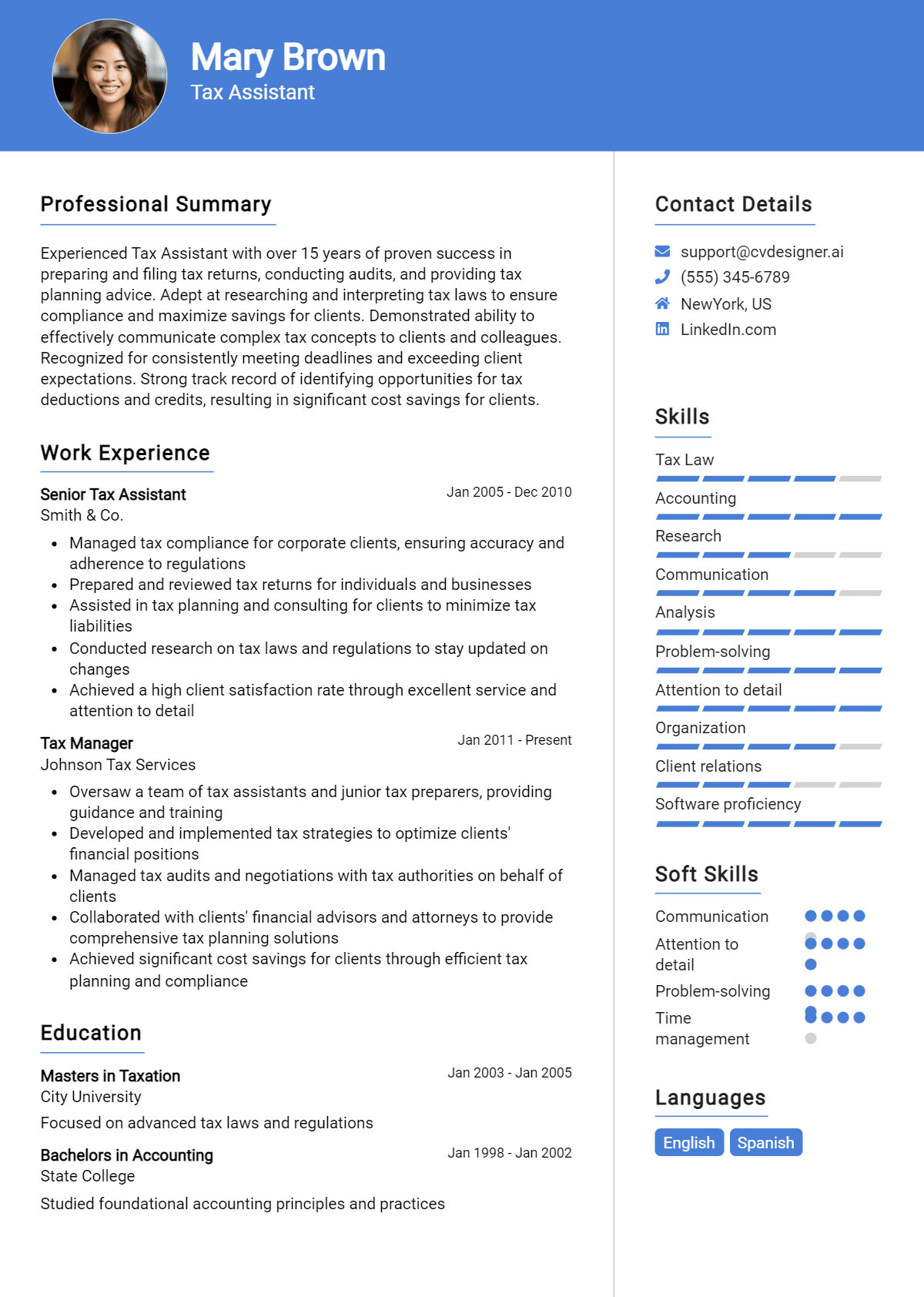

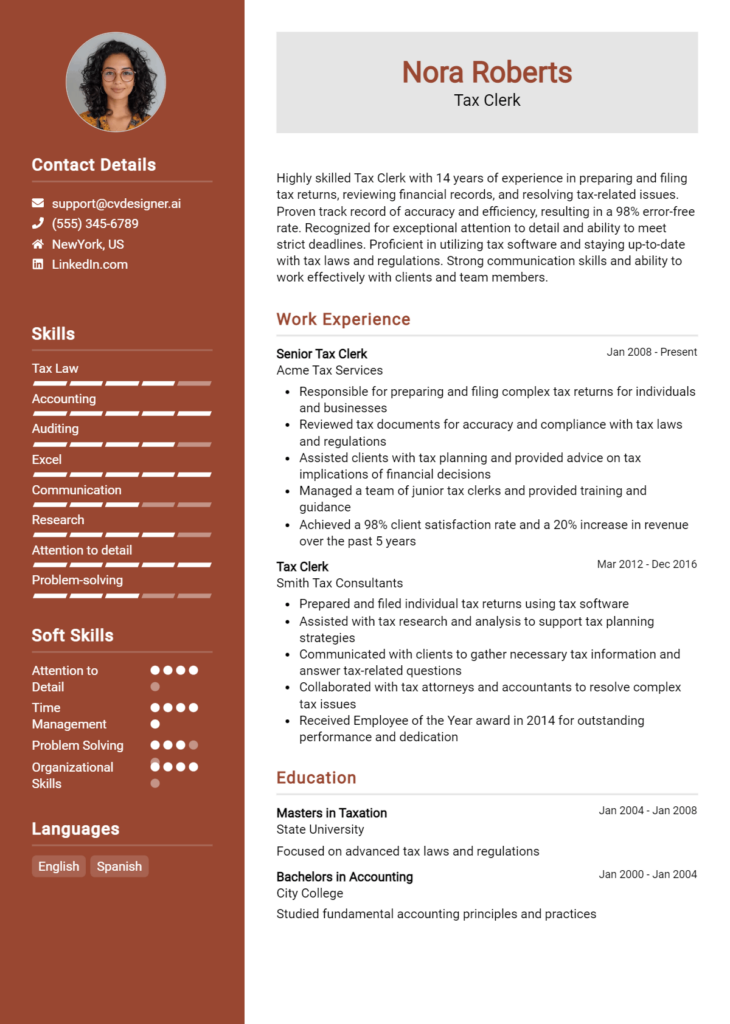

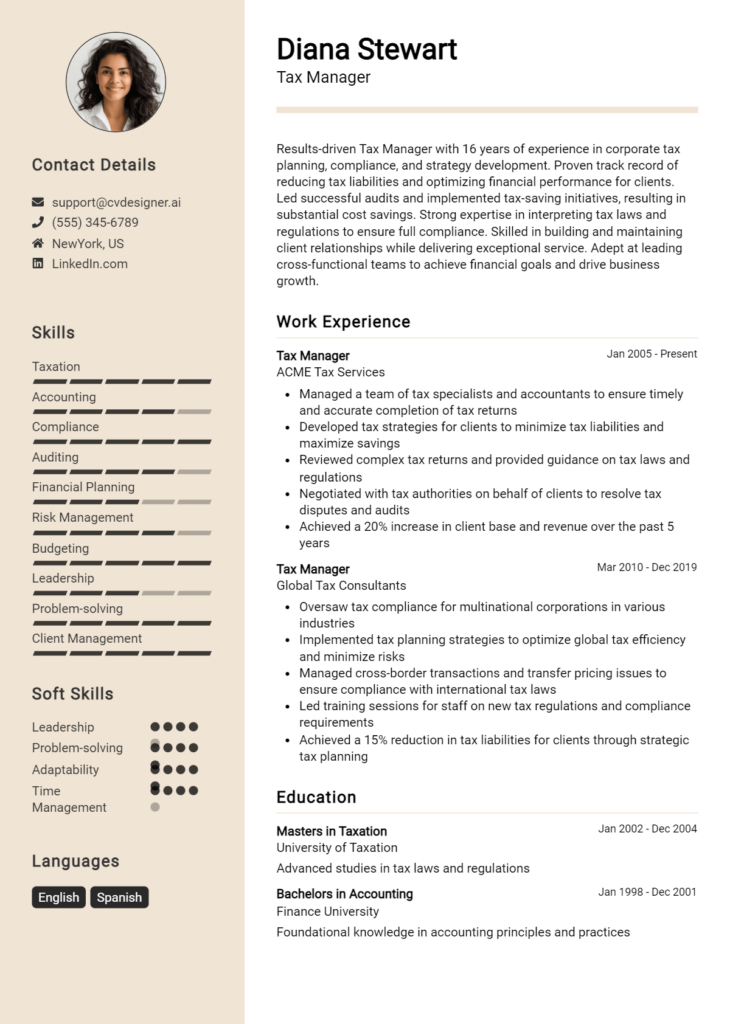

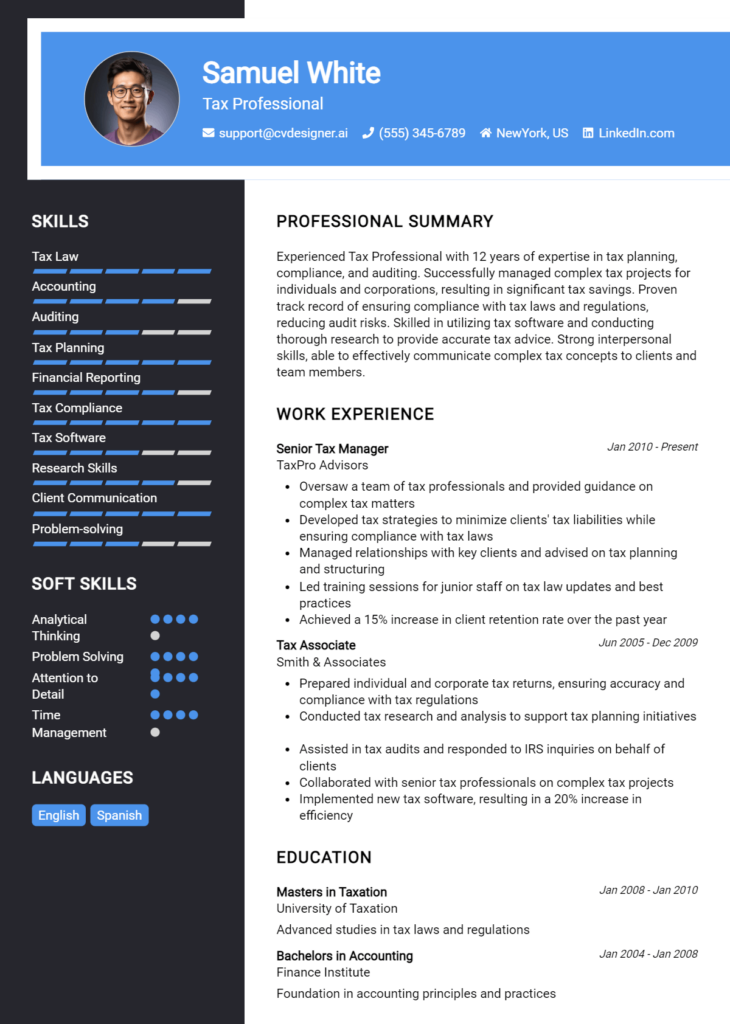

Most Popular Tax Assistant Resume Examples

Explore additional Tax Assistant resume samples and guides and see what works for your level of experience or role.

As a Tax Assistant, you play a crucial role in helping individuals and businesses navigate the complex world of taxation. Your expertise not only aids in ensuring compliance with tax laws but also assists clients in optimizing their tax situations. Given the importance of this role, having a well-crafted resume is essential to stand out in a competitive job market. A compelling resume not only highlights your qualifications and experiences but also reflects your understanding of the tax industry, making you an attractive candidate to potential employers.

In this guide, we will cover everything you need to know to create an impressive Tax Assistant resume. We will explore the key responsibilities and skills required for the role, discuss the best formats to use for maximum impact, and identify common mistakes to avoid. Furthermore, we will provide resume examples tailored for all experience levels, along with tips on effective resume writing and guidance on selecting the right resume templates to enhance your application. Whether you’re just starting your career or looking to advance, this comprehensive guide will equip you with the tools needed to craft a standout resume that showcases your qualifications and catches the eye of hiring managers.

