As the backbone of any tax administration, Revenue Agents play a pivotal role in ensuring compliance with tax laws and maximizing revenue for government entities. Their expertise not only helps maintain the integrity of the tax system but also supports fair and equitable treatment of taxpayers. Crafting a compelling resume is essential for aspiring Revenue Agents, as it highlights your qualifications and sets you apart in a competitive job market. A well-structured resume can open doors to interviews and ultimately secure your desired position in this crucial field.

In this comprehensive Revenue Agent resume writing guide, we will explore several key components to help you create a standout application. We'll delve into the primary responsibilities and skills that Revenue Agents should showcase, as well as the best formats to utilize for maximum impact. You’ll learn about common pitfalls to avoid that could diminish your chances of landing an interview, and we’ll provide resume examples tailored for candidates at all experience levels. Additionally, we’ll share valuable tips on effective resume writing and guide you in selecting the right resume templates to enhance your presentation. Whether you're a seasoned professional or just starting your career, this guide will equip you with the knowledge and tools to craft a compelling resume that captures the attention of hiring managers.

Key Responsibilities and Skills for a Revenue Agent

As a Revenue Agent, your primary responsibility is to ensure compliance with tax laws and regulations while maximizing revenue collection for governmental authorities. This role involves conducting audits, reviewing tax returns, and investigating discrepancies to ensure that individuals and businesses are reporting their income accurately. Revenue Agents also provide guidance to taxpayers on tax-related inquiries and may represent the agency in disputes.

Key Responsibilities:

- Conduct audits of individual and business tax returns to ensure accuracy and compliance with applicable laws.

- Investigate and resolve discrepancies in tax filings and payments.

- Review financial records, documents, and other relevant information during audits.

- Communicate with taxpayers to explain findings, resolve issues, and provide guidance on tax obligations.

- Maintain detailed records of audits and findings to support compliance efforts.

- Stay informed on current tax laws, regulations, and procedures to ensure accurate assessments.

Essential Skills:

- Strong analytical skills to assess financial documents and identify inconsistencies.

- Excellent communication skills for effectively conveying complex tax information to taxpayers.

- Attention to detail to ensure accuracy in audits and documentation.

- Problem-solving skills to resolve discrepancies and challenges that arise during audits.

- Proficiency in using tax software and other relevant technology to conduct audits and analysis.

- Understanding of tax regulations and compliance requirements at the federal, state, and local levels.

Highlighting these skills effectively in your resume skills section is crucial, as employers look for candidates who possess the specific competencies required for the role. Tailoring these responsibilities and skills to match the job description can significantly enhance your chances of getting noticed. Additionally, consider how these skills can be integrated into a strong CV, showcasing your qualifications and experiences that align with the expectations of potential employers. This tailored approach will not only demonstrate your expertise but also your commitment to fulfilling the role of a Revenue Agent effectively.

Best Resume Format and Structure for a Revenue Agent

When crafting a resume for a Revenue Agent position, it's essential to present your qualifications in a clear, organized manner. Here’s a detailed guide on the best resume format and structure to effectively showcase your skills and experiences.

Contact Information

Start your resume with your contact information at the top. Include:

- Full name

- Phone number

- Email address

- LinkedIn profile (optional)

- Location (city and state)

Make sure this information is easily readable and professional.

Professional Summary

A brief, impactful professional summary should follow your contact information. Aim for 2-4 sentences that encapsulate your experience, expertise, and what you bring to the table as a Revenue Agent. Highlight key achievements or skills relevant to the role, such as your knowledge of tax law, auditing experience, or proficiency in financial analysis. This section should grab the employer's attention and encourage them to read further.

Work Experience

In this section, list your relevant work experience in reverse chronological order. For each position, include:

- Job title

- Company name

- Location (city and state)

- Dates of employment (month and year)

- Bullet points detailing your responsibilities and achievements

Focus on quantifiable accomplishments, such as "Increased revenue recovery by 15% through improved audit processes" or "Successfully resolved over 200 taxpayer inquiries, enhancing customer satisfaction ratings." Tailor this section to emphasize experiences that align with the typical duties of a Revenue Agent.

Education

Your education section should include:

- Degree(s) obtained

- Major(s) and minor(s) (if applicable)

- Institution names

- Graduation dates

If you possess additional educational credentials such as certifications in taxation or accounting, include those here. Mentioning relevant coursework can also be beneficial, particularly if you are a recent graduate.

Skills

List your skills relevant to the Revenue Agent role. This can include both hard and soft skills. Examples include:

- Knowledge of tax law and regulations

- Financial analysis and reporting

- Proficiency in accounting software (e.g., QuickBooks, Excel)

- Strong analytical and problem-solving abilities

- Excellent communication and negotiation skills

Organizing this section in bullet points can enhance readability.

