Most Popular Business Banking Relationship Manager Resume Examples

Explore additional Business Banking Relationship Manager resume samples and guides and see what works for your level of experience or role.

As a Business Banking Relationship Manager, you play a pivotal role in fostering and maintaining strong connections between financial institutions and their business clients. Your expertise in understanding the unique needs of businesses and providing tailored financial solutions can significantly impact both client satisfaction and the bank's bottom line. However, to land a role in this competitive field, a well-crafted resume is essential. It serves as your personal marketing tool, showcasing your skills, experience, and accomplishments in a way that resonates with potential employers. In this article, we will guide you through the process of creating an outstanding resume that highlights your capabilities as a Business Banking Relationship Manager.

We will cover key responsibilities and skills that are crucial for success in this role, ensuring you know what to emphasize in your resume. You'll learn about the best formats to use, how to avoid common pitfalls, and we’ll provide resume examples suitable for all levels of experience. Additionally, we will share valuable tips on effective resume writing and guide you in selecting the right resume templates that can make your application stand out. Whether you are just starting your career or looking to advance to a higher position, this comprehensive guide will equip you with the tools you need to craft a resume that opens doors to new opportunities in business banking.

Key Responsibilities and Skills for a Business Banking Relationship Manager

A Business Banking Relationship Manager plays a crucial role in fostering and managing relationships with business clients. Their primary responsibilities revolve around providing financial solutions tailored to the needs of small and medium enterprises, ensuring client satisfaction, and driving the bank's growth.

Key responsibilities include:

- Client Acquisition and Retention: Identifying and onboarding new business clients while nurturing existing relationships to enhance client loyalty.

- Financial Analysis: Assessing the financial health of clients to recommend appropriate banking products such as loans, credit facilities, and cash management services.

- Customized Solutions: Developing and presenting personalized banking solutions that align with clients' business goals.

- Market Research: Keeping abreast of industry trends and competitors to provide clients with informed advice and services.

- Cross-Selling Products: Promoting various banking services and products that could benefit the client’s business operations.

- Risk Management: Evaluating the creditworthiness of potential clients and managing the risks associated with lending.

- Collaboration: Working closely with internal teams, including credit analysts and product specialists, to ensure a seamless client experience.

Essential skills required for a Business Banking Relationship Manager include:

- Strong interpersonal and communication skills

- Excellent analytical and problem-solving abilities

- In-depth knowledge of banking products and services

- Relationship management expertise

- Proficiency in financial analysis and forecasting

- Negotiation and sales skills

- Time management and organizational skills

- Ability to work under pressure and meet deadlines

Highlighting these skills effectively in the resume skills section is vital, as it allows potential employers to quickly assess your suitability for the role. Tailoring these responsibilities and skills to match the specific job description can significantly enhance your chances of standing out in a competitive job market. Additionally, consider how these skills can be demonstrated in your CV to create a strong narrative that showcases your qualifications and experiences relevant to the Business Banking Relationship Manager role.

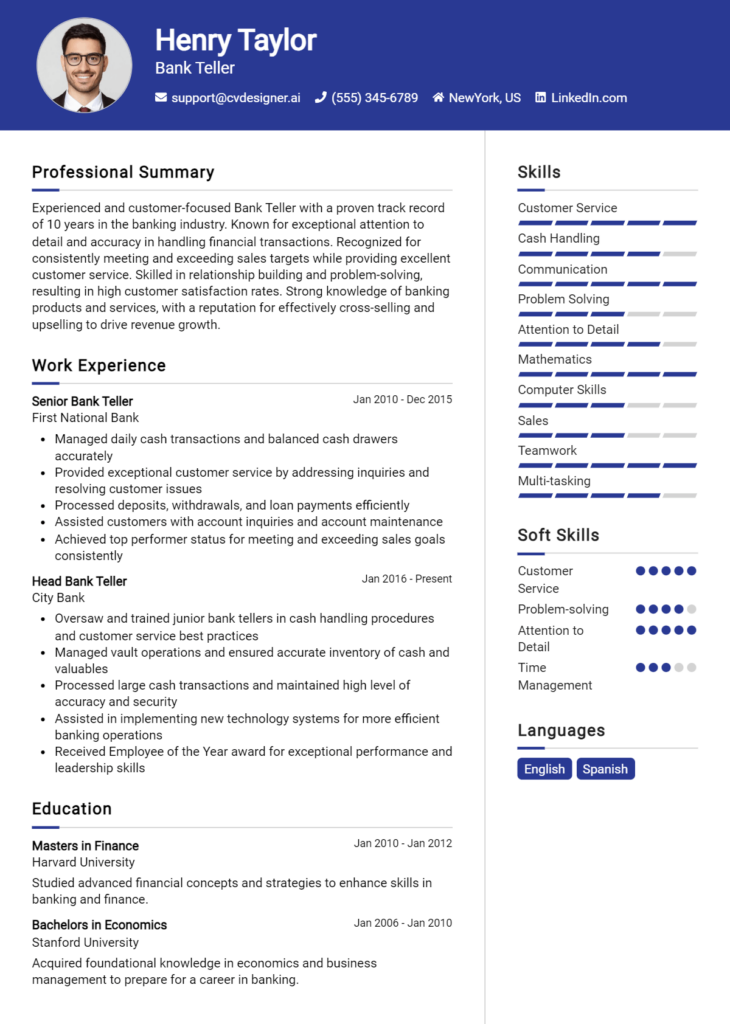

Best Resume Format and Structure for a Business Banking Relationship Manager

When crafting a resume for the role of a Business Banking Relationship Manager, it is crucial to select a format that highlights your skills, experience, and achievements effectively. The following guide outlines the best resume format and essential sections to include:

Contact Information

Begin your resume with your contact information at the top. This section should be clear and easy to read. Include:

- Full Name

- Phone Number

- Email Address

- LinkedIn Profile (optional)

- Location (City, State)

Professional Summary

The professional summary is a brief, impactful statement that showcases your expertise and what you bring to the table. Aim for 3-4 sentences that highlight:

- Your years of experience in business banking

- Key skills, such as relationship management, financial analysis, and client acquisition

- Notable achievements, such as exceeding sales targets or winning awards This section should be tailored to the specific role you are applying for, using keywords from the job description.

