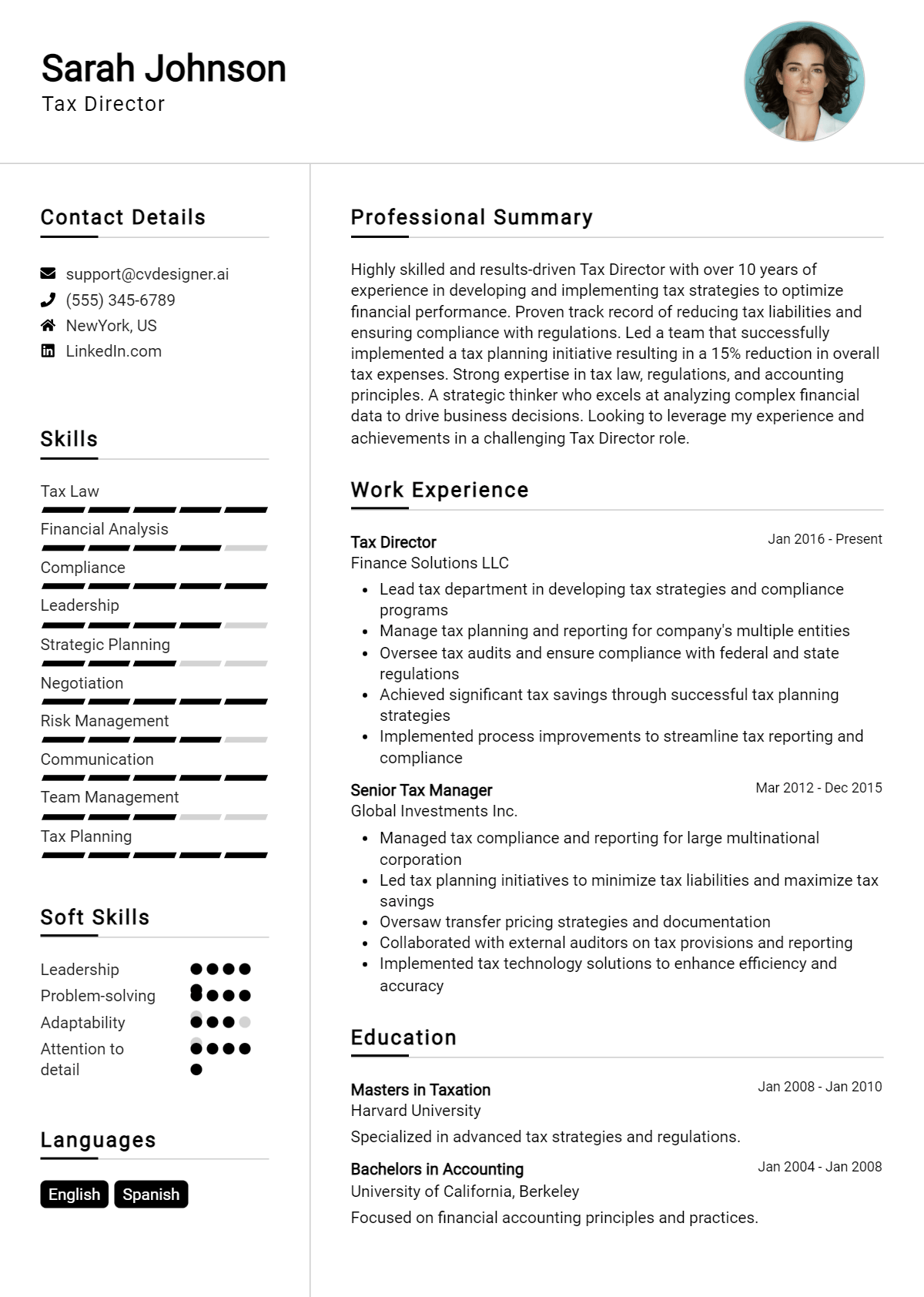

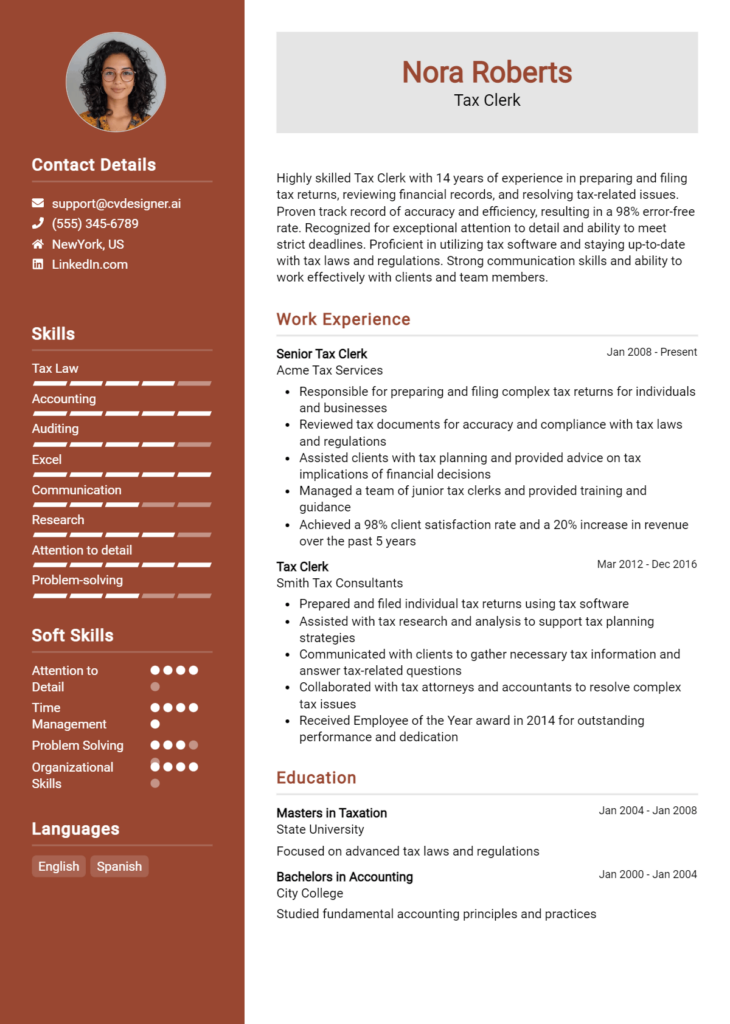

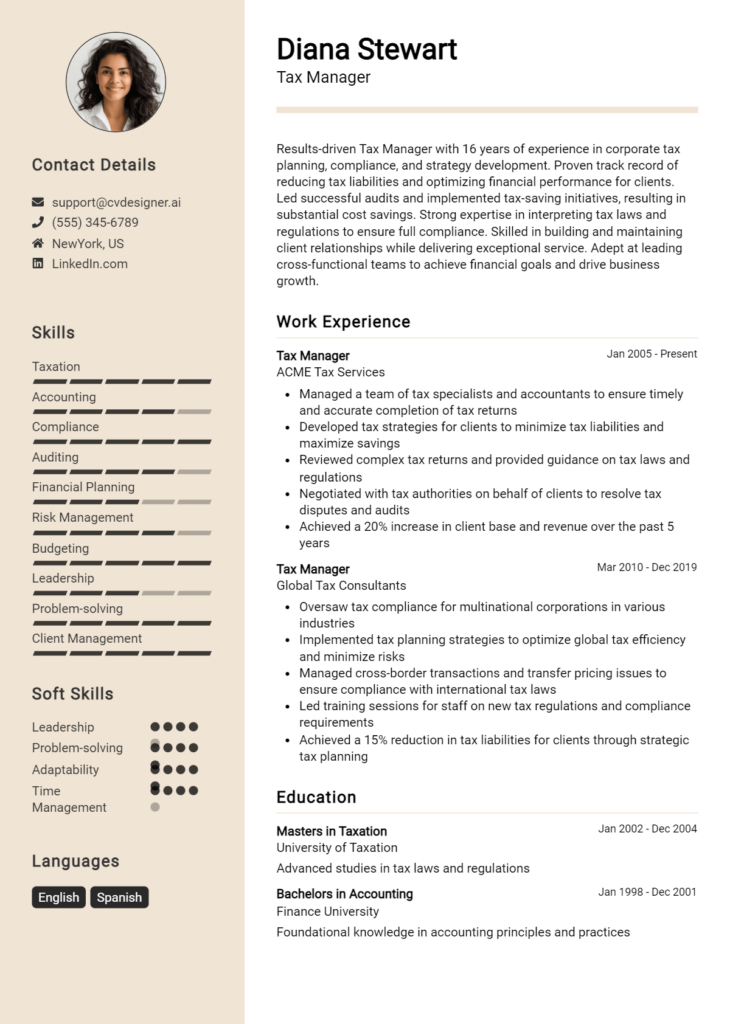

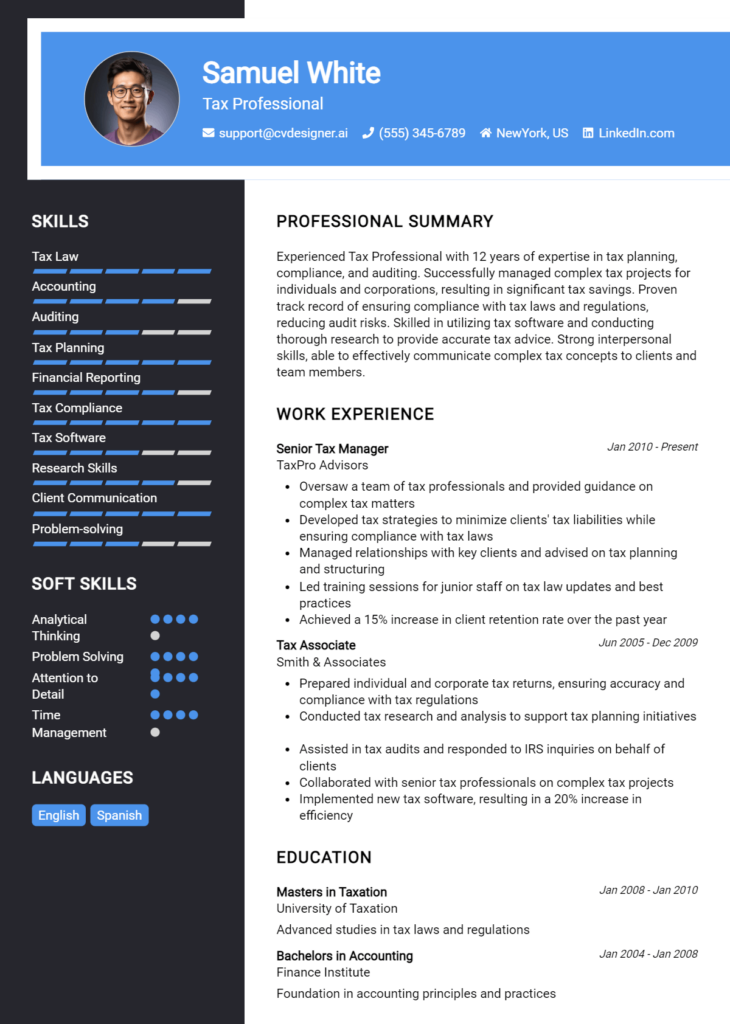

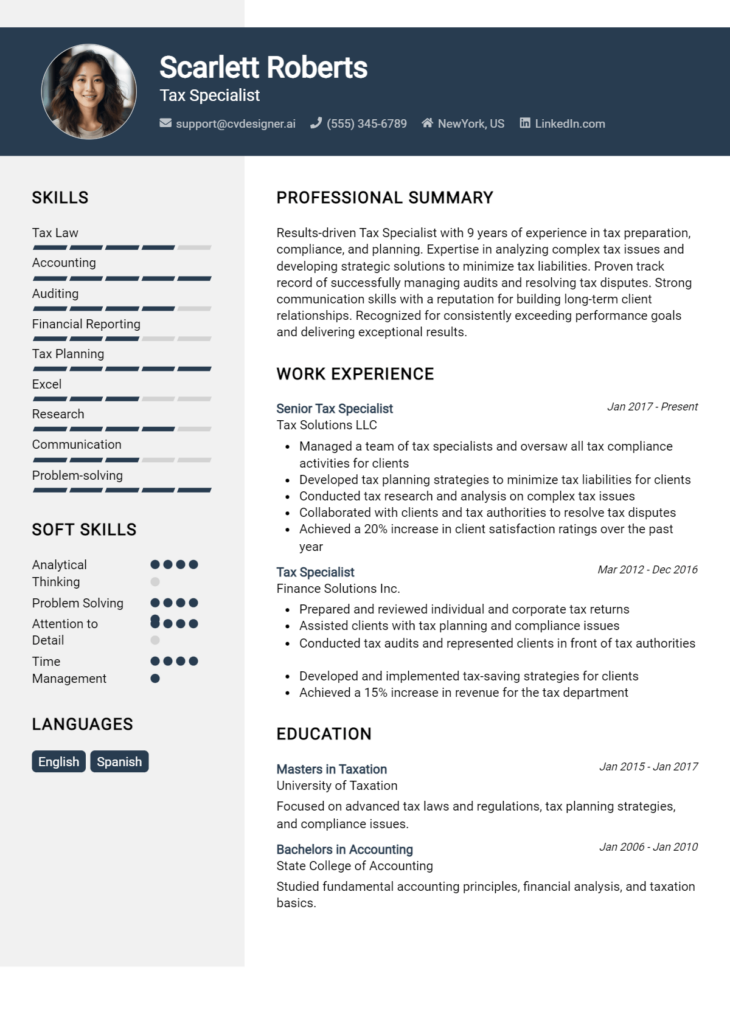

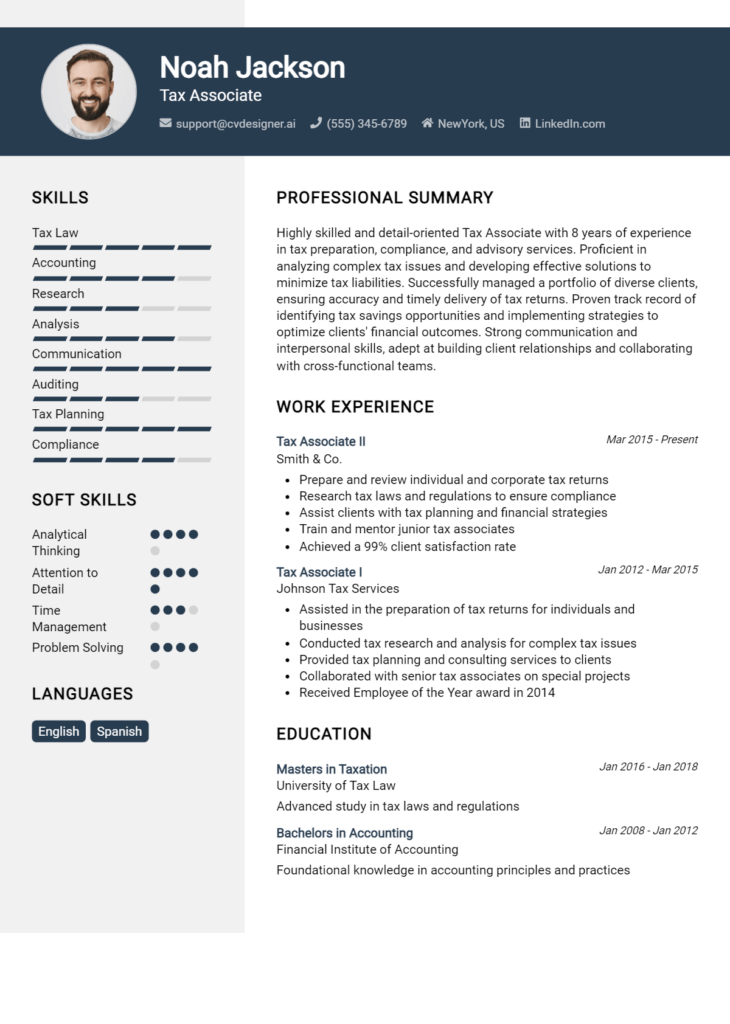

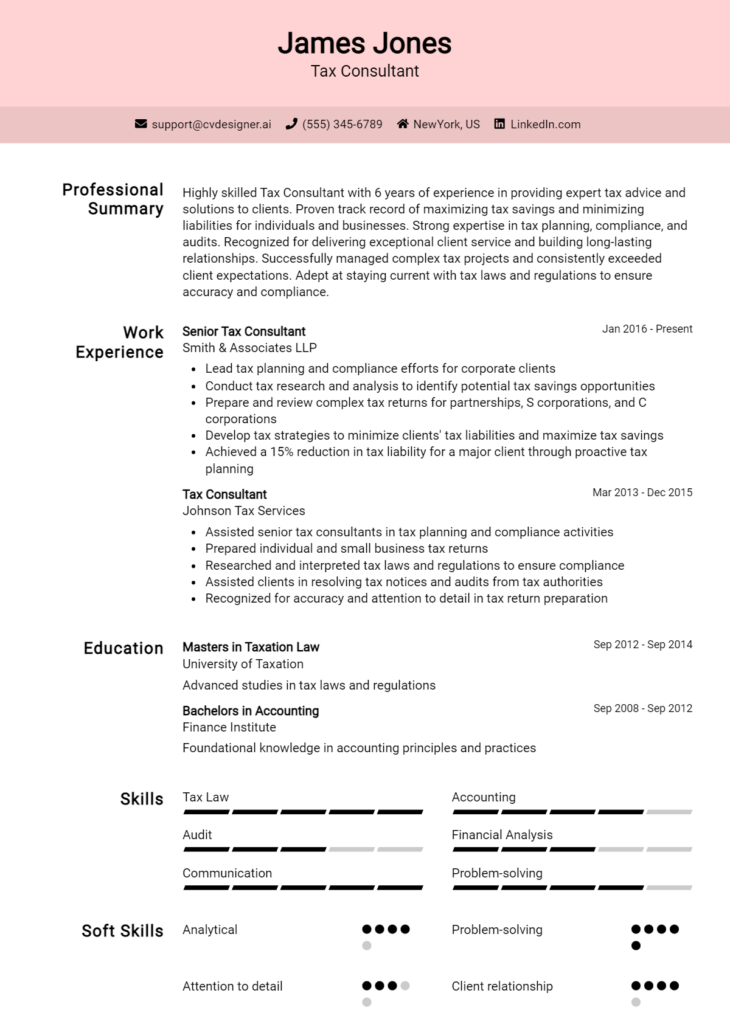

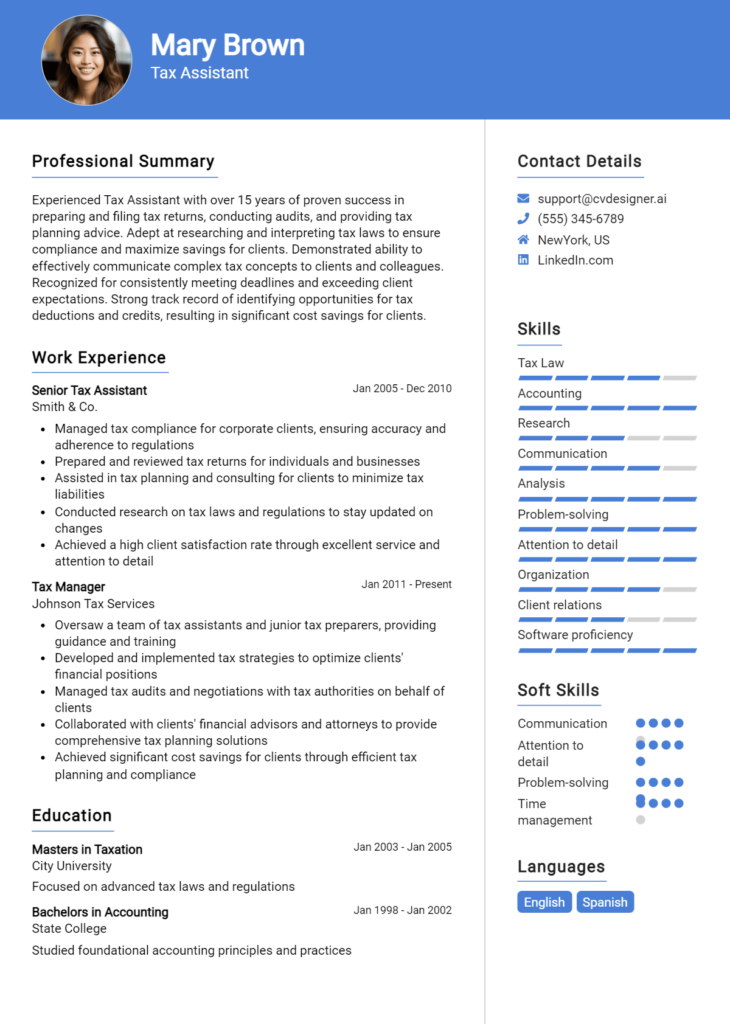

Most Popular Tax Director Resume Examples

Explore additional Tax Director resume samples and guides and see what works for your level of experience or role.

As a Tax Director, you play a pivotal role in guiding organizations through the complex landscape of tax regulations and compliance. Your expertise not only influences financial decisions but also ensures that your company navigates tax obligations efficiently and strategically. Given the significance of this position, crafting a compelling resume that highlights your qualifications, experiences, and accomplishments is crucial for standing out in a competitive job market. A well-structured resume not only showcases your professional journey but also reflects your understanding of the nuances of tax strategy and leadership, making it essential for landing interviews and advancing your career.

In this comprehensive Tax Director resume writing guide, we will delve into the key responsibilities and skills that are expected of someone in this role, ensuring you know what to emphasize. You'll learn about the best resume formats to utilize for maximum impact, as well as the common