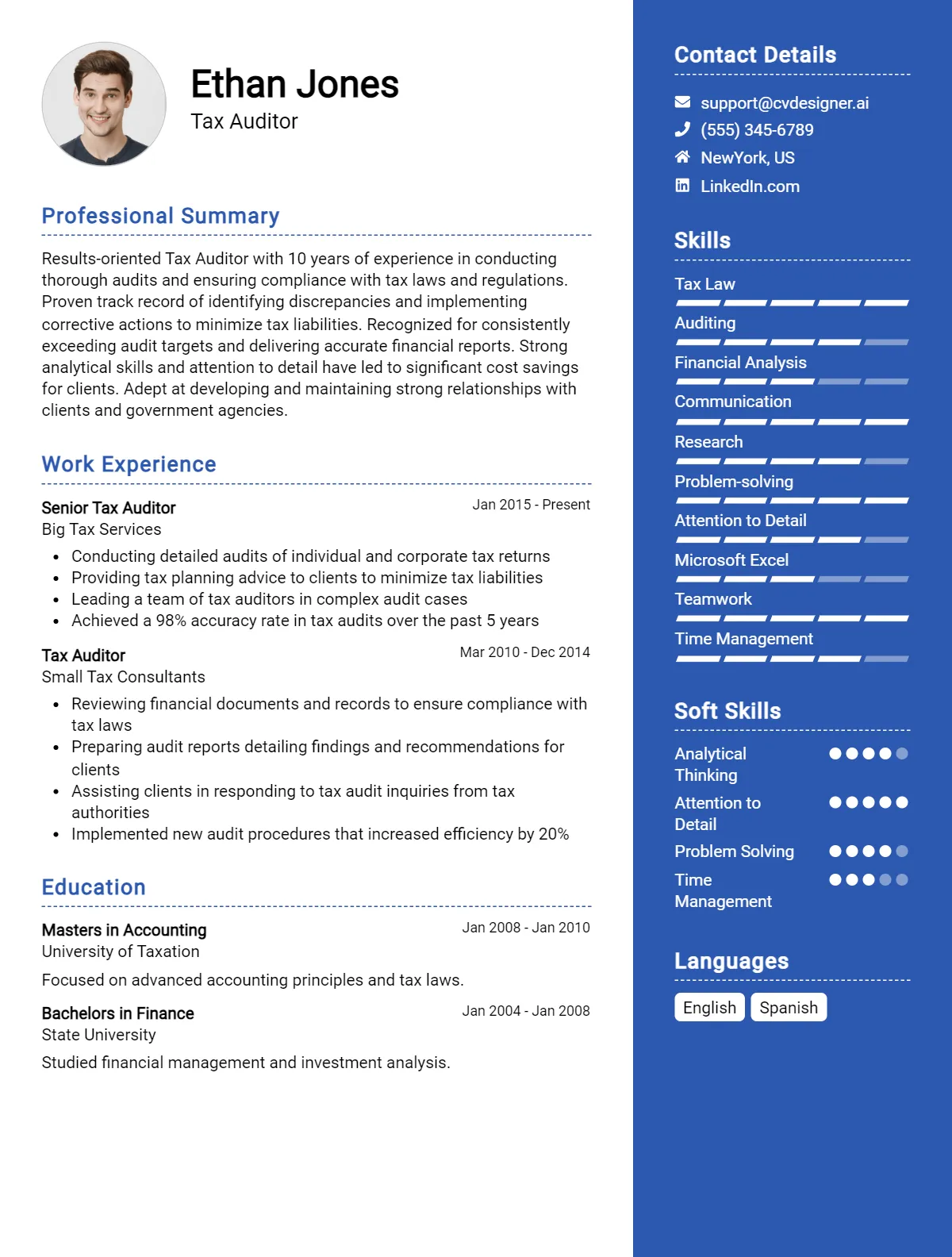

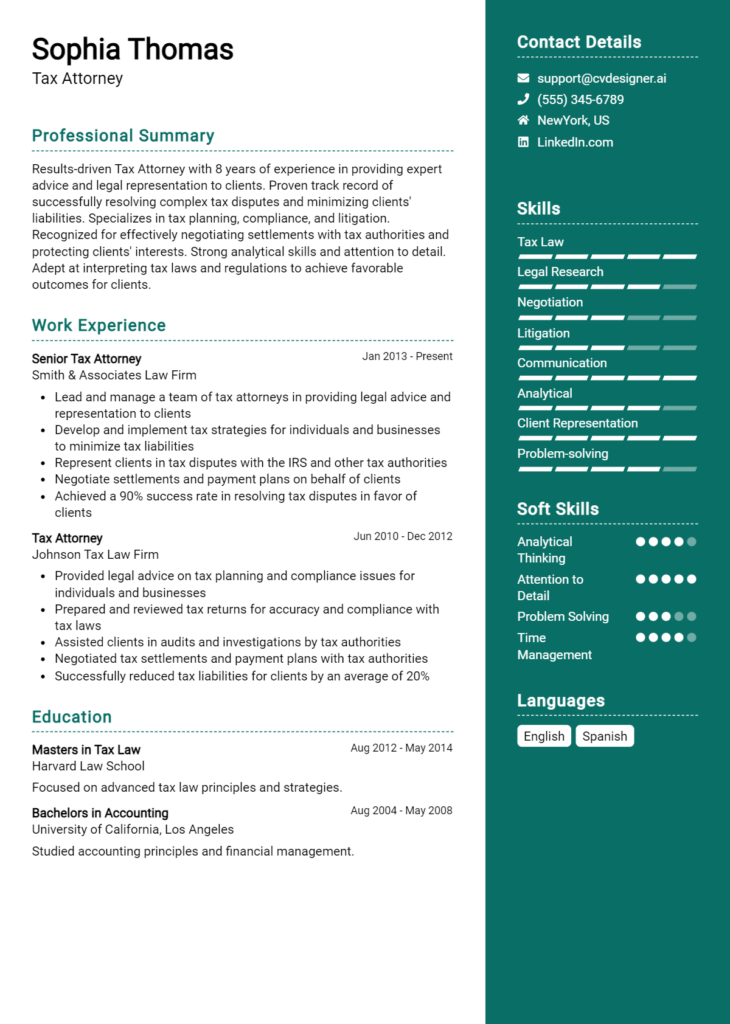

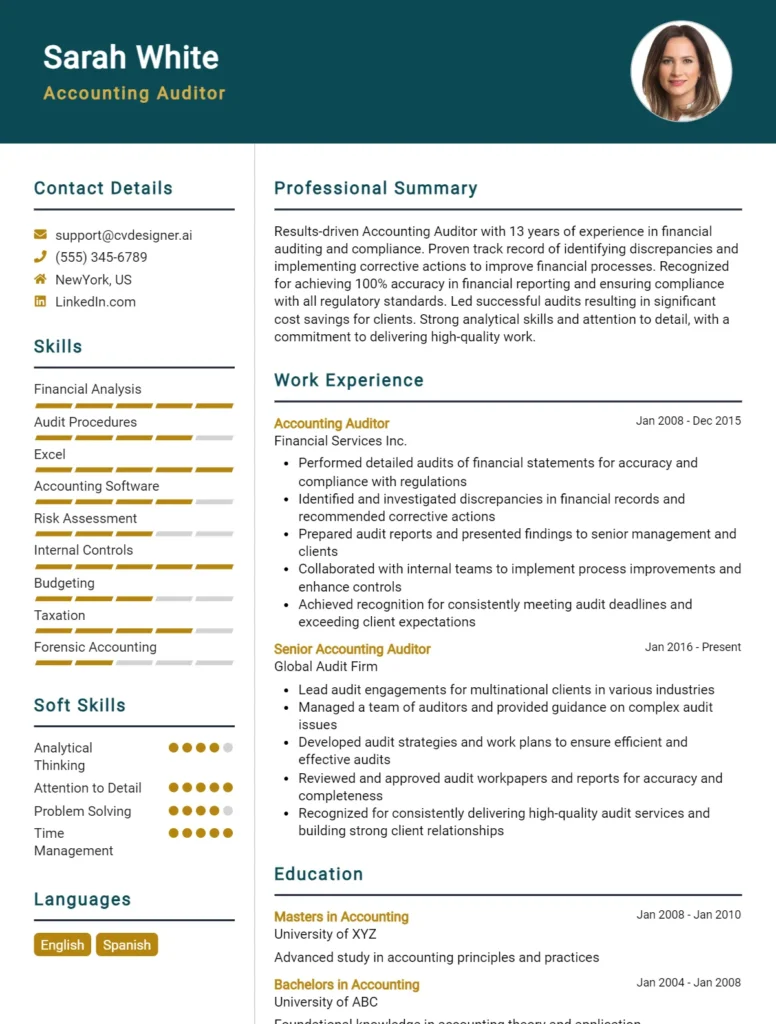

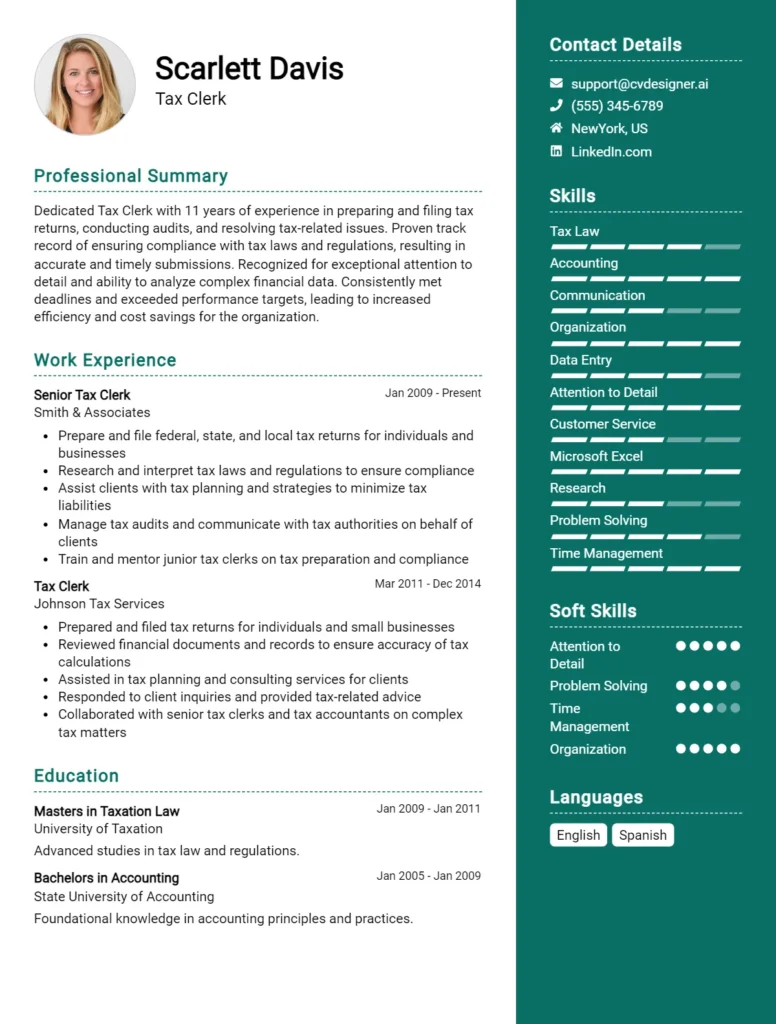

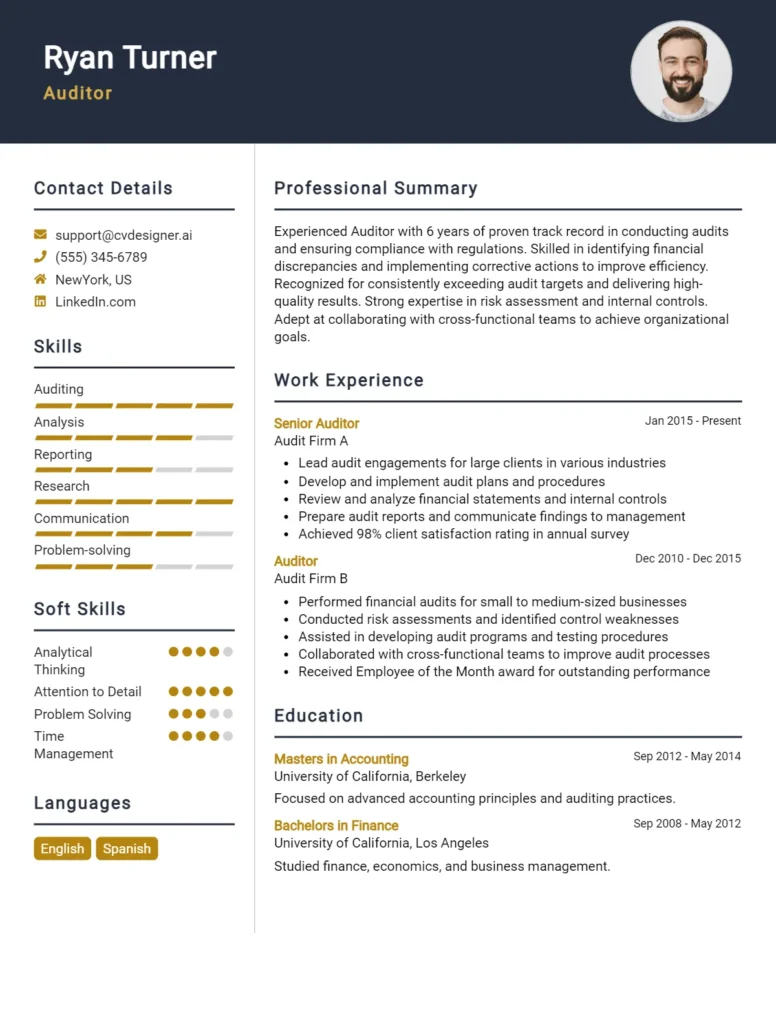

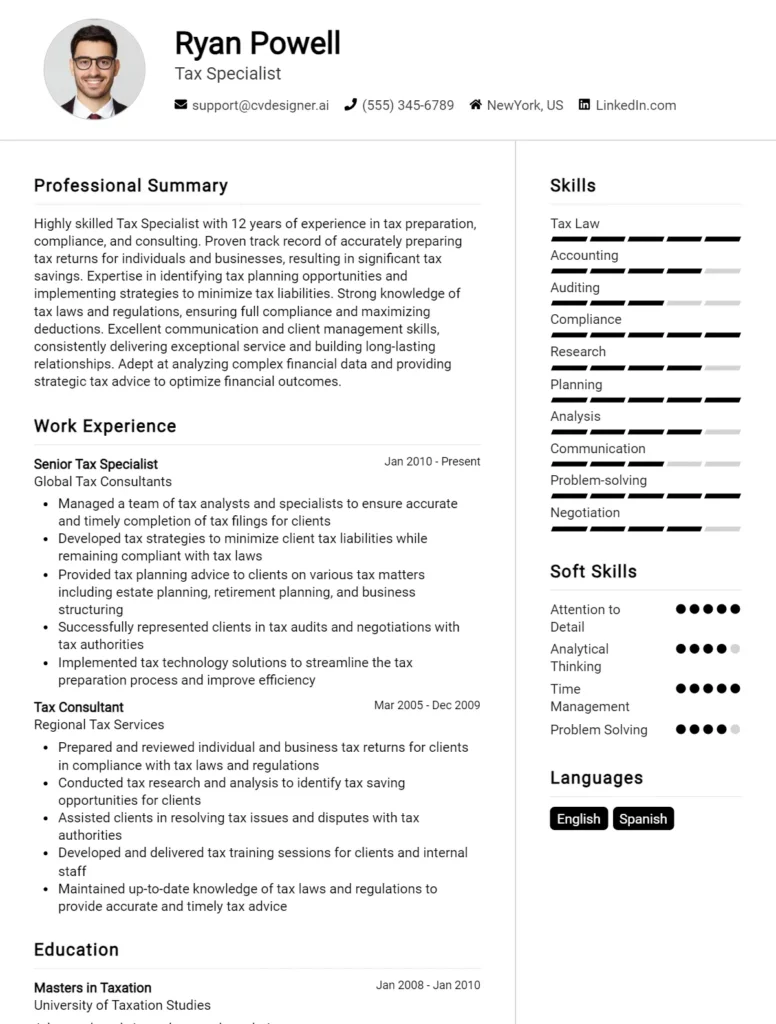

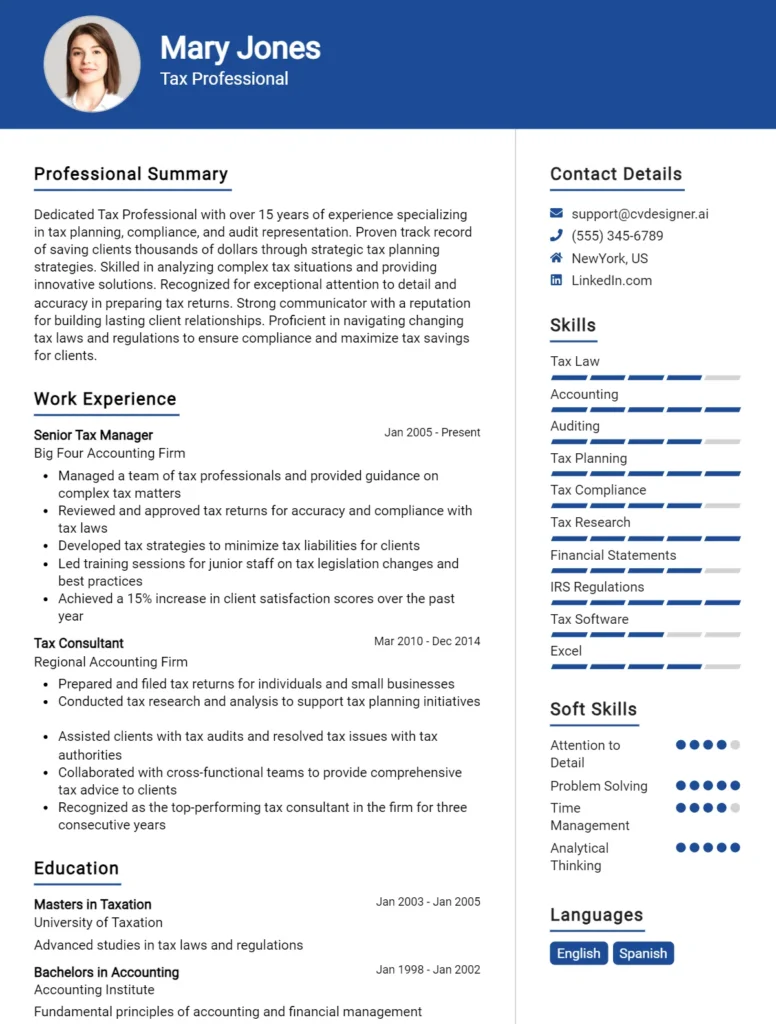

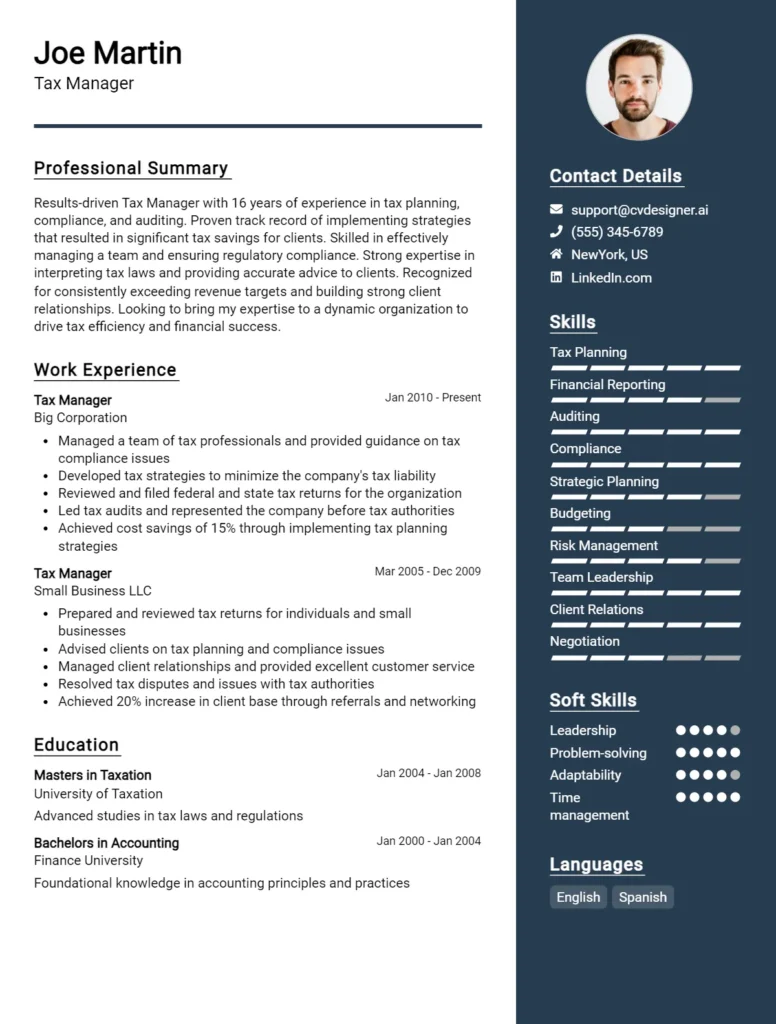

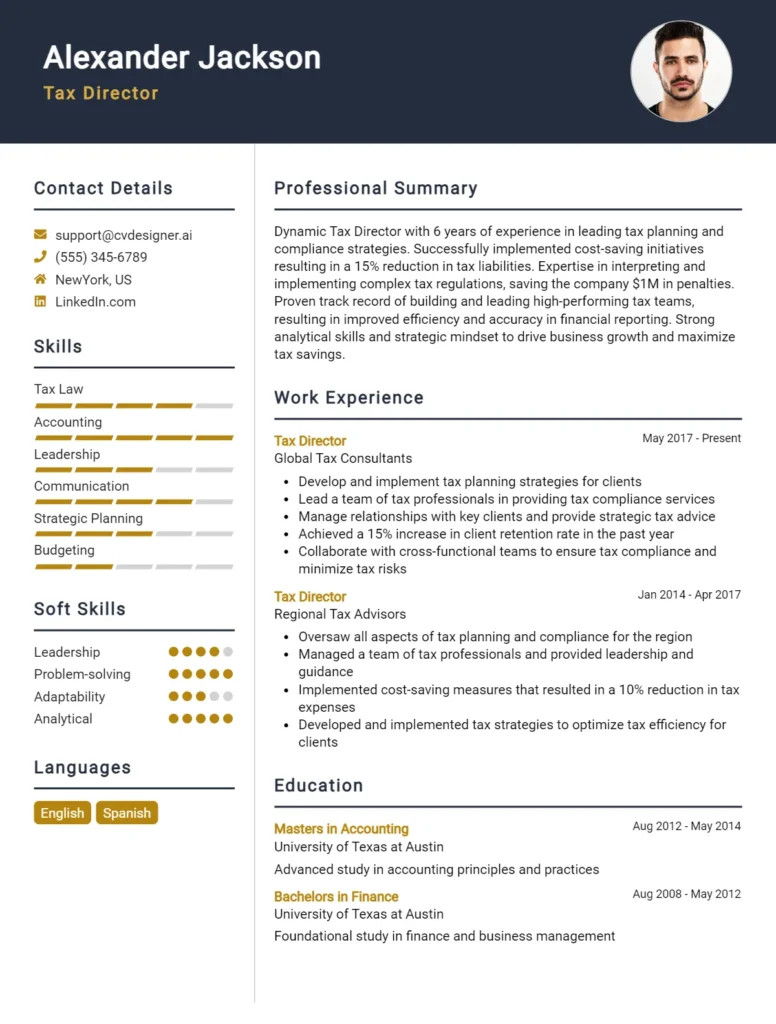

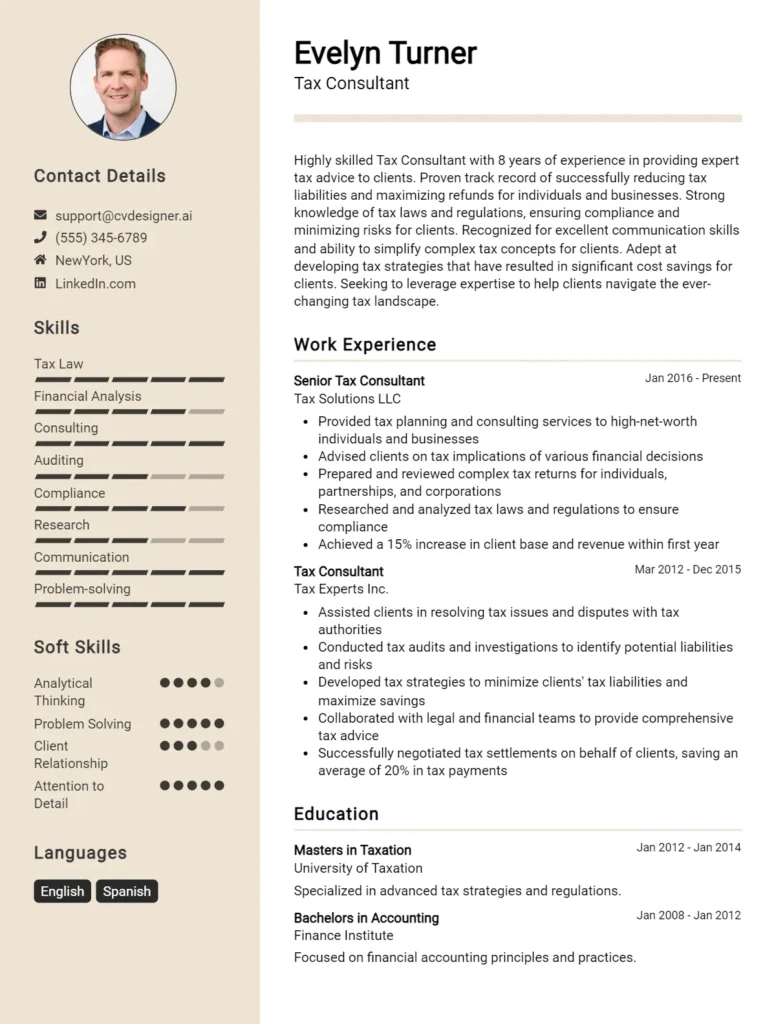

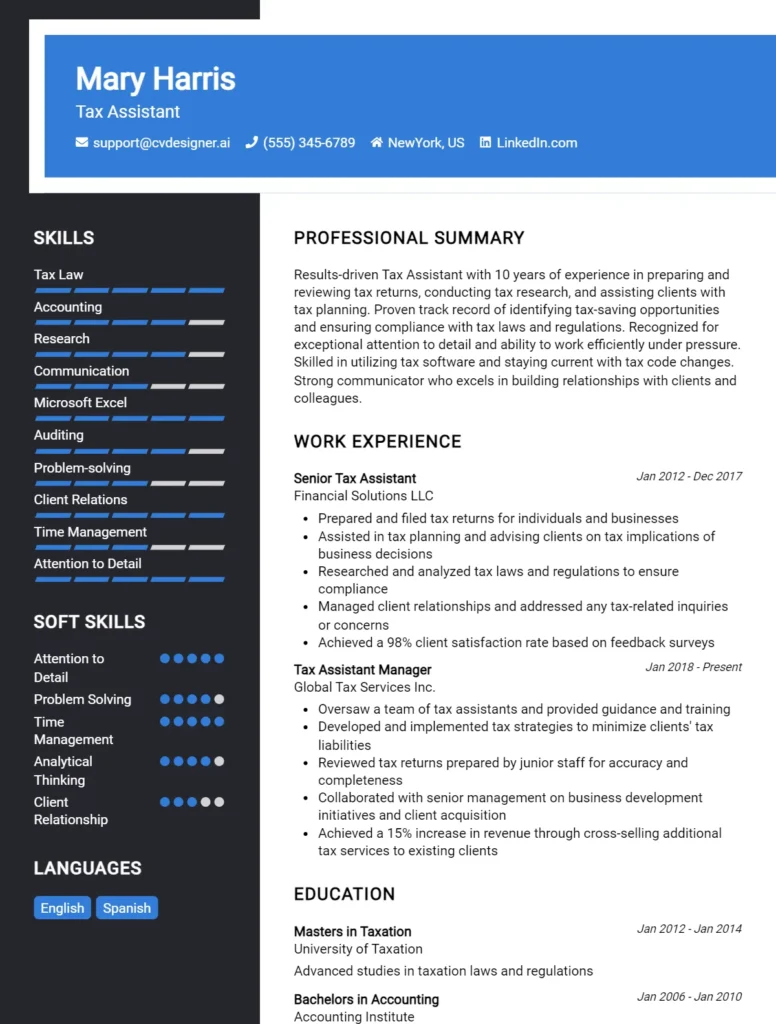

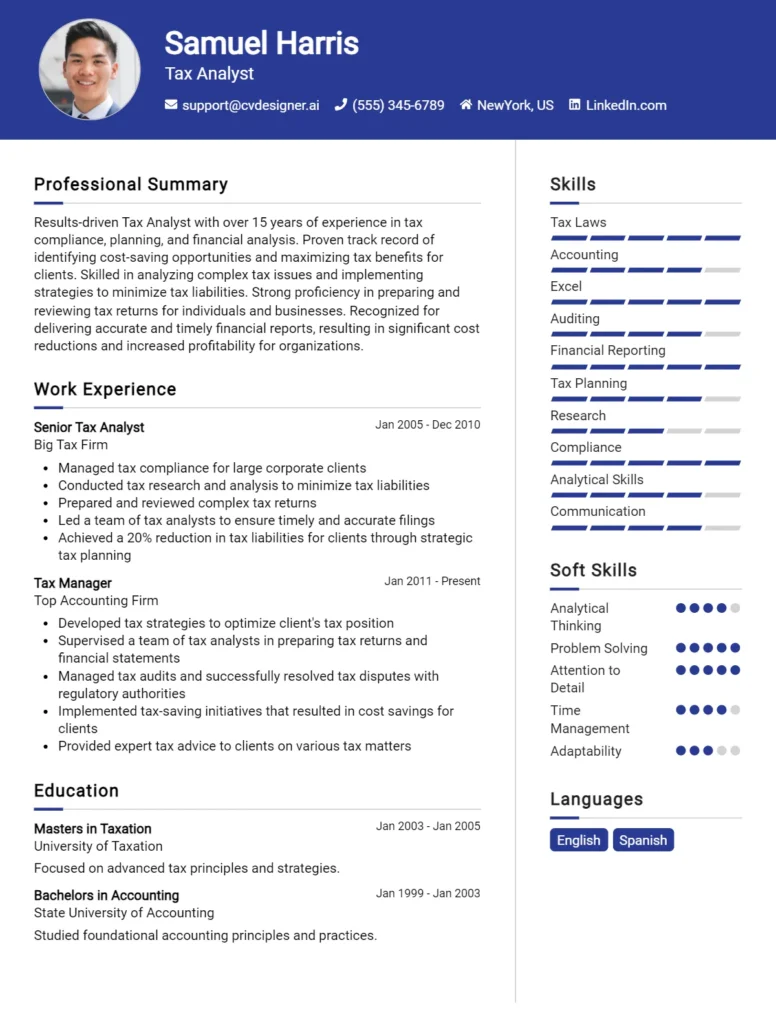

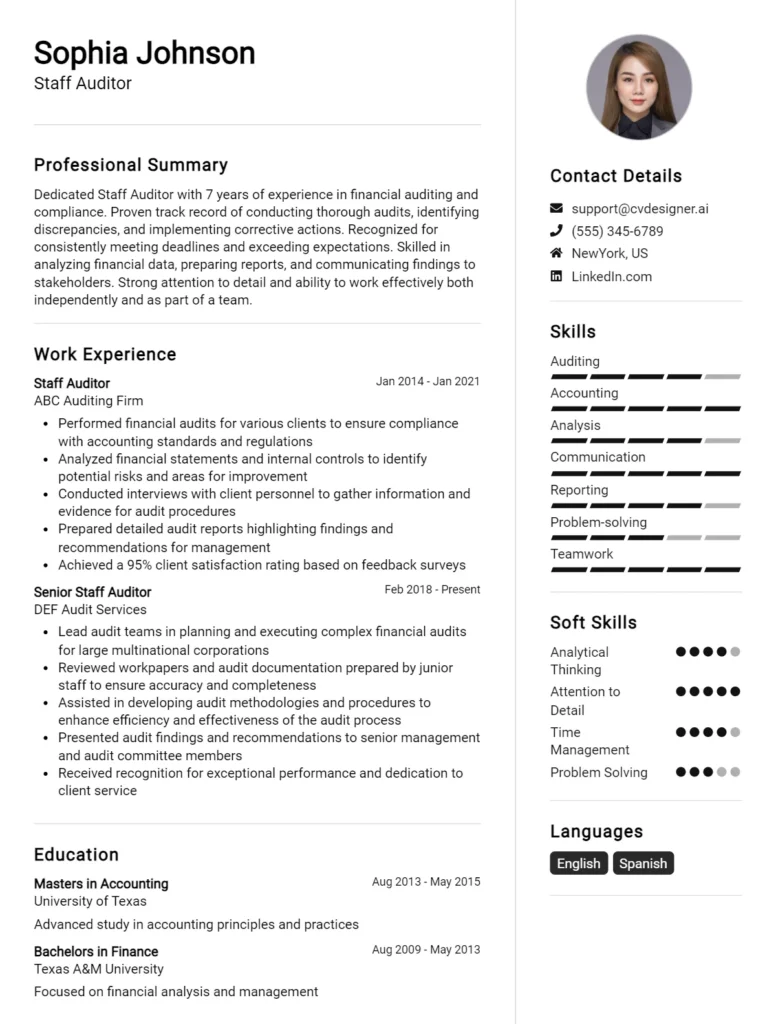

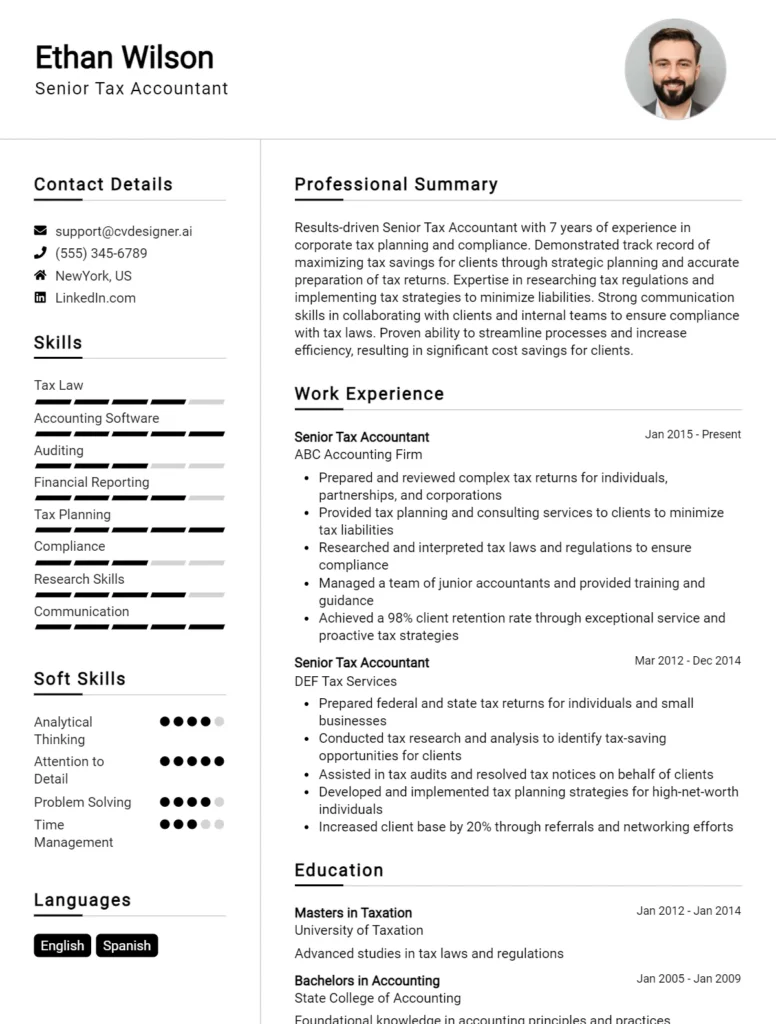

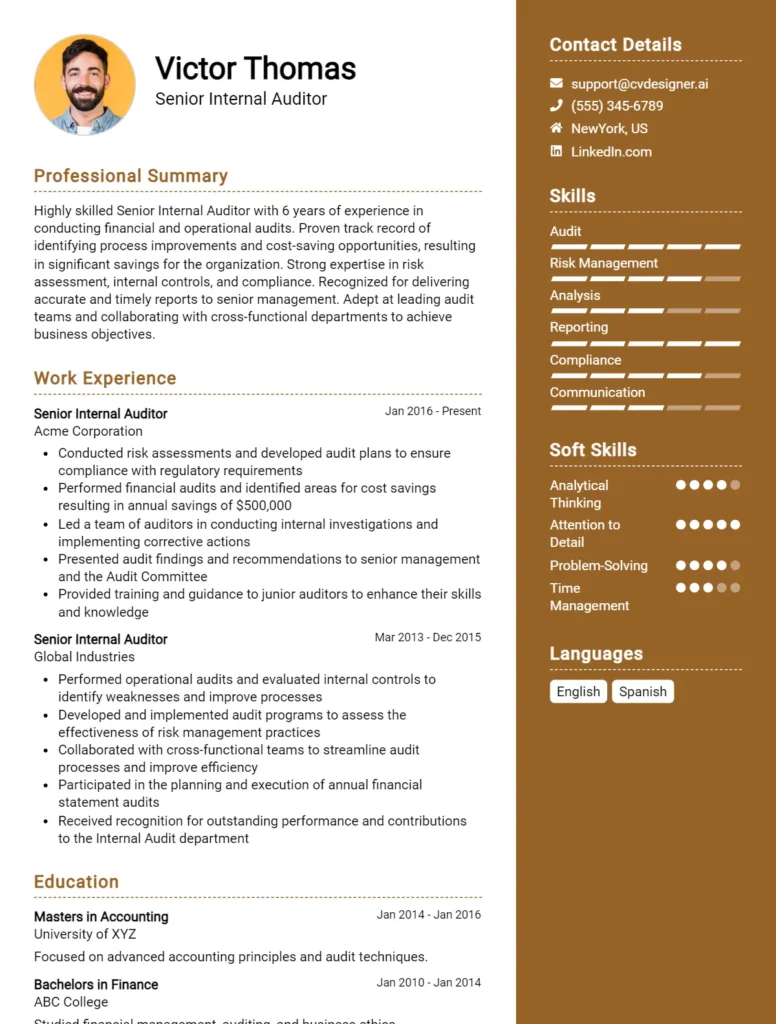

