As a Financial Advisor, you play a crucial role in helping individuals and businesses make informed financial decisions that can significantly impact their future. Your expertise in financial planning, investment strategies, and risk management enables you to guide clients toward achieving their financial goals while navigating the complexities of the financial landscape. But before you can begin making a difference in your clients' lives, you need to capture the attention of potential employers with a standout resume. In the competitive field of finance, a well-crafted resume is not just a document; it’s your first opportunity to make a lasting impression and demonstrate your value as a financial expert.

In this comprehensive guide, we will delve into the essential elements of crafting a compelling Financial Advisor resume. You'll learn about the key responsibilities and skills that employers look for in candidates, ensuring your resume reflects your qualifications accurately. We’ll discuss the best formats to use, highlight common mistakes to avoid that could hinder your job prospects, and provide resume examples tailored for all experience levels—from entry-level positions to seasoned professionals. Additionally, we’ll share valuable tips on effective resume writing techniques and guide you in selecting the right resume templates to enhance your presentation. Whether you’re embarking on a new career or seeking to advance in your current role, this guide will equip you with the tools you need to create a resume that stands out in the financial services industry.

Key Responsibilities and Skills for a Financial Advisor

As a Financial Advisor, the primary responsibilities revolve around helping clients manage their finances, achieve financial goals, and make informed investment decisions. This role typically includes:

- Assessing clients' financial situations through comprehensive analysis.

- Developing personalized financial plans that align with clients' objectives and risk tolerance.

- Monitoring clients' investment portfolios and making recommendations for adjustments as needed.

- Educating clients on various financial products, investment strategies, and market trends.

- Building and maintaining strong client relationships to ensure ongoing support and satisfaction.

- Staying updated on financial regulations, market conditions, and industry trends to provide accurate and relevant advice.

To excel in this role, a Financial Advisor should possess a mix of essential skills:

- Analytical Skills: Ability to analyze financial data and market trends.

- Communication Skills: Proficient in articulating complex financial concepts in a clear manner.

- Interpersonal Skills: Strong ability to build and maintain client relationships.

- Problem-Solving Skills: Capable of developing strategic solutions for clients' financial challenges.

- Attention to Detail: Ensuring accuracy in financial reports and investment analyses.

- Sales Skills: Proficient in persuading clients to invest in financial products or services.

Highlighting these skills effectively in the resume skills section is crucial for standing out to potential employers. Tailoring these responsibilities and skills to match the specific job description can significantly enhance your chances of being selected for an interview.

Moreover, consider how these skills could be relevant in creating a strong CV. By demonstrating your qualifications and experiences in alignment with the role of a Financial Advisor, you can present yourself as a compelling candidate, showcasing your capability to meet clients' financial needs effectively.

Best Resume Format and Structure for a Financial Advisor

When crafting a resume for a Financial Advisor position, it’s essential to choose a format that highlights your skills, experience, and qualifications effectively. Below is a detailed guide on the best resume format and structure for a Financial Advisor.

Contact Information

Start your resume with your contact details at the top. This section should include:

- Full name

- Phone number

- Professional email address

- LinkedIn profile (optional)

- Location (city and state)

Professional Summary

Following your contact information, include a brief professional summary. This section should be 2-4 sentences summarizing your experience, skills, and what you bring to the role. Focus on your key achievements, areas of expertise, and the value you can provide to clients and the organization.

Tip: Use keywords relevant to the Financial Advisor role, such as "financial planning," "investment strategies," and "client relationship management."

Work Experience

The Work Experience section is crucial for demonstrating your relevant job history. List your work experience in reverse chronological order, starting with your most recent position. For each role, include:

- Job title

- Company name

- Location (city and state)

- Dates of employment (month and year)

- Bullet points detailing your responsibilities, achievements, and skills utilized

Tip: Quantify your achievements where possible (e.g., "Increased client portfolio performance by 15% over one year") to showcase the impact of your work.

Education

In the Education section, list your academic qualifications. Include:

- Degree(s) obtained

- Major/field of study

- University/college name

- Graduation date (or expected graduation date)

Tip: If you have relevant honors or coursework, feel free to include them to strengthen your educational background.

Skills

The Skills section should highlight your key competencies that align with the Financial Advisor role. Include a mix of hard and soft skills, such as:

- Financial analysis

- Investment management

- Risk assessment

- Excellent communication

- Client relationship management

- Problem-solving

Tip: Tailor this section to reflect the skills mentioned in the job description you are applying for.

