As an Investment Associate, you play a crucial role in driving the financial success of your firm and its clients. This position requires a unique blend of analytical prowess, strategic thinking, and effective communication skills. Crafting a resume that highlights these competencies is essential to stand out in a competitive job market. A well-structured resume not only showcases your qualifications but also reflects your understanding of the investment landscape, making it an indispensable tool for landing interviews and advancing your career.

In this comprehensive guide, we will explore the key responsibilities and skills expected of an Investment Associate, ensuring you can effectively communicate your experience and value. We will discuss the best resume formats to employ, helping you to present your information in a clear and impactful manner. Additionally, we will identify common mistakes to avoid that could hinder your chances of success. You’ll find tailored resume examples for all experience levels, from entry-level positions to seasoned professionals. Finally, we’ll provide invaluable tips on crafting a standout resume, including selecting the right resume templates to complement your personal brand.

Key Responsibilities and Skills for a Investment Associate

As an Investment Associate, you play a crucial role in supporting investment strategies and managing client relationships. Your key responsibilities typically include conducting market research, analyzing investment opportunities, preparing financial models, and assisting in the due diligence process. You may also be involved in monitoring portfolio performance and generating reports for senior management and clients.

To excel in this position, the following essential skills are required:

- Analytical Skills: Ability to analyze financial data and market trends to make informed investment decisions.

- Financial Modeling: Proficiency in creating and interpreting financial models to assess the viability of investment opportunities.

- Attention to Detail: Precision in reviewing financial documents and reports to ensure accuracy and compliance.

- Communication Skills: Strong verbal and written communication skills for presenting findings and recommendations effectively.

- Research Skills: Capability to conduct thorough market research to identify new investment opportunities.

- Teamwork: Ability to collaborate with various teams, including portfolio managers and analysts, to achieve investment objectives.

- Technical Proficiency: Familiarity with financial software and tools used for analysis and reporting.

Highlighting these skills effectively in the resume skills section is essential, as it allows potential employers to quickly assess your qualifications for the role. Tailoring these responsibilities and skills to match the specific job description can significantly enhance your chances of standing out among other candidates.

Consider how these skills could also be relevant in creating a strong CV. By aligning your experience with the key responsibilities and skills outlined, you can craft a narrative that showcases your suitability for the Investment Associate role, ultimately increasing your appeal to hiring managers.

Best Resume Format and Structure for a Investment Associate

When crafting a resume for an Investment Associate position, it’s essential to choose a format that highlights your qualifications effectively. Below is a guide on the best resume format and structure, including key sections and tips for each.

Contact Information

- Place your name at the top, in a bold, larger font.

- Include your phone number, professional email address, and LinkedIn profile (if applicable).

- Optionally, add your location (city and state) but avoid including your full address for privacy reasons.

Professional Summary

- Write a brief, impactful summary (2-4 sentences) that encapsulates your experience and expertise in investment analysis, financial modeling, or portfolio management.

- Highlight your key achievements and skills relevant to the role, such as your ability to analyze market trends or your proficiency in financial software.

Work Experience

- List your work experience in reverse chronological order, starting with your most recent position.

- For each role, include the job title, company name, location, and dates of employment.

- Use bullet points to describe your responsibilities and achievements. Start each bullet with an action verb and quantify your accomplishments when possible (e.g., "Increased portfolio returns by 20% through strategic asset allocation").

- Tailor your descriptions to reflect skills that are relevant to the Investment Associate role, such as data analysis, client relationship management, and market research.

Education

- List your educational background in reverse chronological order.

- Include your degree(s), major(s), university name, and graduation date.

- If you have relevant coursework or honors, consider including them as well, especially if you are a recent graduate.

Skills

- Create a concise list of skills relevant to the Investment Associate role. Include both hard skills (e.g., financial modeling, Excel proficiency, data analysis tools) and soft skills (e.g., communication, teamwork, problem-solving).

- Tailor this section to reflect the skills mentioned in the job description to increase your chances of getting noticed by applicant tracking systems.

Certifications

- List any relevant certifications that enhance your qualifications, such as Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), or any other finance-specific credentials.

- Include the certification name, issuing organization, and the date obtained.

Additional Sections (Optional)

- Consider adding sections for Professional Affiliations, Volunteer Experience, or Relevant Projects if they bolster your qualifications and relate to the investment field.

General Tips

- Choose a clean, professional format that is easy to read; a combination or chronological format works best for this role.

- Keep your resume to one page, especially if you have less than 10 years of experience.

