Are you passionate about the fast-paced world of trading and investments? Do you have a keen eye for market trends and a knack for analyzing data? If so, then a career as a Trading Analyst might be the perfect fit for you. In this comprehensive guide, we will walk you through the essential steps of crafting a winning Trading Analyst CV that will impress potential employers. From highlighting your analytical skills to showcasing your experience in the financial industry, we will cover it all. Get ready to take your trading career to the next level with our expert tips and tricks!

Key points covered in this guide:

- Tailoring your CV to the Trading Analyst role

- Highlighting your analytical skills and attention to detail

- Showcasing your experience with financial markets and trading platforms

- Including relevant certifications and qualifications

- Formatting and structuring your CV for maximum impact.

What is a Trading Analyst CV?

A Trading Analyst CV is a crucial document that showcases a candidate's skills, experience, and qualifications in the field of trading. It serves as a comprehensive summary of the individual's professional background, highlighting their expertise in analyzing market trends, making informed investment decisions, and managing risk effectively. A well-crafted CV can make a significant difference in helping a Trading Analyst stand out in a competitive job market by demonstrating their proficiency in various trading strategies, financial modeling techniques, and data analysis tools.

Furthermore, a Trading Analyst CV plays a vital role in presenting a candidate's career trajectory and achievements to potential employers. It provides hiring managers with valuable insights into the candidate's track record of success in identifying profitable trading opportunities, optimizing portfolio performance, and delivering measurable results for their clients or organization. By following a CV writing guide, Trading Analysts can ensure that their CV effectively communicates their unique value proposition and positions them as top contenders for lucrative trading roles in the financial industry.

Key Components of a Trading Analyst CV

- Relevant skills such as financial analysis, data analysis, and risk management skills