Key Responsibilities and Skills for a Tax Assistant

As a Tax Assistant, your primary focus will be on supporting tax professionals in the preparation and filing of tax returns, ensuring compliance with tax laws and regulations. Below are the key responsibilities typically associated with this role:

- Assisting in the preparation of federal, state, and local tax returns

- Conducting research on tax issues and regulations

- Collecting and organizing financial data and documentation

- Reviewing financial statements and accounting records for accuracy

- Communicating with clients to gather necessary information

- Staying updated on changes in tax laws and regulations

- Assisting with audits and responding to inquiries from tax authorities

- Maintaining confidentiality and security of sensitive financial information

To excel as a Tax Assistant, certain essential skills are highly valuable:

- Attention to detail and accuracy

- Strong analytical and problem-solving abilities

- Proficiency in tax preparation software and Microsoft Excel

- Excellent communication and interpersonal skills

- Time management and organizational skills

- Understanding of accounting principles and practices

- Ability to work under pressure and meet deadlines

It is crucial to highlight these skills effectively in the resume skills section, as they demonstrate your qualifications for the role. Tailoring these responsibilities and skills to the specific job description will enhance your application and show potential employers that you are a great fit for their needs. Moreover, considering how these skills can be relevant in creating a strong CV will help you present a compelling case for your candidacy. A well-crafted CV that aligns with the expectations of the position can significantly improve your chances of landing an interview.

Best Resume Format and Structure for a Tax Assistant

When crafting a resume for a Tax Assistant position, it's essential to choose a format that highlights your qualifications clearly and effectively. A well-structured resume not only helps you stand out to employers but also complements your cover letter, making a cohesive application package. Here’s a detailed guide on the best resume format and structure for a Tax Assistant.

Contact Information

- Start with your full name at the top, followed by your phone number, email address, and LinkedIn profile (if applicable).

- Ensure that your email address is professional, typically a combination of your first and last name.

Professional Summary

- Write a concise summary (2-3 sentences) that encapsulates your experience, skills, and what you bring to the role of a Tax Assistant.

- Focus on key attributes such as attention to detail, proficiency with tax software, and your ability to meet deadlines.

- Example: "Detail-oriented Tax Assistant with over 3 years of experience in preparing and reviewing tax returns for individuals and small businesses. Proficient in using tax software and dedicated to providing excellent client service."

Work Experience

- List your work history in reverse chronological order (most recent job first).

- Include job title, company name, location, and dates of employment.

- Use bullet points to describe your responsibilities and achievements in each role. Start each bullet with action verbs and quantify your accomplishments where possible.

- Example:

- Assisted in preparing over 150 individual tax returns for the 2022 tax season, ensuring compliance with federal and state regulations.

- Collaborated with the senior tax advisor to streamline the filing process, resulting in a 20% reduction in processing time.

Education

- Include your degree(s), major, school name, and graduation date.

- If you have relevant coursework or honors, consider listing them as well.

- Example: "Bachelor of Science in Accounting, XYZ University, Graduated May 2021."

Skills

- Highlight both hard and soft skills relevant to the Tax Assistant role.

- Hard skills may include tax preparation software (like TurboTax or H&R Block), accounting principles, and financial analysis.

- Soft skills could include communication, organization, and problem-solving.

- Tailor this section to the job description to show alignment with the employer's needs.

Certifications

- If you have any relevant certifications, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), list them here.

- Include the certifying body and the date obtained.

Tips for Including Content

- Tailor your resume for each application by incorporating keywords from the job description.

- Keep your resume to one page, especially if you have less than 10 years of experience.

- Use a clean, professional font and ensure ample white space to make your resume easy to read.

- Consider using a combination resume format, which includes both chronological and functional elements, to showcase relevant skills alongside your work history.

In terms of complementary cover letter formatting, ensure that the design and font style match your resume for a cohesive look. Your cover letter should expand on the experiences mentioned in your resume, providing context and personality. Start with a strong opening that captures attention and relate it to the position, then follow through with specific examples from your work experience that demonstrate your qualifications.

By following this structured approach, you will create a resume that effectively communicates your value as a Tax Assistant and positions you as a strong candidate in the job market.

Writing Tips and Best Practices for a Tax Assistant Resume

When crafting a resume for a Tax Assistant position, it's essential to present your skills and experiences in a clear and compelling manner that highlights your proficiency in tax preparation and compliance. Start by tailoring your resume to the specific job description, ensuring you incorporate relevant industry-specific keywords that demonstrate your understanding of tax regulations and practices. Additionally, using action verbs to describe your responsibilities and achievements can make your contributions stand out. Quantifying your achievements, such as the number of clients served or the percentage of tax savings achieved for clients, can further illustrate your capabilities. A polished and professional look is vital, so consider utilizing resume writing tips to enhance your document. As you reflect on these practices, remember that they also apply when drafting a cover letter to effectively communicate your fit for the role.

- Tailor your resume for each job application by using keywords from the job description.

- Start bullet points with strong action verbs, such as "prepared," "analyzed," or "assisted."

- Quantify your achievements whenever possible, such as "processed over 100 tax returns" or "reduced client tax liabilities by 15%."

- Highlight relevant technical skills and software proficiency, such as experience with tax preparation software like TurboTax or QuickBooks.

- Include any certifications or professional development courses related to tax preparation or accounting.

- Organize your resume in a clear and logical format, using headings and bullet points for easy readability.

- Proofread your resume multiple times to eliminate any grammatical errors or typos, ensuring a professional presentation.

- Keep your resume concise, ideally one page, focusing on the most relevant experiences and skills for the Tax Assistant role.

Common Mistakes to Avoid in a Tax Assistant Resume

When crafting a resume for a Tax Assistant position, it's essential to present your qualifications clearly and effectively. However, many applicants make common mistakes that can undermine their chances of landing an interview. By being aware of these pitfalls, you can enhance your resume's impact and demonstrate your suitability for the role. Here are some common mistakes to avoid when writing your Tax Assistant resume:

- Overloading the resume with excessive information that overwhelms the reader.

- Using generic job descriptions that fail to highlight specific skills and achievements.

- Neglecting to tailor the resume to the specific job description and requirements.

- Failing to include relevant keywords that align with the job posting.

- Using inconsistent formatting that detracts from the professional appearance of the document.

- Ignoring the importance of quantifying achievements and contributions with specific metrics.

- Listing job duties instead of focusing on accomplishments and results.

- Underestimating the value of proofreading for spelling and grammatical errors.

