As a Private Equity Associate, you're stepping into a dynamic world where financial acumen meets strategic decision-making. This role not only demands a deep understanding of market trends and investment opportunities but also the ability to analyze potential acquisitions and drive value creation in portfolio companies. With the competitive nature of the private equity industry, having a well-crafted resume is crucial to capturing the attention of hiring managers. A compelling resume can be your ticket to not just getting an interview, but also showcasing your unique qualifications and fit for this pivotal position.

In this guide, we will cover essential aspects of crafting an outstanding Private Equity Associate resume. You'll learn about the key responsibilities and skills that employers seek in candidates, as well as the best formats to present your information effectively. We will highlight common mistakes to avoid that could undermine your chances of landing an interview. Additionally, we’ll provide resume examples tailored for various experience levels, ensuring you find inspiration regardless of where you are in your career. Finally, we’ll share valuable tips on resume writing and guide you in selecting the right resume templates to elevate your application. Whether you're a seasoned professional or just starting out, this article will equip you with the tools you need to stand out in the competitive realm of private equity.

Key Responsibilities and Skills for a Private Equity Associate

A Private Equity Associate plays a crucial role in the investment process, working closely with senior team members to identify, evaluate, and execute investment opportunities. The key responsibilities for this role typically include conducting thorough financial analysis, performing due diligence on potential investments, and assisting in the management of portfolio companies. Additionally, Private Equity Associates often prepare investment memoranda and presentations to communicate findings and recommendations to stakeholders.

Key Responsibilities:

- Conduct detailed financial modeling and analysis to assess investment viability.

- Perform market research and due diligence on potential investment opportunities.

- Collaborate with senior team members on deal sourcing and execution.

- Monitor and support portfolio companies' performance and strategic initiatives.

- Prepare reports and presentations for internal and external stakeholders.

Essential Skills:

- Strong financial modeling and analytical skills.

- Proficiency in Excel and investment analysis tools.

- Excellent communication and presentation abilities.

- Attention to detail and strong organizational skills.

- Ability to work collaboratively in a fast-paced environment.

When crafting your resume, it’s important to effectively highlight these skills in the resume skills section. Tailoring your responsibilities and skills to match the specific job description can significantly enhance your chances of getting noticed by hiring managers. Consider how each of these skills can be relevant in creating a compelling CV that showcases your qualifications and aligns with the expectations of the Private Equity Associate role.

Best Resume Format and Structure for a Private Equity Associate

When crafting a resume for a Private Equity Associate position, it’s essential to choose a format that emphasizes your experience, skills, and accomplishments in a clear and professional manner. The following sections should be included in your resume, each crafted to highlight your qualifications effectively.

Contact Information

- Include your full name, phone number, email address, and LinkedIn profile. Ensure your email sounds professional.

- Optionally, you can add your city and state, but omit your full address for privacy reasons.

Professional Summary

- Write a brief, impactful summary (2-4 sentences) that highlights your relevant experience, key skills, and career objectives. Tailor this section to reflect your expertise in private equity, deal sourcing, financial modeling, and due diligence.

- Example: "Detail-oriented Private Equity Associate with over 3 years of experience in sourcing, evaluating, and executing investment opportunities in the tech sector. Proven track record of performing comprehensive market research and financial analysis to support investment decisions."

Work Experience

- List your work experience in reverse chronological order, starting with the most recent position. For each role, include your job title, the company’s name, location, and dates of employment.

- Use bullet points to describe your responsibilities and achievements. Focus on quantifiable results and specific contributions to investment deals.

- Example:

- Conducted financial modeling and valuation analyses for potential acquisitions, resulting in a 15% increase in portfolio returns.

- Collaborated with senior partners to perform due diligence on prospective investments, leading to the successful closure of $50M in deals.

Education

- Include your educational background, starting with your highest degree. List the degree obtained, the institution's name, location, and graduation date.

- If applicable, add relevant coursework, honors, or extracurricular activities that demonstrate your knowledge of finance and investment.

Skills

- Highlight both hard and soft skills relevant to private equity. This can include:

- Financial modeling

- Due diligence

- Market research

- Negotiation and communication skills

- Proficiency in Excel, PowerPoint, and financial analysis tools.

Certifications

- Mention any relevant certifications that can enhance your candidacy, such as:

- Chartered Financial Analyst (CFA)

- Financial Modeling & Valuation Analyst (FMVA)

- Certified Public Accountant (CPA)

Additional Sections (if applicable)

- Projects: Briefly describe any significant projects or transactions you worked on that showcase your skills.

- Professional Associations: Include memberships in relevant organizations, such as the CFA Institute or local private equity networks.