Certifications

Certifications can set you apart from other candidates in the financial sector. List any relevant certifications you hold, such as:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Series 7 or Series 65 licenses

Tip: If you are pursuing additional certifications, mention them as "In Progress" to demonstrate your commitment to continued professional development.

Formatting Tips

- Length: Aim for a one-page resume if you have less than 10 years of experience; two pages are acceptable for more extensive backgrounds.

- Font and Size: Use a professional font (e.g., Arial, Calibri, Times New Roman) and keep the font size between 10-12 points for readability.

- Margins and Spacing: Maintain standard margins (1 inch) and use adequate spacing between sections to create a clean layout.

- Bullet Points: Use bullet points for easy reading, ensuring they are concise and impactful.

The format of your resume should complement a well-structured cover letter. A cover letter should expand on the points made in your resume, providing context and demonstrating your enthusiasm for the Financial Advisor role. Adopting a similar design and font style in both your resume and cover letter reinforces your professionalism and attention to detail.

By following this guide, you can create a compelling resume that showcases your qualifications and sets you apart in the competitive field of financial advising.

Writing Tips and Best Practices for a Financial Advisor Resume

When crafting a resume as a Financial Advisor, it’s essential to present a polished and professional image that highlights your relevant skills and accomplishments. Start by tailoring your resume to the specific job you are applying for, using industry-specific keywords that demonstrate your expertise. This approach not only ensures your resume stands out to hiring managers but also helps it pass through applicant tracking systems. Remember to showcase your achievements using quantifiable metrics to illustrate the impact of your work. For a more compelling narrative, use strong action verbs that convey your proactive approach to financial planning and client management. Additionally, maintain a clean and organized format to enhance readability. Don't forget to apply these practices when drafting your cover letter to create a cohesive application.

- Use strong action verbs like “advised,” “analyzed,” “developed,” and “managed” to convey your contributions effectively.

- Quantify your achievements where possible, such as “increased client portfolio value by 20%” or “successfully managed assets worth over $5 million.”

- Incorporate industry-specific keywords such as “financial planning,” “investment strategies,” and “risk management” to showcase your expertise.

- Highlight specific certifications (e.g., CFP, CFA) to establish credibility and expertise in the financial sector.

- Keep your resume concise, ideally one page, focusing on relevant experience and skills that align with the job description.

- Use bullet points for easy reading, ensuring each point clearly communicates your achievements and responsibilities.

- Customize your resume for each application, reflecting the skills and experiences that are most relevant to the specific role.

- Utilize resume writing tips to ensure a professional look and feel in your document.

Common Mistakes to Avoid in a Financial Advisor Resume

Crafting a compelling resume as a Financial Advisor is crucial for standing out in a competitive job market. However, many candidates make common mistakes that can undermine their chances of landing an interview. To ensure your resume effectively showcases your qualifications and expertise, it's essential to steer clear of these pitfalls. Below are some frequent errors financial advisors should avoid:

- Overloading the resume with excessive information, making it difficult to read.

- Using generic job descriptions that fail to highlight specific accomplishments or skills.

- Failing to tailor the resume to align with the job description and required qualifications.

- Neglecting to quantify achievements, such as percentage increases in client portfolios or successful financial strategies implemented.

- Using industry jargon that might not be understood by all hiring managers.

- Ignoring the importance of formatting, leading to a cluttered or unprofessional appearance.

- Forgetting to proofread for typos and grammatical errors, which can diminish credibility.

- Not including relevant certifications or licenses that establish credibility in the financial sector.

- Listing responsibilities instead of focusing on achievements and results.

- Using a one-size-fits-all approach instead of customizing the resume for each application.

To avoid these errors and create a polished resume, consider reviewing the common mistakes to avoid in a resume. Additionally, don’t overlook the significance of your accompanying cover letter; check out the common cover letter mistakes to ensure you make a strong impression across all application materials.