- Work experience in a trading or financial analysis role work experience

- Education in finance, economics, or a related field

- Proficiency in financial software and tools

- Knowledge of trading strategies and market trends

- Strong communication and presentation skills

- Ability to work under pressure and make quick decisions

- Attention to detail and strong analytical skills

- Certifications or licenses related to trading or finance

- Experience with different asset classes such as stocks, bonds, or commodities

- Understanding of regulations and compliance in the financial industry

- Ability to work in a fast-paced and dynamic environment

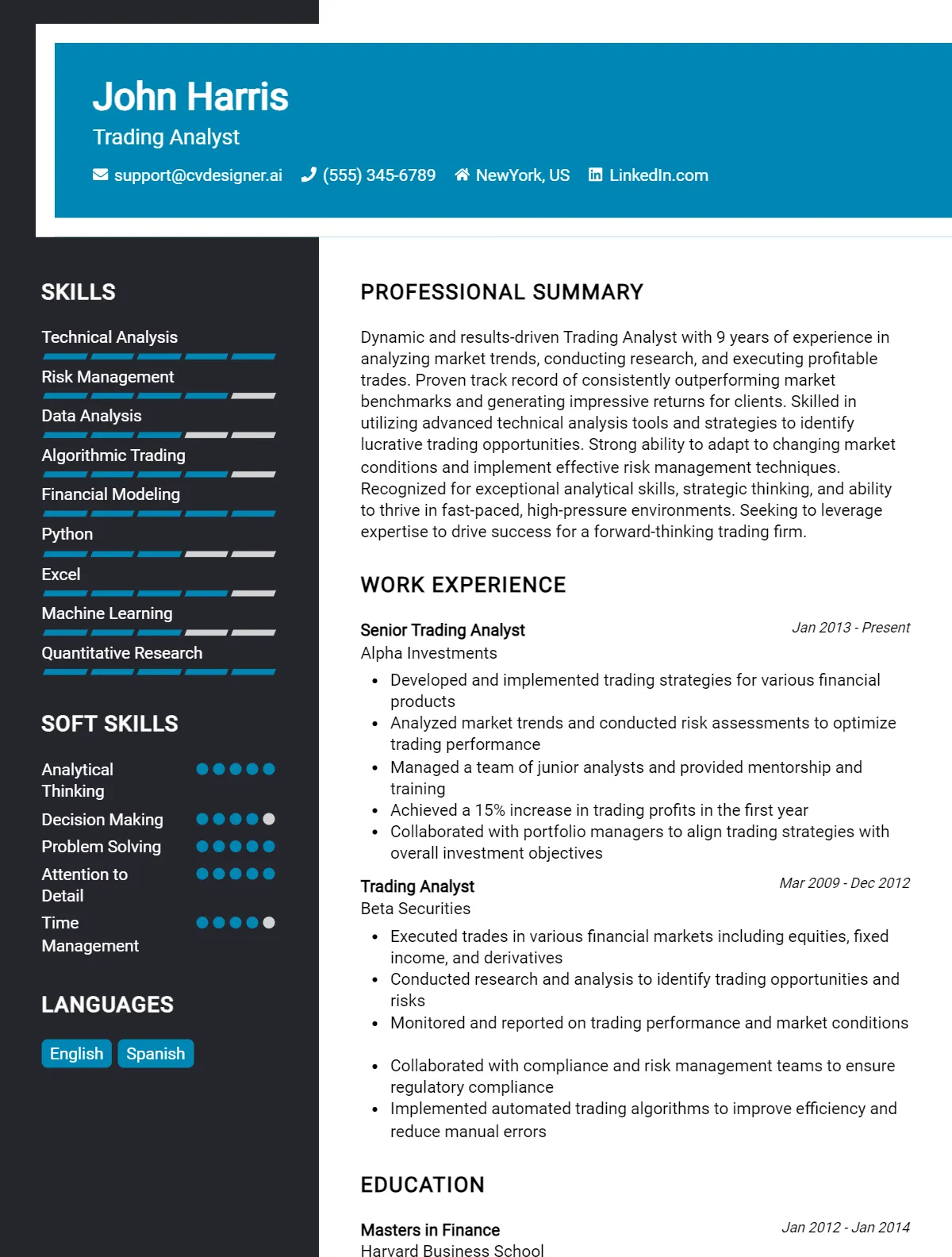

Sample Trading Analyst CV for Inspiration

John Doe

123 Main Street, New York, NY 10001

(555) 555-5555

johndoe@email.com

Professional Summary

Experienced Trading Analyst with a proven track record of successfully analyzing market trends and making informed trading decisions. Skilled in utilizing advanced technical analysis tools and financial models to identify potential trading opportunities. Strong attention to detail and ability to work under pressure in fast-paced trading environments.

Work Experience

Trading Analyst - XYZ Investment Firm, New York, NY

June 2018 - Present

- Conduct market research and analysis to identify potential trading opportunities in equities, commodities, and currencies.

- Develop and implement trading strategies based on technical and fundamental analysis.

- Monitor and evaluate trade performance and make adjustments as needed to optimize profitability.

- Collaborate with traders, portfolio managers, and research analysts to execute trades and manage risk effectively.

Junior Trading Analyst - ABC Trading Company, Chicago, IL

January 2016 - May 2018

- Assisted senior trading analysts in conducting market research and analysis.

- Executed trades on behalf of clients and maintained accurate trade records.

- Monitored market trends and provided timely updates to the trading team.

- Participated in trading strategy development and optimization.

Education

Bachelor of Science in Finance

University of ABC, Chicago, IL

Graduated May 2016

Skills

- Proficient in technical analysis tools such as Bloomberg Terminal and TradingView.

- Strong understanding of financial markets and trading strategies.

- Excellent quantitative and analytical skills.

- Ability to work effectively in a team environment.

- Strong communication and presentation skills.

Publications

- "The Impact of Macro Events on Stock Market Volatility" - Journal of Finance, 2017.

Certifications

- Chartered Financial Analyst (CFA) designation.

This sample CV provides a comprehensive overview of a Trading Analyst's background, experience, and qualifications. It serves as a valuable reference for individuals seeking inspiration to create their own CV for a similar role.

