As a Collection Supervisor, you play a critical role in ensuring the financial health of your organization by overseeing the collections team and implementing effective strategies to recover outstanding debts. This position not only demands strong leadership and communication skills but also requires a keen understanding of financial processes and customer relations. A well-crafted resume is essential to showcase your qualifications and experience, making it your ticket to landing an interview in this competitive field. In this guide, we will provide you with invaluable insights into writing a standout resume that reflects your expertise and aligns with the expectations of hiring managers.

Throughout this article, we will delve into the core responsibilities and essential skills that define a successful Collection Supervisor, helping you to highlight your strengths effectively. You will learn about the best resume formats to utilize, ensuring your application is both visually appealing and easy to read. We will also discuss common mistakes that candidates often make, offering you strategies to avoid pitfalls that could hinder your chances. To further assist you, we will provide resume examples tailored for various experience levels, from entry-level to seasoned professionals. Additionally, you will find expert tips on resume writing techniques and guidance on selecting the right resume templates that complement your personal style and career goals. With this comprehensive guide, you’ll be well-equipped to create a compelling resume that captures the attention of potential employers.

Key Responsibilities and Skills for a Collection Supervisor

A Collection Supervisor plays a crucial role in managing the collections department of an organization, ensuring that outstanding debts are collected efficiently while maintaining positive relationships with clients. The key responsibilities associated with this position typically include:

- Overseeing the daily operations of the collections team, ensuring targets and deadlines are met.

- Developing and implementing effective collection strategies and policies to improve recovery rates.

- Analyzing collection reports and metrics to identify trends and areas for improvement.

- Training, mentoring, and evaluating collection staff to enhance performance and productivity.

- Handling escalated collections issues and negotiating payment plans with clients.

- Collaborating with other departments, such as finance and customer service, to resolve disputes and improve overall processes.

- Ensuring compliance with relevant laws and regulations governing debt collection practices.

Essential skills required for a Collection Supervisor include:

- Strong leadership and team management abilities

- Excellent communication and negotiation skills

- Proficient in data analysis and reporting

- Knowledge of debt collection laws and regulations

- Conflict resolution and problem-solving skills

- Strong organizational and time management skills

- Ability to work under pressure and meet tight deadlines

Highlighting these skills effectively in the resume skills section is vital, as it allows potential employers to quickly see your qualifications for the role. Tailoring these responsibilities and skills to the specific job description is essential to demonstrate your suitability for the position. Additionally, considering how these skills relate to your overall career narrative can help in creating a strong CV that showcases your expertise and enhances your chances of securing an interview.