Certifications

If you have any professional certifications that add value to your application, such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Certified Management Accountant (CMA), include them in a separate section. This demonstrates your commitment to professional development and expertise in the field.

Additional Tips:

- Formatting: Choose a clean, professional resume format. A chronological format is often preferred for Revenue Agents, as it showcases your career progression. Ensure consistent font usage, adequate spacing, and alignment for a polished look.

- Keywords: Use industry-specific keywords from the job description to help your resume pass through Applicant Tracking Systems (ATS).

- Length: Aim for one page, especially if you have less than 10 years of experience. If you have extensive relevant experience, two pages may be acceptable.

Complementing Your Cover Letter

Your resume format should work seamlessly with your cover letter format. Use the same font, color scheme, and header style so that they appear as a cohesive application package. In your cover letter, expand on points highlighted in your resume and provide context or stories that showcase your expertise and enthusiasm for the Revenue Agent position.

By following this structured approach, you will create a compelling resume that effectively communicates your qualifications and makes you a strong candidate for the Revenue Agent role.

Writing Tips and Best Practices for a Revenue Agent Resume

When crafting a resume for a Revenue Agent position, it's essential to present your qualifications and experience in a clear and compelling manner. Start with a strong summary that highlights your expertise in tax regulations, compliance, and financial analysis. Use action verbs to convey your achievements and responsibilities effectively, and be sure to quantify your accomplishments to provide concrete evidence of your impact. Incorporating industry-specific keywords can help your resume get noticed by applicant tracking systems and hiring managers alike. For a polished and professional look, consider utilizing resume writing tips. Additionally, these practices can enhance the quality of your cover letter, making your application even more compelling.

- Start with a strong summary statement that captures your experience and goals.

- Use action verbs such as "analyzed," "developed," and "executed" to describe your roles.

- Quantify your achievements where possible (e.g., “Increased revenue collection by 15% through targeted audits”).

- Incorporate relevant industry-specific keywords to align your resume with the job description.

- Highlight certifications or training related to revenue management and compliance.

- Use bullet points for easy readability and to organize your accomplishments effectively.

- Keep the design clean and professional, ensuring it is easy to navigate.

- Tailor your resume for each position to showcase the most relevant skills and experiences.

Common Mistakes to Avoid in a Revenue Agent Resume

Crafting an effective resume as a Revenue Agent requires careful attention to detail, as potential employers look for specific qualifications, skills, and experiences. However, many applicants fall into common pitfalls that can undermine their chances of landing an interview. To ensure your resume stands out for the right reasons, it's essential to avoid these frequent mistakes:

- Overloading the resume with excessive information, making it overwhelming for the reader.

- Using generic descriptions that fail to highlight unique skills or accomplishments.

- Failing to quantify achievements with specific metrics or outcomes.

- Ignoring the importance of tailoring the resume to the job description.

- Neglecting to include relevant keywords that align with the role.

- Using an unprofessional email address or formatting inconsistently.

- Writing in lengthy paragraphs instead of using concise bullet points.

- Omitting a summary or objective statement that encapsulates your career goals.

- Overlooking grammatical and spelling errors, which can create a negative impression.

- Including irrelevant work experience that does not pertain to the role of a Revenue Agent.

To further enhance your application, consider reviewing the common mistakes to avoid in a resume and ensure your cover letter is equally polished by avoiding the typical cover letter mistakes. By doing so, you’ll present a well-rounded and professional image that can significantly boost your job prospects.

