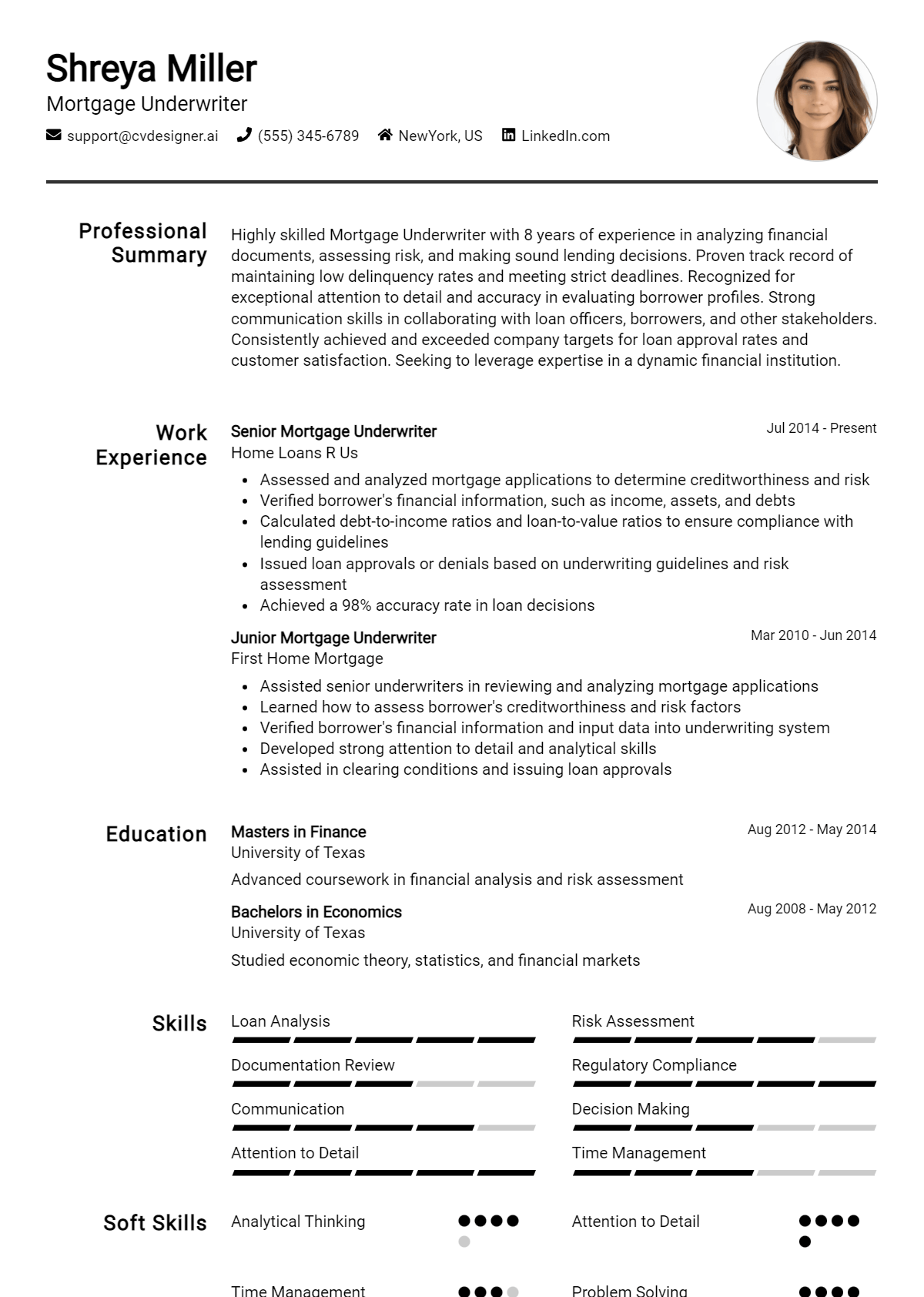

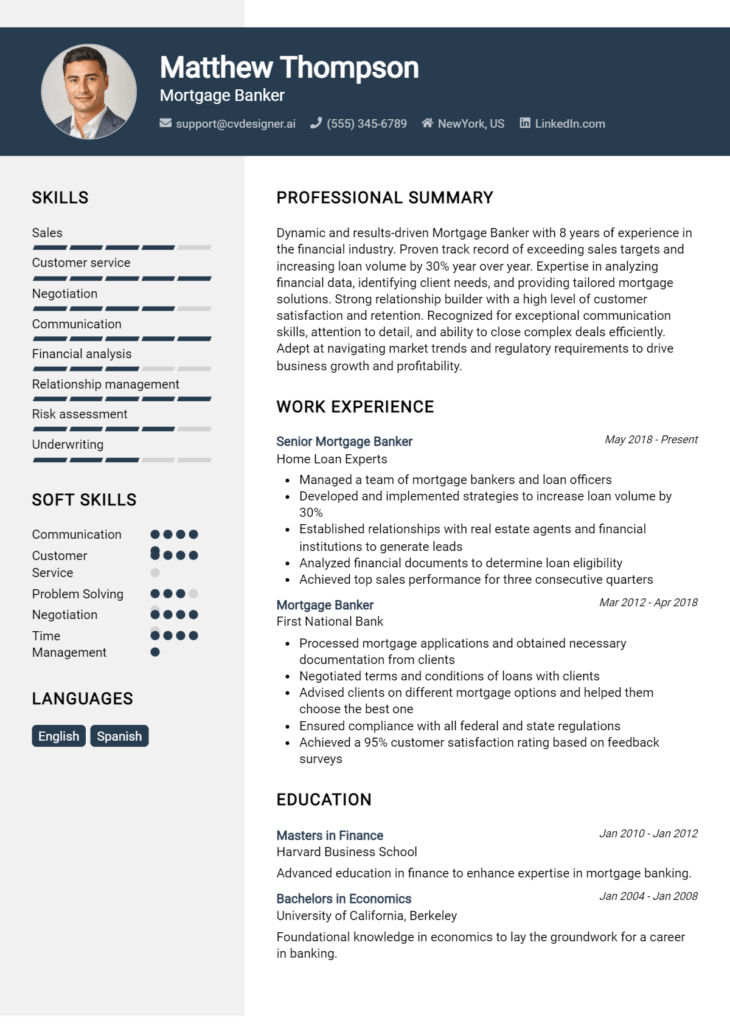

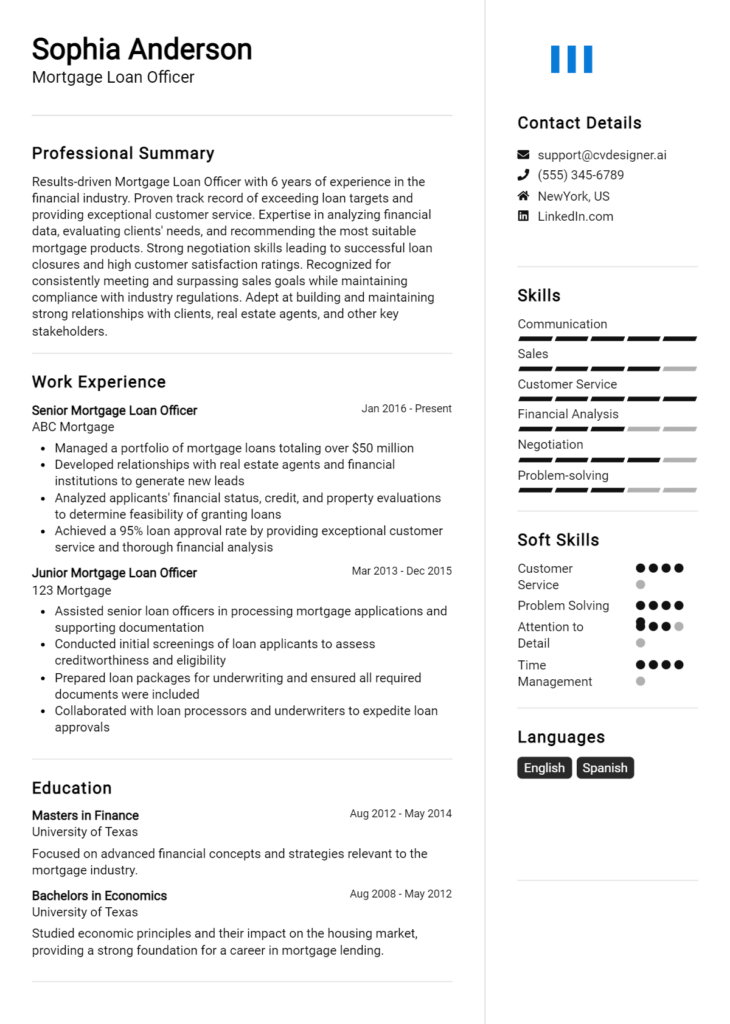

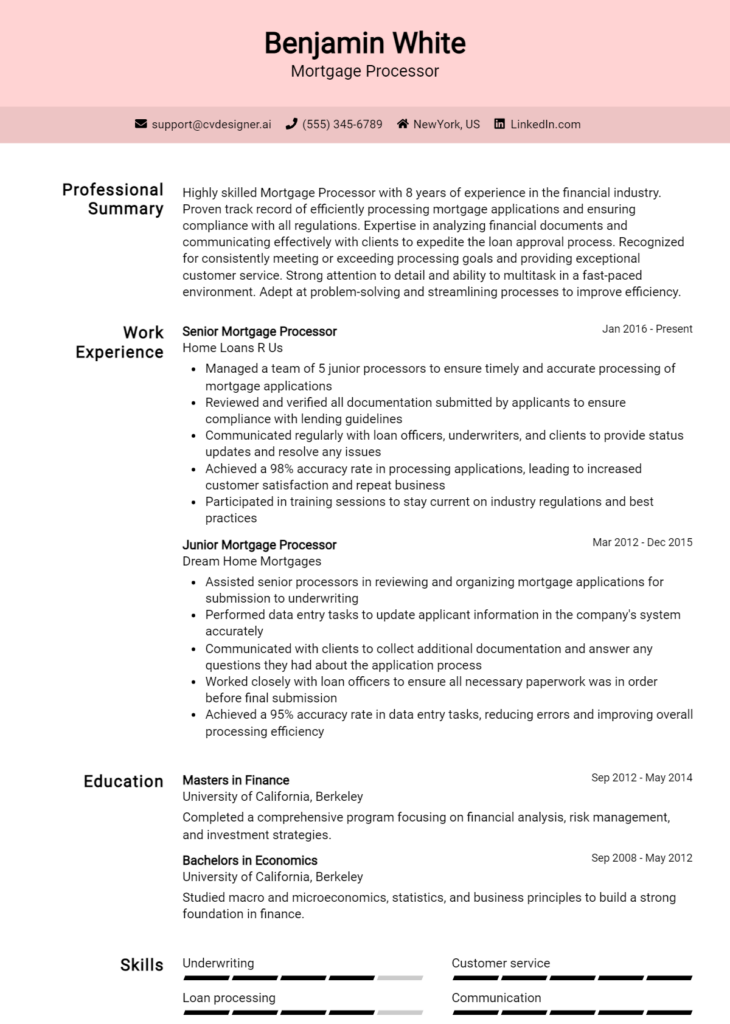

Most Popular Mortgage Underwriter Resume Examples

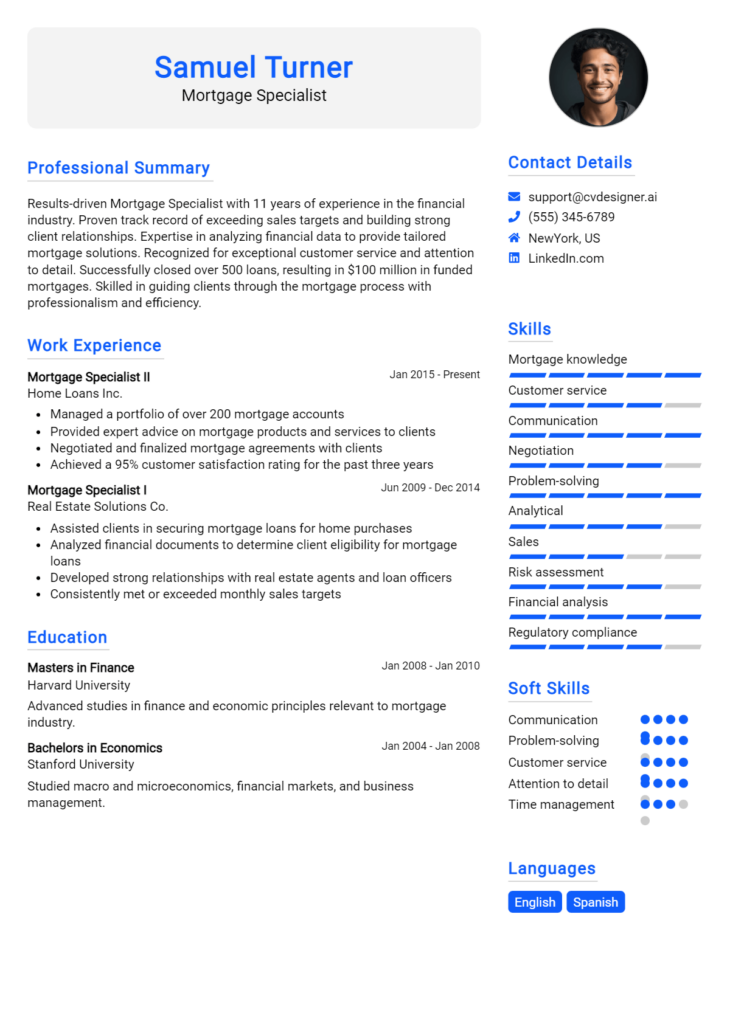

