As a Loan Specialist, you play a pivotal role in helping individuals and businesses navigate the complex world of financing. Your expertise not only aids clients in securing the funding they need but also ensures that they understand their options and obligations. Given the critical nature of this position, having a well-crafted resume is essential to stand out in a competitive job market. An effective resume showcases your skills, experience, and achievements in a way that resonates with hiring managers and demonstrates your value as a candidate.

In this comprehensive guide, we will delve into the essential elements of a Loan Specialist resume. We’ll explore key responsibilities and skills that are integral to the role, recommend the best resume formats to use, and identify common pitfalls to avoid. Additionally, we’ll provide resume examples tailored for various experience levels, offer tips on effective resume writing, and help you choose the right resume templates that align with your personal brand. Whether you’re just starting out or looking to advance your career, this guide will equip you with the tools you need to create a compelling resume that opens doors to new opportunities.

Key Responsibilities and Skills for a Loan Specialist

A Loan Specialist plays a critical role in the financial sector, primarily responsible for evaluating and processing loan applications. They work closely with clients to understand their financial needs and determine the most suitable loan products. Here are some of the key responsibilities associated with this role:

- Assessing clients’ financial situations by reviewing their income, credit history, and other relevant documents.

- Providing guidance to clients on various loan options and assisting them throughout the application process.

- Ensuring compliance with federal and state regulations regarding lending practices.

- Collaborating with underwriters and other financial professionals to facilitate loan approvals.

- Maintaining up-to-date knowledge of loan products, market trends, and regulatory changes.

- Developing and nurturing relationships with clients to encourage repeat business and referrals.

To excel as a Loan Specialist, certain skills are essential:

- Excellent communication and interpersonal skills

- Strong analytical and problem-solving abilities

- Proficiency in financial analysis and understanding of credit risk

- Detail-oriented with strong organizational skills

- Knowledge of loan processing software and financial regulations

- Ability to work under pressure and meet tight deadlines

Highlighting these skills effectively in the resume skills section is crucial for standing out in a competitive job market. Tailoring these responsibilities and skills to match the specific job description not only showcases your qualifications but also demonstrates your understanding of the role. Additionally, consider how these skills can be relevant in creating a strong CV that emphasizes your expertise and aligns with the expectations of potential employers.

