Most Popular Mortgage Loan Officer Resume Examples

Explore additional Mortgage Loan Officer resume samples and guides and see what works for your level of experience or role.

As a Mortgage Loan Officer, you play a pivotal role in helping individuals and families achieve their dreams of homeownership. Your expertise not only guides clients through the complex mortgage process but also requires a blend of financial acumen, interpersonal skills, and market knowledge. Given the competitive nature of the housing market, a well-crafted resume is essential to showcase your qualifications and set you apart from other candidates. Whether you're entering the field or looking to advance your career, a compelling resume can be your ticket to landing the job you desire.

In this comprehensive guide, we will delve into the key responsibilities and skills that define a successful Mortgage Loan Officer. We’ll also discuss the best resume formats to use, highlight common mistakes to avoid, and provide resume examples tailored for all experience levels. Additionally, we will share valuable tips on effective resume writing and help you choose the right resume templates to present your qualifications in the best light possible. Whether you're a seasoned professional or just starting out, this guide will equip you with the tools you need to create a standout resume that catches the eye of hiring managers.

Key Responsibilities and Skills for a Mortgage Loan Officer

As a Mortgage Loan Officer, your primary role involves assisting clients in the mortgage application process, guiding them through various loan options, and ensuring that all necessary documentation is processed accurately and efficiently. You play a crucial part in evaluating creditworthiness, assessing financial information, and determining the best mortgage products suited to clients’ needs.

Key Responsibilities:

- Evaluate and analyze clients' financial information and credit history to determine loan eligibility.

- Educate clients about different mortgage options and help them understand terms and conditions.

- Collect and review loan applications and supporting documentation for accuracy and completeness.

- Communicate with underwriters, real estate agents, and other stakeholders throughout the loan process.

- Maintain detailed records of interactions and transactions, ensuring compliance with regulations.

- Develop and maintain relationships with clients, real estate professionals, and referral sources to generate business.

Essential Skills:

- Strong understanding of mortgage products and financial regulations.

- Excellent communication and interpersonal skills.

- Critical thinking and analytical abilities for assessing financial documents.

- Detail-oriented approach to ensure accuracy in processing applications.

- Proficiency in using loan origination software and financial analysis tools.

- Ability to work under pressure and meet tight deadlines.

When crafting your resume, it’s vital to effectively highlight these skills in the skills section, as they are directly relevant to the responsibilities outlined in the job description. Tailoring your resume to match the specific requirements of the job can significantly improve your chances of securing an interview. Additionally, consider how these skills can be showcased in your CV to demonstrate your qualifications and readiness for the role of a Mortgage Loan Officer.

Best Resume Format and Structure for a Mortgage Loan Officer

The resume format for a Mortgage Loan Officer should be clear, professional, and organized. Here’s a detailed guide to help you craft an effective resume that highlights your qualifications and experience.

Contact Information

- Name: Use a larger font size for your name to make it stand out.

- Phone Number: Ensure it’s current and includes your area code.

- Email Address: Use a professional email address.

- LinkedIn Profile: Include a link if it adds value to your application.

- Address: Optional, but you can include your city and state.

Professional Summary

- Write a brief paragraph (2-4 sentences) summarizing your experience, skills, and what you bring to the role. Focus on your achievements in mortgage lending, customer service, and any relevant accomplishments. Tailor this section to reflect the specific job you are applying for.

Work Experience

- Job Title: Clearly label each position you’ve held.

- Company Name and Location: Include the name of the employer and where it is located.

- Dates of Employment: Use month and year format for clarity.

- Bullet Points: Describe your responsibilities and achievements using bullet points. Start each bullet with action verbs and quantify your accomplishments when possible (e.g., “Increased loan origination by 25% through effective networking and client relationship management.”).

- Focus on relevant experience that demonstrates your expertise in the mortgage industry, such as loan processing, customer consultations, and compliance adherence.

Education

- Degree: List your highest degree first (e.g., Bachelor’s in Finance).

- Institution Name and Location: Include the name of the college or university and its location.

- Graduation Date: Format as month and year.

- You may also include relevant coursework or honors if they relate to the mortgage industry.

Skills

- Highlight both hard and soft skills relevant to a Mortgage Loan Officer. Examples include:

- Knowledge of mortgage products and regulations

- Proficient in loan origination software

- Excellent communication and negotiation skills

- Customer service excellence

- Analytical skills for assessing creditworthiness

Certifications

- List any relevant certifications, such as:

- NMLS License

- Mortgage Loan Originator Certification

- Continuing education courses related to mortgage lending

- Include the date of certification and the certifying body.

Tips for Choosing the Right Format

- Reverse Chronological Format: This is generally the best format for a Mortgage Loan Officer, as it emphasizes work experience and career progression.

- Consistency: Use the same font, size, and formatting throughout the resume for a clean look.

- White Space: Utilize white space effectively to avoid clutter and improve readability.

