Most Popular Insurance Manager Resume Examples

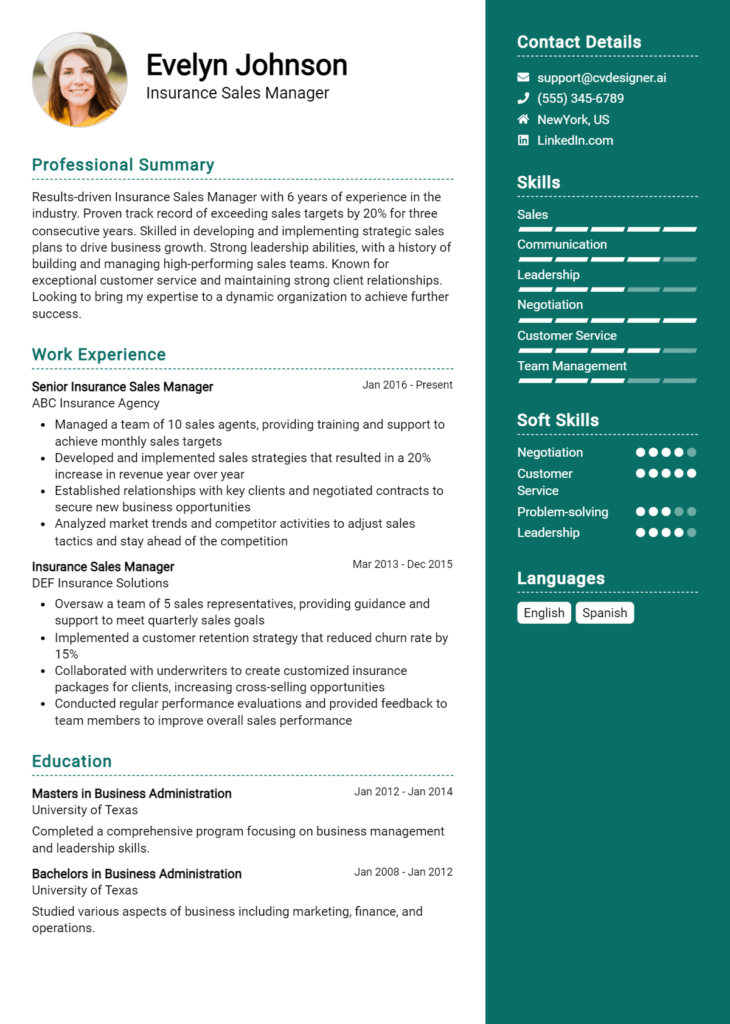

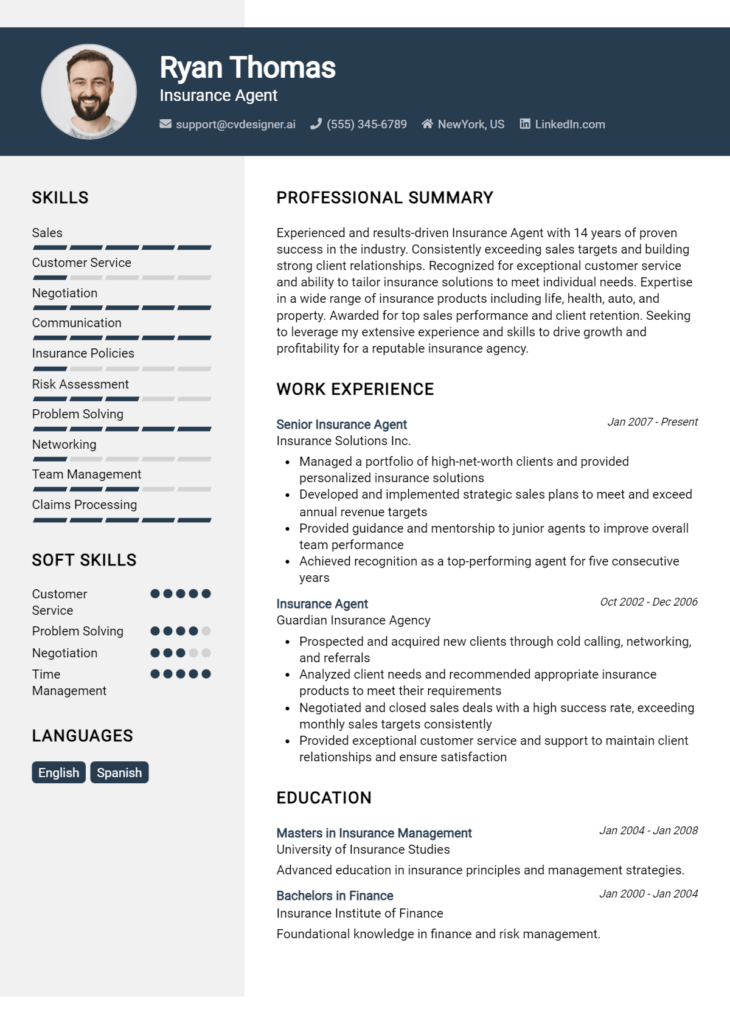

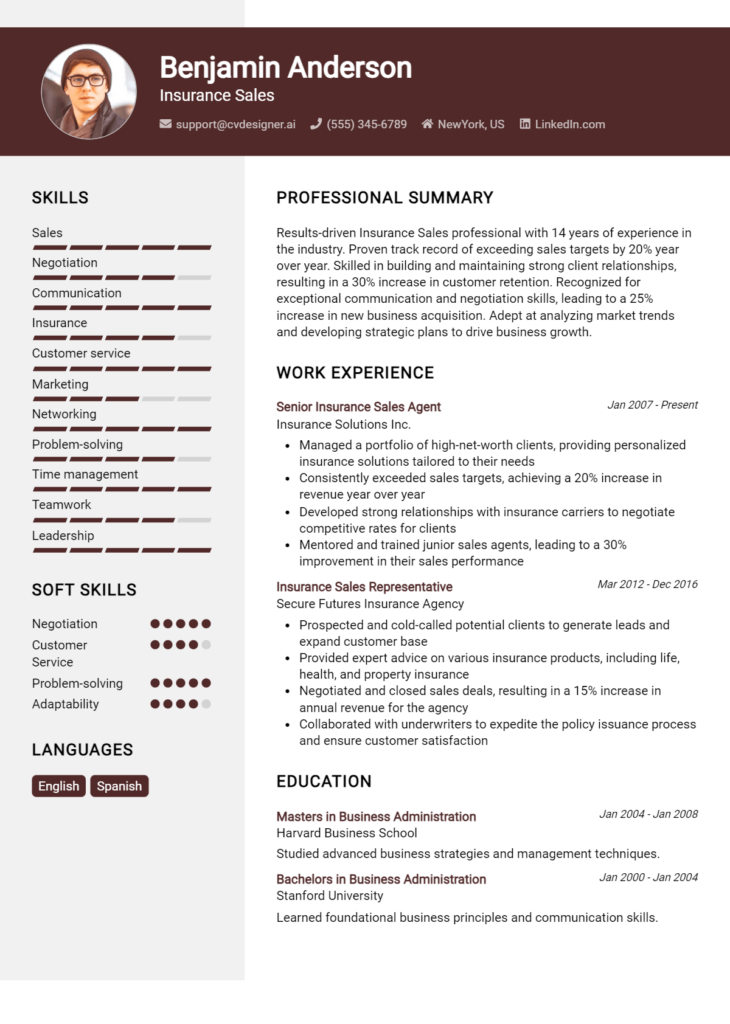

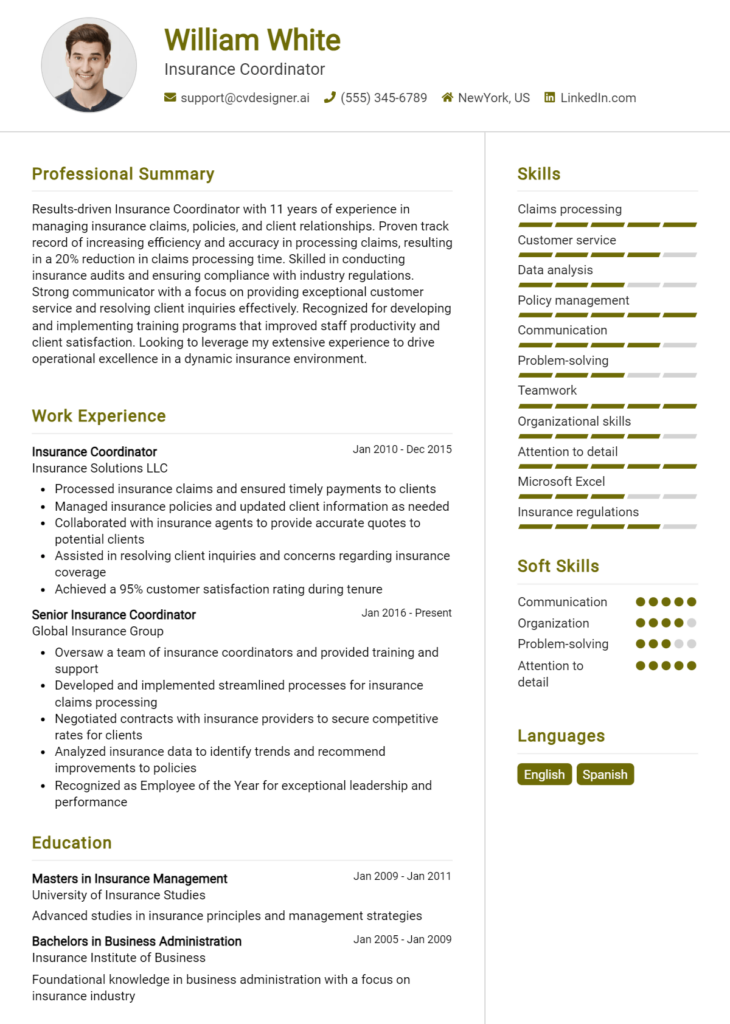

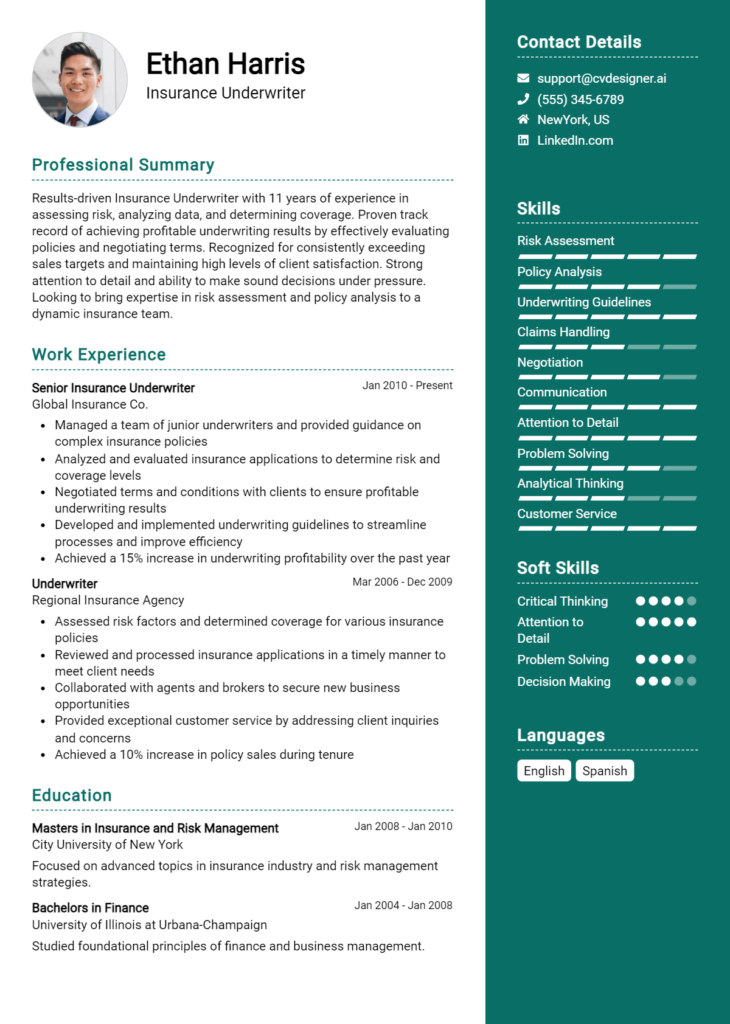

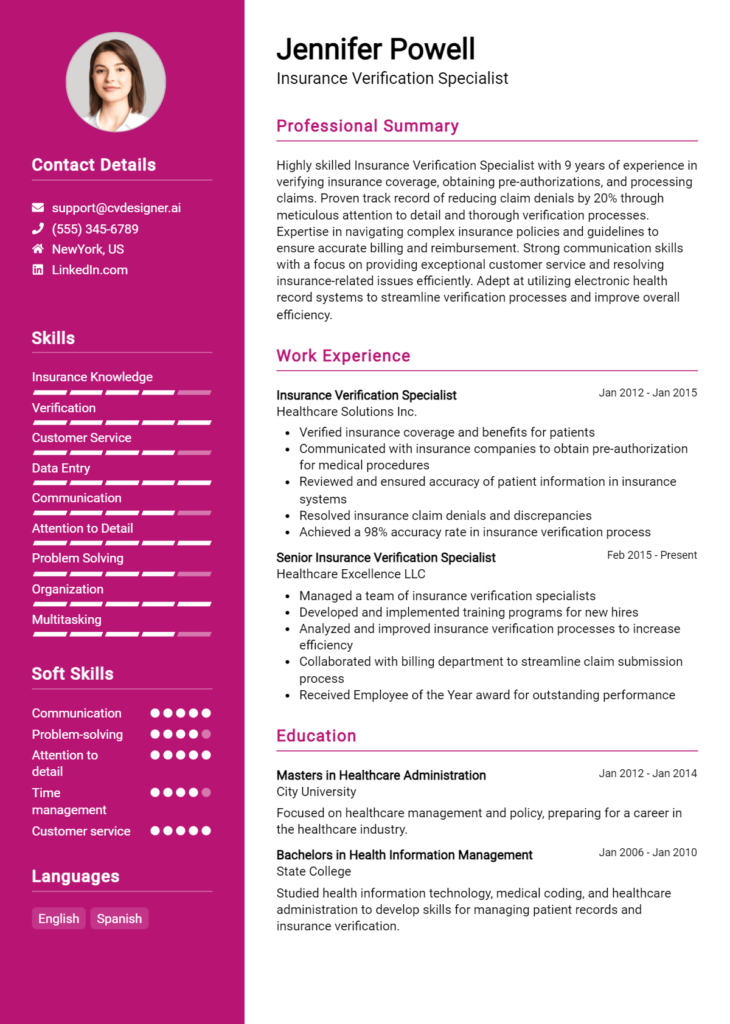

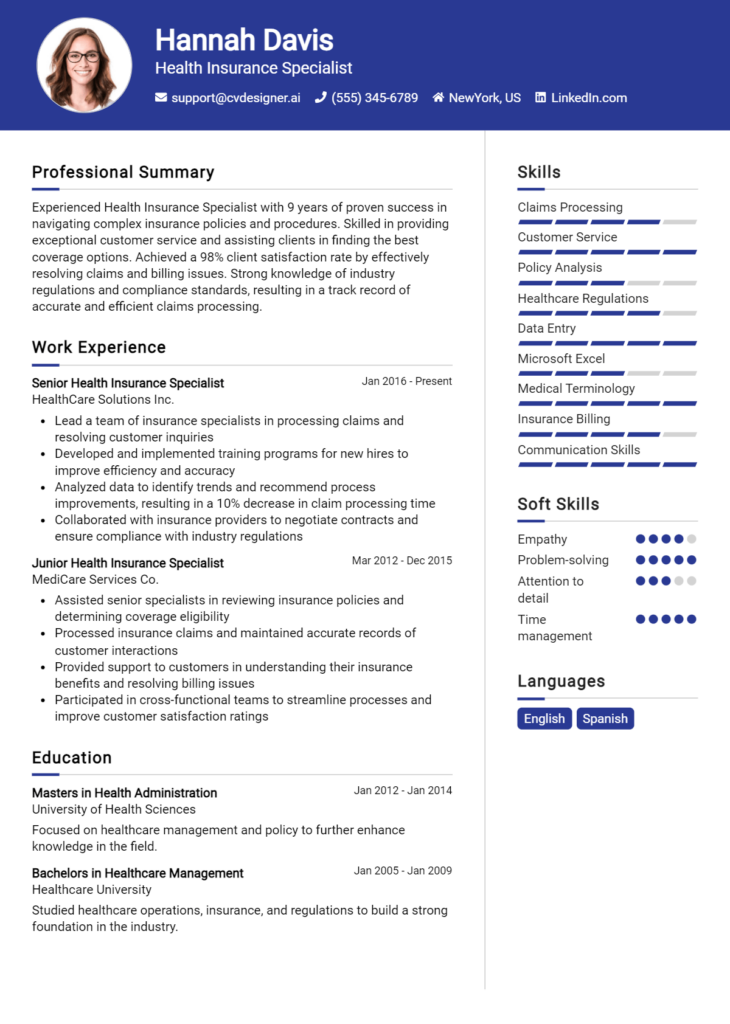

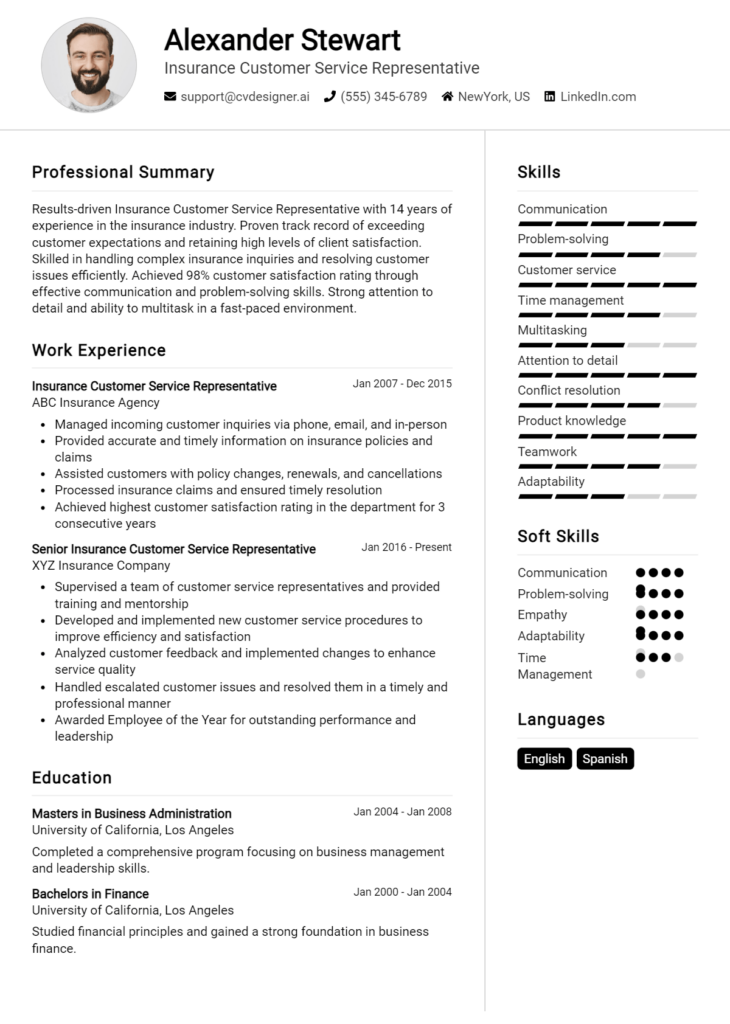

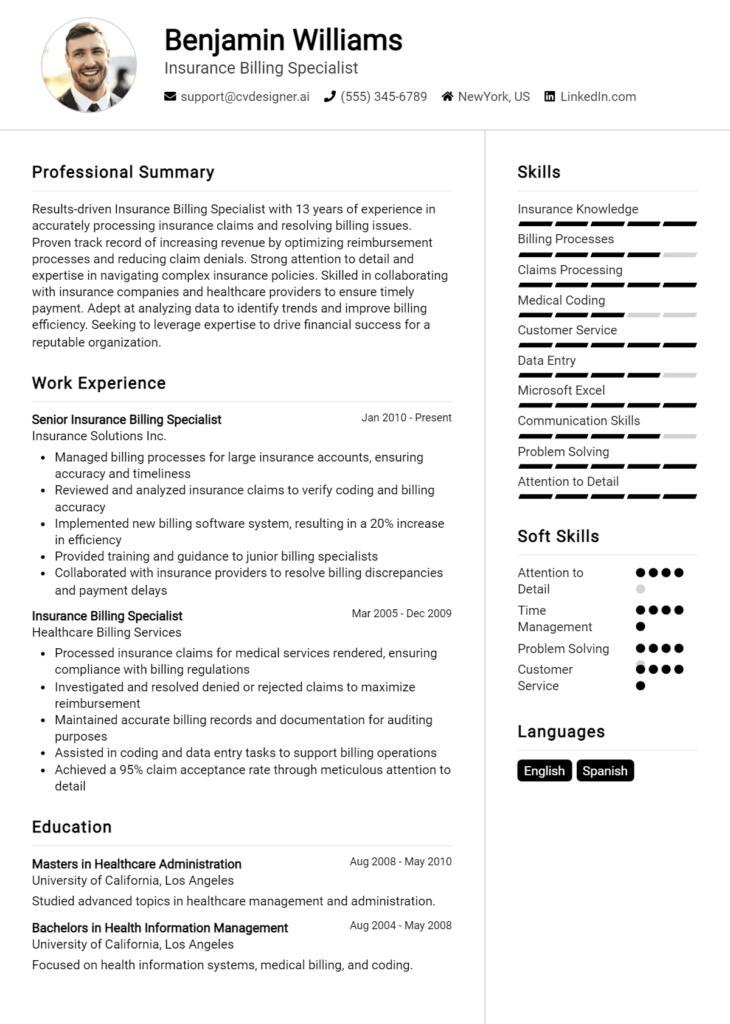

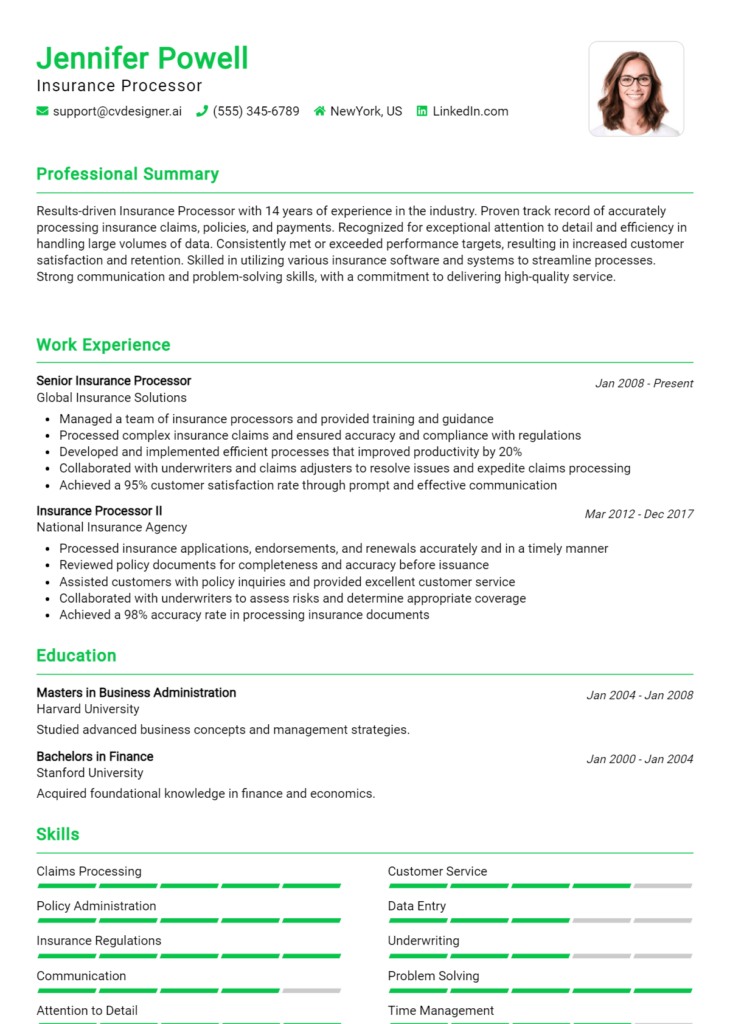

Explore additional Insurance Manager resume samples and guides and see what works for your level of experience or role.