- Languages: List any foreign languages spoken, as this can be a valuable asset in international investments.

Formatting Tips

- Use a clean, professional layout with clearly defined sections. A chronological resume format is typically best for showcasing your career progression.

- Utilize bullet points for readability and keep the font size between 10-12 points. Common fonts include Arial, Calibri, or Times New Roman.

- Limit your resume to one page if you have less than 10 years of experience; two pages may be acceptable for more extensive backgrounds.

A well-structured resume complements a cover letter effectively. While the resume provides a detailed account of your skills and experiences, the cover letter allows you to elaborate on your motivations for applying and how your background aligns with the firm’s goals. Ensure that your resume and cover letter maintain a consistent tone and formatting style to present a cohesive professional image.

Writing Tips and Best Practices for a Private Equity Associate Resume

When crafting a resume for a Private Equity Associate position, it's essential to present a polished, professional image that highlights your analytical skills, financial acumen, and ability to drive investment decisions. Use a clear and concise format, ensuring that your resume is easy to read and visually appealing. Incorporating industry-specific keywords relevant to private equity can help your resume stand out in applicant tracking systems, while action verbs can effectively convey your accomplishments and contributions. Remember to quantify your achievements where possible to provide tangible evidence of your impact. Additionally, leveraging resume writing tips can significantly enhance the overall quality of your document. Keep in mind that these writing practices are equally relevant when drafting your cover letter, as they help create a cohesive narrative of your qualifications.

- Use Action Verbs: Start bullet points with strong action verbs like "executed," "analyzed," or "developed" to convey your contributions effectively.

- Quantify Achievements: Include specific metrics or outcomes, such as "increased portfolio value by 25%" or "conducted due diligence on deals worth $50 million," to provide concrete evidence of your success.

- Incorporate Industry-Specific Keywords: Use terms common in private equity, such as "capital structure," "investment thesis," and "financial modeling," to demonstrate your familiarity with the field.

- Tailor Your Resume: Customize your resume for each application by aligning your experience with the job description, highlighting the most relevant skills and achievements.

- Maintain a Professional Format: Use a clean, organized layout with consistent font styles and sizes to ensure a professional look.

- Highlight Relevant Experience: Focus on experiences that showcase your analytical skills, investment knowledge, and teamwork, making sure to include internships or previous roles in finance or investment.

- Limit Length: Aim for a one-page resume if you have less than ten years of experience, ensuring that every word adds value.

- Proofread Thoroughly: Carefully check for grammatical errors and typos, as attention to detail is crucial in the finance industry.

Common Mistakes to Avoid in a Private Equity Associate Resume

Crafting a compelling resume for a Private Equity Associate role requires careful attention to detail, as the competition in this field is intense. Common mistakes can undermine even the most qualified candidates, making it essential to present your skills and experiences effectively. Here are some prevalent pitfalls to avoid:

- Overloading your resume with excessive information that can overwhelm the reader.

- Using generic job descriptions that fail to showcase your unique contributions and achievements.

- Neglecting to highlight relevant skills, such as financial modeling and valuation techniques.

- Failing to tailor your resume to the specific job description, missing the chance to align your experiences with the role’s requirements.

- Including outdated or irrelevant experiences that do not pertain to private equity.

- Using a cluttered format or font that detracts from readability.

- Omitting quantifiable achievements that demonstrate your impact in previous roles.

- Ignoring the importance of concise bullet points, which can make your resume harder to skim.

- Not proofreading for typos or grammatical errors that can create a negative impression.

To further enhance your application, consider reviewing the common mistakes to avoid in a resume and ensure your cover letter is equally polished by avoiding the common cover letter mistakes that can undermine your candidacy.

Sample Private Equity Associate Resumes

As the private equity industry continues to grow, the demand for skilled professionals in this area is on the rise. A well-crafted resume is essential for standing out in a competitive job market. Below are three sample resumes for the role of Private Equity Associate, tailored for different levels of experience and backgrounds. These examples can guide you in building your own resume, showcasing your unique skills and qualifications. For further inspiration, explore more resume templates and consider leveraging cover letter examples for a comprehensive job application package.