- Omitting important sections, such as contact information or a summary statement.

- Using an unprofessional email address or inappropriate language.

For more detailed insights on avoiding these errors, consider reviewing the common mistakes to avoid in a resume. Additionally, it's crucial to ensure your cover letter complements your resume, so be sure to check out common cover letter mistakes as well.

Sample Tax Assistant Resumes

As a Tax Assistant, you play a crucial role in supporting tax professionals by preparing tax returns, conducting research, and ensuring compliance with tax regulations. Whether you are an experienced professional, a recent graduate, or transitioning from another field, having a well-crafted resume is essential for landing your desired job. Below are three sample resumes tailored for different levels of experience and professional backgrounds.

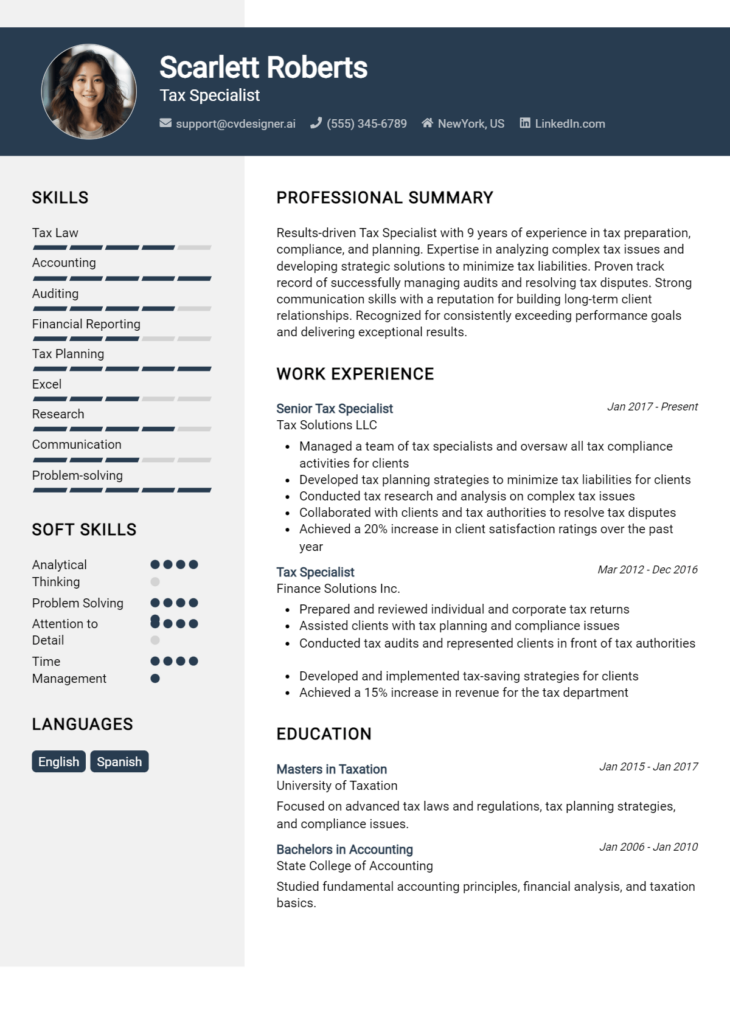