Complementing Your Cover Letter

- Ensure your resume and cover letter have a consistent look and feel. Use the same header for both documents, including your contact information.

- Tailor your cover letter to elaborate on points made in your resume, providing context and showcasing your enthusiasm for the role.

- Use similar language and terminology in both documents to reinforce your brand and professionalism.

By following this structured approach, you’ll create a strong resume that effectively showcases your qualifications as a Mortgage Loan Officer, making a compelling case to potential employers.

Writing Tips and Best Practices for a Mortgage Loan Officer Resume

When crafting a resume as a Mortgage Loan Officer, it's crucial to present your skills and experiences in a clear and impactful way. Highlight your ability to navigate complex financial landscapes, build client relationships, and close deals efficiently. Use a clean, professional layout to ensure readability, and remember that your resume is often the first impression you’ll make. To enhance your application, consider the following tips:

- Use Action Verbs: Start each bullet point with strong action verbs like "facilitated," "negotiated," or "analyzed" to demonstrate your proactive approach.

- Quantify Achievements: Whenever possible, include numbers to showcase your success, such as "closed $5 million in loans in 2022" or "increased client base by 30%."

- Incorporate Industry-Specific Keywords: Tailor your resume to include relevant terminology such as "loan origination," "credit analysis," and "underwriting" to pass through applicant tracking systems.

- Highlight Certifications and Licenses: Make sure to prominently display any relevant licenses (e.g., NMLS) and certifications that bolster your credibility.

- Focus on Client Relationships: Emphasize your interpersonal skills and how you've built a loyal client base through excellent service.

- Showcase Continuous Learning: Mention any courses or training you've completed, especially those related to mortgage products, compliance, and market trends.

- Customize for Each Application: Tailor your resume to each job description, ensuring that the skills and experiences listed align with the specific requirements of the role.

- Professional Look: Utilize resume writing tips to ensure a polished and professional appearance that reflects your attention to detail.

As you draft your resume, also consider how these practices can enhance your cover letter, creating a cohesive and compelling application package.

Common Mistakes to Avoid in a Mortgage Loan Officer Resume

Crafting a compelling resume is crucial for a Mortgage Loan Officer aiming to stand out in a competitive job market. However, many applicants make common mistakes that can detract from their qualifications and experiences. By avoiding these pitfalls, you can ensure that your resume effectively showcases your expertise and value to potential employers.

- Overloading the resume with unnecessary information

- Using generic job descriptions that lack specificity

- Failing to quantify achievements or contributions

- Ignoring the importance of formatting and organization

- Including irrelevant work experience or skills

- Neglecting to tailor the resume for each job application

- Using jargon or technical terms that may confuse hiring managers

- Forgetting to proofread for grammatical and spelling errors

- Not highlighting relevant certifications or licenses

- Using an unprofessional email address

To enhance your chances of success, consider reviewing the common mistakes to avoid in a resume. Additionally, it’s essential to pay attention to your cover letter as well; exploring the common cover letter mistakes can further improve your job application package.