Work Experience

This section is critical as it details your relevant work history. Use a reverse chronological format, listing your most recent position first. For each role, include:

- Job Title

- Company Name

- Location (City, State)

- Dates of Employment (Month Year - Month Year)

Under each job title, use bullet points to describe your responsibilities and accomplishments. Focus on quantifiable achievements, such as:

- "Managed a portfolio of over 100 business clients, increasing customer retention by 15% in one year."

- "Generated $2 million in new business through strategic networking and relationship building."

Education

List your educational qualifications in reverse chronological order. Include:

- Degree(s) Earned

- Major/Field of Study

- University/College Name

- Graduation Date (Month Year)

If you have relevant certifications, you can also include them in this section or create a separate Certifications section.

Skills

Highlight key skills that are relevant to the Business Banking Relationship Manager role. Use a mix of hard and soft skills, such as:

- Financial Analysis

- Relationship Management

- Negotiation

- Risk Assessment

- Communication

- Customer Service

Consider using a bullet point or a grid format for easy readability.

Certifications

If you hold any relevant certifications, such as Certified Financial Planner (CFP) or Certified Commercial Loan Officer (CCLO), list them in this section. Include:

- Certification Name

- Issuing Organization

- Date Obtained (Month Year)

Tips for Each Section

- Use clear, concise language and action verbs to convey your achievements.

- Tailor your resume for each position by incorporating keywords from the job description.

- Keep the formatting consistent, using the same font type and size throughout.

- Limit your resume to 1-2 pages, focusing on the most relevant information.

Complementing Cover Letter Format

The format of your resume can complement your cover letter by maintaining a consistent visual style. Ensure that both documents share the same font, color scheme, and layout. Your cover letter should echo the key points from your resume, elaborating on your professional summary and providing context to your achievements. This cohesive branding will help present you as a strong candidate for the Business Banking Relationship Manager role.

Writing Tips and Best Practices for a Business Banking Relationship Manager Resume

Crafting an effective resume as a Business Banking Relationship Manager requires a strategic approach that highlights your skills, experiences, and accomplishments in a way that resonates with prospective employers. Start by ensuring your resume is clear and professionally formatted, as a polished appearance can make a strong first impression. Tailor your resume for each application by incorporating industry-specific keywords that reflect the job description and your expertise. Remember to use action verbs to convey your contributions succinctly, and quantify your achievements to demonstrate the impact of your efforts. For example, instead of stating "managed client accounts," you could say "successfully managed a portfolio of 50+ client accounts, leading to a 20% increase in overall client satisfaction." Utilizing these resume writing tips can significantly enhance the effectiveness of your resume. Additionally, consider how these practices can be employed when drafting a cover letter to create a cohesive application package.

- Use action verbs such as "developed," "cultivated," and "analyzed" to convey your role more dynamically.

- Quantify your achievements by including metrics like percentage growth, revenue generated, or number of new clients acquired.

- Incorporate industry-specific keywords and phrases that match the job description to pass through applicant tracking systems (ATS).

- Highlight relevant certifications and training that showcase your qualifications in business banking.

- Organize your experience in reverse chronological order, emphasizing your most relevant positions.

- Tailor your summary statement to align with the specific needs and values of the institution you’re applying to.

- Keep formatting consistent with clear headings, bullet points, and a professional font for easier readability.

- Limit your resume to one or two pages, focusing on the most relevant and impactful information to maintain the reader’s attention.

Common Mistakes to Avoid in a Business Banking Relationship Manager Resume

When crafting a resume for a Business Banking Relationship Manager position, it’s crucial to present your qualifications and experiences in the most effective way possible. However, many candidates fall into common traps that can undermine their chances of landing an interview. To ensure your resume stands out positively, here are some frequent mistakes to avoid:

- Overloading with Information: Including too much detail can overwhelm the reader and obscure your key achievements.

- Using Generic Descriptions: Avoid vague language; instead, tailor your descriptions to highlight specific skills and accomplishments relevant to the role.

- Neglecting Quantifiable Achievements: Failing to include metrics or data that demonstrate your impact can make your experience seem less impressive.

- Ignoring the Job Description: Not aligning your resume with the specific requirements and responsibilities mentioned in the job listing can signal a lack of attention to detail.

- Poor Formatting: A cluttered or unprofessional layout can distract from your qualifications; clean, organized formatting enhances readability.

- Inconsistent Tense Usage: Mixing past and present tenses can confuse readers; use past tense for previous jobs and present tense for your current position.

- Omitting Relevant Skills: Not showcasing key banking or relationship management skills can leave your resume lacking; ensure you highlight skills that match the job.

- Failing to Proofread: Spelling and grammatical errors can create a negative impression; thorough proofreading is essential to present a polished document.

- Not Including Keywords: Missing industry-specific keywords can prevent your resume from passing through Applicant Tracking Systems (ATS).

- Using an Unprofessional Email Address: An unprofessional email can detract from your overall presentation; opt for a simple, professional address.

For more insights on avoiding these errors, consider reviewing the common mistakes to avoid in a resume. Additionally, don’t overlook the importance of your cover letter by familiarizing yourself with the common cover letter mistakes that should also be avoided to enhance your job application.