pitfalls to avoid that could cost you opportunities. We will provide resume examples tailored for various levels of experience, offering insights into how to present your unique qualifications effectively. Additionally, we will share valuable tips on how to enhance your resume writing process and guide you in selecting the right resume templates that align with your professional brand. By the end of this article, you will be equipped with the knowledge to create a standout resume that captures the attention of hiring managers.

Key Responsibilities and Skills for a Tax Director

As a Tax Director, you play a crucial role in overseeing an organization’s tax strategy and ensuring compliance with all relevant tax laws and regulations. Your responsibilities typically include:

- Developing and implementing effective tax strategies to minimize tax liabilities and optimize financial performance.

- Ensuring compliance with federal, state, and local tax regulations by overseeing the preparation and filing of tax returns.

- Managing relationships with tax authorities and external auditors to facilitate audits and resolve any issues.

- Leading a team of tax professionals and providing guidance on complex tax matters and planning opportunities.

- Conducting tax research to stay updated on changes in tax legislation and advising the organization on the implications of such changes.

- Collaborating with other departments, such as finance and legal, to ensure alignment in tax planning and compliance efforts.

- Preparing and presenting reports on tax-related matters to senior management and stakeholders.

To excel in this position, a Tax Director should possess the following essential skills:

- Strong knowledge of tax laws and regulations

- Excellent analytical and problem-solving abilities

- Effective leadership and team management skills

- Exceptional communication and presentation skills

- Proficiency in tax software and financial modeling

- Detail-oriented with a strong focus on accuracy

- Ability to work under pressure and meet tight deadlines

Highlighting these skills effectively in the resume skills section is vital for making a strong impression on potential employers. Tailoring your responsibilities and skills to align with the specific job description can significantly enhance your chances of standing out in a competitive job market. Additionally, consider how these skills can be contextualized in your CV to showcase your qualifications and experiences, demonstrating your readiness for the Tax Director role.

Best Resume Format and Structure for a Tax Director

When crafting a resume for a Tax Director position, it's crucial to choose a format that highlights your experience, skills, and leadership abilities effectively. Here’s a detailed guide on the best resume format and structure for a Tax Director:

Contact Information

- Full Name

- Phone Number

- Professional Email Address

- LinkedIn Profile (if applicable)

- Location (City, State)

This section should be at the top of the resume. Ensure that your contact information is current and professional, as this is the first impression you will make.

Professional Summary

- A concise summary that highlights your years of experience, key skills, and what you bring to the table.

- Focus on leadership experience, strategic tax planning abilities, and any significant accomplishments in your previous roles.

- Use keywords relevant to the Tax Director position, such as "tax strategy," "compliance," "regulatory requirements," and "team leadership."

Work Experience

- List your work experience in reverse chronological order (most recent job first).

- Include the following details for each position:

- Job Title

- Company Name

- Location (City, State)

- Dates of Employment (Month/Year)

- Bullet points outlining your responsibilities and achievements, focusing on quantifiable results.

- Emphasize leadership roles, particularly in tax planning, compliance, and audits. Highlight any major projects or initiatives you led, including financial impacts.

Education

- List your highest degree first, including:

- Degree Type (e.g., Master’s, Bachelor’s)

- Major (e.g., Accounting, Taxation)

- Institution Name

- Graduation Date (Month/Year)

- If you have completed any relevant coursework or projects, consider including those as well.

Skills

- Create a section that lists relevant skills in bullet points.