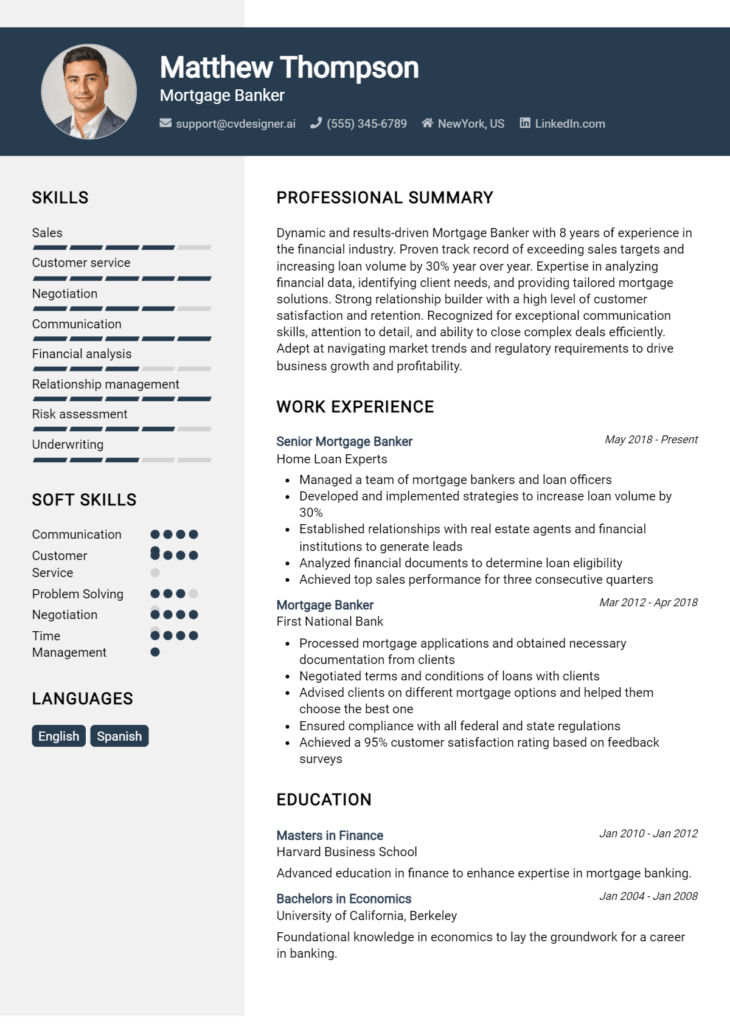

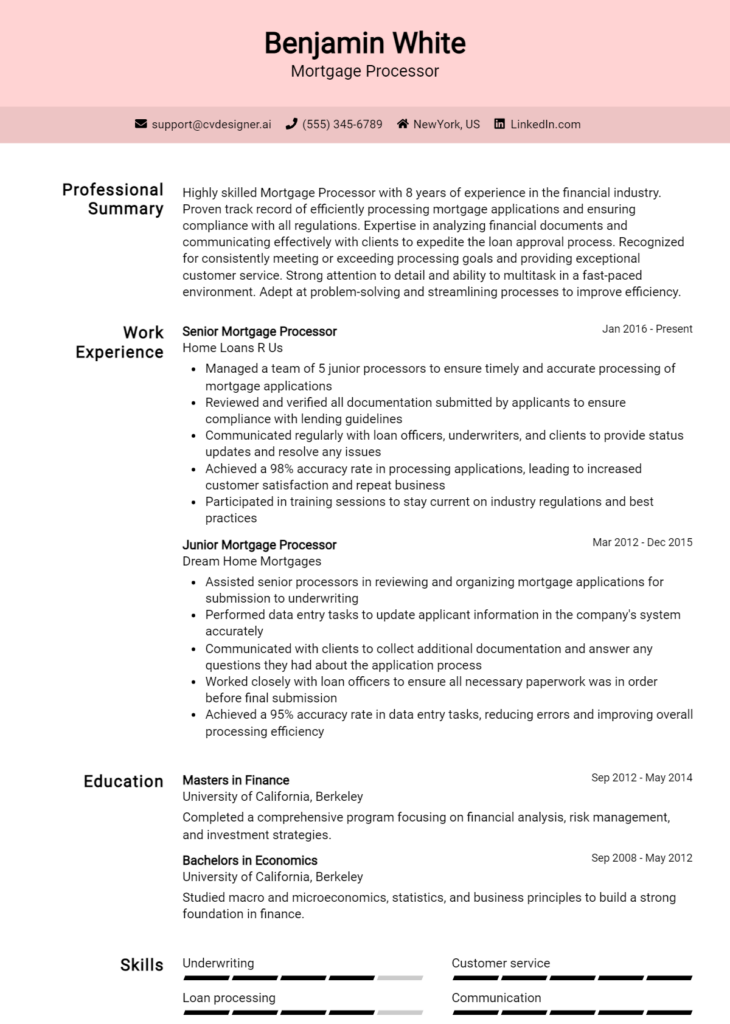

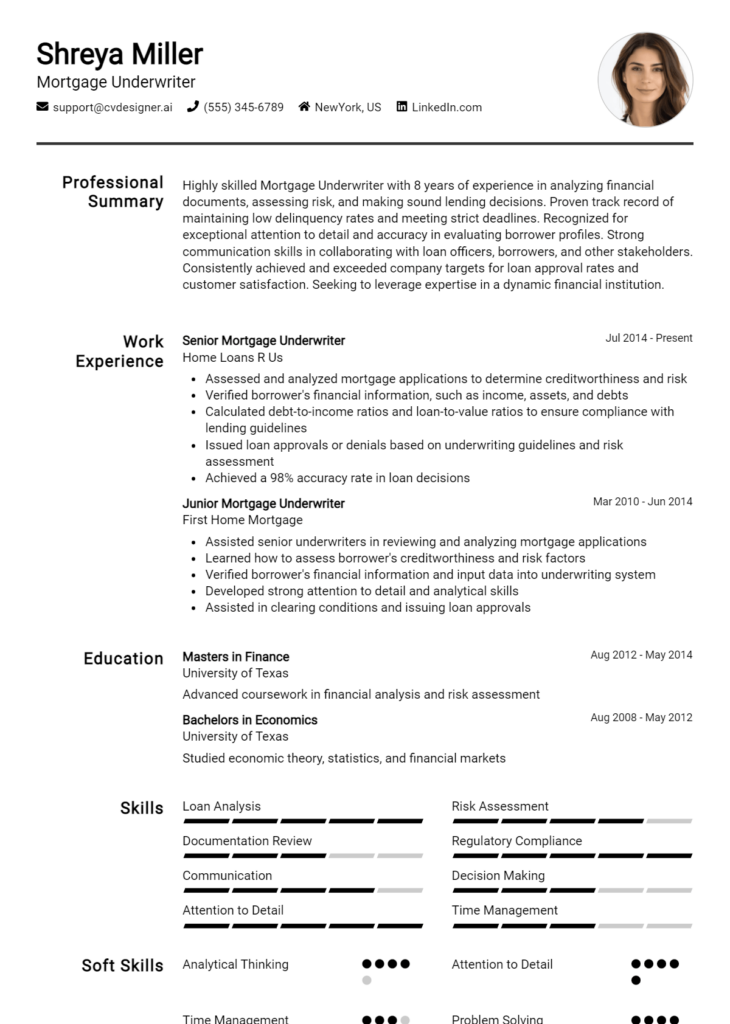

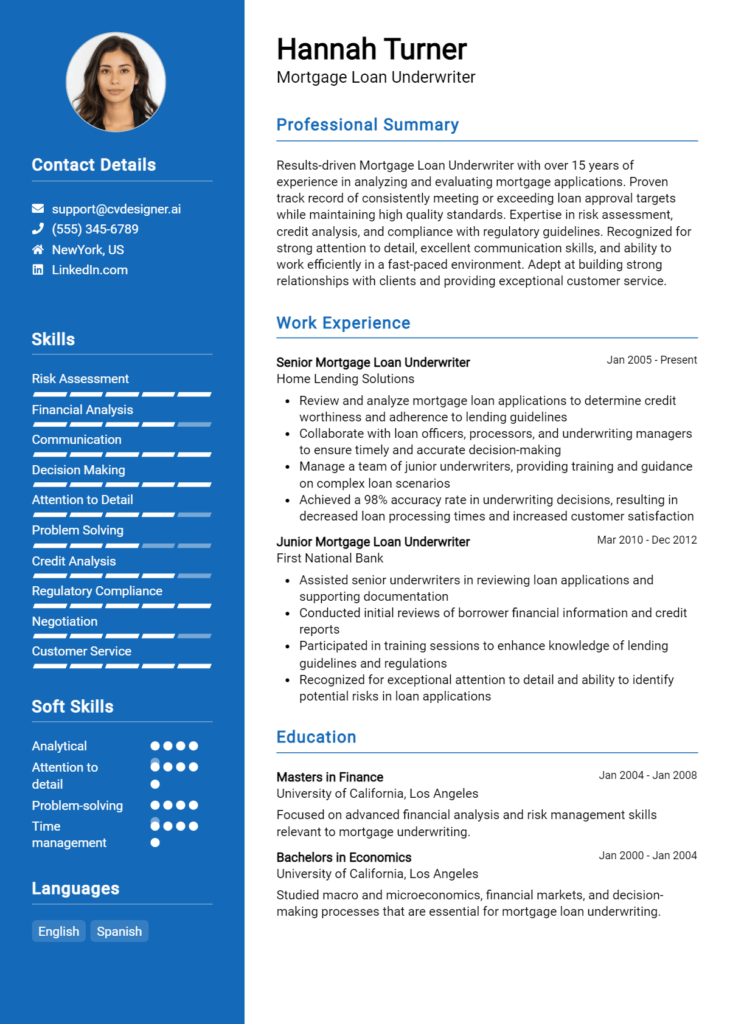

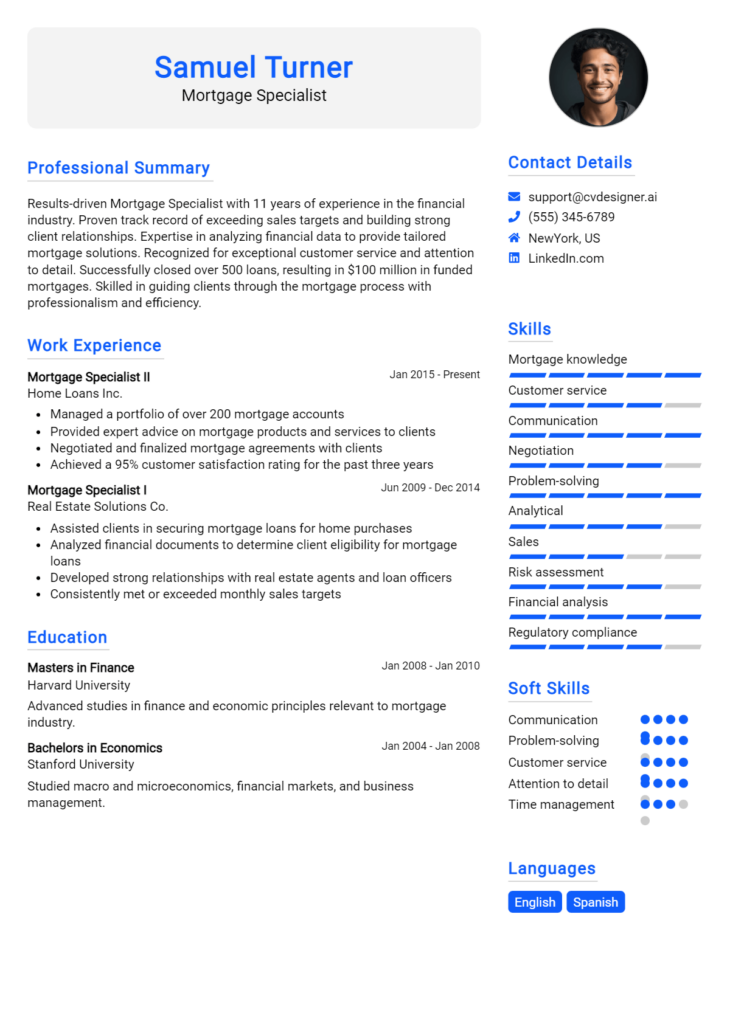

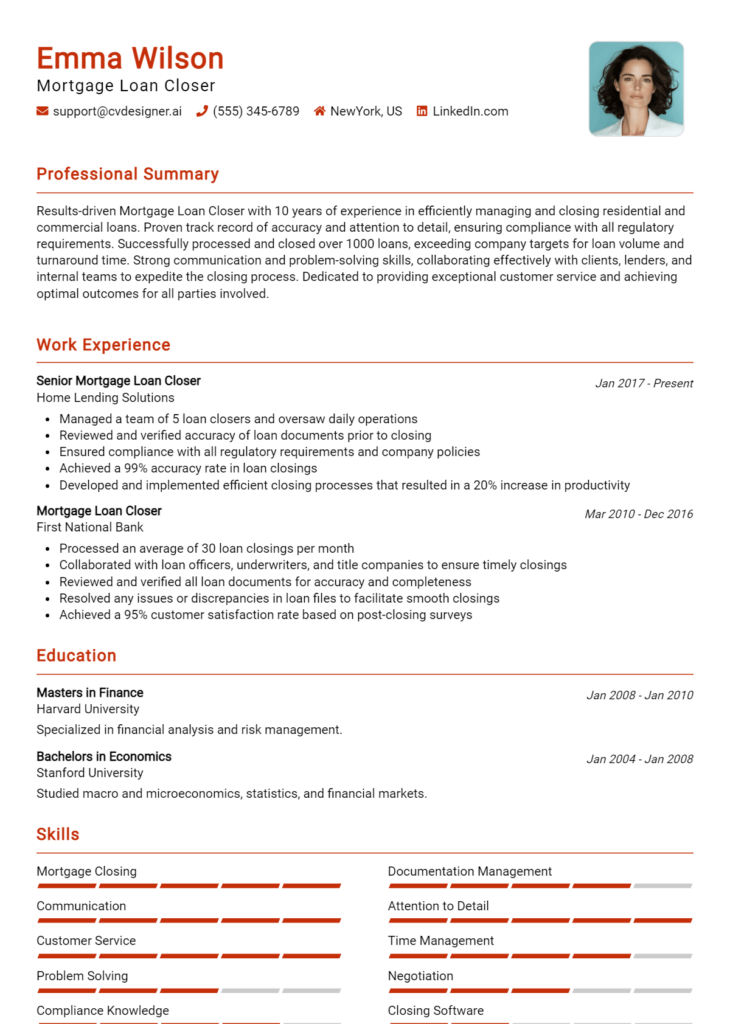

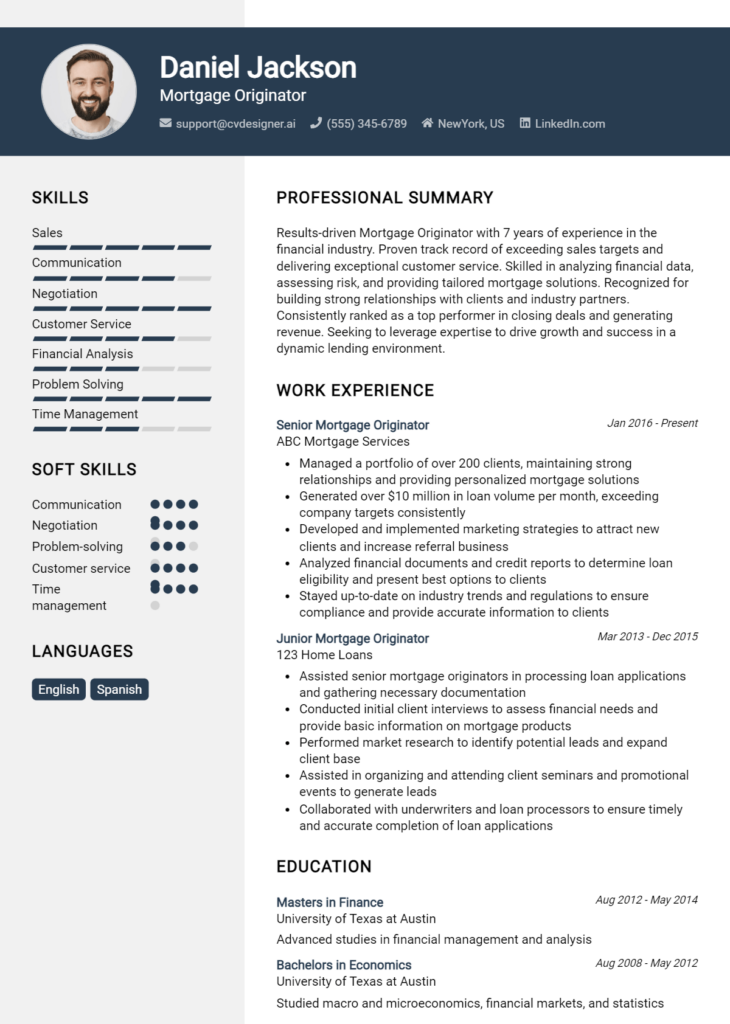

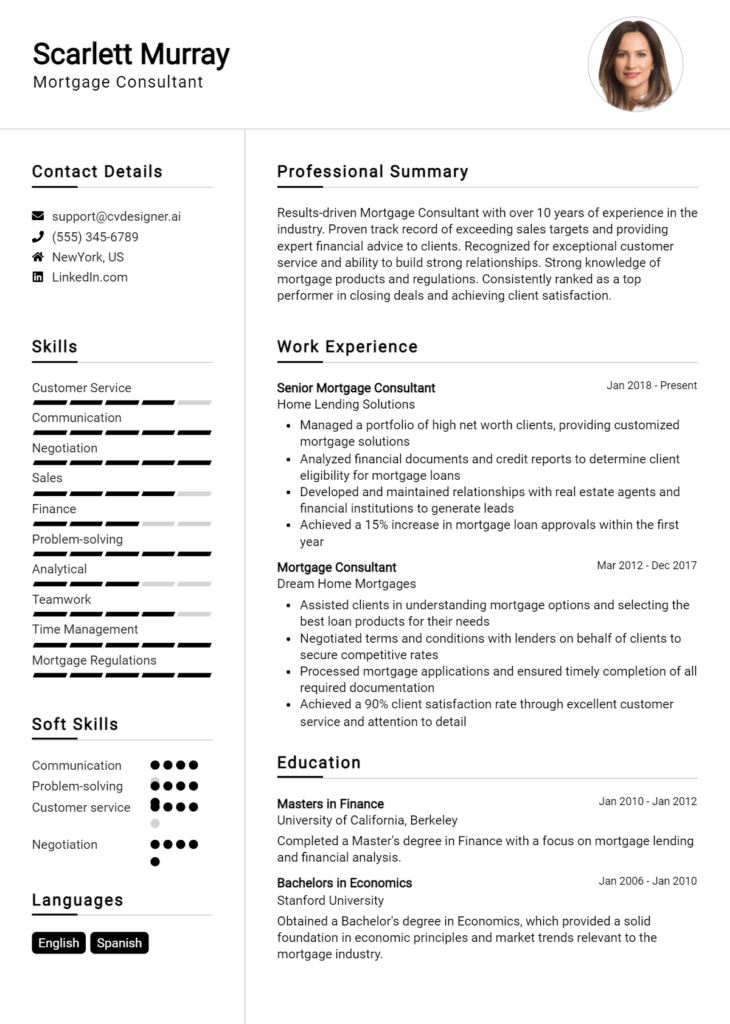

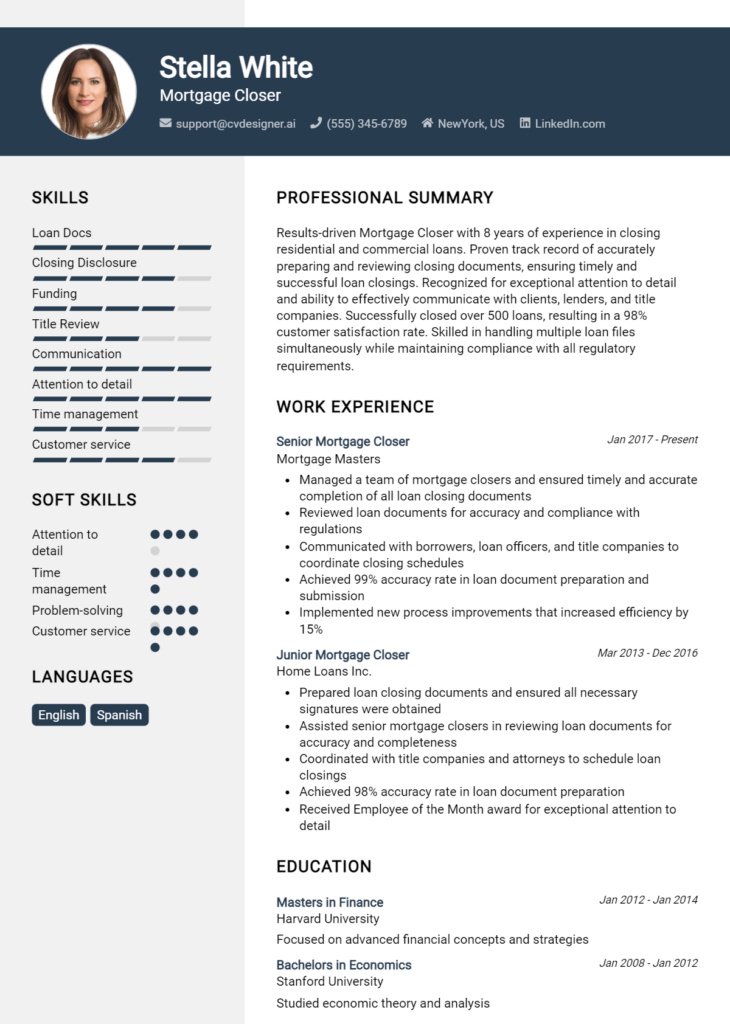