As the backbone of risk management in the financial sector, the role of an Insurance Manager is both pivotal and multifaceted. Tasked with overseeing insurance operations, developing strategies to mitigate risk, and ensuring compliance with regulations, Insurance Managers play a critical role in safeguarding the financial health of organizations. In a competitive job market, a well-crafted resume is essential to stand out from the crowd, showcasing your unique skills and experiences that align with the demands of this significant position. Whether you’re an experienced professional or just starting your career in insurance management, understanding how to effectively present your qualifications is key to capturing the attention of hiring managers.

In this comprehensive guide, we will delve into the essential components of an Insurance Manager resume, highlighting the core responsibilities and skills that should be emphasized. You’ll learn about the best formats to use for your resume, common mistakes to avoid that could hinder your chances of landing an interview, and sample resumes tailored for various experience levels. Additionally, we will provide tips on crafting an impactful resume, including how to choose the right resume templates that reflect your professional persona. By the end of this article, you’ll be equipped with the knowledge and tools needed to create a compelling resume that positions you for success in the competitive insurance landscape.

Key Responsibilities and Skills for a Insurance Manager

An Insurance Manager plays a crucial role in overseeing the operations and administration of insurance policies within an organization. This position involves managing a team of insurance professionals, ensuring compliance with regulations, and optimizing policy offerings to meet client needs.

Key Responsibilities:

- Oversee the development and implementation of insurance policies and procedures.