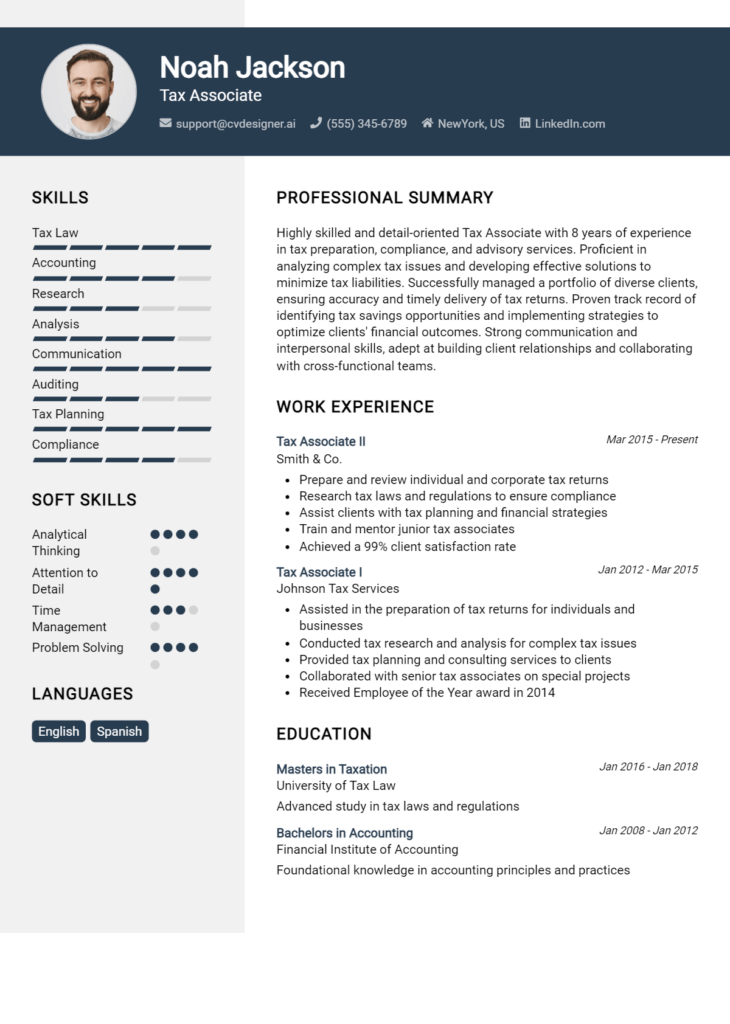

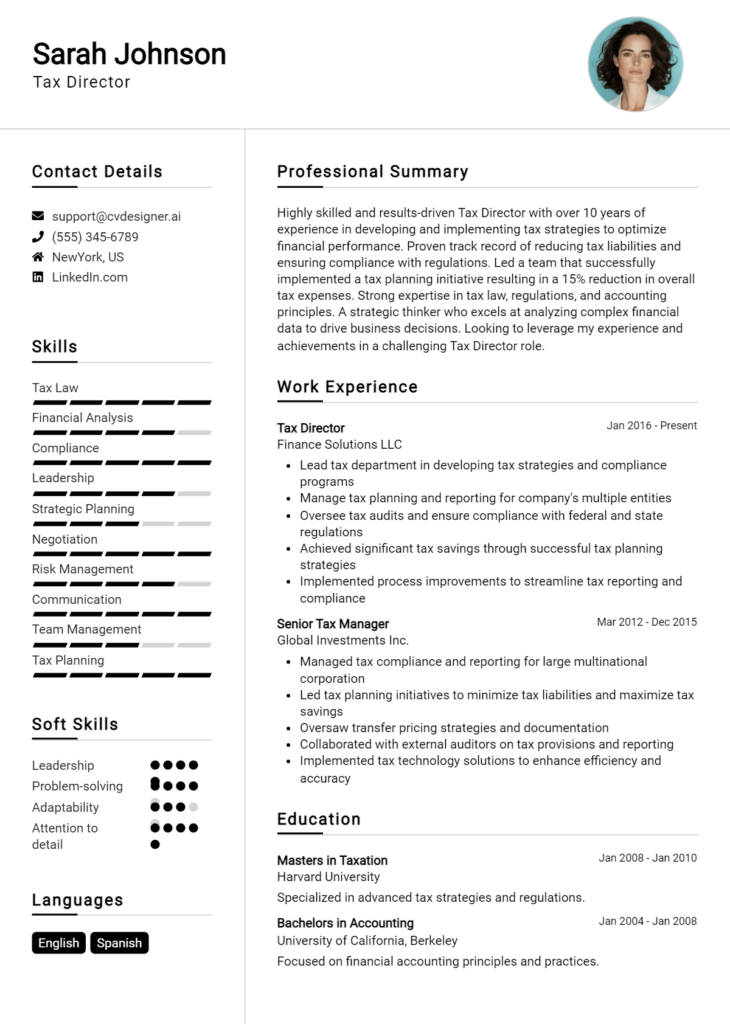

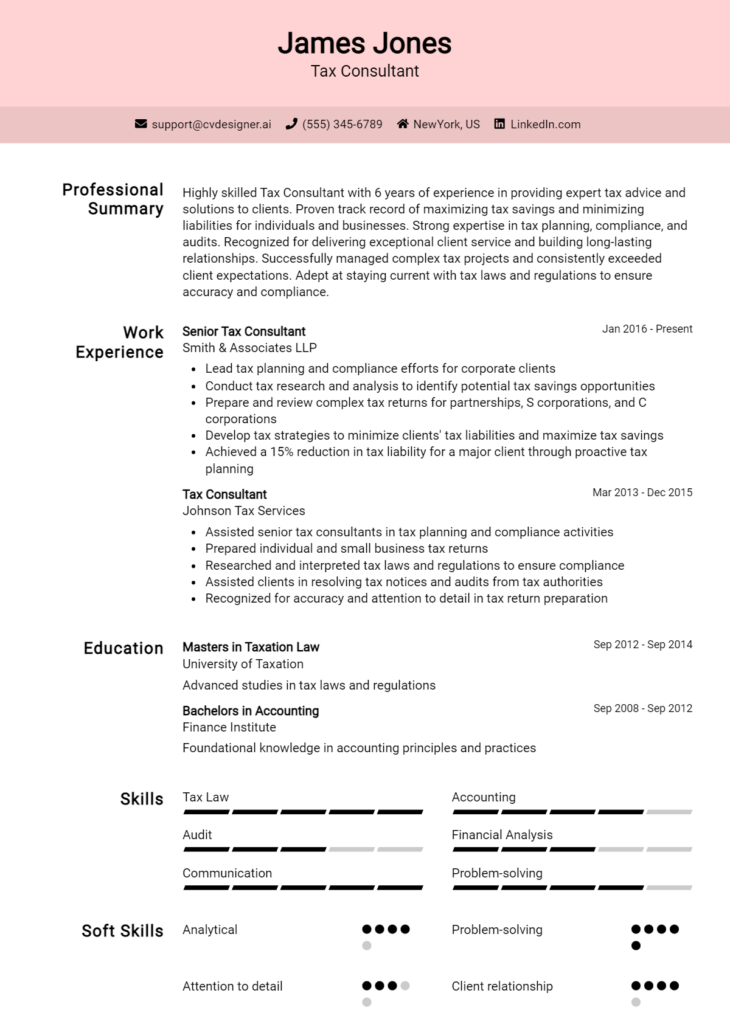

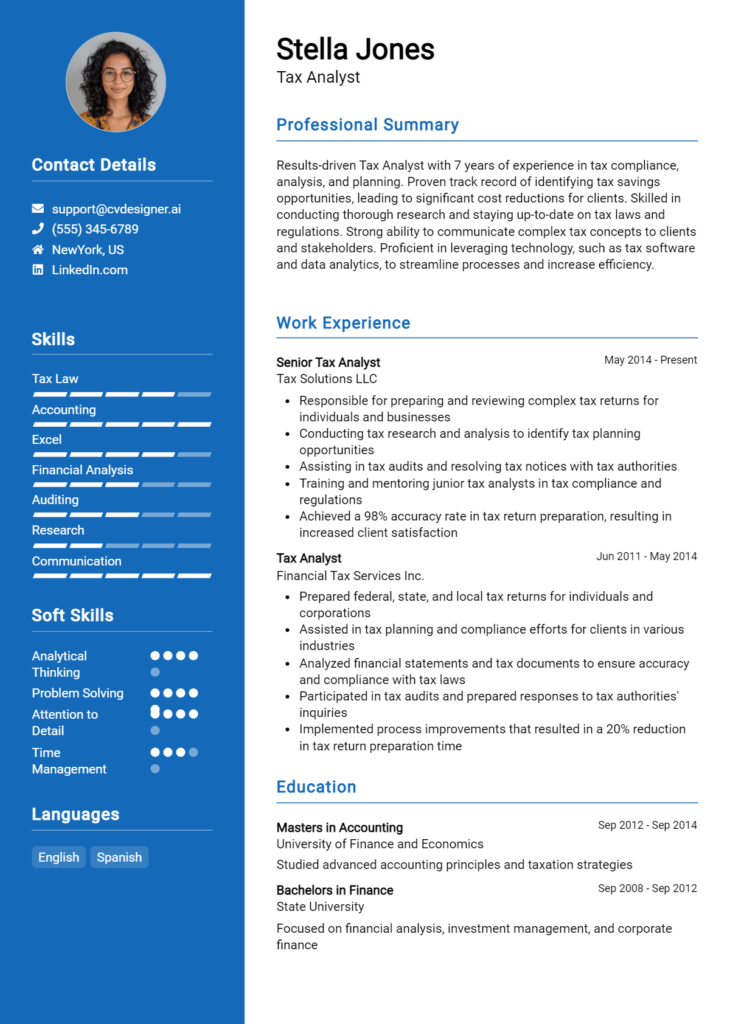

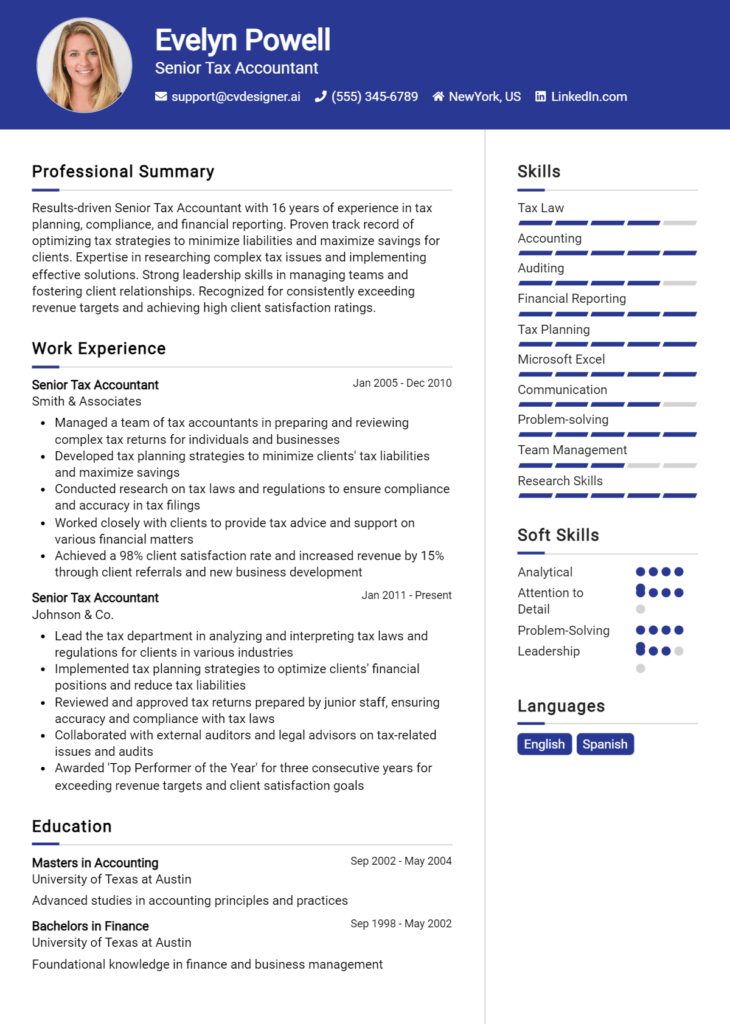

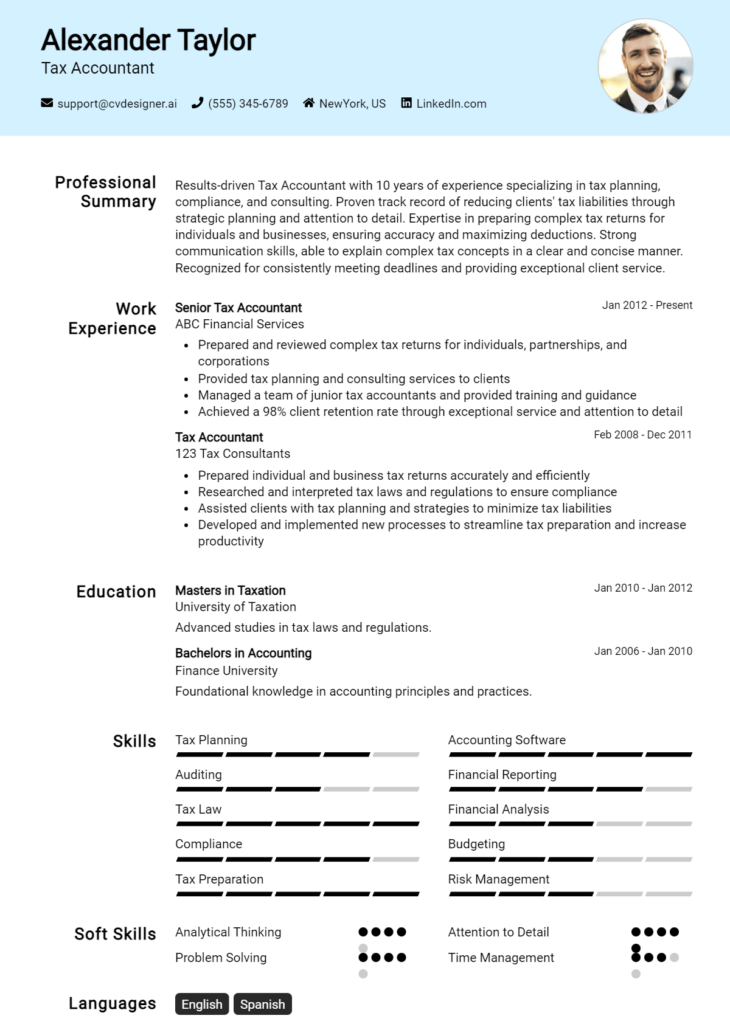

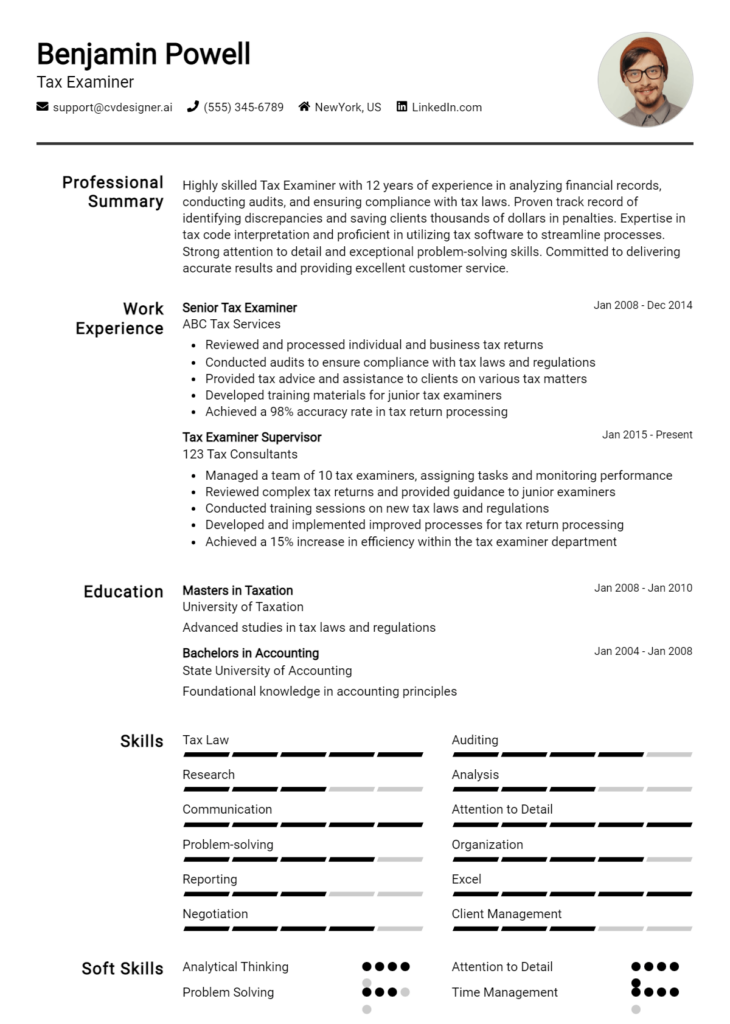

Experienced Tax Assistant Resume

Jane Doe

123 Main Street

City, State, ZIP

(123) 456-7890

janedoe@email.com

Professional Summary

Detail-oriented and experienced Tax Assistant with over 5 years of experience in tax preparation and compliance. Proven ability to manage multiple clients, analyze financial data, and ensure accurate filings. Strong knowledge of federal and state tax regulations.

Experience

Senior Tax Assistant

ABC Tax Services, City, State

January 2018 – Present

- Prepare and review individual and corporate tax returns for over 200 clients annually, ensuring compliance with all tax regulations.