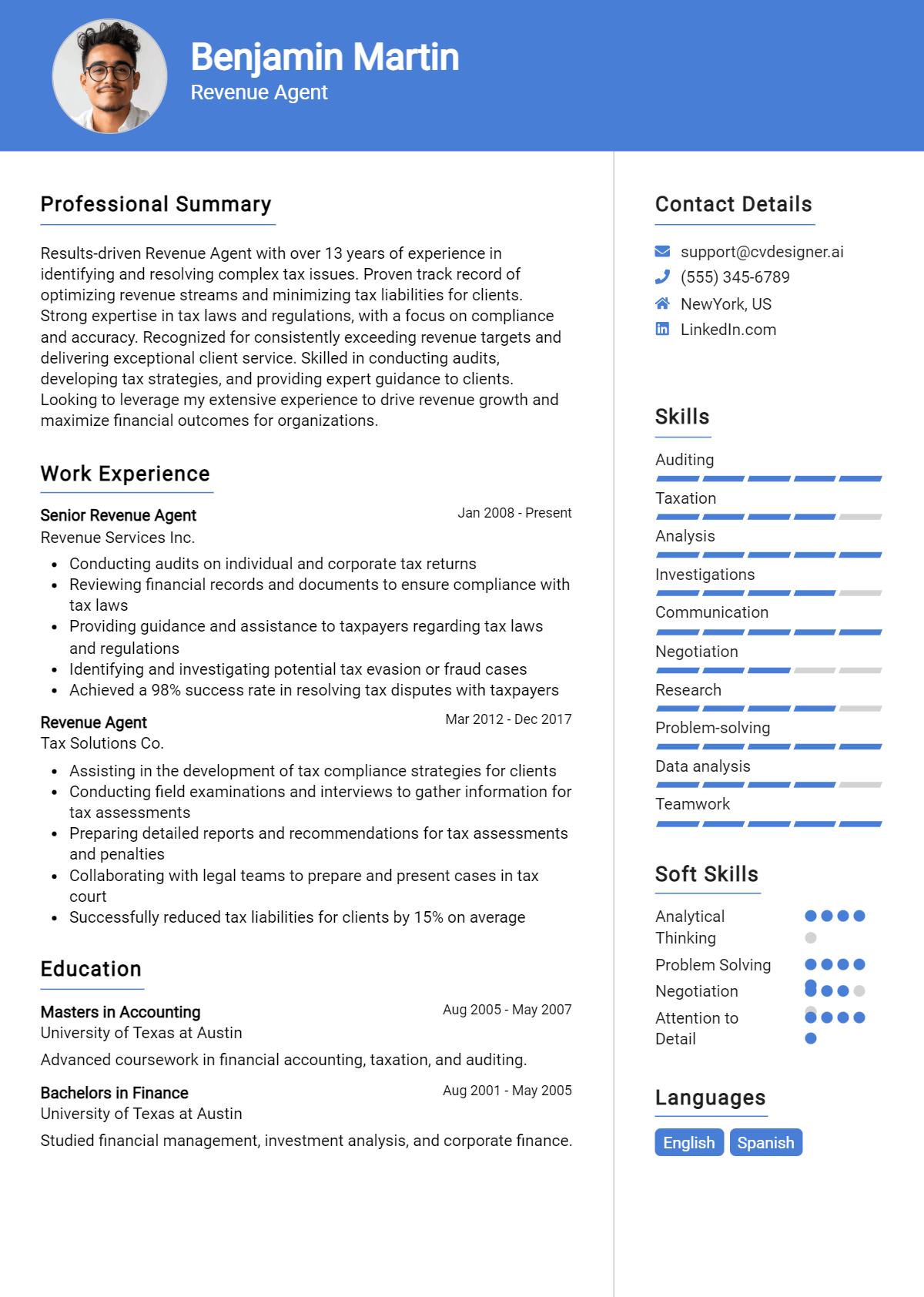

Sample Revenue Agent Resumes

As a Revenue Agent, your primary role involves examining, analyzing, and auditing various financial documents, ensuring compliance with tax laws and regulations. Crafting an effective resume is crucial for showcasing your skills and experience in this field. Below are three sample resumes tailored for different stages of a Revenue Agent's career: an experienced professional, an entry-level candidate, and a career changer.

Experienced Revenue Agent Resume

Jane Doe

123 Tax Lane

Finance City, FS 12345

(555) 123-4567

jane.doe@email.com

Professional Summary

Detail-oriented Revenue Agent with over 8 years of experience in tax compliance and auditing. Proven track record of identifying discrepancies and ensuring adherence to tax regulations while providing exceptional service to clients. Skilled in data analysis, financial reporting, and stakeholder communication.

Professional Experience

Senior Revenue Agent

Department of Revenue, Finance City, FS

January 2018 – Present

- Conducted comprehensive audits for over 200 individual and corporate tax returns, identifying and resolving discrepancies.

- Developed and implemented audit strategies that increased compliance rates by 30% over two years.

- Collaborated with legal teams to address tax disputes, resulting in a 95% success rate in favor of the agency.

Revenue Agent

Department of Revenue, Finance City, FS

June 2015 – December 2017

- Analyzed tax returns and financial documents, ensuring compliance with federal and state tax laws.

- Provided training and support to junior agents, enhancing team efficiency and knowledge sharing.

- Assisted in creating educational materials for taxpayers, increasing awareness of tax obligations.