- Focus on both technical skills (such as proficiency in tax software, tax compliance, financial analysis) and soft skills (such as leadership, communication, and strategic thinking).

- Tailor this section to reflect the skills mentioned in the job description for the Tax Director role.

Certifications

- Include any relevant certifications, such as:

- CPA (Certified Public Accountant)

- EA (Enrolled Agent)

- Any other tax-specific certifications or qualifications you hold.

- List the certifying body and the date obtained for each certification.

Additional Sections (Optional)

- Professional Affiliations: Membership in relevant organizations, such as the American Institute of CPAs (AICPA) or local tax associations.

- Awards and Recognition: Any accolades received for your work in tax or finance.

- Publications or Speaking Engagements: If you have authored articles or spoken at conferences, consider including this to showcase your expertise.

Tips for Choosing the Right Format

- A chronological format is often preferred for Tax Directors, as it allows employers to see a clear progression of your career.

- Use a clean, professional font and consistent formatting throughout the resume; this enhances readability.

- Ensure that your resume is no longer than two pages and utilizes white space effectively to avoid a cluttered appearance.

Complementing Your Resume with a Cover Letter Format

A well-structured cover letter can complement your resume by providing a narrative that connects your experience and skills to the specific Tax Director position. In your cover letter, you can elaborate on your leadership style, discuss specific achievements, and explain why you are a perfect fit for the role. Use a similar format to your resume to maintain consistency—this includes matching the font, header style, and overall tone. This cohesive approach can strengthen your application and leave a lasting impression on hiring managers.

Writing Tips and Best Practices for a Tax Director Resume

When crafting a resume for a Tax Director position, it's essential to present your skills and experiences in a clear, compelling manner that reflects your expertise in tax strategy and compliance. Start by tailoring your resume to highlight your leadership capabilities and strategic thinking, which are crucial in this role. Make sure to use industry-specific keywords that align with the job description, as this will help your resume pass through Applicant Tracking Systems (ATS) and catch the attention of hiring managers. Additionally, quantify your achievements wherever possible to demonstrate your impact in previous roles. Emphasizing your ability to drive revenue, reduce tax liabilities, or streamline processes can set you apart from other candidates. Remember to maintain a professional layout and consider leveraging resume writing tips for optimal formatting. These practices are also beneficial when drafting a cover letter, allowing you to present a cohesive narrative of your qualifications.

- Use strong action verbs such as "led," "developed," "implemented," and "optimized" to convey your responsibilities and achievements.

- Quantify your accomplishments by including metrics, such as "reduced tax liabilities by 20%," to provide tangible proof of your effectiveness.

- Incorporate industry-specific keywords from the job description to demonstrate your familiarity with the latest tax regulations and strategies.

- Highlight your leadership and team management skills, showcasing any experience in mentoring or guiding junior staff.

- Focus on relevant certifications and professional development, such as CPA or advanced tax certifications, to bolster your qualifications.

- Tailor your resume for each application, ensuring you emphasize the skills and experiences that are most relevant to the specific Tax Director role.

- Keep the layout clean and organized, utilizing bullet points for readability and ensuring consistent formatting throughout.

- Proofread carefully to eliminate any errors, as attention to detail is critical in the tax profession.

Common Mistakes to Avoid in a Tax Director Resume

When crafting a resume for a Tax Director position, it's essential to convey your qualifications and expertise clearly and effectively. However, many candidates make common mistakes that can detract from their chances of landing an interview. Avoiding these pitfalls can significantly enhance your resume’s impact, showcasing your experience and skills in a manner that resonates with hiring managers. Here are some of the most frequent missteps to steer clear of:

- Overloading the resume with excessive information, making it difficult to read.

- Using generic descriptions that do not highlight specific accomplishments or skills.

- Failing to tailor the resume to the specific job description and requirements.

- Ignoring the importance of keywords relevant to the tax and finance industry.

- Listing job duties instead of focusing on measurable achievements and contributions.

- Using an unprofessional email address or inappropriate contact information.

- Neglecting to include relevant certifications, licenses, or professional memberships.

- Overusing jargon or technical terms that may not be understood by all readers.

- Making formatting errors, such as inconsistent font sizes or styles.

- Not proofreading for grammatical or spelling mistakes, which can undermine professionalism.

For more insights on how to refine your resume, consider reviewing the common mistakes to avoid in a resume. Additionally, remember that your cover letter is equally important, so check out the common cover letter mistakes that should also be avoided to ensure a cohesive application.

