As an Auto Claims Adjuster, you play a pivotal role in the insurance industry, serving as the bridge between policyholders and insurance companies. Your ability to assess damages, investigate claims, and negotiate settlements directly impacts customer satisfaction and the financial stability of your organization. Given the competitive nature of this field, having a well-crafted resume is not just beneficial; it’s essential. A standout resume not only showcases your skills and experience but also highlights your understanding of the industry, setting you apart from other candidates. This guide will provide you with the tools you need to create a compelling resume that effectively communicates your value as an Auto Claims Adjuster.

In this comprehensive resume writing guide, we will delve into the key responsibilities and skills that define the role of an Auto Claims Adjuster, ensuring you know what to highlight in your application. We will discuss the best resume formats to adopt, common pitfalls to avoid that could undermine your chances, and provide resume examples tailored for all experience levels from entry-level to seasoned professionals. Additionally, you’ll find valuable tips on crafting a standout resume, as well as guidance on selecting the right resume templates that align with your personal brand. With this roadmap at your disposal, you’ll be well-equipped to create a resume that not only captures attention but also secures interviews in this dynamic field.

Key Responsibilities and Skills for a Auto Claims Adjuster

As an Auto Claims Adjuster, you play a crucial role in the insurance industry by evaluating and processing auto insurance claims. You are responsible for investigating claims, assessing damages, and determining the appropriate payouts based on policy coverage. Your work involves direct interaction with policyholders, repair shops, and other parties to gather relevant information and resolve claims efficiently.

Key Responsibilities:

- Investigate and assess auto accidents to determine liability and damages.

- Review insurance policies and coverage to ensure compliance and accuracy.

- Communicate with claimants, witnesses, and repair facilities to gather necessary information.

- Prepare detailed reports outlining findings and recommendations for claim settlements.

- Negotiate settlements with claimants and other involved parties.

- Ensure timely processing of claims in accordance with company policies and state regulations.

- Maintain accurate records and documentation throughout the claims process.

Essential Skills:

- Strong analytical skills to assess damages and evaluate claims.

- Excellent communication skills for interacting with clients and stakeholders.

- Negotiation abilities to settle claims effectively and fairly.

- Attention to detail in reviewing policies and documentation.

- Proficiency in using claims management software and tools.

- Strong organizational skills to manage multiple claims simultaneously.

- Knowledge of automotive repair processes and insurance regulations.

Highlighting these skills effectively in the resume skills section is critical for standing out to potential employers. Tailoring your responsibilities and skills to match the specific job description can significantly enhance your chances of landing an interview. Additionally, consider how these skills could be relevant in creating a strong CV, showcasing your qualifications and experiences that align with the role of an Auto Claims Adjuster. By doing so, you demonstrate your suitability for the position and your understanding of the industry's demands.

Best Resume Format and Structure for a Auto Claims Adjuster

When creating a resume for an Auto Claims Adjuster position, it's essential to choose a format that highlights your qualifications, experience, and skills effectively. Here’s a detailed guide on the best resume format and structure for this role.

Contact Information

Begin your resume with your contact information at the top. This section should include:

- Full Name

- Phone Number

- Email Address

- LinkedIn Profile (if applicable)

- Location (City, State)

Professional Summary

A concise professional summary should follow your contact information. This section offers a snapshot of your qualifications and career highlights. Aim for 2-4 sentences that summarize your experience in claims adjusting, your key skills, and what you bring to the role. Tailor this summary to the job description to ensure relevancy.

Work Experience

The work experience section is crucial for demonstrating your hands-on expertise. Use a reverse chronological format, starting with your most recent job. For each position, include:

- Job Title

- Company Name

- Location (City, State)

- Dates Employed (Month/Year - Month/Year)

Under each job entry, use bullet points to describe your responsibilities and achievements. Focus on quantifiable results and specific tasks relevant to claims adjusting, such as:

- Evaluating and processing insurance claims efficiently.