- Use consistent fonts and spacing to enhance readability.

- Tailor your resume for each application, emphasizing the experiences and skills that align with the specific job description.

The resume format you choose will also complement your cover letter format. A professional, clean style for both documents creates a cohesive and polished application package. Ensure that your cover letter mirrors the tone and style of your resume, reinforcing the key points made in your resume while providing additional context about your motivation and fit for the Investment Associate role. Use similar headings and formatting styles to maintain consistency across both documents, helping to create a strong personal brand.

Writing Tips and Best Practices for a Investment Associate Resume

When crafting a resume for the position of Investment Associate, it's crucial to present a clear and compelling narrative of your qualifications and experiences. Focus on tailoring your resume to highlight relevant skills and accomplishments that align with the expectations of the role. Use a clean layout and professional formatting to enhance readability, while ensuring that your content is concise and impactful. Consider seeking out resume writing tips to refine your document further. Additionally, remember that these best practices also apply to your cover letter, which should complement your resume by providing deeper insights into your motivations and fit for the role.

- Utilize action verbs to convey your impact, such as "analyzed," "developed," "optimized," and "managed."

- Quantify your achievements wherever possible, such as "increased portfolio value by 20% within two years" or "successfully managed a $10 million investment fund."

- Incorporate industry-specific keywords that resonate with the role, such as "financial modeling," "due diligence," "market analysis," and "risk assessment."

- Keep your resume to one page if you have less than 10 years of experience; for more extensive backgrounds, two pages may be acceptable, but ensure every word counts.

- Highlight relevant education, certifications (such as CFA), and professional development experiences that demonstrate your commitment to the investment field.

- Use bullet points for clarity and ease of reading, ensuring each point is succinct and relevant to the job description.

- Tailor your resume for each application by aligning your experiences with the specific skills and competencies mentioned in the job listing.

- Proofread your document carefully to eliminate any errors or inconsistencies, as attention to detail is critical in finance roles.

Common Mistakes to Avoid in a Investment Associate Resume

When crafting a resume for an Investment Associate position, it's crucial to present your qualifications and experiences in a clear, concise, and impactful manner. Many candidates make common mistakes that can detract from their overall appeal, leading to missed opportunities. By being aware of these pitfalls, you can enhance your resume and improve your chances of landing an interview. Here are some common mistakes to avoid:

- Overloading your resume with excessive information that makes it difficult to read.

- Using generic descriptions that fail to highlight specific accomplishments or skills.

- Focusing too much on job duties instead of quantifiable achievements.

- Neglecting to tailor your resume to the specific job description.

- Using jargon or complex language that may confuse the reader.

- Failing to proofread for grammatical or spelling errors.

- Listing outdated skills or experiences that are no longer relevant.

- Ignoring the importance of formatting, leading to a cluttered appearance.

- Not including key metrics or data that demonstrate your impact in previous roles.

- Overlooking the significance of including relevant certifications or licenses.

To ensure your resume stands out, consider reviewing the common mistakes to avoid in a resume. Additionally, don't forget to pay attention to your cover letter, as there are also common cover letter mistakes that you should avoid to create a compelling application package.