- Manage and train insurance staff to ensure high performance and adherence to company standards.

- Analyze market trends and customer needs to develop new products and services.

- Collaborate with other departments to ensure alignment and efficiency in policy delivery.

- Evaluate and mitigate risks associated with insurance operations.

- Monitor regulatory changes and ensure compliance with industry standards.

- Prepare reports and present findings to senior management.

Essential Skills:

- Strong analytical and problem-solving abilities.

- Excellent communication and interpersonal skills.

- Proficiency in risk assessment and management.

- Leadership and team management capabilities.

- In-depth knowledge of insurance products and regulations.

- Strong organizational and time-management skills.

- Proficient in data analysis and financial modeling.

Effectively highlighting these skills in the resume skills section is essential for capturing the attention of hiring managers. Tailoring the listed responsibilities and skills to match the specific job description can significantly enhance your chances of securing an interview. Additionally, consider how these skills can be showcased in a strong CV, emphasizing relevant experience and achievements that demonstrate your proficiency and suitability for the Insurance Manager role.

Best Resume Format and Structure for a Insurance Manager

When crafting a resume for an Insurance Manager position, it's crucial to choose a format that highlights your qualifications, experience, and skills effectively. Below is a detailed guide on the best resume format and structure for this role.

Contact Information

- Your full name at the top, bolded and slightly larger font for emphasis.

- Include your phone number, professional email address, and LinkedIn profile (if applicable).

- Add your city and state, but omit your full address for privacy reasons.

Professional Summary

- Write a concise summary (2-4 sentences) that captures your experience in the insurance industry, specific managerial skills, and what you bring to the role.

- Highlight key achievements, such as successful project completions, team leadership, or process improvements.

- Tailor this section to align with the job description you are applying for, using relevant keywords.

Work Experience

- List your work experience in reverse chronological order, starting with the most recent position.

- For each role, include the job title, company name, location, and dates of employment.

- Use bullet points to describe your responsibilities and accomplishments for each position, focusing on quantifiable outcomes (e.g., "Increased customer retention by 20% through improved service delivery").

- Highlight any management responsibilities, such as overseeing teams, developing policies, or managing budgets.

Education

- Include your highest degree first, followed by other relevant degrees.

- Provide the degree earned, institution name, location, and graduation date.

- If applicable, include relevant coursework, honors, or certifications acquired during your studies.

Skills

- Create a bulleted list of relevant skills that align with the job description.

- Include both hard skills (e.g., risk assessment, claims management) and soft skills (e.g., leadership, communication).

- Highlight specific software or tools you are familiar with, such as insurance management systems or data analysis tools.

Certifications

- List any relevant certifications, such as the Chartered Property Casualty Underwriter (CPCU) or Associate in Risk Management (ARM).

- Include the certifying body and the date obtained or expiration date if applicable.

Additional Tips

- Choose a clean, professional layout with a clear font and sufficient white space to enhance readability.

- Use consistent formatting for headings and bullet points to create a cohesive look.

- Tailor your resume for each job application by emphasizing the most relevant experience and skills.

- Keep your resume to one or two pages, focusing on the most impactful information.

The format of your resume can greatly complement your cover letter. Ensure that both documents share a similar design aesthetic, using consistent fonts and colors. Your cover letter should expand on the key points in your resume, providing context for your achievements and demonstrating your enthusiasm for the role. Together, they should present a unified and professional image that effectively showcases your qualifications as an Insurance Manager.

Writing Tips and Best Practices for a Insurance Manager Resume

When crafting a resume for the role of an Insurance Manager, it's essential to present your qualifications and experience in a clear, impactful manner. Start with a professional summary that highlights your expertise in risk assessment, underwriting, and policy management, while also showcasing your leadership capabilities. Utilize specific action verbs to describe your responsibilities and achievements, ensuring that you quantify your successes wherever possible to demonstrate your value effectively. Incorporating industry-specific keywords will not only help your resume pass through applicant tracking systems but also resonate with hiring managers familiar with the insurance sector. For a polished look, consider using resume writing tips to refine your document. Remember, these best practices are also applicable when drafting a compelling cover letter.

- Use strong action verbs, such as "managed," "developed," "analyzed," and "negotiated," to convey your accomplishments effectively.

- Quantify your achievements with metrics, such as "increased policy renewals by 25%" or "managed a portfolio of over $10 million in assets."

- Tailor your resume to the specific job description, incorporating relevant keywords to align your experience with the employer's needs.

- Highlight leadership experience, detailing how you successfully managed teams, projects, or client relationships.

- Include certifications and licenses pertinent to the insurance industry, such as CPCU or AIC, to enhance your credibility.

- Ensure your resume is visually appealing and easy to read, with consistent formatting and clear section headings.

- Limit your resume to one or two pages, focusing on the most relevant experience and accomplishments to avoid overwhelming the reader.

- Proofread for spelling and grammatical errors to maintain professionalism and attention to detail.

Common Mistakes to Avoid in a Insurance Manager Resume

When crafting a resume for the role of an Insurance Manager, it's crucial to present a polished and professional image. However, many candidates fall into common traps that can undermine their chances of landing an interview. To stand out in a competitive job market, it's essential to avoid these pitfalls and ensure that your resume effectively showcases your qualifications and experience. Here are some common mistakes to avoid:

- Overloading with Information: Including too much detail can overwhelm the reader; focus on relevant achievements.

- Using Generic Descriptions: Tailor your descriptions to reflect the specific requirements of the Insurance Manager role rather than using a one-size-fits-all approach.

- Neglecting Keywords: Failing to incorporate industry-specific keywords can result in your resume being overlooked by applicant tracking systems (ATS).

- Inconsistent Formatting: A lack of uniformity in font, style, and spacing can make your resume appear unprofessional.

- Ignoring Quantifiable Achievements: Not providing measurable results from your past roles can make it difficult for employers to gauge your impact.

- Spelling and Grammar Errors: Typos and grammatical mistakes can give the impression of carelessness; always proofread your resume.

- Using Passive Language: Employ active verbs to convey your accomplishments more powerfully and dynamically.

- Listing Responsibilities Instead of Achievements: Focus on what you accomplished in your previous roles rather than just listing your duties.

- Including Irrelevant Information: Ensure that all content is pertinent to the Insurance Manager position to maintain the reader's interest.

To further enhance your application, consider reviewing the common mistakes to avoid in a resume and also familiarize yourself with common cover letter mistakes that should be avoided to create a cohesive and compelling application package.