- Conduct tax research to provide clients with up-to-date information on tax laws and potential deductions.

- Train and mentor junior staff on tax preparation processes and software usage.

- Collaborate with auditors during tax audits, providing necessary documentation and support.

Tax Assistant

XYZ Accounting Firm, City, State

June 2015 – December 2017

- Assisted in the preparation of tax returns for a diverse clientele, including individuals and small businesses.

- Managed client communications, addressing inquiries and providing guidance on tax-related matters.

- Maintained accurate records and organized client files for easy access during tax season.

Education

Bachelor of Science in Accounting

University of State, City, State

Graduated: May 2015

Skills

- Tax preparation and compliance

- Financial analysis

- Microsoft Excel and Tax software proficiency

- Strong communication and interpersonal skills

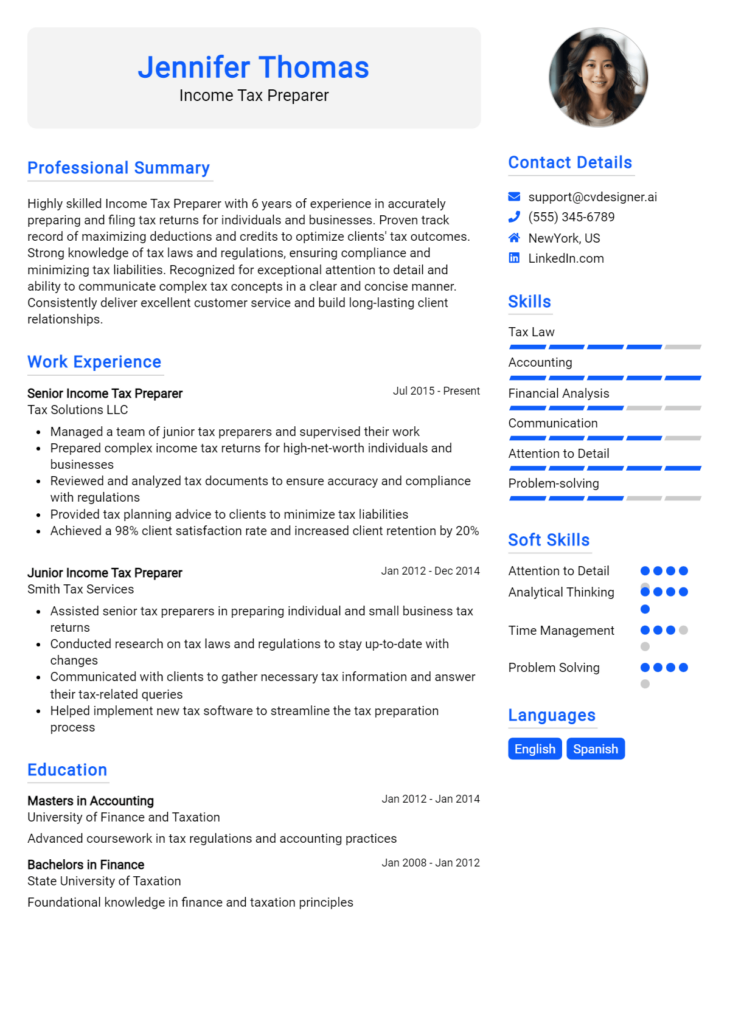

Entry-Level Tax Assistant Resume

John Smith

456 Oak Avenue

City, State, ZIP

(987) 654-3210

johnsmith@email.com

Professional Summary

Motivated and detail-oriented recent graduate seeking an entry-level Tax Assistant position. Strong academic background in accounting and finance, with a passion for tax preparation and compliance. Eager to contribute to a dynamic tax team while gaining practical experience.

Education

Bachelor of Arts in Accounting

State University, City, State

Graduated: May 2023

Relevant Coursework

- Tax Accounting

- Financial Management

- Business Law

- Accounting Information Systems

Internship Experience

Tax Intern

DEF Financial Services, City, State

January 2023 – April 2023

- Assisted in the preparation of tax returns and financial statements under the supervision of senior tax professionals.