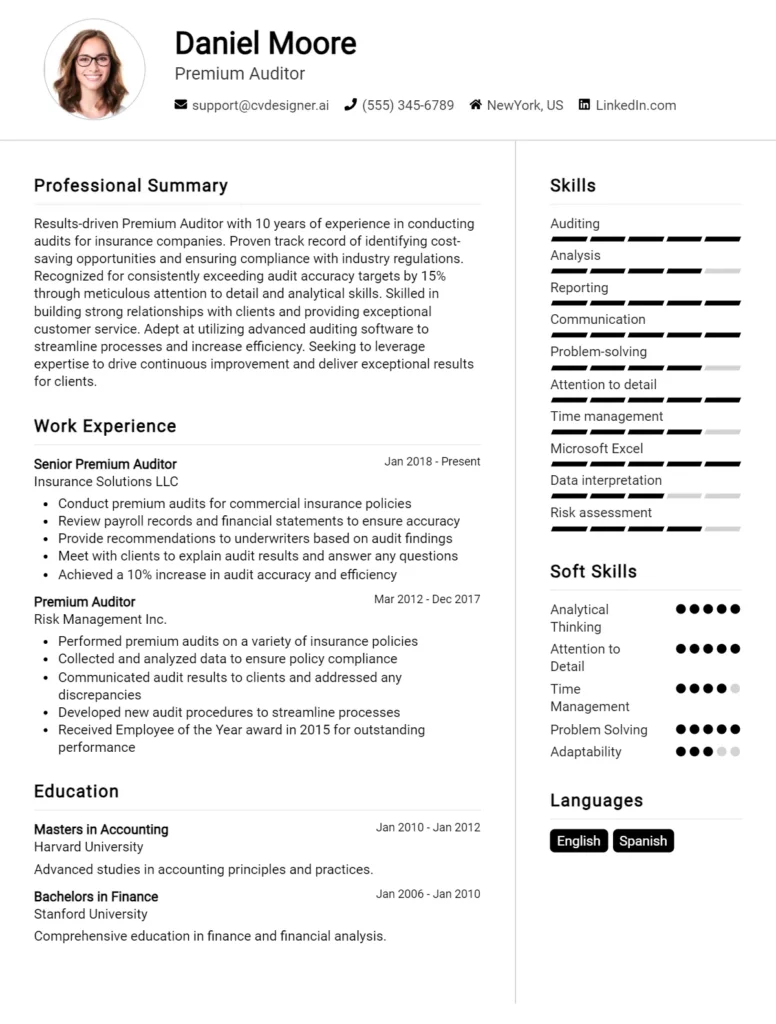

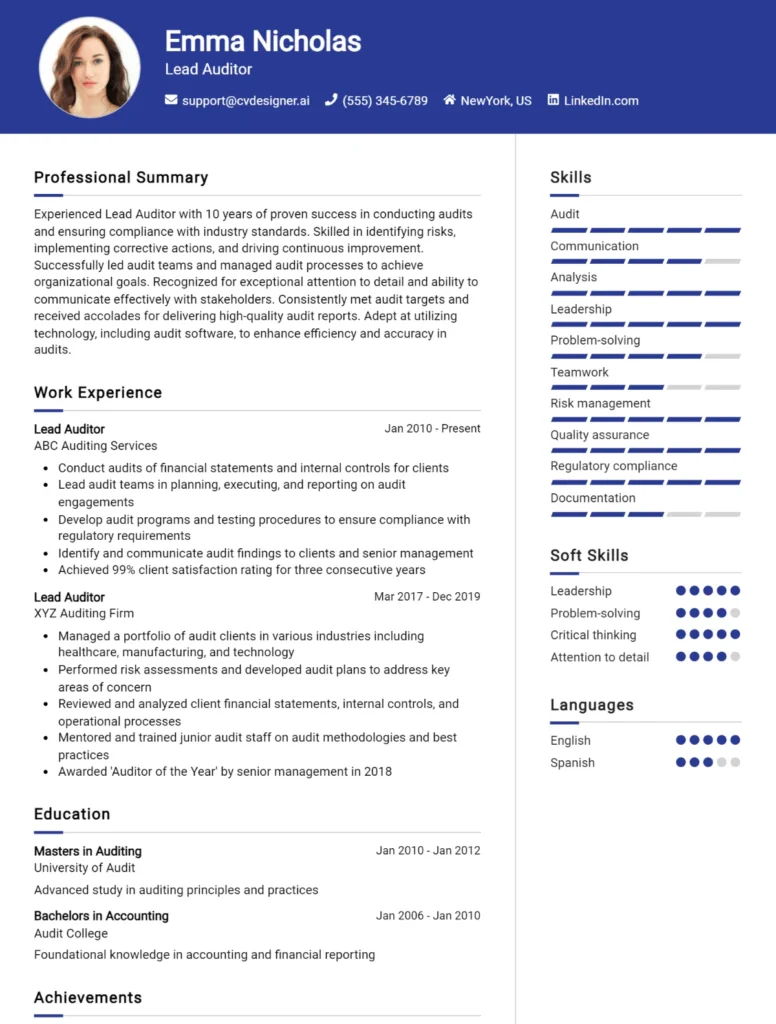

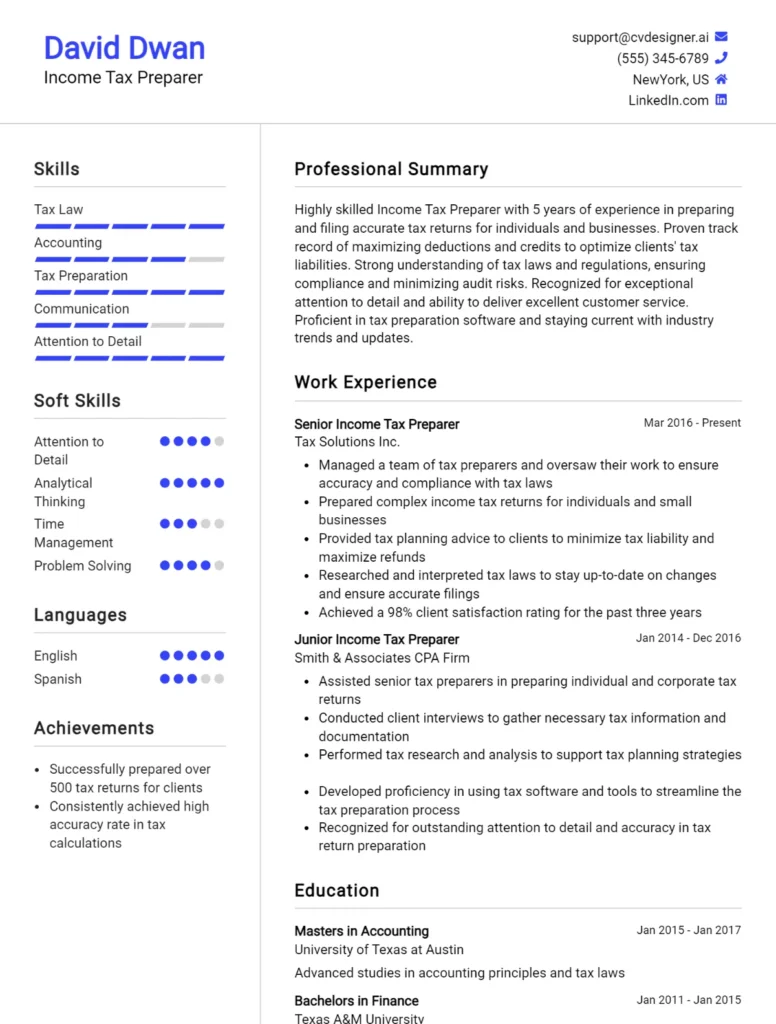

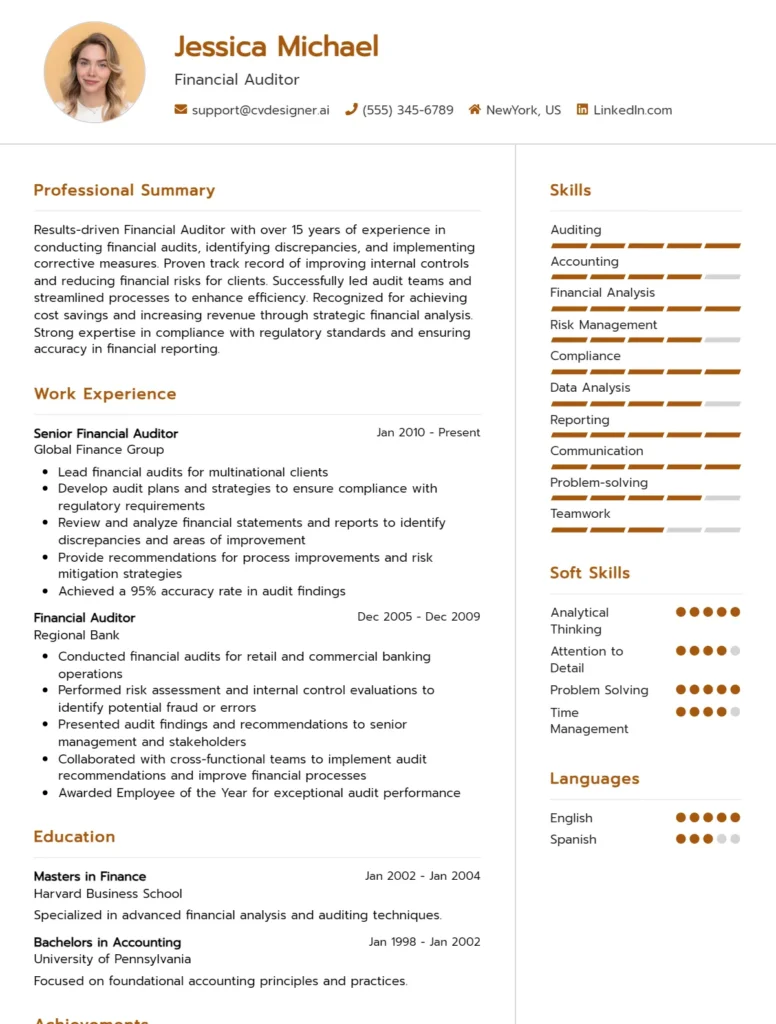

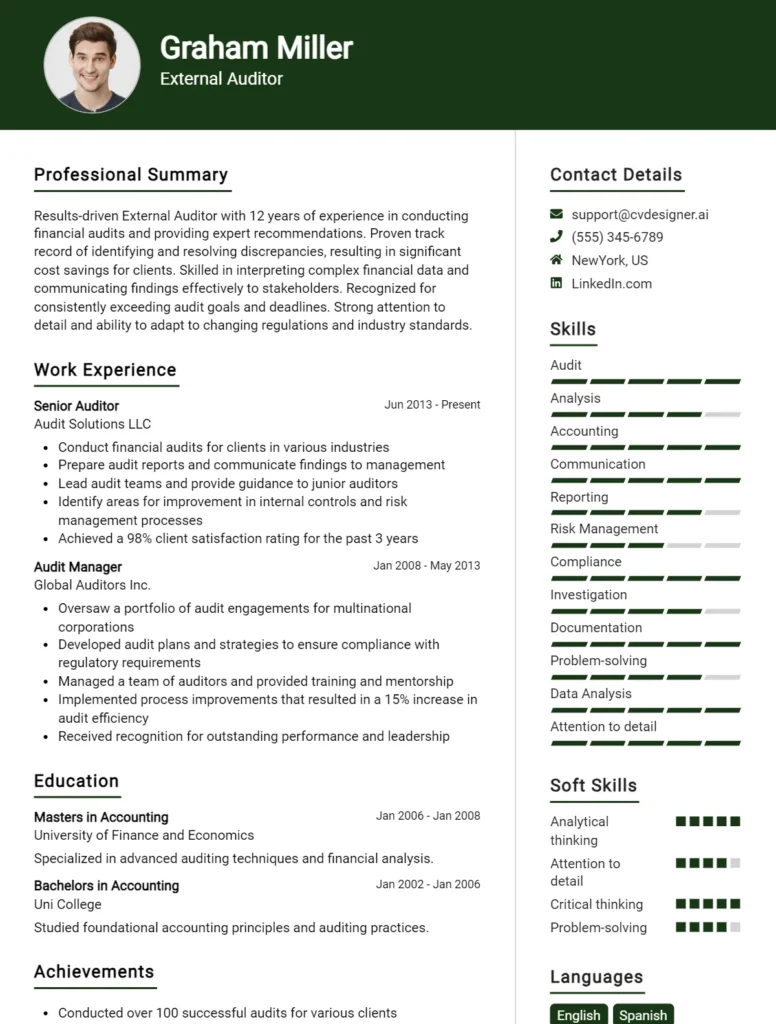

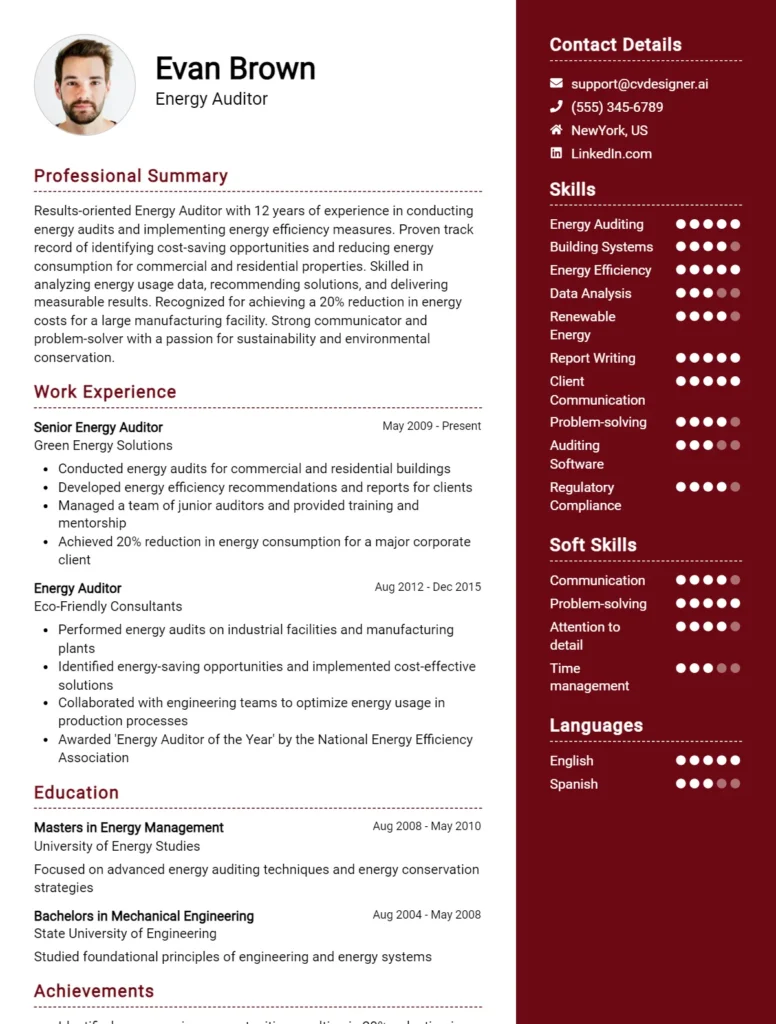

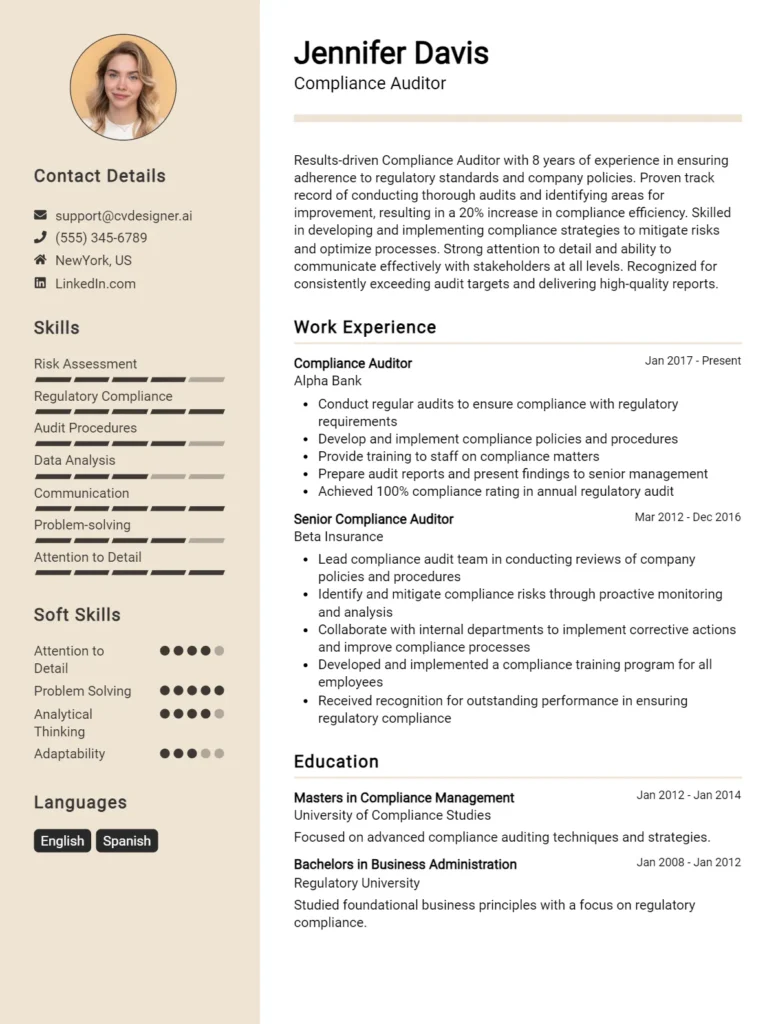

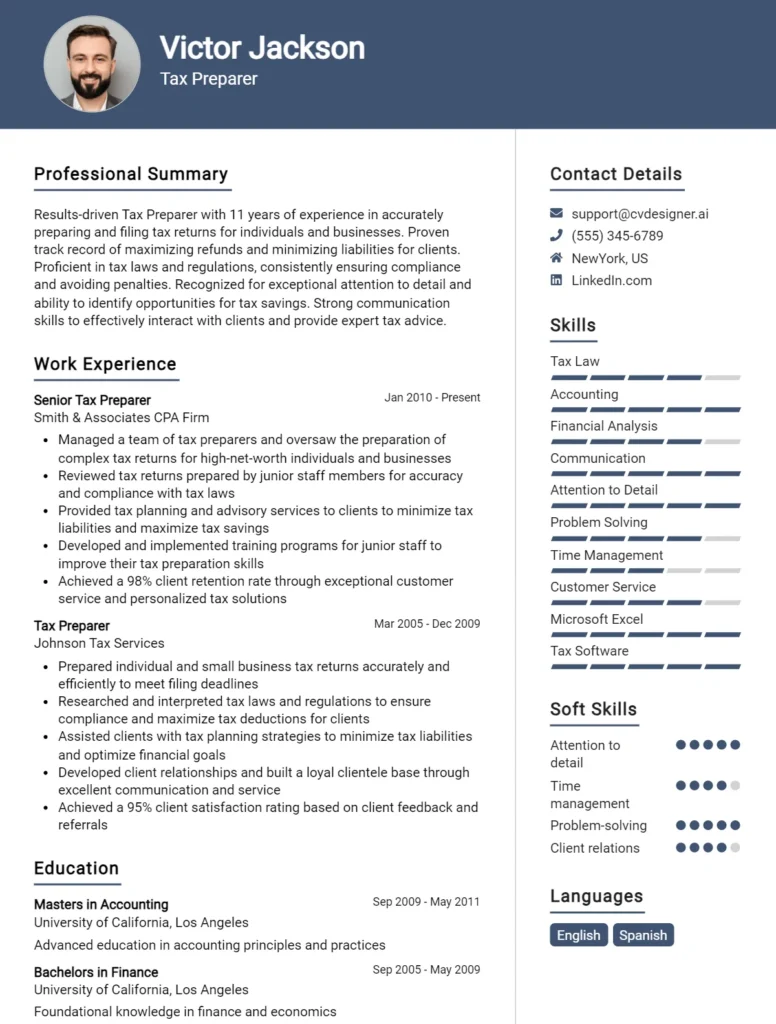

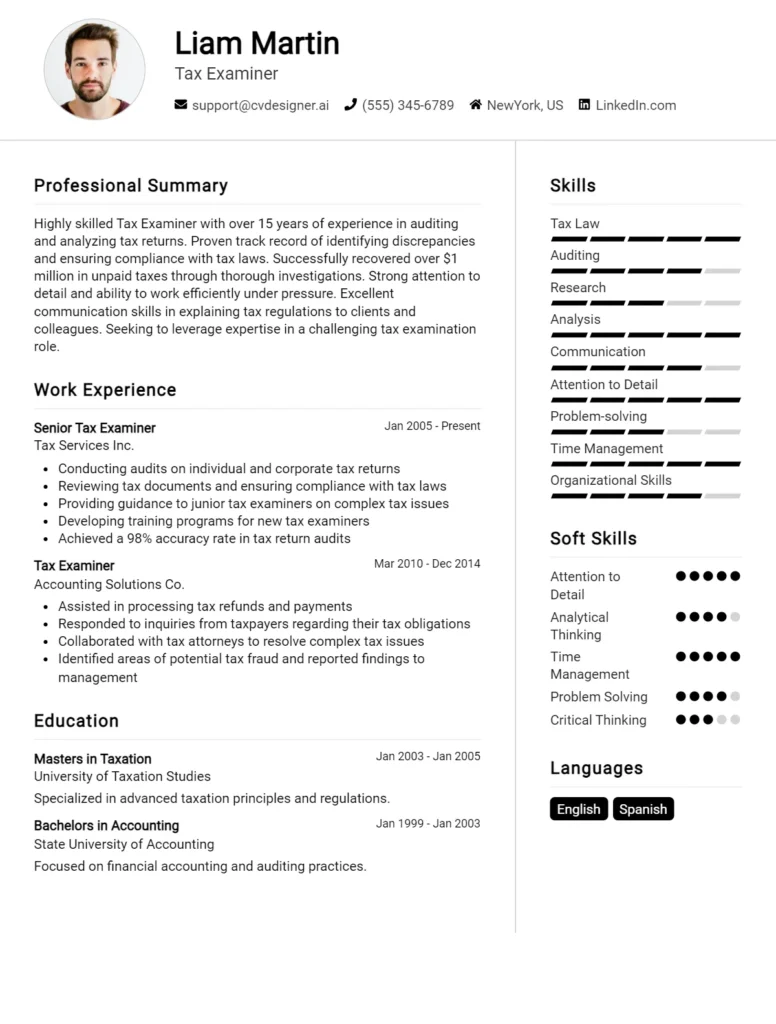

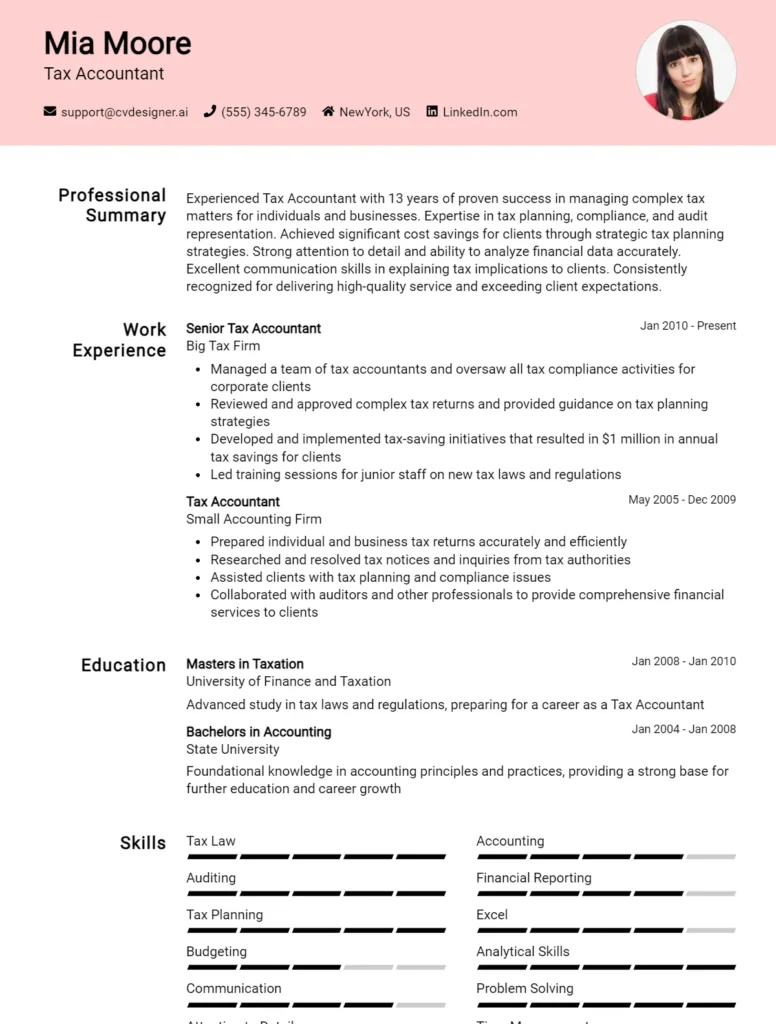

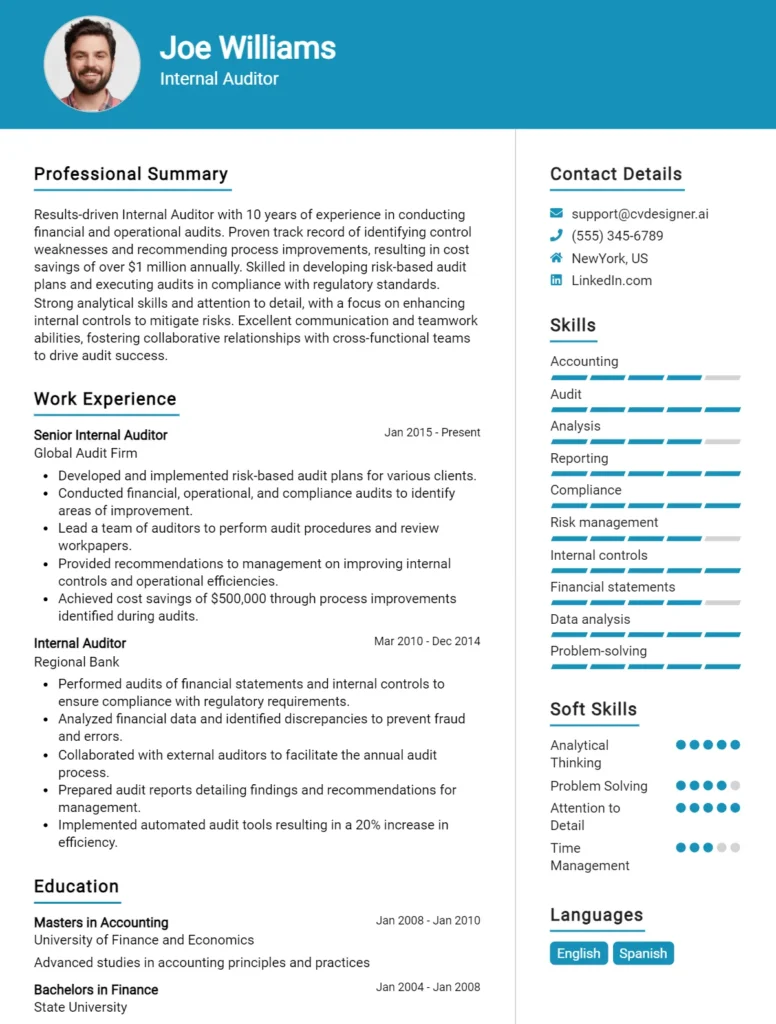

Most Popular Tax Auditor CV Examples

Explore additional Tax Auditor CV samples and guides and see what works for your level of experience or role.