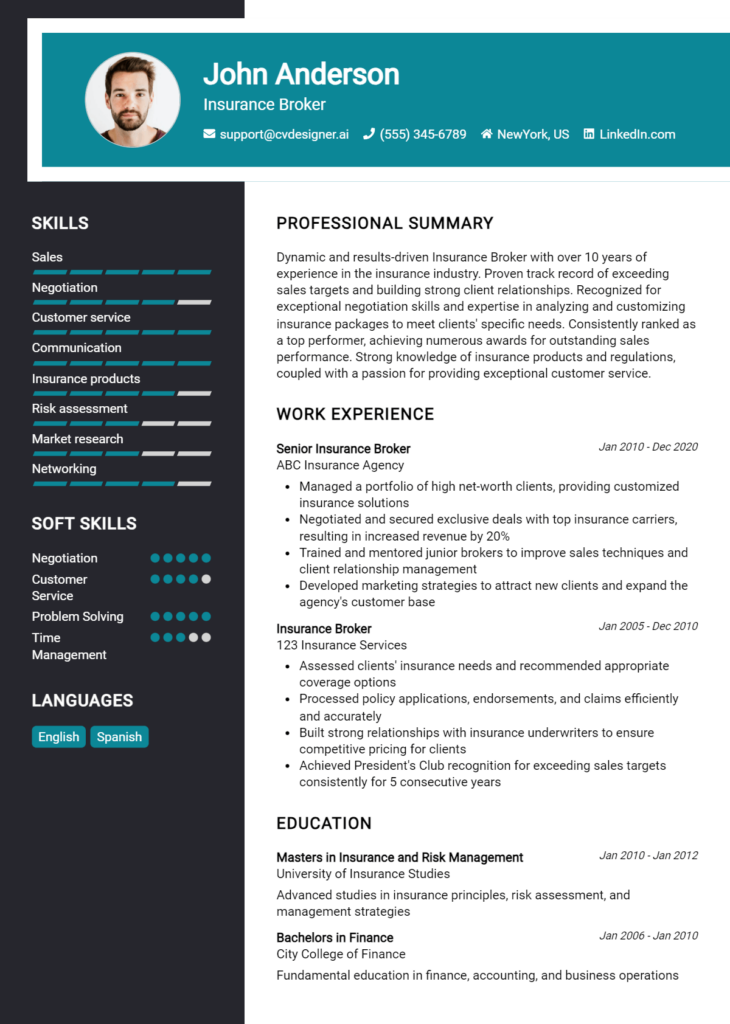

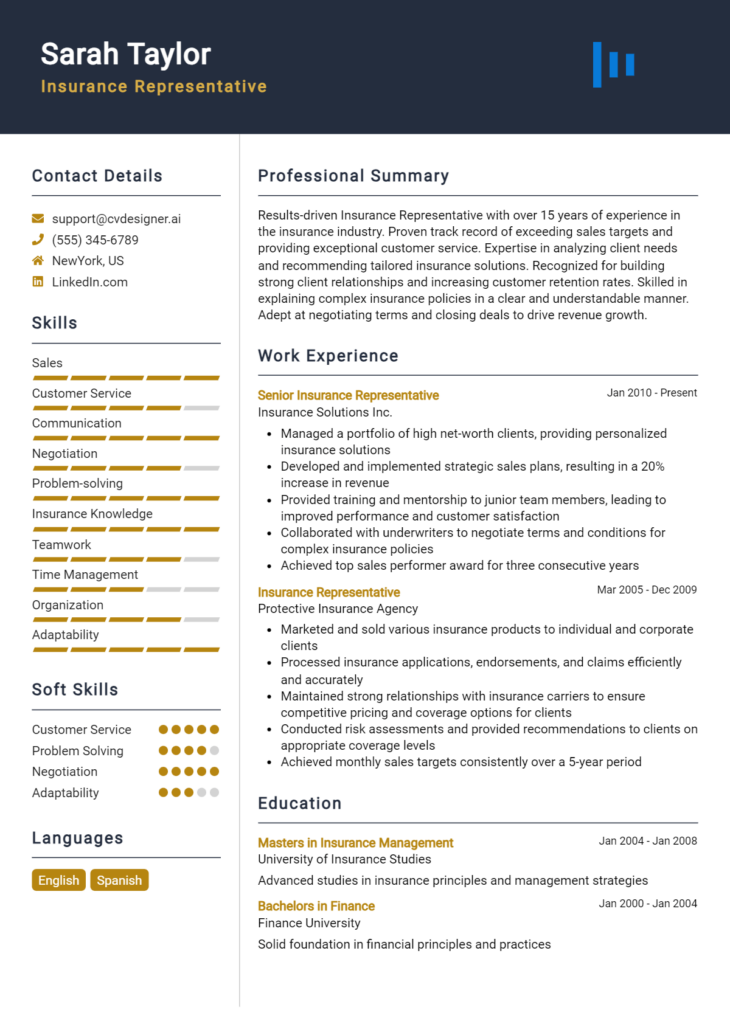

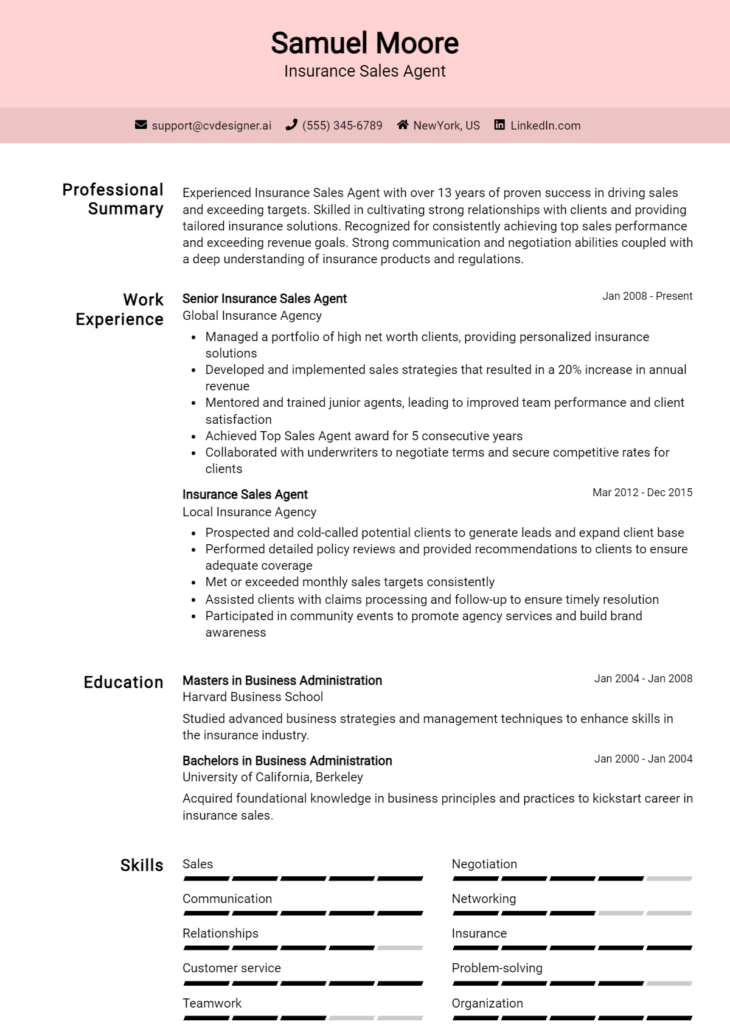

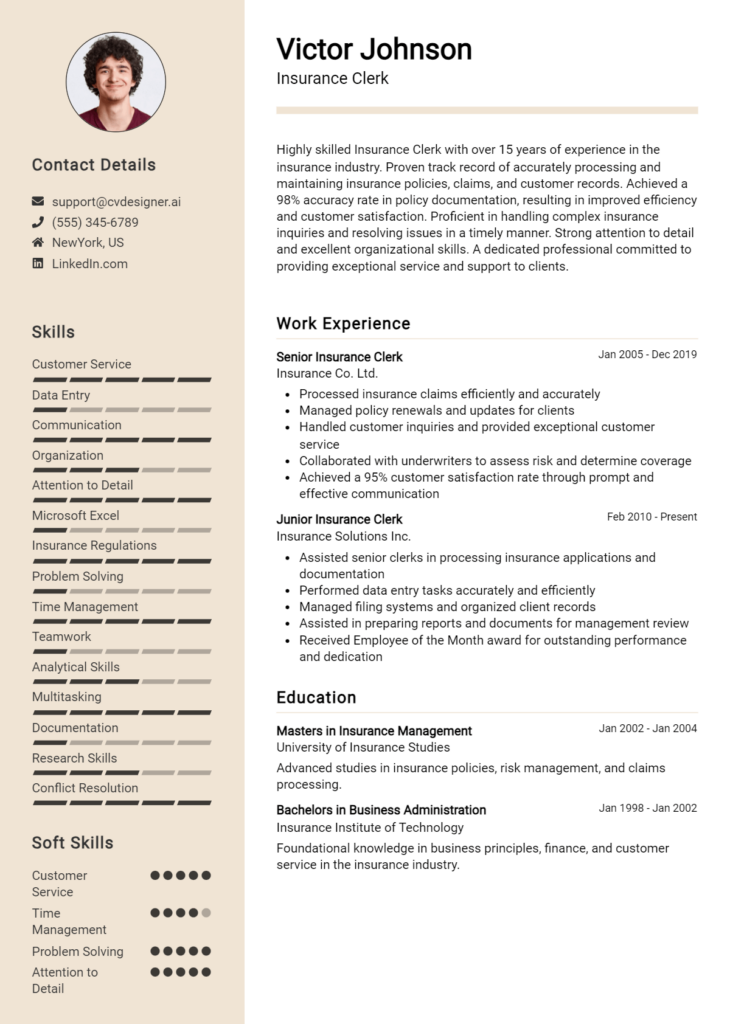

Sample Insurance Manager Resumes

As an Insurance Manager, your resume needs to showcase your expertise in managing insurance operations, developing policies, and ensuring compliance with regulations. Whether you are an experienced professional, an entry-level candidate, or someone transitioning from a different career, tailoring your resume to highlight relevant skills and experiences is crucial. Below are three sample resumes that cater to different backgrounds in the field of insurance management.