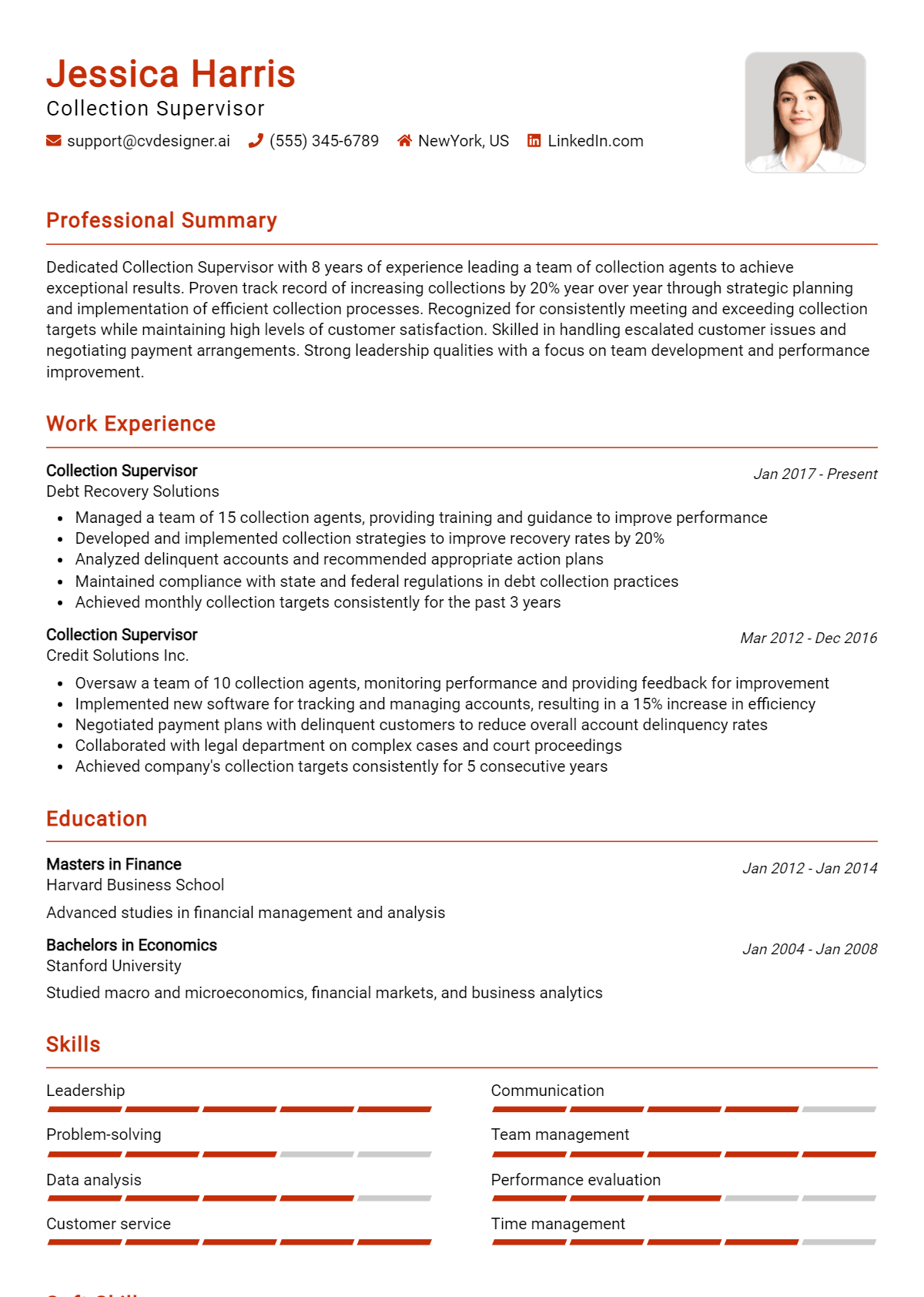

Best Resume Format and Structure for a Collection Supervisor

When crafting a resume for a Collection Supervisor position, it's crucial to choose a format that highlights your skills, experiences, and qualifications effectively. Below is a detailed guide on the best resume format and structure to follow:

Contact Information

- Name: Your full name should be prominently displayed at the top of your resume in a larger font.

- Phone Number: Include a professional voicemail message for contact purposes.

- Email Address: Use a professional email address that includes your name.

- LinkedIn Profile or Professional Website: If applicable, add links to your LinkedIn profile or a personal website showcasing your professional portfolio.

Professional Summary

- This section should be a brief overview of your qualifications and career highlights. Aim for 2-4 sentences that summarize your experience in collections, key skills, and what you can bring to the role.

- Example: "Detail-oriented Collection Supervisor with over 5 years of experience in managing collections teams and optimizing recovery strategies. Proven track record of improving collection rates and maintaining customer relationships while ensuring compliance with regulations."

Work Experience

- List your work experience in reverse chronological order, starting with your most recent position.

- For each job, include:

- Job Title

- Company Name

- Location (City, State)

- Dates of Employment (Month/Year – Month/Year)

- Bullet Points: Use bullet points to describe your responsibilities and achievements. Focus on quantifiable results, such as improved collection rates, reduced delinquencies, or successful training programs for staff.

Education

- Include your highest level of education first, followed by any relevant certifications.

- For each entry, include:

- Degree Obtained

- Field of Study

- Institution Name

- Graduation Year

- If you have completed any specialized training or courses relevant to collections, mention them here as well.

Skills

- List your relevant skills in a bullet-point format. Focus on both hard and soft skills.

- Examples of hard skills could include knowledge of collection software, regulatory compliance, and financial analysis. Soft skills might include communication, problem-solving, and leadership abilities.

Certifications

- If you hold any certifications relevant to collections or finance, such as Certified Collection Professional (CCP) or similar credentials, include them in this section.

- Clearly state the certification name, the certifying body, and the year it was obtained.

Additional Tips:

- Formatting: Choose a clean, professional layout with clear headings and consistent formatting. Use a legible font and keep your resume to one or two pages, depending on your experience.

- Keywords: Tailor your resume to the job description by incorporating keywords that align with the requirements and responsibilities of the Collection Supervisor role.

- Cover Letter Complement: Ensure your resume format complements your cover letter format. Use the same font and color scheme, and maintain the same professional tone. Your cover letter should elaborate on the highlights in your resume while showcasing your enthusiasm for the position.

By following this guide, you will create a compelling resume that effectively showcases your qualifications for a Collection Supervisor role. Tailoring your content to reflect your unique experiences and the specific job you are applying for will enhance your chances of standing out to potential employers.