- Conducting thorough investigations to determine the validity of claims.

- Communicating with policyholders and providing excellent customer service.

- Negotiating settlements and managing adverse claims.

Education

List your educational background in this section. Include:

- Degree(s) obtained (e.g., Bachelor’s in Business Administration)

- Institution Name

- Location (City, State)

- Graduation Date (Month/Year)

If you have completed any relevant coursework or training in insurance or claims management, consider including that information as well.

Skills

Highlight your relevant skills in a dedicated section. Use bullet points for clarity. Focus on both hard and soft skills, such as:

- Strong analytical and investigative abilities

- Proficiency in claims management software

- Excellent communication and negotiation skills

- Knowledge of insurance policies and regulations

- Attention to detail and strong organizational skills

Certifications

If you hold any relevant certifications, such as the Associate in Claims (AIC) or other industry-recognized credentials, include them in this section. List the certification name, granting organization, and the date obtained.

Tips for a Strong Resume

- Use a Clean Layout: Opt for a professional-looking format with clear headings and ample white space. A chronological or combination resume format is often preferred for claims adjusters.

- Tailor Your Content: Customize your resume for each job application by using keywords from the job description.

- Keep It Concise: Aim for a resume length of one page, particularly if you have less than 10 years of experience.

- Proofread Thoroughly: Ensure there are no spelling or grammatical errors, as attention to detail is crucial in this role.

Complementing Cover Letter Format

Your resume should be complemented by a well-structured cover letter. Use a similar format for consistency, including your contact information, the date, the employer's details, and a greeting. Maintain a professional tone and reiterate your qualifications while expressing your interest in the Auto Claims Adjuster position. The cover letter is an opportunity to elaborate on key accomplishments from your resume and explain how they relate to the job.

By following these guidelines, you can create a compelling resume that effectively showcases your qualifications as an Auto Claims Adjuster and sets you apart in the competitive job market.

Writing Tips and Best Practices for a Auto Claims Adjuster Resume

When crafting a resume for an Auto Claims Adjuster position, it’s essential to present your qualifications and experience in a clear and compelling manner. Focus on highlighting relevant skills and accomplishments that demonstrate your expertise in claims processing, customer service, and problem resolution. Make sure to tailor your resume to the specific job description, emphasizing the most pertinent experiences. Utilizing resume writing tips can help ensure your document has a polished and professional appearance, which is crucial in making a strong first impression. Remember that these best practices are also valuable when drafting your cover letter, as consistency in presentation will reinforce your professionalism.

- Use action verbs such as "analyzed," "investigated," and "negotiated" to convey your contributions effectively.

- Quantify your achievements where possible, such as "processed over 200 claims monthly" or "reduced claim resolution time by 30%."

- Incorporate industry-specific keywords like "liability assessment," "coverage analysis," and "third-party negotiations" to align with the job description.

- Highlight your proficiency with claims management software and tools relevant to the industry.

- Emphasize your communication skills by mentioning experiences where you successfully resolved customer disputes or collaborated with other departments.

- Keep your resume concise, ideally one page, while ensuring that all relevant information is included.

- Use bullet points for easy readability and to allow hiring managers to quickly identify key qualifications.

- Proofread your resume for grammatical errors and typos to maintain a professional tone throughout.

Common Mistakes to Avoid in a Auto Claims Adjuster Resume

When crafting a resume for the position of an Auto Claims Adjuster, candidates often overlook key elements that can make or break their chances of landing an interview. A well-structured resume is crucial in presenting your qualifications and experience effectively. However, many applicants fall into common traps that can detract from their overall appeal. To help you create a standout resume, here are some common mistakes to avoid:

- Overloading the resume with excessive information, making it difficult for recruiters to identify key qualifications.

- Using generic descriptions that fail to highlight specific skills relevant to the auto claims industry.

