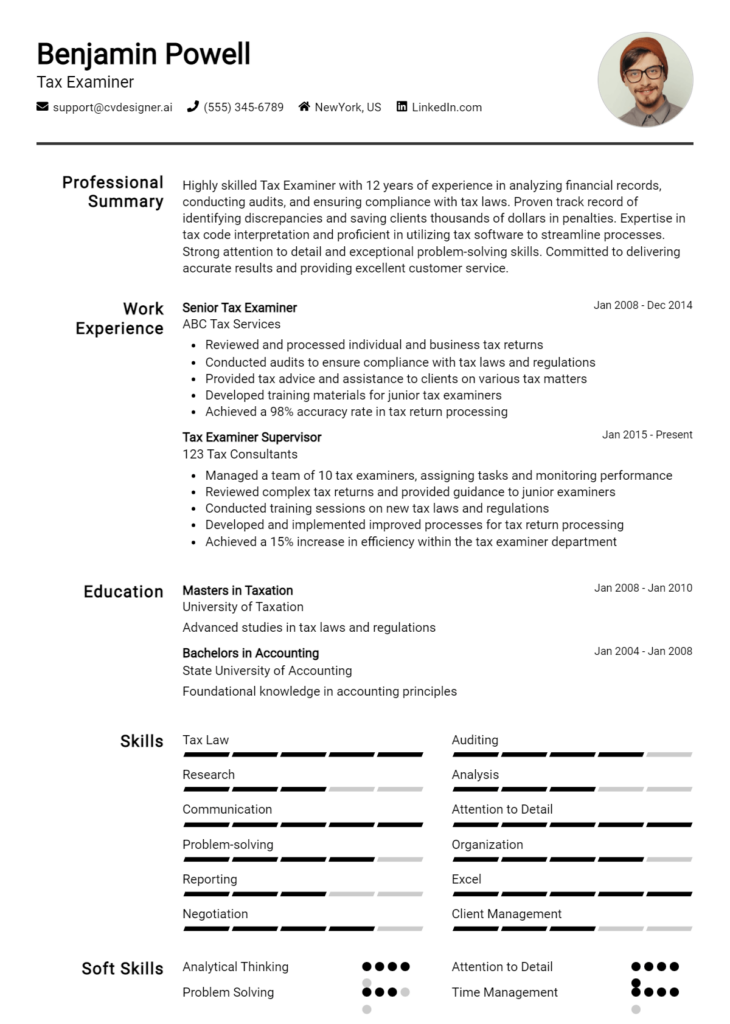

Most Popular Tax Analyst Resume Examples

Explore additional Tax Analyst resume samples and guides and see what works for your level of experience or role.

As the backbone of financial compliance, Tax Analysts play a crucial role in ensuring that individuals and organizations meet their tax obligations while maximizing their financial efficiency. Their expertise not only helps in navigating complex tax regulations but also assists in strategic financial planning. In this competitive job market, a well-crafted resume is your ticket to standing out among other candidates. It effectively showcases your qualifications, experiences, and skills tailored specifically to this important role. Whether you're a seasoned professional or just starting your career in taxation, understanding how to present yourself through your resume is essential for landing interviews and advancing your career.

In this comprehensive guide, we will explore the key responsibilities and skills required of a Tax Analyst, helping you tailor your resume to reflect what employers are looking for. Discover the best resume formats to use for showcasing your expertise, along with common mistakes to avoid that could undermine your chances of catching a hiring manager's eye. We will provide resume examples suitable for all experience levels, ensuring that you have the right template for your unique career stage. Additionally, you will find valuable tips on effective resume writing and how to select the perfect resume templates to enhance your professional image. By the end of this guide, you will be equipped with the knowledge to create a standout resume that propels you toward your next career opportunity.

Key Responsibilities and Skills for a Tax Analyst

As a Tax Analyst, your primary role is to ensure compliance with tax laws and regulations while optimizing tax liabilities for your organization. This involves analyzing financial data, preparing tax returns, and providing strategic advice on tax planning and risk management. You will also be responsible for researching tax legislation, identifying potential tax savings, and collaborating with other departments to ensure accurate financial reporting.

Key Responsibilities:

- Prepare and review federal, state, and local tax returns to ensure accuracy and compliance.

- Conduct thorough tax research to stay updated on current tax regulations and laws.

- Analyze financial data to identify tax-saving opportunities and strategies.

- Assist in audits and respond to inquiries from tax authorities.

- Collaborate with finance and accounting teams to ensure proper tax treatment of transactions.

- Develop and maintain documentation for tax positions and strategies.

- Monitor changes in tax legislation and assess their impact on the organization.

Essential Skills:

- Strong analytical and problem-solving skills.

- Excellent attention to detail and accuracy.

- Proficiency in tax software and financial analysis tools.

- Knowledge of tax regulations and compliance requirements.

- Effective communication skills for conveying complex tax information.

- Ability to work independently and manage multiple deadlines.

- Strong organizational and time management skills.

Highlighting these skills effectively in your resume skills section is crucial for standing out in a competitive job market. Tailoring your responsibilities and skills to match the job description can demonstrate your suitability for the role. Additionally, consider how these skills could enhance your overall CV, providing potential employers with a clear understanding of your capabilities and qualifications as a Tax Analyst.

Best Resume Format and Structure for a Tax Analyst

When crafting a resume for a Tax Analyst position, it is essential to present your qualifications clearly and effectively. Here’s a detailed guide on the best resume format and structure, along with tips for each section.

Contact Information

This section should be placed at the top of your resume. Include the following details:

- Full name

- Phone number

- Professional email address

- LinkedIn profile (optional)

- Location (city and state)

Professional Summary

A brief, impactful summary that encapsulates your experience and skills. Aim for 2-3 sentences that highlight your expertise in tax analysis, any relevant certifications, and your goal in the role. Tailor this section to align with the specific job description.

Tip: Use action verbs and quantifiable achievements to make your summary stand out.