Writing Tips and Best Practices for a Collection Supervisor Resume

When crafting a resume for a Collection Supervisor position, it’s essential to emphasize both your leadership capabilities and your expertise in debt recovery. A well-structured resume should clearly outline your relevant experience, skills, and achievements, while maintaining a professional and polished appearance. Utilizing resume writing tips can greatly enhance the impact of your resume, ensuring it stands out to hiring managers. Remember that these practices can also be beneficial when you’re drafting a cover letter, as they help create a cohesive and compelling application.

- Use strong action verbs such as "managed," "coordinated," and "implemented" to convey your leadership and initiative.

- Quantify your achievements where possible; for example, "increased collections by 20% within six months" or "reduced outstanding debts by $500,000."

- Incorporate industry-specific keywords and phrases that align with the job description to pass through Applicant Tracking Systems (ATS).

- Highlight your experience with relevant software and tools, such as CRM systems or debt collection software, to showcase your technical proficiency.

- Focus on your ability to train and mentor team members, showcasing any specific training programs or initiatives you developed.

- Emphasize your problem-solving skills by providing examples of challenges you faced and how you overcame them.

- Keep the layout clean and professional, using bullet points for easy readability and ensuring consistent formatting throughout.

- Tailor your resume for each application, reflecting the specific requirements and responsibilities outlined in the job posting.

Common Mistakes to Avoid in a Collection Supervisor Resume

When crafting a resume for the position of Collection Supervisor, it’s essential to present your skills and experience effectively to stand out to potential employers. However, many candidates make common mistakes that can detract from their qualifications and diminish their chances of landing an interview. By being mindful of these pitfalls, you can create a more compelling resume that highlights your suitability for the role.

- Overloading the resume with excessive information that can overwhelm the reader.

- Using generic descriptions that fail to showcase specific achievements or skills.

- Failing to tailor the resume to the specific job description, missing keywords that employers look for.

- Not including measurable results or quantifiable achievements, which can demonstrate your effectiveness as a supervisor.

- Ignoring formatting consistency, such as font sizes and styles, which can make the resume look unprofessional.

- Including irrelevant work experience that doesn’t relate to the Collection Supervisor position.

- Neglecting to proofread for grammatical errors and typos, which can undermine your attention to detail.

- Using a one-size-fits-all approach without emphasizing leadership and communication skills crucial for the role.

- Listing duties instead of accomplishments, which can make your experience appear less impactful.

- Failing to include relevant certifications or training that enhance your qualifications.

To further strengthen your application, consider reviewing the common mistakes to avoid in a resume and ensure your cover letter is equally polished by avoiding common cover letter mistakes. By addressing these areas, you can create a powerful application that resonates with hiring managers.

Sample Collection Supervisor Resumes

When applying for a Collection Supervisor position, it's essential to showcase your relevant experience, skills, and accomplishments in a well-structured resume. Below are three sample resumes tailored for different experience levels and career paths to help you craft your own. Each example highlights the skills and qualifications that are crucial for a Collection Supervisor role. For further inspiration, feel free to explore more resume templates and consider complementing your resume with corresponding cover letter examples to create a complete job application package.

Sample Resume: Experienced Professional

John Doe

123 Main St, City, State, ZIP

(123) 456-7890

johndoe@email.com

Professional Summary

Results-driven Collection Supervisor with over 10 years of experience in debt recovery and team management. Proven track record of improving collection rates and streamlining processes to enhance operational efficiency. Strong leadership skills with a focus on training and developing team members to achieve departmental goals.

Work Experience

Collection Supervisor

ABC Collections, City, State

March 2018 - Present

- Led a team of 15 collection agents, achieving a 25% increase in recovery rates over two years.

- Developed and implemented training programs that improved team performance and compliance with regulations.

- Analyzed collection reports to identify trends and optimize strategies for debt recovery.

Senior Collection Agent

XYZ Financial Services, City, State

January 2014 - February 2018

- Managed high-value accounts with a focus on customer retention and payment resolution.

- Conducted negotiations and set up payment plans, resulting in a 30% decrease in overdue accounts.

- Collaborated with legal teams to initiate processes for accounts requiring legal action.

Education

Bachelor of Science in Business Administration

University of State, City, State

Graduated: May 2013

Skills

- Team Leadership

- Debt Recovery Strategies

- Data Analysis

- Customer Relationship Management

- Regulatory Compliance

Sample Resume: Entry-Level Candidate

Jane Smith

456 Oak St, City, State, ZIP

(987) 654-3210

janesmith@email.com

Professional Summary

Motivated and detail-oriented recent graduate with a Bachelor’s degree in Finance. Eager to apply analytical skills and customer service experience to a Collection Supervisor role. Committed to enhancing collection processes and fostering positive client relationships.