Trading Analyst CV Writing Tips

As a Trading Analyst, it's important to showcase your analytical skills, attention to detail, and ability to make informed decisions in a fast-paced environment on your CV. To stand out in a competitive job market, focus on highlighting your experience with market research, data analysis, and risk management. Tailor your CV to emphasize your accomplishments and quantify results where possible. Be sure to include any relevant certifications or licenses, such as the Chartered Financial Analyst (CFA) designation. Here are some specific tips to help you craft a strong Trading Analyst CV:

- Start with a strong summary statement that highlights your key skills and experience in the trading industry.

- Use action verbs to describe your accomplishments, such as "analyzed market trends" or "managed risk exposure."

- Quantify your achievements with specific numbers, such as "increased portfolio returns by 15%" or "reduced trading errors by 20%."

- Include relevant technical skills, such as proficiency in trading platforms or programming languages like Python or R.

- Highlight any experience with different asset classes, such as equities, fixed income, or derivatives.

- Show your ability to work well under pressure by mentioning any experience with high-frequency trading or volatile market conditions.

- Include any internships or volunteer work related to trading, even if they were unpaid, to demonstrate your commitment to the industry.

- Proofread your CV carefully to ensure there are no typos or grammatical errors that could detract from your professionalism.

Trading Analyst CV Summary Examples

As a Trading Analyst, my goal is to utilize my analytical skills and market knowledge to make informed decisions that drive profitability and success for my clients. With a keen eye for trends and a passion for research, I excel at identifying opportunities and mitigating risks in fast-paced trading environments. Here are some examples of compelling CV summaries for a Trading Analyst:

- Dynamic Trading Analyst with 5+ years of experience in financial markets. Proven track record of generating consistent profits through strategic analysis and execution. Skilled in utilizing data-driven insights to optimize trading strategies and maximize returns.

- Results-driven Trading Analyst with a strong background in technical analysis and risk management. Expertise in developing and implementing trading algorithms to achieve superior performance. Adept at staying ahead of market trends and adapting quickly to changing conditions.

- Seasoned Trading Analyst with a deep understanding of global markets and macroeconomic factors. Proficient in conducting thorough research and due diligence to inform investment decisions. Known for delivering exceptional results in high-pressure trading environments.

- Detail-oriented Trading Analyst with a passion for uncovering opportunities in volatile markets. Strong quantitative skills and proficiency in statistical analysis tools. Able to communicate complex financial concepts effectively to stakeholders and make data-driven recommendations.

- Strategic Trading Analyst with a solid foundation in fundamental and technical analysis. Skilled at developing trading strategies that align with clients' risk tolerance and investment goals. Proven ability to navigate complex financial instruments and deliver consistent results.

Build a Strong Experience Section for Your Trading Analyst CV

As a Trading Analyst, I have honed my skills in analyzing market trends, identifying opportunities, and making strategic decisions to maximize returns. My experience in the financial industry has equipped me with the knowledge and expertise needed to thrive in this fast-paced and dynamic environment. Here are 6-8 examples of strong work experience descriptions for a Trading Analyst:

- Conducted thorough market research and analysis to identify potential investment opportunities and risks.

- Developed and implemented trading strategies to optimize portfolio performance and achieve desired outcomes.

- Collaborated with team members to analyze market data, monitor trade executions, and make real-time decisions.

- Utilized advanced technical analysis tools and software to track market trends and predict future movements.

- Managed risk exposure by setting stop-loss orders, monitoring margin levels, and implementing hedging strategies.

- Communicated with clients, stakeholders, and senior management to provide updates on trading activities and performance.

- Executed trades across various asset classes, including equities, commodities, and derivatives, to diversify portfolios and enhance returns.

- Monitored regulatory changes and industry developments to ensure compliance with laws and regulations governing trading activities.

Trading Analyst CV Education Examples

As a Trading Analyst, having a strong educational background is essential in order to excel in the fast-paced world of financial markets. Below are some examples of educational backgrounds that are relevant to a Trading Analyst role:

- Bachelor's degree in Finance or Economics: A solid foundation in finance or economics will provide you with the necessary knowledge and skills to understand market trends and make informed trading decisions.

