Are you looking to embark on a career in tax examination? Look no further! This comprehensive CV guide for Tax Examiners will provide you with all the essential information and tips to excel in this role. From understanding tax laws and regulations to conducting audits and reviews, this guide covers it all. Get ready to dive into the world of taxes and make a meaningful impact in the financial realm. In this guide, you will learn:

- Key responsibilities of a Tax Examiner

- Essential skills and qualifications required for the role

- Tips for effectively reviewing tax returns

- Strategies for conducting thorough audits

- Career progression opportunities in the field

Don't miss out on this golden opportunity to kickstart your career as a Tax Examiner. Let's delve into the intricate world of taxes together!

What is a Tax Examiner CV?

A Tax Examiner CV is a crucial document that outlines the professional experience, skills, and qualifications of an individual applying for a Tax Examiner role. It serves as a snapshot of the candidate’s background, showcasing their relevant work history in tax examination, auditing, and compliance. The CV highlights key achievements, certifications, and educational credentials that demonstrate the candidate’s expertise in tax laws, regulations, and procedures.

In the competitive field of tax examination, a well-crafted CV is essential for standing out to potential employers and securing job opportunities. Employers rely on CVs to assess a candidate’s suitability for the position, looking for relevant experience in tax assessment, analysis, and reporting. A comprehensive and detailed CV can demonstrate the candidate’s ability to handle complex tax matters, conduct audits, and ensure compliance with tax laws, making them a valuable asset to the organization.

Key Components of a Tax Examiner CV

- Relevant education and certifications (e.g. Bachelor's degree in Accounting or Finance, CPA certification)

- Experience in tax law and regulations

- Proficiency in tax preparation software (e.g. TurboTax, QuickBooks)