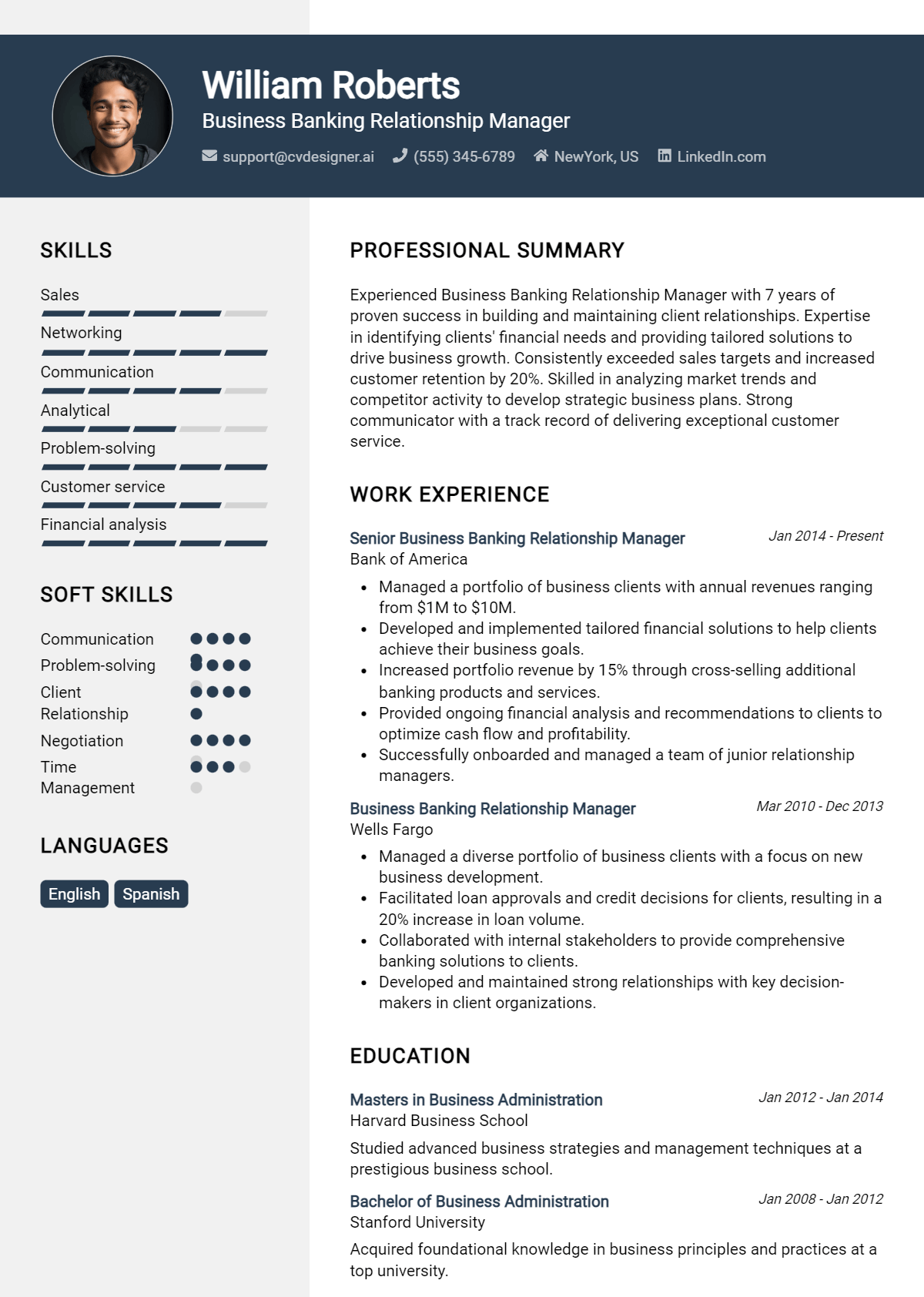

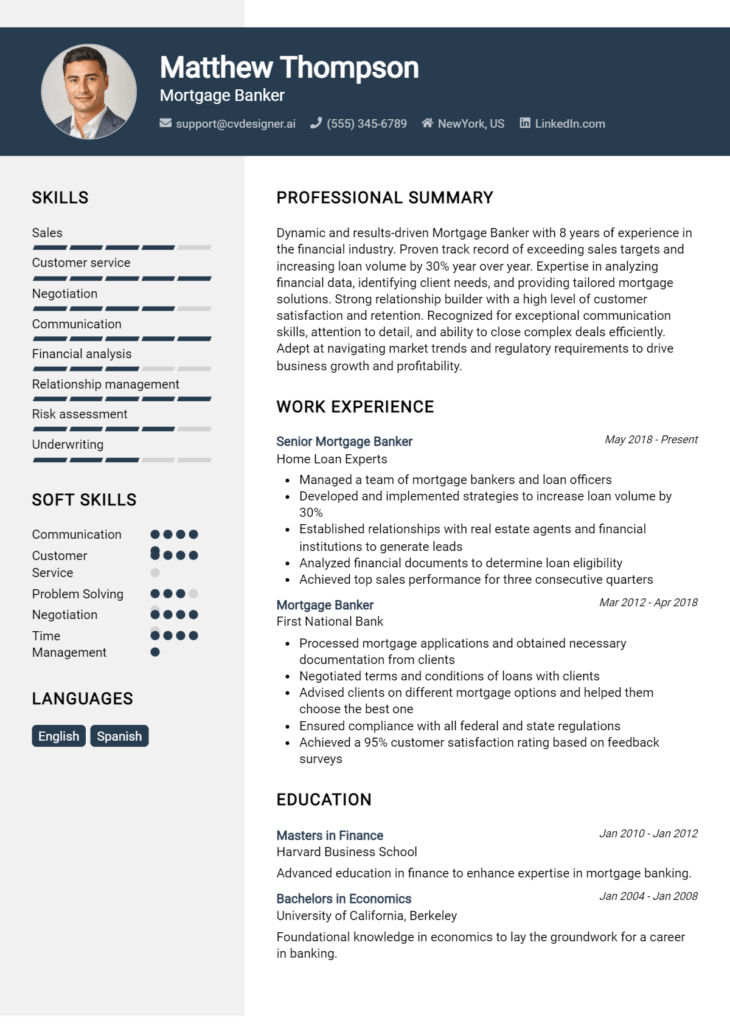

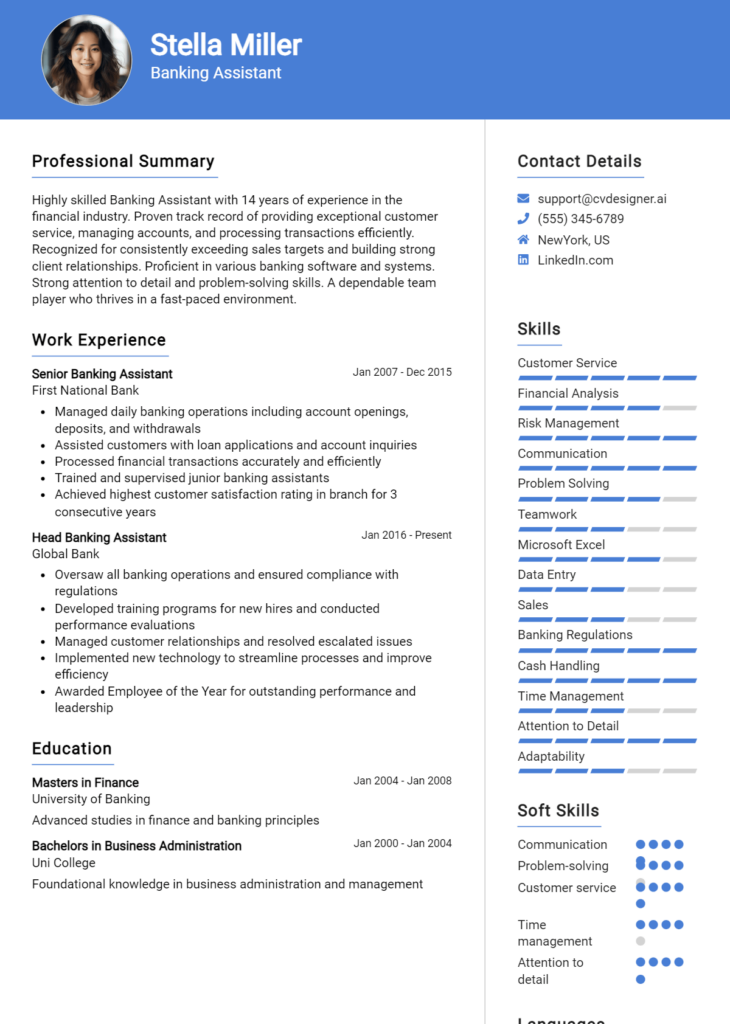

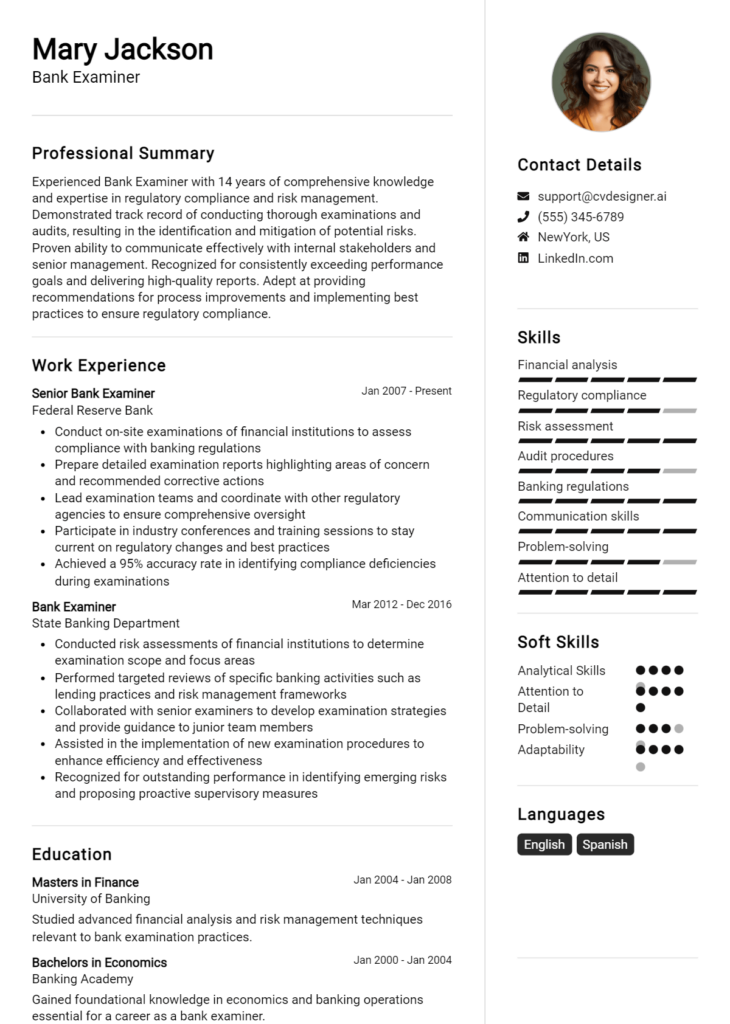

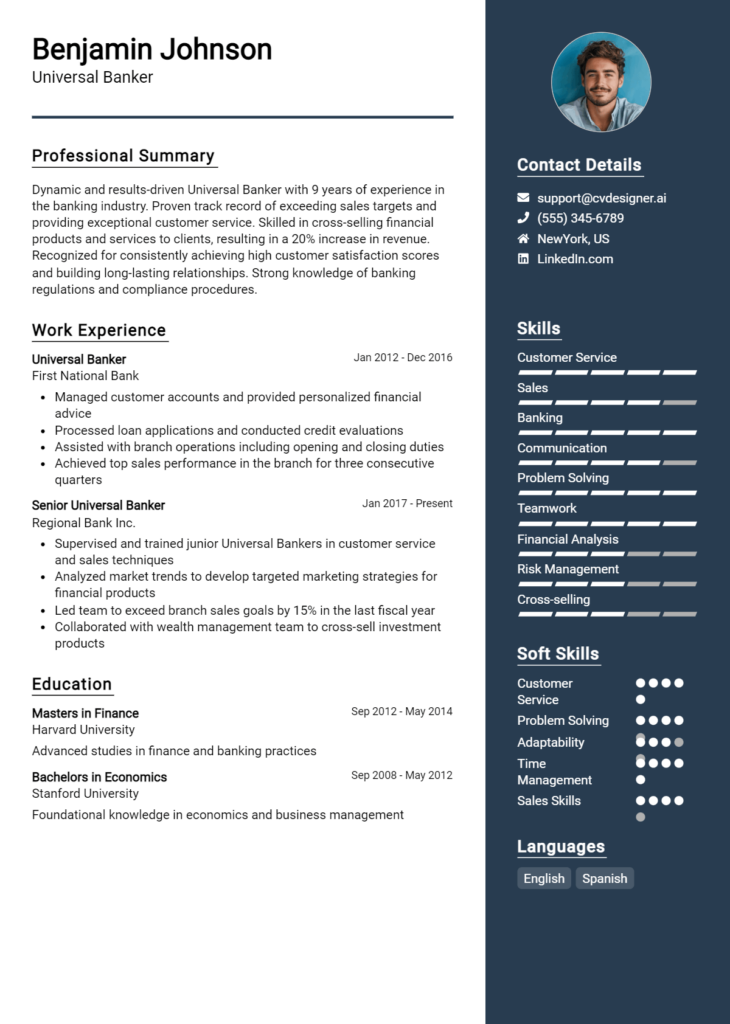