Are you a meticulous individual with a keen eye for detail and a passion for numbers? Do you have a strong understanding of tax laws and regulations? If so, you may have what it takes to excel as a Tax Auditor. In this comprehensive guide, we will walk you through the essential steps to creating an impressive Tax Auditor CV that will catch the attention of potential employers. From highlighting your relevant skills and experience to showcasing your attention to detail, we will cover it all. Stay tuned for expert tips and a sample CV example that will help you stand out in the competitive job market. Don't miss out on this valuable resource for advancing your career in tax auditing!

Key points covered in the article:

- Tailoring your CV to the tax auditing industry

- Highlighting relevant skills and experience

- Showcasing attention to detail

- Including quantifiable achievements

- Formatting and structuring your CV effectively

What is a Tax Auditor CV?

A Tax Auditor CV is a crucial document that outlines the professional background, education, skills, and experience of an individual seeking a career in tax auditing. This document serves as a comprehensive overview of the candidate's qualifications and capabilities in the field of tax auditing, enabling potential employers to assess their suitability for a particular role. A well-crafted Tax Auditor CV can significantly enhance the candidate's chances of securing a job in this competitive industry by highlighting their relevant experience and expertise in tax laws and regulations.

In addition to providing a detailed account of the candidate's professional achievements, a Tax Auditor CV also demonstrates their ability to effectively communicate their expertise and qualifications to potential employers. By showcasing their skills in tax compliance, auditing procedures, and financial analysis, candidates can demonstrate their value to prospective employers and stand out in a competitive job market. Therefore, it is essential for aspiring Tax Auditors to invest time and effort in creating a polished and professional CV that effectively highlights their strengths and qualifications. For guidance on how to write a compelling CV, candidates can refer to this CV writing guide for helpful tips and strategies.

Key Components of a Tax Auditor CV

- Strong knowledge of tax laws and regulations

- Analytical skills for reviewing financial documents

- Attention to detail in identifying discrepancies and errors

- Experience with tax auditing software and tools

- Ability to communicate effectively with clients and colleagues

- Certification in accounting or auditing

- Proficiency in Microsoft Excel and other relevant software

- Previous work experience in tax auditing or a related field

- Familiarity with industry standards and best practices

- Strong organizational skills for managing multiple projects

- Ability to work independently and meet deadlines

- Continuous learning and professional development in tax auditing.

For more information on how to highlight these key components in your CV, visit CV skills and CV work experience.