Work Experience

This is typically the most substantial section of your resume. List your work experience in reverse chronological order, focusing on roles relevant to tax analysis.

For each position, include:

- Job Title

- Company Name

- Location (city, state)

- Dates of Employment (month/year)

- Bullet points that detail your responsibilities and achievements, emphasizing skills such as:

- Tax preparation and compliance

- Financial analysis

- Data management

- Use of tax software

Tip: Quantify your achievements with specific metrics where possible (e.g., “Reduced tax liabilities for clients by 15% through strategic planning”).

Education

List your educational background, starting with the most recent degree. Include:

- Degree Type (e.g., Bachelor of Science in Accounting)

- Major

- University/College Name

- Graduation Date (month/year)

Tip: If you have relevant coursework or honors related to tax analysis, consider including that as well.

Skills

Highlight the key skills that are pertinent to a Tax Analyst role. This section can be presented in bullet points or a simple list format. Consider including:

- Tax compliance and regulations

- Proficiency in tax preparation software (e.g., TurboTax, H&R Block)

- Analytical skills

- Attention to detail

- Communication skills

Tip: Tailor your skills section to match those mentioned in the job description, as many companies use Applicant Tracking Systems (ATS) to filter resumes.

Certifications

If you hold any relevant certifications, this section is crucial. List certifications such as:

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Management Accountant (CMA)

Include the date obtained or the anticipated date if you're currently pursuing a certification.

Additional Sections

Depending on your experience, you may also consider adding:

- Professional Memberships (e.g., American Institute of CPAs)

- Relevant Training or Workshops

- Languages (if applicable)

Formatting Tips

- Use a clean, professional font (e.g., Arial, Calibri) and keep the font size between 10 and 12 points.

- Maintain consistent formatting with headings, bullet points, and spacing.

- Limit your resume to one page, especially if you have less than 10 years of experience.

Cover Letter Complement

The format of your resume should complement your cover letter. Use the same font style and size, and ensure that your contact information matches exactly. This consistency helps create a cohesive application package.

Tip: In your cover letter, expand on your professional summary by providing specific examples of your accomplishments and how they relate to the company's needs.

By following this structured approach, your resume will effectively showcase your qualifications for a Tax Analyst position, making a strong impression on potential employers.

Writing Tips and Best Practices for a Tax Analyst Resume

When crafting a resume as a Tax Analyst, it's crucial to highlight your analytical skills, attention to detail, and familiarity with tax regulations. A well-structured resume should showcase your relevant experience, education, and certifications while maintaining a professional appearance. Utilize resume writing tips to enhance the visual appeal and organization of your resume. Additionally, remember to apply these practices to your cover letter, ensuring that both documents work together to present a cohesive narrative of your qualifications.

- Use Action Verbs: Start bullet points with strong action verbs like "analyzed," "prepared," "evaluated," and "advised" to convey your contributions effectively.

- Quantify Achievements: Where possible, include numbers and percentages to demonstrate the impact of your work (e.g., “Reduced tax liabilities by 15% for clients”).

- Incorporate Industry-Specific Keywords: Use terms relevant to the tax field, such as "compliance," "regulatory," "tax planning," and "financial reporting," to pass through applicant tracking systems (ATS).

- Tailor Your Resume: Customize your resume for each job application by aligning your experiences and skills with the specific requirements listed in the job description.

- Highlight Relevant Certifications: Mention any relevant certifications, such as CPA or EA, prominently to establish your professional credibility.

- Keep It Concise: Limit your resume to one or two pages, focusing on the most relevant information to keep the reader engaged.

- Use Bullet Points: Present your achievements and responsibilities in bullet point format for easier readability and to allow hiring managers to quickly scan your qualifications.

- Proofread Carefully: Ensure your resume is free from grammatical errors and typos, as precision is vital in the tax profession.

Common Mistakes to Avoid in a Tax Analyst Resume

When crafting a resume as a Tax Analyst, it’s crucial to present your skills and experiences effectively to stand out in a competitive job market. However, many candidates fall into common pitfalls that can undermine their qualifications. By being aware of these mistakes, you can enhance your resume's impact and better showcase your expertise in tax analysis. Here are some common mistakes to avoid:

- Overloading your resume with excessive information that makes it cluttered and hard to read.

- Using generic descriptions that fail to highlight your unique skills and experiences.

- Neglecting to tailor your resume to the specific job description, which can lead to missed opportunities.

- Focusing too much on job duties rather than quantifiable achievements and results.

- Ignoring the importance of formatting, resulting in a resume that looks unprofessional or disorganized.

- Failing to include relevant keywords that align with the job you are applying for, which can affect Applicant Tracking System (ATS) filtering.

- Not proofreading for grammatical or typographical errors, which can create a negative impression.

- Listing outdated skills or certifications that do not reflect your current qualifications.

- Omitting essential contact information or using an unprofessional email address.

- Using vague language that does not clearly articulate your contributions or expertise.

To further improve your application materials, consider reviewing the common mistakes to avoid in a resume and also pay attention to common cover letter mistakes that should be avoided, ensuring that both your resume and cover letter present a polished and professional image.