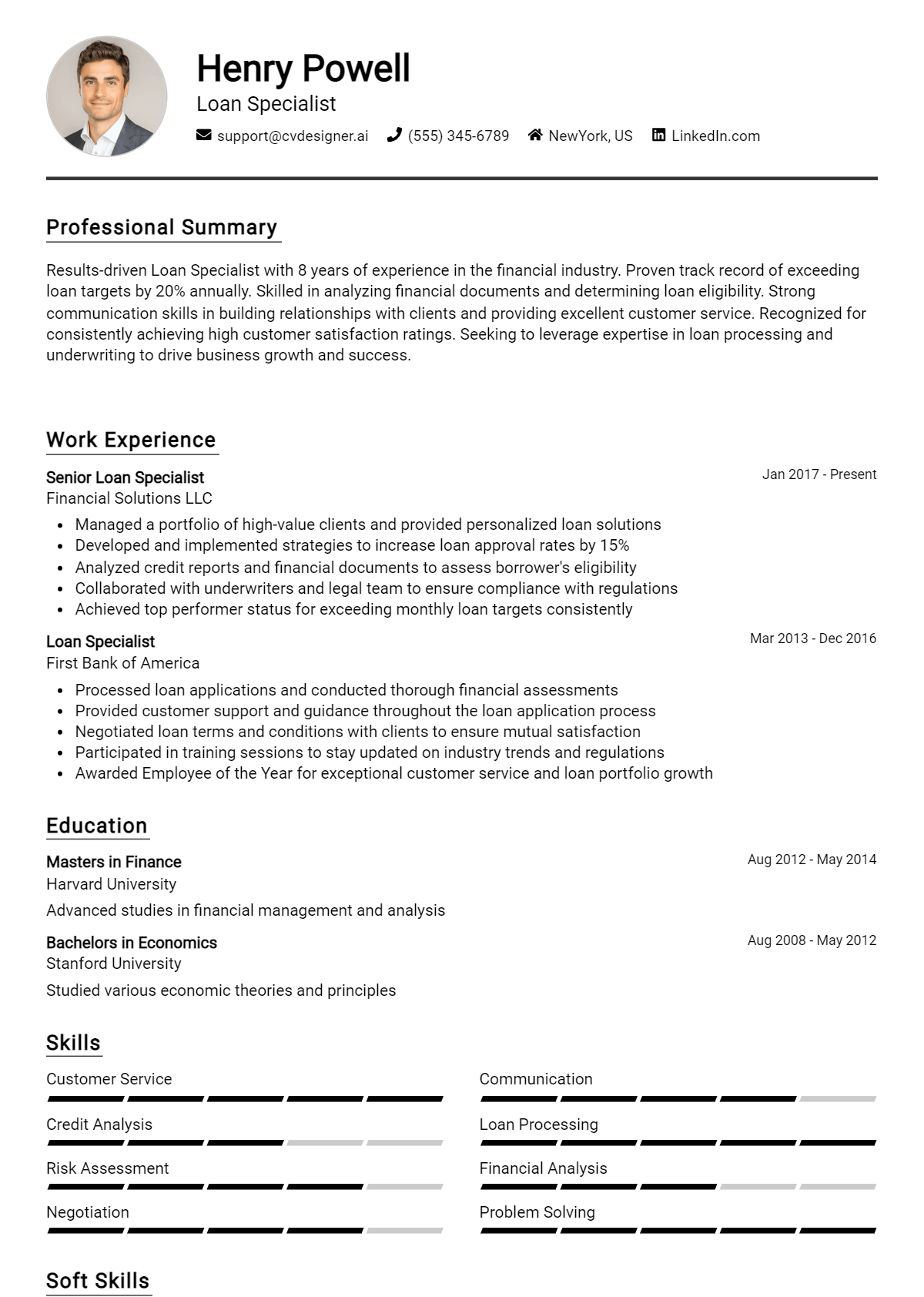

Best Resume Format and Structure for a Loan Specialist

When crafting a resume for a Loan Specialist position, it's essential to choose a format that highlights your relevant skills, experience, and qualifications effectively. Here’s a detailed guide on how to structure your resume:

Contact Information

- Header: Start with your name prominently displayed at the top, followed by your contact information.

- Details: Include your phone number, email address, and LinkedIn profile (if applicable). Make sure to use a professional email address.

Professional Summary

- Brief Overview: Write a 2-3 sentence summary that encapsulates your experience and qualifications as a Loan Specialist. This should include your years of experience, key areas of expertise (e.g., mortgage lending, credit analysis), and any notable achievements.

- Tailoring: Customize this section for each job application to align with the job description.

Work Experience

- Reverse-Chronological Order: List your work experience starting with your most recent job. Include the job title, company name, location, and dates of employment.

- Bullet Points: Use bullet points to describe your responsibilities and achievements in each role. Focus on quantifiable results (e.g., “Increased loan approval rates by 15% through improved customer assessment processes”).

- Relevance: Highlight experiences that relate directly to loan processing, customer service, and financial analysis.

Education

- Degrees: List your highest degree first, including the degree obtained, the institution, and graduation date. If you have relevant coursework or honors, feel free to include those as well.

- Certifications: If you have specialized certifications such as NMLS (National Mortgage Licensing System), include them in this section or create a separate section for certifications.

Skills

- Core Competencies: List key skills that are relevant to the Loan Specialist role. This includes technical skills (e.g., familiarity with loan origination software, understanding of credit reports) and soft skills (e.g., communication, problem-solving).

- Keywords: Incorporate keywords from the job description to pass through Applicant Tracking Systems (ATS).

Certifications

- Relevant Licenses: If you hold any licenses or certifications relevant to loan processing or finance, list them here. This may include state-specific licenses or general certifications from recognized organizations.

Additional Sections (Optional)

- Professional Memberships: If you belong to any professional organizations related to finance or lending, include them.

- Volunteer Experience: If applicable, this can showcase your commitment to the community and enhance your qualifications.

Formatting Tips

- Length: Aim for one page if you have less than 10 years of experience. Two pages may be acceptable for more extensive backgrounds.

- Fonts and Margins: Use a clean, professional font (e.g., Arial or Calibri) and maintain consistent margins (0.5 to 1 inch).

- Consistency: Ensure that formatting (bullet points, font sizes, spacing) is consistent throughout the document.

Complementing Cover Letter

The resume format you choose can complement your cover letter format. Aim for a cohesive look by using the same font and styles. In your cover letter, reiterate key points from your resume, such as specific achievements or skills that relate to the job. This consistency reinforces your professional image and makes your application stand out.

By following this guide, you can create a compelling and well-structured resume that effectively showcases your qualifications as a Loan Specialist, increasing your chances of landing an interview.