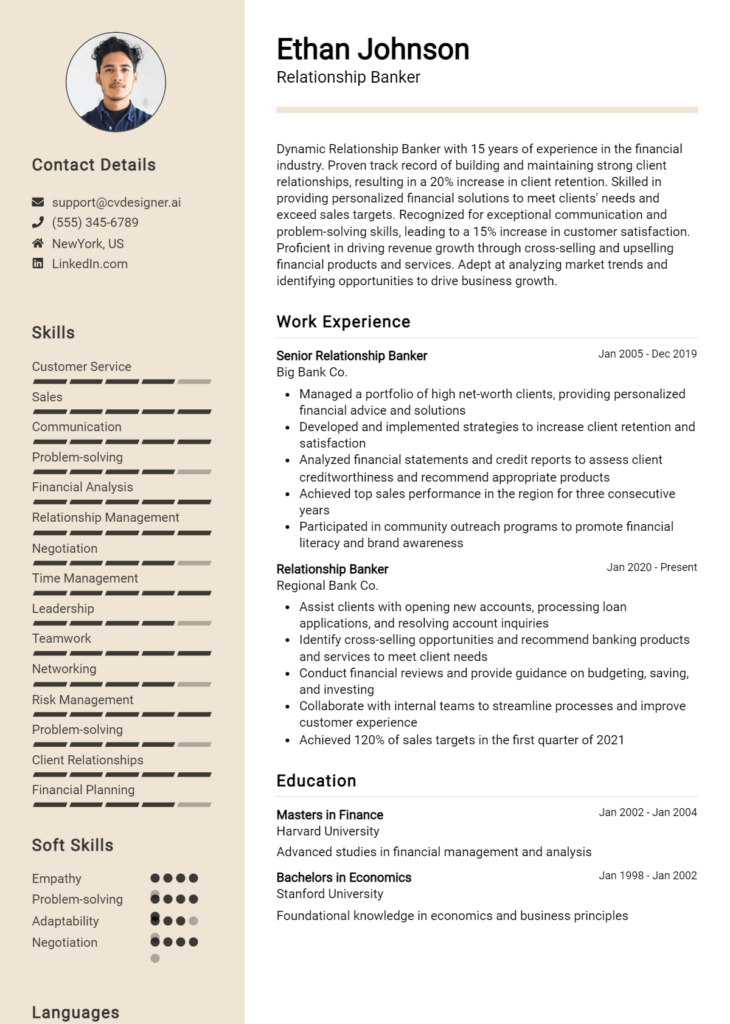

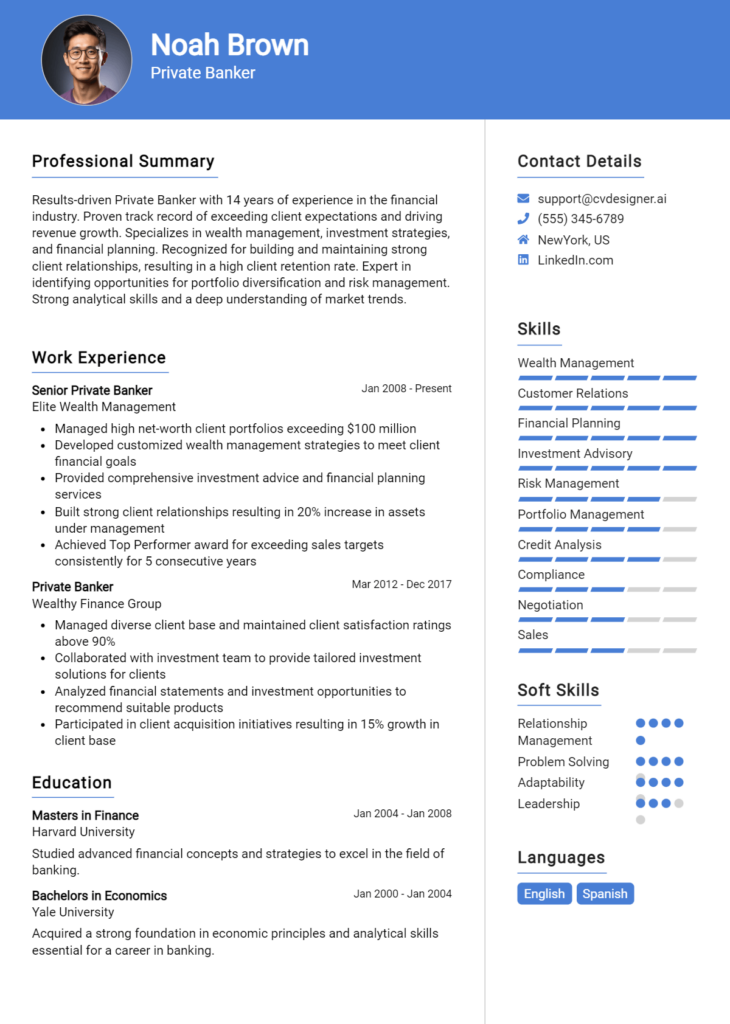

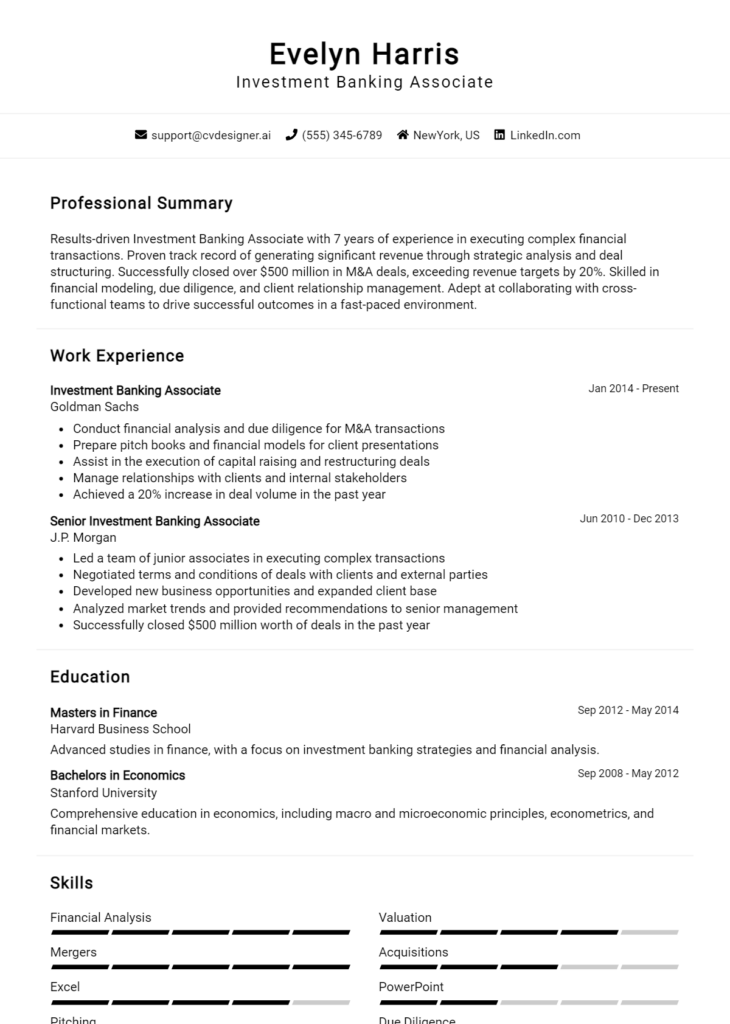

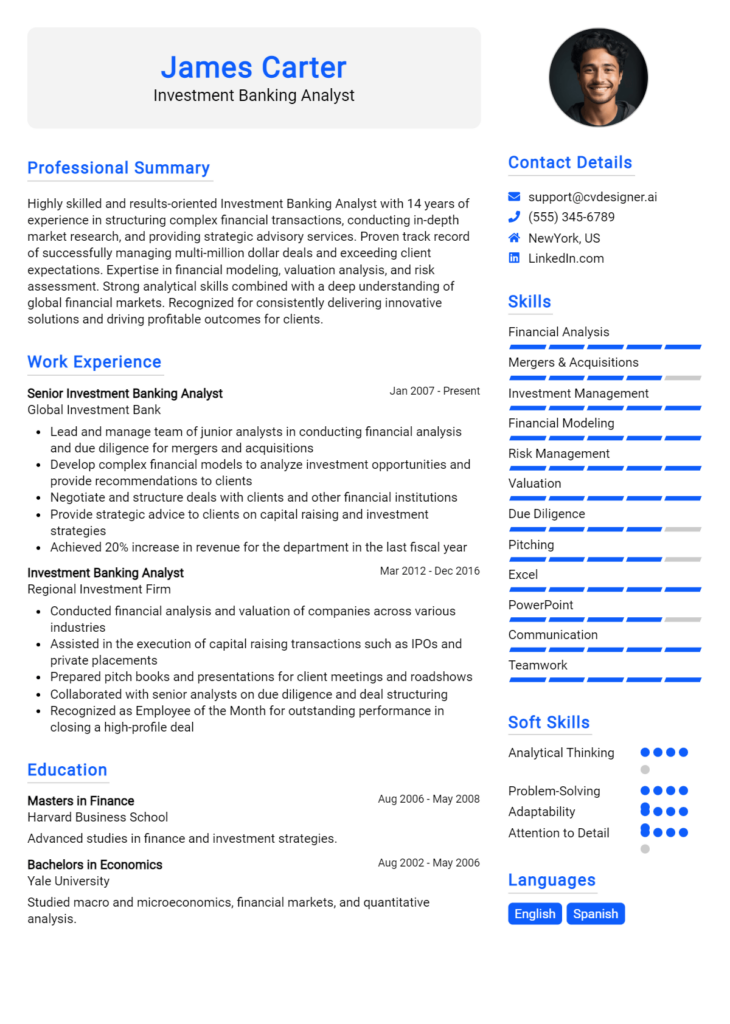

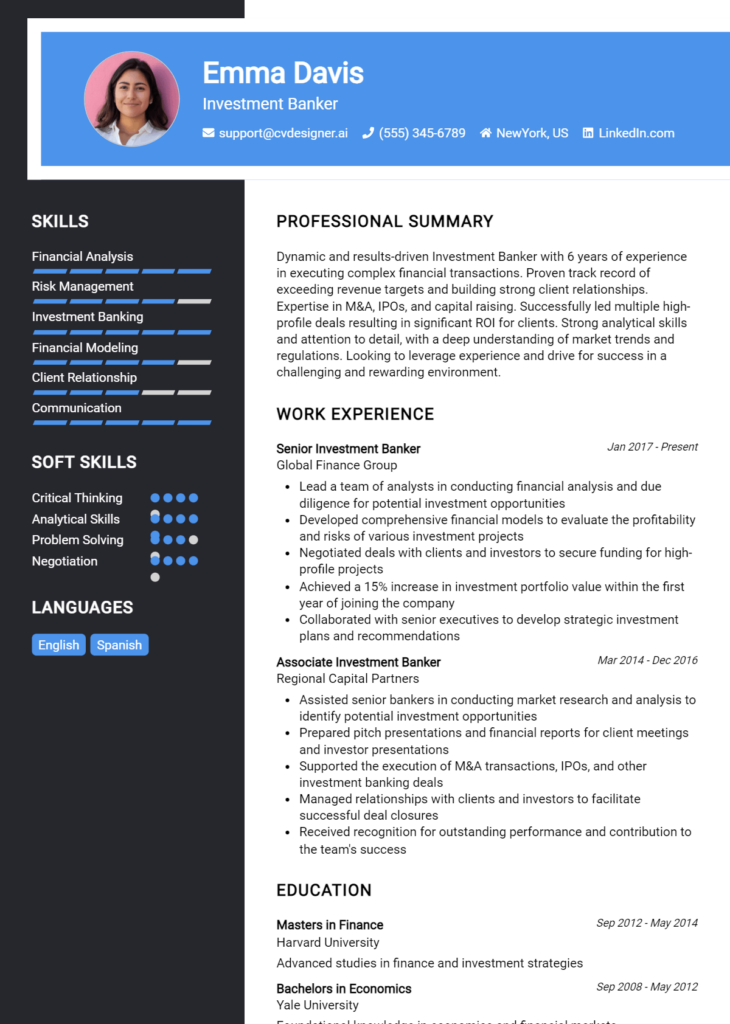