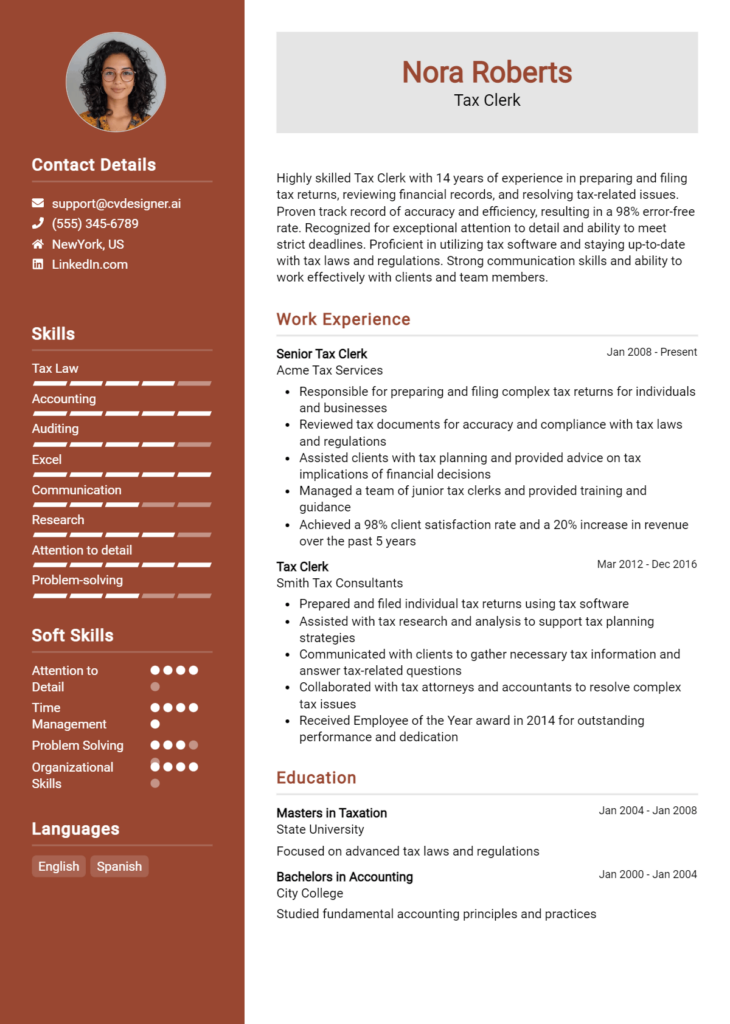

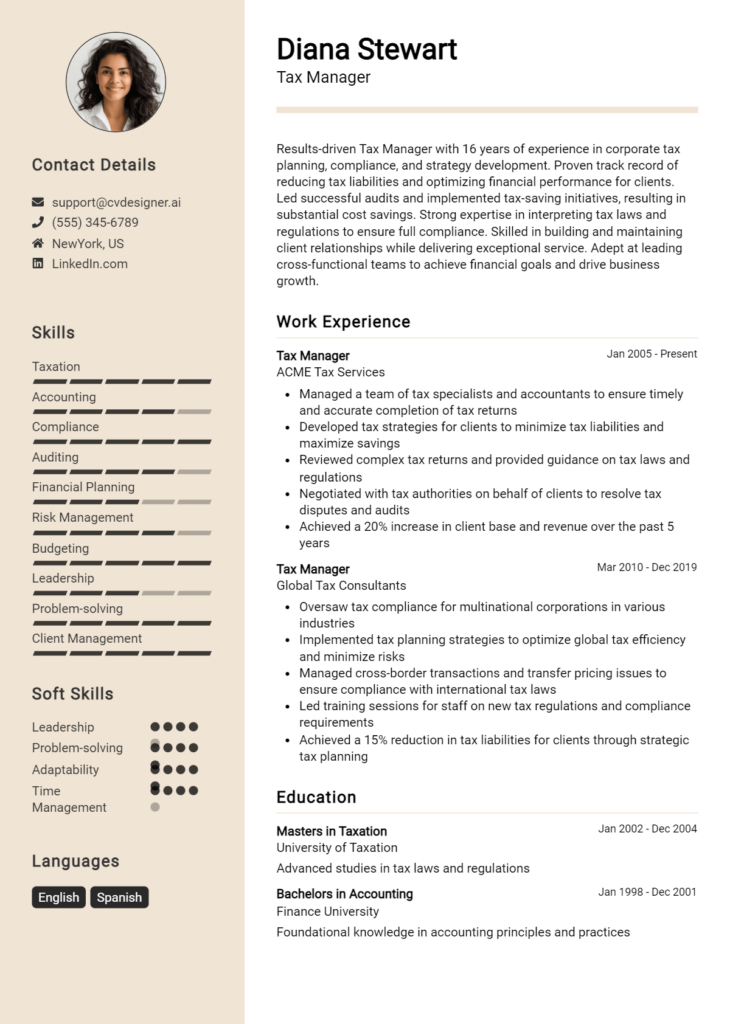

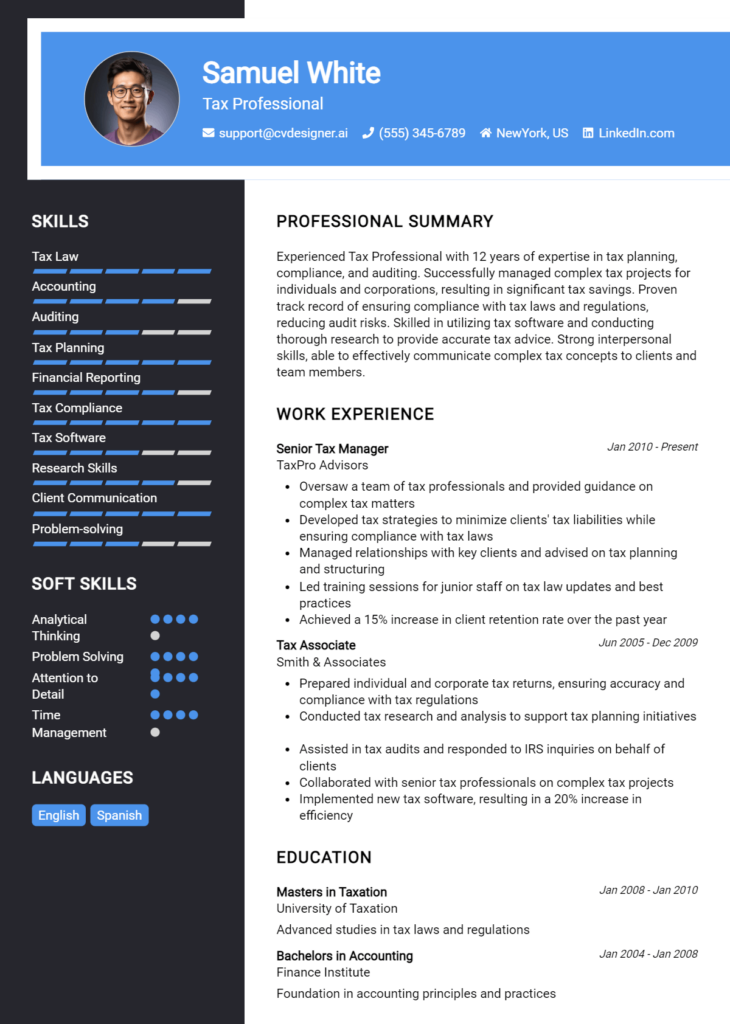

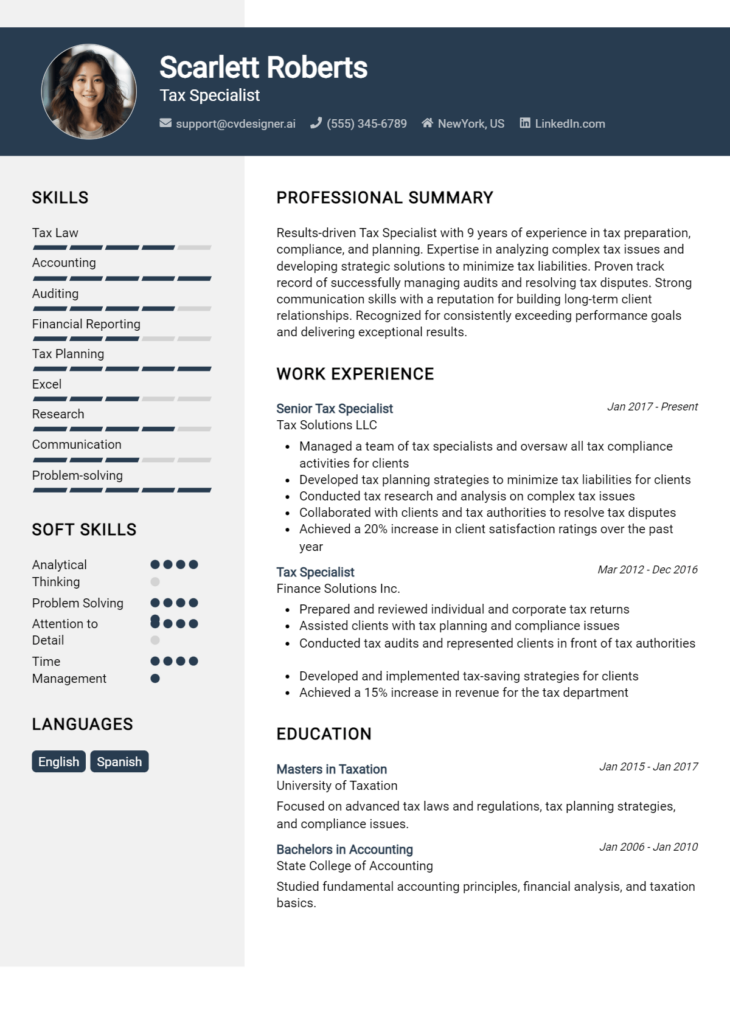

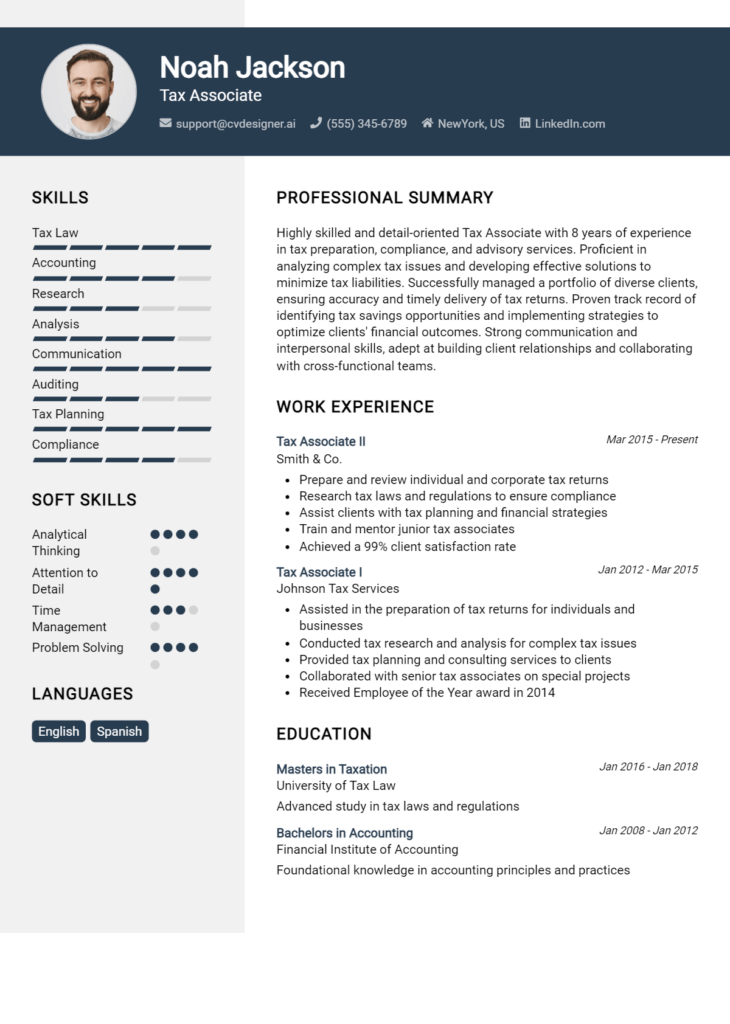

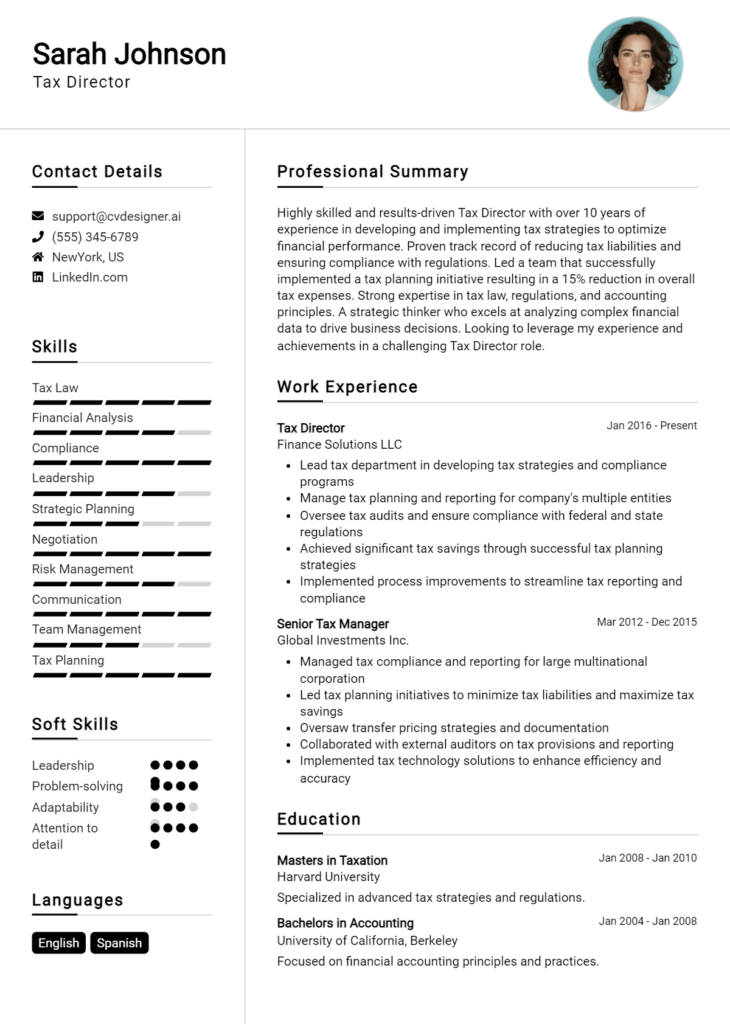