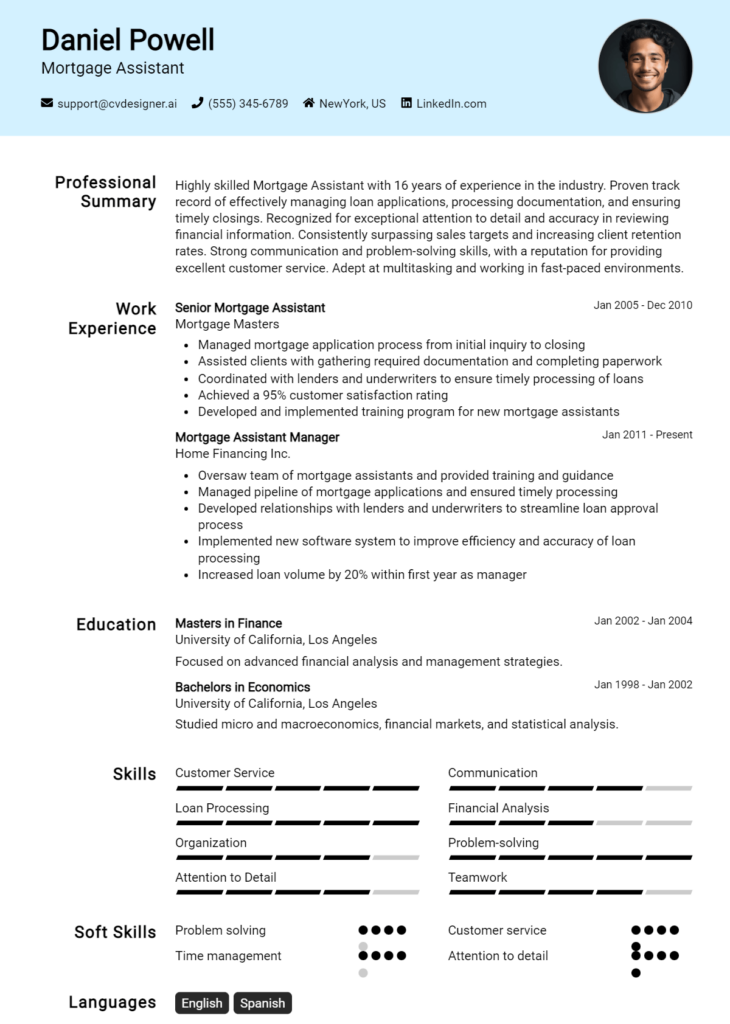

Sample Mortgage Loan Officer Resumes

As a Mortgage Loan Officer, crafting a compelling resume is crucial to stand out in a competitive job market. Below are three sample resumes tailored to different levels of experience and career backgrounds: one for an experienced professional, one for an entry-level candidate, and one for a career changer. These examples can serve as a guide to help you showcase your skills and qualifications effectively.

Experienced Mortgage Loan Officer Resume

John Smith

(123) 456-7890

john.smith@email.com

123 Main St, Anytown, USA

Professional Summary

Results-driven Mortgage Loan Officer with over 10 years of experience in residential and commercial lending. Proven track record of closing loans efficiently while maintaining high customer satisfaction. Expert in analyzing applicants' financial situations and recommending suitable mortgage products.

Professional Experience

Senior Mortgage Loan Officer

ABC Mortgage Company, Anytown, USA

June 2015 – Present

- Managed a portfolio of over 200 clients, ensuring a seamless loan application process from start to finish.

- Achieved 120% of sales targets for three consecutive years through exceptional client service and relationship management.

- Conducted comprehensive financial assessments to recommend tailored mortgage solutions.

Mortgage Loan Officer

XYZ Lending Group, Anytown, USA

January 2010 – May 2015

- Processed and closed an average of 30 loans per month, specializing in FHA and VA loans.