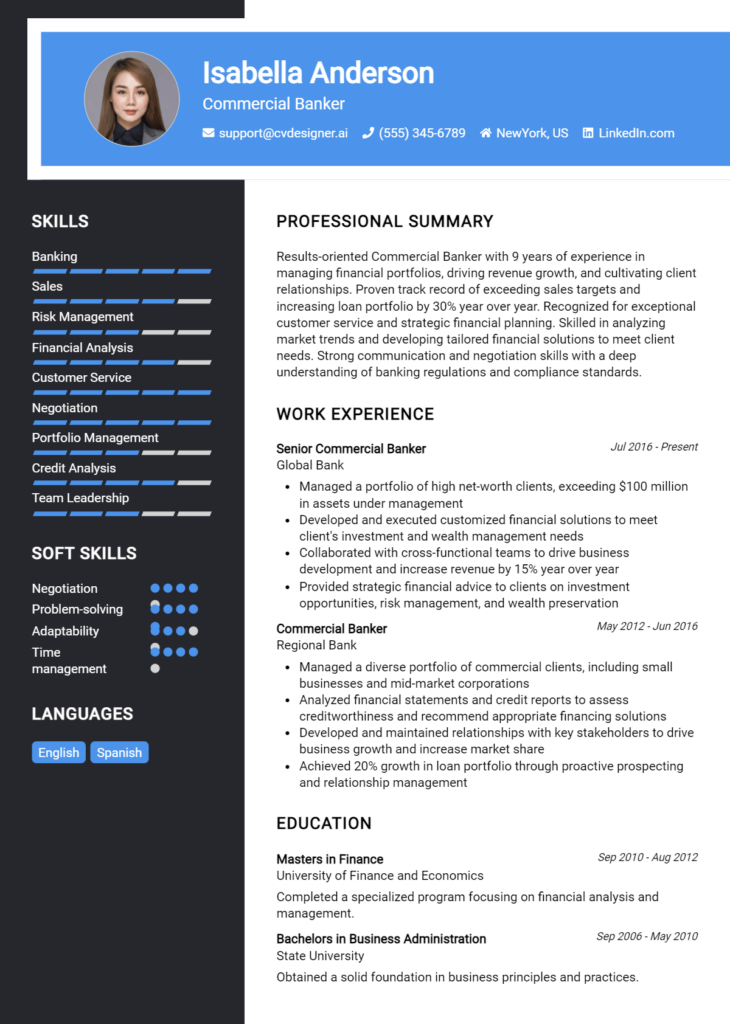

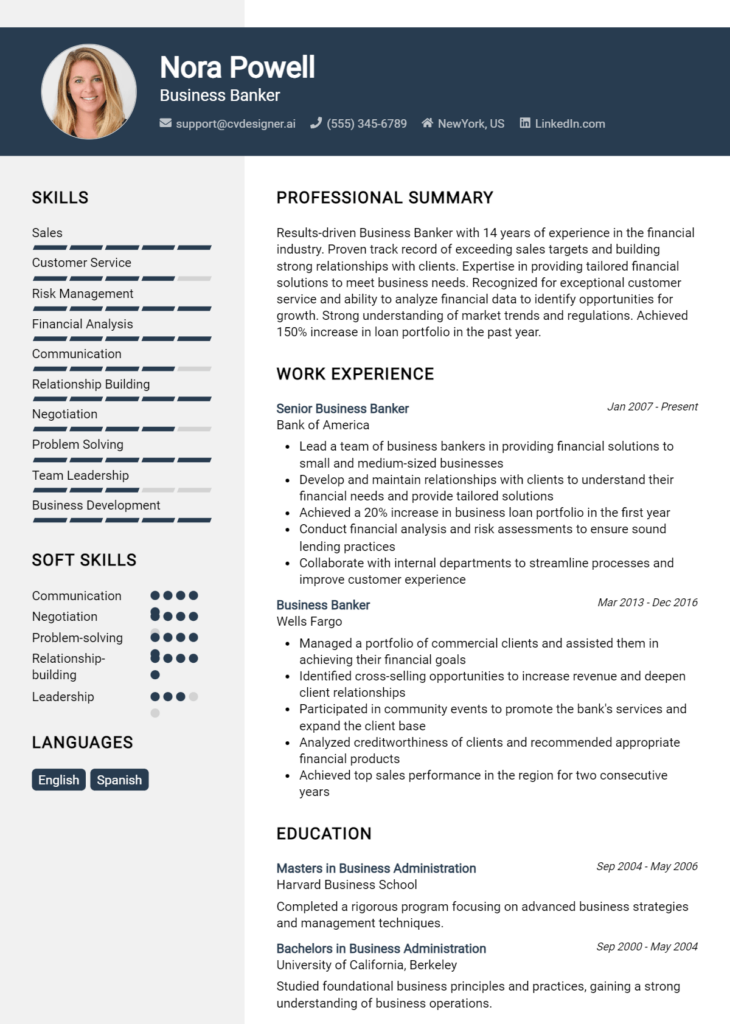

Sample Business Banking Relationship Manager Resumes

As a Business Banking Relationship Manager, your role is pivotal in fostering strong relationships with business clients and ensuring their banking needs are met with tailored financial solutions. Below are three sample resumes tailored to different experience levels and career paths, showcasing the skills and qualifications essential for success in this field. Feel free to explore more resume templates for inspiration, and remember that corresponding cover letter examples can help create a complete job application package.