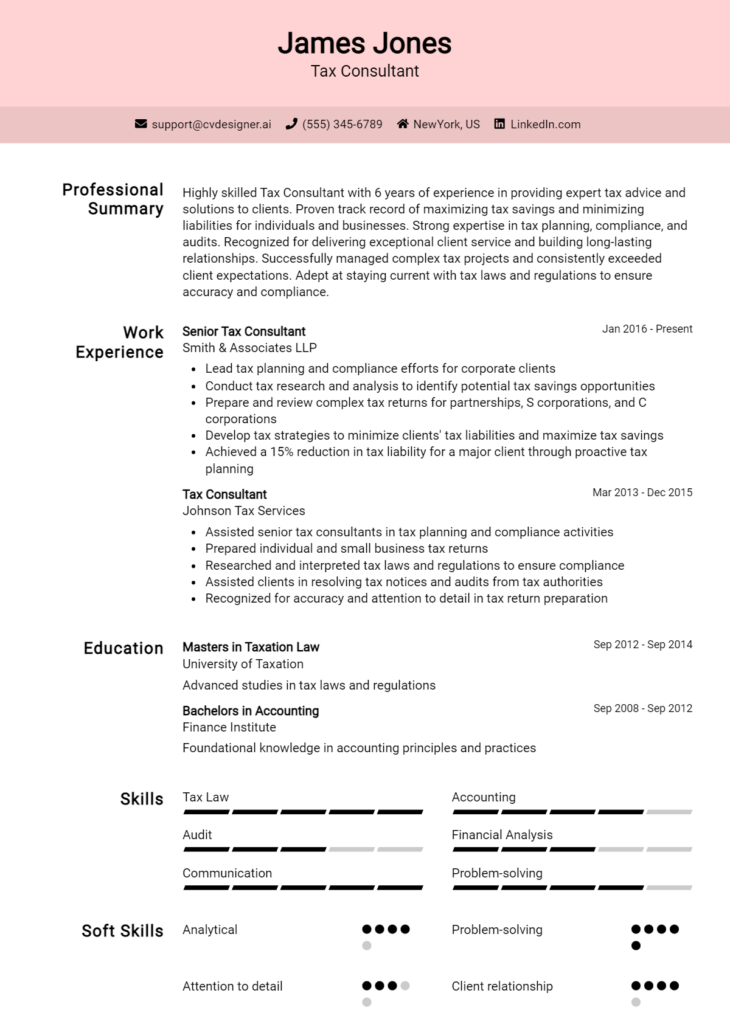

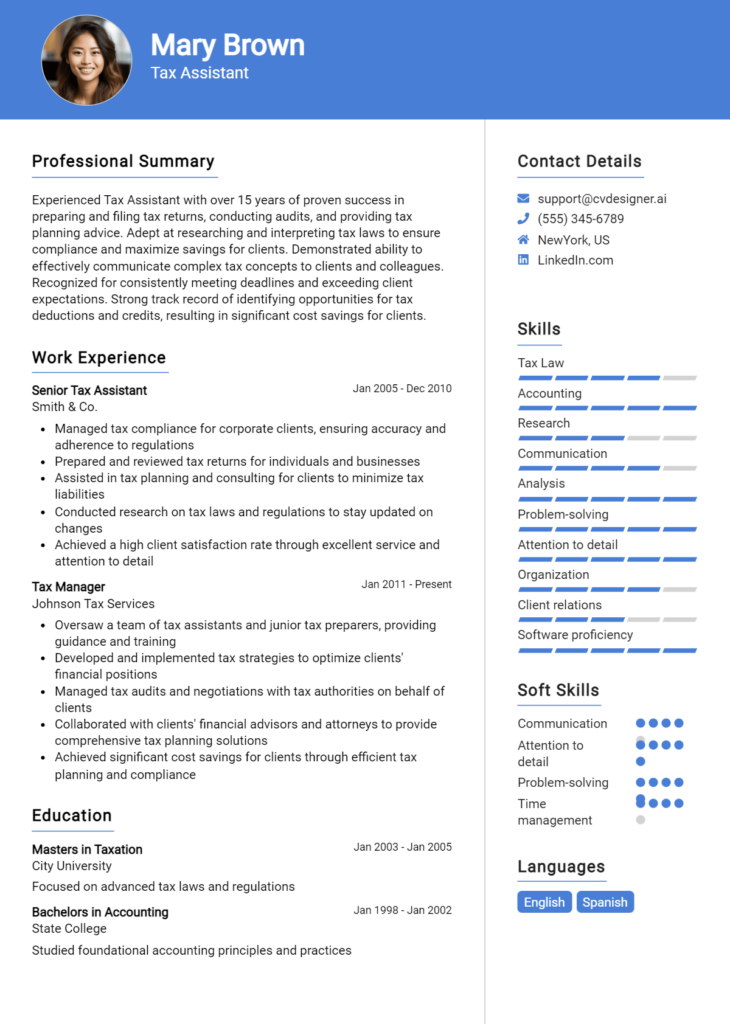

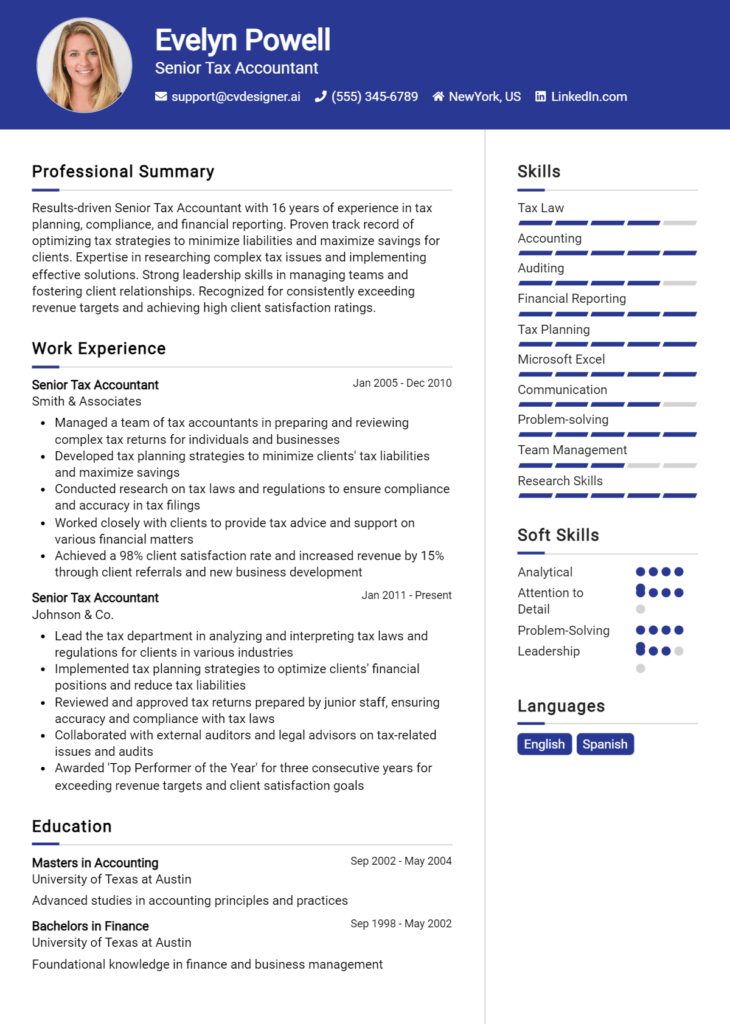

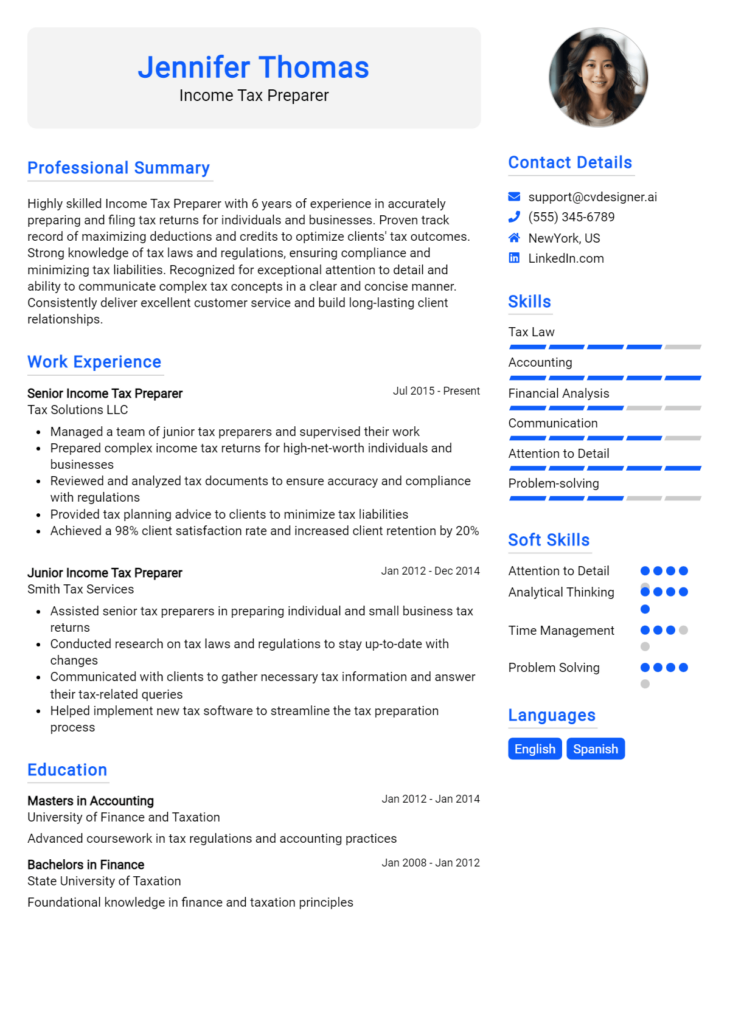

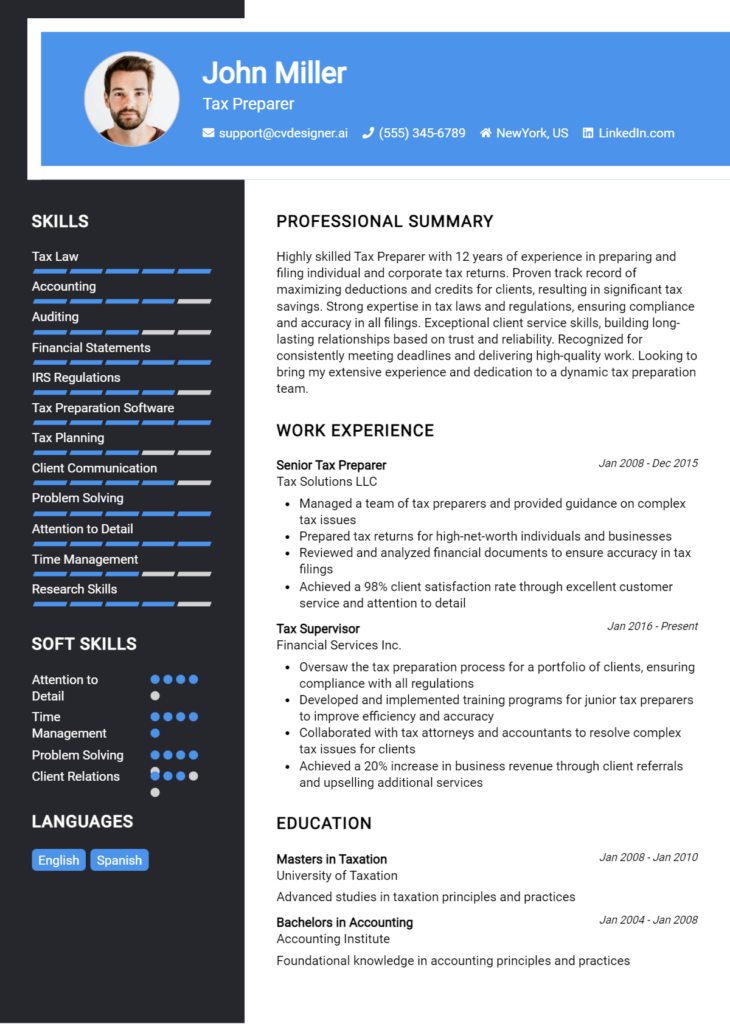