- Strong attention to detail and analytical skills

- Ability to interpret complex tax laws and regulations

- Excellent communication skills, both written and verbal

- Experience conducting audits and investigations

- Strong organizational skills and ability to meet deadlines

- Familiarity with IRS procedures and guidelines

- Ability to work independently and as part of a team

- Knowledge of state and local tax laws

- Experience with tax planning and compliance strategies

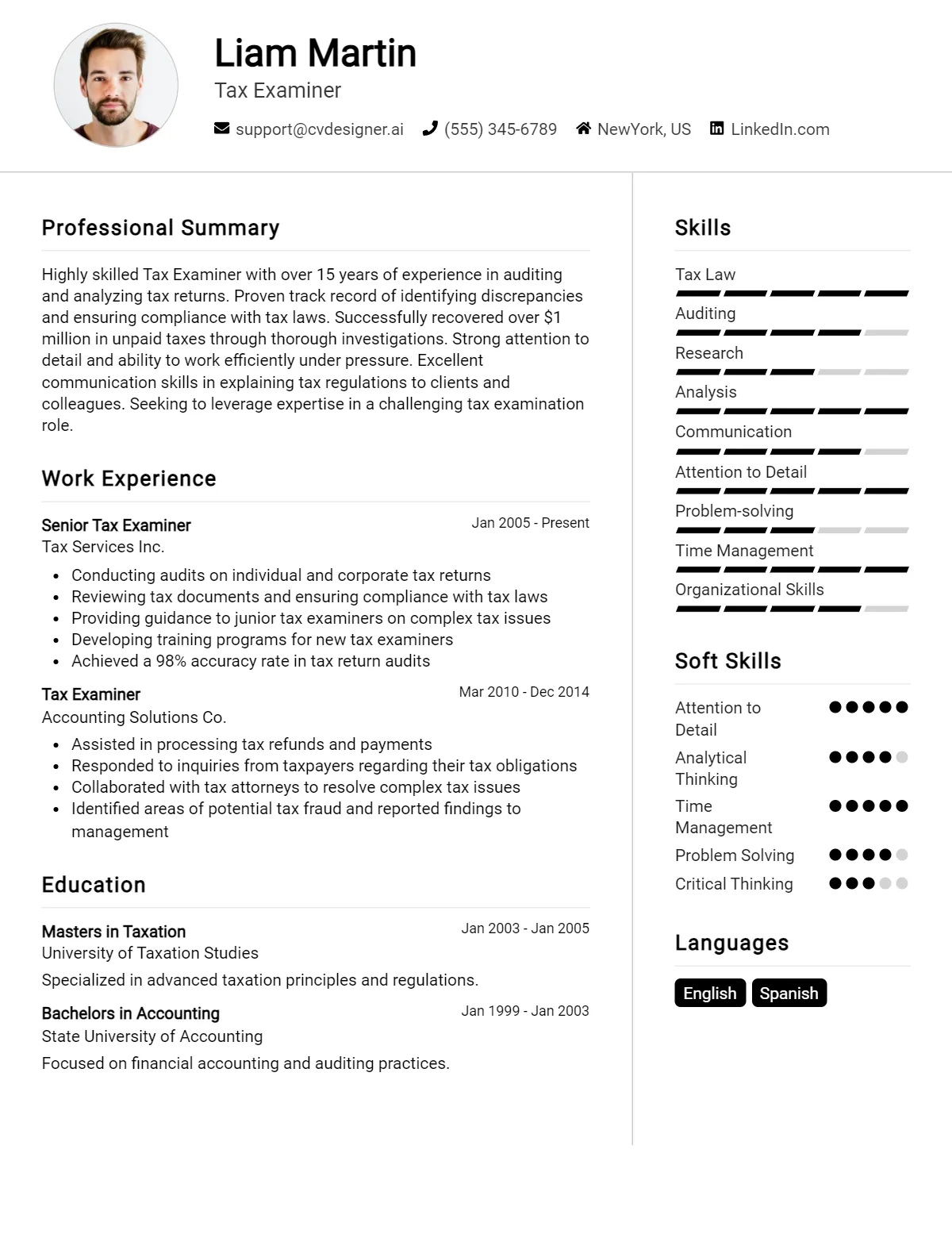

Sample Tax Examiner CV for Inspiration

[Full Name] [Address] [City, State ZIP Code] [Phone Number] [Email Address]

Professional Summary: Dedicated Tax Examiner with over 5 years of experience in reviewing tax returns, conducting audits, and ensuring compliance with tax laws and regulations. Proven track record of accurately analyzing financial documents and resolving complex tax issues. Strong attention to detail and excellent communication skills.

Work Experience: Tax Examiner ABC Tax Services, City, State June 2016 - Present

- Review tax returns to ensure accuracy and compliance with tax laws

- Conduct audits on individual and corporate tax returns

- Communicate with taxpayers to resolve tax issues and answer inquiries

- Collaborate with tax attorneys and accountants on complex cases

- Prepare reports and documentation for tax audits

Tax Assistant XYZ Accounting Firm, City, State January 2014 - May 2016

- Assisted Tax Examiners in reviewing tax returns and conducting audits

- Prepared financial documents and reports for tax filings

- Researched tax laws and regulations to stay updated on changes

- Provided support to clients during tax season

Education: Bachelor's Degree in Accounting City University, City, State Graduated May 2014

Skills:

- Proficient in Microsoft Office Suite

- Strong analytical and problem-solving skills

- Knowledge of tax laws and regulations

- Excellent communication and interpersonal skills

- Detail-oriented and organized

Publications:

- "The Impact of Tax Reform on Small Businesses", Tax Journal, 2018

Certifications:

- Certified Tax Examiner (CTE)

References available upon request.

Tax Examiner CV Writing Tips

As a Tax Examiner, it is important to showcase your strong attention to detail, analytical skills, and knowledge of tax laws and regulations on your CV. To create a standout CV, be sure to include specific examples of your experience in tax examination and auditing processes. Highlight any relevant certifications or training you have received in tax compliance. Tailor your CV to the specific job you are applying for by emphasizing your skills in tax preparation, research, and communication. Make sure to include quantifiable achievements, such as successful audits or identifying cost-saving opportunities for clients. Keep your CV concise and easy to read, focusing on relevant information that will demonstrate your qualifications for the position.

Specific CV Writing Tips for Tax Examiners:

- Include keywords related to tax examination and auditing to pass through applicant tracking systems.

- Quantify your achievements with specific numbers, such as the amount of money saved through tax audits.

- Highlight your knowledge of tax laws and regulations, including any specialized areas of expertise.

- Showcase your ability to work efficiently and meet deadlines in a high-pressure environment.

- Mention any relevant software skills, such as proficiency in tax preparation software or data analysis tools.

- Provide clear and concise descriptions of your previous job responsibilities and accomplishments in tax examination.

Tax Examiner CV Summary Examples

- Detail-oriented Tax Examiner with 5+ years of experience in reviewing and analyzing tax returns for accuracy and compliance. Strong knowledge of tax laws and regulations, with a proven track record of identifying discrepancies and resolving issues promptly. Adept at conducting audits and providing recommendations for improvement.

- Results-driven Tax Examiner with a background in conducting thorough research and analysis to ensure tax compliance. Skilled in interpreting complex tax codes and communicating findings effectively to clients and colleagues. Proven ability to meet strict deadlines and deliver high-quality work under pressure.

- Highly organized Tax Examiner with a passion for accuracy and precision in tax assessment. Proficient in utilizing computer software and databases to streamline processes and increase efficiency. Excellent problem-solving skills and the ability to adapt to changing tax laws and regulations.