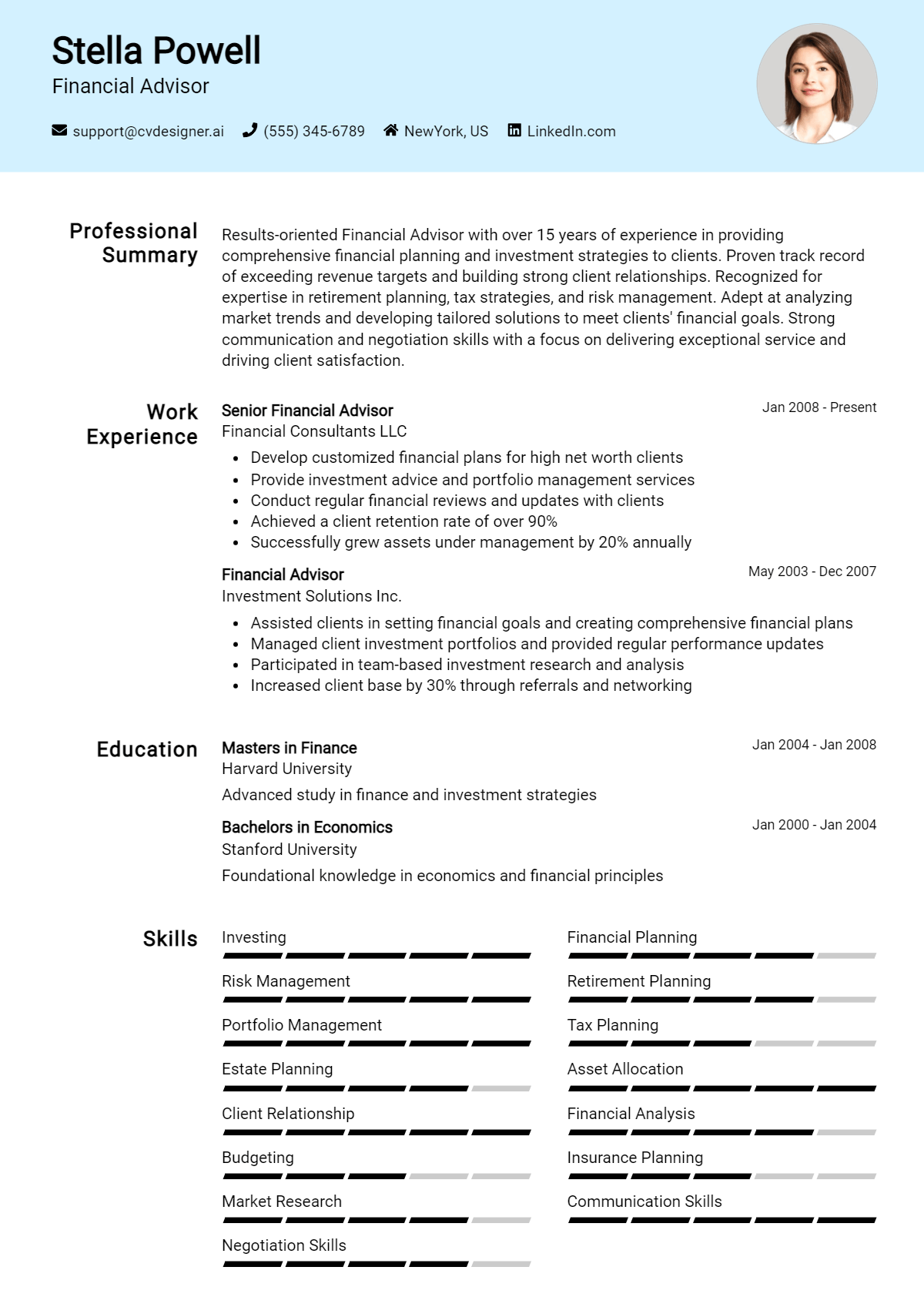

Sample Financial Advisor Resumes

When applying for a Financial Advisor position, having a well-crafted resume is essential to showcase your skills, experience, and qualifications. Below are three sample resumes tailored for different levels of experience in the financial advisory field: one for an experienced professional, one for an entry-level candidate, and one for a career changer. Each resume highlights unique attributes and achievements that can help you stand out to employers. For additional inspiration, feel free to explore more resume templates and consider reviewing corresponding cover letter examples to create a complete job application package.

Experienced Financial Advisor Resume

John Smith

[City, State]

[Phone Number]

[Email Address]

Professional Summary

Dynamic and results-oriented Financial Advisor with over 10 years of experience in providing comprehensive financial planning services to individuals and businesses. Proven track record of increasing client portfolios through strategic investment management and personalized financial advice. Strong analytical skills and commitment to client satisfaction.

Work Experience

Senior Financial Advisor

ABC Investments, City, State

January 2015 - Present

- Developed tailored financial plans for over 200 high-net-worth clients, achieving a 95% client satisfaction rate.

- Managed investment portfolios totaling over $50 million, resulting in an average annual return of 7%.

- Conducted regular market analysis to inform clients about investment opportunities and risks.

Financial Advisor

XYZ Wealth Management, City, State

June 2010 - December 2014

- Assisted clients in achieving financial goals through comprehensive financial planning and investment strategies.