- Failing to tailor the resume to the job description, resulting in a lack of alignment with the employer's needs.

- Neglecting to quantify achievements, which can diminish the impact of your professional experience.

- Using an unprofessional email address that can give a negative impression to potential employers.

- Ignoring the importance of formatting, leading to a cluttered and hard-to-read document.

- Listing duties rather than accomplishments, which does not effectively demonstrate your value.

- Spelling or grammatical errors that can undermine your credibility and attention to detail.

- Failing to include keywords from the job listing, which can hinder your chances of passing through applicant tracking systems (ATS).

- Not including relevant certifications or licenses that are critical in the auto claims field.

To ensure your resume is polished and professional, consider reviewing the common mistakes to avoid in a resume. Additionally, don't overlook the importance of your cover letter, as it is equally vital to make a strong impression; you can learn about common cover letter mistakes to sidestep those pitfalls as well.

Sample Auto Claims Adjuster Resumes

An Auto Claims Adjuster plays a critical role in the insurance industry by evaluating auto accident claims, determining liability, and ensuring fair settlements for all parties involved. This profession requires strong analytical skills, attention to detail, and excellent communication abilities. Below are three sample resumes tailored for different experience levels in the field of auto claims adjusting. Whether you are an experienced professional, an entry-level candidate, or someone changing careers, these examples can provide valuable insights into crafting your own resume. Don’t forget to check out more resume templates for additional inspiration, and consider reviewing corresponding cover letter examples to create a complete job application package.

