication skills for interacting with clients and tax authorities

- Detail-oriented with a high level of accuracy in calculations

- Ability to work independently and as part of a team to meet deadlines

For more information on CV formats, you can visit cv format.

Common Mistakes to Avoid in a Tax Assistant CV

As a Tax Assistant, your CV is one of the most crucial tools in landing a job in the competitive field of tax and accounting. To ensure your CV stands out to potential employers, it's important to avoid common mistakes that can hinder your chances of securing an interview. Here are 8-10 common mistakes to avoid in a Tax Assistant CV:

- Spelling and grammatical errors

- Lack of specific tax-related skills and experience

- Not tailoring your CV to the job description

- Including irrelevant information or personal details

- Failing to highlight your achievements and accomplishments

- Using a generic or outdated CV format

- Neglecting to include relevant certifications or qualifications

- Not showcasing your attention to detail and analytical skills

- Overselling or exaggerating your abilities and experience

- Forgetting to proofread and edit your CV before submitting it.

Key Takeaways for a Tax Assistant CV

- Utilize CV Templates to create a professional and visually appealing resume format.

- Highlight relevant experience in tax preparation, compliance, and research.

- Showcase proficiency in tax software and tools such as QuickBooks and TurboTax.

- Include any certifications or licenses related to tax preparation, such as Enrolled Agent (EA) or Certified Public Accountant (CPA).

- Quantify achievements, such as the number of tax returns processed or amount of tax savings generated for clients.

- Demonstrate strong attention to detail and analytical skills in reviewing financial documents and identifying tax deductions.

- Utilize CV Builder to easily customize and update your CV for each job application.

- Include a cover letter tailored to each job application using Cover Letter Templates to showcase your interest and qualifications for the Tax Assistant role.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.