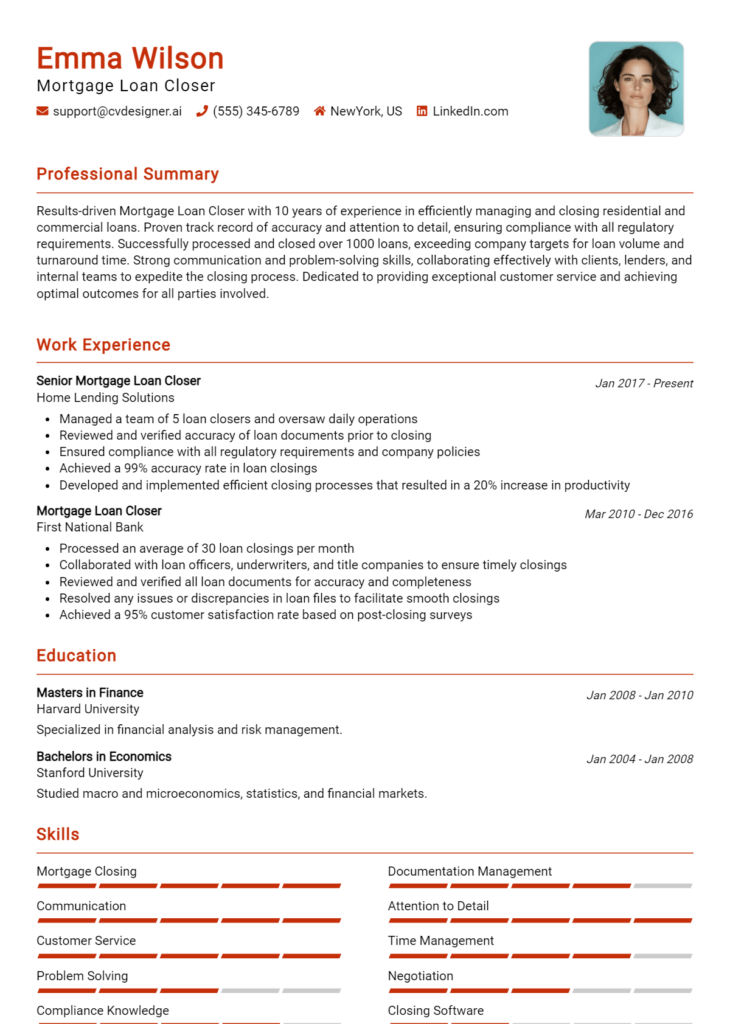

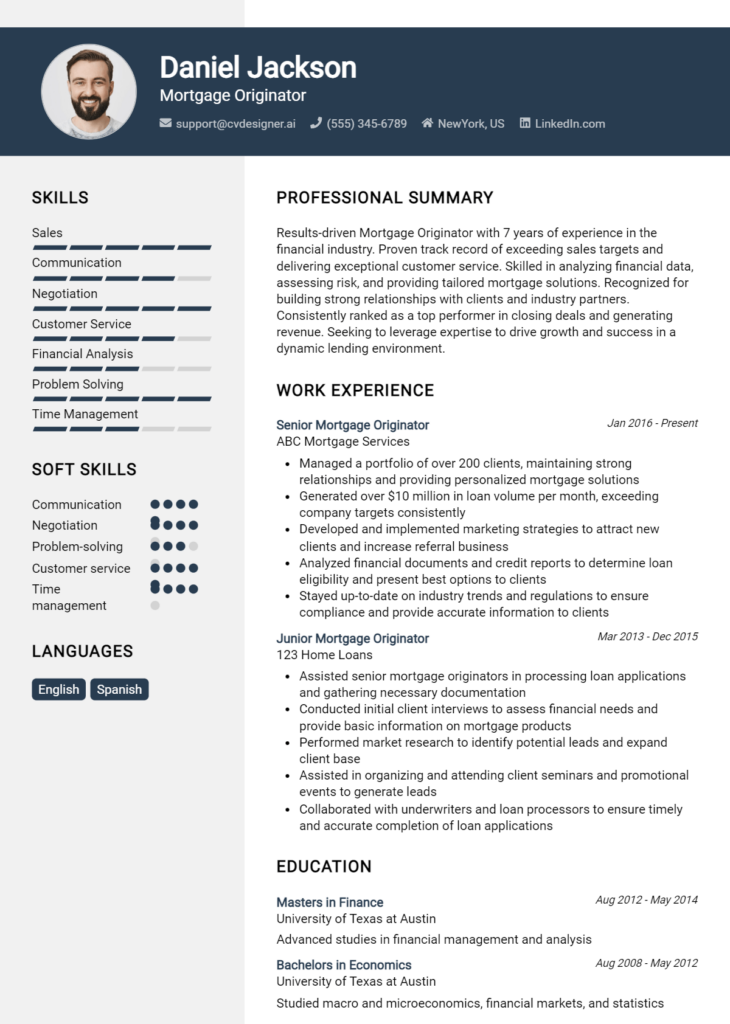

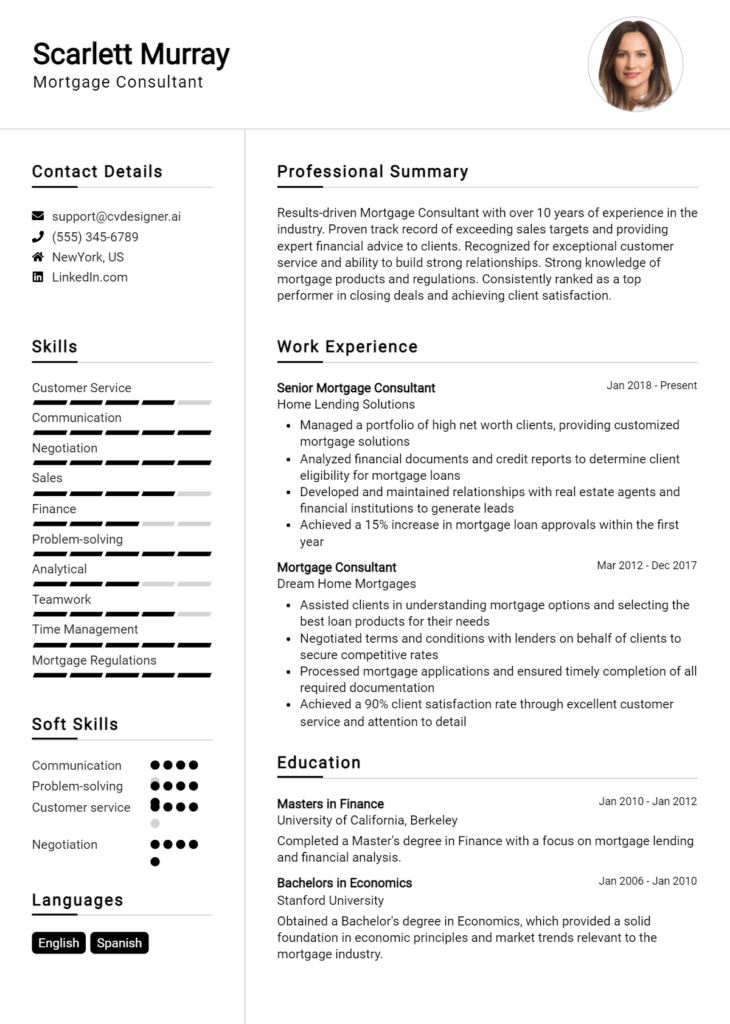

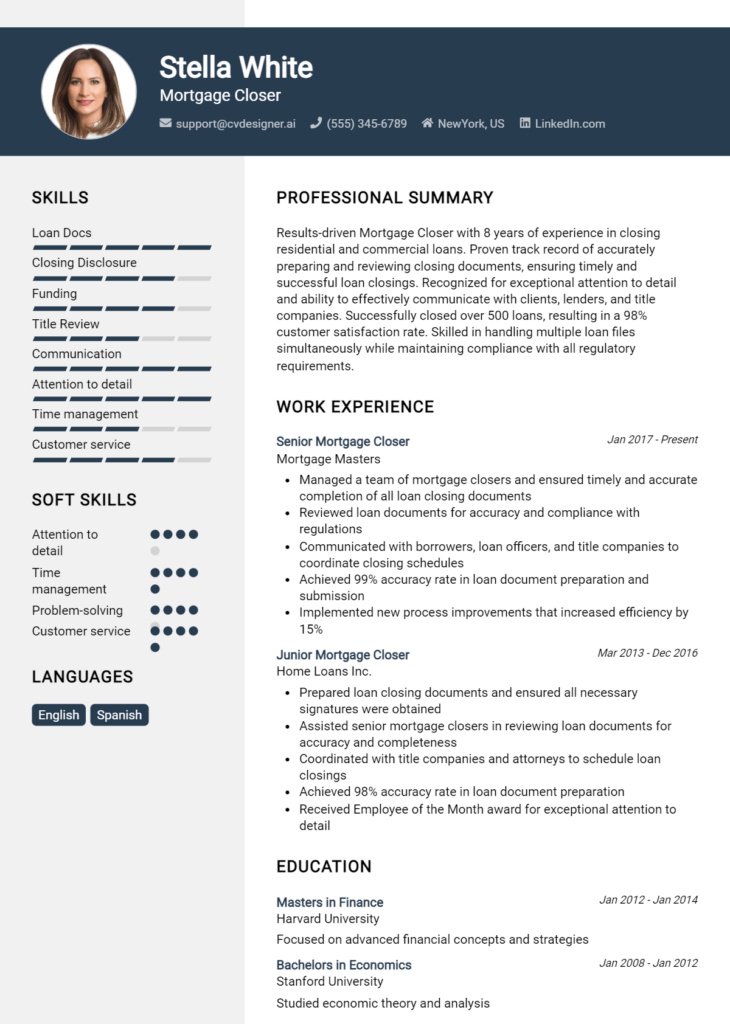

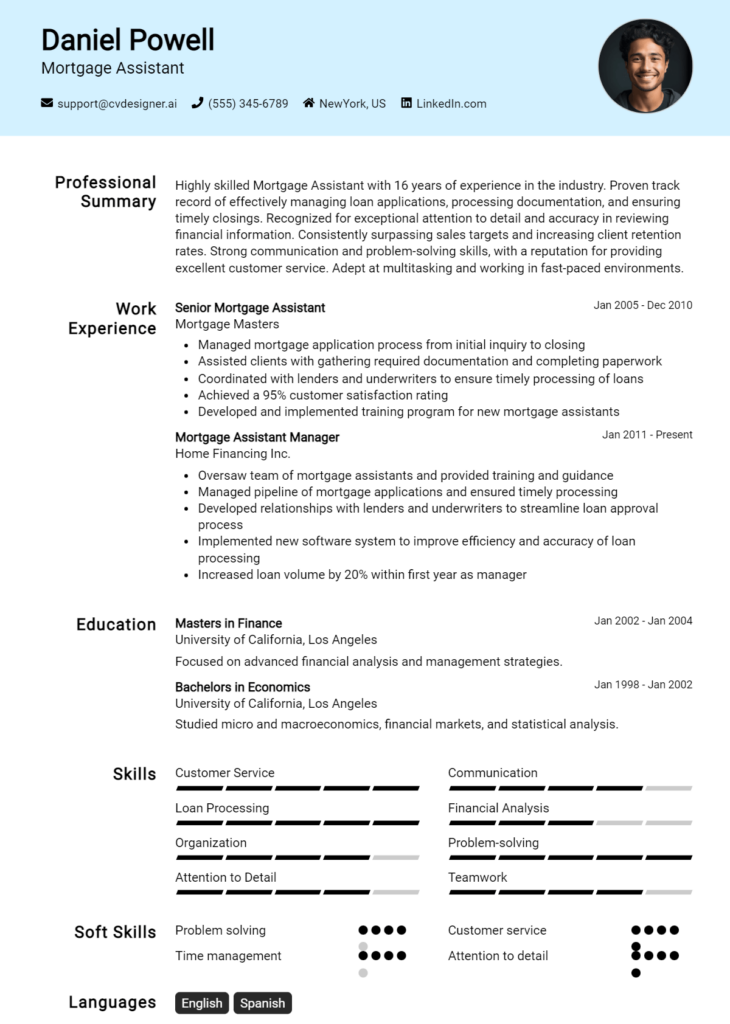

Explore additional Mortgage Underwriter resume samples and guides and see what works for your level of experience or role.

As a Mortgage Underwriter, you play a crucial role in the home financing process, evaluating loan applications to determine risk factors and ensuring that lenders make informed decisions. In a competitive job market, having a well-crafted resume is essential to showcase your expertise and secure the position you desire. A strong resume not only highlights your qualifications but also reflects your understanding of the mortgage industry and your attention to detail—qualities that are vital in underwriting. This article serves as a comprehensive guide to help you craft the perfect Mortgage Underwriter resume that can set you apart from the competition.