- Conducted workshops and seminars on financial literacy, attracting new clients and enhancing community engagement.

- Collaborated with tax professionals to optimize clients’ tax situations, increasing client retention by 15%.

Education

Bachelor of Science in Finance

University of City, City, State

Graduated: May 2010

Certifications

- Certified Financial Planner (CFP)

- Chartered Financial Consultant (ChFC)

Entry-Level Financial Advisor Resume

Emily Johnson

[City, State]

[Phone Number]

[Email Address]

Professional Summary

Motivated and detail-oriented recent finance graduate with internship experience in investment management and client relations. Eager to leverage strong analytical skills and passion for financial planning to help clients achieve their financial goals.

Education

Bachelor of Science in Finance

State University, City, State

Graduated: May 2023

- Dean’s List (2021-2023)

Internship Experience

Financial Services Intern

LMN Financial Group, City, State

June 2022 - August 2022

- Assisted senior advisors in preparing financial plans and investment portfolios for clients.

- Conducted market research and analysis to support investment recommendations.

- Developed educational materials for client workshops, enhancing financial literacy in the community.

Skills

- Financial Planning

- Investment Analysis

- Client Relationship Management

- Microsoft Excel and Financial Modeling

Career Changer Financial Advisor Resume

Michael Brown

[City, State]

[Phone Number]

[Email Address]

Professional Summary

Driven professional transitioning into financial advisory with a strong foundation in sales and customer service. Adept at building relationships and understanding client needs, with a passion for helping individuals achieve financial security. Seeking to leverage transferable skills in a financial advisor role.

Work Experience

Sales Manager

Retail Company, City, State

March 2016 - Present

- Led a team of 15 sales associates, consistently surpassing sales targets by 20% through effective training and motivation.

- Developed strong client relationships, resulting in a 30% increase in repeat business.

- Analyzed sales data to identify trends and inform strategic decisions.

Customer Service Representative

Service Provider, City, State

January 2014 - February 2016

- Provided exceptional service to clients, resolving inquiries and building strong relationships.

- Collaborated with team members to improve service delivery and customer satisfaction.

Education

Bachelor of Arts in Business Administration

City College, City, State

Graduated: May 2013

Certifications

- Preparing for Series 7 and Series 66 Licenses

- Financial Planning Certification (In Progress)

These samples illustrate different paths to becoming a Financial Advisor. Tailoring your resume to reflect your unique experience and skills can make a significant difference in your job search.

Checklist for a Financial Advisor Resume

- Proofread for Spelling and Grammar: Carefully check your resume for any spelling or grammatical errors. Consider using tools like Grammarly or a reliable spell checker.

- Check Formatting Consistency: Ensure consistent font styles, sizes, and spacing throughout your resume. A clean and professional look enhances readability.

- Tailor Your Resume: Customize your resume for each job application. Highlight relevant experience, skills, and accomplishments that align with the specific financial advisory position.

- Use Action Verbs: Start bullet points with strong action verbs that convey your achievements and contributions. Examples include "advised," "developed," and "managed."

- Quantify Achievements: Where possible, include numbers and metrics to showcase your impact. For instance, "Increased client portfolio value by 20% within one year."

- Include Relevant Certifications: List relevant certifications such as CFP, CFA, or other financial designations prominently to demonstrate your qualifications.

- Concise Summary Statement: Craft a compelling summary statement at the top of your resume that encapsulates your professional background and key competencies in financial advising.

- Check for Job-Specific Keywords: Incorporate keywords from the job description to help your resume pass through Applicant Tracking Systems (ATS) and grab the attention of hiring managers.

- Use an AI Resume Builder: Consider using an AI resume builder to ensure that all elements of your resume are well-organized and visually appealing.

- Similar Checklists for Other Documents: Remember that a similar checklist can be followed for creating a CV or a cover letter, ensuring all your application documents are polished and tailored.

Key Takeaways for a Financial Advisor Resume Guide

In conclusion, crafting a standout Financial Advisor resume is vital for showcasing your skills and experiences effectively. By incorporating the examples and tips provided, you can tailor your resume to highlight your unique qualifications and attract potential employers. As a next step, consider downloading a professional template from resume templates, or explore our comprehensive cover letter templates to complement your application. Additionally, using our best resume maker can simplify the process of creating a polished resume. Remember, following similar guidelines will also benefit you in developing a compelling CV and an engaging cover letter. Take these steps to enhance your job application and increase your chances of landing that desired Financial Advisor position!