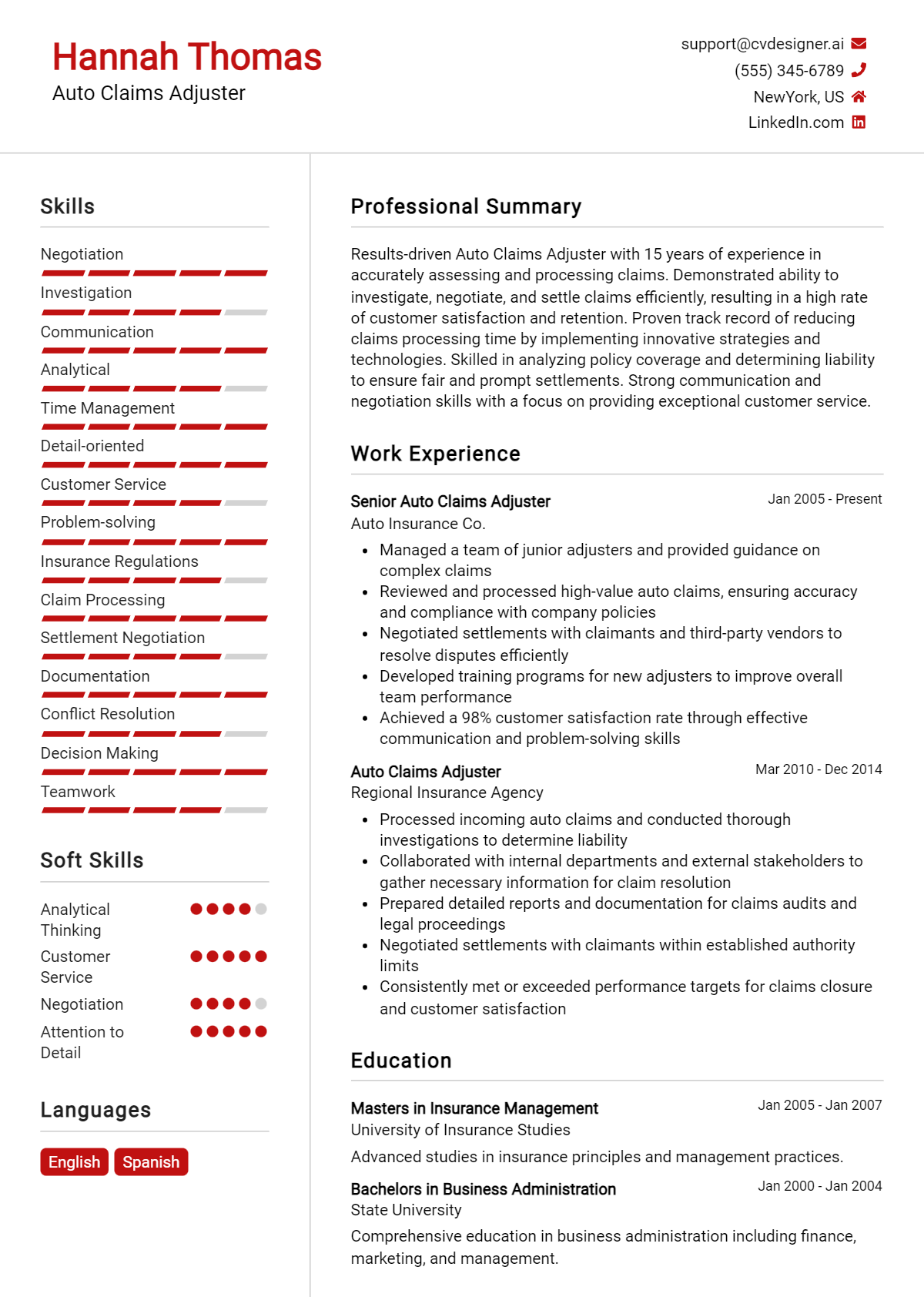

Experienced Auto Claims Adjuster Resume Sample

Jane Doe

123 Main St, Springfield, IL 62701

(555) 123-4567

jane.doe@email.com

Professional Summary

Detail-oriented Auto Claims Adjuster with over 10 years of experience in evaluating and settling complex automobile insurance claims. Proven track record of achieving favorable outcomes for clients while adhering to company policies and industry regulations. Excellent negotiation and analytical skills, with a strong ability to communicate effectively with all stakeholders.

Professional Experience

Senior Auto Claims Adjuster

ABC Insurance Company, Springfield, IL

January 2015 – Present

- Evaluated over 500 auto claims annually, ensuring thorough investigations and timely settlements.

- Collaborated with law enforcement, repair shops, and medical professionals to gather necessary information on claims.

- Trained new employees on best practices in claims adjusting and customer service.

- Achieved a 95% customer satisfaction rating through effective communication and resolution strategies.

Auto Claims Adjuster

XYZ Insurance Group, Springfield, IL

June 2010 – December 2014

- Managed a caseload of 300 auto claims, performing detailed assessments to determine liability and damages.

- Utilized claims management software to track and document all interactions and claim progress.

- Negotiated settlements with claimants to resolve disputes amicably while minimizing company liability.

Education

Bachelor of Science in Business Administration

University of Illinois, Urbana-Champaign, IL

Graduated May 2010

Certifications

- Certified Claims Adjuster (CCA)

- Auto Insurance Claims Management Certification

Entry-Level Auto Claims Adjuster Resume Sample

John Smith

456 Oak St, Chicago, IL 60601

(555) 987-6543

john.smith@email.com

Professional Summary

Motivated and detail-oriented recent graduate with a Bachelor’s degree in Finance seeking to start a career as an Auto Claims Adjuster. Strong analytical skills and a customer-focused approach, eager to learn the ins and outs of the claims process while providing exceptional service to clients.

Education

Bachelor of Science in Finance

DePaul University, Chicago, IL

Graduated May 2023

Relevant Experience

Intern

Insurance Solutions, Chicago, IL

January 2023 – May 2023

- Assisted senior claims adjusters in evaluating auto claims and gathering necessary documentation.

- Conducted initial interviews with claimants to collect information and assess damages.

- Gained hands-on experience with claims management software and customer service protocols.