In this guide, we will explore the key responsibilities and skills that mortgage underwriters should emphasize in their resumes. You'll discover the best resume format to make your application stand out, as well as common mistakes to avoid that could hinder your chances of landing an interview. We will provide resume examples tailored for all experience levels, from entry-level to seasoned professionals. Additionally, we’ll share valuable tips on effective resume writing and guide you in selecting the right resume templates that align with your career objectives. Whether you’re entering the field or looking to advance your career, this guide will equip you with the knowledge you need to create a compelling resume that resonates with hiring managers.

Key Responsibilities and Skills for a Mortgage Underwriter

Mortgage Underwriters play a crucial role in the lending process by assessing and evaluating loan applications to determine the risk associated with lending. Their primary responsibility is to ensure that all mortgage applications comply with company policies and regulatory standards while also analyzing borrowers' financial histories to make informed decisions.

Key Responsibilities:

- Review and analyze loan applications and supporting documentation.

- Assess borrower creditworthiness by evaluating credit reports, income documentation, and employment history.

- Determine property value through the appraisal process to ensure it meets lending criteria.

- Ensure compliance with federal and state regulations as well as internal policies.

- Communicate with loan officers, borrowers, and other stakeholders to clarify documentation or resolve issues.

- Make informed decisions to approve, deny, or request additional information for loan applications.

Essential Skills:

- Strong analytical skills to assess financial data and risk factors.

- Attention to detail for reviewing complex financial documents and ensuring accuracy.

- Knowledge of mortgage underwriting guidelines and regulatory requirements.

- Excellent communication skills to convey decisions and rationale clearly.

- Problem-solving abilities to address potential issues in loan applications.

- Proficiency in using underwriting software and financial analysis tools.

Highlighting these skills effectively in the resume skills section is vital for prospective candidates. Tailoring the responsibilities and skills to the specific job description can significantly enhance your chances of standing out to employers. Furthermore, consider how these skills can be reflected in your CV, showcasing relevant experiences and achievements that demonstrate your capability as a Mortgage Underwriter. A well-crafted CV can effectively communicate your qualifications and align with the needs of hiring managers in the mortgage industry.

Best Resume Format and Structure for a Mortgage Underwriter

When crafting a resume for a Mortgage Underwriter position, it's crucial to select a format that highlights your qualifications, experience, and skills effectively. Here’s a detailed guide on the best resume format and structure:

Contact Information

Begin with your name prominently displayed at the top, followed by your phone number, email address, and LinkedIn profile or professional website if applicable. Ensure that your email address is professional.

Professional Summary

This section should be a brief, impactful paragraph summarizing your experience, skills, and what you can bring to the role. Tailor it to the specific job you are applying for, emphasizing your expertise in risk assessment, financial analysis, and compliance with lending regulations.

Work Experience

List your work history in reverse chronological order, starting with your most recent position. For each job, include the following:

- Job Title

- Company Name

- Location (City, State)

- Dates of Employment (Month/Year format)

Under each position, use bullet points to outline your responsibilities and achievements. Focus on quantifiable results, such as:

- "Reviewed and approved over $1 million in mortgage applications monthly."

- "Reduced underwriting errors by 15% through meticulous attention to detail and adherence to compliance standards."

Education

Include your highest degree first, followed by any relevant certifications or coursework. List the degree obtained, the institution's name, and the graduation date. If you have certifications such as the Certified Mortgage Underwriter (CMU) or other relevant designations, place these prominently in this section or create a separate Certifications section.

Skills

Create a skills section that highlights both hard and soft skills relevant to mortgage underwriting. Examples include:

- Risk assessment and analysis

- Knowledge of loan products and compliance regulations

- Strong attention to detail

- Excellent communication skills

- Proficiency in underwriting software and tools

Certifications

If not included in the Education section, list any relevant certifications you hold here. This could include licenses or training specific to mortgage underwriting, which can give you a competitive edge.

Tips for Formatting Your Resume:

- Use a Clean Layout: Choose a professional font (e.g., Arial, Calibri) and maintain consistent formatting throughout. Use headings and bullet points for clarity.

- Keep It Concise: Limit your resume to one page unless you have extensive experience relevant to the position.

- Tailor Your Content: Customize your resume for each application by incorporating keywords from the job description. This can help in passing through applicant tracking systems (ATS).

- Proofread: Ensure there are no typos or grammatical errors, as attention to detail is crucial in underwriting roles.

A well-structured resume can be complemented by a corresponding cover letter that highlights your passion for the mortgage industry and provides context for your experiences. Use a similar format for the cover letter to maintain consistency. Start with your contact information at the top, followed by a greeting, and then create a compelling narrative about your qualifications. End with a strong closing statement that encourages further discussion about your fit for the role.

By following this guide, you can create a professional and impactful resume that effectively showcases your qualifications as a Mortgage Underwriter.

Writing Tips and Best Practices for a Mortgage Underwriter Resume

Creating a compelling resume as a Mortgage Underwriter requires a strategic approach that highlights your skills, experience, and accomplishments in a concise manner. Begin by tailoring your resume to the specific job you’re applying for; this means incorporating relevant industry-specific keywords that align with the job description. Use action verbs to start each bullet point, showcasing your contributions and responsibilities in previous roles. Quantifying your achievements can make a significant impact, as numbers provide concrete evidence of your capabilities. Also, ensure your resume maintains a professional look by utilizing resume writing tips. Remember, these writing practices are equally important when drafting your cover letter, allowing you to present a cohesive narrative about your qualifications.