Sample Investment Associate Resumes

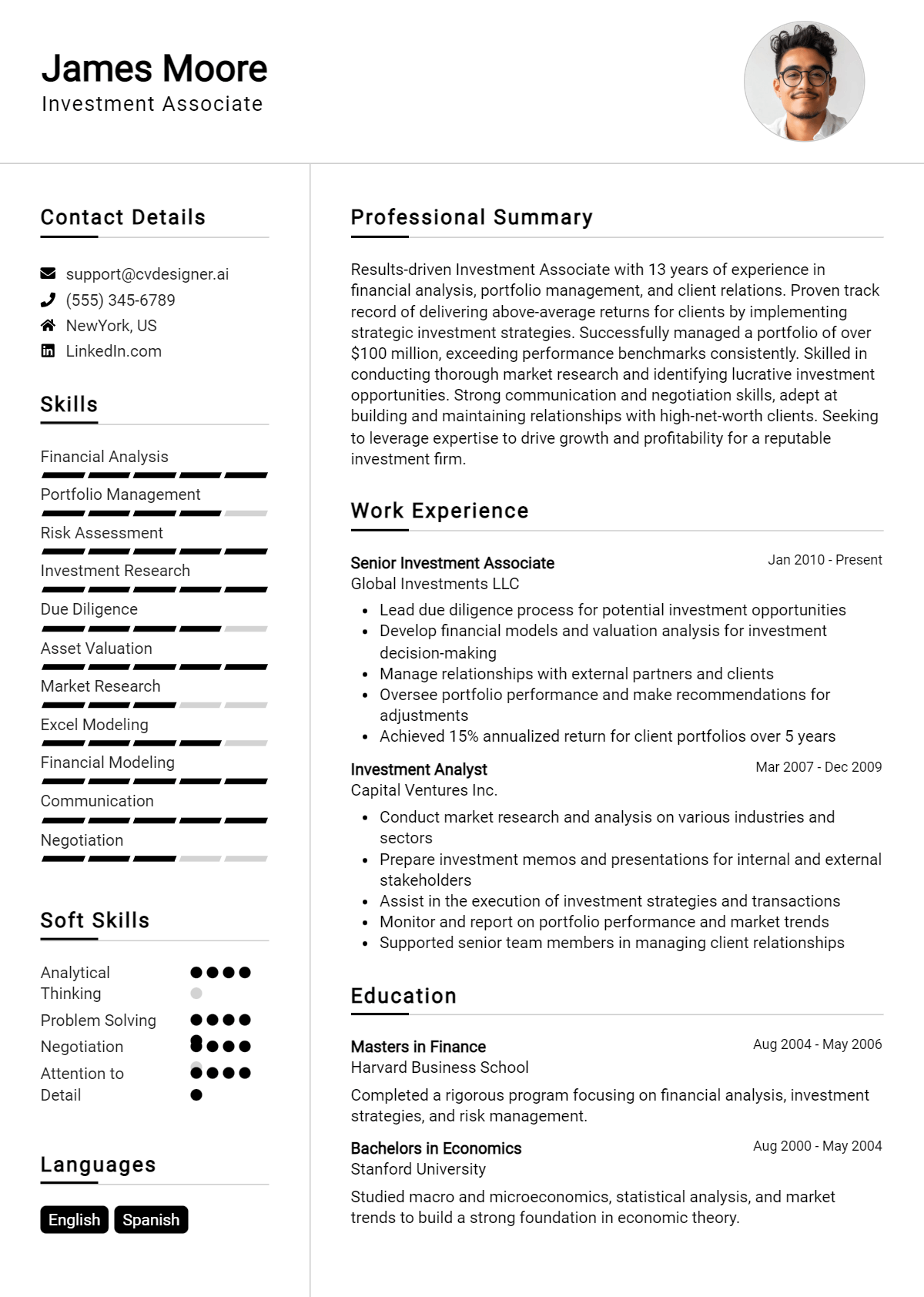

As the finance industry continues to evolve, the role of an Investment Associate has become increasingly critical in helping firms assess investment opportunities and manage portfolios. Below are three sample resumes tailored for this position: one for an experienced professional, one for an entry-level candidate, and one for a career changer. These examples highlight relevant skills, experiences, and educational backgrounds to showcase the candidates' qualifications. For additional inspiration, feel free to explore more resume templates. You can also look at corresponding cover letter examples to create a complete job application package.

Experienced Investment Associate Resume

John Smith

123 Finance Ave, New York, NY 10001

(555) 123-4567

john.smith@email.com

Professional Summary

Dynamic Investment Associate with over 7 years of experience in financial analysis and portfolio management. Proven track record of identifying investment opportunities and maximizing returns while mitigating risk. Strong analytical and quantitative skills, with a deep understanding of market trends and investment strategies.

Experience

Investment Associate

ABC Investments, New York, NY

January 2018 - Present

- Conduct comprehensive analyses of potential investment opportunities, leading to a 15% increase in portfolio performance.

- Collaborate with senior management to create strategic investment plans and risk management frameworks.

- Prepare detailed reports and presentations for clients, enhancing transparency and trust.

Financial Analyst

XYZ Financial Group, New York, NY

June 2015 - December 2017

- Evaluated financial data and market trends to assist in investment decision-making.

- Developed financial models to predict future earnings and cash flow scenarios.

- Presented findings to stakeholders, contributing to a streamlined investment strategy.

Education

Bachelor of Science in Finance

University of New York, NY

Graduated: May 2015

Skills

- Financial Modeling

- Portfolio Management

- Market Research

- Risk Assessment

- Client Relationship Management

Entry-Level Investment Associate Resume

Emily Johnson

456 Market St, Boston, MA 02108

(555) 987-6543

emily.johnson@email.com

Professional Summary

Recent finance graduate with a strong foundation in investment analysis and financial modeling. Eager to apply theoretical knowledge in a practical setting as an Investment Associate. Proven ability to work collaboratively in fast-paced environments and deliver results under pressure.