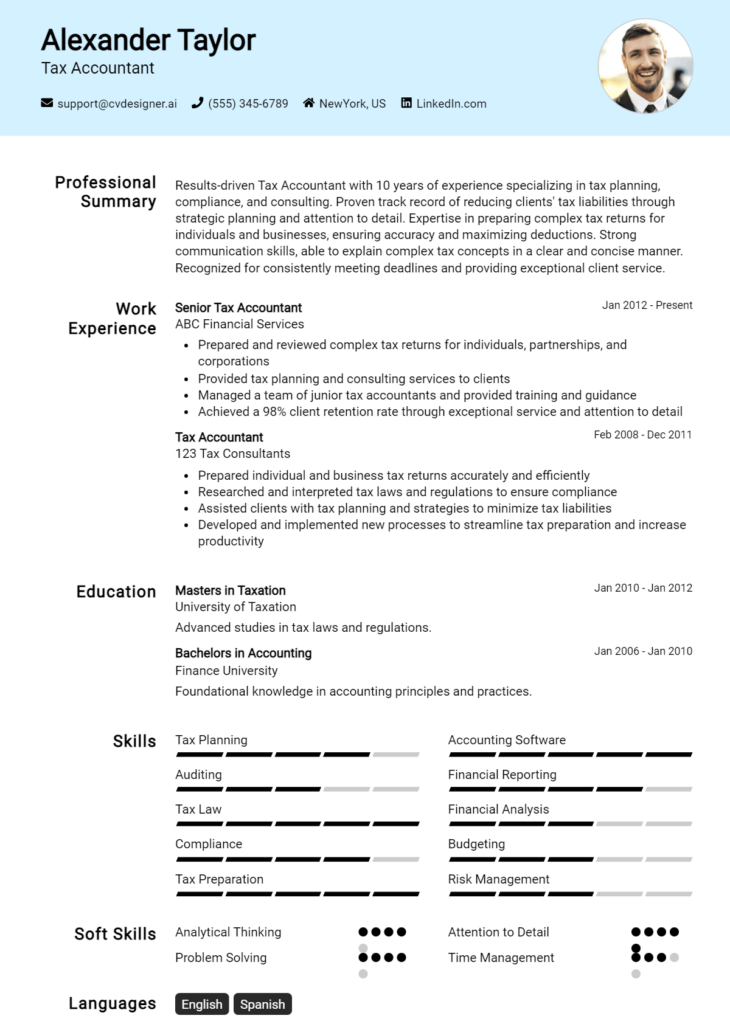

Sample Tax Analyst Resumes

A Tax Analyst plays a crucial role in ensuring compliance with tax regulations, analyzing financial data, and providing insights that help organizations make informed decisions. Whether you are an experienced professional, an entry-level candidate, or someone looking to transition into this field, having a well-structured resume is essential to highlight your skills and experiences. Below are three sample resumes tailored for different levels of expertise in the Tax Analyst role. Readers are encouraged to explore more resume templates for inspiration and consider corresponding cover letter examples to complete their job application package.