- Developed and maintained relationships with real estate agents and financial institutions to generate new business leads.

- Trained junior loan officers on company policies and best practices in mortgage lending.

Education

Bachelor of Science in Finance

University of Anytown, Anytown, USA

Graduated May 2009

Certifications

- NMLS Licensed Mortgage Loan Originator

- Certified Mortgage Planning Specialist (CMPS)

Entry-Level Mortgage Loan Officer Resume

Emily Johnson

(987) 654-3210

emily.johnson@email.com

456 Elm St, Anytown, USA

Professional Summary

Dedicated and detail-oriented recent graduate seeking an entry-level Mortgage Loan Officer position. Strong analytical skills and a passion for helping clients achieve their homeownership goals. Eager to apply my knowledge of finance and customer service in a dynamic lending environment.

Education

Bachelor of Business Administration

University of Anytown, Anytown, USA

Graduated May 2023

Internship Experience

Loan Officer Intern

123 Mortgage Solutions, Anytown, USA

January 2023 – May 2023

- Assisted senior loan officers in processing loan applications, conducting credit checks, and preparing documentation.

- Communicated with clients to gather necessary financial information and provide updates on their application status.

- Participated in training sessions to learn about mortgage products and compliance regulations.

Skills

- Strong analytical and numerical skills

- Excellent communication and interpersonal abilities

- Proficient in MS Office and loan origination software

Career Changer Mortgage Loan Officer Resume

Michael Brown

(555) 123-4567

michael.brown@email.com

789 Oak St, Anytown, USA

Professional Summary

Motivated professional transitioning from a successful career in sales to mortgage lending. Bringing over 5 years of experience in client relationship management and a strong understanding of financial products. Committed to leveraging my skills to assist clients in navigating the mortgage process.

Professional Experience

Sales Manager

XYZ Corporation, Anytown, USA

March 2018 – Present

- Led a team of 10 sales representatives, achieving a 30% increase in annual sales through targeted marketing strategies.

- Developed strong client relationships, ensuring high levels of customer satisfaction and repeat business.

- Analyzed market trends to identify new business opportunities and optimize sales performance.

Customer Service Representative

ABC Retail, Anytown, USA

June 2015 – February 2018

- Provided exceptional customer service by addressing inquiries and resolving issues in a timely manner.

- Assisted customers in selecting products that met their needs, demonstrating strong product knowledge.

Education

Bachelor of Arts in Business Administration

University of Anytown, Anytown, USA

Graduated May 2015

Skills

- Strong negotiation and closing skills

- Ability to analyze financial data

- Experience with CRM software

For more inspiration, consider exploring additional resume templates. Additionally, you can find helpful cover letter examples to complement your resume and create a complete job application package.

Checklist for a Mortgage Loan Officer Resume

- Proofread for Errors: Carefully review your resume for spelling, grammar, and punctuation mistakes. Even minor errors can create a negative impression.

- Consistency in Formatting: Ensure that font styles, sizes, and bullet points are consistent throughout the document. This includes alignment, spacing, and headings.

- Tailor Your Resume: Customize your resume for each job application by aligning your skills and experiences with the specific requirements of the Mortgage Loan Officer position.

- Highlight Relevant Experience: Clearly emphasize your experience in mortgage lending, customer service, and any other relevant roles to demonstrate your suitability for the position.

- Quantify Achievements: Use numbers and metrics to showcase your successes, such as the number of loans processed or closed, to give potential employers a clear picture of your capabilities.

- Include Key Skills: Make sure to list relevant skills such as knowledge of loan products, financial analysis, and excellent communication abilities.

- Professional Summary: Write a compelling summary at the top of your resume that encapsulates your experience and what you can bring to the role.

- Check Contact Information: Double-check that your contact details (phone number, email address) are correct and up to date, ensuring potential employers can easily reach you.

- Use an AI Resume Builder: Consider using an AI resume builder to help organize your resume effectively and ensure all elements are well-structured.

- Replicate for Other Documents: Remember that a similar checklist can be beneficial when creating a CV or cover letter, ensuring your entire application package is polished and professional.

Key Takeaways for a Mortgage Loan Officer Resume Guide

In conclusion, crafting a strong resume as a Mortgage Loan Officer requires careful attention to detail and a clear presentation of your skills and experiences. By utilizing the examples and tips provided in this guide, you can create a compelling resume that effectively showcases your qualifications and sets you apart from the competition. As a next step, we encourage you to download a customizable template from our resume templates section, or explore our cover letter templates to ensure your application is well-rounded. Additionally, consider using our best resume maker to simplify the process of creating a polished, professional document. Remember, following similar guidelines will not only assist you in crafting an impressive resume but also in developing a standout CV and a persuasive cover letter. Take these steps to enhance your job application and increase your chances of securing that desired Mortgage Loan Officer position.