Experience

Intern, Investment Analysis

DEF Capital, Boston, MA

June 2023 - August 2023

- Assisted in the evaluation of investment opportunities, conducting market research and financial analysis.

- Collaborated with senior analysts to prepare investment reports and presentations for clients.

- Participated in team meetings to discuss market trends and investment strategies.

Finance Intern

GHI Securities, Boston, MA

January 2023 - May 2023

- Supported the finance team in managing client portfolios and preparing performance reports.

- Gained hands-on experience with financial software and tools, enhancing analytical skills.

Education

Bachelor of Science in Finance

Boston University, Boston, MA

Graduated: May 2023

Skills

- Financial Analysis

- Excel Proficiency

- Data Visualization

- Research Skills

- Communication

Career Changer Investment Associate Resume

Michael Brown

789 Investment Rd, Chicago, IL 60601

(555) 321-9876

michael.brown@email.com

Professional Summary

Dedicated professional transitioning from a successful career in project management to investment analysis. Strong analytical skills, financial acumen, and a passion for investment strategies. Committed to leveraging diverse experience to contribute to an investment team.

Experience

Project Manager

JKL Enterprises, Chicago, IL

March 2016 - Present

- Managed multiple projects with budgets exceeding $1 million, ensuring timely delivery and stakeholder satisfaction.

- Analyzed project financials and developed forecasts, which resulted in a 20% cost reduction.

- Built and maintained relationships with clients and vendors, enhancing business opportunities.

Financial Analyst (Part-Time)

MNO Financial Services, Chicago, IL

January 2022 - Present

- Conducted financial analyses for small business clients, providing insights that improved profitability.

- Assisted in the preparation of investment proposals and financial reports.

Education

Master of Business Administration (MBA)

University of Chicago, Chicago, IL

Expected Graduation: May 2024

Bachelor of Arts in Business Administration

State University, Chicago, IL

Graduated: May 2015

Skills

- Project Management

- Budgeting and Forecasting

- Financial Analysis

- Team Leadership

- Strategic Planning

These sample resumes illustrate different paths to becoming an Investment Associate, emphasizing the importance of relevant experience and skills. Consider customizing your resume based on your unique background and the specific job requirements.

Checklist for a Investment Associate Resume

- Proofread for Errors: Carefully read your resume multiple times to catch any spelling, grammar, or punctuation mistakes. Consider using tools like Grammarly for an additional layer of review.

- Check for Consistency: Ensure that your formatting is consistent throughout the document. This includes font types, sizes, bullet point styles, and line spacing.

- Tailor to the Job: Modify your resume to highlight experiences and skills that are most relevant to the Investment Associate position you are applying for. Use keywords and phrases from the job description.

- Quantify Achievements: Where possible, include metrics and numbers to demonstrate your achievements. For example, mention percentages, dollar amounts, or specific project outcomes.

- Keep It Concise: Aim for a one-page resume if you have less than 10 years of experience. Remove any unnecessary information that does not directly relate to the job.

- Highlight Relevant Skills: Focus on skills that are essential for an Investment Associate, such as financial analysis, market research, and proficiency with financial modeling tools.

- Professional Summary: Include a brief professional summary at the top of your resume that encapsulates your experience and what you bring to the role, tailored to the Investment Associate position.

- Use Action Verbs: Start bullet points with strong action verbs to convey your responsibilities and achievements effectively (e.g., "Analyzed," "Developed," "Managed").

- Consider Layout and Design: Use a clean, professional layout that enhances readability. Ensure there is enough white space and that sections are clearly defined.

- Utilize an AI Resume Builder: For a well-organized and visually appealing resume, consider using an AI resume builder. This tool can help streamline your formatting and ensure all elements are properly aligned.

For creating a comprehensive application package, a similar checklist can also be followed for your CV or cover letter.

Key Takeaways for a Investment Associate Resume Guide

As you embark on crafting your Investment Associate resume, remember that a well-structured format combined with impactful content is key to capturing the attention of hiring managers. Utilize the examples and tips provided to highlight your unique skills, experiences, and achievements that align with the role. Don't hesitate to enhance your application further by downloading a professional resume template from resume templates or a cover letter template from cover letter templates. For a more personalized approach, consider using our best resume maker to create a standout document. Following these guidelines will also serve you well in developing a compelling CV and an engaging cover letter. Take the next step in your career journey with confidence!