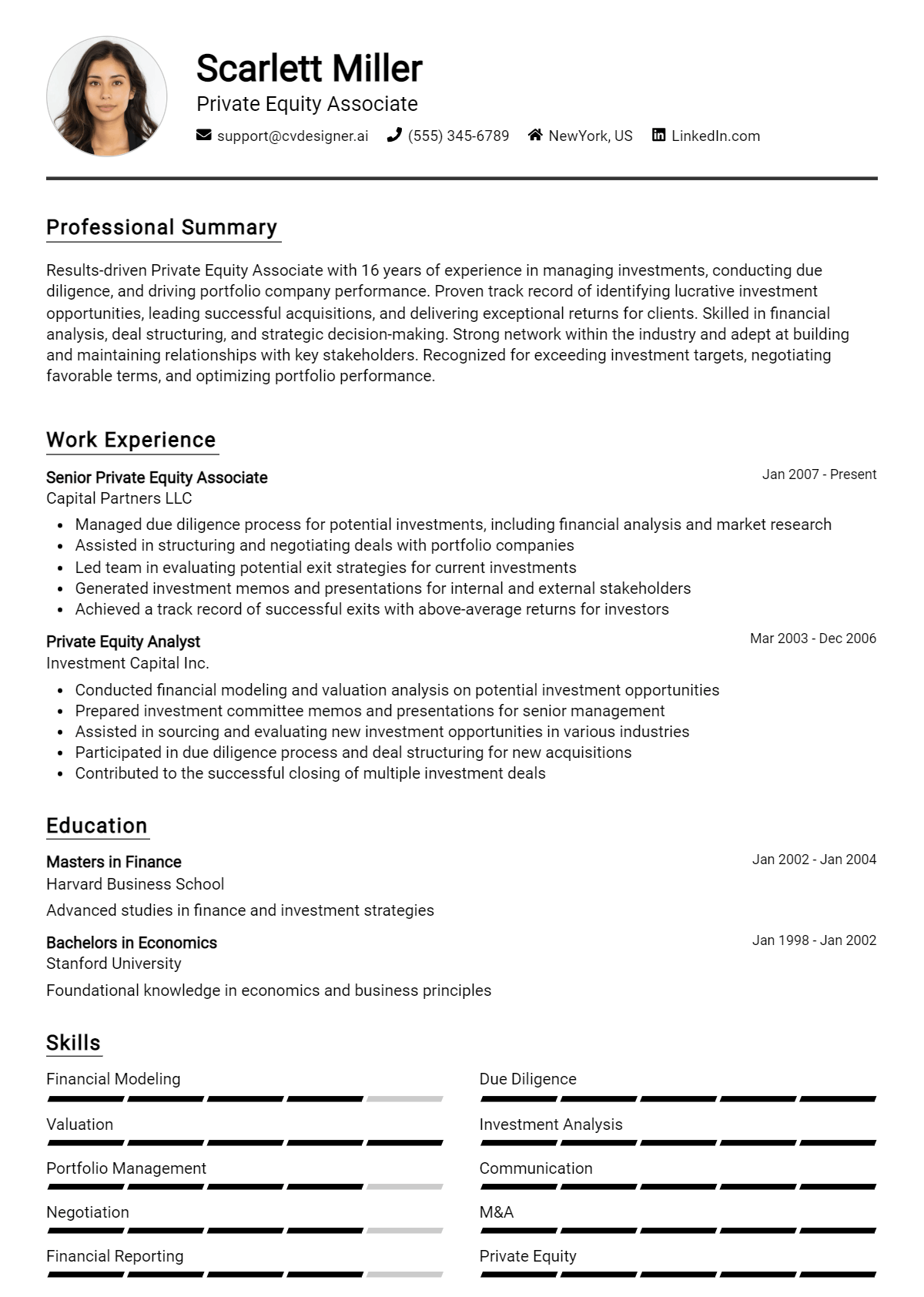

Experienced Professional Resume

John Doe

New York, NY

(555) 123-4567

john.doe@email.com

Professional Summary

Results-driven Private Equity Associate with over 5 years of experience in financial analysis, deal sourcing, and portfolio management. Proven track record of executing successful investments and driving value creation in diverse sectors, including technology and healthcare. Strong analytical skills combined with a strategic mindset to identify and capitalize on investment opportunities.

Experience

Private Equity Associate

ABC Capital Partners, New York, NY

June 2018 – Present

- Conducted extensive financial modeling and due diligence for potential investments, leading to a 25% increase in annual returns.

- Collaborated with management teams of portfolio companies to develop and implement value creation plans, resulting in an average EBITDA growth of 30%.

- Participated in deal negotiations and structuring, enhancing the firm's competitive positioning in the market.

Analyst

XYZ Investment Group, New York, NY

July 2015 – May 2018

- Assisted in the evaluation of investment opportunities, preparing detailed reports and presentations for senior management.

- Supported portfolio monitoring efforts, analyzing performance metrics and identifying areas for improvement.

- Developed comprehensive industry research reports that informed strategic investment decisions.