- Experienced Tax Examiner with a strong background in conducting audits and investigations to ensure compliance with tax laws. Skilled in conducting interviews and gathering evidence to support findings. Proven ability to collaborate with internal and external stakeholders to achieve successful outcomes.

Build a Strong Experience Section for Your Tax Examiner CV

As a Tax Examiner, my role is to review and analyze tax returns, ensure compliance with tax laws and regulations, and resolve any discrepancies or issues. My experience in this field has equipped me with the skills and knowledge necessary to excel in this role. Below are some examples of strong work experience descriptions for a Tax Examiner:

- Conducted thorough reviews of individual and corporate tax returns to identify errors and discrepancies.

- Collaborated with taxpayers and tax preparers to gather additional information and documentation needed for accurate tax assessment.

- Utilized tax software and databases to verify information and calculate tax liabilities.

- Resolved complex tax issues and disputes through effective communication and negotiation with taxpayers.

- Prepared detailed reports and recommendations for tax assessments and adjustments.

- Stayed up-to-date on changes in tax laws and regulations to ensure accurate and compliant tax assessments.

- Trained and mentored junior staff members on tax examination procedures and best practices.

- Assisted in audits and investigations to uncover tax fraud and evasion.

By incorporating these strong work experience descriptions in your CV, you can showcase your expertise and qualifications as a Tax Examiner to potential employers.

Tax Examiner CV Education Examples

As a Tax Examiner, having a strong educational background is crucial to understanding tax laws and regulations. Here are some examples of educational qualifications that would be relevant for a Tax Examiner role:

- Bachelor's Degree in Accounting: A degree in accounting provides a solid foundation in financial principles and prepares individuals to analyze financial documents and understand tax laws.

- Master's Degree in Taxation: A specialized degree in taxation equips individuals with in-depth knowledge of tax codes, regulations, and compliance requirements.

- Bachelor's Degree in Finance: A degree in finance provides a strong understanding of financial markets, investment principles, and risk management, all of which are relevant skills for a Tax Examiner.

- Certified Public Accountant (CPA) Certification: While not a traditional educational degree, obtaining a CPA certification demonstrates expertise in accounting principles, tax laws, and ethical standards.

- Bachelor's Degree in Business Administration: A degree in business administration offers a broad understanding of business operations, management principles, and organizational behavior, all of which are valuable skills for a Tax Examiner.

Skills to Highlight in Your Tax Examiner CV

As a Tax Examiner, it is crucial to possess a combination of soft and hard skills to effectively analyze tax returns, ensure compliance with regulations, and communicate with taxpayers. In your CV, make sure to highlight the following skills:

Soft Skills:

- Attention to detail

- Analytical thinking

- Time management

- Communication skills

- Problem-solving abilities

- Critical thinking

- Adaptability

- Teamwork

- Customer service

- Integrity

Hard Skills:

- Knowledge of tax laws and regulations

- Proficiency in tax software (e.g. TurboTax, TaxAct)

- Data analysis

- Financial reporting

- Auditing

- Research skills

- Mathematics

- Microsoft Excel

- Legal compliance

- IRS procedures and policies.

Common Mistakes to Avoid in a Tax Examiner CV

As a tax examiner, your CV plays a crucial role in showcasing your skills and qualifications to potential employers. To ensure that your CV stands out and accurately reflects your abilities, it's important to avoid common mistakes that can hinder your chances of landing the job. Here are 8-10 mistakes to avoid in a Tax Examiner CV:

- Providing inaccurate or incomplete information about your tax examination experience

- Failing to highlight specific achievements or successes in previous tax examination roles

- Using a generic or one-size-fits-all CV instead of tailoring it to the specific job requirements

- Including irrelevant information or skills that are not related to tax examination

- Neglecting to proofread for spelling and grammatical errors

- Failing to include relevant certifications or qualifications related to tax examination

- Using a confusing or cluttered CV layout that makes it difficult for employers to find key information

- Not including a professional summary or objective at the beginning of your CV to grab the employer's attention

- Omitting contact information or failing to update it with current phone numbers and email addresses

- Exaggerating or fabricating information about your tax examination experience or skills

Key Takeaways for a Tax Examiner CV

- Highlight your experience in tax law and regulations

- Showcase your strong analytical and problem-solving skills

- Include your proficiency in tax software and tools

- Detail your ability to interpret and apply complex tax codes

- Emphasize your attention to detail and accuracy

- Mention any certifications or licenses related to tax examination

- Demonstrate your communication skills, both written and verbal

- Show your ability to work independently and as part of a team

- Include any relevant education or training in tax examination

- Highlight any experience in conducting audits or investigations

- Showcase your ability to meet deadlines and handle high-pressure situations

- Mention any experience in reviewing and analyzing financial documents.

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.