- Master's degree in Financial Engineering: A specialized degree in financial engineering will give you a deeper understanding of quantitative analysis and risk management, which are crucial in trading roles.

- Chartered Financial Analyst (CFA) certification: Obtaining a CFA certification demonstrates a commitment to excellence and a high level of expertise in financial analysis, making you a valuable asset in trading roles.

- Bachelor's degree in Mathematics or Statistics: Strong quantitative skills are essential for analyzing market data and developing trading strategies, making a background in mathematics or statistics highly relevant for a Trading Analyst role.

- MBA with a concentration in Finance: An MBA with a focus on finance will provide you with a broader understanding of business and finance principles, as well as leadership skills that are valuable in a trading environment.

Skills to Highlight in Your Trading Analyst CV

As a Trading Analyst, it is crucial to possess a diverse set of skills to excel in the fast-paced world of financial markets. Employers are looking for individuals who not only have a strong understanding of market trends and data analysis but also possess excellent communication and problem-solving abilities. Highlighting a mix of soft and hard skills on your CV can help you stand out from the competition. Here are 10 soft skills and 10 hard skills that are essential for a Trading Analyst role:

Soft Skills:

- Analytical thinking

- Critical thinking

- Attention to detail

- Adaptability

- Time management

- Decision-making

- Communication skills

- Teamwork

- Stress management

- Problem-solving

Hard Skills:

- Proficiency in financial modeling

- Data analysis

- Risk management

- Market research

- Statistical analysis

- Programming skills (e.g., Python, R)

- Knowledge of trading platforms

- Understanding of economic indicators

- Technical analysis

- Portfolio management

Trading Analyst CV Format

As a Trading Analyst, it is important to showcase your analytical skills and experience in the financial markets on your CV. The best format for different job levels may vary, but generally, it is recommended to include a professional summary, relevant skills and qualifications, work experience, education, and any certifications or awards. Here are 5-6 bullet points to consider when formatting your CV:

- Start with a strong professional summary that highlights your expertise in trading analysis.

- Include specific examples of your experience in market research, trend analysis, and risk management.

- Use bullet points to list your key skills, such as proficiency in financial software, data analysis, and decision-making.

- Highlight any relevant certifications or licenses, such as CFA or Series 7.

- Showcase your educational background, including any degrees in finance, economics, or related fields.

- Be sure to include any relevant work experience, internships, or projects that demonstrate your ability to excel in a trading analyst role.

For more tips on formatting your CV, check out this cv format article.

Common Mistakes to Avoid in a Trading Analyst CV

As a Trading Analyst, your CV is your first opportunity to make a strong impression on potential employers. Avoiding common mistakes can help you stand out and increase your chances of landing the job. Here are some common mistakes to avoid in a Trading Analyst CV:

- Not tailoring your CV to the specific job you are applying for

- Overloading your CV with irrelevant information

- Failing to highlight key skills and achievements

- Using generic language and buzzwords

- Not proofreading for spelling and grammar errors

- Listing tasks instead of accomplishments

- Including outdated or irrelevant experience

- Not including specific examples of your analytical and decision-making skills

- Failing to include relevant certifications or licenses

- Neglecting to include contact information or a professional summary.

Key Takeaways for a Trading Analyst CV

- Highlight quantitative skills and experience in financial analysis

- Showcase proficiency in trading platforms and tools

- Emphasize track record of successful trades and investment strategies

- Include certifications or licenses relevant to trading (e.g. Series 7, CFA)

- Demonstrate ability to analyze market trends and make informed decisions

- Mention experience with risk management and compliance procedures

- Utilize action verbs and quantifiable achievements in bullet points

- Customize CV for specific trading roles and companies

- Use clear and concise language, avoiding jargon or unnecessary details

- Consider utilizing a professional CV template from CV Templates to stand out

- Utilize CV Builder to create a visually appealing and easy-to-read CV

- Include a well-written cover letter tailored to each job application, using Cover Letter Templates for guidance

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.