Sample Tax Auditor CV for Inspiration

John Doe

123 Main Street, City, State, ZIP Code

(555) 555-5555

johndoe@email.com

Professional Summary:

Experienced and detail-oriented Tax Auditor with over 5 years of experience in auditing financial records, preparing tax returns, and ensuring compliance with tax laws and regulations. Adept at identifying discrepancies, analyzing financial data, and providing recommendations for improvements. Strong communication and analytical skills with a proven track record of delivering high-quality audit reports.

Work Experience:

Senior Tax Auditor

ABC Accounting Firm, City, State

June 2018 - Present

- Conducted audits of individual and corporate tax returns to identify errors and discrepancies

- Reviewed financial records and documents to ensure compliance with tax laws and regulations

- Prepared detailed audit reports outlining findings and recommendations for clients

- Collaborated with clients to resolve any tax issues and discrepancies

- Assisted in developing tax planning strategies to minimize tax liabilities for clients

Tax Auditor

XYZ Tax Services, City, State

January 2015 - May 2018

- Conducted field audits of businesses to verify income, expenses, and deductions

- Analyzed financial statements and records to identify potential tax issues

- Prepared audit reports documenting findings and recommendations for clients

- Assisted clients in resolving tax disputes and negotiating settlements with tax authorities

- Participated in training programs to stay updated on changes in tax laws and regulations

Education:

Bachelor's Degree in Accounting

City University, City, State

Graduated: May 2014

Skills:

- Proficient in Microsoft Excel, QuickBooks, and tax preparation software

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Attention to detail and ability to work under pressure

- Knowledge of tax laws and regulations

Certifications:

Certified Public Accountant (CPA)

Member of the American Institute of Certified Public Accountants (AICPA)

Publications:

- "The Impact of Tax Reform on Small Businesses" - Tax Journal, 2019

This sample CV for a Tax Auditor can serve as inspiration for creating your own professional CV that highlights your skills, experience, and qualifications in the field of tax auditing.

Tax Auditor CV Writing Tips

When writing a CV for a Tax Auditor position, it is important to highlight your attention to detail, analytical skills, and knowledge of tax laws and regulations. Tailor your CV to showcase your experience in conducting audits, analyzing financial records, and identifying potential tax issues. Use quantifiable data to demonstrate your achievements and skills in tax auditing. Make sure to include any relevant certifications or licenses you hold. Here are some specific tips to consider when crafting your Tax Auditor CV:

- Start with a strong summary statement that highlights your expertise in tax auditing and showcases your key skills and qualifications.

- Use bullet points to list your relevant experience, including the companies you have audited, the types of audits you have conducted, and any savings or improvements you have made.

- Include specific examples of successful audits you have conducted and the impact they had on the organization.

- Showcase your knowledge of tax laws and regulations by listing any relevant training or certifications you have completed.

- Highlight your ability to work independently and as part of a team, as tax auditing often involves collaborating with other departments and colleagues.

- Quantify your achievements by including metrics or percentages that demonstrate the results of your audits, such as increased compliance or cost savings.

- Proofread your CV carefully to ensure it is free of errors and follows a clear, professional format.

- Tailor your CV to the specific job description and requirements of the Tax Auditor position you are applying for.

Tax Auditor CV Summary Examples

- Detail-oriented Tax Auditor with 5+ years of experience conducting thorough examinations of financial records to ensure compliance with tax laws and regulations. Skilled in identifying discrepancies and recommending corrective actions to minimize tax liabilities for clients.

- Results-driven Tax Auditor with a proven track record of delivering accurate and timely audit reports. Proficient in analyzing complex financial data and communicating findings to clients in a clear and concise manner. Strong understanding of tax codes and regulations.

- Experienced Tax Auditor adept at conducting risk assessments and developing strategies to mitigate potential tax risks for clients. Possess strong analytical skills and attention to detail, ensuring thorough and accurate audits. Ability to work independently or as part of a team in a fast-paced environment.

- Certified Tax Auditor with expertise in conducting audits for individuals and businesses across various industries. Skilled in utilizing auditing software and tools to streamline processes and improve efficiency. Proven ability to provide valuable insights and recommendations to clients for tax planning and compliance.

- Highly organized Tax Auditor with a passion for helping clients navigate complex tax laws and regulations. Proficient in conducting comprehensive audits and identifying opportunities for tax savings. Excellent communication skills and ability to build strong relationships with clients to provide exceptional service.

Build a Strong Experience Section for Your Tax Auditor CV

As a Tax Auditor, my role involves examining and analyzing financial records to ensure compliance with tax laws and regulations. With a keen eye for detail and a strong understanding of tax codes, I have successfully conducted thorough audits for various clients. Below are examples of strong work experience descriptions for a Tax Auditor:

- Conducted detailed reviews of tax returns and financial documents to identify discrepancies and potential areas of non-compliance.

- Collaborated with clients to gather necessary documentation and information for audits, demonstrating strong communication and interpersonal skills.

- Utilized advanced software tools to analyze large datasets and identify patterns or anomalies in financial records.

- Prepared detailed audit reports outlining findings and recommendations for clients to address any issues identified during the audit process.

- Stayed current on changes in tax laws and regulations to ensure audits were conducted in accordance with the most up-to-date guidelines.

- Worked closely with tax attorneys and other professionals to resolve complex tax issues and provide expert advice to clients.

- Managed multiple audit projects simultaneously, prioritizing tasks and meeting strict deadlines to ensure timely completion of audits.

- Trained and mentored junior auditors, sharing knowledge and best practices to ensure consistent quality in audit processes.

Tax Auditor CV Education Examples

As a Tax Auditor, having a strong educational background is essential in understanding complex tax laws and regulations. Here are some examples of educational qualifications that can help you excel in this role:

- Bachelor's degree in Accounting: A solid foundation in accounting principles is crucial for a Tax Auditor to accurately assess financial records and identify potential tax discrepancies.

- Master's degree in Taxation: A specialized degree in taxation can provide in-depth knowledge of tax laws and regulations, making you a valuable asset in ensuring compliance and minimizing tax liabilities.

- Certified Public Accountant (CPA) designation: Holding a CPA license demonstrates your expertise in accounting and taxation, proving your credibility as a Tax Auditor.

- Bachelor's degree in Finance: A degree in finance can provide a strong understanding of financial markets and investment strategies, which can be beneficial in analyzing complex financial transactions for tax purposes.

- Juris Doctor (JD) degree: A background in law can be advantageous for a Tax Auditor, as it can help in interpreting and applying tax laws effectively, especially in cases involving legal disputes or audits.

Skills to Highlight in Your Tax Auditor CV

As a Tax Auditor, it is crucial to possess a combination of soft and hard skills to effectively carry out your duties. Soft skills such as attention to detail, critical thinking, and communication are important for analyzing financial data and communicating findings to clients. On the other hand, hard skills like knowledge of tax laws, accounting principles, and auditing standards are essential for conducting thorough tax audits. Here are 10 soft skills and 10 hard skills to highlight in your Tax Auditor CV:

Soft Skills:

- Attention to detail

- Critical thinking

- Communication

- Problem-solving

- Time management

- Analytical skills

- Teamwork

- Adaptability

- Integrity

- Stress management

Hard Skills:

- Knowledge of tax laws

- Accounting principles

- Auditing standards

- Tax preparation software

- Data analysis

- Risk assessment

- Financial reporting

- Regulatory compliance

- Forensic accounting

- Investigative techniques

By showcasing these skills in your CV, you can demonstrate to potential employers that you have the necessary qualifications to excel in a Tax Auditor role.

Tax Auditor CV Format

As a Tax Auditor, having a well-structured CV is crucial to showcase your skills and experience in a clear and concise manner. When it comes to formatting your CV, it is important to tailor it according to your job level.

For entry-level Tax Auditors, a simple and clean layout is recommended to highlight your education and any relevant internships or projects.

For mid-level professionals, a more detailed CV with a focus on your work experience, accomplishments, and skills is ideal.

For senior-level Tax Auditors, a comprehensive CV that includes detailed descriptions of your achievements, leadership experience, and specializations is key.

When creating your Tax Auditor CV, consider the following format:

- Personal Information: Include your contact information and a professional summary at the top of the CV.

- Work Experience: List your relevant work experience in chronological order, starting with your most recent position.

- Education: Include your degrees, certifications, and any relevant courses or training.

- Skills: Highlight your technical skills, such as knowledge of tax laws and regulations, auditing techniques, and software proficiency.

- Achievements: Showcase any awards, commendations, or quantifiable achievements related to your work as a Tax Auditor.

- References: Optionally, include references or testimonials from previous employers or clients.

For more tips on CV formatting, check out this article on CV format for additional guidance.

Common Mistakes to Avoid in a Tax Auditor CV

As a Tax Auditor, having a well-crafted CV is crucial for standing out in a competitive job market. To ensure that your CV effectively showcases your skills and experience, it is important to avoid common mistakes that can hinder your chances of landing your dream job. Here are 8-10 common mistakes to avoid in a Tax Auditor CV:

- Including irrelevant work experience or skills

- Failing to tailor your CV to the specific job description

- Using a generic or outdated CV template

- Not quantifying your accomplishments or contributions

- Including typos or grammatical errors

- Omitting important certifications or qualifications

- Providing vague or unclear information about your responsibilities and achievements

- Neglecting to highlight your knowledge of tax laws and regulations

- Focusing too much on duties rather than accomplishments

- Using a cluttered or disorganized format that makes it difficult for recruiters to find key information.

Key Takeaways for a Tax Auditor CV

- Utilize a clean and professional CV template from CV Templates to showcase your experience and skills effectively

- Highlight your tax auditing experience and accomplishments in a clear and concise manner

- Include relevant certifications or licenses such as CPA or CMA

- Showcase your attention to detail and analytical skills in your work experience section

- Use quantifiable achievements to demonstrate your impact in previous tax auditing roles

- Include a skills section that highlights your knowledge of tax laws and regulations

- Utilize the CV Builder to customize your CV and make it stand out to potential employers

- Consider adding a cover letter using Cover Letter Templates to further explain your interest in the tax auditing role and why you are a strong candidate

Build your CV in minutes

Use an AI-powered cv builder and have your cv done in 5 minutes. Just select your template and our software will guide you through the process.