Writing Tips and Best Practices for a Loan Specialist Resume

When crafting a resume as a Loan Specialist, it’s crucial to present your skills and experiences in a clear, compelling manner that highlights your qualifications for the role. Start by tailoring your resume to the specific job description, ensuring that you use relevant industry jargon and keywords that align with the loan and finance sector. This will not only help you pass through Applicant Tracking Systems (ATS) but also demonstrate your familiarity with the industry. Use action verbs to convey your responsibilities and achievements effectively, and quantify your accomplishments whenever possible to showcase your impact. A well-organized resume that adheres to professional formatting standards will further enhance your chances of standing out to hiring managers. For more detailed guidance, consider exploring resume writing tips and remember that similar practices can be beneficial when drafting a cover letter.

- Use action verbs such as "analyzed," "processed," "recommended," and "secured" to begin your bullet points.

- Quantify your achievements with specific numbers (e.g., "processed 200+ loan applications monthly" or "increased loan approval rates by 15%").

- Incorporate keywords from the job posting, such as "credit analysis," "risk assessment," and "customer service," to demonstrate your suitability for the role.

- Highlight any relevant certifications or training, such as NMLS licensure or coursework in finance or lending practices.

- Tailor your resume to reflect the specific skills and experiences that align with the position you are applying for.

- Keep your resume concise and focused, ideally limited to one page, especially if you have less than 10 years of experience.

- Use bullet points for easy readability and to allow hiring managers to quickly scan your qualifications.

- Ensure your contact information is up to date and formatted correctly, making it easy for potential employers to reach you.

Common Mistakes to Avoid in a Loan Specialist Resume

When crafting a resume for a Loan Specialist position, it's crucial to present your skills and experiences in a clear and impactful manner. However, many candidates make common mistakes that can detract from their qualifications and reduce their chances of landing an interview. To ensure your resume stands out for the right reasons, it’s important to avoid the following pitfalls:

- Overloading the resume with excessive information or irrelevant details.

- Using generic descriptions that fail to highlight specific achievements or skills.

- Neglecting to tailor the resume to the Loan Specialist role and the specific requirements of the job posting.

- Failing to quantify accomplishments, which can make your contributions less tangible.

- Using jargon or technical terms without explanation, which may confuse hiring managers.

- Ignoring formatting and design principles, leading to a cluttered or difficult-to-read document.

- Including outdated or irrelevant work experience that does not support your candidacy.

- Making grammatical or spelling errors, which can create a negative impression.

- Listing responsibilities instead of demonstrating how you added value in previous roles.

- Forgetting to include relevant certifications or licenses that enhance your credibility as a Loan Specialist.

For more insights on avoiding these errors, consider reviewing the common mistakes to avoid in a resume. Additionally, it’s equally important to pay attention to your cover letter; check out the common cover letter mistakes that should also be avoided to ensure a polished application.

Sample Loan Specialist Resumes

A Loan Specialist plays a critical role in evaluating and processing loan applications, ensuring that clients receive the financial assistance they need while adhering to regulatory requirements. Below are three sample resumes tailored for different experience levels: an experienced professional, an entry-level candidate, and a career changer. Each resume highlights relevant skills and accomplishments that can help you stand out in the competitive finance industry. For additional inspiration, consider exploring more resume templates. You can also find corresponding cover letter examples to help create a complete job application package.

Experienced Loan Specialist Resume

John Doe

123 Main St, Anytown, USA 12345

(123) 456-7890

johndoe@email.com

Professional Summary

Detail-oriented Loan Specialist with over 8 years of experience in loan processing and underwriting. Proven track record of managing high-volume workloads while ensuring compliance with all regulatory standards. Strong analytical skills with a commitment to providing exceptional client service.

Work Experience

Senior Loan Specialist

ABC Financial Services, Anytown, USA

June 2016 - Present

- Processed over 300 loan applications annually, achieving a 95% approval rate.

- Conducted thorough credit analyses and risk assessments to determine loan eligibility.

- Collaborated with clients to gather necessary documentation and explain loan products.

- Trained and mentored junior staff members, improving team efficiency by 20%.

Loan Officer

XYZ Bank, Anytown, USA

January 2014 - May 2016

- Managed client relationships throughout the loan process, resulting in a 30% increase in repeat business.

- Developed and implemented marketing strategies that expanded the client base by 15%.

- Ensured compliance with federal and state mortgage regulations during loan processing.

Education

Bachelor of Science in Finance

University of Anytown, Anytown, USA

Graduated May 2013

Skills

- Loan Processing & Underwriting

- Regulatory Compliance

- Client Relationship Management

- Financial Analysis

- Risk Assessment

Entry-Level Loan Specialist Resume

Jane Smith

456 Oak St, Anytown, USA 12345

(987) 654-3210

janesmith@email.com

Objective

Motivated and detail-oriented finance graduate seeking an entry-level Loan Specialist position to leverage analytical skills and customer service experience to assist clients in securing loans.