- Use strong action verbs such as "analyzed," "evaluated," and "approved" to convey your impact in previous roles.

- Quantify your achievements whenever possible, such as the number of loans underwritten or the percentage of loans approved.

- Incorporate industry-specific keywords like "risk assessment," "credit analysis," and "loan regulations" to pass through applicant tracking systems (ATS).

- Highlight relevant certifications, such as the Certified Mortgage Underwriter (CMU) designation, to bolster your credibility.

- Keep your resume format clean and organized, utilizing bullet points for easy readability.

- Tailor your resume for each job application by emphasizing the most relevant experience and skills.

- Include a summary statement at the top that encapsulates your experience and value proposition as a Mortgage Underwriter.

- Proofread your resume to eliminate any grammatical errors or typos, ensuring professionalism throughout.

Common Mistakes to Avoid in a Mortgage Underwriter Resume

Crafting a resume for a Mortgage Underwriter position requires a keen understanding of the skills and qualifications necessary for the role. However, many candidates make common mistakes that can hinder their chances of landing an interview. By avoiding these pitfalls, you can create a more compelling and effective resume that showcases your expertise and professionalism. Here are some common mistakes to steer clear of:

- Overloading the resume with excessive information, making it cluttered and hard to read.

- Using generic descriptions that fail to highlight specific skills or accomplishments relevant to mortgage underwriting.

- Neglecting to tailor the resume to the job description, missing key qualifications or keywords.

- Failing to quantify achievements, such as the number of loans processed or the percentage of loan approvals.

- Using jargon or technical terms without explanation, which may confuse hiring managers not familiar with the terminology.

- Ignoring formatting consistency, such as font size, style, and spacing, which can make the document appear unprofessional.

- Omitting relevant certifications or licenses, which are crucial in the mortgage industry.

- Listing duties instead of accomplishments, which undermines the impact of your experience.

- Not including a summary statement that encapsulates your qualifications and career goals.

- Failing to proofread for spelling and grammatical errors, which can detract from your professionalism.

To further enhance your application, consider reviewing the common mistakes to avoid in a resume and ensure your cover letter is equally polished by avoiding the common cover letter mistakes. Attention to detail in both documents can significantly improve your chances of standing out in a competitive job market.

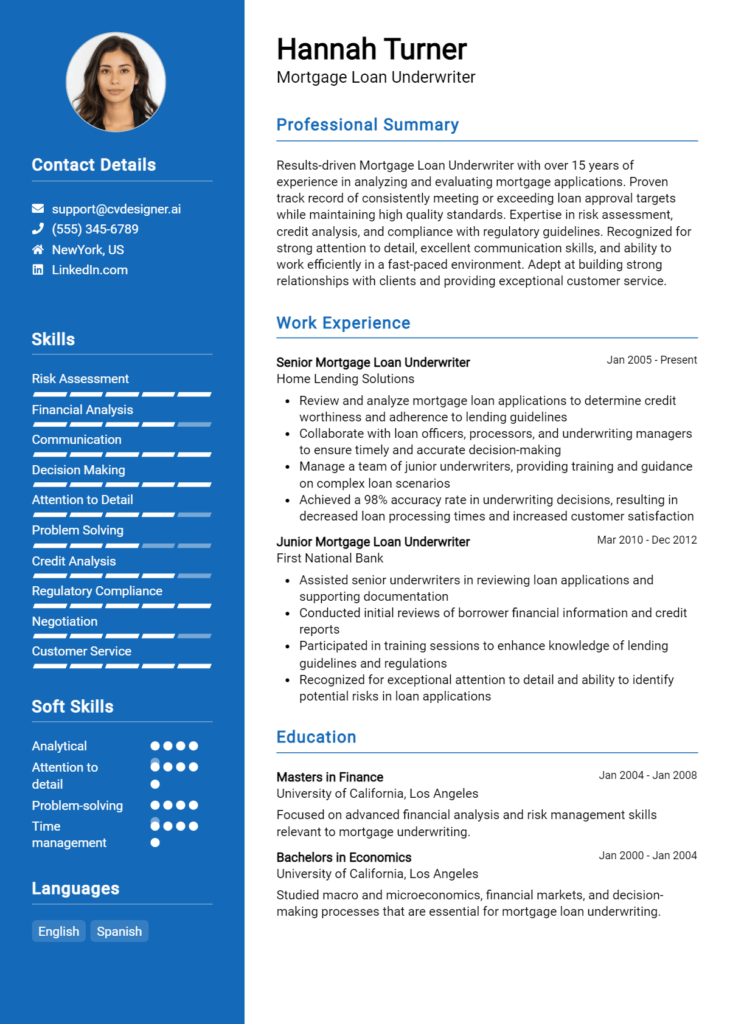

Sample Mortgage Underwriter Resumes

Mortgage Underwriters play a critical role in the home financing process, assessing the creditworthiness of applicants and ensuring that loans meet all necessary guidelines. Crafting an effective resume is essential for standing out in this competitive field. Below are three sample resumes that represent a range of experience levels and career paths: one for an experienced professional, one for an entry-level candidate, and one for someone transitioning from a different career.

Experienced Mortgage Underwriter Resume

Jane Smith

123 Home St.

Cityville, ST 12345

(123) 456-7890

jane.smith@email.com

Professional Summary

Detail-oriented Mortgage Underwriter with over 8 years of experience in evaluating loan applications and financial documents to assess risk and ensure compliance with lending standards. Proven track record of reducing turnaround times and increasing loan approval rates. Strong analytical skills and a commitment to customer service.