Work Experience

Customer Service Representative

Retail Solutions, City, State

June 2022 - Present

- Provided exceptional customer service while handling inquiries and resolving issues related to billing and payments.

- Assisted in processing payments, ensuring accuracy and compliance with company policies.

- Collaborated with team members to identify and escalate collection issues to management.

Intern, Financial Analyst

Financial Insights, City, State

January 2022 - May 2022

- Conducted market research and analyzed financial data to support collection strategies.

- Developed presentations to communicate findings to senior analysts, contributing to improved decision-making.

- Supported the finance team in maintaining accurate records of accounts receivable.

Education

Bachelor of Science in Finance

University of State, City, State

Graduated: May 2022

Skills

- Analytical Thinking

- Customer Service

- Microsoft Office Suite

- Communication Skills

- Time Management

Sample Resume: Career Changer

Alex Johnson

789 Pine St, City, State, ZIP

(456) 789-0123

alexjohnson@email.com

Professional Summary

Dedicated professional with 7 years of experience in sales and customer relations seeking to transition into a Collection Supervisor role. Strong negotiation skills and a customer-oriented approach, combined with a commitment to achieving collection goals while maintaining positive relationships.

Work Experience

Sales Associate

ABC Electronics, City, State

March 2016 - Present

- Consistently exceeded sales targets while managing customer accounts and resolving payment issues.

- Developed strong relationships with clients, leading to a 40% increase in repeat business.

- Collaborated with management to implement new sales strategies that improved payment collection timelines.

Customer Relations Specialist

XYZ Services, City, State

June 2014 - February 2016

- Handled customer inquiries regarding account status and payment options, achieving a customer satisfaction rating of 95%.

- Assisted in developing training materials for new hires focusing on effective communication and problem-solving techniques.

- Monitored accounts for overdue payments and initiated follow-up procedures.

Education

Associate Degree in Business Management

Community College of State, City, State

Graduated: May 2014

Skills

- Negotiation Skills

- Customer Relationship Management

- Sales Strategy Development

- Team Collaboration

- Problem-Solving

By utilizing these sample resumes as a guide, you can tailor your own resume to highlight your unique qualifications for a Collection Supervisor position. Don’t forget to check out the additional resources available to enhance your job application.

Checklist for a Collection Supervisor Resume

- Proofread for Typos and Errors: Carefully read through your resume to eliminate any spelling or grammatical mistakes. Consider using tools or an AI resume builder to help catch errors you might have missed.

- Check for Consistency: Ensure that all formatting, fonts, and bullet points are consistent throughout the document. This includes using the same font size for headings and body text, and consistent date formats.

- Tailor Your Resume: Customize your resume for the Collection Supervisor position by incorporating keywords and phrases from the job description. Highlight relevant experience and skills that align with the requirements of the role.

- Highlight Relevant Experience: Focus on your previous roles in collections or supervisory positions. Use quantifiable achievements to demonstrate your impact, such as percentage increases in collection rates or reductions in delinquency.

- Emphasize Soft Skills: Include essential interpersonal and leadership skills such as communication, conflict resolution, and team management that are crucial for a Collection Supervisor role.

- Use Action Verbs: Start bullet points with strong action verbs to convey your contributions and accomplishments effectively. Examples include "Led," "Managed," "Improved," and "Streamlined."

- Include Professional Summary: Write a compelling professional summary at the top of your resume that captures your experience, skills, and what you bring to the Collection Supervisor role in a concise manner.

- Keep It Concise: Aim for a one-page resume, especially if you have less than 10 years of experience. Focus on the most relevant information that showcases your suitability for the position.

- Review Contact Information: Double-check that your contact information is accurate and up-to-date, including your phone number, email address, and LinkedIn profile (if applicable).

- Utilize an AI Resume Builder: Consider using an AI resume builder to ensure all elements are well-organized and presented professionally. A similar checklist can be followed for creating a CV or cover letter.

Key Takeaways for a Collection Supervisor Resume Guide

As you embark on the journey of crafting your Collection Supervisor resume, remember that a strong resume is your ticket to standing out in a competitive job market. Utilize the examples and tips provided to highlight your skills, experience, and accomplishments effectively. Tailor your resume to reflect your unique qualifications and the specific demands of the Collection Supervisor role. For next steps, consider downloading a professional resume template from resume templates to give your document a polished look. Don't forget to pair your resume with a well-crafted cover letter using our cover letter templates. If you're looking for a more personalized touch, try our best resume maker to build your resume from scratch. Following these guidelines will not only enhance your resume but also assist you in creating a compelling CV and cover letter that effectively convey your strengths. Good luck, and take the next step toward your career advancement!