Education

Bachelor of Arts in Finance

State University, Anytown, USA

Graduated May 2023

Internship Experience

Loan Processing Intern

LMN Credit Union, Anytown, USA

January 2023 - May 2023

- Assisted in the processing of loan applications, ensuring accuracy and completeness.

- Evaluated client credit histories and financial documents under the supervision of senior staff.

- Developed knowledge of loan products and regulatory guidelines through hands-on experience.

Customer Service Representative

Retail Store, Anytown, USA

June 2021 - December 2022

- Provided exceptional customer service to a diverse clientele, improving customer satisfaction ratings.

- Managed cash transactions and resolved customer inquiries effectively.

Skills

- Strong Analytical Skills

- Customer Service Excellence

- Attention to Detail

- Basic Financial Knowledge

- Team Collaboration

Career Changer Resume

Michael Johnson

789 Pine St, Anytown, USA 12345

(321) 654-9870

michaeljohnson@email.com

Summary

Dedicated professional with 5 years of experience in sales and customer relations, transitioning to a Loan Specialist role. Proven ability to assess client needs and deliver tailored solutions. Eager to apply strong interpersonal and analytical skills in the finance sector.

Professional Experience

Sales Associate

Retail Company, Anytown, USA

March 2019 - Present

- Cultivated strong relationships with customers, resulting in a 25% increase in sales.

- Analyzed customer preferences to recommend products, demonstrating strong analytical skills.

- Collaborated with team members to develop strategies that enhanced customer engagement.

Customer Service Team Lead

Service Organization, Anytown, USA

May 2017 - February 2019

- Oversaw a team of customer service representatives, providing training and support to improve service quality.

- Handled complex customer inquiries and resolved issues, enhancing customer satisfaction ratings by 35%.

Education

Certificate in Finance

Anytown Community College, Anytown, USA

Completed August 2023

Skills

- Sales & Customer Relations

- Strong Communication Skills

- Problem Solving

- Financial Acumen

- Team Leadership

These resumes can serve as a starting point for creating your own compelling documents. Remember to personalize them with your experiences and achievements. For further assistance, visit resume templates and check out cover letter examples to complete your application package.

Checklist for a Loan Specialist Resume

- Proofread for Errors: Carefully read through your resume to catch any spelling, grammar, or punctuation mistakes. Consider using tools like Grammarly for additional assistance.

- Check Formatting Consistency: Ensure consistent font styles, sizes, and spacing throughout the document. This includes headers, bullet points, and margins.

- Tailor to the Job Description: Match your skills and experiences with the specific requirements listed in the job posting. Use similar language to demonstrate fit.

- Highlight Relevant Experience: Prioritize work experiences and achievements that directly relate to loan processing, customer service, or financial analysis.

- Quantify Achievements: Include measurable outcomes to demonstrate your effectiveness as a Loan Specialist, such as the number of loans processed or percentage of customer satisfaction.

- Use Action Verbs: Start each bullet point with strong action verbs (e.g., "Analyzed," "Processed," "Assisted") to convey your contributions effectively.

- Include Relevant Skills: List important skills for a Loan Specialist, such as knowledge of loan regulations, customer service skills, and proficiency in loan processing software.

- Keep It Concise: Aim for a clear and concise resume, ideally one page. Remove any irrelevant or outdated information that doesn’t support your candidacy.

- Seek Feedback: Have a trusted colleague or mentor review your resume for clarity and impact. Fresh eyes can catch errors you might have missed.

- Consider Using an AI Resume Builder: Utilize an AI resume builder to help organize all elements of your resume effectively, ensuring it meets industry standards.

For those creating a CV or cover letter, a similar checklist can be followed to ensure quality and relevance.

Key Takeaways for a Loan Specialist Resume Guide

In conclusion, crafting a strong resume as a Loan Specialist is essential in showcasing your skills, experience, and achievements to potential employers. By utilizing the examples and tips provided in this guide, you can effectively highlight your qualifications and stand out in a competitive job market. We encourage you to take the next step by downloading a tailored resume template from resume templates, or if you're also in need of a cover letter, explore our collection of cover letter templates. For a more personalized approach, consider using our best resume maker to create a professional-looking resume with ease. Additionally, following similar guidelines will aid you in crafting a compelling CV and an impactful cover letter. Take action today to enhance your job application materials and increase your chances of landing that ideal Loan Specialist position!