- Conducted research on tax regulations and assisted in the analysis of client financial data.

- Participated in client meetings, gathering necessary documentation for tax filings.

Skills

- Knowledge of tax regulations

- Proficient in Microsoft Office Suite

- Strong analytical and problem-solving skills

- Excellent written and verbal communication

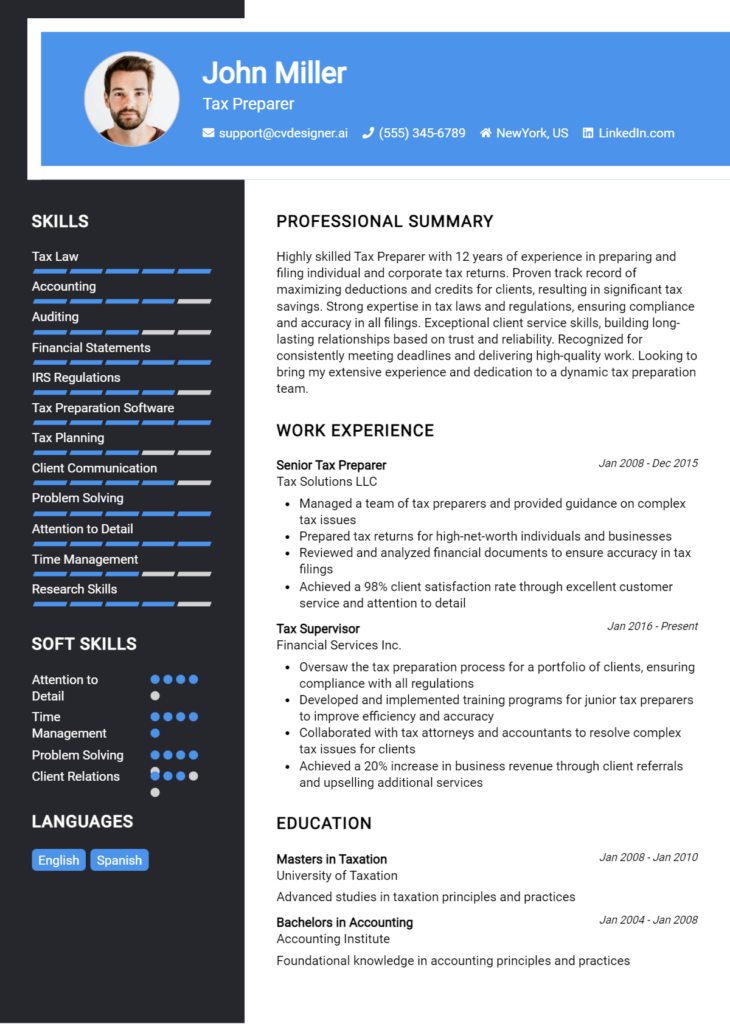

Career Changer Tax Assistant Resume

Emily Johnson

789 Pine Lane

City, State, ZIP

(555) 123-4567

emilyjohnson@email.com

Professional Summary

Dedicated professional with 7 years of experience in project management, transitioning to a Tax Assistant role. Strong analytical skills and attention to detail, combined with a solid understanding of financial principles. Committed to leveraging previous experience to provide exceptional support in tax preparation and compliance.

Experience

Project Manager

GHI Corporation, City, State

March 2016 – Present

- Managed multiple projects simultaneously, ensuring timely completion and adherence to budgets.

- Analyzed project budgets and expenses, providing reports to senior management and making recommendations for cost-saving measures.

- Developed strong relationships with clients and stakeholders through effective communication and problem resolution.

Administrative Assistant

JKL Enterprises, City, State

January 2015 – February 2016

- Provided administrative support to the finance department, including data entry and document management.

- Assisted in the preparation of financial reports and maintained accurate financial records.

- Coordinated meetings and prepared agendas, ensuring effective communication among team members.

Education

Certificate in Tax Preparation

Community College, City, State

Completed: August 2023

Skills

- Project management

- Financial analysis

- Excellent organizational skills

- Proficient in accounting software and Microsoft Excel

For further inspiration, explore more resume templates and consider corresponding cover letter examples to create a complete job application package.

Checklist for a Tax Assistant Resume

- Proofread for Errors: Carefully read through your resume to eliminate any spelling, grammar, or punctuation mistakes. Consider using online tools or asking a friend for an extra set of eyes.

- Check Formatting Consistency: Ensure that font styles, sizes, and colors are consistent throughout the document. Uniformity enhances professionalism and readability.

- Tailor Your Resume: Customize your resume to align with the specific job description of the Tax Assistant position. Highlight relevant skills and experiences that match the employer’s requirements.

- Use Action Verbs: Start each bullet point in your experience section with strong action verbs (e.g., "Prepared," "Assisted," "Analyzed") to convey your contributions effectively.

- Quantify Achievements: Where possible, include numbers or percentages to quantify your accomplishments (e.g., "Processed 100+ tax returns" or "Achieved a 95% accuracy rate"), which provides context to your skills.

- Include Relevant Skills: Make sure to list key skills that relate directly to tax assistance, such as knowledge of tax regulations, proficiency in accounting software, and strong analytical abilities.

- Keep it Concise: Aim for a one-page resume unless you have extensive experience. Be succinct and focus on the most relevant information to maintain the reader's interest.

- Use a Professional Email Address: Ensure your contact information is up to date, and use a professional-sounding email address that reflects your name.

- Consider an AI Resume Builder: To ensure all elements are well-organized and visually appealing, consider using an AI resume builder.

- Follow a Similar Checklist for Other Documents: Remember that a similar checklist can be applied when creating a CV or cover letter.

Key Takeaways for a Tax Assistant Resume Guide

By utilizing the examples and tips provided in this guide, you can craft a strong and impactful resume tailored for a Tax Assistant role. A well-structured resume not only highlights your relevant skills and experience but also demonstrates your attention to detail—an essential quality in the field of taxation. To take the next step in your job application process, consider downloading a professional resume template from resume templates, or enhance your chances with a compelling cover letter by checking out our cover letter templates. For an even more personalized touch, try our best resume maker to create a visually appealing and organized document. Remember, following similar guidelines will also aid you in developing a persuasive CV and an effective cover letter. Start your journey towards securing your desired position today!