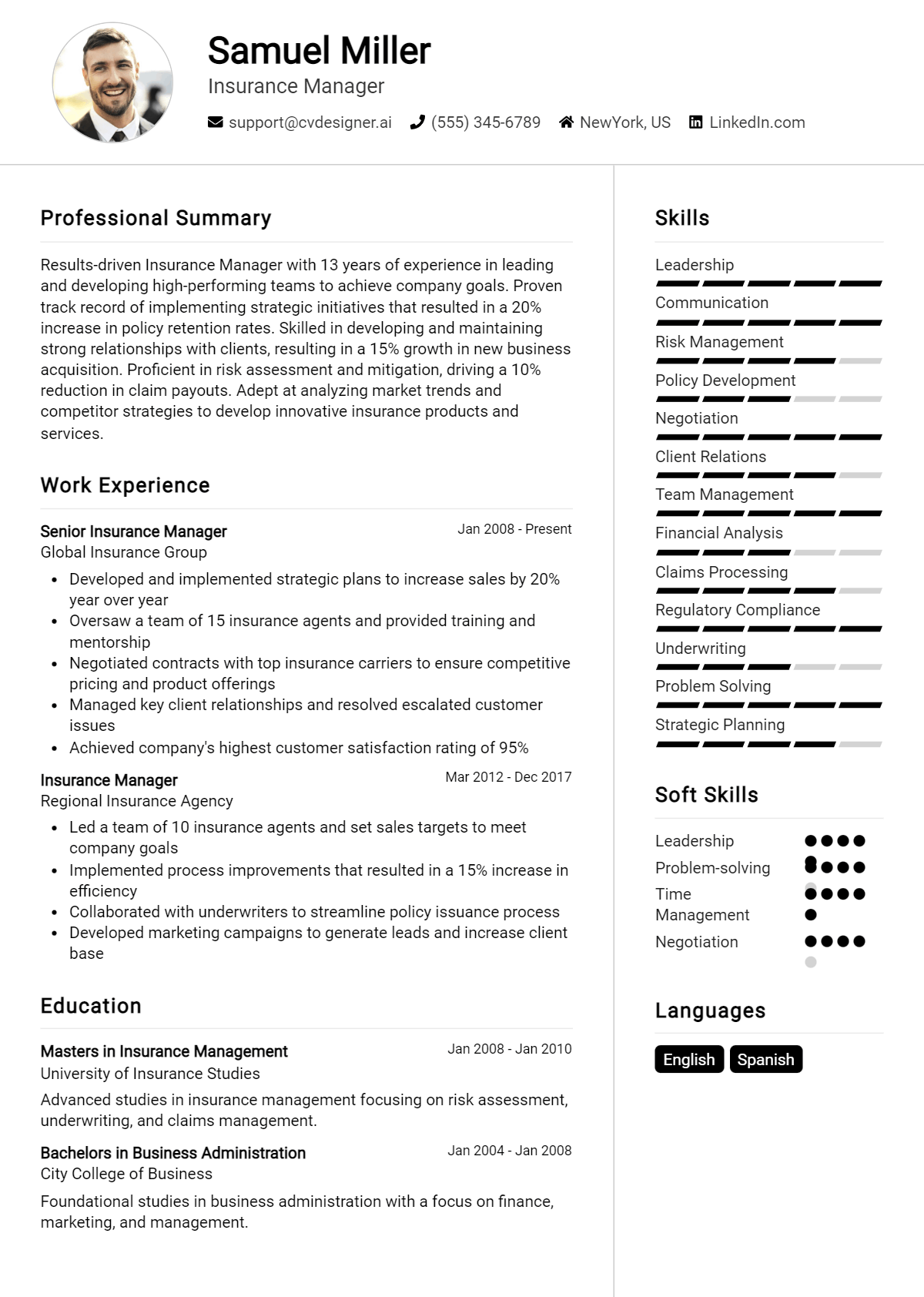

Experienced Insurance Manager Resume

John Doe

123 Main St, Anytown, USA

(123) 456-7890

john.doe@email.com

Professional Summary

Dynamic and results-oriented Insurance Manager with over 10 years of experience in the insurance industry. Proven track record in developing and implementing strategic operational policies, managing a diverse team, and enhancing client satisfaction. Expertise in risk assessment, claims management, and regulatory compliance.

Professional Experience

Insurance Manager

ABC Insurance Company, Anytown, USA

June 2015 - Present

- Lead a team of 15 insurance professionals, overseeing daily operations and ensuring compliance with industry regulations.

- Developed and implemented new policies that increased customer satisfaction by 30%.

- Conducted risk assessments and claims evaluations, reducing fraudulent claims by 20%.

- Collaborated with senior management to create strategic plans that improved operational efficiency.

Assistant Insurance Manager

XYZ Insurance Solutions, Anytown, USA

January 2010 - May 2015

- Assisted in managing a portfolio of client accounts, providing high-quality customer service and support.

- Analyzed claims data and created reports to identify trends and areas for improvement.

- Trained new employees on company policies, procedures, and customer service best practices.

Education

Bachelor of Science in Business Administration

University of Anytown, Anytown, USA

Graduated: May 2009

Entry-Level Insurance Manager Resume

Jane Smith

456 Oak St, Anytown, USA

(789) 012-3456

jane.smith@email.com

Professional Summary

Motivated and detail-oriented recent graduate with a Bachelor’s degree in Finance, seeking an entry-level Insurance Manager position. Strong analytical skills and a passion for the insurance industry. Eager to leverage academic knowledge and internship experiences to drive operational success.

Education

Bachelor of Science in Finance

University of Anytown, Anytown, USA

Graduated: May 2023

Internship Experience

Insurance Intern

DEF Insurance Agency, Anytown, USA

June 2022 - August 2022

- Assisted the insurance team with processing claims and updating client records.

- Conducted market research to support new policy proposals.

- Participated in team meetings, providing insights on improving customer engagement strategies.

Skills

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal abilities

- Proficient in Microsoft Office Suite (Excel, Word, PowerPoint)

- Knowledge of insurance regulations and compliance

Career Changer Insurance Manager Resume

Michael Johnson

789 Pine St, Anytown, USA

(456) 789-0123

michael.johnson@email.com

Professional Summary

Dedicated professional with over 8 years of experience in project management and business operations, transitioning into the insurance industry. Proven ability to manage teams, optimize processes, and drive organizational success. Looking to leverage transferable skills in a challenging Insurance Manager role.

Professional Experience

Project Manager

GHI Corporation, Anytown, USA

April 2015 - Present

- Managed cross-functional teams to deliver projects on time and within budget, achieving a 95% satisfaction rate.

- Developed and maintained project documentation to ensure compliance with company policies and regulations.

- Analyzed project performance data to identify trends and implement process improvements.

Business Operations Coordinator

JKL Enterprises, Anytown, USA

January 2012 - March 2015

- Coordinated daily operations and assisted in the development of new business strategies.

- Conducted training sessions for employees on operational procedures and best practices.

- Supported management in preparing reports and presentations for stakeholders.

Education

Bachelor of Arts in Business Management

University of Anytown, Anytown, USA

Graduated: May 2011

For more inspiration, explore additional resume templates that can be tailored to highlight your unique qualifications. Don’t forget that corresponding cover letter examples can help you create a complete job application package that stands out to potential employers.

Checklist for a Insurance Manager Resume

- Proofread for Errors: Carefully read through your resume to correct any spelling, grammar, or punctuation mistakes. Consider using tools like spell check or grammar check for additional support.

- Check Consistency: Ensure that font styles, sizes, and formatting are consistent throughout the document. This includes headings, bullet points, and spacing.

- Tailor Your Resume: Customize your resume for the specific Insurance Manager role you are applying for by incorporating keywords from the job description. Highlight relevant skills and experience that align with the employer's needs.

- Highlight Achievements: Focus on quantifiable achievements in your previous roles, such as increased customer satisfaction ratings or improved claims processing times. Use metrics where possible to demonstrate your impact.

- Use Action Verbs: Start bullet points with strong action verbs to convey your responsibilities and accomplishments effectively. Words like "managed," "developed," and "analyzed" can make your experience more engaging.

- Include Relevant Certifications: Clearly list any relevant certifications or licenses you hold that are pertinent to the insurance industry, such as a Chartered Property Casualty Underwriter (CPCU) designation.

- Keep It Concise: Aim for a clear and concise resume that is ideally one page long, especially if you have less than 10 years of experience. Avoid unnecessary jargon and filler content.

- Professional Format: Use a clean, professional format that enhances readability. Consider using an AI resume builder for well-organized sections and polished layouts.

- Update Contact Information: Double-check that your contact information is current and includes a professional email address. Ensure that your LinkedIn profile is up to date if you choose to include it.

- Follow a Similar Checklist for Other Documents: Remember that a similar checklist can be beneficial when creating a CV or a cover letter. Tailor each document to ensure they all present a cohesive professional profile.

Key Takeaways for a Insurance Manager Resume Guide

As you embark on creating your Insurance Manager resume, remember that a well-structured and compelling document is key to showcasing your qualifications and attracting the attention of potential employers. Utilize the examples and tips provided in this guide to highlight your expertise in risk assessment, policy management, and team leadership. Tailor your resume to reflect your unique experiences and achievements, ensuring it resonates with the specific job requirements. To further enhance your application, consider downloading a professional template from resume templates or a tailored cover letter template. You can also streamline the process by using our best resume maker to create a polished and eye-catching resume. Additionally, following similar guidelines will aid you in crafting a compelling CV and an effective cover letter. Take these next steps to ensure your application stands out and propels you toward your desired role in the insurance industry.