Experienced Professional Resume

John Doe

123 Business Lane

City, State, Zip

(123) 456-7890

johndoe@email.com

Professional Summary

Dynamic and results-driven Business Banking Relationship Manager with over 10 years of experience in developing strong client relationships and delivering effective financial solutions. Proven track record of managing multi-million dollar portfolios, enhancing client satisfaction, and driving revenue growth. Strong analytical skills combined with excellent interpersonal communication.

Experience

Senior Business Banking Relationship Manager

ABC Bank, City, State

January 2015 - Present

- Managed a portfolio of over 100 business clients, resulting in a 30% increase in client retention rates.

- Developed customized financial solutions, including loans and investment strategies, leading to a 15% growth in portfolio profitability.

- Conducted financial analysis and risk assessments to provide tailored advice to clients.

- Trained and mentored a team of junior relationship managers, enhancing team performance and productivity.

Business Banking Relationship Manager

XYZ Financial Services, City, State

June 2010 - December 2014

- Cultivated relationships with small to medium-sized enterprises, achieving a 25% increase in new account openings.

- Collaborated with cross-functional teams to ensure seamless service delivery and compliance with banking regulations.

- Spearheaded community outreach initiatives that raised brand awareness and fostered goodwill among potential clients.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated May 2010

Skills

- Client Relationship Management

- Financial Analysis

- Loan Structuring

- Team Leadership

- Risk Management

- Excellent Communication Skills

Entry-Level Candidate Resume

Jane Smith

456 Start-Up Avenue

City, State, Zip

(987) 654-3210

janesmith@email.com

Professional Summary

Ambitious and motivated recent graduate with a degree in Finance and a passion for business banking. Eager to leverage analytical skills and a strong customer service background as a Business Banking Relationship Manager. Committed to building lasting client relationships and providing exceptional financial guidance.

Education

Bachelor of Science in Finance

University of City, City, State

Graduated May 2023

Internship Experience

Business Banking Intern

DEF Bank, City, State

June 2022 - August 2022

- Assisted relationship managers in onboarding new business clients, ensuring a smooth transition to banking services.

- Conducted market research and analysis to support financial product recommendations for clients.

- Developed promotional materials for client engagement initiatives, contributing to a 10% increase in client inquiries.

Skills

- Customer Service

- Financial Analysis

- Data Entry and Management

- Strong Analytical Skills

- Excellent Written and Verbal Communication

Career Changer Resume

Michael Johnson

789 Career Path Lane

City, State, Zip

(555) 123-4567

michaeljohnson@email.com

Professional Summary

Dedicated professional transitioning from a successful career in sales to Business Banking Relationship Management. Strong background in customer relations, problem-solving, and strategic planning. Eager to apply transferable skills to build fruitful relationships with business clients and help them achieve their financial goals.

Experience

Sales Manager

GHI Corporation, City, State

March 2018 - September 2023

- Led a sales team to exceed quarterly targets by an average of 20%, demonstrating strong leadership and motivational skills.

- Developed and maintained relationships with key clients, resulting in a 30% increase in repeat business.

- Analyzed market trends to identify new business opportunities and optimize sales strategies.

Customer Service Representative

JKL Services, City, State

June 2015 - February 2018

- Provided exceptional service to customers, resolving inquiries and complaints efficiently and effectively.

- Assisted in training new staff on customer engagement best practices, enhancing overall team performance.

Education

Bachelor of Arts in Business Administration

State University, City, State

Graduated May 2015

Skills

- Relationship Management

- Strategic Planning

- Sales Forecasting

- Negotiation Skills

- Problem Solving

- Excellent Communication Skills

These resumes illustrate a range of experiences and backgrounds suitable for the Business Banking Relationship Manager role. Tailoring your resume to highlight relevant skills and experiences can significantly enhance your chances of landing an interview.

Checklist for a Business Banking Relationship Manager Resume

- Proofread for Errors: Carefully read through your resume to catch any spelling or grammatical mistakes. Consider using tools like Grammarly for additional help.

- Check for Consistency: Ensure that formatting is uniform throughout your resume. This includes font style, size, bullet point style, and spacing.

- Tailor to the Job Description: Customize your resume to highlight skills and experiences that align with the specific requirements of the Business Banking Relationship Manager position you are applying for.

- Highlight Relevant Experience: Focus on your most relevant work experience, emphasizing achievements and responsibilities that pertain to business banking and relationship management.

- Use Action Verbs: Start each bullet point with strong action verbs to convey your contributions effectively (e.g., "developed," "managed," "analyzed").

- Quantify Achievements: Whenever possible, use numbers to demonstrate your impact (e.g., "Increased client portfolio by 30% within one year").

- Include Keywords: Incorporate industry-specific keywords from the job description to help your resume pass through Applicant Tracking Systems (ATS).

- Keep It Concise: Aim for a clear, concise format, ideally keeping your resume to one page unless you have extensive relevant experience.

- Professional Appearance: Ensure that your resume looks professional, using a clean layout and adequate white space for readability.

- Review Contact Information: Double-check that your name, phone number, email address, and LinkedIn profile (if applicable) are current and correctly formatted.

Consider using an AI resume builder to ensure all elements are well-organized and visually appealing. You can also follow a similar checklist for creating a CV or cover letter.

Key Takeaways for a Business Banking Relationship Manager Resume Guide

In conclusion, crafting a standout resume as a Business Banking Relationship Manager is essential for showcasing your skills and experiences effectively. By utilizing the examples and tips provided, you can tailor your resume to highlight your strengths and achievements in the banking sector. To take the next step in your job search, consider downloading a professional resume template from resume templates, or create a persuasive cover letter using our cover letter templates. Additionally, our best resume maker can help you design a polished resume that catches the eye of hiring managers. Remember, adhering to similar guidelines will also assist you in developing a compelling CV and a strong cover letter. Start building your professional portfolio today and increase your chances of landing that desired position!