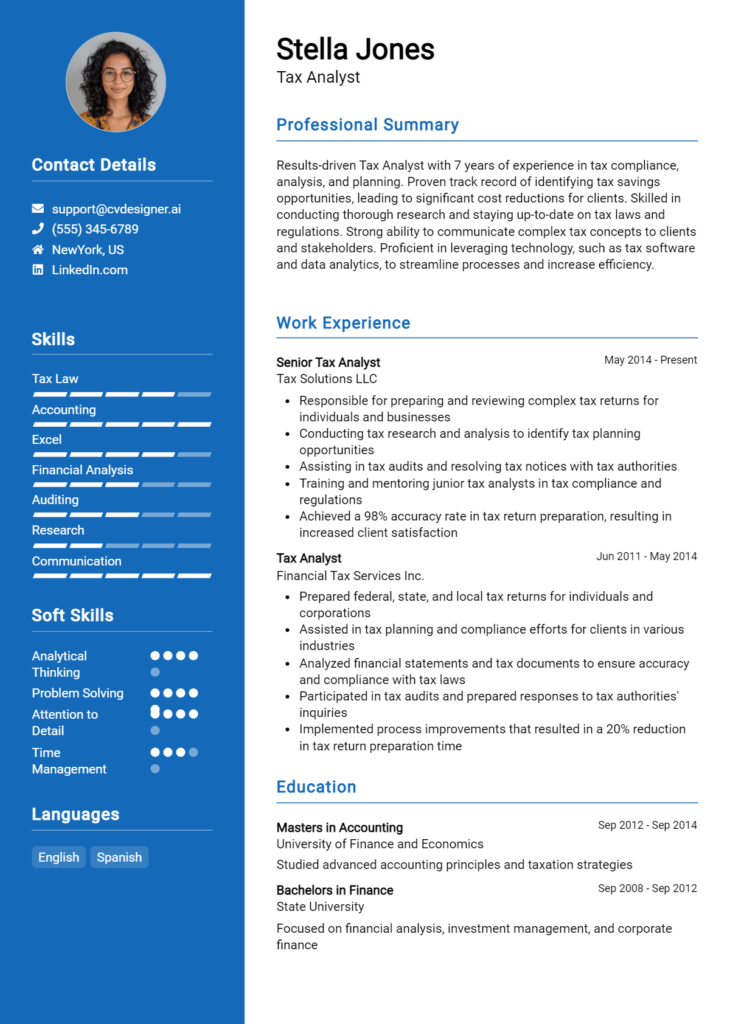

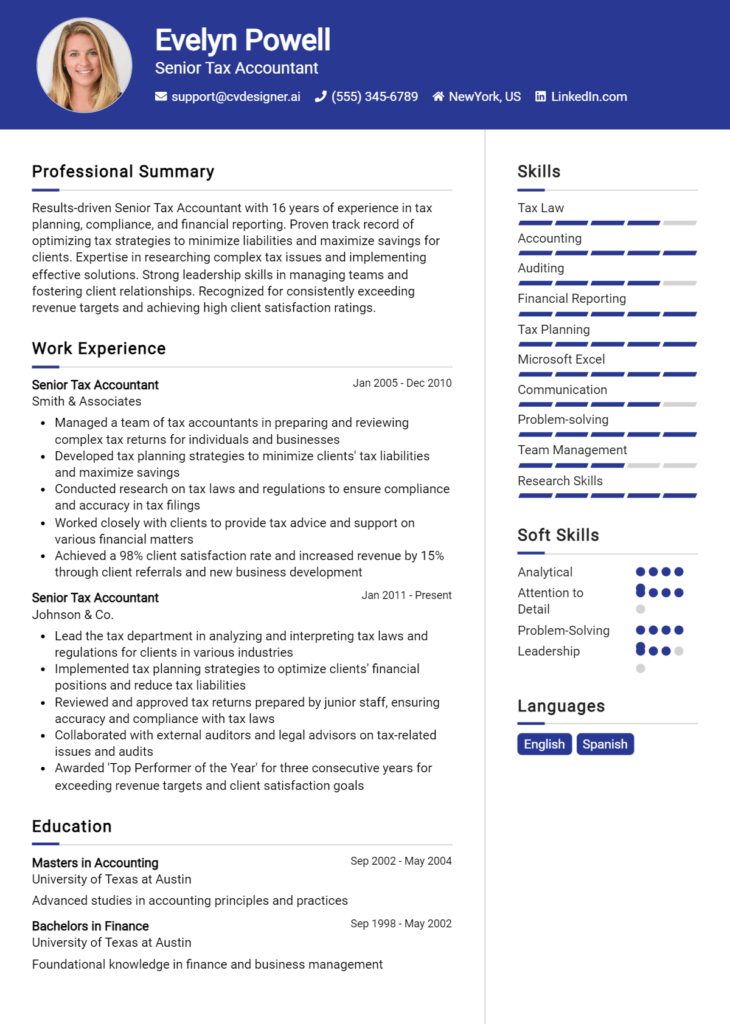

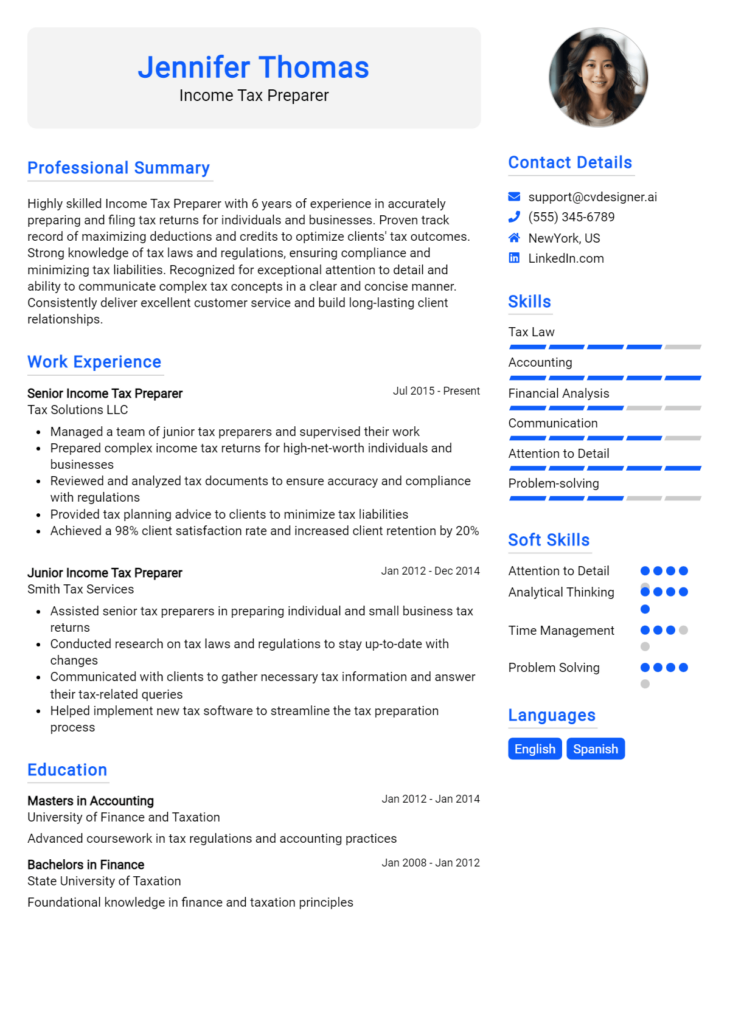

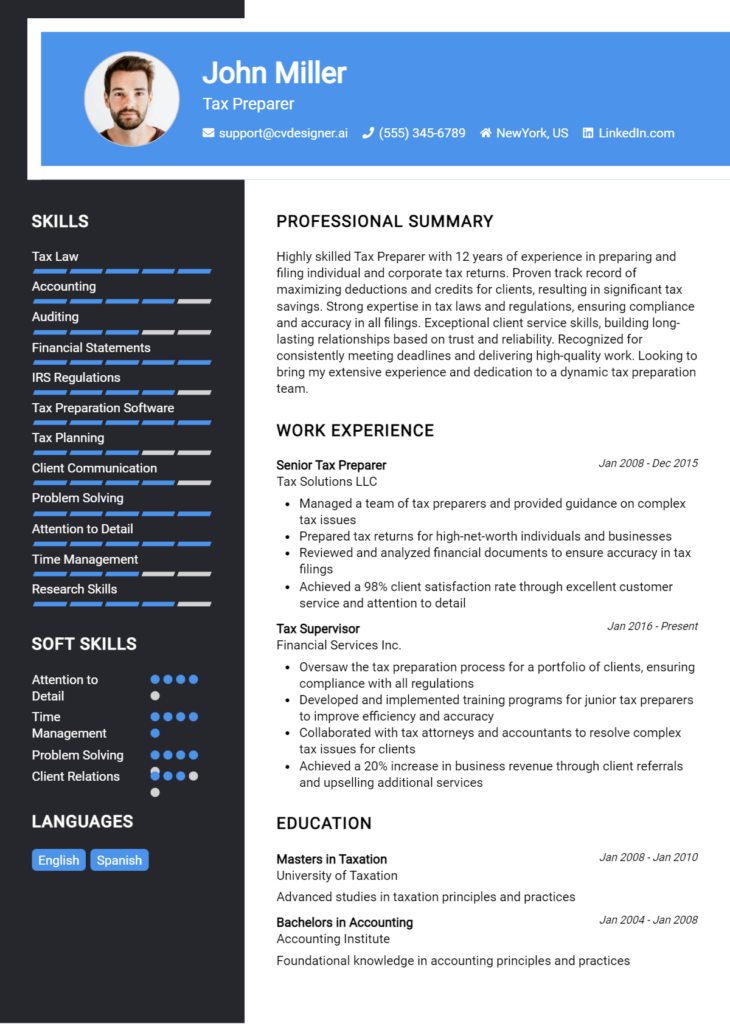

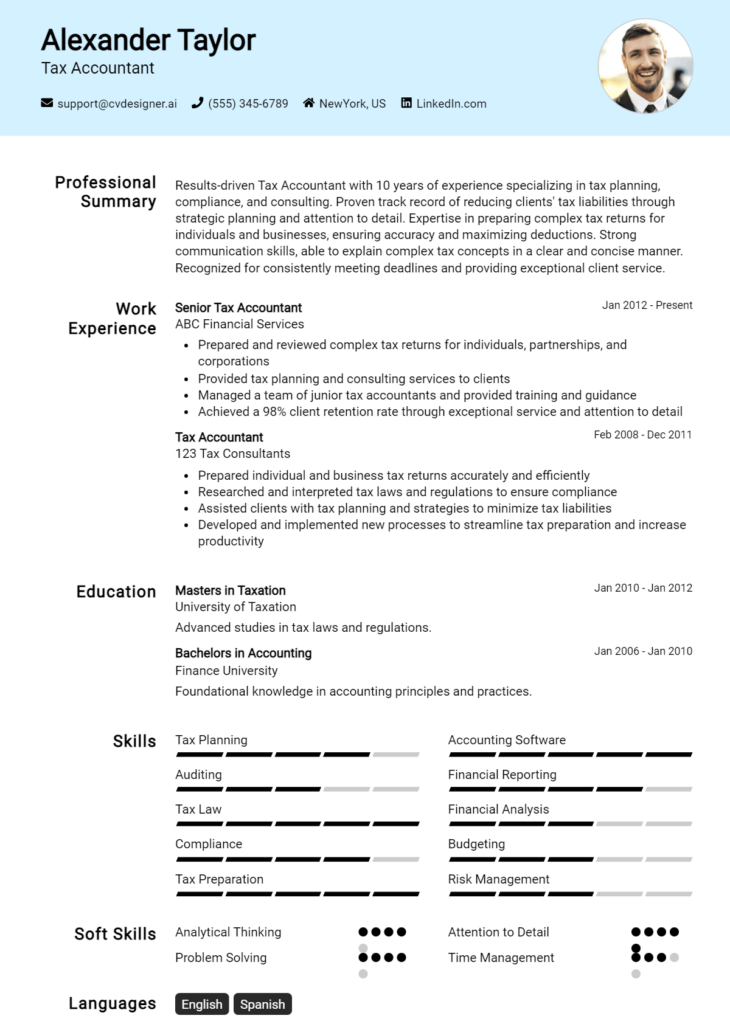

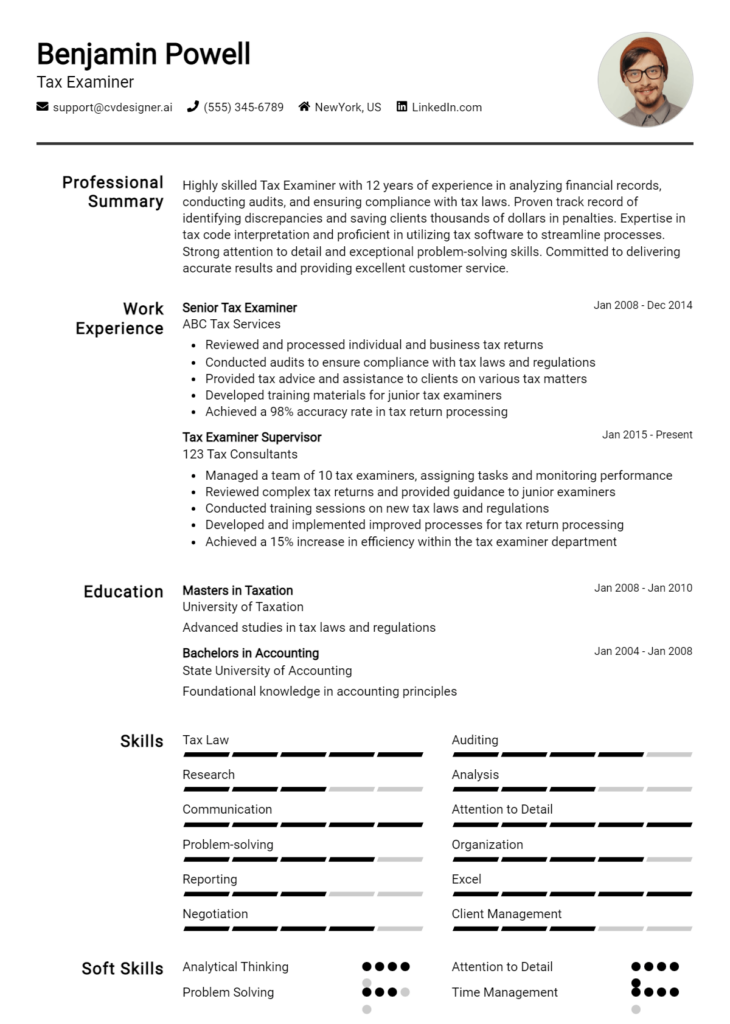

Sample Tax Director Resumes

The role of a Tax Director is pivotal within any organization, requiring a deep understanding of tax regulations, strategic planning, and a keen ability to lead teams in navigating complex tax scenarios. Below are three sample resumes tailored for different stages in a professional's career—one for an experienced professional, one for an entry-level candidate, and one for a career changer. Each resume highlights relevant skills and experiences to help you craft your own as you pursue a role in tax management.