Customer Service Representative

Tech Retail Inc., Chicago, IL

June 2021 – December 2022

- Provided exceptional service to customers, addressing inquiries and resolving issues in a timely manner.

- Developed strong communication and problem-solving skills while working in a fast-paced environment.

Career Changer Auto Claims Adjuster Resume Sample

Emily Johnson

789 Pine St, Atlanta, GA 30301

(555) 345-6789

emily.johnson@email.com

Professional Summary

Results-driven professional with over 8 years of experience in project management and customer relations, seeking to transition into an Auto Claims Adjuster role. Adept at analyzing data, managing projects, and fostering strong relationships with clients. Eager to leverage transferable skills to contribute to a dynamic claims team.

Professional Experience

Project Manager

Innovatech Solutions, Atlanta, GA

February 2015 – Present

- Managed multiple projects simultaneously, ensuring completion within budget and deadlines while maintaining high client satisfaction levels.

- Analyzed project data to identify trends and improve processes, resulting in a 20% increase in efficiency.

- Developed training materials and conducted workshops on project management best practices.

Customer Relations Specialist

CustomerFirst Corp, Atlanta, GA

July 2012 – January 2015

- Handled client inquiries and complaints, providing tailored solutions to enhance customer experience.

- Collaborated with cross-functional teams to resolve issues and improve service delivery.

- Recognized for outstanding service with the Employee of the Month award twice.

Education

Bachelor of Arts in Communication

Georgia State University, Atlanta, GA

Graduated May 2012

Skills

- Strong analytical and problem-solving abilities

- Excellent communication and negotiation skills

- Proficient in Microsoft Office Suite and claims management software

By reviewing these sample resumes, you can gain insights into how to highlight your unique skills and experiences as an Auto Claims Adjuster. Remember to tailor your resume to the specific job you're applying for and showcase your strengths effectively.

Checklist for a Auto Claims Adjuster Resume

- Proofread for Errors: Carefully read through your resume multiple times to catch any spelling, grammar, or punctuation mistakes. Consider using tools like spell check to assist.

- Check for Consistency: Ensure that your formatting is consistent throughout the document, including font sizes, styles, and bullet point alignment. Uniformity enhances readability.

- Tailor to the Job Description: Modify your resume to align closely with the specific requirements and keywords mentioned in the auto claims adjuster job listing. Highlight relevant experience and skills.

- Highlight Relevant Experience: Ensure that your most pertinent work experience and achievements are prominently featured. Use metrics and specific outcomes to showcase your impact in previous roles.

- Use Action Verbs: Start your bullet points with strong action verbs to convey your contributions effectively. Examples include "assessed," "negotiated," and "resolved."

- Include Relevant Certifications: If applicable, list any relevant certifications or licenses related to auto claims adjusting, such as the AIC or other industry-specific credentials.

- Contact Information: Double-check that your contact information is accurate and up-to-date. Include a professional email address and a phone number where you can be easily reached.

- Limit Length: Aim to keep your resume to one page, especially if you have less than 10 years of experience. Be concise and focus on the most relevant information.

- Professional Layout: Use a clean, professional layout that is easy to read. Consider utilizing an AI resume builder to help ensure that all elements are well-organized and visually appealing.

- Cross-Apply for Other Documents: Remember that a similar checklist can be followed for creating a CV or cover letter. Consistency across these documents is crucial for a cohesive professional presentation.

Key Takeaways for a Auto Claims Adjuster Resume Guide

In conclusion, creating a standout resume as an Auto Claims Adjuster is crucial for securing your desired position in the industry. By utilizing the examples and tips provided, you can effectively highlight your skills, experience, and achievements that align with the demands of this role. To take the next step in your job application journey, consider downloading a professional resume template from resume templates or crafting a compelling cover letter using our cover letter templates. For a more tailored approach, our best resume maker can help you design a resume that stands out. Remember, following similar guidelines will also assist you in crafting an impressive CV and a persuasive cover letter. Start building your future today!