Education

Master of Business Administration (MBA)

Columbia Business School, New York, NY

Graduated: May 2015

Bachelor of Arts in Economics

University of California, Berkeley

Graduated: May 2013

Entry-Level Candidate Resume

Jane Smith

Los Angeles, CA

(555) 987-6543

jane.smith@email.com

Professional Summary

Ambitious recent graduate with a strong foundation in finance and investment analysis, seeking an entry-level Private Equity Associate position. Adept at financial modeling, research, and analysis. Eager to leverage academic knowledge and internships to contribute to a dynamic team in the private equity sector.

Education

Bachelor of Science in Finance

University of Southern California, Los Angeles, CA

Graduated: May 2023

- Relevant coursework: Corporate Finance, Investment Analysis, Mergers & Acquisitions

Internships

Private Equity Intern

123 Capital, Los Angeles, CA

June 2022 – August 2022

- Assisted in conducting market research and financial analysis for potential investment opportunities.

- Collaborated with senior associates to prepare investment memos and presentations for internal review.

Investment Banking Intern

456 Financial Group, Los Angeles, CA

June 2021 – August 2021

- Supported analysts in financial modeling and valuation of companies across various sectors.

- Participated in client meetings, helping to gather and analyze key financial information.

Career Changer Resume

Michael Johnson

Chicago, IL

(555) 234-5678

michael.johnson@email.com

Professional Summary

Dynamic professional transitioning from a successful career in corporate finance to a Private Equity Associate role. Possesses strong analytical and problem-solving skills, with a keen interest in investment strategies. Experienced in financial modeling, project management, and cross-functional collaboration.

Experience

Senior Financial Analyst

Global Corp, Chicago, IL

April 2018 – Present

- Managed financial reporting and analysis for a $200M business unit, driving strategic financial decisions.

- Developed complex financial models to forecast revenue and evaluate investment opportunities.

- Collaborated with cross-functional teams to implement cost-saving initiatives, resulting in a 15% reduction in operational expenses.

Financial Analyst

National Bank, Chicago, IL

June 2015 – March 2018

- Conducted comprehensive credit analysis and risk assessment for corporate clients seeking loans.

- Assisted in the development of financial performance reports, providing actionable insights to senior management.

Education

Bachelor of Science in Finance

University of Illinois, Chicago

Graduated: May 2015

These sample resumes illustrate how to effectively present your experience and skills for a Private Equity Associate role. Tailor yours to highlight the most relevant achievements and competencies to make a lasting impression on potential employers. For more inspiration, check out additional resume templates and consider utilizing corresponding cover letter examples to enhance your job application.

Checklist for a Private Equity Associate Resume

- Proofread for Typos and Errors: Carefully read through your resume to catch any spelling, grammar, or punctuation mistakes. Consider using tools like Grammarly or consulting a peer for an additional review.

- Ensure Consistency in Formatting: Check that font styles, sizes, bullet points, and spacing are consistent throughout the document. This helps create a professional appearance.

- Tailor Content to the Job Description: Customize your resume for the Private Equity Associate role by incorporating relevant keywords and phrases from the job listing. Highlight experiences and skills that directly match the position.

- Highlight Relevant Skills and Experiences: Emphasize your financial modeling, due diligence, and valuation skills, along with any specific industry knowledge that aligns with the role.

- Quantify Achievements: Use numbers and metrics to demonstrate your impact in previous roles. For example, mention the percentage increase in portfolio value or the number of deals closed.

- Maintain a Professional Tone: Use formal language and avoid slang. Your resume should reflect your professionalism and suitability for a high-stakes role in private equity.

- Include a Summary Statement: Start with a concise summary that captures your career highlights and what you bring to the Private Equity Associate position. This should be tailored to reflect your unique qualifications.

- Use Action Verbs: Begin bullet points with strong action verbs like "analyzed," "developed," or "managed" to convey your contributions effectively and dynamism in your work history.

- Check Contact Information: Make sure your phone number, email, and LinkedIn profile (if included) are up-to-date and professional.

- Consider an AI Resume Builder: To ensure all elements are well-organized and visually appealing, consider utilizing an AI resume builder for your final draft.

Remember, a similar checklist can be followed when creating a CV or cover letter.

Key Takeaways for a Private Equity Associate Resume Guide

As you embark on crafting your Private Equity Associate resume, remember that a well-structured and tailored document can significantly enhance your chances of landing that coveted position. Utilize the examples and tips provided in this guide to showcase your relevant experience, skills, and accomplishments effectively. For the next steps, consider downloading a professional resume template from resume templates or a cover letter template from cover letter templates. Additionally, our intuitive resume maker can assist you in creating a standout resume with ease. By following similar guidelines, you can also develop a compelling CV and impactful cover letter. Take action today and set yourself apart in the competitive private equity landscape!