Sample Resume: Experienced Tax Director

Jane Doe

[Your Address]

[City, State, Zip]

[Your Phone Number]

[Your Email Address]

Professional Summary

Results-oriented Tax Director with over 15 years of experience in corporate tax strategy, compliance, and audits. Proven track record in leading teams to optimize tax efficiency and ensure adherence to regulations. Expert in international tax law and mergers and acquisitions.

Professional Experience

Senior Tax Manager

XYZ Corporation, New York, NY

June 2015 - Present

- Led a team of 10 tax professionals in managing the company's tax compliance and strategy.

- Developed and implemented tax planning strategies that reduced tax liabilities by 30%.

- Collaborated with cross-functional teams to ensure tax considerations were integrated into business decisions.

Tax Consultant

ABC Consulting, New York, NY

January 2011 - May 2015

- Advised clients on federal and state tax compliance and reporting requirements.

- Conducted tax audits and provided recommendations for process improvements.

- Assisted in the successful integration of tax-efficient practices for clients undergoing mergers and acquisitions.

Education

Master of Science in Taxation

University of New York, NY

Graduated May 2010

Bachelor of Business Administration in Accounting

State University, NY

Graduated May 2008

Certifications

- Certified Public Accountant (CPA)

- Chartered Global Management Accountant (CGMA)

Skills

- Tax Compliance and Planning

- International Taxation

- Strategic Leadership

- Financial Analysis

- Mergers and Acquisitions

Sample Resume: Entry-Level Tax Director

John Smith

[Your Address]

[City, State, Zip]

[Your Phone Number]

[Your Email Address]

Objective

Detail-oriented recent graduate with a Bachelor’s in Accounting and internship experience in tax compliance. Eager to leverage academic knowledge and hands-on experience to contribute to a dynamic tax team.

Education

Bachelor of Science in Accounting

University of State, City, State

Graduated May 2023

Internship Experience

Tax Intern

ABC Tax Services, City, State

January 2023 - May 2023

- Assisted in preparing individual and corporate tax returns.

- Conducted research on tax regulations and assisted in compliance audits.

- Supported senior tax consultants in client meetings and tax planning initiatives.

Projects

- Conducted a comprehensive analysis of local tax regulations for a class project, earning recognition from faculty for thoroughness and clarity.

Skills

- Proficient in Microsoft Excel and tax software (e.g., TurboTax, H&R Block)

- Strong analytical and problem-solving skills

- Excellent communication and teamwork abilities

Sample Resume: Career Changer to Tax Director

Emily Johnson

[Your Address]

[City, State, Zip]

[Your Phone Number]

[Your Email Address]

Professional Summary

Dynamic finance professional with 10 years of experience in corporate finance and accounting, transitioning into tax management. Proven record of driving financial analysis and strategic planning to optimize business performance.

Professional Experience

Finance Manager

DEF Corporation, City, State

March 2015 - Present

- Managed financial reporting and analysis, resulting in a 20% improvement in budget accuracy.

- Collaborated with tax advisors to ensure compliance with financial regulations.

- Developed financial models to assess tax implications of business strategies.

Accountant

GHI Associates, City, State

June 2012 - February 2015

- Prepared financial statements and assisted in the annual audit process.

- Conducted variance analysis and provided insights for financial decision-making.

Education

Bachelor of Science in Finance

State University, City, State

Graduated May 2012

Certifications

- Enrolled Agent (EA)

- Certified Management Accountant (CMA) (in progress)

Skills

- Financial Analysis and Reporting

- Strategic Planning

- Tax Compliance Understanding

- Advanced Excel Skills

- Team Leadership

Explore more resume templates for inspiration to help you create a standout resume. Additionally, corresponding cover letter examples can assist in crafting a complete job application package.

Checklist for a Tax Director Resume

- Proofread for Errors: Carefully review your resume for spelling, grammar, and punctuation mistakes. Consider using tools or software to catch any overlooked errors.

- Consistency in Formatting: Ensure that fonts, bullet points, and headings are consistent throughout the document. This helps create a professional appearance.

- Tailor to the Job Description: Customize your resume to highlight the skills and experiences that are most relevant to the Tax Director position you are applying for.

- Quantify Achievements: Use specific numbers and metrics to illustrate your accomplishments, such as the percentage of tax savings achieved or the size of the teams you've managed.

- Focus on Relevant Experience: Prioritize your work history and experiences that directly relate to tax management, compliance, and strategy development.

- Highlight Key Skills: Include a section dedicated to core competencies, such as tax planning, regulatory compliance, and leadership abilities.

- Use Action Verbs: Start bullet points with strong action verbs like "developed," "led," or "implemented" to convey your contributions effectively.

- Check Length and Clarity: Aim for a concise resume that is ideally one to two pages long. Ensure that it is easy to read and understand at a glance.

- Get Feedback: Have a trusted colleague or mentor review your resume for additional insights and suggestions for improvement.

- Utilize an AI Resume Builder: Consider using an AI resume builder to help structure and organize your resume effectively. This can also streamline the process and enhance the overall presentation.

Remember, a similar checklist can be applied when creating a CV or cover letter.

Key Takeaways for a Tax Director Resume Guide

In conclusion, crafting a standout resume as a Tax Director is essential to showcasing your expertise and leadership in tax strategy and compliance. By utilizing the examples and tips provided, you can create a compelling document that highlights your achievements and skills in a way that resonates with potential employers. As the next step in your job search, consider downloading a tailored resume template from resume templates or explore our cover letter templates to complement your application. For a more personalized approach, try our best resume maker to refine your resume further. Remember, adhering to similar guidelines will also be beneficial when crafting a persuasive CV and cover letter. Take these steps to enhance your application and increase your chances of landing your desired role.