Experienced Tax Analyst Resume Sample

John Doe

123 Tax Lane

City, State, ZIP

(123) 456-7890

john.doe@email.com

Summary

Highly skilled Tax Analyst with over 8 years of experience in tax compliance, planning, and reporting. Proven track record of identifying tax-saving opportunities and ensuring regulatory compliance. Adept at using advanced tax software and conducting detailed financial analyses.

Professional Experience

Senior Tax Analyst

ABC Corporation, City, State

January 2018 – Present

- Managed the preparation and filing of federal and state tax returns for a portfolio of clients valued at over $500 million.

- Conducted in-depth tax research and analysis to provide clients with strategic tax planning advice, resulting in an average tax savings of 15%.

- Collaborated with cross-functional teams to ensure compliance with local, state, and federal regulations.

- Trained and mentored junior tax staff on tax regulations and software applications.

Tax Analyst

XYZ Inc., City, State

June 2015 – December 2017

- Assisted in the preparation of corporate tax returns and estimated tax payments, achieving a 100% accuracy rate.

- Developed comprehensive tax projections and scenarios for management to analyze potential impacts.

- Researched and interpreted tax laws and regulations to ensure compliance and minimize risks.

Education

Bachelor of Science in Accounting

University of State, City, State

Graduated: May 2015

Certifications

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

Entry-Level Tax Analyst Resume Sample

Jane Smith

456 Tax Avenue

City, State, ZIP

(987) 654-3210

jane.smith@email.com

Summary

Detail-oriented and motivated recent graduate with a Bachelor’s degree in Accounting. Strong analytical skills with a foundational understanding of tax regulations and compliance processes. Eager to contribute to a team and support tax planning initiatives.

Education

Bachelor of Science in Accounting

University of City, City, State

Graduated: May 2023

Internship Experience

Tax Intern

DEF Tax Advisors, City, State

January 2023 – April 2023

- Assisted in preparing tax returns for individual and corporate clients under the supervision of senior analysts.

- Conducted research on various tax issues and compiled reports to support tax filings.

- Participated in client meetings to discuss tax strategies and compliance requirements.

Relevant Coursework

- Federal Income Taxation

- Tax Planning and Management

- Corporate Taxation

Skills

- Proficient in Microsoft Excel and tax software (e.g., TurboTax, H&R Block)

- Strong analytical and problem-solving abilities

- Excellent written and verbal communication skills

Career Changer Tax Analyst Resume Sample

Michael Johnson

789 Finance Road

City, State, ZIP

(321) 654-9870

michael.johnson@email.com

Summary

Results-driven financial analyst with 5 years of experience in financial reporting and analysis, seeking to transition into a Tax Analyst role. Strong understanding of financial principles and tax regulations, combined with proven analytical skills and attention to detail.

Professional Experience

Financial Analyst

GHI Financial Services, City, State

March 2018 – Present

- Developed financial models and conducted variance analyses to support budgeting and forecasting efforts.

- Collaborated with the accounting team to ensure accurate financial reporting and compliance with regulations.

- Analyzed financial data to identify trends and provide actionable insights to management.

Junior Financial Analyst

JKL Enterprises, City, State

June 2016 – February 2018

- Assisted in preparing monthly financial reports and conducted reconciliation of accounts.

- Supported the finance team in developing forecasts and financial plans.

Education

Bachelor of Business Administration in Finance

University of Business, City, State

Graduated: May 2016

Certifications

- Certified Management Accountant (CMA) (In Progress)

Skills

- Strong knowledge of financial analysis and reporting

- Proficient with Excel, SAP, and financial modeling tools

- Familiar with tax regulations and compliance requirements

These sample resumes provide a clear guide for crafting a compelling document tailored to your experience level and career goals. For further inspiration, be sure to check out additional resume templates and cover letter examples to enhance your job application package.

Checklist for a Tax Analyst Resume

- Proofread for Errors: Carefully read through your resume to catch any spelling, grammar, or punctuation mistakes. Consider using tools like Grammarly for additional support.

- Consistent Formatting: Ensure that your font, font size, and bullet point style are consistent throughout the document. This helps create a polished and professional appearance.

- Tailor to the Job Description: Customize your resume to highlight skills and experiences that align with the specific requirements of the Tax Analyst role you're applying for. Use keywords from the job posting.

- Clear and Concise Language: Use straightforward language and avoid jargon. Aim for clarity in your descriptions of responsibilities and achievements.

- Quantify Achievements: Where possible, include numbers to demonstrate your impact. For example, mention the percentage of tax savings achieved for clients or the number of tax returns processed.

- Relevant Experience First: List your most relevant work experience at the top of your employment history section. This may include internships, part-time jobs, or volunteer positions related to tax analysis.

- Professional Summary: Consider including a brief professional summary at the top of your resume that encapsulates your key qualifications and career goals.

- Contact Information: Make sure your contact information is up-to-date and prominently displayed at the top of the resume.

- Use an AI Resume Builder: Utilize an AI resume builder to help you organize all elements of your resume efficiently and ensure a clean layout.

- Similar Checklists for CV and Cover Letter: Remember, a similar checklist can be followed for creating a CV or cover letter, ensuring that all your application materials are cohesive and professional.

Key Takeaways for a Tax Analyst Resume Guide

In conclusion, crafting a compelling resume as a Tax Analyst is crucial to standing out in a competitive job market. By utilizing the examples and tips provided in this guide, you can effectively showcase your skills, experiences, and accomplishments. We encourage you to take the next step in your job application journey by downloading a tailored resume template from resume templates or a cover letter template from cover letter templates. Additionally, consider using our best resume maker to streamline the creation process. Remember, adhering to similar guidelines will also aid in developing a persuasive CV and cover letter. Start building your standout application today!