Education

Bachelor of Science in Accounting

University of Finance, Finance City, FS

Graduated: May 2015

Certifications

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

Entry-Level Revenue Agent Resume

John Smith

456 Audit Ave

Finance City, FS 12345

(555) 654-3210

john.smith@email.com

Objective

Motivated recent graduate with a degree in Accounting, seeking to leverage analytical skills and knowledge of tax regulations as an Entry-Level Revenue Agent. Eager to contribute to a team and assist in ensuring tax compliance.

Education

Bachelor of Science in Accounting

University of Finance, Finance City, FS

Graduated: May 2023

Relevant Coursework

- Taxation Principles

- Financial Auditing

- Business Law

Internship Experience

Tax Intern

Local Tax Firm, Finance City, FS

January 2023 – April 2023

- Assisted in preparing tax returns for individuals and small businesses, ensuring accuracy and compliance with tax laws.

- Conducted research on tax regulations, contributing to a 20% reduction in errors in client filings.

- Collaborated with senior accountants to gather necessary documentation for audits.

Skills

- Proficient in Microsoft Excel and accounting software

- Strong analytical and problem-solving abilities

- Effective communication skills, both written and verbal

Career Changer Revenue Agent Resume

Emily Johnson

789 Compliance Blvd

Finance City, FS 12345

(555) 987-6543

emily.johnson@email.com

Profile

Dedicated professional with a background in financial analysis and a passion for tax compliance. Recently completed coursework in taxation and auditing, seeking to transition into a Revenue Agent role. Strong analytical skills combined with a keen attention to detail and a commitment to ethical practices.

Professional Experience

Financial Analyst

XYZ Corporation, Finance City, FS

March 2018 – September 2023

- Analyzed financial statements and prepared reports for senior management, contributing to strategic decision-making.

- Conducted variance analysis and identified trends, improving budget forecasting accuracy by 25%.

- Collaborated with external auditors to provide necessary documentation and explanations during audits.

Customer Service Representative

ABC Services, Finance City, FS

June 2015 – February 2018

- Managed customer inquiries regarding billing and account issues, maintaining a 95% customer satisfaction rating.

- Developed training materials for new hires, enhancing the onboarding process and team performance.

Education

Certificate in Taxation and Auditing

Community College of Finance, Finance City, FS

Completed: August 2023

Bachelor of Arts in Business Administration

University of Commerce, Finance City, FS

Graduated: May 2015

Skills

- Strong proficiency in financial analysis and reporting

- Excellent research and data interpretation abilities

- Familiar with tax compliance and auditing principles

Explore more resume templates for inspiration to enhance your job application. Additionally, corresponding cover letter examples can help you create a complete job application package.

Checklist for a Revenue Agent Resume

- Proofread for Spelling and Grammar: Carefully read through your resume to catch any typos or grammatical errors. Consider using grammar-checking tools for additional assistance.

- Check for Consistency: Ensure uniformity in formatting, such as font size, style, and bullet points throughout the document. Consistency gives a professional look to your resume.

- Tailor Your Resume: Customize your resume for the specific Revenue Agent position you are applying for. Highlight relevant skills and experiences that align with the job description.

- Include Relevant Keywords: Incorporate industry-specific keywords from the job listing to pass any Applicant Tracking Systems (ATS) and catch the recruiter’s attention.

- Highlight Achievements: Showcase quantifiable achievements and contributions in previous roles, emphasizing how they relate to the responsibilities of a Revenue Agent.

- Use Action Verbs: Start each bullet point with strong action verbs to convey your accomplishments and responsibilities more dynamically.

- Limit Length: Keep your resume concise, ideally to one page, unless you have extensive experience that justifies a longer format.

- Check Contact Information: Verify that your contact details (phone number, email, LinkedIn profile) are accurate and up-to-date for potential employers to reach you easily.

- Format for Readability: Ensure that your resume is easy to read with clear headings, sufficient white space, and logical sections.

- Utilize an AI Resume Builder: Consider using an AI resume builder to ensure that all elements are well-organized and professionally presented.

A similar checklist can also be followed for creating a CV or cover letter.

Key Takeaways for a Revenue Agent Resume Guide

In conclusion, crafting a standout resume as a Revenue Agent is crucial to catching the attention of hiring managers and showcasing your qualifications effectively. By leveraging the examples and tips provided in this guide, you can create a resume that highlights your skills in tax compliance, auditing, and revenue generation. Take the next step by downloading a professional resume template from resume templates or exploring our tailored cover letter templates to complement your application. Additionally, consider using our best resume maker for a streamlined and user-friendly experience. Remember, adhering to these guidelines will not only enhance your resume but also assist you in developing a compelling CV and cover letter. Your journey to securing the perfect Revenue Agent position starts with a strong application—don’t hesitate to utilize these resources!