Professional Experience

Senior Mortgage Underwriter

ABC Lending Company, Cityville, ST

June 2017 – Present

- Evaluate and underwrite residential mortgage loans, ensuring compliance with company policies and regulatory requirements.

- Analyze borrowers' financial data, credit reports, and property appraisals to determine loan eligibility.

- Collaborate with loan officers and processors to address issues and streamline the underwriting process, leading to a 15% increase in approval rates.

- Mentor junior underwriters and provide training on underwriting guidelines and best practices.

Mortgage Underwriter

XYZ Financial Services, Cityville, ST

March 2015 – May 2017

- Reviewed and processed a high volume of loan applications while maintaining strict adherence to company policies.

- Conducted thorough risk assessments and made informed decisions on loan approvals or denials.

- Assisted in developing underwriting policies that improved efficiency and reduced errors by 20%.

Education

Bachelor of Science in Finance

University of Cityville, Cityville, ST

Graduated May 2014

Entry-Level Mortgage Underwriter Resume

Mark Johnson

456 Loan Rd.

Townsville, ST 67890

(987) 654-3210

mark.johnson@email.com

Professional Summary

Motivated and detail-oriented recent graduate with a degree in Finance seeking to start a career as a Mortgage Underwriter. Strong analytical skills and a foundational understanding of mortgage lending processes. Eager to learn and contribute to a dynamic underwriting team.

Education

Bachelor of Science in Finance

University of Townsville, Townsville, ST

Graduated May 2023

Internship Experience

Mortgage Underwriting Intern

LMN Bank, Townsville, ST

January 2023 – April 2023

- Assisted underwriters in reviewing loan applications and verifying borrower information.

- Gained hands-on experience in analyzing credit reports and financial statements.

- Participated in team meetings to discuss risk assessments and underwriting strategies.

Relevant Coursework

- Mortgage Lending and Underwriting

- Risk Management in Banking

- Financial Analysis

Career Changer Mortgage Underwriter Resume

Angela Roberts

789 Equity Blvd.

Villagetown, ST 13579

(321) 987-6543

angela.roberts@email.com

Professional Summary

Dedicated professional with over 5 years of experience in real estate sales transitioning into mortgage underwriting. Strong understanding of the property market and client financial needs. Excellent communication and analytical skills with a focus on providing exceptional service.

Professional Experience

Real Estate Agent

Realty Experts, Villagetown, ST

March 2018 – Present

- Guided clients through the home buying process, providing insights on financing options and mortgage products.

- Developed strong relationships with lenders, enhancing knowledge of underwriting guidelines and market trends.

- Conducted market analyses to assist clients in making informed purchasing decisions.

Sales Associate

Home Goods Store, Villagetown, ST

June 2015 – February 2018

- Excelled in a customer-focused environment, achieving top sales performance through effective communication and problem-solving.

- Trained new employees in sales techniques and product knowledge, fostering a collaborative team atmosphere.

Education

Bachelor of Business Administration

Villagetown University, Villagetown, ST

Graduated May 2015

For more inspiration, explore various resume templates that can help you design a compelling resume. Additionally, consider reviewing corresponding cover letter examples to create a complete job application package.

Checklist for a Mortgage Underwriter Resume

- Proofread for Errors: Carefully read through your resume to catch any spelling, grammar, or punctuation mistakes. Consider using tools like Grammarly to assist with this task.

- Check for Consistency: Ensure that your formatting is consistent throughout the document. This includes font styles, sizes, bullet point usage, and date formats.

- Tailor to the Job Description: Customize your resume for each job application by incorporating relevant keywords and phrases from the job description. Highlight your experience and skills that align with the specific role of a Mortgage Underwriter.

- Highlight Relevant Experience: Clearly outline your previous positions and responsibilities that relate to mortgage underwriting. Use action verbs and quantifiable achievements to demonstrate your impact.

- Include Certifications and Education: Make sure to list any relevant certifications (such as FHA, VA, or USDA underwriting) and your educational background that pertain to the mortgage industry.

- Use Clear, Concise Language: Avoid jargon and overly complex language. Aim for clarity, ensuring that hiring managers can quickly grasp your qualifications and experience.

- Organize Sections Logically: Structure your resume with clear headings (e.g., Summary, Experience, Education, Skills) to make it easy for recruiters to navigate.

- Limit Length to One Page: Aim for a concise resume, ideally one page long, especially if you're early in your career. Focus on the most relevant information.

- Include Professional Contact Information: Ensure your contact details are up-to-date and professional. Include your phone number, email address, and LinkedIn profile if applicable.

- Consider Using an AI Resume Builder: To ensure all elements of your resume are well-organized and formatted correctly, consider utilizing an AI resume builder.

Remember, a similar checklist can also be applied when creating a CV or a cover letter.

Key Takeaways for a Mortgage Underwriter Resume Guide

In conclusion, creating a strong resume as a Mortgage Underwriter requires careful attention to detail and a clear presentation of your skills and experience. By utilizing the provided examples and tips, you can effectively showcase your qualifications to potential employers. We encourage you to take the next steps in your job search by downloading a professional resume template from resume templates or crafting a tailored cover letter using our cover letter templates. Additionally, you can enhance your resume with our user-friendly resume maker. Remember, following similar guidelines will also aid you in developing a compelling CV and a persuasive cover letter. Start today and take your career to the next level!